What is a gift

The Civil and Labor Codes of the Russian Federation establish the following definitions:

- A gift that is not related to the employee’s work activity. For example, issuing souvenirs for an employee’s anniversary or a holiday.

- Rewarding an employee for his labor merits. For example, for the fulfillment of a plan or for the successful execution of a transaction, the employer decided to reward subordinate employees with gift certificates, vouchers, equipment or other gifts.

According to Part 1 of Article 572 of the Civil Code of the Russian Federation, a gift should be considered any thing (including money, electronic and paper gift certificates and even postcards) that the donor transfers to the recipient free of charge. In our case, the donor is the employer, and the recipient is one of the subordinate employees. In this case, a special document is drawn up - a gift agreement.

A gift agreement is required only if the souvenir being given has a value of more than 3,000 rubles, and the donor is a legal entity - the employing organization. If the price of the gift is lower than the specified amount, it is not necessary to draw up a gift agreement.

IMPORTANT!

For employees of budgetary institutions, and especially civil servants, it is recommended to draw up a gift agreement, regardless of the cost of the gift. This will protect the employer and employee from “corruption” problems and from claims from controllers from the Federal Tax Service.

What to do if there are many recipients? For example, for the New Year, the director of a manufacturing enterprise decided to give expensive souvenirs to 1,500 employees. Do not enter into a gift agreement with each of the employees of the enterprise. There is a way out of the situation. Draw up a multilateral gift agreement in which the donor is the same employer. And the recipients are all the company employees who were decided to be awarded with gifts. Such standards are enshrined in Article 154 of the Civil Code of the Russian Federation.

Article 191 of the Labor Code of the Russian Federation determines that the employer has the right to reward a subordinate for achievements in his work. The cost of the gift is part of the recipient’s remuneration, which entails compliance with certain tax laws. Keep in mind that the transfer of such a souvenir is not formalized by a gift agreement, but is regulated in an employment contract (agreement, contract).

In essence, such a gift is a bonus, but not issued in cash, but transferred in kind, that is, in non-monetary form. Read about the features of bonuses for employees at the end of the year in the article “How to calculate and accrue the 13th salary.”

ConsultantPlus experts looked at how to arrange specific gifts:

- theater tickets;

- Gift certificates;

- for children;

- souvenirs for contractors.

Use these instructions and samples for free.

to read.

Definition of a gift

In accordance with the current legislation (Labor and Civil Code), the following characteristics are established:

- monetary or other material value;

- transferred into ownership free of charge;

- as a remuneration not related or related to work activity (in connection with a memorable date or at the end of the year, for example).

In this case, the donor is the employer, and the recipient is the employee (Article 191 of the Labor Code of the Russian Federation). And although accounting and tax accounting of children's New Year's gifts to employees are not specifically regulated by regulations, the general rules are clear from the interpretation of current legislative norms. In addition, regulatory authorities periodically publish explanations on the application of certain legal norms.

ConsultantPlus experts looked at how to arrange specific gifts:

- theater tickets;

- Gift certificates;

- for children;

- souvenirs for contractors.

Use these instructions and samples for free.

How to arrange gifts for employees

Encouraging employees is an initiative of the employer. If the manager decides to reward employees in the form of gifts, the gifts to employees must be properly executed. The employer will need:

- Order for the purchase and issuance of gift products.

- List of souvenirs issued to employees.

- Donation agreement, if necessary.

Let's start with the order for the delivery of presents. To purchase souvenirs and present gifts in a formal atmosphere, an official order from the manager is required. Formalize it with an organization order. It is permissible to use standardized forms T-11 or T-11a. It is allowed to use any form. Please fill out the order according to the general rules. Please provide a list of employees. It is permissible to separate it into a separate annex to the order.

The law makes it possible to divide orders: in the first order, a specific instruction is given to the responsible employee to purchase souvenirs, certificates, gifts, postcards, and in the second order, a list of employees who will be awarded awards is determined.

Then create a list of gifts for employees. Compose the document in any form. The most convenient way to do this is to use a table that will indicate the full name, position of the employee, the name of the gift and its value. We recommend that you provide separate columns for the signatures of the recipient employees and the date of delivery. Please note that the signature on the statement is a fact of receipt of the gift. The employee indicates the date of receipt personally.

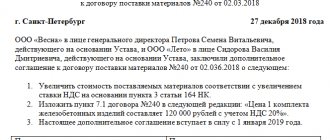

Next, you will have to draw up a gift agreement. Let us remind you that the conclusion of this document is mandatory under the following conditions:

- The donor is a legal entity. That is, the employer encourages its employees and their children. Or the company decided to reward its customers, contractors or business partners.

- The price of the souvenir is more than 3000 rubles.

If both conditions are met, then the gift agreement is a mandatory document; only if it is available and properly executed is it possible to legally transfer the souvenir to the recipient.

Simplified form of gift agreement

The standard form is general, that is, it is suitable for different donation options. Therefore, it is not necessary to use the generalized form. The employer has the right to limit himself to drawing up a gift agreement in simple written form.

To simplify registration, please note the following mandatory details in the document:

- Title of the document.

- Date and place of compilation.

- Name of the parties: donor and donee employee.

- Subject of the agreement, its characteristics and cost.

- Signatures of the parties.

Income tax on gifts

After documenting the donation, accounting and taxation of New Year's gifts for the children of employees and the employees themselves are carried out. Personal income tax is calculated on all types of income of a citizen. There are no exceptions. There are rights to benefits and exemptions, but there are no exceptions. Even a gift to an employee or his child in kind (an item, equipment, dishes and even a vase) is subject to income tax.

IMPORTANT!

The tax base for calculating an employee’s personal income tax includes both tangible and intangible income (Clause 1, Article 210 of the Tax Code of the Russian Federation). This means that all income received by a citizen is subject to taxation, including income received in the form of cash, tangible and intangible assets. Consequently, the present is the same income of the employee, and, accordingly, tax is withheld from it.

If the donor is the employer, then he charges personal income tax. Let us recall that the employer acts as a tax agent in relation to his subordinates. The organization maintains accounting and taxation of New Year's gifts according to the general rule: from all income that was received by an employee from a specific employer, the tax agent withholds and transfers it to the personal income tax budget.

If the total value of all gifts received for the reporting year by an individual employee is no more than 4,000 rubles, then this type of remuneration is not subject to personal income tax (clause 2, clause 2, article 211, clause 28, article 217 of the Tax Code of the Russian Federation, letter of the Ministry of Finance No. 03- 04-06/16327 dated 05/08/2013). This means that if during the calendar year you received from your employer, for example, a painting worth 1,500 rubles (regardless of the holiday), then personal income tax will not be withheld. But keep in mind that if you are given another valuable gift in the same year, for example, worth 5,000 rubles, then personal income tax will be withheld from 2,500 rubles (5,000 + 1,500 – 4,000).

Calculating the tax base for gifts is simple:

- Let's sum up the prices of all souvenirs received.

- We subtract the amount of the benefit due - 4000 rubles.

- From the positive difference we calculate personal income tax at the appropriate rate.

Income tax rates are determined in the generally accepted manner. Tax residents of Russia will be withheld 13%. And if the citizen is a non-resident, then the personal income tax rate is 30%. A tax resident of our country is considered to be those citizens who reside on the territory of the Russian Federation for at least 183 days in the reporting period, that is, in a calendar year.

Accounting for gifts in accounting

The delivery to employees is reflected in the account entry. 73. It is incorrect to use account 70, since the donation is not related to the performance of work duties.

Instructions on how to carry out accounting and taxation of New Year's gifts for children of employees in an organization:

Acquisition

| Dt 10 Kt 60 | Purchase price taken into account |

| Dt 19 Kt 60 | Input VAT included |

| Dt 68 Kt 19 | Input VAT claimed for deduction |

There is another way to take into account the purchase of children's gifts - to include their cost directly in the debit of account 91 without reflecting the acquisition on the account. 10. Accounting for acquired valuables for employees’ children is carried out on the balance sheet (for example, in account 012 “Gifts and other property”). This is explained by the fact that purchased materials are not recognized as an asset, since the organization does not expect to receive economic benefits from their use (clause 8.3 of the “Accounting Concept in the Russian Market Economy”).

Issue

| Non-monetary | |

| Dt 73 Kt 41 (10, 43) | The transfer to the donee is reflected |

| Dt 91 Kt 73 | The cost is recognized as an expense. |

| Dt 91 Kt 68 | VAT charged on gratuitous transfer |

| Dt 70 Kt 68 | Personal income tax is withheld from the employee’s salary for donations over 4,000 rubles. |

| Dt 99 Kt 68 | PIT is reflected in the amount of 20% of the value of the gift, since for income tax such amounts are not accepted as expenses |

| Cash | |

| Dt 73 Kt 50 | Money issued from the cash register |

| Dt 91 Kt 73 | The cost is recognized as an expense. |

| Dt 70 Kt 68 | Personal income tax is withheld from the employee’s salary for donations over 4,000 rubles. |

| Dt 99 Kt 68 | Reflected PNO in the amount of 20% of the cost of the donation |

The proposed postings are relevant for reflecting gifts for the employees themselves and their children and transferring them for any holidays and dates.

For public sector employees, different rules apply. The Ministry of Finance recommends purchasing them according to KOSGU for New Year's gifts in 2021 - 349, counting them as assets and immediately writing them off to account 040120272 (order 209n dated November 29, 2017, letter No. 02-07-07/31230 dated April 26, 2019).

When to withhold personal income tax from a gift

The withholding date and deadline for remitting income taxes on gifts received depend on the form in which the gift is given. Note:

- If money was gifted, then income tax is withheld on the day the money was transferred to the donee. For example, on the day of a New Year's corporate party. And the withheld personal income tax should be transferred to the budget no later than the day following the date of delivery of the money. For example, the day after a corporate event.

- If the incentive is made in material form, then how to withhold 13% or 30%? Tax will have to be withheld from wages or other amounts of remuneration for work. Moreover, withhold personal income tax from the next payment to the employee - advance payment for the first half of the month worked, wages for the remainder of the billing period. And the withheld tax must be transferred no later than the next day after the day of withholding.

Please note that if the company was unable to withhold personal income tax from the souvenir for any reason, then the Federal Tax Service should be notified about this in the appropriate manner. To do this, fill out a 2-NDFL certificate for the employee with taxpayer attribute “2” and submit the reporting document to the Federal Tax Service no later than March 1 of the year following the reporting year.

For example, in 2021, the institution gave an employee a gift worth 5,000 rubles. It was not possible to withhold personal income tax (the employee quit). Therefore, the organization is obliged to submit 2-NDFL for the employee before 03/01/2021.

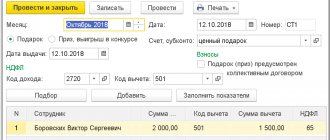

In the report, reflect the cost of the souvenir under income code 2720. The income code should be indicated for all types of incentives, even with a cost of up to 4,000 rubles. Indicate the non-taxable value of the gift of 4,000 rubles (deduction) in the appropriate columns of the 2-NDFL certificate under deduction code 501.

The type of gift does not matter for personal income tax purposes. Income tax is withheld regardless of the relationship in which it is received. Therefore, calculate the tax on remuneration received under a gift agreement and under an employment agreement.

Procedure for taxation of gifts to staff or contractors

Personal income tax

Income tax is calculated on amounts over RUB 4,000. Moreover, personal income tax is calculated on both tangible and intangible income.

When calculating personal income tax you need to:

- summarize the cost of all gifts given to an employee in the reporting year;

- subtract 4,000 rubles from the result. — the amount of tax-free income;

- calculate personal income tax at a rate of 13% (for residents) and 30% (for non-residents).

If the gift is in the form of money, then personal income tax is withheld immediately on the day of payment, and is transferred no later than the day following the day the gift is given.

If the gift is not monetary, then personal income tax is withheld from the cash payment that is closest in date, and is transferred no later than the day following the day of withholding.

Insurance premiums

Regardless of how much the gift costs, insurance premiums do not need to be charged on it. This is stated in Art. 420 of the Tax Code of the Russian Federation or in Art. 20.1 of Law No. 125-FZ.

VAT

According to Art. 146 of the Tax Code of the Russian Federation, VAT must be charged on gifts, and on their purchase price without VAT. If a company donates its own products, then VAT is charged on its cost.

For all gifts according to the completed statement, you need to generate one invoice. Input VAT can only be deducted if there is a supplier invoice.

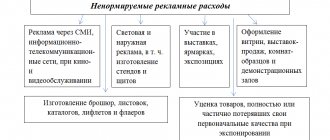

Income tax

According to Art. 270 of the Tax Code of the Russian Federation, there is no need to charge income tax on a gift. The fact is that it is transferred to the employee free of charge, and therefore its value does not need to be taken into account when calculating tax.

Summary of taxes and fees

In general, the following main points regarding taxes and fees can be identified:

- Personal income tax is paid on amounts greater than 4,000 rubles, calculated on an accrual basis. For residents the tariff is 13%, for non-residents - 30%;

- insurance premiums are not calculated and paid;

- VAT is charged on the cost of the gift without VAT or on the cost price;

- income tax is not calculated.

Insurance premiums from gifts

The employer's obligations to accrue social insurance from gifts directly depend on their type. If gifts are issued within the framework of civil law relations, that is, under a gift agreement, then there is no need to charge insurance premiums. Please note that this condition applies only to employees of the institution.

If a gift is given to a citizen who is not in an employment relationship with the organization (a souvenir to a client), then there is no need to accrue insurance coverage. Moreover, the presence of a gift agreement does not play any role (clause 1, 4 of article 420 of the Tax Code of the Russian Federation, clause 1 of article 20.1 of law No. 125-FZ, letters of the Ministry of Finance dated December 4, 2017 No. 03-15-06/80448, Ministry of Labor dated 27.10 .2014 No. 17-3/B-507).

When a gift is given as part of an employment contract as an employee’s remuneration for work, certain achievements and other working conditions, insurance premiums must be charged.

Therefore, in order to avoid additional costs for paying insurance premiums from gifts to employees, a gift agreement is concluded. Let us repeat that the cost of the gift is not important. The form of the gift does not matter, be it an item, a certificate or money. If there is a written gift agreement, then the employer does not pay contributions to the Federal Tax Service and Social Security. As a result, there is no basis for calculating insurance premiums.

IMPORTANT!

Check the gift agreement for content! No references or references to employment agreements are included in the document. Eliminate references to collective bargaining agreements. Remove labor law language and interpretations from the agreement. Do not allow the conditions for determining a gift to be fixed depending on the position or labor achievements or results. If the document contains such wording, then controllers will recognize the gift as one of the types of remuneration for work. And they will charge additional insurance premiums from the cost of gifts.

Should insurance premiums be charged?

There is no need to calculate insurance premiums, including for injuries, from the cost of children's gifts. If only because there is no labor relationship between the children of employees and the organization, and therefore there is no object for taxation of contributions (clause 1 of Article 420 of the Tax Code of the Russian Federation, clause 1 of Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ, see . also letter of the Ministry of Health and Social Development of the Russian Federation dated May 19, 2010 No. 1239-19).

In addition, paragraph 4 of Art. 420 of the Tax Code of the Russian Federation directly provides that payments under civil contracts, within the framework of which the transfer of ownership of property occurs, do not relate to the object of contributions. And a gift agreement is just such an agreement.

See also “You may not have to pay fees on holiday gifts even in the absence of a gift agreement.”

VAT on gifts

According to paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation and the opinion of experts from the Ministry of Finance (letter No. 03-07-11/16 dated January 22, 2009), a gift is a freely transferred value dedicated to a holiday or significant date, which is subject to value added tax. The organization that presented the souvenirs must charge VAT and deduct the amount of input tax (if there is an invoice). Based on the results of the transaction, the operating result is zero, since the accrued and written off amounts are similar to each other.

The tax base for calculating VAT is the cost of the souvenir, and the tax itself is calculated at an 18% rate (clause 3 of Article 164 of the Tax Code of the Russian Federation).

IMPORTANT!

VAT on gifts given after 01/01/2019 is calculated at the new rate of 20%. Read about all changes in fiscal legislation in the article “All changes in taxes for 2021.”

If the gifted value is formalized as a reward for particularly distinguished employees, that is, the possibility of such reward is included in the provisions on remuneration and bonuses, then the gifts will not be salable and VAT will not be charged on them. Value added tax is not charged on the amount of a gift given to employees in the form of monetary incentives.

If the institution is on the simplified tax system and does not pay VAT, then the deduction does not apply, since input tax is not possible in the organization. On a simplified basis, in case of a gift, there is no need to pay VAT (Clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

If the organization has a general tax system or UTII, then VAT on themed souvenirs for employees is charged according to the general rules (clause 4 of Article 346.26 of the Tax Code of the Russian Federation), since donation is not the activity in connection with which the organization was transferred to the UTII regime .

Income tax on a gift

Letters of the Ministry of Finance of Russia No. 03-04-06/6-329 dated November 22, 2012 and No. 03-03-06/1/653 dated October 19, 2010 establish that when taxing profits, the cost of gifts is not taken into account (clause 16 of Article 270 of the Tax Code RF), since they are considered gratuitously transferred property. Accounting for gifts to employees in accounting includes the amount of accrued VAT as part of the “Other expenses” account, while in the NU for gratuitous transfer the cost of the gift is not taken into account. The result is the resulting difference and the institution’s permanent tax obligations (PBU 18/02 “Accounting for calculations of corporate income tax”).

If gifts are equated to the cost of remuneration that stimulates employees based on the results of work, then these costs are taken into account in the income tax (clause 25 of Article 255 of the Tax Code of the Russian Federation). The accountant must demonstrate certain evidence that the gift is an incentive for achieving high production results.

The taxpayer’s salary regulations must confirm the possibility of such operations, and incentive clauses must be included in the regulations and the collective agreement. The delivery is made as follows:

- An order or directive from the manager is being prepared to award bonuses to particularly distinguished employees. The order must refer to a specific clause in the bonus regulations.

- A list of awarded employees and a register with signatures of employees confirming receipt of remuneration are compiled.

IMPORTANT!

Gifts purchased through subsidies or LBO cannot be recognized as income tax expenses!

Tax accounting of New Year's gifts for children of employees

The cost of gifts donated free of charge is not taken into account in expenses for profit tax purposes (clause 16 of article 270 of the Tax Code of the Russian Federation). The transferring party also does not receive income recognized for the purposes of Chapter 25 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated October 27, 2015 No. 03-07-11/61618).

According to the general rule, for the purpose of accounting for VAT, the gratuitous transfer of property (in this case, the giving of gifts) is a sale and is subject to VAT (paragraph 2, paragraph 1, clause 1, article 146 of the Tax Code of the Russian Federation). In this regard, the following should be taken into account:

- VAT presented by the supplier when purchasing gifts is accepted for deduction in the general manner, since they are used in activities subject to VAT (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated August 18, 2017 No. 03-07-11/53088).

- In the tax period when the gifts were transferred, it is necessary to calculate and pay VAT to the budget on their market value (clause 2 of article 154, article 105.3 of the Tax Code of the Russian Federation). When determining the tax base for VAT for the gratuitous transfer of goods, you can apply the prices indicated in the primary accounting documents for this operation (letter of the Ministry of Finance of Russia dated October 4, 2012 No. 03-07-11/402). The moment of determining the tax base is the day the gift is transferred to the recipient (clause 1, clause 1, article 167 of the Tax Code of the Russian Federation).

- VAT amounts calculated when transferring gifts are not included in income tax expenses (Clause 16, Article 270 of the Tax Code of the Russian Federation).

- Since individuals are not VAT payers, invoices for the transfer of gifts to each individual may not be issued, but to reflect the transaction in the sales book, an accounting statement or summary document containing summary (consolidated) data on these transactions ( letter of the Ministry of Finance of Russia dated 02/08/2016 No. 03-07-09/6171).

Gifts to employees of an organization and their children are not subject to personal income tax, provided that the total value of gifts received by an individual during the tax period (calendar year) does not exceed 4,000 rubles. (10,000 rubles for certain categories of citizens) (Article 216, paragraph 28 of Article 217 of the Tax Code of the Russian Federation, paragraph 33 of Article 217 of the Tax Code of the Russian Federation). In this case, the issuance of gifts must be documented (letter of the Ministry of Finance of the Russian Federation dated August 12, 2014 No. 03-04-06/40051). Income in the form of gifts exceeding 4,000 rubles respectively. and 10,000 rub. per year, are subject to personal income tax on a general basis (Article 211 of the Tax Code of the Russian Federation).

Since the gift is transferred to the recipient under a gift agreement providing for the transfer of ownership of the property transferred as a gift, there is no object of taxation with insurance premiums and contributions for insurance from NS and PZ (clause 4 of Article 420 of the Tax Code of the Russian Federation, clause 20.1 of the Federal Law of July 24 .1998 No. 125-FZ). In addition, children of employees are not in an employment relationship with the organization, therefore, payments made in their favor are not recognized as subject to insurance premiums (clause 2 of the letter of the Ministry of Finance of the Russian Federation dated 01.08.2017 No. 03-04-06/48824, letter of the Ministry of Health and Social Development RF dated May 19, 2010 No. 12309-19). In order to avoid disputes with inspection authorities, the issuance of New Year's children's gifts should be formalized by a gift agreement in writing (letter of the Ministry of Finance of Russia dated January 20, 2017 No. 03-15-06/2437).

Considering that the procedure for recognizing the cost of children's New Year's gifts as expenses in accounting and tax accounting is different (expenses are recognized in accounting, but not in tax accounting), in accordance with PBU 18/02, a permanent difference will arise in the assessment of expenses and the corresponding constant will be recognized tax liability (TLO). In the accounting accounts, the recognition of PNO is reflected by the entry Dt 99 “Profits and losses” Kt 68 “Calculations for taxes and duties”.

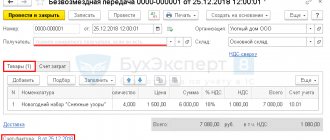

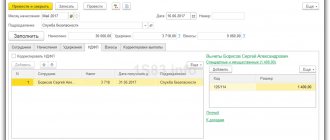

In the 1C: Accounting 8 program, the purchase of gifts is reflected in the Receipt document (act, invoice)

, issuance of gifts - with the document

Gratuitous transfer

.

Children's gifts

In almost every institution, children of employees are given sweet New Year's boxes. There are no exceptions for the design of such gifts - accounting and tax accounting of children's New Year's gifts to employees is carried out as follows:

- Calculate personal income tax if the amount of all gifts exceeds 4,000 rubles. Example: an employee received a souvenir for March 8 (500 rubles), a present for the company’s anniversary (3,000 rubles), and for the New Year she was given two bags (1,000 rubles each). Let's sum up the cost of all gifts for a calendar year: 500 + 3000 + 1000 + 1000 = 5500 rubles. Personal income tax will have to be withheld from the excess amount: 5500 – 4000 = 1500 rubles. Apply the rate depending on the taxpayer status: resident - 13%, non-resident - 30%.

- Insurance premiums are not charged for gifts to employees' children. Such gifts are not remuneration for work and have nothing to do with the labor relationship between the employer and the employee.

- When calculating income tax, do not take into account the costs of purchasing souvenirs for employees' children.

- Charge VAT on the purchase price of the gift without VAT, and if you give your own manufactured products, charge VAT on the cost of production.

Don't forget to decorate your children's gifts accordingly. Issue an order for the issuance of gifts, create a delivery list. Employees - parents of children who will receive gift boxes for the New Year - must sign for receipt.

Are gifts taxable?

An employer has the right to give its employee a gift in connection with production achievements, or for any event (for example, a birthday or holiday). The accounting features of this operation depend on the basis for the delivery of the gift, since:

- A gift associated with production achievements is regarded as a bonus, which is an integral part of remuneration for work, and it must be taken into account as part of the salary with its characteristic entries. The possibility of rewarding an employee with a gift should be provided for by the internal regulations on bonuses.

- A gift for a non-production purpose (for a holiday, anniversary, memorable event) has nothing to do with remuneration and is made within the framework of a civil process agreement concluded orally or in writing (clauses, article 574 of the Civil Code of the Russian Federation).

A gift is taxed differently than a bonus:

- For VAT purposes, the delivery of a gift is regarded as a gratuitous sale (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

- As for personal income tax, you do not need to pay income tax on the value of gifts not exceeding 4,000 rubles (Clause 28, Article 217 of the Tax Code of the Russian Federation), but it will have to be withheld from the amount exceeding the specified limit.

- Gifts of a non-production nature are not subject to insurance premiums (clause 4 of Article 420 of the Tax Code of the Russian Federation).

Gift Tax Reminder

We offer a simple and convenient table for an accountant to use, which will allow you to quickly determine how to properly keep accounting for children's New Year's gifts and souvenirs for the organization's employees themselves.

| Type of tax burden | A gift given within the framework of civil legal relations | A gift given as part of an employment relationship (as remuneration for work) |

| Personal income tax | Withhold personal income tax at the appropriate tax rate on the cost of a souvenir exceeding 4,000 rubles. Remuneration worth up to 4,000 rubles is not taxed. | |

| Insurance coverage (compulsory insurance, compulsory medical insurance, VNIM, NS and PZ) | Don't charge. Conclude a gift agreement to avoid problems with controllers. | Charge the entire cost at the general insurance rates. |

| VAT | Charge VAT in the prescribed manner. | Exclude the cost of a gift given as part of an employment relationship from the VAT calculation base. |

| Income tax or simplified tax system | Do not include them in expenses when calculating the tax base. | Take into account expenses when calculating the tax base. |

How to reflect in accounting

For accounting purposes, the cost of New Year's gifts is classified as other expenses (clause 12 of PBU 10/99). We bring to your attention a table that clearly shows how to arrange gifts for employees for the New Year in accounting (the cost of the gift is 500 rubles):

| the name of the operation | Debit | Credit | Sum |

| Acquisition of assets subject to transfer, excluding VAT | 10 (41) | 60 (76) | 416,67 |

| Allocation of input VAT | 19 | 60 (76) | 83,33 |

| Payment for goods and materials | 60 (76) | 50 (51) | 500,00 |

| Transferring gifts to employees and their children | 73 | 10 (41) | 416,67 |

| Reflection of expenses in accounting | 91 | 73 | 416,67 |

| Accrual of VAT on the sale of goods and materials free of charge | 91 | 68 | 83,33 |

| Acceptance of VAT for deduction | 68 | 19 | 83,33 |

It is necessary to sort out separate accounting entries for children's New Year's gifts for employees: sometimes an accountant wonders to which account the goods and materials should be credited. It is allowed to account for gifts on account 10 (Materials), however, since the transfer on a gratuitous basis relates to sales, it is recommended that the value be credited to account 41 (Goods).

In addition, it is not a violation to reflect expenses without using account 73. In this case, upon transfer of inventory items, the following posting is immediately made: Dt 91 Kt 41 (10).

As for accounting for gifts in a budgetary institution in 2021, the cost of purchased inventory items is reflected in off-balance sheet account 007.

In accordance with the order of the Ministry of Finance dated November 29, 2017 No. 209n and the order of the Ministry of Finance dated May 13, 2019 No. 69n, under Art. 349 “Increase in the cost of other disposable inventories” of KOSGU, New Year's gifts for children of employees in 2021 are reflected at the cost of acquisition, since such inventory items belong to the category of gift products.

Accounting for gifts in non-profit organizations

Instructions on how to register gifts for employees for the New Year (including their children) in accounting:

- If the reward is in the form of a bonus for high performance results:

- accrual of employee incentives in the form of a bonus as part of salary expenses - Dt 20, 21, 23, 25, 26, 29, 44 Kt 70;

- calculation of insurance premiums - Dt 20, 21, 23, 25, 26, 29, 44 Kt 69;

- the employee received a bonus payment - Dt 70 Kt 91.1, 90.1;

- withholding of income tax - Dt 70 Kt 68;

- accounting for the amount of the bonus in the expenses of the institution - Dt 91.2, 90.2 Kt 10, 41;

- VAT calculation - Dt 91.2, 90.3 Kt 68.

- If an employee is given a New Year’s souvenir worth over 4,000 rubles:

- accounting for the purchase price as expenses - Dt 91.2 Kt 10, 41;

- VAT calculation - Dt 91.2 Kt 68;

- accrual of permanent tax liability - Dt 99 Kt 68;

- withholding personal income tax from an employee - Dt 70 Kt 68.

Gift accounting

Based on the Chart of Accounts and instructions for its use (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), the acquisition and issuance of children's gifts can be reflected in accounting as follows:

Debit 41 Credit 60 - children's New Year's gifts were capitalized;

Debit 19 Credit 60 - reflects the VAT presented by the supplier;

Debit 68, subaccount “Calculations for VAT”, Credit 19 - “input” VAT is accepted for deduction;

Debit 73 Credit 41 - reflects the transfer of gifts to employees;

Debit 91 Credit 73 - the cost of gifts is included in other expenses;

Debit 91 Credit 68, subaccount “Calculations for VAT” - VAT is charged on the cost of gifts.

Due to the fact that these expenses do not reduce taxable profit, organizations applying PBU 18/02 (approved by order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n) will have a permanent tax difference and a corresponding permanent tax liability (PNO):

Debit 99, subaccount “Permanent tax liability” Credit 68, subaccount “Calculations for income tax” - for the amount of PTI.