Home / Real estate / Land / Purchase and sale

Back

Published: 12/17/2016

Reading time: 12 min

0

1272

It takes a lot of money to buy land. But Russians have the opportunity to return part of the amount spent. To do this, you need to apply for a property tax deduction.

Not all Russians can return the 13% personal income tax back, and this tax break does not apply to the purchase of every plot of land.

- What conditions must a taxpayer meet and what is needed to apply for a deduction? Features of obtaining a tax deduction when purchasing land without a house

- Features of obtaining a tax deduction when purchasing a plot with a house

- Features of obtaining a tax deduction when purchasing land with a mortgage

Buying land: what tax breaks are possible

In accordance with Art.

220 of the Tax Code of the Russian Federation, the buyer of land for the construction of housing, land with an already built house or a share in these objects can take advantage of a property deduction for personal income tax. IMPORTANT! The purchase of land for another purpose does not provide a deduction.

In this case, the buyer must have in hand papers indicating ownership of the house or confirming the intended use of the land for the construction of a residential building.

NOTE! Until 01/01/2010 Art. 220 was in effect in a different version - expenses for the purchase of land were not mentioned as deductions. Therefore, only those who registered housing on the site after the specified date will receive a tax deduction on the land plot.

Documents for receiving a deduction

To receive a deduction, a citizen will need to collect the established package of documents.

They can be divided into the following groups:

- application for deduction;

- tax documentation (declaration);

- documents confirming the acquisition of land (purchase and sale agreement);

- payment documents;

- certificate of ownership of the house/extract from the Unified State Register;

- mortgage loan documents (loan agreement, payment schedule);

- payment documents confirming the existence of construction and finishing costs

- houses (contracts for finishing and general construction work, receipts for the purchase of building materials, documentation on connecting to electrical networks);

- information about taxable income;

- bank account details (statement);

- marriage certificate (if available).

Documents are presented in copies simultaneously with the originals.

Return documents must be submitted within 3 years after purchase. For example, if a house and land were purchased in 2021, the deduction must be filed before 2021, otherwise the statute of limitations will expire and the money will not be returned.

Tax officials will check the submitted information for up to 3 months. After which the applicant will receive the overpayment to the bank account specified in the application.

Who and how can claim a deduction when purchasing land?

Only residents of the Russian Federation have the right to a tax deduction if they have income taxed at a rate of 13% (except for income in the form of dividends). At the same time, they must purchase land at their own expense and register it or the house on it (a share in the said property) in the name of themselves, their minor children (including adopted children) or wards under the age of 18.

The deduction will not be processed if:

- The purchase and sale of land, housing or shares was carried out between interdependent persons, for example close relatives.

- Expenses for land, housing or shares were paid at the expense of employers, maternal capital, and funds from the state subsidy program.

The taxpayer is given a deduction:

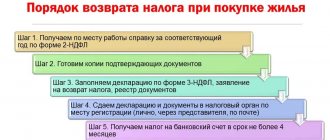

- by the tax inspectorate at the end of the year after filing and checking the declaration and other documents by returning income tax to the applicant’s bank account;

- by the employer on the basis of a notification from the tax authority by reducing the tax base for the tax by the amount of the claimed deduction.

The taxpayer decides independently how it is more convenient to receive the deduction.

Tax Refund Options

There are two ways to receive a deduction when buying an apartment.

With the employer this year. In this case, you do not need to submit a declaration in Form 3-NDFL. The deduction will be provided based on notification. The tax office issues such a document upon application. This method of providing a deduction is that the employer reduces taxable income for the year by the deduction amount and ceases to withhold personal income tax. You receive it along with your salary. clause 8 art. 220 NK

According to the declaration next year. This option is suitable for returning personal income tax for previous periods or in the absence of an employment contract. You can file your return at any time during the next year or even later. The April 30 deadline for deductions does not apply: it must only be observed when declaring income. clause 7 art. 220 NK

What is the amount of tax deduction when purchasing land?

The amount of tax deduction when purchasing a land plot is determined by the amount of acquisition costs, but is limited to 2 million rubles. and you can only get it once. But the distribution of the deduction for objects depends on the year in which the person first claimed the right to it.

- If the ownership right was registered after January 1, 2014, then in case of incomplete use of the deduction for the first object, the balance can be transferred to the next one and so on until the limit of 2 million rubles is completely exhausted.

Example 1: In February 2014, V.V. Petrov bought and registered land for construction for 1 million rubles, and in 2015 received a tax deduction on land in the specified amount. In February 2015, he expanded the plot by purchasing neighboring land for 700 thousand rubles. At the end of 2015, he will be able to claim a deduction in the amount of 700 thousand rubles. The balance is 300 thousand rubles. can be used on the next object.

- If the ownership of the property was registered in 2013 or earlier, then in this case, transfer of the deduction when it is not fully used is not allowed in accordance with the version of the Tax Code in force at that time.

Example 2: Petrov V.V. from example 1 registered a land plot in December 2013. In 2014, he will be able to receive a deduction of 1 million rubles, but the deduction will not apply to the plot purchased later (subparagraph 3, paragraph 1, article 220 of the Tax Code, letter of the Ministry of Finance dated June 23, 2015 No. 03-04-05/36283) .

How to get a tax deduction for the purchase of land and return the tax

The declaration is verified within three months. Another month is allocated by law for the transfer of personal income tax to the taxpayer’s account. In total, it may take about four months from the moment the declaration is submitted until the money is returned to the account.

The application for the right to deduction is checked for about a month. Within 30 days, the tax office issues a notice of the right to deduction. It must be taken to the employer. If there is such a notification, then the accounting department will stop withholding personal income tax from the salary until the accrued income from the beginning of the year does not exceed the deduction amount specified in the notification. If it was not possible to use the entire deduction in a year, the balance is carried over to the next year, but the notification must be received again.

The declaration and application can be sent to the tax office every year, taking into account the balance of the deduction and the tax already returned. Until the entire personal income tax amount is returned.

When is a property tax deduction applicable when selling a land plot?

Not only the purchase of housing is accompanied by a deduction for personal income tax. When selling a plot of land, an income tax deduction is also provided, but in a slightly different form. After all, if upon purchase submitting a declaration and receiving a deduction is a voluntary matter, then when selling property, submitting a declaration (if the maximum period of ownership of such property of 3 or 5 years has not been exceeded) with the calculated tax payable is the responsibility of an individual.

The amount of the deduction is provided in the amount of documented expenses that an individual incurred to purchase the property being sold. If there are no supporting documents, then the value is 1 million rubles. - the maximum for reducing the taxpayer’s income received from the sale of his own housing (houses, apartments, rooms), dachas, garden houses, land plots and shares in all listed property.

IT SHOULD BE NOTED! When selling other property, such as motor vehicles, the deduction is limited to 250 thousand rubles.

How to submit documents to the tax office for a tax deduction

If the deduction is claimed for previous years, you need to submit a tax return in Form 3-NDFL. For each year there is a separate declaration. If two spouses claim a deduction for one apartment, then each submits a declaration for himself. A complete package of documents must be attached to the declaration: copies of them are sufficient. In addition to the declaration and supporting documents, you must attach an application for a tax refund with details of where to transfer the overpaid amount of personal income tax.

A certificate of income must be attached to the declaration. It can be taken at work or downloaded from the taxpayer’s personal account. Certificates for the previous year appear in your personal account around April of the following year or later, when employers submit reports.

To receive a deduction this year from your employer, you need to submit an application to confirm your right to deduction. It is convenient to fill out and send it in the taxpayer’s personal account on the website nalog.ru. In this case, there is no need to fill out a declaration.

What is a tax deduction for land tax of 6 acres

The calculation of land tax is carried out by the tax authorities. An individual can only check its correctness and, in case of disagreement, contact the tax authorities with an application and relevant documents for recalculation.

Starting from 2021, when calculating land tax, a tax deduction has been established, reducing it by the cadastral value of 600 square meters. m for one plot of land. This means that if the area of the plot does not exceed 600 sq. m (6 acres), then no tax is charged, but if it exceeds, then the liability will be calculated for the remaining area.

The deduction is applicable to the persons listed in clause 5 of Art. 391 of the Tax Code of the Russian Federation: pensioners, veterans, disabled people, etc.

Under what conditions can a tax refund be issued when purchasing a plot of land without a house?

A property deduction is also issued if a plot of land with a house is purchased, which will subsequently be demolished.

The following persons can count on receiving a property deduction when purchasing land:

- citizens of Russia;

- citizens of other countries applying for Russian citizenship who have lived within the country for 183 days during the year;

- officially employed citizens paying income tax at a rate of 13%.

Purchasing a plot of land is a major purchase, sometimes comparable to paying for a country cottage. Purchasing land is associated with high costs, even if a loan has been issued in advance. Some taxpayers may be able to ease this financial burden by receiving a property tax deduction. The conditions for its provision are as follows:

- The applicant must be a tax resident of Russia. This must be understood in such a way that citizenship does not play a role, but a person must certainly pay personal income tax at a rate of 13% on wages and other earnings, and also live in the country for at least 183 days a year.

- The tax base can be reduced by a maximum of 2 million rubles, that is, personal income tax returns are made in an amount of no more than 260 thousand rubles. If less than 2 million was spent on the purchase of the plot, the deduction will also be less, in proportion to the expenses.

- The land plot must belong to the category of land for individual housing construction (IHC).

- To receive the deduction, you will first have to obtain a building permit as confirmation of the fact that the land was purchased for housing construction.

- Tax compensation will also be provided for the costs of paying interest on the loan taken to purchase the plot.

Results

Individuals - residents of the Russian Federation, when purchasing a land plot, can take advantage of a property deduction in the amount of expenses incurred, but not more than 2 million rubles. In this case, the acquired plot must be intended for residential construction or a residential building must already be built there.

The sale of land may also be accompanied by a personal income tax deduction: either in the amount of expenses previously incurred when purchasing the land, if supporting documents are available, or in a fixed amount of 1 million rubles.

A deduction for land tax is 6 acres, which are not taxed for the categories of individuals listed above.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to get a deduction

In fact, a property deduction will be provided for a property located on a land plot - a residential building. The tax base will be reduced by including the costs of acquiring land in the total costs of constructing a residential property. Currently, the law establishes the maximum possible deduction for the acquisition and construction of real estate in the amount of 2 million rubles.

Based on this limitation, the deduction amount will be determined as follows:

- the purchase price of a land plot for the construction of individual housing construction is fixed - for example, 500 thousand rubles;

- after completion of construction and commissioning of the house, the cost of the work performed is calculated - for example, 2,500,000 rubles;

- the total cost of building a house is determined: 2,500,000 + 500,000 = 3 million rubles;

- since the total amount of costs exceeds the maximum allowable deduction, to calculate the amount of personal income tax for refund, only 2 million rubles will be taken into account: 2,000,000 x 13% = 260,000 rubles.

Thus, in the example considered, you can apply for a personal income tax transfer from the budget in an amount not exceeding 260 thousand rubles. This does not mean that the owner of the house and plot will be able to receive the specified amount in full within one year - the Tax Code of the Russian Federation allows for the return in one year only of personal income tax, which was actually withheld and transferred to the budget based on the results of the previous year.

For example, if the amount of personal income tax withheld at the place of work was 100,000 rubles, this is the amount the owner of the house and land will be able to receive as a deduction. The law allows the unused balance of the deduction to be transferred to future periods, i.e. full reimbursement of the amount of 260,000 rubles can be spread over several years.

If the total costs of purchasing a plot of land and building a house did not exceed 2 million rubles, the deduction will be calculated based on actual costs.

For example, if expenses amount to 1,500,000 rubles, no more than 195,000 rubles can be returned from the budget.

The deduction is provided on the basis of the following documents:

- declaration form in form 3-NDFL, in which the citizen indicates the composition of expenses, the amount of income tax withheld and calculates the amount of deduction;

- land purchase agreement;

- deed of transfer;

- design and estimate documentation confirming the amount of costs for the construction of the facility;

- payment documents confirming payment of the price of the site, as well as the cost of building materials - receipts, payment orders, receipt orders, receipts from stores, etc.;

- an extract from the state register of the Unified State Register of Real Estate, confirming ownership of the plot and residential building;

- a general passport for each owner;

- certificate 2-NDFL from the place of work, which indicates the amount of income tax withheld and transferred to the budget;

- application for refund of personal income tax from the budget, indicating account details.

Particular attention must be paid to filling out the 3-NDFL declaration form. All information on this form must correspond to the actual costs of acquiring the site and constructing individual housing construction. Documents for deduction are submitted by April 30 of the year following the year of registration of rights to a residential property. After this, funds from the budget are transferred to the applicant’s account in a non-cash form.

Territory

In order to return part of the taxes by purchasing land, it is recommended to choose a plot that meets the following requirements:

- The land is intended for individual housing construction, country houses and household plots with the right to build residential buildings (letter of the Federal Tax Service No. ED-4-3/20904 dated December 10, 2012). Deductions are not provided for land purchased simply for gardening, horticulture, or development of subsidiary farming. This is indicated in the letter of the Ministry of Finance No. 03-04-05/dated 31.10. 2013

- A residential building was built on it. Ownership rights have been registered to it and the land. From the moment of registration of ownership of a residential building and the territory on which it is built, the right to a personal income tax benefit appears. It doesn't matter when the expenses were incurred.

- The land was purchased with the applicant's personal funds. If it was purchased with funds from family capital, the budget or the employer, a tax refund will be denied.

- The plot is not purchased from family members or close relatives. For example, a daughter cannot buy land from her father; she will be denied a benefit due to the interdependence of the seller and the buyer.

- A residential building with all available permits and technical documentation must be built on the site, and not a building suitable for living.

- The land and house were registered as property after 2010.

The benefit is allowed to be claimed for three previous tax periods, but no more. It is given only for one residential building with a land plot.

Amount of deduction for the purchase of land

The legislation determines exactly how much can be returned to citizens in each individual case.

Thus, the amount of the benefit in question is tied to the income tax rate and is equal to 13%. But these percentages are calculated not from the amount of citizens’ income, but from the amount of their expenses incurred for the above-mentioned purposes. At the same time, the legislator limits the maximum amount of amounts from which personal income tax can be returned to citizens.

So:

- expenses for purchasing a plot of land and building a private house on it are limited to 2 million rubles;

- When citizens pay interest on borrowed funds, the amount of the deduction base is limited to 3 million.

However, these restrictions were introduced into legislation after 2014. So, if citizens bought an allotment before the specified year, then when they apply for a tax deduction for them, the refund amount is calculated based on the amount of all expenses, regardless of their total amount.

In cases where the amount of the taxpayer’s expenses does not reach the established amount, the deduction is drawn up based on the amount of expenses actually incurred, and the remainder of the limit is left for the future. If the expenses are much more than the established limit, then the refund is calculated based on the amount of the specified limit.

The calculation of the refund is carried out, as a rule, by the employer or the tax authority when citizens submit an application and the necessary documents. The calculation is carried out based on the amount indicated in the payment documents.

However, much depends on exactly how the citizen plans to receive the refund. In each of these cases, you must collect your package with a document and contact various institutions.