When and why do you take SZV-STAZH

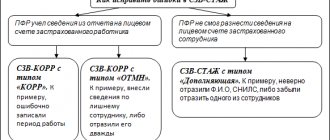

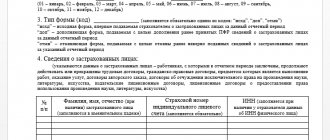

The form is designed specifically for policyholders to transfer personalized information on insured employees and employees under civil law and licensing agreements to the Pension Fund. The report is submitted to the territorial Pension Fund in two cases:

- If necessary, assign payments to an employee who is retiring. There are no deadlines, the form is submitted as needed.

- Report for the year. Deadline: March 1 of the year following the reporting year. The annual SZV-STAZH indicates information about the periods worked, accrued and paid pension contributions for the year.

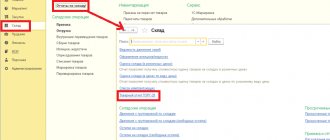

How to prepare for a Pension Fund inspection?

In accordance with Federal Law No. 167-FZ[1], state (municipal) institutions that make payments to individuals are policyholders. This status imposes certain obligations on these organizations, which, in particular, include the obligation to timely and in full transfer insurance premiums, submit documents necessary for maintaining individual (personalized) records, as well as for the assignment (recalculation) and payment of compulsory insurance coverage . In turn, the Pension Fund of the Russian Federation has the right to check documents related to the appointment (recalculation) and payment of compulsory insurance coverage, the provision of information on individual (personalized) accounting of insured persons, as well as to demand and receive from insurers the necessary documents, certificates and information on issues arising in during these checks. In this article we will consider issues related to the implementation of such checks.