What is included in management expenses

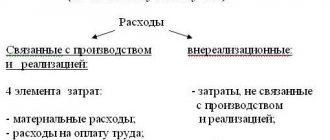

The rules for recognition and division of costs are fixed in PBU 10/99. The managerial type of expenses includes funds allocated to pay office staff, pay off obligations on bills for communication services, security alarms, housing and communal services, etc. Administrative expenses include a wide range of costs that are not directly related to the production of products, they are not used in the process of activities in the field of trade or services.

Examples of this type of cost could be:

- paid bills for office supplies;

- conducting seminars and trainings for company employees;

- entertainment expenses;

- depreciation charges for fixed assets used at administrative facilities;

- maintenance and repair of equipment intended for operation by management personnel.

Everything that relates to management costs can be included in the cost of production in two ways:

- write-off as goods manufactured by the enterprise are sold;

- write-off of the full amount of costs incurred, linked to the period of their occurrence.

How are selling expenses different from administrative expenses? The need for the former is determined by the trading activities carried out by the company, the latter are needed to maintain the administrative apparatus of the company. Business expenses may include funds transferred to packaging suppliers, payment for services for packaging products, loading and delivery. Management costs are characterized by predictability, their predicted volume can be approximately calculated, commercial expenses are characterized by dependence on the number of products produced and sold.

What do business expenses include?

Selling expenses include the costs of selling products, which are collected in account 44. Read more about what is included in a company's selling expenses below.

Selling and administrative expenses are...

The company must disclose information about commercial and administrative expenses in the financial results report:

- line 2210 indicates commercial expenses;

- line 2220 - administrative expenses.

Neither the Tax Code of the Russian Federation nor other regulations contain a clear formulation of what exactly should be classified as commercial expenses and what should be classified as management expenses. In practice, selling and administrative expenses are the company’s expenses reflected in accounts 44 and 26, respectively.

What are management costs?

Administrative expenses include amounts generated on account 26 and associated with the maintenance of the company’s common property and the organization of its activities. A distinctive feature of such expenses is that they are not directly related to production, provision of services or trade. An example of management expenses would be the following expenses:

- on guard;

- payment for the Internet, housing and communal services and communications;

- entertainment expenses;

- salaries of accountants, lawyers, personnel officers and other administrative and management personnel;

- labor protection and seminars for workers;

- stationery.

Administrative expenses can be included in the cost of production as products are sold. Then the accountant must write them off by posting to the debit of account 20 (23 or 29) and the credit of account 26.

The second way to account for administrative expenses is to attribute them in full to the cost of the reporting period in which they arose. In this case, the accountant will post Dt 90 Kt 26.

The chosen procedure for accounting for management expenses must be specified in the company’s accounting policy (clause 20 of PBU 10/99).

Learn more about account 26 from the publication “Account 26 in accounting (nuances).”

What are included in business expenses?

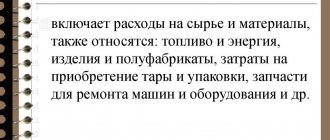

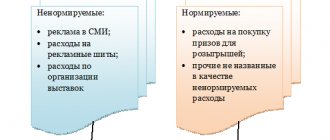

Unlike administrative expenses, selling expenses include company costs that are associated with production or trading activities. For companies operating in the manufacturing sector, commercial expenses will include expenses for packaging products, their delivery to the buyer’s warehouse, advertising events, etc.

The commercial expenses of a trading company include the costs of transporting and storing goods, wages, rent or maintenance of buildings where trade is carried out, advertising, entertainment expenses, etc.

We will tell you how to properly arrange entertainment expenses in this article.

What are the business expenses of companies involved in agricultural procurement and processing? These are expenses for the maintenance of procurement and receiving points, the maintenance of livestock and poultry (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

In accounting, commercial expenses are collected in the debit of account 44. In this case, there are 2 ways to take such expenses into account in cost:

- Write off completely by posting Dt 90 Kt 44.

- Write off partially to account 90. In this case, according to the chart of accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), you need to distribute:

- costs of packaging and transportation between types of products sold (for manufacturing firms);

- transportation costs between goods sold and warehouse balances at the end of the month (for trading companies);

- commercial expenses - in the debit of account 15 and account 11 (for those companies engaged in the procurement and processing of agricultural products).

The company indicates the chosen method of distribution in its accounting policies.

Whether business expenses are reflected in the balance sheet, see this article.

Results

The legislative acts of the Russian Federation do not contain a clear list of commercial costs. Based on the established practice of Russian accounting, commercial expenses should be attributed to account 44. Based on this principle, commercial expenses can be recognized as those costs that are listed in the instructions to the Chart of Accounts in the description of account 44.

For more information on how an organization can create its own working chart of accounts and which accounts to include in it, read this publication.

Administrative expenses - accounting account and typical entries

For expenses related to management needs, synthetic accounting account 26 “General business expenses” is intended. It is active, the balance formed on it must be written off monthly.

Typical entries to reflect incurred management costs:

- D26 - K21 - shows the valuation of semi-finished products of own production, which were used for the needs of the administrative facility;

- D26 – K43 – the price of consumed finished products is included in management expenses;

- D26 – K60 or 76 – services received from third parties are taken into account;

- management accounting of labor costs is carried out using entries D26 - K70 in relation to accrued earnings and D26 - K69 in terms of insurance premiums.

Accountable amounts related to administrative expenses are reflected as D26 - K71. If part of the management costs is transferred to branches (provided that they were initially incurred by the parent company), then correspondence is drawn up between debit 26 and credit 79. Deficiencies are written off by posting D26 - K94.

There are two methods for further writing off administrative expenses.

The first method assumes that the costs of maintaining the company’s administration, according to the requirements of accounting policies, are subject to partial inclusion in the cost of production. The accounting entries will be as follows:

- D20 – K26 for allocating part of production costs;

- when a company specializing in the service sector writes off administrative expenses, the posting looks like D29 - K26;

- when calculating the cost of products of auxiliary production, administrative expenses will be transferred through correspondence D23 - K26.

At the next stage, when selling goods, the accumulated cost, including management costs, is written off to account 90.

With the second method of accounting for management expenses, posting a write-off will immediately transfer them to account 90: D90 - K26.

Management expenses: composition, accounting, analysis

Articles on the topic

Administrative expenses are expenses that are in no way related to production activities. For example, administrative staff salaries, office maintenance and servicing, postal and advertising costs. In this article we will look at what else is included in management expenses, how to reflect them in accounting and determine the financial result.

In this article you will learn

:

What are administrative expenses

Management costs are those costs of an organization that cannot be associated with the production process, that is, they are not involved in the production of goods or services. For example, if employees of a production workshop received wages, then this expense item is included in the cost of production, and the salary of the chief accountant should be included in management expenses, since he is not involved in production. If costs can be attributed to at least one of the organization’s production areas, then they are already considered commercial. Management costs can be included in the cost of production, but not all at once, but by distribution among all types of manufactured products in proportion to revenue for a certain period (month, quarter, year). See also how to calculate the cost of production: calculation formulas, cost distribution methods.

Download and use it

:

How it will help

: plan administrative and management expenses and minimize the risk of including unreasonable costs in the budget.

What is included in management expenses

This list is not complete; it can be supplemented with certain items depending on the specifics of the organization’s activities (for example, maintaining a canteen, medical center, security, cleaning the area in front of the building, etc.).

Read also

: Techniques for managing administrative and management expenses

How it can help: In many companies, planning administrative and management expenses drags on for months. But even during this time, it is not always possible to develop a reliable budget, since the approval process involves a large number of participants, each of whom tries to approve, or in other words, “push through” additional cost items. Nevertheless, it is quite possible to draw up a realistic budget for these expenses, and deviations in it will not exceed 5–10 percent.

How it will help

: Two-thirds of your colleagues monitor the company's key financial indicators weekly and spend half their working day doing so. We learned how to turn an accounting program into a convenient system for monitoring and managing your business with your own hands.

Accounting

Despite the fact that administrative expenses are not directly related to the main production activities of the enterprise, they are reflected in the expense accounts, namely, in account 26 “General business expenses”. There are two ways to write them off:

1. They are recognized as conditionally constant and written off at the end of the month to the cost of production. For this purpose, the following entry is made in the accounting registers: Debit 90 “Sales” Credit 26 “General expenses”. This procedure must be specified in the organization's accounting policies. Posting means that administrative expenses are written off to the cost of goods manufactured in the month in which they are included in the expenses of ordinary activities.

Management expenses in financial statements

All transactions performed by an enterprise in a specific period must be reflected in the financial statements. The Balance Sheet form shows the final account balances as of a certain date, and the Financial Results Statement form indicates cumulative data.

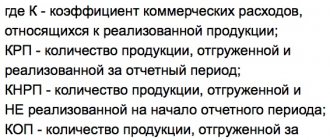

Administrative expenses in the balance sheet are not an independent line, but a component sum of other lines, depending on which account the debit was made to at the end of the month. The identification of the management type of costs in reporting is carried out in line 2220 of the Financial Results Report, provided that the second accounting method is used. When administrative expenses are determined, the formula for calculating them for reporting comes down to an analysis of credit turnover on account 26 in combination with the debit of account 90.

Reflection of management costs in accounting

Administrative expenses do not depend on the volume of business activity, so they cannot be written off to “Main production” at the end of the month (account 20). They are taken into account in “General expenses” (D 26).

Features of accounting are that there are two write-off methods:

Reflection in accounting

- traditional - are recognized as conditionally constant and are fully related to the full cost, carried out as K 26, D 90

- based on the division of administrative costs into semi-fixed and semi-variable

When using the second method, the reduced production cost is calculated, conditionally fixed expenses are written off to “Cost of sales” (D 90-2), that is, they are recognized as costs of the reporting period that reduce income.

There are 3 options for writing off the conditionally variable part:

- K 26, D 20 - if they relate to the main production

- K 26, D 23 - if they relate to auxiliary production

- K 26, D 29 - if they relate to service facilities or production

Administrative costs are included in the cost price after the sale of products (goods) and are written off to “Sales” (account 90). The income statement is reflected in line 040.

Some economists express the opinion that administrative costs can be written off on D 91 if there were no sales during the reporting period.

Disputes with the tax office most often arise over expenses for the services of management companies. If there is an agreement, a document confirming payment, and an acceptance certificate for work performed, there should be no claims. Tax authorities may consider this type of service to be economically unprofitable and aimed at tax evasion. Analyzing the decisions made by the courts in similar cases, we can conclude that most entrepreneurs manage to prove that such expenses are justified.

Management budget

When forming a forecast for income and expenses for different areas of spending, it is recommended to calculate standard values or set limits for reporting periods.

The budget can be prepared using one of three methods:

- Traditional, using the linking of the administrative expense limit to the general wage fund (the method is considered obsolete).

- Indexation method - data from the reporting year is taken as a basis and increased by a certain percentage.

- Focus on results - the amount of funds allocated for management needs directly depends on the expected and achieved results of the enterprise.

What are administrative expenses and how do they differ from commercial expenses?

Expenses that have no connection with the main production, work performed, sales of services and products are what administrative expenses include.

Commercial ones, on the contrary, are directly related to the listed types of activities (salary of the head of the production department and others).

Regulations, laws and documents that govern this issue:

- Law No. 129-FZ;

- PBU (Accounting Regulations) 10/99 clause 20 and 1/2008 clause 4;

- letter of the Ministry of Finance No. 07-05-06/191 dated 02.09.2008;

- Chart of accounts of the Ministry of Finance 31.10. 2000.

Regarding the last point: accounts for conducting SD are determined taking into account the scope of activity of the enterprise, its size and structure, organizational and legal form and other features.