Payment for shift work: general points

The rotation method differs from all other systems for organizing the work and rest regime of workers primarily in that it provides a number of additional legislative guarantees to workers involved in work on a shift basis (Article 302 of the Labor Code of the Russian Federation).

All shift workers are guaranteed by the Code:

- shift pay as a method of labor;

- payment or free provision of housing;

- payment for days of round trip travel and days of delay in travel due to weather conditions based on the daily rate.

For shift workers working in the Far North or equivalent areas, the following are guaranteed:

- additional increasing coefficients (regional - depend on the area of work);

- allowances for work in the North (the so-called northern, calculated as a percentage of earnings);

- additional paid holidays - the number of days depends on the area of work.

The collective and/or labor agreement may also provide for other guarantees, such as the provision of free food during shifts.

Payroll when applying a work schedule on a rotational basis can be carried out using remuneration systems (or a combination of them for different cases):

- tariff system;

- salary systems;

- time-based;

- time-bonus;

- piecework;

- piecework-bonus;

- other methods and forms of remuneration not prohibited by law.

With the rotational method, remuneration is based on general economic methods. Payroll calculation is based on the tariff rate per hour or per unit of production. The tariff schedule may cover all positions and professions of the enterprise, or may apply only to certain categories of workers, leaving others on the salary system.

Watch and personnel

An employer who uses a rotational method of organizing labor and paying for it has a number of obligations to employees in accordance with the law:

- tracking the working time of each employee on shift (duration - no more than a month, in exceptional cases - up to 3 months);

- summary recording of working hours;

- provision of housing and three meals a day;

- organization of medical examinations, payment of sick leave;

- payment not only for labor, but also for travel to the place of work, the use of a number of allowances for labor;

- advance preparation and approval of a work schedule and familiarization of employees with it, with a shift duration of no more than half a day.

Attention! The duration of the shift is calculated in total with the rest time from shift to shift (Labor Code of the Russian Federation, Art. 299).

Employees must be familiarized with the schedule no later than two months before starting work. The document must be approved by the trade union of the employing organization. When drawing up a schedule, you should keep in mind that working without a rest break, in two shifts in a row, is strictly prohibited.

Shift workers may be provided with the following types of payments:

- salary;

- allowance for the shift, taking into account travel time for each day of the shift;

- payment for overtime between shifts;

- coefficients for complexity, work intensity, hazardous working conditions, depending on the industry;

- “climate” allowance, if work is carried out in the corresponding regions, the so-called northern one, etc.

Attention! The shift bonus has a fixed amount only for employees of federal structures (30% - general rate, Siberia, Far Eastern region - 50%, Northern region - 75% of the average daily rate). Commercial structures set its dimensions independently.

All working and rest conditions must be clearly stated in the employment agreement, collective agreement, and other legal acts of the organization. In accordance with labor legislation, the following are not allowed to work on a rotational basis:

- pregnant women;

- minors;

- persons for whom a certain climate is harmful for medical reasons;

- women with children under 3 years of age.

Salary for shift work

In general, wages on a rotational basis consist of the following components:

- payment for work performed during the shift - according to tariff rates, categories, production standards;

- payment for overtime hours - is summed up once per accounting period (month, quarter, year - depends on the internal remuneration policy of the enterprise) upon its completion;

- payment for additional days of inter-shift rest (paid days off) for overtime on shift (Article 301 of the Labor Code of the Russian Federation, clause 4.3 of the Basic Provisions on the shift method of organizing work, approved by Resolution of the USSR State Committee for Labor of December 31, 1987 No. 794/33-82 [hereinafter referred to text - Basic provisions No. 794/33-82]);

- allowances: for shift work,

- for the area of work (the Far North and areas equivalent to it),

- for particularly difficult working conditions,

- for harmful working conditions;

Working hours during the shift method are recorded on a cumulative basis.

You can find out more about the features of this method of recording working time here: “Total recording of working time - examples of calculation.”

We calculate wages for hours worked

This calculation depends on the remuneration system used in your company:

- <if>the employee’s work is paid on the basis of an hourly tariff rate:

- <if>the employee’s work is paid on the basis of a daily tariff rate:

- <if>the employee’s work is paid on a salary basis, then the calculation is made in two stages.

STEP 1. Calculate the hourly part of the salary. There are two possible options for this calculation. The option you choose must be specified in the company’s local regulations (for example, in the regulations on shift work).

OPTION 1. Taking into account the average monthly number of working hours for the calendar year:

This option is convenient because the hourly part only needs to be calculated once at the beginning of the year and can then be applied throughout the year. In addition, pay for shift workers will be more equal.

OPTION 2. Taking into account the standard working hours of a particular month according to the production calendar:

With the second option, the hourly part of the salary will be different in different months. Therefore, pay for shift workers will be less uniform.

STEP 2. We calculate the employee’s salary for the time worked:

Compensation and allowances for shift work

As a rule, employers make compensation payments to shift workers - payment for travel from the place of assembly/place of residence to the place of work and back (tickets) and days of travel (tariff or average daily earnings for days on the road). An enterprise can reimburse the cost of travel, or it can issue tickets to its employees, purchasing them centrally from transport companies. Sometimes large companies organize the transportation of their employees on special flights, ordering airplanes, watercraft, and railway cars. Aspects of payment for travel to employees will be discussed in more detail below.

The shift allowance replaces daily travel allowances. The bonus for working on a shift basis is calculated for all days of the shift and for the days the employee is on the road on the way to the shift and back. The amount of allowances at commercial enterprises is established by collective agreement. For state-owned enterprises, there are regulations establishing the amount of allowances.

Details related to the payment of bonuses for shift work are discussed in the Guide “Shift Work” from ConsultantPlus. Get trial access to the system for free and proceed to the explanations.

Industry standards must be taken into account when calculating salaries. Especially if the company is a party to an industry agreement. If such an agreement is not signed by the enterprise, it may be equal to the norms of industry standards, but they will not be binding for the enterprise.

The amount of the bonus for shift work can be set:

- as a percentage of the salary (tariff rate);

- in a fixed amount.

Taxation of premiums on insurance premiums

Benefits paid to employees are subject to insurance premiums. The exception is the amount of compensation in the form of bonuses provided to rotational workers. Tax-exempt payments are made upon reimbursement of expenses arising in connection with the performance of labor duties (clause 2 of Article 422 of the Tax Code of the Russian Federation).

The amounts provided to individuals to compensate for expenses and listed in clause 3 of Art. 217 Tax Code of the Russian Federation. The condition for tax exemption is the determination of the amount of payment in contracts or other internal documents of the enterprise.

Payroll calculation using the rotation method - example

Foreman Ivanov I.I. works at an enterprise that uses a rotational work schedule.

Shift work conditions are as follows:

- Shift work schedule: 15/15(16). 16 days of rest are provided in months in which there are 31 days, 14 days of rest in February. In our example, the month under consideration is December 20XX.

- In December, the shift begins on the 5th. 4 days of the month (from the 1st to the 4th) - the road to the shift. The end of the watch is on the 19th, from the 20th to the 23rd - the road from the watch.

- The working shift on watch is 11.5 hours all days except the day before the end of the watch. On this day, work lasts 11 hours.

Question: Why are there no days off for 15 days of work during a shift?

Answer: in accordance with table 3.1 “Recommended work and rest regimes” of the Guidelines for optimizing work and rest regimes for rotational and expeditionary rotation methods of organizing work in the North, approved. Ministry of Health of the USSR 04/25/1988 No. 4614, with a 15-day work schedule, shifts are organized in such a way that by changing shifts from the day shift to the night shift, the required number of hours for inter-shift rest is formed (according to clause 4.3 of the Basic Provisions No. 794/33-82, the duration of inter-shift rest including lunch breaks - at least 12 hours).

- The hourly tariff rate is 300 rubles/hour.

- Compensation for shift work is 700 rubles/day.

- Payment for travel time is 100% of the daily wage based on an 8-hour working day.

- The accounting period is quarter. For our example, we provide salary calculations for December and calculate payment for hours worked overtime in the accounting period. The employee worked for the 4th quarter of 20XX: in October - 184 hours, in November - 172 hours, in December - 172 hours. Or 528 hours per quarter when the norm is 519 hours.

ATTENTION! In the context of the COVID-19 pandemic, officials have developed rules for working on a rotational basis. Initially, they were valid until the end of 2021. But the government, by Decree No. 2310 dated December 28, 2020, extended the validity of these rules until the end of 2022.

Read more about the temporary work rules for shift workers in the review from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

We remind you that the employer is required to draw up a work schedule for the entire accounting period (in our case, a quarter). In our example, this is table 1.

The following markings are used to indicate days in the schedule:

- DD - days on the road;

- RD - working days of the shift;

- Airborne Forces - a day off during a shift between shifts (in our case there are no such days);

- On weekends.

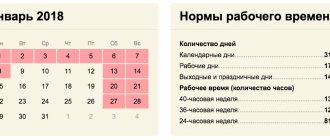

In order to more clearly display the periods of work and rest of I. I. Ivanov, we present the calendar of December 20XX with the calculation of days on the road, on shift and days of inter-shift and inter-shift rest:

- from December 1 to December 4 - 4 days on the way to the place of work;

- from December 5 to December 19 - 15 days on duty;

- from December 20 to 23 - 4 days on the way home;

- from December 24 to December 31 - 7 days off.

Only 8 days on the road, 15 working days, 8 days of rest.

1. Number of hours worked per month:

14 × 11.5 + 1 × 11 = 172 hours.

2. The employee worked 15 days. With a 40-hour work week and a normal work shift, the number of hours that an employee would have worked for the same period in December (see paragraph 4 of clause 4.5 of Basic Provisions No. 794/33-82):

15 working days × 8 hours = 120 hours.

3. Number of days of shift work:

(172 – 120) / 8 = 6.5 days.

For these days, paid days off are provided (paragraph 3 of article 301 of the Labor Code of the Russian Federation, clause 4.5 of the Basic Provisions No. 794/33-82). The December report card takes the form presented in Table 2.

When drawing up the report card, we use form T-12, approved. Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. The employer is obliged to keep records of working hours, as stated in Art. 91 and Art. 300 Labor Code of the Russian Federation. At the same time, the form for recording working hours can be independently developed by the enterprise. In our case, the enterprise established in its accounting policy that the T-12 form is used to record working time.

In this case, payment for weekends will be carried out in the following way: 6 days - for 8 hours, 1 day - for 4 hours.

We mark work days, days off and paid days off in the same way as indicated in the T-12 form, namely:

- days off between shifts and between shifts - B;

- working days during a shift - VM;

- paid days off - OV.

4. Let's calculate the salary for the time worked:

172 hours × 300 rub./hour = 51,600 rub.

5. Supplement for shift work:

(15 days of watch + 8 days of travel) × 700 rub./day = 16,100 rub.

6. Payment for overtime (paid days off):

6.5 days × 8 hours × 300 rub./hour = 15,600 rub.

7. Payment for days on the road:

8 days × 8 hours × 300 rub./hour = 19,200 rub.

8. Total wages for December:

51,600 + 16,100 +15,600 + 19,200 = 102,500 rub.

9. In addition, in December it is necessary to pay the employee for hours of overtime work according to the summarized schedule. From the conditions of the example, it is known that the employee worked 516 hours during the quarter, which is 5 hours more than the standard:

5 × 8 × 300 = 12,000 rubles.

In total, for work on a rotational basis in December, the enterprise is obliged to pay foreman Ivanov I.:

102,500 +12,000 = 114,500 rub.

Calculating the salary of an employee working on a rotational basis in the North

Payroll calculation for an employee working on a rotational basis in the North has its own peculiarities.

Regional coefficients have been established that must be used when calculating wages. So, if in the above example Ivanov I.I. worked in the Far North, in the Khanty-Mansiysk region, then the northern coefficient applied to his salary is 1.7.

In addition, there is also a bonus for working in the North (“northern”). This premium depends not only on the region, but also on the length of service of the employee in the Far North and in equivalent regions.

Let’s assume that Ivanov I.I.’s northern bonus is 50%.

Then Ivanov I.I.’s salary for working on shift in December 20XX:

172 × 300 × 1.7 + 172 × 300 × 0.5 = 87,720 + 25,800 = 113,520 rubles.

We add all additional payments and compensations calculated in the example above. The final salary of I. I. Ivanov:

113,520 + 16,100 + 15,600 + 19,200 + 12,000 = 176,420 rub.

To clarify the principle of application of northern surcharges and their sizes, read the article “The size of the northern surcharge in the Far North regions.”

Security: payment after the watch

If a person works in security on a rotational basis, then inter-shift rest is provided to him on the same conditions as other employees working on a rotational basis. Security guards usually have overtime after their shift. Therefore, they are calculated paid days off in the same way as in the example above. At the end of the accounting period (month, quarter or year), security staff may be paid overtime based on a double tariff rate.

Moreover, if payment for the main shift time has already been made, then the employer makes an additional charge for overtime (overtime for the accounting period), as in the example above. An employee has the right to receive additional days of rest instead of extra pay for overtime (Article 152 of the Labor Code of the Russian Federation).

More details about the rules for calculating payment for overtime work can be found in the article “How is overtime work paid according to the Labor Code of the Russian Federation?”

We calculate payment for inter-shift rest days

Such days are provided to shift workers for overtime during the shift period. After all, as a rule, their working day is longer than the standard eight-hour day and they work a six-day shift. 301 Labor Code of the Russian Federation. Consequently, work for each week on shift significantly exceeds the standard working hours for a week according to the production calendar. For each day of inter-shift rest, the employee must be paid one daily tariff rate or a daily part of the salary, unless a higher amount of payment is established by local regulations (for example, regulations on the rotation method), a collective or labor agreement. 3 tbsp. 301 Labor Code of the Russian Federation. For information on how to calculate the number of days of inter-shift rest, read on p. 54 of this number.

The amount of payment for inter-shift rest days per month is calculated as follows:

Using formula (8), the amount of payment for inter-shift rest days per month can be calculated for workers who have a daily tariff rate.

The procedure for calculating the daily tariff rate based on the hourly tariff rate or salary has not been established. Its size can be determined as follows:

- <if>the employee has an hourly wage rate:

- <if>the employee has a salary (monthly tariff rate):

OPTION 1. Taking into account the average monthly number of working days per year:

OPTION 2. Taking into account the norm of working days of a particular month according to the production calendar:

To avoid uneven payment for inter-shift rest days by month due to fluctuations in the norm of working days in different months, it is better to calculate salaries for salaried employees taking into account the average monthly number of working days for the year (option 1).

Payment for travel from shift upon dismissal

If an employee quits while on shift, a legitimate question arises: is the organization obligated to pay him for travel from the shift upon dismissal? First, let’s consider whether the organization is obliged to pay the shift worker’s travel and in what amount.

There are several starting points for making a decision on paying for workers’ travel to and from their shifts:

- from place of residence to place of gathering;

- from the gathering place to the place of work;

- from place of residence to place of work.

ATTENTION! In accordance with sub. 2 p. 1 art. 422 of the Tax Code of the Russian Federation, all types of compensation payments (within the limits established by law) related to the employee’s performance of his job duties are not subject to insurance premiums for payers who are organizations, individual entrepreneurs or individuals - employers. The procedure for paying compensation to employees for travel expenses to their place of work must be fixed in a collective agreement and employment contracts.

Regarding the question of whether the employer is obliged to pay for travel from the place of work to the place of residence for an employee who quit after the end of the shift, there cannot be a clear answer. If this clause is not separately stated in the employment contract with the employee, then the employer is not obliged to pay for travel. The person quit - he ceased to be an employee of the enterprise, and the employer’s obligations to him ceased from the moment of his dismissal.

If a person, working in the Far North, quits and at the same time took leave, then the employer is obliged to pay for his travel to the place of vacation. Since in this case, the employment relationship ends only from the end of the vacation or another date different from the end date of work on the shift.

Tax accounting of percentage increase in wages

According to general rules, labor costs include any accruals to employees in cash and (or) in kind, incentive accruals and allowances, compensation accruals related to working hours or working conditions, bonuses and one-time incentive accruals, expenses related to the maintenance these workers, provided for by the norms of the legislation of the Russian Federation, labor agreements (contracts) and (or) collective agreements (Article 255 of the Tax Code of the Russian Federation).

ACCOUNTING SUPPORT

As already noted, the possibility of applying a bonus depends on the employee’s length of service (Article 317 of the Labor Code of the Russian Federation). However, additional guarantees and compensation for persons working in the regions of the Far North can be established by collective agreements, agreements, and local regulations (Article 313 of the Labor Code of the Russian Federation).

Important!

The company may provide in the labor and (or) collective agreement with the employee, bonuses from the first day of work for young people (up to 30 years old). Such allowances can be taken into account in labor costs in full (Letter of the Ministry of Finance of the Russian Federation dated October 7, 2013 No. 03-03-06/1/41462).

When applying the simplified tax system (the object is “income reduced by the amount of expenses”), payments calculated on the basis of percentage allowances are part of the remuneration and are taken into account when calculating the single tax (Article 315, Article 317 of the Labor Code of the Russian Federation). Allowances are recognized at the time of their payment to the employee (clause 1, clause 2, Article 346.17 of the Tax Code of the Russian Federation).

ACCOUNTING SERVICES FOR LEGAL ENTITIES

There are no specific features regarding the determination of the tax base for personal income tax. A percentage bonus is income received by an employee in cash, and therefore is subject to personal income tax along with wages on a general basis (clause 1 of Article 210 of the Tax Code of the Russian Federation, clause 6 of clause 1 of Article 208 of the Tax Code of the Russian Federation).

Insurance contributions for compulsory pension (social, medical) insurance, as well as contributions for insurance against accidents and occupational diseases are calculated in the generally established manner (Part 1 Article 1, Part 1 Article 7 of the Law of July 24, 2009 No. 212- Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”, hereinafter referred to as Law No. 212-FZ, from January 1, 2021 - in accordance with Chapter 34 “Insurance contributions”).

Results

Remuneration for shift work has its own characteristics. Payment is made for work performed during the shift according to tariff rates, categories, and production standards. In addition, bonuses are paid for work on a shift basis, for days on the road, for the area of work (the Far North and areas equivalent to it). Overtime work is paid based on the results of the accounting period. The main difficulties for an accountant of a commercial enterprise arise if the local acts of the enterprise do not clearly define the procedure for calculating and paying wages to persons involved in work on a rotational basis.

Sources:

- Labor Code of the Russian Federation

- Resolution of the State Labor Committee of the USSR, the Secretariat of the All-Union Central Council of Trade Unions, the Ministry of Health of the USSR dated December 31, 1987 No. 794/33-82

- Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Withholding of personal income tax from the amounts of the bonus received

The Ministry of Finance clarified the procedure for taxation of payments to rotational workers in letter No. 03-04-05/7999 dated 02/09/2021.

According to the explanations of specialists from the Ministry of Finance, bonus payments to shift workers are recognized as compensation provided for special working conditions. Amounts are exempt from income tax on the basis of the provisions of paragraph 3 of Art. 217 Tax Code of the Russian Federation. To apply the exemption, you must have the following grounds:

- Non-taxable amounts for commercial enterprises must be established by regulations or internal documents of the enterprise. The amounts are confirmed by the representative or trade union body of the employees.

- Payments to rotational workers from state funding are established by budget standards at the appropriate level.

Employers use the allowance to cover expenses, but must not make payments beyond the cap. According to experts from the Ministry of Finance, the amount of the bonus should be comparable to the expenses of employees during the shift period

Deputy Director of the Department V.A. Prokaev (letter dated July 13, 2021 No. 03-04-06/49149).

A significant excess of the amount over costs may lead to additional attention to the accounting of the enterprise and the adoption of a decision by the inspectors of the Federal Tax Service on additional assessment of income tax.