Home / Situations

Back

Published: 11/04/2019

Reading time: 4 min

0

463

A contract is an agreement between subjects of civil legal relations to establish, change or terminate rights or obligations. A contract for the provision of paid services between individuals is an obligation of one citizen to perform a service or work for a fee.

- Which contract is better to conclude?

- Legal regulation

- Do I need to pay taxes and who does it?

- Who pays insurance premiums

Here it should be understood that not only individual entrepreneurs are individuals registered as entrepreneurs, but also ordinary citizens are full-fledged objects of civil legal relations.

The essence and types of civil contracts

Civil contracts are agreements that are drawn up according to the rules of the Civil Code of the Russian Federation.

The main of these rules (Article 421 of the Civil Code of the Russian Federation) determines the possibility of concluding an agreement on any conditions that suit its parties (unless otherwise established by law for a certain type of agreement). The parties to such agreements can be, in different combinations, both legal entities and individuals (including those acting as individual entrepreneurs), i.e. the agreement can be concluded between:

- legal entities;

- individuals;

- legal entity(ies) and individual(s).

By type, civil law contracts are divided into those drawn up:

- on transactions with property (purchase and sale, exchange, donation, lease);

- performance of work, provision of services.

Despite the fact that the Civil Code of the Russian Federation separates contracts for work and services (their outcome is different - obtaining a result in the first case and carrying out certain actions in the second), the principles for drawing up the contracts concluded under them are very similar. And it is these contracts, in situations where the executor under them is an ordinary individual (not acting as an individual entrepreneur), that attract the closest attention of inspectors. This is due to the fact that taxation of income paid under such agreements is carried out according to special rules.

Below we will look at the features of registration and taxation of a civil contract with an individual performing work for the employer (i.e., who has entered into a contract agreement).

Distinctive features of a contract

Who can become an employer under a civil contract - GPA - with an individual concluded in connection with the performance of work? Any person - legal or natural, and the latter may be an individual entrepreneur or one without this status. In turn, the executor can be either an ordinary individual or an individual entrepreneur.

What distinguishes relations under such an agreement? First of all, the presence of specific work of a certain volume that must be done within a specified time frame. It is allowed for the contractor to carry it out both on his own and by persons attracted by him, using for this purpose both his own materials and equipment, and the customer’s materials and equipment.

In the process of performing work under the GPA, its performer is not subject to the work regime in force at his employer, but is responsible for:

- for the quality of what he or the persons involved did;

- compliance with contract deadlines;

- safety of property and materials transferred to him by the customer.

The specifics of the terms of such an agreement also depend on what type of contract work performed by an individual belongs to (Chapters 37, 38 of the Civil Code of the Russian Federation).

Advantages of leaving the “shadow”

Among the advantages of acquiring official status are:

- minimum tax fee – 4-6% (for comparison, individual entrepreneurs will have to pay up to 13% of income);

- simplified process of interaction with legal entities - the company does not have to hire employees and make deductions from their salaries;

- open advertising of services without the risk of persecution by specialized services;

- the possibility of receiving a decent pension upon reaching a certain age.

Let us note that the state intends to bring all private performers out of the “shadow” and begin to receive up-to-date information on their income level. Active measures are being taken, in particular, a registration mechanism has been developed to facilitate the inclusion of all freelancers in a single database. It also becomes decisive in determining the tax rate - from 4 to 6 percent (depending on the category of services provided, as well as the class of consumers). To encourage citizens to register for self-employment, a bonus is provided - a one-time deduction in the amount of ten thousand rubles. As for evading mandatory payments, penalties are imposed for this.

Above, we examined in detail the features of taxation, as well as what taxes the self-employed population, represented by citizens of the Russian Federation, has to pay, what the state takes from them.

We hope the information presented was useful and helped you find an answer to your question. And if you want to optimize and automate your work processes, pay attention to products from Cleverence. In our catalog you can find a ready-made solution for your business. Number of impressions: 112

GPA for work between individuals - what are its consequences?

The Civil Code of the Russian Federation does not prevent the conclusion of a civil contract between individuals. However, a number of questions arise here regarding who is responsible for paying taxes on the income received by the executor. Let us recall that each of the parties to such an agreement may be an individual entrepreneur, and due to this, the following options for the parties to the agreement are possible:

- both of them (the employer and the contractor) are individual entrepreneurs;

- the employer is an individual entrepreneur, and the performer is an ordinary individual;

- the employer is an ordinary individual, and the contractor is an individual entrepreneur;

- both of them are ordinary individuals.

In the first option, the relationship is the same as between legal entities or between a legal entity and an individual entrepreneur, i.e., everyone pays the taxes required for him, and the amount of payment under the GPA is a regular settlement between counterparties.

In the second option, the individual entrepreneur, in relation to income paid to an individual, is the payer of insurance premiums and the tax agent for personal income tax withheld from this income.

In the third option, the individual employer does not impose any taxes on the income paid to the individual entrepreneur. The latter makes all the necessary payments from his own income.

And with the fourth option, both parties have a need to make tax payments and prepare reports:

- for the contractor - in relation to the tax on income received, since the individual employer is not included in the number of tax agents (clause 1 of Article 226 of the Tax Code of the Russian Federation);

- from the employer - in relation to insurance premiums from this income (subclause 1, clause 1, article 419, clause 2, article 420 of the Tax Code of the Russian Federation).

The latter requires, accordingly, registration with the Federal Tax Service as a payer of contributions. Thus, both parties with this version of the GPA have consequences that are not desirable in contracts of this kind that are concluded infrequently.

Self-employment tax: what it is, principles and conditions

Let us note that the analyzed concept is not new to Russian legislation. Thus, the Tax Code of the Russian Federation gives the following definition: “This is the entrepreneurial activity of individuals, consisting in the provision of paid services or the sale of goods produced independently.”

Today, Federal Tax Service structures are considered self-employed citizens who:

- do not have the status of an individual entrepreneur;

- do not work for someone officially;

- provide services to meet personal needs;

- do not hire additional employees.

As a rule, we are talking about creating products on our own - the so-called “handmade”.

Not long ago, a law was approved that determines what tax contributions SLs must pay, as well as what exactly they are required to do. The list included:

- supervision of persons under 18 years of age;

- care for elderly and sick people;

- tutoring;

- help with housework;

- cleaning;

- repair and construction;

- sewing skills;

- hairdressing services;

- software installation;

- photo services.

The described rules also apply to the sale of hand-made goods.

Taxes for parties to a civil contract with an individual

What taxes will arise in a civil contract with an individual? Here, again, everything depends on the capacity in which (an ordinary individual or individual entrepreneur) the performer acts.

An ordinary individual (including an individual entrepreneur who enters into such an agreement as an ordinary individual) will be regarded as an employee registered with the employer under the GPA. And from his income the employer will accrue and pay:

- Personal income tax (except for the situation when the employer is also an ordinary individual), withholding it from the employee’s income (clause 1 of Article 226 of the Tax Code of the Russian Federation);

If you have access to ConsultantPlus, see recommendations from K+ experts on how to calculate and pay personal income tax on payments under service and contract agreements with resident individuals. If you don’t have access, sign up for a free trial access to K+ and learn the procedure.

- insurance premiums for compulsory health insurance and compulsory health insurance (such income is exempt from accrual of contributions to compulsory health insurance in terms of disability and maternity - subclause 2, clause 3, article 422 of the Tax Code of the Russian Federation);

- insurance premiums for injuries, if such a condition is provided for in the GPA (Clause 1, Article 20.1 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ).

How to calculate insurance premiums when accepting work under a contract with an individual who is not an individual entrepreneur, experts from the K+ system explained in the Contract Guide. Get free trial access to ConsultantPlus.

An ordinary individual who has entered into a GPA on his own will only have to pay personal income tax in a situation where his employer also becomes an ordinary individual.

An individual entrepreneur who has entered into a relationship under a GPA agreement as an individual entrepreneur will have to accrue and pay all payments required for an individual entrepreneur:

- due to the applied taxation system;

- insurance premiums for compulsory medical insurance and compulsory medical insurance;

- taxes, the accrual of which is required by the presence of an object of taxation.

Find a comparative description of special modes, the use of which is preferred by individual entrepreneurs, here.

Do companies working with self-employed people receive tax benefits?

How to work with self-employed LLCs or individual entrepreneurs - what tax consequences will they face? Cooperation with the self-employed for legal entities and individual entrepreneurs will have both positive and negative consequences in terms of taxation.

A positive point is that companies and individual entrepreneurs working with the self-employed receive tax benefits in the form of the disappearance (due to the absence of an employment relationship) of the obligation to pay insurance premiums and personal income tax on the income due to the self-employed. Accordingly, there is no need to submit reports on these payments to the Federal Tax Service and extra-budgetary funds.

However, it is permissible not to charge insurance premiums to a legal entity or individual entrepreneur who has paid income to a self-employed person only if they receive a check from the self-employed person with the required details for this document. Among these details (clause 6 of article 14 of law No. 422-FZ):

- the name of the document and the date of its generation, corresponding to the moment the payment was received by the self-employed;

- Full name of the seller and his Taxpayer Identification Number;

- information about the regime applied by him in the form of tax on professional income;

- information characterizing the item of sale;

- cost sold;

- TIN of the buyer, who is a legal entity or individual entrepreneur;

- code (QR code) allowing the buyer to check the fact that the document is reflected in the Federal Tax Service accounting system;

- data (TIN and name) of authorized persons (electronic platform operator or bank) - with their participation in the settlement process;

- which is a unique check number assigned to it at the time of creation in the “My Tax” Federal Tax Service system.

In addition, only this check will allow a company or individual entrepreneur to take as expenses a payment made to a self-employed person (clauses 8-10 of Article 15 of Law No. 422-FZ).

Relationships between legal entities and self-employed people are under the close scrutiny of tax authorities. We told you here how to properly formalize your relationship with a self-employed person so that it is not reclassified as an employment relationship.

An advantage is the possibility of accepting for accounting a check received as an electronic document (clauses 4, 5 of Article 14 of Law No. 422-FZ). But the amount of costs accepted under this check as expenses taken into account when forming the tax base (when using such regimes as OSNO, simplified tax system with the object “income minus expenses” and unified agricultural tax) will decrease due to the non-assessment of insurance premiums on it.

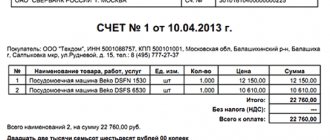

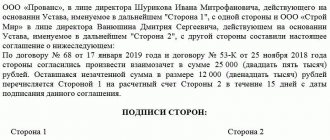

Form and content of a civil contract with an individual - sample

How is the GPA completed? Since it contains quite a lot of conditions that require special reservations, it is always drawn up in writing. It should reflect:

- names and details of the contracting parties;

- subject of the task entrusted to the performer;

- conditions for its implementation (volumes, quality, timing, ownership of raw materials and necessary equipment);

- cost of work, terms of payment for them;

- rights and obligations of the parties (including the condition on the accrual or non-accrual of contributions for injuries);

- procedure for accepting completed work;

- liability of the parties for violations of the terms of the agreement.

To learn about which points in the GAP you should pay special attention to, read the article “Contract agreement and insurance premiums: nuances of taxation.”

A sample civil legal agreement with an individual, executed by a legal entity, can be viewed on our website:

We do not provide a sample of a civil law agreement between individuals, since there are no special rules for its execution. Only the tax consequences will be special for him.

The self-employed person exceeded the income limit and lost his status. What should a legal entity do?

Among all other features, NPA has an important limitation on the income limit. A self-employed person can enjoy all the privileges and concessions until his annual income exceeds 2.4 million rubles. or 200,000 rub. per month. Therefore, experts recommend applying the NAP to those who are confident that their income will not “go beyond” this amount. We discussed in more detail all the pros and cons of NAP earlier, in the article “Individual entrepreneur or self-employment: which is more profitable and easier?”

If a self-employed person exceeds the established income limit, he automatically loses the right to apply NPA from the date of excess. At the same time, the taxation procedure remains the same in relation to income taken into account for the purposes of applying the NPA before the date of loss of the right (Letter of the Federal Tax Service of the Russian Federation dated February 20, 2019 N SD-4-3 / [email protected] ).

In this case, the legal entity must calculate and pay personal income tax and insurance premiums in relation to the individual (if it is not an individual entrepreneur) from the date of loss of the right to apply the income tax (including from the date the amount of 2.4 million rubles is exceeded).

All the most interesting things about business are on our Telegram channel. Join us!

Results

A civil contract is distinguished by freedom in establishing its terms. The parties to such an agreement can be any person. By type, these agreements are divided into those concluded:

- on property transactions;

- in connection with the performance of work and services.

The greatest number of questions are raised by situations where the contractor under a contract for the performance of work (rendering services) is an ordinary individual. It becomes an employee for its customer, but is not subject to the rules of labor legislation, and its income is subject to taxation in a special manner.

Sources:

- Civil Code of the Russian Federation

- Tax Code of the Russian Federation

- Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to compose

The nuances of formalizing, amending and terminating an employment contract between an employee and an individual employer are considered by labor legislation, and are specified in Chapter. 48 (Articles 303 – 309). This agreement must include the following terms:

- Subject of the contract (type of work).

- Salary. Should not contradict section 6 of the Labor Code of the Russian Federation.

- The rights and obligations of the employee, as well as the employer, defined by Article 21, Article 22 of the Labor Code of the Russian Federation.

- The duration of the agreement, established by agreement, may or may not be certain.

- Work and rest schedules defined by this agreement, but not inconsistent with sections and 5 of the Labor Code of the Russian Federation.

- Amendments to the contract by the employer-entrepreneur are allowed only if it is impossible to continue activities on the same terms for objective reasons. The employee must be warned about this 2 weeks in advance.

- Termination of the agreement is carried out on the grounds established by the Labor Code or the agreement.

- Dispute resolution is carried out by the court if independent settlement is impossible.

In addition to the responsibilities related directly to labor relations, the legislator imposes on the employer responsibilities related to the execution and validity of the agreement (Article 303 of the Labor Code).

- Compliance with the mandatory written form of the contract.

- Payment of mandatory payments for the employee provided for by regulations.

- If this is the first job for this employee, the employer provides the necessary information to the Pension Fund of the Russian Federation for the purpose of registering the employee there, as well as opening his personal account.

- If the employer is not an entrepreneur, he registers: the conclusion of this employment agreement with the local government authorities at the place of his registration (registration);

- termination of the agreement in the authority where it was registered upon conclusion. When continuation of the employment relationship is impossible, as well as registration of termination of the contract, the employee himself contacts the authorities for this purpose within a month. Examples of such cases: death of the employer, lack of information about him for two months (Article 307 of the Labor Code).

The list of documents required to conclude this agreement corresponds to the list established by Article 65 of the Labor Code of the Russian Federation:

- identification document (passport or other document);

- work book, except when this is the employee’s first job;

- SNILS (allowed in electronic form), if available;

- for persons liable for military service or subject to conscription - a military ID or other registration document;

- diploma, certificate or other document confirming the presence of a specialty, category, profession;

- in appropriate cases - a certificate of no criminal record, non-use of narcotic substances or another document that takes into account the specifics of these labor relations.

The Law places the responsibility for making entries in the employee’s work book on the employer – individual entrepreneur. An employer who does not have such status does not have the right to do so (Article 309 of the Labor Code).

Sample

Sample employment contract between individuals.doc