VAT restoration during reorganization

If the legal successor works under the general regime and receives during the reorganization the technical and technical services that the previously reorganized company took into account in VAT deductions, then nothing needs to be restored.

If the successor organization received technical and technical information from the reorganized company and will use these technical and technical information either in other activities that are not subject to taxation, or in other activities that are not subject to VAT, then it must necessarily restore the VAT that was declared. deductible, and VAT of the reorganized company (clause 3.1 of Article 170 of the Tax Code of the Russian Federation).

Therefore, during the reorganization, the successor must first of all figure out whether the reorganized company has claimed a deduction, as well as where the GWS will be sent, and into what activity - taxable or not subject to VAT.

According to the changes, the restoration of tax amounts by the legal successor is carried out on the basis of invoices issued to such an organization and attached to the transfer deed or separation balance sheet, based on the value of the transferred goods (work, services), property rights indicated in them, and in relation to the transferred fixed assets and intangible assets - in an amount proportional to the residual (book) value without taking into account revaluation.

Submission of any types of reports to all regulatory authorities: Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, Rosstat, RAR, RPN.

To learn more

If there are no invoices, then the restoration of tax amounts is carried out by the legal successor on the basis of an accounting certificate-calculation using the tax rates in force at the time of acquisition of goods and services, property rights, fixed assets by the specified organization, to the cost of goods and services, property rights, and in relation to fixed assets and intangible assets - in an amount proportional to the residual (book) value without taking into account the revaluation specified in the transfer act or separation balance sheet.

Reinstatement of VAT in cases not directly provided for by the Tax Code of the Russian Federation

There are a number of controversial situations related to the restoration of VAT. Let's look at them.

1. Write-off of under-depreciated fixed assets.

The procedure for writing off under-depreciated fixed assets is established in Section. VI Methodological guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n (subject to subsequent amendments).

According to paragraphs. 8 clause 1 art. 265 of the Tax Code of the Russian Federation, expenses for the liquidation of fixed assets being decommissioned, including amounts not accrued in accordance with the established useful life of depreciation, as well as expenses for the liquidation of unfinished construction projects and other property, the installation of which has not been completed (expenses for dismantling, disassembly, removal of disassembled property), subsoil protection and other similar work are included in non-operating expenses not related to production and sales.

From January 1, 2009, expenses in the form of amounts of underaccrued depreciation are included in non-operating expenses only for depreciable property items for which depreciation is calculated using the straight-line method.

In addition, from January 1, 2009, in a similar manner, the organization has the right to include in non-operating expenses the costs of writing off intangible assets, including under-depreciated cost, if depreciation was calculated using the straight-line method.

According to the opinion of the Ministry of Finance of Russia, set out in Letters dated January 29, 2009 N 03-07-11/22, dated November 22, 2007 N 03-07-11/579 and dated December 7, 2007 N 03-07-11/617, the organization must, when write-off, restore the amount of VAT previously accepted for deduction in the part attributable to the residual value according to accounting data, without taking into account revaluation.

Recovered VAT amount based on paragraphs. 2 p. 3 art. 170 of the Tax Code of the Russian Federation is taken into account as part of other expenses in accordance with Art. 264 Tax Code of the Russian Federation.

The courts do not support the position of the Ministry of Finance (Definitions of the Supreme Arbitration Court of the Russian Federation dated January 29, 2010 N VAS-17594/08, dated November 5, 2009 N VAS-13991/09, Resolutions of the Federal Antimonopoly Service of the West Siberian District dated December 15, 2009 N A45-4004/2009, dated 06/08/2009 N F04-3363/2009 (8255-A45-34, FAS Moscow District dated 11/19/2009 N KA-A40/12329-09).

Considering the case of the FAS Moscow District dated November 19, 2009 N KA-A40/12329-09, the court took into account the Decision of the Supreme Arbitration Court of the Russian Federation dated October 23, 2006 N 10652/06, which declared para. Section 13 “For the purpose of applying Article 171 of the Tax Code of the Russian Federation” Appendix to the Letter of the Federal Tax Service of Russia dated October 19, 2005 N MM-6-03/ [email protected]

This paragraph contains explanations that the amounts of tax accepted by the taxpayer for deduction in accordance with Art. Art. 171 and 172 of the Tax Code of the Russian Federation on goods (work, services), including fixed assets and intangible assets acquired to carry out operations recognized as objects of taxation in accordance with Chapter. 21 of the Tax Code of the Russian Federation, but not used for these operations, must be restored and paid to the budget.

2. Write-off of property due to shortages identified during inventory, fire, theft, etc.

The Letter of the Ministry of Finance of Russia dated May 15, 2008 N 03-07-11/194 states the following.

Disposal of property for reasons not related to sale, in particular as a result of a fire, on the basis of the provisions of Art. Art. 39 and 146 of the Tax Code of the Russian Federation is not subject to VAT. Therefore, tax amounts on such property are not subject to deductions.

In this regard, the amounts of VAT previously accepted for deduction on goods lost as a result of the fire, including fixed assets, should be restored. In this case, for fixed assets, tax amounts are subject to restoration in the amount of amounts proportional to the residual (book) value of fixed assets without taking into account revaluation.

The Supreme Arbitration Court of the Russian Federation objected to the Ministry of Finance. In the above-mentioned Decision of the Supreme Arbitration Court of the Russian Federation dated October 23, 2006 N 10652/06, the Court recognized the provisions contained in paragraph. Section 13 “For the purpose of applying Article 171 of the Tax Code of the Russian Federation” of the Appendix to the Letter of the Federal Tax Service of Russia dated October 19, 2005 N MM-6-03 / [email protected] , ineffective. In this case, the Court proceeded from the following.

Clause 3 of Art. 170 of the Tax Code of the Russian Federation provides for cases in which tax amounts accepted for deduction by the taxpayer on goods (work, services), including fixed assets and intangible assets, property rights, are subject to restoration.

A shortage of goods discovered during the inventory of property, or the theft of goods, is among the cases listed in clause 3 of Art. 170 of the Tax Code of the Russian Federation do not apply.

Thus, the contested paragraph of the Appendix to the said Letter of the Federal Tax Service of Russia contains a rule imposing on taxpayers the obligation to contribute to the budget the amounts of VAT previously accepted for offset, which is not provided for by the Tax Code of the Russian Federation.

An interesting clarification was issued by the Russian Ministry of Finance on the issue of recovering VAT paid at customs when a foreign supplier provides a discount after customs clearance.

Specialists from the financial department explained that if the provision of a discount by a foreign supplier does not reduce the customs value of goods imported into the territory of the Russian Federation and, accordingly, the amount of VAT payable to the customs authority, then the restoration of VAT amounts accepted for deduction in connection with the receipt of such a discount is not made ( Letter dated 06/04/2008 N 03-07-08/141).

Restoration of VAT upon transition to UTII

The changes, which will come into force on January 1, 2021, will allow companies and individual entrepreneurs to reduce recoverable VAT amounts. But to do this, they will need to carefully maintain separate records.

Thus, taxpayers who, after the transition to UTII, will continue to pay VAT (for other types of activities), can restore VAT only after they begin to use the corresponding GWS, fixed assets or intangible assets in the activities transferred to UTII.

According to the new edition of paragraphs. 2 p. 3 art. 170 of the Tax Code of the Russian Federation, the tax in this case is restored in the period when the taxpayer began to use these objects in the specified manner.

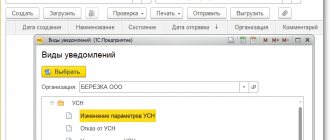

How the changes will affect accounting policies

The changes will affect separate accounting of both taxable and non-VAT-taxable transactions. Therefore, it is important to look at what is registered specifically for you, whether you have separate accounting.

If you are a legal successor or an organization that combines “imputation” with the general taxation regime, then separate accounting must be mandatory. And it needs to be written down in the accounting policy. It is important to determine what non-VAT-taxable transactions are, how the proportion for the distribution of input VAT is calculated, and how to maintain separate accounting.

Thanks to separate accounting, it will be possible to determine at what point it is better to classify an object as an activity subject to UTII in order to easily restore VAT in the most appropriate period.

Recovery from issued prepayments

Consumers can use the amount of value added tax on the prepayment issued as a deduction when calculating VAT. To do this, you need to fulfill several requirements:

- have an invoice for prepayment issued by the seller;

- make a note in the purchase book;

- payment must be made.

The amount of the deposit payment is used in the deduction in the period when the transfer was made.

In the tax period when the products were received and entered into the warehouse, the tax is restored in the amount of the deposit payment. You can then use the deduction based on the delivery invoice for the specific delivery note.

Changes to VAT for exports and a new list of documents to confirm the zero rate

These changes come into effect on April 1, 2021. They will affect those who declare a zero rate and export. According to the changes, the list of documents that need to confirm this zero rate is changing.

For international postal shipments or for express cargo, a customs declaration register is added to the list of documents. It is maintained electronically. This register will need to be included in the package of documents that are collected to confirm the zero rate. Without it, the package of documents will be incomplete, and tax authorities can easily refuse to apply the zero rate.

Elena Strokova, 3rd class adviser to the State Civil Service of the Russian Federation, expert consultant on taxes and accounting, tells more about the changes:

What is said in paragraph 4 of Art. 170 of the Tax Code of the Russian Federation?

In paragraph 4 of Art. 170 of the Tax Code of the Russian Federation deals with the issues of assigning VAT to one or another category, which depends on the type of VAT taxation applied.

Thus, this norm provides for the following operations:

- free from VAT - the tax is included in the price (clause 2 of Article 170 of the Tax Code of the Russian Federation);

- subject to VAT - a deduction is applied (Article 172);

- combined - VAT categories are used in proportion depending on the scheme recorded by the company in the accounting policy, which must take into account the provisions of clause 4.1.

A company will not be able to deduct tax and include it in expenses if it is not accounted for by taxation categories (letter of the Ministry of Finance dated November 11, 2009 No. 03-07-11/296). A company may not divide VAT into categories if transactions that do not include VAT amount to 5% of the total amount of its expenses (Letter of the Ministry of Finance dated December 29, 2008 No. 03-07-11/387). Then the entire tax is deductible (Article 172 of the Tax Code of the Russian Federation).

To ensure comparability of indicators, VAT should be excluded from them. The procedure for calculating expenses under the Tax Code of the Russian Federation is not given, so the company needs to include in its accounting policy a provision on assessing expenses and calculating 5%.

Read about separate accounting in the article “The Ministry of Finance has clarified how to calculate the proportion for separate accounting of “input” VAT .

Clarification of the procedure for deducting VAT on intangible assets

The changes will take effect from January 1, 2021. It is necessary to pay attention to the new editions of clause 6 of Art. 171 and paragraph 1 of Art. 172 of the Tax Code of the Russian Federation.

In the case of the creation of intangible assets, deductions of tax amounts presented to the taxpayer upon acquisition of GWS, property rights, or actually paid by him when importing goods into the territory of the Russian Federation for the creation of such intangible assets, can be accepted after registration of the corresponding GWS, property rights.

Sign up for webinars and online courses on accounting and taxation to stay up to date with important changes.

To learn more

Recovering VAT from prepayment

If advance payments have been made, the consumer can take advantage of the VAT deduction, and the seller can pay tax on the advance payment received. The basis for the seller and consumer to purchase such opportunities will be an invoice, which is issued for prepayment.

An invoice is issued for the amount of payment. When the product is shipped, the consumer and the seller have their amounts restored.

In cases where the taxpayer does not determine the amount of tax to be deducted, it does not need to be restored.

New VAT benefits for civil aviation in 2021

Amendments to Ch. 21 of the Tax Code of the Russian Federation, which was introduced by Federal Law No. 324-FZ of September 29, 2019, expanded VAT benefits. They come into effect on January 1, 2021.

Thus, a zero VAT rate is established for the import into Russia of civil aircraft subject to registration in the State Register of Civil Aircraft of the Russian Federation, and aircraft engines, spare parts and components used for the construction, repair and modernization of civil aircraft on the territory of Russia (Article 150 of the Tax Code of the Russian Federation) .

A number of transactions related to civil aviation are also exempt from VAT:

- for the sale of civil aircraft registered in the State Register of Civil Aircraft of the Russian Federation;

- for the transfer or leasing of civil aircraft registered (subject to registration) in the State Register of Civil Aircraft of the Russian Federation;

- for the sale of aircraft engines, spare parts and components used for the construction, repair and modernization of civil aircraft in Russia.

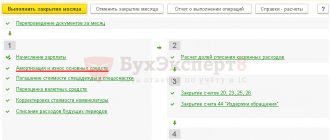

When should VAT be restored?

Cases when it is necessary to restore VAT are prescribed in Article 170 of the Tax Code of the Russian Federation (clause 3).

For example, it is necessary to restore VAT if materials are purchased during the period of application of the general regime, and are used after the transition, for example, to a simplified regime (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation). In this case, the company is obliged to restore VAT in the last tax period before applying the special regime. The restored VAT must be “added” to the calculated one, reflecting it on page 080 of section 3 of the VAT return for the fourth quarter of the year preceding the year in which you switched to the “simplified tax”.

We have combined all the situations in which VAT should be restored in the table.

| Situation | Link to the Tax Code of the Russian Federation |

| Property, property rights, intangible assets (IMA) are transferred as a contribution to the authorized capital of another company | Subclause 1 of clause 3 of Article 170 of the Tax Code of the Russian Federation |

| Goods (works, services), incl. fixed assets, intangible assets are subsequently used in the operations specified in clause 2 of Art. 170 Tax Code of the Russian Federation | Subclause 2 of clause 3 of Article 170 of the Tax Code of the Russian Federation |

| Fixed assets, intangible assets and other property are transferred to the legal successor during the reorganization of the legal entity | Subclause 2 of clause 3 of Article 170 of the Tax Code of the Russian Federation |

| Property is transferred to a participant in a simple partnership agreement when his share is allocated from the common property of the parties to the agreement, or when it is divided | Subclause 2 of clause 3 of Article 170 of the Tax Code of the Russian Federation |

| The buyer transfers payment, including partial payment for future deliveries of goods (work, services) | Subclause 3 of clause 3 of Article 170 of the Tax Code of the Russian Federation |

| If the price of previously shipped goods (works, services) changes downwards | Subclause 4 of clause 3 of Article 170 of the Tax Code of the Russian Federation |

| When receiving subsidies from the federal budget to reimburse the costs of paying for purchased goods (works, services), including VAT, as well as for paying tax when importing goods into the territory of the Russian Federation | Subclause 6 of clause 3 of Article 170 of the Tax Code of the Russian Federation |

It is necessary to restore VAT only in the above cases and this list is closed. However, in practice, tax authorities often oblige companies to restore taxes in other cases. For example, when liquidating a fixed asset before the end of its depreciation period (letter of the Ministry of Finance of the Russian Federation dated March 18, 2011 No. 03-07-11/61).

But in such situations, the company can challenge the actions of the tax authorities in court. Arbitration practice on such issues is in favor of taxpayers.

Other recovery cases

VAT should be restored in several more cases.

1.

If a company has transferred an advance to the seller, it can deduct the VAT paid as part of the advance. At the time of shipment and receipt of an invoice from the seller, the company deducts VAT on the purchased goods. And VAT, offset when paying the advance, is restored.

Please note: from October 1, 2014, a rule has been in force according to which the amounts of VAT accepted for deduction in relation to the advance payment should be restored in the amount related to the goods shipped (work performed, services rendered, transferred property rights), in payment of which the amounts are subject to offset advance That is, if the seller shipped the goods for an amount less than the advance received, the buyer is obliged to recover VAT only in the amount indicated on the shipment invoice.

2.

If the company transferred an advance to the supplier, accepted VAT for deduction, and then terminated the contract (and the seller returned the advance), then the tax should also be restored. In addition, VAT, according to the Ministry of Finance, will have to be restored even if the customer writes off the receivables in the form of an advance paid to the contractor for work not completed by him (letter of the Ministry of Finance of the Russian Federation dated January 23, 2015 No. 03-07- 11/69652, dated April 11, 2014 No. 03-07-11/16527).

3.

If after the purchase the cost of purchased goods (works, services) has decreased, then VAT must be restored in the amount of the difference between the tax amounts on the cost of purchased goods before and after the reduction. In this case, VAT is restored during the period of receipt of either primary documents for changes in the cost of purchased goods or an adjustment invoice (depending on what happened earlier).

4.

If a company is provided with subsidies from the federal budget to reimburse the costs of paying for purchased goods (work, services), including tax, as well as to reimburse the costs of paying tax upon import, then VAT is restored during the period of provision of subsidies.

5.

If the company began to use the purchased (built) property in operations not subject to VAT, then the tax is restored within 10 years, starting from the year in which the accrual of tax depreciation began.

A similar rule applies to reconstructed (modernized) real estate properties. In this case, VAT is restored for 10 years, starting from the year in which tax depreciation began to be calculated on the changed value of the object.

note

From January 1, 2015, the norm on the restoration of VAT on goods (works, services) that are used in transactions at a rate of 0% was excluded from the Tax Code (clause 5, clause 3, article 170 of the Tax Code of the Russian Federation).

This norm ordered taxpayers to restore previously deductible VAT in the event of further use of goods (work, services) in sales operations subject to VAT at a zero rate in accordance with paragraph 1 of Article 164 of the Tax Code. The tax had to be restored in the period in which the goods were shipped (work performed, services provided). Let us recall that in this norm, among the operations taxed at a zero VAT rate, the sale of goods for export, services for the international transportation of goods, work (services) for the processing of goods placed under the customs procedure of processing on the customs territory, services for the provision of railway rolling stock are named and (or) containers, as well as transport and forwarding services, services for transporting passengers and luggage, etc.

Results

Line 090 of Section 3 of the VAT return reflects the restored amounts of VAT previously accepted for deduction when transferring an advance to the supplier and receiving an invoice from him. VAT previously accepted for deduction on advances is restored in the following cases:

- when there was a change in conditions (or termination of the contract) and the return of the previously transferred advance;

- upon receipt of goods (performance of work, provision of services, transfer of property rights).

In accounting, the VAT recovery is reflected by reverse posting: Dt 76/VA Kt 68/02.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.