What can and cannot be adjusted

There are a number of errors that are considered non-critical in payment orders, i.e. subject to editing (for example, an incorrectly entered BCC - budget classification code, TIN, KPP, name of the organization, etc.) and they are the ones that are corrected by submitting the appropriate application to the tax office.

At the same time, there are inaccuracies that cannot be corrected in the manner described above:

- incorrectly specified name of the receiving bank;

- Invalid federal treasury account number.

In cases where the sender of the payment made errors in such details, the function of paying the contribution or tax will not be considered completed, which means the money will have to be transferred again (including late fees, if any).

What errors may not be corrected?

Minor typos, spelling and punctuation errors in the “Purpose of payment” field do not require correction. For example, if the payer missed a comma or abbreviated words incorrectly, this will not affect the flow of funds to the budget. It is not necessary to contact the Federal Tax Service for clarification.

Check whether the error distorts the essence of the payment. For example, if the assignment incorrectly indicates the reporting or tax period, there is a typo in the registration number of the policyholder, etc. Similar shortcomings will have to be corrected by the Federal Tax Service.

IMPORTANT!

The inspectorate has the right to independently correct the deficiency identified in the payment order. For example, if the payer made a mistake in the reporting period and indicated “2119” instead of “2020”. The inspection clarifies similar errors without a statement from the organization. But if the Federal Tax Service does not have enough information to make an adjustment, then the error will remain uncorrected.

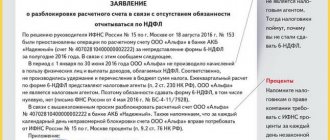

Features of drawing up an application

An application for clarification of payment to the tax service today does not have a unified uniform form, so employees of organizations and enterprises have the opportunity to write it in any form or, if the company has a developed and approved document template, based on its sample. The main thing is that office work standards are observed in terms of the structure of the document, and some mandatory information is also entered.

In the header you need to indicate:

- addressee: name and number of the tax service department to which the application is sent, its location, position, last name, first name and patronymic of the head of the territorial inspection;

- similarly, information about the applicant company is entered into the form;

- then in the middle of the line the name of the document is written, and just below it is assigned an outgoing number and the date of preparation is indicated.

In the main part of the application you should write:

- what kind of mistake was made, indicating a link to the payment order (its number and date);

- Next, you need to enter the correct information. If we are talking about some amounts, it is better to write them in numbers and words;

- Below it is advisable to provide a link to a provision of law that allows for the inclusion of updated data in previously submitted documents;

- if any additional papers are attached to the application, this must be reflected in the form as a separate item.

What happens if you don't submit a letter?

If the payer discovers an error, the tax service must be informed about it.

If the payment is made using incorrect details, it will take a long time to return it through the court.

And you need to pay the tax again until a penalty is charged on the amount owed.

If there is an error in the payment order

If incorrect data is indicated in a payment order, the standard procedure for contacting the tax service is used.

You can only change basic information, for example, change from KBK to KBK, which is correct. But you won’t be able to change your bank account details this way. You must first make the payment again and claim back the previously paid amount.

What to pay attention to when filling out the form

Just like the text of the application, there are no special requirements for its execution, so it can be formed on a simple sheet of any convenient format (usually A4) or on the organization’s letterhead.

You can write the application by hand or type it on a computer.

The main thing is that the document contains a “living” signature of the head of the applicant company or a person authorized to act on his behalf (in this case, the use of facsimile autographs, i.e. printed by any method, is prohibited).

There is no strict need to certify the form with a seal - this should be done only if the use of stamp products is enshrined in the regulatory legal acts of the enterprise.

The application should be made in two copies , one of which is transferred to the tax office, and the second remains in the hands of the representative of the organization, but only after the tax specialist puts a mark on it accepting the document.

What to do if there is an error in a payment order?

Are you familiar with the situation when you hastily issued a payment order for tax transfer, the bank executed the order, and subsequently you discovered an error in the KBK - what to do in this situation?

The solution is simple: you need to file an application with the tax office to clarify the payment. The Ministry of Finance also speaks about this in letter dated January 19, 2017 No. 03-02-07/1/2145.

The same should be done if an error is made in other fields of the payment order, such as:

- basis of payment>;

- TIN and KPP of the sender or recipient;

- taxpayer status>;

- tax payment period>;

- OKTMO>;

- number or date of the basis document>;

- purpose of payment;

- from 01/01/2019 - Federal Treasury account (provided that the money went to the budget).

Remember that payment can be clarified only if three conditions are met. Read more about them in the Ready-made solution from ConsultantPlus.

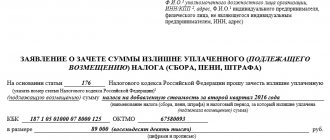

Let's look at the procedure for completing and a sample letter to clarify a payment to the tax office if the KBK is indicated incorrectly.

How to submit an application

The application can be submitted in different ways:

- The simplest, fastest and most accessible way is to come to the tax office in person and hand over the form to the inspector.

- Transfer with the help of a representative is also acceptable, but only if he has a notarized power of attorney.

- It is also possible to send the application via regular mail by registered mail with acknowledgment of receipt.

- In recent years, another method has become widespread: sending various types of documentation to government accounting and control services via electronic means of communication (but in this case, the sender must have an officially registered electronic digital signature).

Can you clarify?

Both the payer himself and another person who transferred the tax on behalf of the payer (paragraph 2, clause 7, article 45 of the Tax Code of the Russian Federation) can make an amendment to the payment. How to clarify the payment to the tax office if the checkpoint is incorrect? Contact the Federal Tax Service with a corresponding application.

If the mistake made by the accountant did not affect the transfer of tax to the budget, the company can clarify the following details:

- Treasury account number;

- basis of payment;

- payment affiliation;

- taxable period;

- payer status;

- TIN, checkpoint of the payer;

- TIN, checkpoint of the recipient.

The current legislation contains a list of errors that can be corrected by clarifying the payment (clause 7 of Article 45 of the Tax Code of the Russian Federation, Procedure, approved by order of the Federal Tax Service dated December 29, 2016 No. ММВ-7-1/731). Please note that in 2021, it is possible to clarify the payment even if there is an error in the Treasury account number.

Starting from 01/01/2019, you can clarify such a payment by submitting an application to the Federal Tax Service. Previously, you had to pay the tax again and return the erroneous payment. How to clarify a payment to the tax office if OKTMO is incorrect? Also write an application to clarify the payment.

The tax inspectorate can find the mistake. In this case, the company will be asked to correct it by sending a message to clarify the details. Having studied the circumstances of the error, you need to prepare a statement describing the problem and asking for the payment to be taken into account.

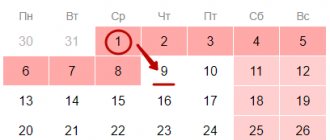

Also, an error made in a payment order can be found by the accountant himself. How to clarify a payment to the tax office if the recipient is incorrect? Write an application in any form and attach documents confirming the transfer of tax payments to the budget. Having received the application, tax authorities will review the documents and make a decision to clarify the payment. They are given 10 working days for this. Based on the results of the decision, the tax will be recognized as paid, and the penalties accrued at that time will be written off.

The period will begin to be calculated from the date of receipt of the application from taxpayers or from the date of signing the act of joint reconciliation of calculations (paragraph 2, paragraph 4, paragraph 8, article 78, paragraph 6, article 6.1 of the Tax Code of the Russian Federation, order of the Federal Tax Service dated July 25, 2017 No. MMV- 7-22/579).

Now you know how to clarify a payment to the tax office if the period is incorrect or if other errors are made. We will also explain how to submit an application for clarification of payment due to an error in the KBK.

Description of the procedure

There is no such procedure in legislative acts and other normative documents - formally the possibility of clarification is not provided. However, in practice this phenomenon is very common, since the violation in the payment document is not particularly critical and, as a rule, the situation is resolved quite simply.

In general, the sequence of actions is as follows:

- First you need to contact the other party who made the mistake.

- Then notify the bank by sending it correspondence according to the sample given above (or your own form).

- Then you need to receive a written response from the bank, which is attached to the payment order. The second party also receives the same answer, which also saves the document in case of a possible audit or legal dispute.

NOTE. This procedure is not prescribed in the legislation, but judicial practice in most cases describes exactly this procedure. Therefore, notifying all parties is a mandatory step.

Each stage is discussed in more detail below.

Notice to the other party

There are two options:

- If your company receives a payment, then you need to contact the person who sent the money.

- If you are the sender yourself and discover an error, then you need to notify the recipient about it.

First case

When you have received a payment, but the documents indicate its purpose incorrectly, it is often associated with supply situations (for example, when an advance payment has been sent, but already completed supplies have not yet been paid for). Then the recipient has reason to think that new payments must first satisfy previous demands (as well as interest on penalties) and only after that can advance payments for future deliveries be credited.

However, in practice, a company cannot arbitrarily, i.e. unilaterally change the purpose of payment. The fact is that the payer’s funds are his property, which he disposes of solely at his own discretion. This means that there is only one way - to obtain his written consent for clarification, for which you send a letter using a sample that completely coincides with the examples given above.

NOTE. Often, contracts provide for the possibility of independently determining payment and unauthorized change of this indicator if necessary. However, judicial practice shows that this provision is often recognized as contrary to civil law. But if the transfer amount is larger than expected, then the difference can be transferred to pay off debts independently, without asking for consent.

Second case

And in the case when you yourself are the payer, but for some reason you made a mistake, you will need to perform 2 actions at once:

- First, a written request is sent to coordinate this change with the counterparty who received the funds in his account.

- Then you need to send a letter to the bank through which this financial transaction was made.

If the bank refuses or ignores

The bank has the right to refuse the request. Moreover, such a right is fully justified from the point of view of legislation. It is considered that the credit institution has already fulfilled its obligation when it has made a transfer to the specified account and the funds have already been credited.

As a rule, banks are quite loyal to such an error and correct it at the first request. But even if the organization refuses to do this, the most important thing is to make sure that the letter reaches the bank, and that it refuses. Thus, having a written response from representatives of the credit institution is the main purpose of writing a letter of clarification . If the bank ignores the request, you need to obtain a written refusal. And if a credit institution refuses to accept a document, it is sent by registered mail. The notification of delivery is kept until the situation is completely resolved.

NOTE. In any case, it is important to verify that the bank actually satisfied the request and made the appropriate amendment. To do this, the company has the right to request an account statement - in most cases, such a procedure is paid (cost according to bank tariffs).

Arguments in case of dispute

A dispute may arise not only between your company and a counterparty, but also in connection with tax audits. In this case, it is better to prepare in advance to defend your position, for which you can use the following legal arguments:

- First of all, you need to state that the payment order refers to strict reporting documents, which means that no corrections are allowed in it. Accordingly, since the bank had already transferred the funds, you could not do anything else but to start the procedure for clarifying the purpose of the payment.

- Likewise, no corrections or deletions are allowed in cash and bank documents.

- Banks cannot interfere in the procedure, since they are authorized only to provide transfers and other types of financial services in accordance with the agreement.

- It is also impossible to renew an obligation that has been terminated. This means that if you have already sent funds for purchased goods or services, then the obligation to pay formally ceases. And then, when you want to change the purpose and agree on this with the counterparty, the obligation to pay for the goods, as it were, becomes unfulfilled (because the money was spent on another purpose). But the obligation has actually already taken place - therefore, it is no longer possible to terminate it.

Thus, despite the absence of a legally established procedure for clarification and a sample of the corresponding letter, in practice such an issue is resolved quite simply - it is only important to notify all interested parties and obtain their written consent.