The most important component of an enterprise's accounting system is maintaining its settlement system. This element can be called the most important, since money in any enterprise is much more important than the internal movement of goods and balances in warehouses.

In conditions of fierce competition, it is very difficult to carry out mutual payments at large enterprises, when goods can be sold on credit, since there is no complete confidence in the client’s solvency.

Mutual settlements are a mechanism for the direct redistribution of income from the sale of goods and services between organizations directly involved in the sale of specific goods (services). In contrast to the previously existing mechanism for the redistribution of income, mutual settlements between communication organizations are carried out on a contractual basis for a certain volume of goods, taking into account guidelines developed for each company.

Concept and essence

From a legal point of view, offsets and mutual settlements are a civil law transaction, that is, actions of subjects of civil law relations aimed at the emergence, change or termination of civil rights and obligations (Article 153 of the Civil Code of the Russian Federation). Accordingly, mutual settlement is a transaction aimed at terminating civil rights and obligations.

Mutual settlement as a type of civil transaction is not directly regulated by the Civil Code of the Russian Federation. The specified regulatory document, as one of the ways to terminate obligations, indicates only the possibility of compensation of mutual claims (Article 410 of the Civil Code of the Russian Federation) between two persons. However, by virtue of paragraph 2 of Art. 421 of the Civil Code of the Russian Federation, which enshrines the principle of freedom of contract, clearing operations with a large number of participants are quite acceptable, since these operations do not contradict the essence of civil relations.

The legal basis for mutual settlements is determined by the rules of civil law on compensation of mutual claims. At the same time, in some cases, for mutual settlement it is necessary to carry out other operations, in particular, the transfer of the right of claim (Article 382 of the Civil Code of the Russian Federation).

Mutual settlement is an agreement between the parties to civil law relations on the mutual termination of certain obligations in a fixed amount in relation to each other.

The important point is that:

- obligations bear homogeneity;

- a deadline was set for meeting time commitments.

Settlement cannot be performed if:

- the obligation of either party is related to compensation for damage caused to health, payment of alimony;

- for the obligations of either party, the statute of limitations has expired;

- concluding a mutual settlement agreement is expressly prohibited by law or contract.

In business activities, organizations interact with each other as counterparties, suppliers and buyers. The most important part of working with counterparties is accounting. Mutual settlements show where part of the organization’s financial resources are located and the main sources of these funds. Thus, the amount of money that can be directed into the further turnover of the company depends on timely monitoring of mutual settlements.

Mutual settlements are carried out in the context of counterparties and settlement documentation in the context of concluded contracts.

The calculation is made on the basis of accounting according to primary documents.

Accounting for settlements allows you to determine the total amount of debt for any period of time, as well as understand when and on what documents it appeared.

Settlement between counterparties

Settlement in 1C 8.3 is carried out using the standard document “Debt Adjustment”. You can find it in the “Sales” or “Purchases” menu sections, in both cases in the “Settlements with counterparties” subsection, “Debt Adjustment” item:

Let's consider filling out the document.

The most important is the “Type of operation” field. Here you need to select the correct type of adjustment from the drop-down box.

Let's look at how, depending on the specified type of operation, the filling of the lower fields will change. Click, the program offers you to choose: offset of advances, offset of debt, transfer of debt, write-off of debt and other adjustments.

We choose the first type - advance payment. In the second field “Credit advance payment” you can select either the buyer or the supplier.

Depending on your choice, indicate in the “On account of debt” field to whom the advance is credited: our organization to the supplier/our organization to a third party or the buyer to our organization/third party to our organization:

The next type of operation is debt offset, which is filled out in the same way as advance payment offset. In the second field we indicate to whom: the buyer or the supplier. In the third we also choose: our organization in front of the supplier/buyer or our organization in front of a third party.

If you select the type of operation “Transfer of debt”, then the “Transfer” field appears active and from the drop-down window we select where: buyer’s debt, buyer’s advances, supplier’s debt, supplier’s advances.

Next, select the “Debt write-off” type. The “Write off” field is filled in similarly to the previous type: buyer’s debt, buyer’s advances, supplier’s debt, supplier’s advances.

And the last type of operation is “Other adjustments”, here it is possible to perform absolutely any action that concerns mutual settlements. Using this item, you can arrange all four mutual settlements described earlier. To do this, you need to fill in the fields with the necessary data.

We will transfer debt from one counterparty-buyer to another. Fill in the fields:

- Type of operation – debt transfer;

- Transfer – buyer’s debt;

- We skip the number and date, since they are generated automatically after posting the document;

- Buyer (debtor) – select the counterparty from whom the debt needs to be transferred;

- The new buyer is the counterparty to whom we transfer the debt.

Now click the “Fill” button and select “Fill with mutual settlement balances”:

The tabular part has been filled in based on the entered information. The contract for the counterparty, the settlement document, the amount and the accounting account are displayed.

You need to fill out the line “New contract”, that is, select the contract to which you are transferring the debt, and post the document. Now you need to print out the “Act of Mutual Settlement” using the button in the top panel and submit it for signature.

You can view the transfer of debt in the balance sheet. It went away from one counterparty, and from another it formed:

Requirements for organizing a settlement system

When working with regular clients, as a rule, mutual settlements are carried out in accordance with a scheme developed through negotiations between the parties. This system is convenient for all participants.

There are some requirements in this area that must be strictly followed.

Requirements for the system of mutual settlements between enterprises:

- truthfulness;

- the output of data on mutual settlements should be quick and easy;

- ability to manage debt;

- detailed reports of any complexity.

This system includes two subsystems: the first characterizes the movement of goods (warehouse), the second characterizes the movement of money (cash finance). Both of these subsystems are inseparable from each other and participate in mutual settlements.

Settlement rules are simpler

When the parties intend to settle by netting, they enter into two agreements between themselves. Under one contract, one party must provide some services, perform work, or deliver goods.

In accordance with the second agreement, the same party must purchase something from the counterparty. These may be property rights, services or goods. In order to pay off debt to each other by offsetting mutual obligations, an application from one of the partners is required.

The second party to the transaction must provide written confirmation that they have received the application. As a rule, offset is formalized as a bilateral act. As you can see, from a legal point of view, netting is actually easier to arrange.

Types of mutual settlements

Mutual settlements can be divided into several types, of which the three largest are:

- payments for orders: in the case when payment is made for a specific customer order;

- Contract settlement: All purchases and sales are carried out in accordance with the contract signed between the parties. This may be the sale of goods on credit or purchase with prepayment;

- invoice payments: in this case, the purchase or sale is paid separately for specific invoices.

Thus, mutual settlements represent a direct redistribution of income from the sale of goods or services between organizations that provide services or sell goods.

Simply put, it is the buying and selling of goods. In most cases, an accountant-economist conducts all settlement operations; he is also responsible for all reporting documentation for mutual settlements.

To control quality in modern conditions, it is simply necessary to use high-quality software.

As a rule, a competent reflection of current transactions allows the company to quickly and timely obtain any information about the state of mutual settlements between counterparties.

Results

If two business entities have mutual homogeneous obligations (for example, to pay for goods or services supplied in the same currency), then such obligations can be canceled by drawing up a netting agreement. Such a document must comply with the provisions of Art. 410 and 411 of the Civil Code of the Russian Federation.

You can learn more about the procedure for netting commercial obligations in the following articles:

Settlements between legal entities can be carried out both in cash and by bank transfer (Article 861 of the Civil Code of the Russian Federation).

In addition, settlements between legal entities can be made using securities - a bill of exchange (Article 128, paragraph 2 of Article 142 of the Tax Code of the Russian Federation). Payment by bill of exchange between legal entities is carried out taking into account the requirements specified in the Law “On Bills of Exchange and Promissory Note” dated March 11, 1997 N 48-FZ.

Non-cash payments between legal entities are made by transferring funds from bank accounts to bank accounts (clause 3 of Article 861 of the Civil Code of the Russian Federation) and are regulated by the Regulations on the rules for transferring funds, approved by the Bank of Russia on June 19, 2012 N 383-P.

Settlements between legal entities in cash must be made in accordance with the requirements established by Bank of Russia Directive No. 3073-U dated October 7, 2013 “On cash payments.”

Basic documents

Among the settlement documents are:

- documents for the shipment of products (invoices, acceptance certificates, sales certificates, etc.);

- payment documents (payments, consumables, orders);

- documents – basis of transactions (agreements, specifications).

Based on the nature of the documentation, mutual settlement transactions can be divided into the following:

- simple - when only documents for shipment and payment are drawn up;

- transactions on invoices - documents on shipment and payment are drawn up on the basis of invoices;

- transactions under contracts - shipment and payment documents are drawn up under contracts.

Settlement agreement

A settlement agreement between organizations implies the repayment of debts of several companies to each other.

This situation is possible if both enterprises act under the same or different agreements with customers and suppliers at the same time. The procedure can be initiated when there is a debt for goods provided or services provided by both parties that cannot be repaid in the near future.

The offset can be made in full of the debt or only part of the amount of overdue payment under the contract. Civil law imposes such requirements on the debts of enterprises, which are planned to be compensated through offset.

The basic requirements for settlements under a mutual settlement agreement between organizations are as follows:

- mutual settlement implies that both parties have financial claims against each other due to delays in payments under existing contracts;

- an agreement on mutual settlement between organizations is possible if the obligations are homogeneous - they have the same indicators (if this is a cash equivalent, then the currency of settlement must match);

- deadlines for fulfilling contractual obligations regarding payment for goods, work or src=»https://FB.ru/misc/i/gallery/5158/2950747.jpg» class=»aligncenter» width=»788″ height=»793″ have been accepted [/img]

The settlement agreement cannot be applied if:

- the debt was formed in accordance with the amount of compensation for harm caused to the health of an individual or his life;

- debts were formed under writs of execution for the collection of alimony;

- the statute of limitations has expired (Article 411 of the Civil Code of the Russian Federation).

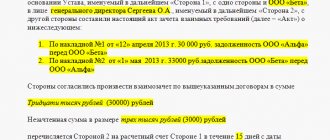

A standard agreement on mutual settlement between legal entities implies an indication of the exact amounts of debt of both parties to the agreement, with the allocation of VAT. To do this, at the stage of preparing the contract form, mutual reconciliation of calculations is performed. The agreed act of reconciliation is attached to the contract along with documentation substantiating the fact of overdue debt.

A settlement agreement between organizations (a sample can be seen below) requires the following details:

- date and place of conclusion of the contract;

- names of the parties;

- names of company representatives with supporting documents of authority;

- a list of financial obligations that need to be repaid;

- indication of the terms of mutual settlements.

At the end, a phrase is necessary that when the date of entry into force of the provisions of the agreement arrives, the details of the parties and their addresses must be indicated. At the end of the document there must be signatures of authorized persons and company seals.

We will consider the mutual settlement agreement between an organization and an individual and its features below. With this type of settlement, one party is the creditor, the other is the debtor. The features of this type of calculation are as follows:

- homogeneous nature of the requirements (financial);

- clearly established deadlines;

- the possibility of settlements not for the entire volume of debts at once, but in parts;

- possible if there are at least two obligations between the parties (debt and payment).

Conditions under which offset can be carried out

Offsetting allows you to pay for goods or services received in return.

In difficult market relations, many enterprises in the small sector of the economy experience certain problems with finances - they are often in short supply, they are invested in turnover, goods, etc., and yet it is necessary to pay off with partners. This is where mutual offset fits perfectly.

Key conditions for implementing this method of calculation:

- the presence of at least two contractual obligations in relations between companies . Moreover, according to one of them, each organization must be a creditor, according to the second, a debtor: in this way, mutual “overlapping” of debts occurs. In some cases, several enterprises participate in mutual settlements at once - the law fully allows this.

- the homogeneous nature of the obligations (for example, in the form of finances); in addition, it is necessary that certain deadlines be allocated for the offset to be completed or the possibility of demand be stipulated.

Organizations can use offset not for the entire amount of obligations, but partially, in other words, they can offset in the amount of the smallest debt. The rest can be paid in monetary terms.

Characteristics of Sberbank bills

Let's take a closer look at what a Sberbank bill of exchange is for mutual settlements between organizations. Any bill of exchange, regardless of the purpose of its creation and the person who issued it, is primarily a valuable document. It acts as a significant fulfillment of an obligation, for which the debtor pays a certain amount of money to the creditor after a certain period of time.

The bill of exchange is used for mutual settlements between individuals and between organizations, including between financial institutions. Sberbank also belongs to them. Such bills act as a universal payment method. The bank issues them for quick payments for the supply, sale of goods or provision of services. In addition, the account can be used as collateral when obtaining a loan product from the bank. But the Sberbank bill of exchange is most often used for settlements between organizations.

Sberbank's bill of exchange for mutual settlements between organizations contains security that confirms the bank's obligation to the holder to pay a certain amount for a certain period. The bill of exchange is required for settlements; its registration can be carried out at any branch of Sberbank.

A bill of exchange is an A4 format document. It includes the amount that the client deposited. In addition, the city and date of issue are indicated.

A bank promissory note is a security that contains a written promissory note of a banking organization to the holder of the bill.

This tool provides the following benefits:

- convenient and fast payment for services, works and goods;

- profitable investments for profit;

- use as a guarantor when receiving credit funds or guarantees from a bank.

Promissory note programs provided by banks are similar to depository programs: the client invests funds, and in return receives something from the banking institution, similar to a promissory note. Thus, the bank confirms that the funds are accepted and undertakes to return them on the appointed day.

An interest-bearing bill means an indication of the interest that is charged on its amount. Nominal interest amounts can be expressed both in rubles and in other currencies. To obtain such a promissory note, you must deposit money, which is a nominal security promissory note.

This type of Sberbank bills is the most popular means because it is very similar to a deposit.

An ordinary discount bill does not specify the conditions for accrual of funds at face value, which can be used in rubles or foreign currency. To receive it, you need to deposit an amount equal to the value of the contract for the future sale of the security. The recipient's income is calculated as the difference between the sale price and the face value.

The bank account is paid by Sberbank units that are authorized to carry out such transactions. These may be branches of a banking organization.

Sberbank also provides other services for bills of exchange:

- Exchange of bills. Thus, the account holder can exchange one bill for several others that have a lower face value, or receive several bills for one higher face value

- Storage. Sberbank provides the opportunity for each recipient to store certificates of deposit and bank bills. The client determines the retention period.

- Delivery and issue of securities. To eliminate the risks associated with the self-movement of securities, you can entrust the bank with the issuance and delivery of purchased certificates of deposit and bills of exchange at your place of residence. This benefit can only be used by legal entities.

Settlement under contracts

Let's consider an example when our company ordered 3 office chairs from a supplier for the amount of 6 thousand rubles, but has not yet paid for this delivery. After some time, we provided lawn mowing services for 4 thousand rubles. In the program, it is necessary to offset and reduce the debt to 2 thousand rubles.

You can find acts of offset in the 1C “Purchases” menu, or “Sales” select the “Debt Adjustment” item.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

All previously entered documents on debt adjustments will open in front of you. Create a new document. The most important thing here is to correctly indicate the type of operation. In this case, we will offset with the same company, but under different agreements: supply and provision of services. Therefore, “Debt Settlement” was chosen.

In the “Off the Debt” position, select “To Supplier”. In the case where it is owed not to us, but to us, the “Buyer” item is selected.

Next, in the “On account of debt” item, select the value “Supplier to our organization.”

In the “Supplier (creditor)” detail, select the company with which you need to make a settlement. In our case, accounting in the program is kept for several organizations at once, so in the header we will also select the necessary one (which has a debt).

In the document on offsetting in 1C 8.3 there are two tabs reflecting the list of documents on which accounts payable (ours) and accounts receivable (to us) were formed. You can fill in the data either manually or automatically. To automatically fill, click the “Fill” button on the desired tab and select the appropriate item from the menu that appears. Both tabs are completed separately, but the interface is the same.

On the first tab, a document for the purchase of office chairs in the amount of 6 thousand rubles appeared. The second – provision of lawn mowing services for 4 thousand rubles. The amounts vary and this can be seen at the bottom of the form (- 2 thousand rubles).

To ensure correct settlement, we will adjust our debt to the supplier on the first tab. Let's set 4 thousand rubles instead of 6 thousand rubles.

Next, we will record and post the document. We have created a netting transaction with our counterparty in the amount of 4 thousand rubles.

In the same way, you can set off with the buyer. The only difference is in the other parameters of the document header.

Mutual settlements for cash payments

Most often, non-cash payments are used between legal entities, since when paying for goods or services there is almost always a movement of large sums of money. Mutual settlements between organizations for cash have a number of features.

To pay in cash, you need to spend extra money on organizing payment security.

Another disadvantage of cash is that it is much more difficult to keep track of accounting accuracy.

In our legislation there is a restriction on cash payments in mutual settlements.

One of the rules for regulating money circulation between legal entities is Directive of the Central Bank of the Russian Federation 1843-U dated 06/20/07.

Based on paragraph 1 of the Instructions, the maximum allowable amount of cash payments between firms is 100,000 rubles under one contract.

This requirement does not apply to the following types of calculations:

- after payment of wages;

- when issuing accountable amounts.

A limit on the limit occurs when cash payments are made between:

- organizations;

- organization and individual entrepreneur;

- several individual entrepreneurs.

This limitation applies to payments under a single agreement.

For example, if two individual entrepreneurs have signed a contract for an amount of more than one hundred thousand rubles, it is impossible to pay cash in full; you will have to pay in two parts:

- one hundred thousand to pay in cash;

- pay the balance by bank transfer.

Limit amount of cash payments between legal entities

The Central Bank of Russia has established a limit for cash payments between legal entities in the amount of 100,000 rubles under one agreement concluded between these organizations (clause 2, clause 6 of Bank of Russia Directive No. 3073-U dated October 7, 2013).

Restrictions on cash payments between legal entities also apply to settlements between individual entrepreneurs and a legal entity in cash (clause 2, clause 6 of Bank of Russia Directive No. 3073-U dated October 7, 2013).

But cash payments between an individual and a legal entity are carried out without restrictions on the amount (clause 5 of Bank of Russia Directive No. 3073-U dated October 7, 2013).

The restriction on cash payments between legal entities does not apply to cash payments between individuals who are not registered as an individual entrepreneur (clause 1 of Bank of Russia Directive No. 3073-U dated October 7, 2013).

Letter of mutual settlements and its characteristics

The letter on mutual settlements between organizations does not have a strict form, but there is a list of information requirements that must be indicated in it.

Drawing up such a letter is possible only in cases where the period for making cash payments has expired.

A letter on mutual settlements between organizations (a sample is given in the article) must contain the following information:

- place and date;

- name and details of organizations;

- Full name of representatives;

- information about the amounts of debts;

- effective date;

- addresses and details, seals of the parties.

Reconciliation Act

To reconcile mutual claims with the counterparty, it is necessary to draw up a reconciliation report of mutual settlements between organizations. Initially, it is necessary to draw up an act of approval of mutual settlements with a breakdown for each concluded contract (if there were several of them).

This will determine the exact amount of debt that can be paid off by offset. It is also necessary to draw up an act in the context of contracts concluded with the counterparty. This will determine the exact amount of debt that can be settled through offset. There is no need to put a stamp on the act. This is done in accordance with business customs.

The significance of this document is quite great. It reflects the reconciliation of calculations and recording the absence of debt. It also enables counterparties to protect themselves from further claims.

The legal end of the signing of the act can also be considered the reflection of the debt of one of the parties to the agreement to the other with the recognition of the debt.

Such an act does not apply to primary ones, since it does not meet all accounting requirements. It only confirms the existence of debt according to the primary documents of the counterparties.

Registration of an act of mutual settlements begins with an application sent to one of the organizations by the other. The debt itself can be determined on the basis of the act of reconciliation.

It is necessary to take into account two important points when drawing up a form for a reconciliation report between organizations:

- You can only pay in cash;

- these debts should not be related to the return of alimony and compensation for damage.

Offsetting between organizations

As an example, consider a situation similar to the one described above. Our organization also purchased 3 office chairs for the amount of 6 thousand rubles from. We only provided the lawn mowing service to someone else. Let's assume that they have the same owner and we need to pay off part of the debt for the purchase of chairs with the service provided.

In this example, filling out the document will be almost identical to the previous one. For the value of the “On account of debt” detail, indicate “Third party to our organization.” Now you will need to select two counterparties at once: a supplier and a third party.

The document details in this example will no longer differ from the previous one.

The movement of the document will be similar to the movement in the previous example, only here two different counterparties are involved as subaccounts.

The Debt Adjustment document is not limited to these two examples. For example, you can write off a bad debt, offset an advance, transfer a debt, and much more.

Now you can check the result of mutual settlements by making a reconciliation report with the counterparty.