09.07.2019

1

537

5 minutes.

When concluding an employment contract, the employer and employee fix the working hours. In most cases, we are talking about a forty-hour week, unless a rotation method is provided. When an employee, at the request of his superiors, overworks a certain number of hours, he has the right to receive monetary compensation or an additional day off for them. The features of providing the second are described in the article.

Labor Code of the Russian Federation

Employees have the opportunity to take time off for previously worked time:

- Who went to work on Saturday or Sunday.

- Worked on official holidays.

- We stayed late at work at the request of our manager. If the delay occurred on the initiative of the employee, the likelihood of realizing this opportunity is low.

- Who worked on days that were days off for them at an enterprise with a 24-hour or daily operating schedule.

It is also worth remembering that in the Labor Code of the Russian Federation there is no such thing as time off. It is used only in colloquial speech, but is absent from the official and legal sides. Instead, the Labor Code of the Russian Federation has another concept - a day of rest. This is stated in Article 153 of the Labor Code of the Russian Federation.

For your information

A day of rest is more of a compromise solution. If a person goes to work on a non-working day, he is required to pay him. But, from the employer’s point of view, providing an additional free day is much simpler and more convenient - in this case, the working day and the day off for previously worked hours are simply swapped.

Article 153 talks about the standards of remuneration during non-working hours - every employee who decides to take so-called time off must be familiar with it.

Features of time off for early hours worked

Delays at work due to production needs are a common occurrence. Sometimes management asks you to work a shift on a day off. By law, every hour of attendance on duty outside of the schedule must be compensated financially, and at a higher rate. This is not profitable for the employer, so an additional day off is often granted if a sufficient number of hours have been accumulated.

Employees who:

- They worked on Saturday or Sunday on a five-day schedule.

- You went to work on a holiday or your official day off.

- We stayed late at work at the request of management.

It is important to know! If a person, on his own initiative, decides to spend more time in the company, then it is difficult to achieve compensation.

An employee should first familiarize himself with the specifics of payment for overtime work and work on holidays. As a rule, the rate per hour is several times higher, therefore, it is more profitable for the employee to receive money rather than a day off. Management cannot deny this right, but will do everything to ensure that the employee prefers an additional day of rest.

How to write time off for previously worked time?

Article 153 of the Labor Code of the Russian Federation states that another day of rest can be provided only at the request of the employee - that is, no one can oblige him to this. The choice: another day off, or the monetary compensation is not paid by the employer.

If the decision is nevertheless made in favor of time off, it is important to follow three rules:

- You can choose only one type of compensation: money or a free day; it is impossible to demand both;

- According to the law, it is impossible to apply this sequence in practice: first not coming to work, and then working. You can only rest for the time that was devoted to work earlier;

- The employee is obliged to notify his superiors of his desire. It is impossible to not go to work and then formalize it - in this case, absence from work will be perceived as absenteeism.

Attention

If you want to take advantage of the right to time off, you must notify your superiors in advance and this must only be done in writing - a verbal agreement in this case is invalid.

The application should be submitted a few days before the desired day off, especially if it requires adjustments to the current work schedule. Only after the employer reads it and signs it, the day indicated in it will be considered a day off.

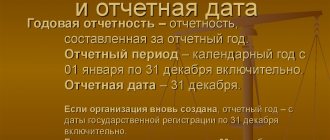

Rules for registration of the accounting sheet

If an employee is absent from work during the period of leave, it is important to correctly fill out the time sheet. This is usually carried out by the head of the department, who knows whether each employee was at his workplace during the working day.

When drawing up a time sheet, the day when the employee was on leave is indicated by the letters “РВ”. This indicates that the day of absence will be paid and the employee's earnings will be maintained.

The designation “RV” deciphers that the day of rest was unscheduled due to work on a weekend (holiday).

Application for time off

It is very simple to write an application for time off for previously worked time - the application form is standard. But, it is important not to forget that such a concept as “time off”, as mentioned above, does not exist in the legislation. That is why the application is written not for time off, but for an additional day off on account of previously worked time.

The application can be either handwritten or printed using a standard form used by the company. If there is none, here is a simple reminder:

- In the “header”, that is, in the upper right corner, it is necessary to indicate whose name is written, and then from whom, indicating the surname, initials of the name and patronymic, as well as the position held;

- Below, in the middle of the sheet, the word “Statement” is written in large letters;

- After that there is the main text: “Please provide me with a day off (the desired date is indicated) for the early hours worked (date of return to work)”;

- The employee's signature and date are placed in the lower right corner.

Features of payment for time off

How time off for previously worked time is paid is regulated by labor legislation and internal documents of the enterprise.

When processing

Payment of time off for overtime is 200%, i.e. The normal rate of payment is doubled. This applies to both hourly and piecework forms. However, it is worth considering that overtime for 3 hours on a regular working day will be charged according to two payment levels:

- 1 and 2 hours are paid at one and a half rates;

- After 2 hours of work, payment is double.

If the processing happened on a regular weekend or holiday, then the payment should be at least double the amount.

A special case is the payment of vacation pay. If vacation is not used, additional days off can be added to it.

Upon dismissal

A violation would be dismissal without payment of compensation. If there are no selected days off for previously worked time, then the employee must receive compensation payments in the standard amount.

If time off was planned at the end of the month, then the non-use of such days must be compensated with the same amounts that would have to be paid:

- 1.5 times in the first and second hour;

- at double rate for subsequent hours.

With a shift work schedule

A shift implies a certain amount of work. Therefore, this mode of operation requires compensation payments at the end of the month. They are paid at standard overtime rates.

Typical shift work hours are no more than 40 hours. If the employee counts more hours that were required to be worked, then the countdown of the increased tariff begins on a general basis.

For previously worked time

The employer is required to compensate paid time off in cash. As in other cases, a double factor is also applied here, that is, double the rate on a guaranteed day off or a slightly reduced rate for the first hours of overtime work on a regular day.

Procedure for provision

After the application is signed, the manager issues an order and gives it to the employee for review. As soon as the latter signs, his request is considered valid.

You also need to know: if an employee needs an additional day off, he does not have to work overtime to provide it - there are two other ways to get another day off, or even several, when you can solve all your business:

- Take a day off as paid vacation;

- Take a vacation at your own expense.

Let's take a closer look at these two options:

Time off towards vacation

After six months of work in the company, each employee is given 28 days of paid leave. You can use them either by using them all at once or by dividing them into several parts. The only rule that is important to follow in this case is to go on vacation once for at least 14 days. The remaining time can be used as you please.

To do this, you need to write a statement about your desire to take extraordinary paid leave, indicate from what date and for how many days. You can use it one day or take it for several days in a row.

Vacation at your own expense

If there are no vacation days left, or another six months have not passed since the date of registration with the company, you have the opportunity to take a vacation at your own expense at any time. It will not be paid - the salary will be deducted from the rate for those days that the person was absent.

The application is written in the same form, only the following must be written as the main text: “I ask you to grant me leave without pay from (indicate the start date of the leave) for (number of days) for the reason (indicate it).” Most often, the reason is simply “family reasons.”

The decision to provide leave at his own expense always remains with the employer. If an employee does not have a good reason why he cannot come to work, he may be denied time off.

There are only three reasons why leave without pay is mandatory:

- wedding;

- birth of a child;

- death of a relative.

Sometimes it is necessary to provide a document confirming the veracity of the reason specified in the application.

Salary for actual time worked

Wages are remuneration for an employee’s work, which depends on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed. In articles about time tracking or payroll, we often see “depends on the actual time worked.” But let's figure it out, actually worked time - what is it?

Actual time worked

Actual time worked is the time an employee performs his direct labor duties and work.

It is possible to determine a remuneration system in which wages are calculated for the time actually worked for employees whose work should be assessed based on the days or hours that they actually worked.

It can be:

- employees whose work is difficult to standardize or whose work cannot be accounted for (for example, management, administrative and managerial personnel);

- employees who do not influence the increase in production volume (for example, if the result of work is determined primarily by the productivity of equipment);

- workers whose labor productivity is difficult (impossible) to determine.

Payment for actual time worked

How to calculate an employee’s salary, is it possible to pay for the actual time worked with a salary? Let's take it in order.

There are 5 remuneration systems. The division of remuneration systems into certain types is quite conditional.

Thus, the remuneration system, in which the employee’s salary is calculated for the time actually worked, is called time-based.

In this case, the salary is determined based on a fixed tariff rate (hourly, daily or monthly). The time-based form of remuneration consists of a simple and bonus payment system.

In the time-bonus wage system, regular time-based earnings are combined with the payment of a bonus for achieving certain indicators.

With a simple time-based wage system for an employee, you can determine:

- tariff rate (hourly or daily);

- monthly salary.

If an employee has a daily or hourly wage rate, then wages should be calculated in proportion to the time actually worked by the employee using the formula:

- the volume of hours or days actually worked in a month must be multiplied by the hourly (daily) rate. We will receive a month's salary.

If an employee has a monthly salary, then the calculation will directly depend on whether he has worked out the month in full or not. If the month is worked in full, the salary does not depend on the number of working days or hours that are obtained for the month according to the schedule. In this case, the salary is always equal to the monthly salary (tariff rate): the monthly salary is equal to the monthly salary.

If the month is not fully worked out, then the salary should be calculated based on the time actually worked by the employee. We use the formula:

- the number of days or hours actually worked in the month for which we calculate the salary must be multiplied by the daily or hourly tariff rate. This will be your monthly salary.

To calculate the daily or hourly rate, the monthly salary must be divided by the standard number of days or hours of work according to the production calendar for the corresponding month. We receive a daily or hourly tariff rate.

Example:

The seller Petrova's work shift is 9 hours. She works every other day, so in August she will have 16 shifts. The total number of hours worked is 144.

Wages are set hourly and amount to 120 rubles per hour. That is, on the day of Petrov, provided he works a full shift, he receives 1,080 rubles. (120 rubles x 9 hours).

Accordingly, her monthly earnings will be 17,280 rubles. (RUB 1,080 x 16 shifts).

If Petrova, for some reason, did not work one full shift, for example, 6 hours, or did not show up for a particular shift, asking for it to be postponed, for example, to September, then the salary is reduced accordingly.

Employment contract (example)

The remuneration system can be determined for an individual specific employee, for several employees, or for the entire staff of employees. The choice of a remuneration system in any case must be economically justified, correspond to the economic characteristics of the organization, and contribute to the activities of the organization.

The remuneration system should be fixed in a collective agreement or other local regulation. It is not necessary to specify the remuneration system in the employment contract. It can contain a link to a document that sets out the company’s current remuneration system (for example, the Regulations on the remuneration of employees).

Source: https://spmag.ru/articles/zarabotnaya-plata-za-fakticheski-otrabotannoe-vremya

How is time off paid for time previously worked?

If an employee decides to choose an additional day off instead of paying for overtime, he will not be paid, as mentioned above. The employee will receive money only for the days worked: that is, for the time that he went out or stayed extra. Roughly speaking, the days are simply swapped; this does not affect payment in any way.

In the case where the time off was taken as vacation pay, payment for it is made in accordance with the vacation pay that will be accrued. In accounting, special formulas are used for this.

Days off taken at your own expense are not paid. The employee himself takes responsibility for this.

Payment

An employee performing duties on a day off has the right to receive a day for rest or payment.

These rules are specified in the country's Labor Code, in article 153.3. If the employee chooses time off, the time is not paid. As a result, no paid time off will be provided. Output is accrued except for the time when the employee is released from duties. The monthly salary is calculated taking into account the day of rest. It doesn’t matter when the employee wanted to register it. Taking into account the provisions of Article 13 of the Labor Code of the Russian Federation, the amount of payment for a day off is determined:

- contracts;

- acts;

- internal regulations.

Acts must be considered at a general working meeting. They are confirmed by the trade union organization of the company.

You can initially provide for remuneration for work performed on holidays or weekends. This is done when hiring. The smallest available amount of labor payments is adjusted based on the above acts.

Important: payment of a day of rest in a single amount is a payment on top of the regulated salary. The entire amount must be paid.

Deadlines

The Russian Labor Code does not say when a person should use time off for previously worked time - the choice is completely left to him. In fact, you can use it several months after unscheduled working hours or days.

The only exception to this can be the case if the deadlines for their provision are stipulated in the internal regulations of the company, with which the employee was familiarized with when hired, or to which he signed, if the regulations were updated during the work process.

The number of days or hours of leave is directly proportional to the number of days or hours during which the employee was present at the workplace.

What the law says

Time off for previously worked time is provided to the employee based on his application. If the authorities approve it, an order is issued. Issues related to overtime hours are taken into account in paragraphs 152-153 of the current Labor Code.

There are rules according to which an employee is paid for additional work. But they are also established in accordance with the instructions of Article 152 of the Labor Code of the Russian Federation.

- For the first two hours, overtime pay increases 1.5 times, and for the rest of the time worked, the payment is doubled.

- The amount of monetary compensation can be negotiated based on the provisions of the contract. The nuances and conditions for calculating compensation can be taken into account in the employment agreement.

- Additional rest days are measured according to hours worked.

Each employee chooses the type of compensation himself.

This right is granted on the basis of the instructions of the Labor Code, so the employer does not have the opportunity to determine this independently. Important: when a task needs to be completed, the employer negotiates with the employee the type of compensation. There is only one type of compensation for overtime hours.

Time off for previously worked time in the report card

The work process, taking into account weekends, vacation days, absenteeism and business trips, is recorded in a special table - a working time sheet. This is the main document used in accounting to calculate payroll. That is why the accuracy of the reflection of real data for drawing up a report card is very important.

In the table, each concept has its own designation:

- If an employee has been granted time off, this is reflected in the report card with the letters “OV”;

- In the case where additional days off were taken on account of paid leave, “FROM” is indicated;

- If the employee took several days at his own expense, the letters “TO” are entered in the timesheet.