In 2021, almost any taxable citizen of the Russian Federation can receive an income tax deduction at their place of work or at the tax office. Who has such a right, especially if we are talking about buying a second apartment? This and other important points will be discussed in the article.

According to the legislation, citizens of the Russian Federation have the right to receive a tax deduction in case of purchasing property

. For those who have already taken advantage of this opportunity, a reasonable question arises about the possibility of returning the tax deduction again and under what conditions.

Who can return the tax deduction

According to the law, in 2021, all taxpayers are given a second chance to take advantage of the property deduction. According to Article 19 of the Tax Code, these can be legal entities and individuals paying taxes.

In addition, such citizens must reside permanently in Russia for one year (clause 1 of Article 207 of the Tax Code).

This justification does not apply to certain categories:

- military personnel forced to serve outside the country;

- employees of government agencies sent abroad.

These citizens are considered residents, regardless of their location throughout the year.

To return the tax deduction, you must have a stable income subject to personal income tax.

. If you don't have one, you won't be able to get compensation.

What is meant by re-deduction

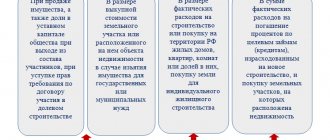

This is understood as a prerogative for Russians, which consists in the legal right to return part of the funds (13% of the due contribution to the state budget) when purchasing real estate or as a result of paying interest on a home loan from a bank.

The permissible amount of the benefit is limited to 2,000,000 rubles, when taking out a mortgage - 3,000,000 rubles. Therefore, when subtracting 13% from them, the result is 260 thousand. The exact amount of compensation is determined by the year the property was purchased - before or after 2014.

Order until 2014

Conditions for the return of deductions when purchasing property before the specified year:

- maximum size – 260 thousand rubles. of the total acquisition cost;

- 13% of the total bank interest accrued upon concluding a mortgage agreement.

If a person managed to fully take advantage of the existing benefit before changes in legislation, then he does not have the right to apply for compensation again. Even if the amount of compensation was less than 260 thousand, the balance is irrevocably burned.

When the mortgage was not issued or the interest was not declared to the tax office for reimbursement, there remains a chance of receiving compensation again in subsequent years.

Situation after 2014

The procedure for returning property deductions has changed after amendments to the law. The following monetary compensations are currently in effect:

- 260 thousand rubles. – when purchasing property;

- 390 thousand rubles. - for mortgage lending.

No matter how many times real estate is purchased, if you want to return the deducted tax, they focus on the standard 13% and the limit of 2 million rubles, which in total gives 260 thousand rubles. This amount cannot be exceeded.

If a citizen managed to buy a residential property before the turning point and issued a tax deduction for it, then the second time he will be able to return it only on the interest paid.

So, from January 1, 2014, it is possible to re-claim a tax deduction if:

- the resident became the owner of real estate after the specified date;

- until 2014, the resident did not take advantage of his privilege to return the deduction.

Return Policy

Most citizens of the Russian Federation have an idea of the possibility of obtaining a tax deduction when purchasing residential real estate. These rights can be exercised by any persons granted the status of tax residents of Russia. Those. all persons deducting personal income tax in different ways.

Let's try to figure out whether it is possible to get a deduction if a citizen has already applied for it once and has now bought a second apartment. Since 2014, the rules for providing property deductions have changed. Before this period, an individual could only exercise his right to deduction once. It did not matter whether the entire amount guaranteed by the state in the form of a deduction was completely spent.

Since the beginning of 2014, when purchasing a second apartment, a citizen also has the right to receive a deduction. But only on the condition that previously, in the case of purchasing an apartment, he did not receive the entire amount.

Starting in 2021, the deduction was “tied” not to a real estate transaction, but to an individual. The property tax deduction in Russia is 2 million rubles. for the purchase of an apartment and 3 million rubles. for payment of interest on the loan. Considering that the income tax in the Russian Federation is 13%, this means that a citizen can actually return 260 thousand rubles. for the purchase and 390 thousand rubles. for interest on the loan.

It is not always possible to receive them in one transaction, and especially in one tax period. Now citizens can take advantage of the deduction when buying an apartment as many times as they decide. But only until the entire amount is spent. For example, a citizen uses the right to receive a deduction by purchasing his first apartment and returns 210 thousand rubles. After purchasing a second apartment with a mortgage, he receives the remainder of the deduction in the amount of 50 thousand rubles, as well as an additional 300 thousand rubles. for paying interest on a mortgage. It turns out that he will no longer be able to receive a tax deduction for the purchase of another apartment, but if he takes out another mortgage loan and pays interest, the state is guaranteed to return 90 thousand rubles to him.

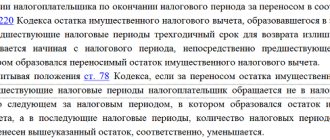

Only current income tax payers can receive the deduction. In most cases we are talking about employees. But this is optional. If a citizen pays personal income tax on income other than salary, he can also exercise the right to register it. Pensioners who no longer pay taxes can also receive a deduction. But only if one condition is met: they paid personal income tax during the three years preceding the transaction, not necessarily during the entire specified period, but at least for some period of time.

The deduction will be given specifically for the purchase. If the property was acquired on the basis of gratuitous contracts, it is not provided.

Tax deduction calculation

How to return income deductions when buying a second apartment

In the case of the acquisition of real estate, it is not prohibited to return the deducted income tax a second time, provided that the entire limit was not previously exhausted - 13% of 2 million rubles

.

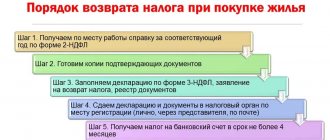

The procedure for purchasing a second residential property follows standard technology:

- submit an application listing the general grounds;

- prepare a tax return;

- collect a package of documents.

There are two ways to receive monetary compensation - through the employer or the inspection.

In the first case, you will need to take the following actions:

- Submit the required documents to the Federal Tax Service.

- Wait for a decision from the tax office.

- Receive the notice and give it to the accounting department. Then they write an application for the return of the deducted personal income tax.

After this, starting next month, personal income tax will no longer be withheld from the employee’s salary. This will continue until the required amount is compensated.

They return the money through the Federal Tax Service in the same way: they submit documents and write an application. Only in this case can the deduction amount be received in full by transferring it to a personal account.

The procedure for obtaining a tax deduction through the inspection takes about 3 months

. If any inaccuracies or inconsistencies are discovered during the audit, the applicant is notified of this. If a positive decision is made, the citizen is asked to provide account details for transferring funds.

It is allowed to file a property tax deduction declaration one year after purchasing real estate.

Mortgage interest deduction

Purchasing a home with a mortgage requires lengthy material costs. The total total amount is disproportionately higher than when buying an apartment without taking out a loan. Therefore, for such payers an additional tax deduction is provided for interest, which must be paid monthly.

Its size is 3 million rubles. This means that you can actually get a tax deduction, the maximum amount of which will be 390 thousand rubles. Standard rules apply regarding its registration. Those. You can also get it when buying a second apartment, but only for paying mortgage interest.

If a citizen received a deduction in the amount of 2 million rubles. after purchasing the first apartment, and bought the second as part of a mortgage loan, he is only entitled to a deduction of 3 million rubles.

Required documents

When repeatedly approving a property deduction, you must collect the following documents:

- completed application form;

- forms 3 and 2-NDFL (indicating income and tax payments);

- photocopies of a passport or any other document that can be used to identify the applicant;

- TIN, marriage and birth certificates;

- residential real estate purchase/sale agreement;

- documentation from the bank (when taking out a mortgage);

- a certificate confirming ownership of real estate;

- payment details of the receiving bank.

If the applicant works two jobs with official employment, then it is allowed to provide a 2-NDFL certificate from both employers.

A sample of filling out an application to the tax office can be found below.

If you need to request a deduction a second time, you will need to collect all the documentation again and submit it to the tax office. When an application is submitted for the return of a deduction for the same object, it is enough to submit only a certificate from an accountant and a tax return

.

Documents for registration of deduction

The exact list depends on the nature of the transaction for the acquisition of premises (). Here is a sample list with brief comments:

- passport;

- 3-NDFL;

- – when receiving a salary from the employer;

- an agreement under which the right to an apartment was obtained (purchase and sale or equity participation in construction);

- transfer deed - mandatory for shared construction; at the request of the parties, it is separately drawn up during the sale and purchase;

- confirmation of payment under the apartment agreement;

- documents confirming payment of finishing costs, if any;

- a loan agreement with a payment schedule and a certificate of interest paid - when applying for interest deduction;

- birth certificate of a child, if the apartment was bought by his parents;

- decision to establish guardianship if the apartment was purchased for the ward.

All listed documents, except the passport, 2-NDFL and 3-NDFL, must be copied or scanned for submission. Be prepared to present the originals for verification at the request of the inspector. If you are deducting expenses for construction materials, receipts should be stapled onto A4 sheets before copying/scanning. Additionally, make a free-form table with a list of checks and the total amount.

Recommended article: What to do if your apartment rent increases

When can you get rejected?

When the tax inspectorate considers an application for the return of a property deduction, a refusal is possible in the following cases:

- purchase (sale) is carried out between people who are closely related;

- the residential property is purchased by the employer;

- incorrectly filled out form 2-NDFL;

- when a military mortgage is issued, where the financing of the transaction comes from government subsidies or maternity capital.

If an apartment or other residential property was purchased after a change in legislation, then a resident of the Russian Federation has the right to deduct as many times as the limit of the permissible amount allows - 260 thousand rubles.

Procedure for receiving a deduction

A taxpayer has the right to apply for an INV:

1. To the tax authorities at the place of residence (electronically through the portal of the Federal Tax Service or State Services, through Russian Post).

List of documents:

- declaration in form 3-NDFL (in addition to the deduction amount, the form must include information from the certificate of income and the amount of accrued and withheld tax received from the employer, and the certificate itself must be attached to the declaration);

Note:

1. Taxpayers who submit reports solely for the purpose of obtaining a deduction (i.e., are not required to independently declare their income) are not tied to the deadlines for filing a declaration established by the Tax Code of the Russian Federation.

2. Currently, a certificate in form 2-NDFL for past tax periods can be obtained through the Federal Tax Service portal (State Services) without contacting the employer.

3. Copies of the following documents are attached to the declaration as attachments, and the originals are presented to the inspector only for verification and remain in the hands of the taxpayer.

- documents confirming the right of ownership of the property:

| Acquiring a share in a house, apartment, room | an extract from the Unified State Register or an act of transfer of housing and a purchase and sale agreement (participation in shared construction) |

| Purchase of a plot for individual housing construction or with a finished house as shared ownership | extracts from the Unified State Register for land and house |

| Loan interest repayment | target loan agreement, mortgage agreement, loan repayment and interest schedule |

- payment documents confirming the costs of purchasing real estate and/or paying interest on the loan;

- application for a personal income tax refund in the form approved by order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected] (Appendix No. 8).

- marriage certificate, if spouses apply for the deduction;

- birth certificate (adoption, certificate of guardianship and trusteeship authorities), if you need to receive a deduction for the share of a minor;

- application for the distribution of property deductions between co-owners.

The tax office must check the submitted documents and make a decision within a period not exceeding 3 months from the date of receipt of the declaration. If everything is in order with the documentation, then the funds will be transferred at a time to the taxpayer’s personal account specified in the personal income tax refund application within 30 days.

2. To the employer , having previously confirmed the right to a deduction with the inspectorate.

List of documents to apply to the Federal Tax Service:

- application to confirm the right to property tax deductions (you can use the attached form or write in free form);

- the documents listed in the previous paragraph confirming the right to an INV (3-NDFL declaration is not submitted).

After 30 days, the tax authority will issue a notification of the right to an INV.

List of documents for the employer:

- application for provision of an INV (you can use the attached form or write in free form);

- notification of the right to apply a deduction received from the Federal Tax Service.

The employer does not return the money to the employee, but gives him wages taking into account the deduction (that is, he does not withhold personal income tax in the amount of 13%) from the month following the month of filing the application.