What primary documents should be

As a general rule, every fact of economic life must be confirmed by primary documents. This also applies to the receipt of materials. You will receive some documents from the supplier, and prepare some yourself. The composition of the primary material depends on the method of obtaining the materials. If you receive materials produced by your organization, then the documents will only be those that you or department employees draw up yourself.

Materials can be purchased:

- under paid contracts, such as delivery, exchange, etc. Including through accountable persons;

- free of charge under a gift agreement;

- as a contribution to the authorized capital;

- making them yourself;

- received upon liquidation of fixed assets;

- even discovered during inventory if surpluses are identified.

Documents are drawn up according to forms approved in advance by the manager. These can be unified or independently developed forms. In the second case, the document must contain all the necessary details.

This follows from the provisions of Article 9 of the Law of December 6, 2011 No. 402-FZ and paragraphs 11, 29, 43 and 44 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia of December 28, 2001 No. 119n.

Situation: is it necessary to print out the receipt order drawn up when receiving materials in electronic form?

Answer: no, it is not necessary if the document has electronic signatures.

The receipt order can be drawn up both on paper and electronically. In any case, the document must be signed by responsible employees. This may be a storekeeper or other financially responsible person in the warehouse who receives and delivers materials. Moreover, if you keep records on the basis of electronic documents, then they need to be certified with electronic signatures.

This procedure follows from paragraphs 12 and 14 of the Methodological Guidelines, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, the provisions of Law dated April 6, 2011 No. 63-FZ and is confirmed in the letter of the Ministry of Finance of Russia dated May 19, 2006 No. 02 -14-13/1297.

At what cost to receive materials?

Materials must be received, that is, reflected in accounting, at actual cost. This requirement is expressly established in paragraph 5 of PBU 5/01. This rule always applies. Define cost as the amount of actual costs for purchasing or manufacturing materials. Therefore, for example, when you buy materials, you need to take into account not only the cost indicated by the supplier in the invoice, but also transportation and procurement costs.

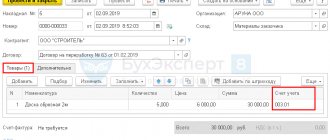

Typically, materials are reflected in the debit of account 10 “Materials” at the actual cost of each accounting unit.

However, you have the right to apply a different procedure. In particular, you can reflect materials at accounting prices. Such, for example, as:

- planned prices. They are usually budgeted for a certain period;

- negotiable prices. When materials are purchased under a special contract that determines their possible cost;

- actual cost of materials for the previous reporting period. Namely month, quarter, year;

- average group price. When the planned price is set not for a specific item number, but for their group.

In this case, deviations from the actual cost must be recorded. Take into account differences with the actual cost on account 16 “Deviation in the cost of material assets.” Costs for the acquisition and procurement of materials must first be accumulated in account 15 “Procurement and acquisition of material assets.”

This procedure follows from the provisions of paragraph 5 of PBU 5/01, paragraph 80 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and the Instructions for the chart of accounts (accounts 10, 15, 16).

Fix the selected option for accounting for the receipt of materials in the accounting policy for accounting purposes (clause 7 of PBU 1/2008).

In the actual cost of materials, do not take into account:

- general business and other similar expenses, except when they are directly related to the purchase of materials;

- refundable taxes – VAT and excise taxes. True, this rule does not always apply. Organizations and entrepreneurs that are exempt from paying these taxes can also include them in the cost of materials.

Such instructions are in paragraphs 6 and 7 of PBU 5/01.

A complete list of costs that are included in the cost of materials is given in the table.

Power of attorney to receive

There are several ways to pick up materials from the supplier's warehouse. For example, pickup. The supplier may also deliver the materials himself. Nobody prohibits using a third-party carrier.

When you pick up materials at your own expense, only an employee authorized by a power of attorney can receive them from the supplier. Compile it in one copy. For this you can use:

- unified forms No. M-2, No. M-2a (Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a);

- a power of attorney developed independently - provided that it contains all the necessary details (Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

The choice must be approved by the manager by order to the accounting policy.

Form No. M-2a is used when receiving material assets by proxy is of a massive nature. A power of attorney in form No. M-2 or No. M-2a can be issued only to employees. The power of attorney must contain all details, including a sample signature of the employee in whose name it is issued. Powers of attorney are usually issued for a period of no more than 15 days. If materials are received as planned, then a power of attorney can be issued for a month. This procedure is described in section 3 of the instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a.

The power of attorney must be certified by the signature of the head of the organization and the seal. Issue such a document to the employee against receipt and register it in the log of issued powers of attorney. Don’t forget to also put the date of preparation on the power of attorney. Without this information, such a document is void. This means that the employee will not be able to receive materials from the supplier.

All this follows from the provisions of Article 9 of the Law of December 6, 2011 No. 402-FZ, Articles 182–189 of the Civil Code of the Russian Federation, paragraph 45 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia of December 28, 2001 No. 119n.

Warehouse accounting: what is it and why is it needed?

Warehouse accounting is a set of procedures aimed at documenting various warehouse operations. The main ones include:

- acceptance of goods (raw materials, materials) from the supplier;

- product placement;

- movement of goods between warehouses (and other related departments);

- release of goods from the warehouse for one purpose or another (for shipment, for production).

[adsp-pro-1]

These operations can be detailed in various ways. For example, goods acceptance usually includes:

- receipt of goods (raw materials, material) from the supplier;

- acceptance of goods for accounting;

- checking the goods to ensure that the actual delivery characteristics correspond to those stated in the accompanying documentation.

Video - warehouse accounting and product distribution in the SUBTOTAL service (LINK):

Thanks to accounting for warehouse operations, a business entity gets the opportunity to:

- Exercise control:

- over the current inventory (knowing what, where and in what quantity it is);

- over significant consumer statuses of the product (for example, its expiration dates);

- over the movement of goods to the warehouse, within the warehouse, between the warehouse and other departments (knowing what, where and in what quantity was received or released).

- Optimize (using data reflected in the accounting documentation for such operations):

- completeness of inventory in warehouses, on the sales floor (in production);

- sales volumes;

- schemes for organizing the storage of goods;

- procedures for interaction with suppliers;

- turnover of goods.

Accounting also helps to increase the transparency of operations - from the point of view of their adaptability to monitoring for unauthorized actions of employees, identifying and correcting mistakes they make.

[adsp-pro-9]

Warehouse accounting can be:

- nomenclature (when the object of accounting is a separate commodity item);

- varietal (when various categories (“grades”) become additional accounting objects, into which goods of different positions can be combined;

- batch (when even larger units (“batch”) are introduced into accounting, combining several categories of goods).

Of course, these accounting options can be applied alternately depending on the specific area of warehouse management (and thus complement each other). A small enterprise is characterized by areas with predominantly nomenclature accounting. The larger the business, the more plots appear with varietal and batch accounting.

Video - features of maintaining and organizing warehouse accounting at an enterprise:

Regardless of the type of accounting, enterprises use unified forms of documentation of warehouse operations. Their use is determined not only by the solution of the above tasks, which are related to the control and optimization of the warehouse, but also by the requirements regarding accounting (which all business entities in the status of legal entities are required to maintain).

Reception at the warehouse

The receipt of materials is processed by the storekeeper or other materially responsible person of the warehouse. The responsible employee must draw up a receipt order on the same day. In one copy in a form approved by the manager. It could be:

- unified form No. M-4 (Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a);

- a form that you created yourself. It is important that it contains all the necessary details (Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

Typically, a separate receipt order is issued for each delivery. However, when several batches of bulk homogeneous goods arrive from the same supplier during the day, it is permissible to act differently. The storekeeper has the right to draw up one receipt order. To do this, at the end of the day, he determines the total for all cargo from one supplier and indicates it in the receipt order.

This is stated in paragraph 49 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, Article 9 of the Law dated December 6, 2011 No. 402-FZ and paragraph 7 of PBU 1/2008.

Advice: to reduce paperwork, you don’t have to issue a receipt order. It can be replaced with a stamp. Place it directly on the supplier's document. For example, on an invoice.

In the stamp, indicate all the necessary details. Fix the chosen option for documenting the receipt of materials at the warehouse in the accounting policy for accounting purposes. This procedure is provided for in paragraph 4 of paragraph 49 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and paragraph 7 of PBU 1/2008.

Upon acceptance, the responsible employee must check the quantity and quality of received materials. If the result reveals a defect or shortage, you can file a claim with the supplier. Do this on the basis of the materials acceptance certificate. For example, according to form No. M-7. In it, indicate the quantity and cost of defective materials (size of the shortage).

This procedure is provided for in paragraph 44 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

If the actual quantity (quality, range) of materials does not correspond to the documents of the transferring party, the receipt order is not issued. In this case, the materials must be accepted by a special commission, which draws up an act, for example, in form No. M-7, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a. This procedure is provided for in paragraphs 6–8 of paragraph 49 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

In practice, materials are sent to departments without going through the warehouse. However, they still need to be received at the warehouse and the transfer to the department must be completed immediately. At the same time, documents for receipt and delivery are drawn up. For example, according to forms No. M-4, M-8, M-11, M-15. In the receipt and expenditure documents, make a note that the materials were issued without delivering them to the warehouse (in transit). This procedure is provided for in paragraph 1 of paragraph 51 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Documentation of receipt and expenditure of material assets

Definition 1

Documentation is the process of generating documentation that is necessary to accept a particular fact of economic life.

Documenting the movement of material assets allows an enterprise to build a system for monitoring their safety in storage areas within the enterprise and with responsible persons, as well as the opportunity to obtain the necessary information for effective management and control of the use of material assets at all stages of production.

Registration of the movement of values can be carried out both according to unified forms and according to independently developed by the enterprise. However, such forms must necessarily contain the following details:

Finished works on a similar topic

- Coursework Documentation of receipt and expenditure of material assets 480 rub.

- Abstract Documentation of receipt and expenditure of material assets 230 rub.

- Test work Documentation of receipt and expenditure of material assets 240 rub.

Receive completed work or specialist advice on your educational project Find out the cost

- Title of the document;

- Date of;

- Name of the organization that issued the document;

- Contents of the economic fact;

- Natural and (or) monetary meter, indicating the unit of measurement;

- Positions of persons participating in the transaction and their signatures.

Name and units of measurement

It is not necessary to receive materials under the same name indicated by the supplier. It is enough to indicate in your accounting policy that you plan to keep records using a specially developed nomenclature. Please note that the names of goods in receipt documents and accounting registers may not match. Describe the technology for processing accounting information that comes from material suppliers. The legitimacy of this approach is confirmed by the letter of the Ministry of Finance of Russia dated October 28, 2010 No. 03-03-06/1/670.

Materials must be received in a certain quantity in the appropriate units of measurement. Usually the data provided by the supplier is used. Specialists from the Russian Ministry of Finance also point to this in a letter dated January 24, 2006 No. 07-05-06/09.

However, there are two special cases where a different procedure applies. First: when materials are received according to one unit of measurement, and you release them into production according to another. For example, materials are received in tons, but are released in pieces. In this case, arrive with materials and indicate them on warehouse cards in two units of measurement at once. Write the vacation unit in parentheses. True, you can do it differently. It is enough to issue an act of conversion to another unit of measurement. Then you will receive and issue materials according to the unit of measurement that you usually use. A special form of the act has not been approved, so you have the right to develop and approve it yourself. For example, according to this template (Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

And the second case is when the received materials can be reflected in completely different units of measurement in which the supplier took them into account. This is if the seller’s accompanying documents contain larger or, conversely, smaller units of measurement of materials than are accepted by you. In this situation, you can receive materials according to the unit of measurement accepted in your accounting. For example, do this when a supplier ships you kilograms, but you account for materials in tons.

Such instructions are in paragraph 50 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Accounting for receipt of materials in warehouses

Home Favorites Random article Educational New additions Feedback FAQ⇐ PreviousPage 46 of 85Next ⇒

Delivery of goods delivered by an authorized person to the enterprise is carried out at the appropriate warehouse against the receipt of the warehouse manager (storekeeper). The financially responsible person checks the compliance of the materials with the data specified in the accompanying documents, and if there are no discrepancies, issues a receipt order (Form No. M-4), which is signed by the warehouse manager and the forwarder. Either on the receipt of the transport document or in part of local cargo, a stamp is placed on the supplier’s document (bill of lading or others), the imprint of which indicates the details of the receipt order, thus eliminating the need to issue a receipt order.

Materials arriving at enterprise warehouses must be carefully checked in relation to their compliance with the range, quantity (count, weight, volume) and quality specified in the accompanying documents.

If materials arrived with damaged packaging, shortage in weight, inadequate quality or having a quantitative discrepancy, or discrepancy in assortment with the data of the supplier’s accompanying documents, as well as when materials arrive without documents, acceptance is carried out by a commission that draws up a Material Acceptance Certificate (Form No. M -7).

The act is drawn up by the selection committee with the obligatory participation of a representative of the supplier or a representative of a disinterested organization, a materially responsible person and a representative of the supply department. This act is the legal basis for filing a claim with the supplier (sender).

The act is drawn up in two copies, and after accepting the material assets, the act with the attached documents (waybills, etc.) is transferred: one copy to the organization’s accounting department to record the movement of material assets, the other to the supply department or accounting department to send a letter of claim to the supplier.

If there is an acceptance certificate, a receipt order is not issued. Reception acts and receipt orders for the posting of material assets should, as a rule, be drawn up on the day of their receipt.

Raw materials, semi-finished products and other material assets must be accounted for in appropriate units of measurement (by weight, volume, count, etc.). In cases where material (for example, sheet iron) is received in one unit of measurement (by weight) and consumed in another (by account), then its receipt, storage and release must be reflected in documents and analytical registers simultaneously in two units of measurement.

The receipt of materials manufactured or processed by workshops and areas of own production and deposited in the warehouse of material assets must be formalized by issuing a demand invoice (Form No. M-11). The same invoices also document operations for the delivery by workshops (sites) to a warehouse or storeroom of a workshop (site) from the production of leftover unconsumed materials (if they were previously received upon request), as well as the delivery of waste from production, waste from defects.

The invoice requirement is used to account for the movement of material assets within an organization between structural units or financially responsible persons.

The invoice in two copies is drawn up by the financially responsible person of the structural unit handing over material assets. One copy serves as the basis for the depositing warehouse to write off valuables, and the second copy serves as the basis for the receiving warehouse for recording valuables.

The invoice is signed by the financially responsible persons of the deliverer and the recipient, respectively, and submitted to the accounting department to record the movement of materials.

Materials may also come from accountable persons who purchase them in cash.

Accountants of enterprises should pay attention that the expenses of accountable persons must be confirmed by such primary documents as:

· documents confirming the fact of payment for received inventory items indicating the purchase price (receipts for cash receipt orders, cash register receipts, documents equivalent to strict reporting forms);

· documents confirming the fact of receipt of inventory items.

When purchasing material assets from an individual, the purchase act must contain information about the seller, such as the address of his permanent residence and passport details, and if the individual is an individual entrepreneur, then his identification number must be indicated.

In addition, when issuing funds on account for the purchase of inventory from a legal entity engaged in wholesale or small wholesale trade, it is necessary to issue a power of attorney to the accountable person and register it in the journal of issued powers of attorney.

Materials received from the dismantling and dismantling of buildings and structures are accounted for on the basis of an act on the recording of material assets received during the dismantling and dismantling of buildings and structures (form No. M-35).

To ensure effective control over the safety of material assets, the state of the warehouse and weighing facilities is important.

By order of the enterprise, each warehouse is assigned a permanent number, which is subsequently indicated on all documents related to the operations of this warehouse. If the enterprise has several warehouses, then it is necessary to concentrate materials of certain groups (main and auxiliary materials, fuel, spare parts, low-value and wearable items, etc.) in each of them.

Inside warehouses, materials should be arranged in sections, then by type and grade in stacks, on racks and shelves in order to ensure quick acceptance, release and checking of availability.

A material label is attached to each batch of material indicating the necessary parameters (name of material, item number, unit of measurement, price, material availability limit).

Warehouses must be provided with working scales, measuring instruments and measuring containers.

The enterprise must establish a list of officials (warehouse manager, storekeeper) responsible for the acceptance and release of material assets, with whom a liability agreement is concluded. A storekeeper can be released from his position only after a complete inventory of inventory items and their transfer according to an act approved by the head of the enterprise.

All services of the enterprise are provided with a list of persons who are authorized to receive and release materials from warehouses, as well as the right to issue passes for the removal of material assets from the enterprise.

The presence and movement of material assets is carried out in quantitative terms by their names, types, grades, sizes and other indicators in materials warehouse cards or equivalent technical media, in accordance with the order of storage of materials, caused by both the conditions of production consumption of materials and requirements for organizing warehousing. Accounting for inventories is carried out in units of measurement provided for in the relevant collections of accounting prices.

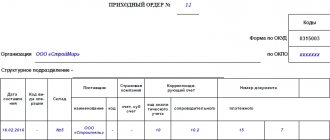

Cards for warehouse accounting of materials (form No. M-17) are prepared by the accounting department as incoming documents are received and in accordance with the nomenclature of materials and are transferred to the financially responsible persons against receipt in the register along with incoming documents.

Varietal quantitative accounting of the movement of material assets is carried out directly by financially responsible persons (warehouse managers, storekeepers, etc.). In some cases, it is allowed, with the consent of the financially responsible person, to entrust the maintenance of warehouse accounting cards to accountants (operators).

A separate card must be opened for each material item number.

In the received warehouse accounting cards, the storekeeper fills in the details characterizing the storage locations for materials (racks, cells, etc.). A material (rack) label is attached to the storage location.

In warehouses with a small range of materials, instead of warehouse accounting cards, it is allowed to keep records in sort accounting books prepared in accordance with the established procedure, providing for the details indicated in the warehouse accounting cards.

16.5.3. Documentation of materials consumption

Materials are released from the warehouse:

· into production for the manufacture of products;

· for repair and household needs;

· for processing at other enterprises;

· for external sales;

· for free transfer to other enterprises.

The release of material assets to other warehouses, storerooms of workshops, areas should be considered not as release to production, but as internal movement.

The main type of material consumption is release for production.

The release of materials to production, as a rule, should be carried out on the basis of pre-established limits. Limiting the supply of materials to production helps control the consumption of materials and compliance with the norms of their production consumption, improves the supply of production with materials and promotes the rhythmic operation of workshops and saving materials. Limiting the release of materials for production should be based on approved progressive standards for material consumption, the volume of production programs of workshops, taking into account carryover stocks of materials unused by workshops at the beginning and end of the month.

The limit for the release of materials for production is set by the supply department or other departments as directed by the head of the enterprise based on the corresponding calculations of the planning and production department. The established limits for material release can be changed if it is necessary to clarify the limit on the balance of material in work in progress (at the beginning of the month), replace material, or correct errors made when calculating the limit. Limit changes are made by the same persons who are granted the right to approve them.

Limit cards are the most widely used as consumable documents. If the need for materials is irregular, then they are released upon request.

Limit and withdrawal cards are intended for registration of the release of materials that are systematically consumed in the manufacture of products, as well as for ongoing monitoring of compliance with established limits for the supply of materials for production needs and are a supporting document for writing off material assets from the warehouse.

The release of materials using limit cards can be made only from one pre-assigned warehouse, only the names of materials indicated in the limit cards and strictly within the quantities established by the limits.

Limit cards are issued by the supply department or planning department for one name of material (item number) and, as a rule, for one cost code (order). In some cases, a limit intake card can be opened as a whole for an order for the entire range of consumed materials.

The limit collection card is issued in two copies for a period of one month. Before the beginning of the month, one copy is transferred to the structural unit - the consumer of materials, the second - to the warehouse.

The release of materials into production is carried out by the warehouse upon presentation by a representative of the structural unit of his copy of the limit card.

The storekeeper must weigh or measure the released material in the presence of a representative of the workshop (site) and note the date and quantity of the released material in both copies of the limit-fence card, after which he displays the remainder of the limit for this nomenclature number of the material. The limit and intake card of a structural unit is signed by the storekeeper, and the limit and intake card of the warehouse is signed by a representative of the structural unit.

To reduce the number of primary documents, where appropriate, it is recommended to register the issue of materials directly in materials accounting cards (Form No. M-17). In this case, expenditure documents for the release of materials are not drawn up, and the operation itself is carried out on the basis of limit cards, issued in one copy, and accounting documents that have no significance. The vacation limit can also be indicated on the card itself. When receiving materials, the representative of the structural unit signs directly on the materials accounting cards, and the storekeeper signs on the limit-fence card.

Excessive supply of materials and replacement of some types of materials with others is allowed only with the permission of the head of the organization, chief engineer or persons authorized to do so.

According to the limit-fence card, records are also kept of materials not used in production (returns). In this case, no additional documents are drawn up.

At the end of the month, limit cards are submitted to the accounting department.

Limit-fence cards are used to maintain warehouse operational accounting of materials, as well as synthetic and analytical accounting of materials that are maintained in the accounting department for materially responsible persons.

The value of limit-fence cards lies not only in the control function. The use of limit-fence cards makes it possible to reduce by several times the number of one-time primary documents issued when issuing and consuming material resources; in addition, worker productivity increases and time is saved.

To reduce the number of primary documents when computers are used, it is recommended to use a system for registering the release of materials (for example, from workshop storerooms) directly in warehouse accounting cards. In this case, expenditure documents for the release of materials are not drawn up, and the operation itself is carried out on the basis of limit or fence cards (books), issued in one copy and having no significance as accounting documents. The vacation limit can also be indicated on the card itself. When receiving materials, the workshop representative signs directly on the warehouse record card. The code for the direction of costs (costing object, shop and other needs) is also reflected here. With this system, the warehouse accounting card is an analytical accounting register and at the same time performs the functions of a source document.

Moving Materials

from one warehouse or storeroom of a workshop (site) to another warehouse or to another storeroom of a given enterprise should be formalized by drawing up a demand invoice for the internal movement of materials (form No. M-11). The demand invoice is issued based on the order of the supply department during the systematic replenishment of workshop storerooms from base warehouses.

The invoice in two copies is drawn up by the financially responsible person of the structural unit handing over material assets. One copy serves as the basis for the depositing warehouse to write off valuables, and the second copy serves as the basis for the receiving warehouse for recording valuables.

The same invoices document operations for the delivery of unspent materials from production to a warehouse or storeroom, if they were previously received upon request, as well as the delivery of waste and scrap.

The invoice is signed by the financially responsible persons of the deliverer and the recipient, respectively, and submitted to the accounting department to record the movement of materials.

Outsourcing of materials

must be formalized by the supply department on the basis of contracts, orders and other relevant documents and the written permission of the head of the enterprise or persons authorized by him, by issuing an invoice order for the release of materials to the outside.

The invoice for the release of materials to the third party (form No. M-15) is written out by an employee of the supply department in two copies: the first copy is transferred to the warehouse as the basis for the release of materials, the second - to the recipient of the materials. Based on the invoice, an invoice is issued to pay organizations for the materials supplied.

When transporting goods by road, instead of a consignment note for the release of materials, a consignment note is issued.

In the same way, the release of materials to the farms of your organization located outside its territory (department of capital construction, housing and communal services, etc.) is issued.

The release of materials to third parties for processing purposes can be carried out if there are contracts or agreements for this.

Leave and passes are issued upon presentation by the recipient of the materials of a power of attorney to receive valuables, completed in the prescribed manner.

⇐ Previous46Next ⇒