In accordance with clause 1.7.2 of the Bank of Russia Regulation No. 385-P dated July 16, 2012, the owner of a bank account is required to indicate the purpose of the payment in his payment orders. All payment documents must disclose the essence of the transaction being carried out, and correctly filled in field 24 (payment purpose) will help to do this.

When filling out this column, you should keep in mind that the maximum number of characters is set for it - 210. Such information is contained in Appendix 11 to Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds.”

It is very important to use the correct wording in payments, since Banks can block a questionable (in their opinion) transaction or even refuse to service the company and blacklist it.

If the Bank terminates an agreement with an organization, it transfers data about this company to the Central Bank, which, in turn, blacklists it and does not recommend other credit organizations to cooperate with it. As a result, the company cannot open a current account, work with counterparties by bank transfer, or work in general, since the legislation of the Russian Federation obliges LLCs to have a settlement account.

Buyers from such an organization bear their own risk: when working with an organization on the Central Bank’s blacklist, be prepared to prove your expenses and legal deductions to the tax authorities.

What should I write in the payment instructions?

In the “Purpose of payment” column, you must indicate the payer’s basic information about the purpose of the money transfer.

It is advisable to include more information in the purpose of payment. It is not prohibited by law to provide any additional information. It is highly undesirable to write the purpose in one word, for example Advance

,

Tax

,

For materials

.

Such information may include:

- Accountable funds.

- Name and payment of work, service, product.

- Date and number of the agreement, contract, agreement, etc.

- More information about value added tax.

- Renting real estate, transport, etc.

VAT?

VAT

is always written in the purpose of payment. In any payment orders and under any tax regime.

| VAT INCLUDED | Without VAT |

| If the amount of VAT is allocated in the payment amount, for example, Payment in the amount of 10,000.00 rubles, including VAT 1,800.00 rubles . | If you do not allocate or do not work with VAT or this payment is in no way related to VAT (for example, another tax), then you end up adding to the purpose of the payment - Without VAT or not subject to VAT . |

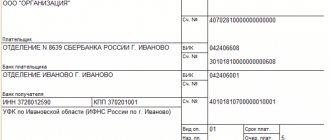

Payment purpose field in a payment order

All payment documents, including payment orders, must contain a clear statement of the nature of the transaction being carried out. To do this, the purpose of the payment is indicated in the payment order (clause 1.7.2 of Bank of Russia Regulation No. 579-P dated February 27, 2017).

Field 24 “Purpose of payment” is reserved for the description of the payment in the payment order. This is a required detail and the bank will not be able to process the payment without it. The law does not impose strict requirements for filling it out, but it should make it clear what exactly the funds are being transferred for. There may be several options:

- Payment of mandatory payments (taxes, fees, insurance premiums, penalties, fines, etc.).

- Transfer of salaries to employees.

- Transfer of funds to an accountable person for expenses.

- Payment of household needs.

- Transfer of funds to counterparties.

- Payment of income to founders.

- Payment for goods purchased, services provided or work performed.

- Transfer of funds to another account of an organization or individual entrepreneur.

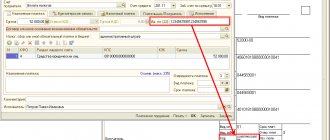

Depending on the basis for transferring funds, the purpose of the payment also changes. Let's consider what to write in field 24 for different types of payments.

When filling out field 24, you must keep it within 210 characters (Appendix 11 to the Procedure, approved by Bank of Russia Regulation No. 383-P dated June 19, 2012).

Tax

- It is necessary to indicate for which tax the payment is being made.

- Specify the period for which the tax is to be paid.

- Please provide your policyholder number or other additional information.

Example: Insurance contributions for compulsory pension insurance in a fixed amount for incomes over 300 rubles. for the 2nd quarter of 2021 Reg. No. 071-058-052397. Without VAT.

Example: Advance payment for the simplified tax system for 2021. Without VAT.

Example: VAT accrued based on the results of own activities for the 1st quarter of 2021. Without VAT.

Example: Corporate income tax (except for consolidated groups of taxpayers) based on the results of 2021, credited to the federal budget (payment amount - 100,000 rubles). Without VAT.

See also: Samples of payment orders in the Business Pack program and in Excel

Purpose of payment when paying contributions

When paying insurance premiums, the purpose of payment must indicate:

- type of insurance premium;

- the period for which contributions are paid;

- FSS registration number (only for contributions for “injuries”).

Here are examples of filling out field 24 when paying contributions for employees to compulsory health insurance, compulsory medical insurance, compulsory social insurance:

| Type of insurance premium | Example of filling out field 24 “Purpose of payment” | Sample of filling out a payment order |

| For pension insurance (at the Federal Tax Service) | “Insurance contributions for compulsory pension insurance for February 2021” | Sample payment order to the Pension Fund for contributions for employees in 2020 |

| For medical insurance (at the Federal Tax Service) | “Insurance premiums for compulsory health insurance for February 2021” | Sample payment order to compulsory medical insurance for contributions for employees in 2020 |

| In case of temporary disability and maternity (at the Federal Tax Service) | “Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for February 2021” | Payment order for VNiM contributions for employees in 2021 |

| For injuries (in the Social Insurance Fund) | “Insurance contributions to the Social Insurance Fund for compulsory social insurance against industrial accidents and occupational diseases for January 2021. Registration number in the FSS - 7712123453" | Payment order for injury contributions in 2021 |

Refill

An individual entrepreneur can replenish his account without any restrictions.

Example: Top up your account. Without VAT.

An organization cannot replenish an account without reason, unlike an individual entrepreneur.

For organizations, only the founder can replenish the account and only in one of the following ways: Contribute financial assistance; Make a contribution to the organization’s property; Make payment for goods/works (services); Apply for a loan; Top up the UK.

Example: Payment of funds under loan agreement No. 125 dated March 29, 2018 with the founder. Without VAT.

Example: Contribution of authorized capital to Romashka LLC from the founder Leonid Viktorovich Ivanov. Without VAT.

Payment for goods/services

- When paying for work, indicate the number and date of the contract (number and date of the invoice) on the basis of which the calculation is made.

- It is desirable that the payment amount be commensurate with the size and turnover of the company.

- Provide the numbers, names and dates of other documents justifying the operation of transferring funds - invoice number and date, work acceptance certificate number and date, invoice number, etc.

- Indicate for what goods, works/services you are transferring payment (Appendix No. 1 to the Central Bank Regulation No. 383-P dated June 19, 2012). If there are a lot of products, you can generalize or indicate the most expensive products from the list.

It will be suspicious for a bank if a small company buys expensive goods.

If a client orders expensive services or frequently, the bank has the right to request certificates of completed work and reports.

Banks can check purchased goods against the organization’s OKVED code, especially if such transactions occur frequently.

Example: Payment for repair work under contract No. 205-R dated March 29, 2018 and acceptance certificate No. 156 dated August 15, 2018. VAT excluded.

Example: Payment for construction materials under contract No. 205-R dated March 29, 2018 and invoice No. 156 dated August 15, 2018. Including VAT 3885.00 rubles.

Example: Payment for a Philips 123H2 coffee machine under agreement No. 205-R dated March 29, 2018. Without VAT.

Example: Advance payment for transport services on invoice No. 20 dated February 25, 2018. including VAT (18%) 3530.18 rubles.

General requirements for filling out the field

The rules for filling out a payment order are prescribed in the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P “On the rules for transferring funds.” The document does not have strict requirements for filling out the “Purpose of payment” field; the main condition is the maximum number of characters. The number of characters in the field, including spaces, must not exceed 210 characters.

If 210 characters are not enough to describe the purpose of the transfer, then the Bank of Russia allows abbreviations and generalizations that will not lead to distortion of information or the formation of an incorrect opinion. In other words, you can shorten it - but so that the essence is clear.

In addition, the Central Bank in the Regulations has created a list of details

, which are required to be decrypted when generating a payment document:

- purpose of payment;

- name of goods, works or services;

- number and date of contracts and other commodity documents, if any;

- other information necessary for identification;

- VAT amount.

The rules for filling out the “Purpose of payment” field differ depending on who is sending the transfer – an individual or a legal entity.

Rent

- When transferring payment for rent, indicate the date and number of the lease agreement.

- Be sure to indicate for what period you are making payments.

- It is recommended to indicate what type of rent you are paying for - real estate, transport, etc.

It will be suspicious for the bank if the rental amount is overstated. This can happen if you are transferring rent for several months.

Example: Rent for January 2021 under real estate lease agreement No. 1565 dated 08/21/2016. Without VAT.

Example: Rent for January 2021 under real estate lease agreement No. 1565 dated 08/21/2016. Including VAT 5548.00 rubles.

Accountable funds

- When transferring accountable funds to employees' bank cards, indicate this in the purpose of the payment.

- It is advisable to indicate for what purposes the money is transferred - for the purchase of goods, business trips, ordering services, etc.

A credit institution may request confirmation that personal income tax was paid on this money, since it will consider that these funds received are the employee’s income if the word “On account” is not indicated.

If large sums are transferred under the report or frequently, the bank may request supporting documents - reports, checks, etc.

Example: Transfer of funds to employee Ivan Leonidovich Petrov against a report for the purchase of goods. Without VAT.

What to write to companies and individual entrepreneurs when transferring money from account to account

There is little point for legal entities to come up with fancy language to please bankers. It is enough to briefly and clearly state in one phrase the reason for moving company funds from one account to another. See below for how such formulations might look.

Since strict rules have not been invented in this regard, each company has the right to fill out the “Purpose of payment” field at its own discretion.

Examples of payment purpose wording when transferring funds between your accounts:

Individual entrepreneurs have the right to do the same.

How to deposit money into the LLC current account, read the article

Many banks, when generating payment orders electronically, allow you not to fill out the “Purpose of payment” field at all if the transfer is made between client accounts.

The payment order for the payment of insurance premiums has its own nuances, which ConsultantPlus experts talk about in the ready-made solution “How to fill out the fields of the payment order for the payment of insurance premiums for compulsory medical insurance, compulsory medical insurance, VNIM and for injuries in the Social Insurance Fund.” If you don't already have access to the system, get a free trial online.

Payment for goods/services for another company

The purpose of the mandatory payment must include the name of the counterparty and the product/service for which the money is being transferred.

Sometimes banks require the purpose to indicate the basis for such a transfer. This could be a letter from a counterparty requesting a transfer of money. The original letter itself may also be requested by the bank.

Example: Payment for repair work under contract No. 205-R dated March 29, 2018 and acceptance certificate No. 156 dated August 15, 2018. Payment is made for the organization of Romashka LLC on the basis of letter No. 1532. Without VAT.

Example: Payment for construction materials under contract No. 205-R dated March 29, 2018 and invoice No. 156 dated August 15, 2018. Payment is made for the organization of Romashka LLC on the basis of letter No. 1532. Including VAT 3885.00 rubles.

Paying taxes for another company

It is impossible to return money transferred to the budget for another organization or individual!

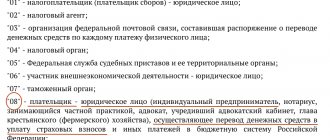

In the “Payer Status” field, indicate the status of the person for whom you are paying the tax. Enter in this field:

- 01 - if you pay tax for a company

- 09 - when you transfer tax for individual entrepreneurs

- 13 – for an individual

- 02 - for a tax agent

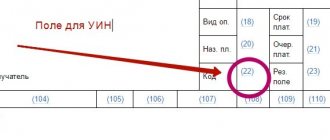

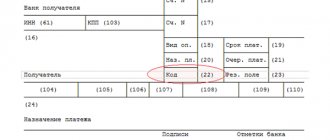

The TIN and KPP must be indicated to the organization/individual entrepreneur or individual for whom you are paying the tax. For individual entrepreneurs and individuals at the checkpoint, write “0”. If an individual does not have a tax identification number, then write “0”, but then in field 22 you need a UIN.

In the payer field, you must indicate the organization for which the tax is being transferred (Romashka LLC).

In the purpose of payment, it is necessary to indicate the INN of the checkpoint of the organization that actually pays the tax // the name of the organization for which they are paying (Romashka LLC) // and then the purpose.

Example: TIN 6165000000 KPP 616500000 // Romashka LLC // VAT accrued based on the results of its own activities for the 1st quarter of 2021. Without VAT.

Why deposit personal money into a current account?

Ivan registers as an individual entrepreneur and opens a coffee shop.

Nobody knows about the coffee shop - so far only random passers-by and friends drop by. It’s good that Ivan brews delicious coffee - people are starting to recommend it. But in the first month of work, expenses are still higher than income. It's time to pay the rent: Ivan replenishes his current account with personal money.

In six months, Ivan recoups half of his investment and even hires a barista. The barista convinces the entrepreneur that buying a new coffee machine is a smart move because the coffee will taste even better. And if you launch an advertising campaign, there will be a line in the coffee shop. Ivan agrees and again deposits cash into the checking account.

The barista was right: business is looking up. A year later, Ivan is already opening a second coffee shop and preparing documents to launch a franchise. But the renovation of a new premises and the services of a lawyer are expensive. There is not enough money in the current account, and the entrepreneur replenishes it again.

Ivan could have other reasons for replenishing: paying off debts to partners, settling accounts with employees, paying taxes and insurance premiums. It is important that Ivan makes all business-related expenses from his current account. If you purchase equipment, pay suppliers and pay salaries using a personal card, there will be no expenses on your current account. This is bad if you pay tax on profits: expenses from a personal card cannot be taken into account as business expenses - the tax will be higher. To avoid this, pay business expenses from the individual entrepreneur’s account.

Dividends

- It is necessary to indicate the minutes of the meeting of founders on the basis of which the payment is made.

- Indicate for what period dividends are paid and what part is paid.

A credit institution sometimes asks to pay 13% personal income tax on it simultaneously with the payment of dividends.

Example: Payment of 1/2 of the dividends for 3 months of 2018 based on the minutes of the meeting of founders No. 15 dated April 21, 2018 (personal income tax withheld). Without VAT.

Purpose of payment when paying dividends

Fill out the purpose of payment in the payment slip when paying dividends as follows:

- type of transaction (payment of dividends);

- details of the minutes of the shareholders meeting, on the basis of which funds are transferred.

For example: “Transfer of dividends according to the minutes of the shareholders meeting No. 5 dated 02/01/2020.”

If tax is paid on dividends paid, then in field 24 you need to indicate:

- type of tax paid (income tax if dividends are paid to an organization or personal income tax if to an individual);

- date of transfer of income.

For example: “Income tax for individuals on the income of the founder. The income payment date is February 4, 2021.”

Loan

Banks are always suspicious of any loans.

- Indicate the percentage (rate) at which you are issuing a loan.

- If you are issuing a loan in installments, indicate the total loan amount.

- It is very likely that you will immediately need to provide documents to justify the loan.

An interest-free loan makes banks more suspicious. Sometimes it’s better to even indicate at least a small bet.

Loan for 600 tr. and above be under special control of the bank.

Example: Issuance of funds under interest-bearing loan agreement No. 12 dated February 21, 2018 (15% per annum). The total amount under the loan agreement is 100,000 rubles. Without VAT.