In the article we will consider the calculation of average daily earnings taking into account the minimum wage and the issuance of sick leave for care in “1C: Salaries and personnel management 8”, ed. 3.1

- How to reflect participation in the FSS Pilot Project in 1C

- We calculate the insurance period in “1C: ZUP 8”

- How is the calculation of benefits not less than the minimum wage

- Calculation of benefits at the expense of the Social Insurance Fund, limited by the minimum wage

- Registration of sick leave in 1C:ZUP 8, paid for from the Social Insurance Fund

FSS pilot project

By making monthly contributions to the Social Insurance Fund, the organization insures its employees in case of temporary disability. There are other cases when employees receive benefits and vacations from the Social Insurance Fund.

Thus, in the regions participating in the pilot project, benefits are assigned, calculated and paid directly to employees not by organizations, but by regional branches of the Federal Social Insurance Fund of the Russian Federation. Since July 1, 2021, more than 30 regions of the country have been participating in the FSS Pilot Project.

If your organization is participating in the Pilot Project, then in the “Organization Settings” on the “Accounting Policy” tab, using the “Accounting Policy” hyperlink in the “Benefits at the expense of the Social Insurance Fund” field, you must select the effective date of the region’s transition to the pilot project.

For example, the Rostov region switched to a pilot project, i.e. direct payments to the Social Insurance Fund, from July 1, 2015

We go to “1C: Salaries and HR Management 8”, ed. 3.1 .

Next, on the sick leave sheet, on the “Pilot Project” tab, fill in the sick leave data and the employee’s application for payment of benefits. On the “Reporting and Certificates” tab, go to “Benefits at the expense of the Social Insurance Fund”, where we create registers for sending this sick leave via TKS.

Fill out the FSS calculation certificate 2019

The fund needs the FSS 2021 calculation certificate to clearly see the reality of your requirements. After all, in it you will describe in detail the following data:

- Accrued contributions: total amount and by month;

- Payments transferred to the Fund: total and monthly breakdown;

- Social Security debt;

- The company's debt on contributions;

- How many benefits were paid: in total and monthly;

The indicators are presented within one reporting period. Let's look at the table and see a sample of filling out the lines of the FSS calculation certificate.

| Line | What do we include? | |

| The amount of debt on contributions at the beginning of the reporting period | Such arrears are usually caused by due payments being made in the next month. Therefore, at the end of the quarter, the amount of debt for the last month of the quarter usually creeps out, which the company will repay at the beginning of the next | |

| How many contributions have been accrued? | Total figure for the entire period | |

| 3,4,5 | Monthly breakdown | Only for the last 3 months of the period |

| FSS debt | It is counted in two ways:

| |

| Total amount spent on social benefits | Include only those payments that are reimbursed from the Social Insurance Fund. First of all, this applies to sick leave. Remember that the employer pays for the first three days. That is, this three-day money needs to be removed from the total amount | |

| 13,14,15 | Monthly payment breakdown | Take the last 3 months of the billing period |

| How many fees have you paid? | total amount | |

| 17,18,19 | Monthly payment transfers | Last three months of the billing period |

| The company's debt to the Social Insurance Fund | Line 21 = line 2 – line 16 |

We fill out the remaining lines only if there are corresponding operations.

To fill out the FSS calculation certificate, let’s take the following example.

Example. In the first quarter of 2021, Radost LLC had the following operations regarding the payment of contributions and the issuance of benefits:

- The amount of accrued contributions to Social Security for the 1st quarter of 2021 is 60,000 rubles. (January 2021 – 15,000, February – 25,000, March – 20,000);

- Of this amount, “Joy” has already transferred 40,000 rubles to the budget. (for January - 15,000 and for February - 25,000 rubles). Payment for March will only be made in April;

- Benefits for compulsory social insurance were issued in the amount of 54,000 rubles, of which in January 2021 - 14,000, in February - 17,000, in March - 23,000.

As we see, the contributions paid are not enough to provide for all workers in need of social support. Therefore, the accounting department of “Joy” turned to the FSS. To do this, she calculated the amount she needed: (40,000 + 54,000) – 60,000 = 34,000 rubles.

After all, requests can only be made within the framework of real needs and specific figures. Let's fill out the FSS 2021 calculation certificate using an example.

- Line 2 – 60,000 (these are our accrued contributions for the reporting period)"

- Lines 3, 4, 5 – 15,000, 25,000, 20,000, respectively (we break down the accruals monthly);

- Line 12 – 54,000 (these are benefits paid for the quarter);

- Lines 13, 14, 15 – we specify the money issued by month for the 1st quarter of 2019;

- Line 16 – 40,000 (we reflect the total amount of contributions transferred to the fund);

- Lines 17 and 18 – we detail the transferred contributions by month;

- Line 21 – enter the debt to the fund – 20,000 (60,000 – 40,000), we will pay it in April 2021.

Now check out how the above data is reflected in the document for Social Insurance.

Sample of filling out a certificate-calculation of the Social Insurance Fund 2019

In addition to the calculation certificate, Appendix 2 is also sent to the FSS, which is a transcript of the benefits paid.

Insurance experience

To calculate the average daily earnings of benefits, it is necessary to reflect the “Insurance Experience”, which is entered into the employee’s card in “Labor Activity”. It is calculated from the number of full months (30 days) and a full year (12 months) in calendar order. Those. First you need to select complete years and complete months. And divide the balances into 30 days and 12 months/

The “Insurance period for payment of sick leave” includes periods of work that were subject to social insurance in case of disability and in connection with maternity, if contributions were paid for them. “Insurance period taking into account non-insurance periods” is the insurance period for paying sick leave, taking into account non-insurance periods, namely military service. During service, length of service is taken into account, but contributions are not accrued. The length of service influences how much percent of the sick leave will be accrued. Military service is taken into account from January 1, 2007. On the “Payment” tab in the sick leave certificate, the “Apply benefits” flag means non-insurance periods.

Benefit for registration in the early stages of pregnancy from February 1, 2021

This benefit is supposed to be paid once (that is, in a lump sum). Women who:

- registered in medical institutions before 12 weeks of pregnancy;

- have the right to maternity benefits (Article 9 of Law No. 81-FZ).

This benefit will be paid in a new amount from February 1, 2021 - 628.47 rubles. rubles However, a controversial situation is possible. Let's give an example.

The benefit for registration in the early stages of pregnancy should be paid in addition to the maternity benefit (Article 9 of Law No. 81-FZ). Therefore, the benefit for registration in the early stages of pregnancy must be transferred in the amount that is established on the start date of maternity leave. In our case, the woman went on maternity leave on February 2, 2021. Therefore, the registration allowance should be paid in the amount of 628.47 rubles (including indexation by a factor of 1.025). If the start of maternity leave was in January 2021, then the benefit would be in a smaller amount - 613.14 rubles.

Benefit calculation is not less than the minimum wage

The following indicators influence the calculation of benefits:

- “Assign benefit from”, because the sick leave period may differ from the paid period on sick leave;

- “Insurance period” – affects the percentage of benefits accrual;

- “Benefit Limitation”;

- "Share of part-time";

- “Apply benefits”;

- “Violation of regime c”;

- “Start date of payment in the amount of 50%.”

From July 1, 2021, the minimum wage is 7,800 rubles.

Benefits must be paid no less than calculated from the minimum wage. Based on the minimum wage, a payment is due if in the previous two years the employee had no earnings (no earnings) subject to insurance contributions or it was less than the minimum wage. However, there is no basis for recalculating reporting periods.

How to calculate average earnings in 2021? Earnings are taken for 2015 and 2021. (limited by the maximum value of the base), summed and divided by 730.

If the calculation is based on the minimum wage, then (7800*24)/730 =256.44 is the average daily earnings.

In “1C: Salary and Personnel Management 8”, ed. 3.1, if the average estimated earnings are less than the minimum wage, then the program will calculate benefits based on the minimum wage multiplied by the length of service.

Example. Let's consider the situation of calculating benefits if there are no certificates from other places of work.

If the experience is more than 8 years, then the average daily earnings are multiplied by 100% and we get 256.44 rubles. in a day.

If the work experience is from six months to 5 years, then the average daily earnings are multiplied by 60% and amount to 153.86 rubles. in a day.

If the work experience is more than 8 years and works at ½ rate, then the share is taken into account in the calculation, and the average daily earnings will be: 256.44 * 0.5 * 100% = 128.22 rubles.

If an employee works in an area that uses a regional coefficient (for example, 1.2), has more than 8 years of work experience and works full time, the average daily earnings will be: 256.44 * 100% * 1.2 = 307.73 rubles.

If an employee works in an area that uses a regional coefficient (for example, 1.2), has a work experience of six months to 5 years and works at ½ rate, the average daily earnings will be: 256.44 * 0.5 * 60% * 1.2 = 92.32 rub.

Example. Let's consider the situation of calculating benefits if certificates have been provided.

We indicate the certificates in the “Payroll calculation” tab – “See. See also” – “Certificates for calculating benefits”. If there is no certificate, but the employee says that there was income, then you can request data from the Pension Fund.

In the program, we set the flag “Take into account the earnings of the previous policyholder” in the sick leave. If the average daily earnings are more than the minimum wage, then it is calculated based on earnings; if it is less, then the calculation is based on the minimum wage.

If there is a certificate and the amount of income exceeds the maximum base value for calculating insurance premiums (in 2015 - 670,000 rubles, in 2016 - 718,000 rubles), then the “Benefit Limit” of the maximum base value will be automatically set on the sick leave certificate for calculating insurance premiums. Then the average daily earnings will be considered (670,000+718,000)/730=1901.37. because it is more than the minimum wage. If there is a regional coefficient, then this earnings will be multiplied by it.

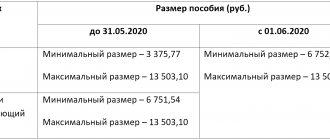

FSS announced the amounts of child benefits for 2021

The Federal Social Insurance Fund has announced the amounts of child benefits for 2021. Thus, all benefits will increase due to changes in the annual bases for insurance premiums, TASS reports.

New benefit levels - 2021

The maximum amount of maternity benefits for 140 days of leave will increase from January 1, 2021 to 322 thousand rubles; this year it exceeded 301 thousand rubles. This was reported to TASS on Wednesday by the press service of the Social Insurance Fund (FSS).

“The maximum amount of maternity benefits for 140 days of leave from 01/01/2021 will be 322,190.40 rubles,” the fund said.

The maximum monthly benefit for child care up to 1.5 years will increase to almost 28 thousand rubles instead of 26 thousand rubles in 2021, the Social Insurance Fund reported.

To calculate benefits, wages for the two previous years are taken, but not higher than the maximum base. The maximum bases for calculating insurance contributions to the Fund for 2021 and for 2021 are 815 thousand rubles and 865 thousand rubles, respectively, which allows increasing the maximum amount of maternity benefits, as well as monthly child care benefits, the FSS explained .

The fund also reported that the maximum amount of temporary disability benefits for one day of sick leave will increase from 2,150.68 rubles in 2021 to 2,301.36 rubles in 2021.

New benefit for 1st and 2nd child

The authorities have approved a new mandatory child benefit from the birth of the 1st and 2nd child up to 3 years of age. Benefits will be paid monthly. Each region has established its own benefit amount, which is tied to the minimum subsistence level per child. The average benefit is 10,000 rubles.

Previously it was planned that children from 1.5 to 3 years old would receive benefits. However, on July 24, the State Duma adopted a law according to which the payment applies to children from birth to 3 years.

Payments will be available to families whose income for each family member does not exceed two subsistence minimums. The subsistence allowance is taken to be the one established in your region for the working population.

The right to benefits is from birth until the child turns three years old. The table below shows the cost of living for all regions of the Russian Federation. The table is very easy to use. Download. Select your region. And determine whether the employee is entitled to benefits or not.

There are 4 family members in total. Dad, mom, two children. Mom is on maternity leave. Dad works and earns 50,000 rubles. One child is 2 years old, the second is 5 years old. In the region, the cost of living is 13,000 rubles for the working population. Let's check whether the mother is entitled to benefits.

So, it turns out that there are 4 family members in total. Moreover, the income for all family members is only 50,000 rubles.

Let's check the right to benefits by multiplying the cost of living by 4 terms seven and two:

- 12,000 rub. x 4 x 2 = 96,000 rubles.

Thus, the mother will receive a new child benefit from January 1, since the income for family members turned out to be less than twice the subsistence level for all members.

How much money will parents receive?

The childcare benefit for children under 3 years of age will depend on the cost of living for children.

Below is a table with the cost of living for children in all 85 regions of the Russian Federation. It can be used to determine the amount of benefits. Actually, the amount of the benefit is equal to the subsistence minimum per child.

Please note that the benefit will be paid from January 1, 2021. In the meantime, you can get another benefit for children under one and a half years old

. Below we have provided the form of a certificate that must be issued by the accounting department in order to receive benefits.

Certificate from work, without which you cannot receive a new benefit

To receive benefits, the accounting department issues a special certificate to the employee.

It follows from the project that they receive a new benefit every month from social security. But to do this, employees will ask the accounting department for a certificate of income for the last 12 months. Complete the certificate in any form. Reflect in it the accrued income, including amounts not subject to personal income tax: financial assistance, compensation, etc.

For a sample certificate of income for the last 12 months, see the article in the magazine “Simplified”:

A certificate without which benefits will not be issued

As long as you work according to the old rules. But from 2021 you need to switch to a new benefit calculation. begun consultations in the BukhSoft program

according to the new law. And registering for parental leave will take you a few minutes. The BukhSoft program will automatically prepare for you all the samples of necessary documents. Try it now for free access.

Take parental leave

Subscribe to “Simplified” for six months, and read for 12 months!

best promotion is valid until December 16th

when subscribing to the magazine “Simplified” -

an annual subscription at the price of six months.

Hurry up to pay

the bill

. Gift for subscription - the book “Simplified. Annual report 2021.”

December 16 is the last day of the promotion

The magazine “Simplified” opened a channel in Yandex.Zen

Our magazine has opened a channel in Yandex.Zen. Subscribe to avoid fines and inspections. Receive only the most important news just for you!

Subscribe to the channel

Source: https://www.26-2.ru/news/355639-fss-nazval-razmery-detskih-posobiy-na-2021-god

Calculation of benefits limited to the minimum wage

The benefit cannot be calculated more than the minimum wage if:

- The employee's length of service is less than 6 months;

- the employee violated the regime, and this was noted on the sick leave;

- the employee, without a good reason, did not appear on time for a medical examination or a medical and social examination;

- disability occurred as a result of alcohol, drug, toxic intoxication or actions related to such intoxication.

Other articles on calculating sick leave in 2021 using “1C: Salaries and Personnel Management 8”

Read

If the length of service is less than 6 months and there is income from the policyholder, for example, 500,000 rubles, the maximum benefit amount will be 7800/number of days per month.

In August 7800/31=251.61 rubles. in a day. There will be a limit on sick leave “in the amount of MMOT”. Average daily earnings, taking into account length of service, will be 500,000/730*60%= 410.96 rubles. But since we have a daily limit, it will be considered 251.61 rubles.

If the length of service is less than 6 months, there are no certificates from insurers and you work at ½ rate, then the average daily earnings will be 256.44 * 0.5 * 60% = 76.93 rubles.

If the length of service is less than 6 months, there are no certificates from insurers, and the employee works in an area that uses a regional coefficient (for example, 1.2), then the average daily earnings will be 256.44 * 0.5 * 60% * 1.2 = 92.32 rub. At the same time, the benefit limit will also be increased by the regional coefficient.

If the length of service is more than 8 years and the regime was violated, when calculating sick leave, the limitation on benefits will apply exactly from the day that is entered on the sick leave in “Violation of the regime from:”. Regardless of the amount of average earnings (which will be more than the minimum wage), the benefit will be calculated in August at 251.61 rubles per day, from the date of violation of the regime. But violation of the regime is not always a limitation of the MMOT benefit; specific cases with the social insurance fund must be considered.

Benefits from the Social Insurance Fund - in what cases are they paid?

What benefits are paid from the Social Insurance Fund? In addition to various compensations paid by employers, citizens have the right to receive the following Social Security benefits in cases specified by law:

- upon the occurrence of temporary disability of the employee due to illness or domestic injury;

- in case of an industrial injury to an employee;

- if it is necessary for the employee to provide care to the patient;

- if it is necessary to bury a relative;

- for pregnancy and childbirth;

- at the birth of a baby;

- in connection with registration in the early stages of pregnancy;

- while on leave to care for a small child;

- when adopting a child.

FSS benefits for 2021 have been increased: according to Decree of the Government of the Russian Federation No. 74 of January 26, 2018, “children’s” subsidies were indexed 1.025 times - that is, the amounts were increased by 2.5 percent (for example, it was 100 rubles, now it is 102 rubles 50 kopecks ).

The actual values of FSS benefits as of March 2018 are given below. However, legislators have already announced that they plan to carry out indexation at least once more in the near future.

m.ppt.ru

Registration of sick leave

A sick leave can be created through the “Personnel” – “Sick Leave” section or through the “Payroll” – “Sick Leave” section. In the header of the document we indicate the month the sick leave was accrued, the date the sick leave was issued in the database, the employee to whom the sick leave was issued and the sick leave number.

On the “Main” tab there are required fields to fill in: “Reason of disability” and “Exemption from work”.

Example. The cause of disability is illness or injury at work.

For example, an employee has been working for more than 8 years at his main place of work and part-time. Basic annual salary – 300,000 rubles. per year, and part-time – 30,000 rubles. in year. For sick leave, we select an employee at his main place of work - it is to him that we indicate exemption from work on sick leave. The payment percentage is 100%. The program automatically calculates earnings for two places of work, i.e. 660,000 rub. this is divided by 730. In the timesheet for both employees, the program will indicate sick leave.

An external part-time worker has the right to receive sick leave for each place of work if he has worked for the same employers in the two previous years. Accordingly, benefits are assigned and paid for each place of work. If an employee was working for different employers at the time of the insured event, the benefit is accrued and paid in one of the places of work of the employee’s choice, while when calculating average earnings, income is taken into account from all places of work for the previous two years, the employee must provide certificates from another employer.

Example. The reason for the disability is caring for a sick family member.

The calculation of sick leave depends on the age of the sick person who needs care, and on the degree of relationship. When caring for a child (children under 18 years old - for some cases of illness) and for an adult, there are different calculation methods. This benefit will be paid entirely by the Social Insurance Fund from the first day of incapacity for work.

For outpatient treatment of a child, sick leave will be calculated for the first 10 days depending on the length of service, subsequent days - 50% of average earnings. For inpatient treatment - depending on the insurance period. For outpatient treatment for an adult family member, the entire benefit depends on length of service.

But there is a limit on the number of days to pay child care benefits depending on age. For example, an employee has a child who is 2 years old (the maximum number of child care days per year is 60). The child is sick twice – 45 and 40 days. In the program, we see that the child is indicated in the employee’s card under the “Family” hyperlink. Initially, if sick leave was not provided before payroll, we create a document “Absenteeism, Absenteeism” (section “Human Resources - Employee Absences”). Where “Type of absence” is set, set it to “Absence for unknown reasons.” After sick leave is granted, we register incapacity for work for 45 days. Sick leave will automatically recalculate “Absence for unknown reasons” on the “Recalculation of the previous period” tab.

Example. Child care is outpatient.

On the “Child Care” tab, select “Child Care Case” 09 – up to 7 years old, outpatient, select a child. The field “Remaining paid days of care” will initially be 60 days, since the days have not yet been used. On the “Payment” tab, indicate the dates of sick leave in the “Assign benefits from” column. We will have only 45 days. The first 10 days will be calculated from the length of service, and then the program will automatically enter the date in the “Start date of payment in the amount of 50%” field.

We fill out the second sick leave for 40 days. On the “Main” tab we indicate the entire period. On the “Childcare” tab, fill in “Remaining paid days of care” – 15. On the “Payment” tab, the period of paid sickness will be indicated, in our case 15 days. The remaining days will be without payment. For the first 10 days, the calculation will be based on length of service, and for the next 5 days, it will be based on 50% of average earnings. And the remaining days are not paid, sickness absence is simply entered on the timesheet.

Example. Child care – inpatient and outpatient.

If in the “Case of child care” field 09 is up to 7 years old, in a hospital, then the benefit will be calculated based on the length of service.

If there are two entries on the sick leave: hospitalization, which continued with outpatient care, formally this is one sick note, but in the program we register two sick notes. First, for the hospital, on the basis of it we create a sick leave, which is its continuation. And in it we already choose outpatient. On the “Payment” tab, the program will automatically indicate in this sick leave from which day it is necessary to accrue a payment of 50%. The “start date of incapacity for work” will correspond to the date from the first sick leave. For the second sick leave, the first 10 days of service will be paid, and from the 11th day - in the amount of 50%.

For children from 7 to 15 years old there is a limit: no more than 15 days per case and no more than 45 days per year. That is, if there are several sick days, then for the first one we will receive payment for the first 15 days of caring for a sick child, if it is more than 15 days. On the “Main” tab, in the “Exemption from work from” field, enter the date from the sick leave for the entire period of sick leave. On the Child Care tab, select “09 – from 7 to 15 years, outpatient.” Initially, the balance of paid days is 45 days. 15 days are paid, the first 10 are based on length of service, 5 are paid based on 50%. For subsequent sick leave, the balance of paid days changes, but the calculation remains the same - 10 days based on length of service, 5 based on 50%.

Comparative table of benefits taking into account the latest changes in legislation

How have benefit levels changed recently?

| Name | Amount in rubles | ||

| 2018 | from 01/01/2019 | from 02/01/2019 | |

| One-time payment at the birth of a child | 16 759,08 | 16 759,08 | 17 479,72 |

| Minimum paid for the maintenance of the first child up to one and a half years old | 4465,2 | 4512 | 4152 |

| Compensation for subsequent children | 6284,65 | 6284,65 | 6554,89 |

| Maximum payable for children | 24 536,57 | 26 152,27 | 26 152,27 |

| Payment for an adopted child, under guardianship or trusteeship | 16 759,08 | 16 759,08 | 17 479,72 |

| Funds for a disabled person or for a child under 7 years of age, for several children who are brothers and sisters of each other to be raised in a family. Transfer to a family means adoption, establishment of guardianship and trusteeship | 128 053,07 | 128 053,07 | 133 559,35 |

| Minimum amount transferred in case of pregnancy or childbirth | 51 380,38 | 51 919 | 51 919 |

| Maximum for the same reasons | 282 493,40 | 301 095,20 | 301 095,20 |

| Payment for registration in the early stages of pregnancy | 628,46 | 628,46 | 655,48 |

| Compensation for the pregnant wife of a serviceman | 25 639,76 | 26 539,76 | 27 680,97 |

| Funds transferred to the child of a serviceman undergoing military service upon conscription | 11 374,17 | 11 374,17 | 11 863,26 |

| Funds paid to the child of a serviceman in the event of loss of a breadwinner | 2287,64 | 2287,64 | 2386,01 |

| Monthly compensation due for the maintenance of a child living in the Chernobyl zone until the age of one and a half years | 3241,05 | 3241,05 | 3380,42 |

Other cases of caring for sick family members

If the child is disabled, then the entire period of outpatient and inpatient care is paid. In the “Remaining paid days of care” field, the initial value is 120. If a child has HIV infection, or post-vaccination complications or malignant tumors, the entire sick leave period is subject to payment. In the program, the field “Remaining paid days of care” is not indicated - which means it does not exist.

Continuation of sick leave without a primary document is a continuation of sick leave for another family member. Each sick leave is a separate insured event. It is paid as a primary one, even if it is marked “Continuation”. The benefit will be calculated based on the number of days, and the limit on this benefit will be calculated separately for each parent.

Caring for an adult family member – no more than 7 days per case, no more than 30 days per year.

Refund terms

After the policyholder has submitted the necessary documents to the Social Insurance Fund, including a certificate of calculation completed in the prescribed manner, the Fund checks and reviews the applicant’s documents. If there are no violations and all required documents are provided, the Fund makes a positive decision, a copy of which is sent to the tax authority. The period for allocating funds to the policyholder is 10 calendar days (from the date of provision of the package of documents)

As a general rule, after this period, if a positive decision is made, the policyholder must receive compensation. However, this applies only to those cases when, when checking the information reflected in the calculation certificate and other documents, the Fund did not have any questions for the applicant. If, when considering an application for reimbursement of insurance amounts, discrepancies or irregularities in the reporting are identified, the insurer may order an additional inspection (“office” or on-site), and in this case, it will be possible to receive the reimbursed amount only after its official completion (clause 3 and 4, Article 4.6 of Law No. 255-FZ).

Other causes of disability

- If the reason for the disability is quarantine (when the child goes to kindergarten and there is a quarantine order), then one of the parents is entitled to sick leave. A sick leave certificate can be issued by a doctor only on the basis of an order. It is issued for the entire quarantine period and for the period of contact with infected patients. Days of care are not counted, and they are calculated from length of service.

- If the cause of disability is an injury at work or an occupational disease , then the program establishes 100% payment regardless of length of service. And the “Benefit Limit” is the maximum amount of the monthly insurance payment.

- If the cause of incapacity for work is further treatment in sanatorium-resort institutions, then sick leave will only be paid for 24 days.

- If the cause of disability is prosthetics, this must be confirmed by medical evidence. In this case, the entire period is paid.

And any family member can receive the right to benefits under “Parental Leave”. The right to benefits remains if the vacationer works part-time or from home. The program assigns benefits in the “Personnel” or “Salary” - “Parental Leave” section.

Payments for the third child

State benefits for the 3rd child in 2021 remain standard; if maternity capital has not been issued earlier, with the birth of the third child the family can apply for it. Plus the usual monthly care allowance for up to one and a half years.

The payment of other benefits is decided by the regional administration. Krasnodar authorities, for example, pay such families 10,412 rubles monthly. until the child reaches 3 years of age. Plus, the family receives about 5 thousand rubles annually for each child.

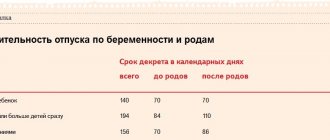

Maternity benefit from February 1, 2021

Minimum allowance for BiR

Maternity benefits paid by employers are not indexed annually. That is, from February 1, 2018, the maternity benefit has not increased. However, please note that the maximum benefit amount has increased since 1 January 2018, as the new maximum average daily earnings must be taken into account when calculating benefits from the beginning of 2021. Let me explain.

Maternity benefits are paid in a lump sum and in total for the entire period of maternity leave, which is (Part 1, Article 10 of Law No. 255-FZ):

- 140 days (in general);

- 194 days (with multiple pregnancies);

- 156 days (for complicated births).

Maternity benefits, in general, should be calculated from the average earnings for the billing period, that is, for the two years preceding the onset of illness, maternity leave or vacation (from January 1 to December 31). Accordingly, if an employee goes on maternity leave in 2018, then the billing period will be 2021 and 2021 (Part 1, Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

However, earnings for the billing period should not be less than a certain amount. The state guarantees the calculation of benefits based on the minimum allowable earnings. It is defined like this:

In total, the minimum earnings for the billing period in 2021 are 227,736 rubles. (RUR 9,489 x 24)

Another value that will be required to calculate maternity benefits is the minimum average daily earnings. To find out the minimum average daily earnings for calculating benefits, the accountant needs to divide the resulting value by 730. The following formula is used:

Accordingly, from January 1, 2021, the minimum average daily earnings is 311.967123 rubles per day (227,736 rubles / 730 days). From January 1, 2021, the average daily earnings for calculating benefits cannot be less than this value.

If maternity leave began in 2021, then the minimum average daily earnings for calculating maternity benefits should be taken equal to 311.97 rubles. If actual earnings are below the minimum, then benefits had to be calculated from this value. Here are the minimum amounts of maternity benefits from January 1, 2021:

- RUR 43,675.80 (311.967123 × 140 days) – in the general case;

- RUB 60,521.62 (311.967123 x 194 days) – in case of multiple pregnancy;

- RUR 48,666.87 (311.967123 x 156 days) – for complicated childbirth.

Maximum allowance for BiR

The maximum maternity benefit that a worker can receive is limited to the maximum average daily earnings. In 2021 it is 2021.808219 rubles. (718,000 rub. + 755,000 rub.) / 730.

Thus, the maximum amount of maternity benefits in 2021 will be:

- RUB 282,493.15 – during normal childbirth (2017.808219 x 140);

- RUB 314,778.08 – for complicated childbirth (2017.808219 x 156);

- RUB 391,454.79 – for complicated multiple births (2017.808219 x 194).

From February 1, 2021, the maximum allowable amount of maternity benefits does not change, since it does not depend in any way on indexation. The coefficient 1.025 does not affect the size.

One-time benefit for the birth of a child from February 1, 2018

One of the parents has the right to a lump sum benefit upon the birth of a child. If two or more children were born, then the benefit is paid for each of them (Article 11 of Law No. 81-FZ). The employer must pay the benefit within six months after the birth of the child if the employee has submitted the documents necessary to assign the benefit (Article 17.2 of Law No. 81-FZ). Due to the indexation of benefits from February 1, 2021, an ambiguous situation may arise when assigning.

The amount of a lump sum benefit for the birth of a child should be calculated on the date of birth, and not on the date of application for benefits (FSS letter dated January 17, 2006 No. 02-18/07-337). In our case, the child was born in 2017, so the benefit amount will be 16,350.33 rubles. (excluding indexation by a factor of 1.025). A one-time benefit for the birth of a child in the indexed amount (RUB 16,759.09) is paid if the child is born from February 1, 2018.