Regulatory regulation

Toll processing is the performance of work on the production of products from the customer’s material under a contract (Article 702, Article 713 of the Civil Code of the Russian Federation).

BOO. When transferred for processing, there is no transfer of ownership: the materials continue to be accounted for on the customer’s balance sheet. For the processor, they are reflected in off-balance sheet account 003 “Materials accepted for processing” (clause 156 of the Guidelines for accounting for inventories, approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n, Chart of Accounts 1C).

Income and expenses from processing work are related to income and expenses for ordinary activities (clause 5 of PBU 9/99, clause 5 of PBU 10/99.).

WELL. The contractor’s revenue from performing work on processing the customer’s raw materials (materials) is income from sales (clause 1 of Article 248 of the Tax Code of the Russian Federation).

VAT. The transfer of raw materials to the processor is not a sale to the customer and is not subject to VAT (Article 38, Article 146 of the Tax Code of the Russian Federation).

The implementation of processing work by the contractor is subject to VAT (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation, clause 5, article 154 of the Tax Code of the Russian Federation).

Documenting

When transferring materials for processing to the contractor, issue an invoice in form No. M-15. In the documents, indicate that the materials were transferred for processing on a toll basis.

After processing the materials, the performing organization must submit the following documents:

- invoice in form No. M-15;

- report on the consumption of materials (clause 1 of article 713 of the Civil Code of the Russian Federation). This document must contain information about materials received and not used for production, the quantity and range of materials (products) received. It also indicates how much waste was received, including returnable waste. The surplus must be returned to the seller, unless otherwise provided by the contract;

- act of acceptance and transfer of work for the cost of processing work (Article 720 of the Civil Code of the Russian Federation).

When receiving materials from processing, the customer must issue a receipt order (Form No. M-4). If finished products are obtained as a result of processing materials, issue an invoice for the transfer of finished products to storage locations (Form No. MX-18).

Step-by-step instruction

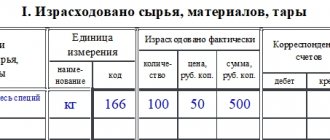

On September 02, the Organization received from the customer STROITEL LLC raw materials for the manufacture of products:

- edged board 5 cubic meters at a price of 6,000 rubles, in the amount of 30,000 rubles.

On September 12, the Organization manufactured the following products:

- street bench 100 pcs.

On September 13, the Organization handed over to the customer:

- finished products,

- certificate of completion of work in the amount of 120,000 rubles. (including VAT 20%).

On September 30, the salary of an employee engaged in processing work was accrued in the amount of 20,000 rubles.

On September 30, depreciation of fixed assets used in processing was accrued in the amount of RUB 5,208.33.

The Organization's accounting policy stipulates that the calculation of the cost of products (work) is carried out using planned prices. The planned cost of work on the manufacture of benches has been approved:

- 300 rub. - per unit products.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Receipt of materials for processing | |||||||

| 02 September | 003.01 | — | 30 000 | Receipt of materials from the customer for processing | Receipt (act, invoice) - Materials for processing | ||

| Write-off of materials for production | |||||||

| 03 September | 003.02 | 003.01 | 30 000 | Write-off of materials for production | Request-invoice | ||

| Production of finished products | |||||||

| 12-th of September | 20.02 | 20.01 | 30 000 | 30 000 | 30 000 | Release of finished products at planned cost | Shift production report |

| Receipt of finished products | |||||||

| 12-th of September | 002 | — | 30 000 | Transfer of finished products to the warehouse | Manual entry - Operation | ||

| Transfer of products to the customer | |||||||

| September 13 | — | — | — | Transfer of finished products to the customer | Transfer of goods - Transfer of products to the customer | ||

| — | 002 | 30 000 | Write-off of finished products from warehouse | Manual entry - Operation | |||

| Implementation of processing work | |||||||

| September 13 | 62.01 | 90.01.1 | 120 000 | 120 000 | 100 000 | Proceeds from the sale of work | Sales of processing services |

| 90.02.1 | 20.02 | 30 000 | 30 000 | 30 000 | Write-off of the planned cost of work | ||

| — | 003.02 | 30 000 | Write-off of customer materials from accounting | ||||

| 90.03 | 68.02 | 20 000 | VAT accrual on revenue | ||||

| Submission of the SF for the implementation of work | |||||||

| September 13 | — | — | 120 000 | Drawing up an invoice for shipment | Invoice issued for sales | ||

| — | — | 20 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Calculation of wages and insurance premiums | |||||||

| September 30th | 20.01 | 70 | 20 000 | 20 000 | 20 000 | Payroll | Payroll |

| 70 | 68.01 | 2 600 | 2 600 | Withholding personal income tax | |||

| 20.01 | 69.01 | 580 | 580 | Calculation of contributions to the Social Insurance Fund | |||

| 20.01 | 69.03.1 | 1 020 | 1 020 | Calculation of contributions to the FFOMS | |||

| 20.01 | 69.11 | 40 | 40 | Calculation of contributions to NS and PP | |||

| 20.01 | 69.02.7 | 4 400 | 4 400 | Calculation of contributions to the Pension Fund | |||

| Depreciation calculation | |||||||

| September 30th | 20.01 | 02.01 | 5 208,33 | 5 208,33 | 5 208,33 | Depreciation calculation | Closing the month - Depreciation and wear and tear of fixed assets |

| Adjustment of the cost of processing materials supplied by the supplier | |||||||

| September 30th | 20.02 | 20.01 | 1 248,33 | 1 248,33 | 1 248,33 | Adjustment of the cost of work performed | Closing the month - Closing accounts 20, 23, 25, 26 |

| 90.02.1 | 20.02 | 1 248,33 | 1 248,33 | 1 248,33 | Adjustment of the cost of work performed | ||

Rules for recording transactions with DS from the customer and contractor

The main feature of accounting for such operations is that these same raw materials/materials are not transferred into the ownership (on the balance sheet) of the contractor - therefore, they are taken into account by him in off-balance sheet account 003 (Article 156–157 of the order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n) .

This means that the customer himself does not write off the DS from the balance sheet, but transfers it to a special subaccount 7 of analytical accounting, opened to account 10 (Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). Accordingly, the ownership of the finished product produced by the contractor from the DS also remains with the processing customer (clause 1 of article 220 and clause 2 of article 703 of the Civil Code of the Russian Federation). This determines:

- The customer has the fact that the fact of transfer of DS for processing in tax accounting (under OSN and simplified taxation system) is not shown. The cost of processing services is subsequently included in material costs, and for the OSN - at the time the processor signs the report, and for the simplified tax system - after payment for the services of the contractor. The cost of the DS transferred for processing is written off by the customer in the amount indicated by the processor in its report on the consumption of raw materials (clause 1 of Article 713 of the Civil Code of the Russian Federation).

- The contractor has the fact that he accepts the DS into off-balance sheet account 003 at the cost specified in the processing agreement. If the contract does not indicate the price of the transferred materials/raw materials, then the processor can keep records in conventional units of cost.

The accounting features of the contractor are also determined by the fact that he:

- Opening an off-balance account is necessary for timely control of the availability and movement of financial assets.

- Finished products that were produced from the DS are also recorded in the off-balance sheet account. It is accepted for storage and accounted for at a conditional price. Accounting is carried out by quantity and amount. It is necessary to organize analytical accounting of DS by customer, by type of DS and by their location.

- The fact of receipt of DS from the customer is not reflected in tax accounting, and finished products manufactured for the supplier are also not taken into account.

- The cost of work performed is recognized as revenue from sales, and the date of reflection of this fact in accounting for taxpayers on the OSN is the date the customer signs the report, and on the simplified tax system - the date of receipt of payment from him.

You will learn about how accounting is carried out using off-balance sheet accounts in our article “Rules for maintaining accounting on off-balance sheet accounts”.

In the case of transfer to the customer of semi-finished products obtained as a result of processing of DS, which require further refinement at the customer’s place, they are accounted for by the customer on account 21 or on a separate sub-account to account 10 at the actual price, which is determined by calculating all costs incurred (clause 5 , 7 PBU 5/01, approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n).

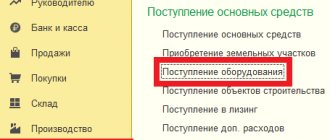

Receipt of materials for processing

Register the receipt of raw materials from the customer with the document Receipt (act, invoice) operation type Materials for processing in the section Production - Processing - Receipt for processing - Create button (or section Purchases - Purchases - Receipts (acts, invoices) - Receipt - Materials for processing button) .

Indicate in the header of the document:

- Counterparty - customer under the processing agreement, selected from the Counterparties directory;

- Agreement - agreement with the customer: Type of agreement - With the buyer .

Specify on the Products :

- Nomenclature - the name of the received materials, selected from the Nomenclature directory;

- Amount - the cost of materials indicated in the transfer document (in our example - 6,000 rubles);

- Accounting account - 003.01 “Materials in warehouse”.

Postings according to the document

The document generates the posting:

- Dt 003.01 - reflection of customer-supplied materials on the balance sheet.

Display of processing company services

In the process of using customer-supplied raw materials and performing various works, the processor incurs its own costs, which include the price of its own inventory, depreciation, staff salaries and other expenses. These costs are subject to VAT and are recorded in the debit and credit of certain accounts. The customer's raw materials used are not included in the costs.

Accounting for materials or raw materials received from the customer-vendor is carried out in 1C 8.3 on the basis of the following documents:

- “Receipt order” - a special document about the receipt of services and inventory items, which displays the receipt of raw materials from the customer-vendor.

- “Requirements-invoice” document, which reflects the fact of transfer of raw materials to the customer-supplier for processing, etc.

- A document on the provision of services is drawn up in the form of an Act, which displays the entire process of processing and use of customer-supplied raw materials to fulfill the order.

- “Consignment note” - a document confirming the return of products to the customer indicating information about the return of unused raw materials.

Next, to obtain the value of actual costs, it is necessary to calculate depreciation of equipment, wages to employees and close the month.

Write-off of materials for production

Reflect the transfer of materials to production with the document Requirement-invoice in the section Production - Production - Requirements-invoices - Create button (or Warehouse - Warehouse - Requirements-invoices - Create button).

Indicate in the header of the document:

- Warehouse - a warehouse from which materials are transferred.

Specify on the Customer Materials :

- Customer - the customer under the processing agreement, selected from the Counterparties directory.

Indicate in the table section:

- Nomenclature - transferred materials, selected from the Nomenclature directory;

- Accounting account - 003.01 “Materials in warehouse”;

- Transfer account - 003.02 “ Materials transferred to production.”

Postings according to the document

The document generates the posting:

- Dt 003.02 Kt 003.01 - transfer of customer-supplied materials to production.

Production of finished products

Reflect the production output from the customer's materials using the document Production Report for a Shift in the section Production - Product Output - Production Reports for a Shift - Create button.

Indicate in the header of the document:

- Cost account - 20.01 “Main production”;

- Warehouse - a warehouse where customer materials are stored.

Specify on the Products :

- Products - products made from customer materials are selected from the Nomenclature directory (in our example - Street Bench ): Type of nomenclature - Products .

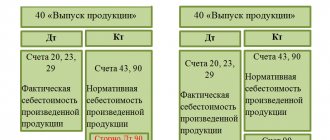

Postings according to the document

The document generates the posting:

- Dt 20.02 Kt 20.01 - the costs of production are reflected at the planned cost.

simplified tax system

If an organization applies a simplification and pays a single tax on the difference between income and expenses, take into account the costs of processing raw materials on a toll basis as part of material expenses (subclause 5, clause 1, clause 2, article 346.16, subclause 6, clause 1, art. 254 of the Tax Code of the Russian Federation).

Work on processing materials must be taken into account if two conditions are met: they are paid for and accepted from the contractor. Please include the cost of recyclable materials in your expenses at the time of payment. Such rules are established by subparagraph 1 of paragraph 2 of Article 346.17, paragraph 2 of Article 346.16 and paragraph 5 of Article 254 of the Tax Code of the Russian Federation.

If processing costs form the initial cost of fixed assets, the organization can also take them into account when taxing. For more information about this, see How to use the simplified tax system to take into account the receipt of fixed assets and intangible assets.

Organizations that use simplification for the object do not take into account income and expenses for processing materials (Article 346.14 of the Tax Code of the Russian Federation).

Receipt of finished products

Reflect the receipt of the customer's finished products at the warehouse using the document Transaction entered manually in the Transactions - Accounting - Transactions entered manually - button Create - Transaction section.

Please indicate:

- Debit - 002 “Inventory assets accepted for safekeeping”;

- Col. — quantity of products arriving at the warehouse;

- Amount - the cost of incoming products at the price of the raw materials used.

Tax accounting

Tax accounting for transactions that occur between two organizations can be accompanied by a number of difficulties. They concern costs - direct and indirect. Difficulties are also possible with regard to production balances and the procedure for their assessment.

The method for allocating different types of expenses must be determined by companies initially. This point is regulated by Article 318 of the Tax Code of the Russian Federation. Direct costs must be distributed in accordance with the accounting policies of the company, which in this case plays the role of the taxpayer. Indirect expenses are considered in the current period and are classified as a cost type for tax accounting purposes. They are recorded in full.

When planning and selling finished products in a warehouse, the processing organization must distribute direct costs of general purpose between types of activities. VAT is 18%. The law does not look at either the manufactured products or the processed raw materials. The object of taxation is the work performed by the processor, and not the moment relating to the sale of products.

You can deduct VAT if it was paid at the time of purchasing raw materials for production. The same applies to the tax at the time of payment for services, work of employees, and other items on which the processor had to spend money.

Tolling conditions are any conditions defined in contracts between a business entity (customer) and a business entity (manufacturer), under which excisable products are manufactured, which are the property of the customer.

An agreement for the processing of customer-supplied raw materials is a civil law agreement, since it contains the characteristics of a contract agreement. The subject of the agreement for the processing of toll raw materials is the provision of services and the processing, enrichment or processing of toll raw materials into finished products.

Contracting agreements on tolling terms spread during the period of market reforms. Processing of raw materials supplied on a toll basis is quite widely used in the agricultural sector of the economy, the oil refining industry, in the production of alcohol and other areas of production. A characteristic feature of these relationships is that in all cases, the owners of customer-supplied raw materials transferred for processing and the manufacture of finished products from them are the customers, except for raw materials and finished products, which are payment to the performers for processing.

According to tolling conditions, payments for processing, processing, enrichment or use of tolling raw materials can be carried out in cash, by allocating part of tolling raw materials or finished products, or using three forms simultaneously with the consent of the customer and the contractor.

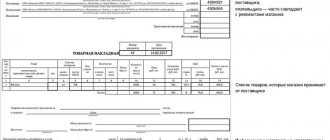

Transfer of products to the customer

Create a document Transfer of goods type of operation Transfer of products to the customer in the section Production - Processing - Transfer of products to the customer - Create button.

Indicate in the header of the document:

- Counterparty - customer under the processing agreement, selected from the Counterparties directory;

- Agreement - an agreement with the customer;

- Warehouse - a warehouse from which products are transferred.

Specify on the Products :

- Nomenclature - product name, selected from the Nomenclature directory;

- Quantity - the quantity of products transferred.

The document does not generate postings: it is used to generate printed forms. By clicking the Print , you can print a form approved by the accounting policy as a document for transferring products to the customer:

- invoice for the release of materials to the side (M-15),

- waybill,

- consignment note (1-T),

- waybill (TORG-12),

- universal transfer document (UDD).

Document flow when transferring customer-supplied raw materials

No, of course, the price of materials is indicated by you without VAT. For the same reason that implementation does not occur. Regarding the documentary reflection of transactions and cost accounting, I found this very fresh and quite interesting explanation. Just note that the emphasis there is on accounting with the contractor and on the fact that he also uses his own raw materials in the process, in addition to customer-supplied ones. An organization under a contract for processing raw materials supplied by the customer into finished products in its manufacture uses, in addition to the raw materials supplied by the customer, its own materials and attracts co-contractors. The cost of the recycler's own materials is included in the total cost of recycling services. What primary documents for the vendor should reflect these costs in monetary terms? What cost should be reflected in the MX-18 invoice when transferring finished products to the supplier - the costs of the processor plus the cost of the processed raw materials supplied by the supplier? How is accounting done for a processor? September 13, 2011 An agreement for the processing of customer-supplied raw materials is a type of contract, therefore the relationship between the parties - the customer (owner of materials, supplier) and the processor - is regulated by Chapter 37 of the Civil Code of the Russian Federation. The right of ownership to products made from customer-supplied raw materials arises not from the processor, but from the customer (clause 1 of article 220, clause 2 of article 703 of the Civil Code of the Russian Federation). According to paragraph 2 of Art. 220 of the Civil Code of the Russian Federation, unless otherwise provided by the contract, the owner of the materials (customer), who has acquired ownership of the item made from them, is obliged to reimburse the cost of processing to the person who carried out it. The work contract specifies the price of the work to be performed or the methods for determining it (Clause 1, Article 709 of the Civil Code of the Russian Federation). The price in the contract includes compensation for the contractor’s costs and the remuneration due to him (clause 2 of Article 709 of the Civil Code of the Russian Federation). The contractor is obliged to use the material provided by the customer economically and prudently, after completion of the work, provide the customer with a report on the consumption of the material, and also return the remainder of it or, with the consent of the customer, reduce the price of the work taking into account the cost of the unused material remaining with the contractor (Clause 1, Article 713 of the Civil Code of the Russian Federation) . The processor is responsible for the safety of both received materials and finished products until they are delivered to the customer (Article 714 of the Civil Code of the Russian Federation). The processing organization (performer) has the right to engage a subcontractor to perform work on processing materials (clause 1 of Article 706 of the Civil Code of the Russian Federation). In this case, the contractor is responsible for the results of the subcontractor’s activities to the supplier (customer), as well as responsibility to the subcontractor for the fulfillment of the terms of the contract by the supplier (clause 3 of Article 706 of the Civil Code of the Russian Federation). According to clause 156 of the Guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n, customer-supplied materials are materials accepted by the organization from the customer for processing (processing), performing other work or manufacturing products without paying the cost accepted materials and with the obligation to fully return processed (processed) materials, delivery of completed work and manufactured products. According to the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, to summarize information on the availability and movement of raw materials and materials of the customer accepted for processing (customer's raw materials), not paid The manufacturing organization designated account 003 “Materials accepted for processing.” The customer's raw materials accepted for processing are accounted for in account 003 “Materials accepted for processing” at the prices stipulated in the contracts. Analytical accounting for account 003 “Materials accepted for processing” is carried out by customers, types, grades of raw materials and materials and their locations. Thus, both raw materials received for processing and finished products are accounted for in account 003 “Materials accepted for processing” until the finished product is transferred to the customer. To account for materials in the warehouse and materials transferred to production, subaccounts are opened: 003-1 “Materials in warehouse”; 003-2 “Materials in production”. The costs of the processor that he incurs during the processing process (the cost of his own materials, wages, insurance premiums, depreciation of fixed assets, general business and general production expenses) are taken into account in the production cost accounts (on account 20 “Main production”) with subsequent write-off to account 90. If the processor, in addition to processing customer-supplied raw materials, produces products from its own materials, then it must keep separate records for both material and other costs. This requirement arises from the fundamentally different reflection in accounting of operations for the production of products from own and from customer-supplied raw materials. Since, when transferring raw materials or materials for processing, the ownership of the specified property remains with the seller, the processor does not have the right to reflect the received property (as well as the manufactured finished products) on its balance sheet. In accounting, operations for processing customer-supplied raw materials are accompanied by the following entries: Debit 003-1 - customer-supplied raw materials received from the customer are accepted for accounting in the warehouse; Debit 003-2 Credit 003-1 - customer-supplied raw materials released into production; Debit 20 Credit 10 - own materials written off; Debit 20 Credit 02, 25, 26, 69, 70, etc. — the costs of processing customer-supplied raw materials are taken into account; Debit 62 Credit 90, subaccount “Revenue” - revenue for services for processing customer-supplied raw materials is reflected; Debit 90, subaccount “Cost of sales” Credit 20 - actual costs for processing customer-supplied raw materials are written off; Loan 003-2 - actual consumption of customer-supplied raw materials is written off; Debit 90, subaccount “Profit from sales” Credit 99 - the financial result has been determined. Documentation At the time of transfer of materials for processing, the customer must issue an invoice for the release of materials to the third party (form N M-15, approved by Decree of the State Statistics Committee of the Russian Federation of October 30, 1997 N 71a) with the mark “supply raw materials”. After execution of the order, the processor is obliged to submit to the customer a report on the consumption of materials (clause 1 of Article 713 of the Civil Code of the Russian Federation), which may contain the following information: the name and quantity of materials received and used in production, the result of processing (processing), data on waste received (if there are some). In addition to the report, an act of acceptance and transfer of completed work is drawn up indicating the list and cost of work performed (Article 720 of the Civil Code of the Russian Federation). Unified forms of these documents have not been approved, so the contractor develops them independently. When developing documents, it is necessary to comply with all the conditions for recognition of a document as a primary document, listed in paragraph 2 of Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting” (hereinafter referred to as Law N 129-FZ). If the contract for the processing of customer-supplied raw materials stipulates that the cost of the processor’s own materials used for the manufacture of finished products is included in the total cost of processing services, then in this case, in our opinion, write out for the own raw materials (consumables) used in the manufacturing process The seller does not need a consignment note in form N TORG-12, approved by Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132. Thus, according to the Instructions for the use of the TORG-12 consignment note form, it is used to formalize the sale (issue) of inventory items to a third-party organization. Drawed up in two copies. The first copy remains with the organization handing over the inventory items and is the basis for their write-off. The second copy is transferred to a third party and is the basis for the recording of these valuables. In our case, the basis for writing off used own materials for the processor is a demand invoice (M-11), a limit card (M-8), an accounting statement, etc. In this case, the use of your own materials is an integral part of the service for processing raw materials supplied by customers. In this case, the cost of the processor’s own materials is included in the cost of services. In our opinion, if the cost of the own materials used by the processor is included in the total price of the contract (in the cost of processing services), then there is no need to separately decipher the cost of services and the cost of materials used in the work completion certificate. At the same time, in this case it is necessary to take into account the provisions of the contract, which may establish a mandatory breakdown of the cost of processing services and the cost of materials used by the processor. If the processor, which has assumed the obligation to manufacture finished products from raw materials supplied by the customer, involves subcontractors (co-contractors) to fulfill these obligations, then in this case the cost of the services of the co-contractor to the processor does not need to be indicated in the primary documents transferred to the customer. Current legislation does not oblige the processor to provide the seller with a report on services purchased from third parties. With regard to the invoice for the transfer of finished products, it should be noted that currently there is neither a unified form that is used to formalize the return (receipt) of finished products from the processor to the seller, nor a procedure for filling out such forms. In practice, experts suggest using: an invoice for the release of materials to third parties (unified form N M-15); invoice for the transfer of finished products to storage places (unified form N MX-18, approved by Decree of the State Statistics Committee of Russia dated 08/09/1999 N 66); goods invoice (unified form N TORG-12, approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 N 132). If the parties use an invoice for the transfer of finished products to storage locations in Form N MX-18 to return finished products, then in terms of filling out the “Unit Price” column, the following must be taken into account. The current legislation does not explain at what cost the finished product should be transferred to the seller and, accordingly, what price should be indicated in the document accompanying the transfer of the finished product (in your case - in Form N MX-18). In our opinion, in Form N MX-18, the cost of the transferred finished product can be indicated in the following expression: based on the sum of the accounting value of customer-supplied materials and own processing costs (including the cost of the processor’s own materials used) (the general principle of assessing property based on the amount of actual costs, provided for in paragraph 1 of Article 11 of Law No. 129-FZ); by the amount of processing costs (based on the specified paragraph of Law N 129-FZ, taking into account that actual costs are only expenses incurred by the organization itself); at the accounting value of customer-supplied materials without including the costs of processing (since the cost of the latter will be presented to the customer in a separate document-act). Since the formation of the actual cost of products, the distribution of costs (including processing) for individual types of products is carried out by the supplier, and the processing costs themselves are taken into account on the basis of a separate document (service acceptance certificate), the cost of the finished product indicated in The processor's invoice is of no fundamental importance to the seller. Accordingly, the order in which the processor evaluates finished products produced on a toll basis is not so significant. In conclusion, we note that since the list of primary documents drawn up during the processing of customer-supplied raw materials is not defined at the legislative level, nor is the procedure for filling them out, then in this regard we believe that the list of documents used by the organization must be enshrined in the accounting policy . The answer was prepared by: Expert of the Legal Consulting Service GARANT Member of the Chamber of Tax Consultants Yana Stepovaya The conclusion I made for myself is the following: options are possible. And you should probably specify in the contract with the contractor which party, how and in which primary documents reflects the transactions under the contract in order to avoid further misunderstandings and have reasonable data for calculating the cost of production. This will be your bilateral regulatory document.

Write-off of products from warehouse

Reflect the write-off of products from the warehouse with the document Transaction entered manually in the section Operations - Accounting - Transactions entered manually - button Create - Transaction.

Please indicate:

- Credit - 002 “Inventory assets accepted for safekeeping”;

- Col. — quantity of products transferred from the warehouse;

- Amount - the cost of the transferred products.

Implementation of processing work

Create a document Sales of processing services in the section Production - Processing - Create button - Sales of processing services. It can also be created based on the document Request-invoice or Production report for a shift , then part of the document will be filled out automatically.

Check the completion of the document.

In the header please indicate:

- Counterparty - customer under the processing agreement, selected from the Nomenclature directory;

- Contract - an agreement with the customer,

On the Customer Materials , specify:

- Nomenclature - the name of the customer’s materials used, selected from the Nomenclature directory;

- Quantity - the amount of materials used;

- Accounting account - 003.02 “Materials transferred to production.”

On the Products (processing services) , indicate:

- Nomenclature - products made from customer materials are selected from the Nomenclature directory; in the bottom line, indicate the name of the processing work for the work completion certificate;

- Quantity - the number of products produced;

- Price - the price for work to produce a unit of product;

- Planned price - the planned cost of production per unit of production;

- Accounting account - 20.02 “Production of products from customer-supplied raw materials”;

- Nomenclature group - nomenclature group for processing work;

- Specification - filled in when using product specifications in 1C, selected from the Product Specifications (in our example, not filled in).

Postings according to the document

The document generates transactions:

- Dt 62.01 Kt 90.01.1 - revenue from the implementation of processing work;

- Dt 90.02.1 Kt 20.02 - write-off of the cost of work performed at the planned price;

- Kt 003.02 - write-off of customer materials;

- Dt 90.03 Kt 68.02 - VAT calculation.

Accounting: transfer and processing results

When materials are transferred for processing on a toll basis, sales do not occur, since ownership remains with the organization that ordered the work (Clause 1, Article 220 of the Civil Code of the Russian Federation). Therefore, do not write off the cost of materials from the balance sheet of the customer organization, but take them into account in a separate subaccount 10-7 “Materials transferred for external processing” (clause 157 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n):

Debit 10-7 Credit 10

– materials were transferred for processing.

Further accounting of materials sent for processing depends on the result of processing. Accounting rules vary depending on the following cases:

- the result of processing is a finished product;

- recycling only prepares the material for use;

- recycled materials are used in the manufacture (creation) of fixed assets.

If, as a result of processing, a finished product is obtained, then the processing costs form the cost of the finished product (clause 5 of PBU 10/99). Reflect this operation like this:

Debit 20 (23...) Credit 10-7

– materials from processing are returned and they are taken into account in the cost of finished products;

Debit 20 (23…) Credit 60

– the cost of processing work is taken into account in the cost of finished products.

If materials are prepared for use, processing costs increase the cost of these materials (clauses 68, 71 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n). Reflect this operation like this:

Debit 10 Credit 10-7

– materials from processing were returned;

Debit 10 Credit 60

– the cost of processing work is taken into account in the cost of materials.

If materials obtained from processing are used in the creation (manufacturing) of fixed assets, processing costs form the initial cost of these fixed assets (clause 8 of PBU 6/01). Reflect this operation like this:

Debit 08 Credit 10-7

– materials from processing are returned and they are taken into account in the initial cost of fixed assets;

Debit 08 Credit 60

– the cost of processing work is taken into account in the initial cost of fixed assets.

Submission of the SF for the implementation of work

Register an invoice using the Write invoice at the bottom of the document Sales of processing services .

Invoice data is automatically filled in based on the document Sales of processing services :

- Operation type code : “Sales of goods, works, services and operations equivalent to it.”

Documents and document flow

The scheme with customer-supplied raw materials is not typical in the production process, so many enterprises that need to use it are forced to study the accounting and documentation procedures.

Let us consider the main forms of documents involved in the execution of such operations.

Contract

The conclusion of an agreement is the starting point in the process of interaction between counterparties.

The main points of contractual relations that require reflection in the tolling scheme:

- volume and nomenclature of DS;

- name of finished products;

- technical and design documentation;

- DS delivery time;

- period of production and shipment of products;

- transportation principle;

- prices for the contractor's services;

- rationing of diesel fuel consumption;

- conditions for returning the vehicle to the owner and compensation for damage in case of shortage.

Consignment note M-15

This form is intended for registration of movement of goods, and is also an accompanying document when transporting finished products. The document must be drawn up in at least two copies, one for each party.

Certificate of acceptance and transfer of materials

This form duplicates the information contained in the M-15. Therefore, the decision to draw up this document is made by the parties independently.

Act of non-conformity

The act form is developed and approved as an annex to the contract. Designed for situations where, at the time of transfer of the DS, deviations in quantity, nomenclature, and quality are identified. This is a two-sided document. That is, if a disagreement is discovered regarding the supply of DS, both parties must record the difference by signing an act.

Receipt order

Form M-4 is used when registering the receipt of materials from the contractor. It is a warehouse accounting document.

MX-18

An invoice in form MX-18 is issued for the transfer of finished products to the processor’s storage areas.

KS-2

The full name of this document is the act of acceptance of completed work. The frequency of formation of the KS-2 form is determined by the parties to the transaction. Formation for a reporting period, for example, a month is allowed. To correctly formulate the cost price, the customer may set requirements for each shipment, which causes certain inconvenience for the contractor in case of large volumes.

Certificate of acceptance and transfer of finished products

The document form is voluntary for execution by the parties. Its content duplicates the essence of documents M-15 and KS-2.

Recycling report

The form is developed by the parties to the agreement independently. Comes as an appendix to KS-2. It is mandatory to indicate the range of products and raw materials used for production. The quantity and units of measurement are indicated. Cumulative measurement of indicators is not provided. The document is drawn up in two copies.

Invoice

Operations for processing DS are not exempt from VAT, therefore it is necessary to prepare an invoice in two copies. Unlike the above forms, the invoice form was approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 and allows only the introduction of additions, without a radical restructuring of the document.

Consumption rates

The rationing of the expenditure of DS must be clearly stated in the contract. The customer can provide ready-made planning data, or the calculation is made as per execution, but subject to approval from the supplier.

Act on overexpenditure of DS

The form is drawn up when discrepancies between the planned DS consumption indicators and the actual data indicated by the processor in the report are identified. Based on the results of drawing up the act, a decision is made on reimbursement of expenses or their inclusion in the customer’s cost price.

Documents for download (free)

- Contract agreement for processing of customer-supplied raw materials

- Form No. M-15

- Act on excess consumption of materials and waste

- Certificate of acceptance and transfer of finished products to the seller

- Certificate of acceptance and transfer of materials for processing

- Processor's report

- Form No. M-4

- Form No. MX-18

This list of forms is recommended at the legislative level. Since since 2013 there are no mandatory rules for their application, the parties to contractual relations independently decide on the execution of certain documents. Forms can also be rearranged and supplemented.

Depending on the specifics of production, it is possible to use such management documents as a buyer’s order for production, shift assignment, invoice for movement, invoice for return of DS, act of write-off of raw materials and others.

Calculation of wages and insurance premiums

At the end of the month, accrue wages to employees involved in the production of work using the Payroll document in the Salaries and Personnel section - Salary - All accruals - Create button - Payroll.

Postings according to the document

The document generates transactions:

- Dt 20.01 Kt - payroll;

- Dt Kt 68.01 - personal income tax withholding from wages;

- Dt 20.01 Kt 69.01 - calculation of insurance contributions for social insurance;

- Dt 20.01 Kt 69.03.1 - calculation of insurance premiums to the Federal Compulsory Medical Insurance Fund;

- Dt 20.01 Kt 69.11 - calculation of insurance premiums from NS and PZ;

- Dt 20.01 Kt 69.02.7 - calculation of insurance premiums for pension insurance.

Adjustment of the cost of processing materials supplied by the supplier

At the end of the period, when all information on costs has been collected, when performing the Month Closing procedure in the Operations - Period Closing - Month Closing section, the amount of planned expenses is compared with the actual ones. Regular operation Closing accounts 20, 23, 25, 26 adjusts the cost of production (work, services) for the difference between plan and actual.

Regular operation Closing accounts 20,23,25,26 generates the following posting:

- Dt 20.02 Kt 20.01 - adjustment of the planned cost of work to the actual cost.

Calculation of actual cost:

Expenses Actual amount Planned cost Difference Salary 20 000,00 Insurance premiums 6 000,00 Depreciation 5 208,33 Contributions to the Social Insurance Fund from NS and PP 40,00 Total 31 248,33 30 000,00 1 248,33 In the example, the actual cost of finished products, calculated at the end of the month, is greater than the planned cost. Therefore, the program brings the planned cost of production to the actual cost using additional posting Dt 20.02 Kt 20.01 for the amount of the difference between the actual and the plan.

Postings for accounting of DS

The reflection in the accounting of transactions with DS at the customer will be as follows:

- Dt 10.7 Kt 10.1 (10.8) - transfer of DS to the contractor;

- Dt 10.1 Kt 10.7 - receipt of processed materials;

- Dt 10.1 Kt 60 - the cost of work on processing DS is added to the cost of materials;

- Dt 19 Kt 60 - VAT is taken into account on the cost of processing work;

- Dt 68 Kt 19 - VAT is accepted for deduction;

- Dt 60 Kt 51 - the contractor is paid for the work performed on processing the DS;

- Dt 20 Kt 10.1 - materials processed on the outside were sent to production;

- Dt 43 Kt 20 - finished products made from DS are registered.

In case of receipt of products from the contractor that are considered semi-finished products, the customer can make the following entries:

- Dt 21 (10.2) Kt 10.7 - write-off of DS for the production of semi-finished products;

- Dt 21 (10.2) Kt 60 - including the cost of processing services there;

- Dt 19 Kt 60 - VAT on processing is taken into account;

- Dt 20 Kt 21 (10.2) - the semi-finished product is released into production.

The contractor will use the following entries in accounting for transactions with DS:

- Dt 003 - DS accepted from the customer and sent for processing;

- Dt 20 Kt 02 (10, 23, 25, 26, 60, 69, 70) - the costs of processing DS are taken into account;

- Kt 003 - finished products from the DS have been shipped to the customer;

- Dt 62 Kt 90.1 - revenue from processing work is reflected;

- Dt 90.3 Kt 68 - VAT is charged on the cost of processing work;

- Dt 90.2 Kt 20 - the cost of processing is written off;

- Dt 51 Kt 62 - payment received from the customer.

NOTE! Displaying information on account credit 10 from the contractor is possible only in relation to his own materials (for example, fuel and lubricants for the equipment on which the work is performed). The cost of DS is never included in the contractor’s cost price.

Income tax return

In the income tax return, proceeds from the sale of processing work are reflected:

- Sheet 02 Appendix No. 1: PDF page 011 “revenue from the sale of goods (works, services) of own production.”

The nomenclature group related to the sale of products, services and works of own production must be indicated in the Nomenclature groups for the sale of products and services in the Main section - Settings - Taxes and reports - Income tax tab. PDF

The correct completion of page 011 of Appendix No. 1 to Sheet 02 of the income tax return depends on this setting.

Read more Setting up accounting policies

Purchase Invoice

In order to actually reflect the receipt of raw materials at the warehouse, it is necessary to create a “Receipt Invoice” document based on the buyer’s order.

By analogy with filling out the price of materials in the “Buyer’s Order” document, here you indicate the price of raw materials, focusing on the fact that this will be exactly the cost for which your organization is responsible to the seller. And the cost of the transferred raw materials will not be taken into account when calculating the cost of products made from them.

The invoice must indicate the consignment of goods. In this example, the batch “Customer's raw materials” is indicated.

The specified materials are reserved on order, and no one will be able to use them for any other purposes - only for the production of the rack specified in the order.