What off-balance sheet accounts are intended for accounting for inventory items?

The very definition of off-balance sheet accounts specified in the instructions to the Chart of Accounts (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) indicates that these are accounts that are not taken into account in the organization’s balance sheet; their indicators are not involved in assessing the financial position of an economic entity. The chart of accounts and its instructions provide for 11 off-balance sheet accounts, 3 of which are intended for accounting for inventory items:

- Account 002 - it records inventory items that are in the organization’s warehouse, but are not already or not yet its property.

- Account 003 is intended to account for raw materials and materials that the manufacturing organization receives from the customer for processing.

- Account 004 is used by commission agent organizations to account for goods accepted under the terms of a commission agreement.

You can get acquainted with the off-balance sheet accounts provided for in the Chart of Accounts and the features of their use in the article “Rules for maintaining accounting records on off-balance sheet accounts.”

The following is typical for all property off-balance sheet accounts: the receipt of assets is reflected only in debit, write-off only in credit, there is no correspondence in off-balance sheet accounts.

ConsultantPlus experts explained when and how to account for materials on off-balance sheet accounts. If you don't have access to the system, get a free trial online.

Reasons for transfer from off-balance sheet accounts 03 and 07

From 01/01/2020, the Federal Standard “Reserves”, approved. by order of the Ministry of Finance of Russia dated December 7, 2020 No. 256n (hereinafter referred to as the “Reserves” Standard). According to clause 45 of the Standard “Inventories”, items of property that were not previously recognized as part of inventories and (or) reflected in off-balance sheet accounting are transferred to the balance sheet. This norm of the transitional provisions of the “Inventories” Standard is the starting point for the question: to transfer or not. This means that in order to answer it, you need to understand what property satisfies the above standard.

Strict reporting forms (for example, work record forms) and property intended for donation were previously not taken into account on the balance sheet. To account for them, only off-balance sheet accounts 03 and 07 were used, respectively. However, starting from 01/01/2019, prerequisites appeared for accounting for such objects as part of material inventories.

The procedure for accounting for such property has recently been unstable: there were no clear instructions, the provisions of regulatory legal acts contradicted each other*(1) and one could only rely on the explanations of the Russian Ministry of Finance*(2). Therefore, from January 1, 2019, public sector institutions established the procedure for accounting for strict reporting forms and property intended for donation in their accounting policies in accordance with clarifications of the Ministry of Finance of Russia * (2).

In particular, this accounting procedure provided for the reflection on balance sheet accounts of only objects located in the institution’s warehouse. As soon as the property was transferred to the employee responsible for issuing it, it was written off from the balance sheet and recorded on off-balance sheet accounts 03 and 07 until the moment of delivery and registration. Let us note that for a long time the procedure for accounting for the property in question could be traced using the draft order to amend the Instructions, approved. by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (hereinafter referred to as Instruction No. 157n). It coincided with what was described in the letters of the Russian Ministry of Finance * (2).

More on the topic: Form 0503773 in 2021: what to consider?

Please note: from October 17, 2021, the changes planned by the project regarding the accounting of strict reporting forms and “gifts” were officially included in Instruction No. 157n.

Only inventories that meet the concept of an asset can be taken into account on balance sheet accounts. Namely, objects owned by an institution and (or) in its use, controlled by it, from which useful potential or economic benefits are expected to flow (clause 7 of the Federal Standard “Reserves”, approved by order of the Ministry of Finance of Russia dated December 7, 2018 No. 256n, pp. 35, 36 of the Federal Standard “Conceptual Framework”).

So, we draw conclusions from the above. Only objects can be transferred from off-balance sheet accounts 03 and 07 to balance sheet account 105 06 (for example, forms of work books, receipts, certificates of commendation, diplomas, etc.) that:

- Are assets;

- Located in the institution's warehouse. Since, according to the procedure for recording strict reporting forms, property intended for donation, only objects in the warehouse will be accounted for in account 105 06. Objects issued for use (delivery, filling) are accounted for in off-balance sheet accounts;

- Purchased before 01/01/2019. Since in relation to objects received from 01/01/2019, as a rule, accounting has already been organized using both off-balance sheet accounts 03, 07, and balance sheet account 105 06 according to the procedure developed on the basis of letters from the Ministry of Finance of Russia * (2) and enshrined in the accounting policy .

How to transfer materials to an off-balance sheet account?

Paragraph 4 clause 5 PBU 6/01 indicates the need for proper accounting of property written off as expenses as inventories. And paragraph 5 of PBU 1/2008 talks about organizing accounting policies in such a way that assets and liabilities belonging to the organization are accounted for separately from others.

However, to account for material assets, the cost of which has already been written off as expenses, there are off-balance sheet accounts 002, 003 and 004. Instructions for using the Chart of Accounts also provide for the possibility of introducing additional off-balance sheet accounts. Thus, to account for materials that continue to be in the organization and used in its business activities, it is possible to provide an additional account on the balance sheet, and the regulations for its use can be fixed in the accounting policies. Such an off-balance sheet account may be account 012 “Material assets in operation.”

In the accounting program “1C: Accounting”, popular among accountants, for example, an MC account with a number of sub-accounts has been introduced for similar purposes:

- MC02 “Working clothes in operation”;

- MC03 “Special equipment in operation”;

- MC04 “Inventory and household supplies in operation.”

After the property is capitalized and put into operation, its value is written off as the organization’s expenses, and the property itself, assigned to the responsible persons, will be listed on the balance sheet. When this property ceases to be used for one reason or another, it will need to be written off from the off-balance sheet account in which it was recorded.

At the same time, analytical accounting of materials is carried out according to nomenclature and storage locations, which makes it possible to control the availability and use of these values, and in the case of additional costs associated with their use, to justify these costs.

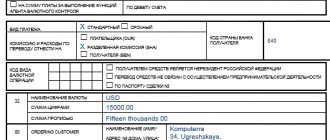

When transferring material assets into operation, the relevant documents are issued, for example, a demand invoice (form M-11), and the following entries are made:

- Dt 20, 26, 44 (cost accounts) Kt 10 “Materials”;

- Dt 012 (MC).

In the event of complete depreciation of the property recorded off the balance sheet, or its disposal for other reasons, a document for write-off is drawn up and a posting is recorded on the credit of the off-balance sheet account: Kt 012 (MC).

Regulations for accounting for values recorded on the balance sheet and monitoring them, as well as a list of documents used for these purposes, must be developed by the organization itself and consolidated in its accounting policies.

Transferring materials into operation in 1C 8.3 - step-by-step instructions

We will enter this data into the previously created document, since both the transfer date and the rest of the header details will match.

In the tabular section on the “Special equipment” tab, almost the same data is indicated as in the case of special clothing.

In this case, only the transfer count 10.11.2 will differ. The program will fill in some data automatically.

To do this, it is important to indicate in the nomenclature card that the “Santa Claus” uniform is special equipment.

The document will generate movements similar to the case with workwear, only in this situation the off-balance sheet account MTs.03 is also used.

The last tab will reflect the commissioning of the office organizer.

We took it to the inventory and household items. accessories. Filling out the tab is similar to the previous examples. In this situation, in the way of reflecting expenses, we indicated that repayment of the organizer will occur when it is put into operation.

How to sell materials from an off-balance account?

To sell property recorded off the balance sheet, its contractual value is determined. When selling, an entry for the sale of other property is generated:

- Dt 62 “Settlements with buyers and customers” Kt 91 “Other income and expenses.”

If an organization operates on OSNO, VAT is charged upon the sale of an asset:

- 91 “Other income and expenses” Kt 68 “Calculations for VAT”.

The disposal of property is carried out according to the credit of the off-balance sheet account of its accounting:

- Kt 012 (MC).

Moreover, the cost of such property is zero due to the fact that it has already been taken into account in the organization’s costs when transferring it into operation. Funds from the sale of this property are the income of the organization.

IMPORTANT! To generate documents for sale and the corresponding entries in the accounting program, it is often necessary to restore the property being sold in the organization’s assets, if the functionality of the program does not provide for transactions for the sale of property recorded off the balance sheet. For this purpose, inventory items to be sold are restored to the account from which they were previously written off, at a symbolic cost - for example, 1 kopeck.

Off-balance sheet accounting

Let's look at typical accounting entries for off-balance sheet accounts using examples.

Settlements under an uncovered letter of credit

Let’s say that an agreement was concluded between Image LLC and Design LLC for the supply of equipment (524,000 rubles), payment for which is made from an uncovered letter of credit. The bank's commission for opening an uncovered letter of credit is 0.25% (RUB 1,310). Payment in favor of Design LLC was made by the bank upon delivery of the equipment and provision by the supplier of the delivery note and invoice.

The following entries were made in the accounting of Image LLC:

| Dt | CT | Description | Sum | Document |

| 009 | Accounting for an uncovered letter of credit opened by a bank | 524,000 rub. | Agreement for opening a letter of credit | |

| 76 | Write-off of bank commission for opening an uncovered letter of credit | RUB 1,310 | Agreement for opening a letter of credit | |

| 08 | 60 | Acceptance for accounting of equipment supplied by Design LLC | RUB 444,068 | Packing list |

| 08 | 76 | Inclusion of bank commission in the initial cost of equipment | RUB 1,310 | Agreement for opening a letter of credit |

| 19 | 60 | Reflection of input VAT | RUR 79,932 | Packing list |

| 01 | 08 | Commissioning of equipment | RUB 445,378 | OS commissioning certificate |

| 68 VAT | 19 | Acceptance of input VAT for deduction | RUR 79,932 | Invoice |

| 60 | 76 | Transfer of funds to Design LLC from an uncovered letter of credit | 524,000 rub. | Payment order |

| 76 | Repayment of bank debt under a letter of credit | 524,000 rub. | Payment order | |

| 009 | Write-off of an uncovered letter of credit | 524,000 rub. | Certificate of repayment of letter of credit |

Securing collateral

A product supply agreement was concluded between Stolitsa LLC and Karavella JSC, according to which Karavella JSC pledges equipment worth RUB 814,350 as security for payment. Payment for the goods was not reflected in a timely manner, and therefore the equipment is transferred to the disposal of Stolitsa LLC, after which Stolitsa sells it.

| Dt | CT | Description | Sum | Document |

| 008 | Obtaining payment security | RUB 814,350 | Pledge agreement | |

| 008 | Write-off of payment security | RUB 814,350 | Pledge agreement | |

| 002 | Accounting for equipment accepted under a pledge agreement | RUB 814,350 | Pledge agreement | |

| 002 | Equipment sold | RUB 814,350 | Transfer and Acceptance Certificate | |

| 91 | Income from the sale of equipment is reflected | RUB 814,350 | Bank statement |

Inventory of materials off balance sheet

Clause 27 of the Accounting Regulations, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, establishes the mandatory inventory of all property and liabilities before drawing up annual reports and in some other cases. At the same time, the accounting policy may stipulate that it should be carried out more frequently. Mandatory audit applies to both balance sheet and off-balance sheet accounts.

The rules for conducting an inventory of inventories and the documents accompanying them can be found in the article “Inventory of inventories.”

Balance sheet and off-balance sheet accounting.

Home Favorites Random article Educational New additions Feedback FAQ⇐ PreviousPage 3 of 4Next ⇒

· balance sheet accounts are all accounting accounts combined into one system that correspond with each other; their indicators are reflected in the balance sheet (in this case, balance sheet accounts can be reflected in several balance sheet items);

· off-balance sheet accounts are accounting accounts whose balances are not included in the balance sheet, but are shown behind the balance sheet.

Off-balance sheet accounts include:

* reserve funds of banknotes and coins * obligations of borrowers * payment documents submitted to the bank for collection (to receive payments) * valuables accepted for storage * strict reporting forms, check and receipt books, letters of credit for payment, etc.

Accounting for the formation of authorized capital

Within the framework of account 75, analytical accounts must be opened for each founder in order to monitor the timeliness and completeness of their contributions stipulated by the charter.

The forms of contributions are not limited by law and can be any: it is important that they are agreed upon in advance between the founders and assessed by them. The most common forms of contributions are fixed assets, intangible assets, equipment for installation, unfinished capital investments and work in progress, materials, finished products, goods, cash, securities, etc. We will consider the reflection in accounting of the procedure for making deposits in different forms.

If a contribution to the authorized capital is made in the form of fixed assets, then the basis for reflecting this operation in the accounting of the newly created organization will be an Act on the Acceptance and Transfer of Fixed Assets drawn up and signed by the parties (Form N OS-1), approved by the head of the receiving organization. In this act, in addition to all the details provided for in the document form itself, it is necessary to indicate what exactly is being transferred, in what quantity and at what cost. According to current legislation, the transferred property is valued at market value, but not lower than the balance sheet of the transferring party: D-t. 08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”.

Accounting for the processes of creation and acquisition of fixed assets

Fixed assets (fixed assets) are means of production that are involved either directly in the production process or in its provision. Such funds wear out gradually, transferring their cost to the products produced.

The process of acquiring fixed assets is usually accompanied by a large number of primary documents, which include a purchase and sale agreement, an application for the supply of a specific value, a supplier invoice, other “external” documents, as well as internal production documents, quality certificates for basic components and subsystems, etc.

Products received in serviceable containers are checked, as a rule, at the final recipient's warehouse for compliance with the terms of the contract, standards, technical specifications, as well as accompanying documents certifying the quality and completeness of the supplied products (technical passport, certificates, invoice, specification, protocols tests, etc.). The absence of the specified accompanying documents (all or some) does not suspend the acceptance of products. In this case, a report is drawn up on the actual quality and completeness of the received products and indicates which documents are missing.

For certain types of products, the parties can establish mandatory warranty and other types of tests with the subsequent drawing up of intermediate and final quality acceptance certificates on the identification of defects and deviations after testing individual components, systems and subsystems, on the results of comprehensive testing, on operational repairs and modifications performed, etc. . P.

Accounting for the materials procurement process

The chart of accounts for accounting financial and economic activities gives enterprises the right to choose how to approximately reflect the acquisition process and procurement of materials in accounting. The traditional version of reflecting this process in accounting involves entries in accordance with the debit of the account. 10 “Materials”, 12 “Low-value and wear-and-tear items” as well as credit account. 60 “Settlements with suppliers and contractors”, 71 “Settlements with accountable persons”, 76 “Settlements with many different debtors and creditors” and others. Material valuables that are not cheap on a long journey, paid for, but not received by the enterprise and generating income, are characterized in this approach to accounting by the balance according to the debit of the account. 60 (payment of valuables - debit to account 60 and many other similar accounts, as well as credit to account 51 “Current account”). Non-cheap material assets on a long journey, unpaid, are not reflected in this accounting option in synthetic accounting. The second approach to the problem, as well as to the reflection in the accounts of the process of procurement and purchase of materials, assumes an objective chance of using, in addition, two synthetic accounts: 15 “Procurement and purchase of materials” and 16 “Variance in the cost of materials”. This effective approach can be secondary if necessary, when the corporation has adopted a method for valuing inventories written off for further production according to planned (accounting) prices, including the amounts of transportation and procurement costs.

PRODUCTION PROCESS ACCOUNTING

Production is the main economic process in the activities of most enterprises and is the process of manufacturing products, performing work and services. The volume of product output, its quality and competitiveness depend on the correct organization of the production process.

The organization of the production process depends on the specifics of the enterprise’s activities and the structure of its management, therefore the production process has its own characteristics for each type of activity. But for production of any type it is characteristic that in the production process of manufacturing products, performing work and services, material and labor resources are used, as well as means of labor that support the production process.

At large industrial enterprises with a complex structure of the organization of the production process, the following accounts are used to keep track of production costs:

20 “Main production”; 21 “Semi-finished products of own production”; 23 “Auxiliary production”; 29 “Service industries and farms.”

Account 20 “Main production” records costs directly related to the main production process of producing finished products, performing work and providing services.

Account 21 “Semi-finished products of own production” reflects the costs of producing semi-finished products of own production at enterprises where they are accounted for separately. Semi-finished products of our own production can be used for subsequent processing in the main production or for external sale.

Account 23 “Auxiliary production” records the costs of production allocated to independent divisions that provide the main production process with electricity, steam, gas, and also carry out repairs of fixed assets, transport services for the enterprise, etc. In addition, tools, spare parts, etc. can be manufactured in auxiliary production shops.

Account 29 “Service production and facilities” records costs at enterprises that have non-production facilities on their balance sheet. Service industries and farms include workshops, canteens, laundries, kindergartens, holiday homes, residential buildings, dormitories, etc.

In small enterprises and enterprises with a simple production structure, accounting is usually kept using one account 20 “Main production”.

The result of the production process is the release of finished products, the cost of which is formed taking into account the production costs necessary for its manufacture. Production costs associated with the production of products are called production costs.

17) Income, expenses - financial result of the organization: basic concepts and principles of accounting

Accounting for financial results and profit distribution is central and one of the most important issues in the entire accounting system. At the same time, the main function of accounting is to determine and reflect the financial results of the organization for the reporting period. In the accounting of the Russian Federation, the concept of profit has many meanings. From the professional point of view of an accountant, the basic value is the difference between the income and expenses of the organization; if expenses exceed income, then they speak of a loss incurred.

Since the late 90s. In the regulatory framework of accounting, a new term “economic benefit” has appeared, which means the growth of an organization’s assets with a simultaneous decrease in its accounts payable. This term forms the basis for the accounting definition of income and expenses.

The income of an organization is understood as an increase in economic benefits as a result of the receipt of assets (cash, other property) and (or) repayment of liabilities, leading to an increase in the capital of this organization, with the exception of contributions from participants (owners of property). An organization's expenses are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property).

The comparison of income and expenses, i.e., the calculation of the financial result of an organization, is based on the fundamental principle of accounting of the temporal certainty of the facts of economic activity. In accordance with it, income and expenses of the organization's economic activities are taken into account in the reporting period in which they occurred, regardless of the actual time of receipt or payment of funds associated with these facts. It is from the application of this principle that the rules for generating information about the income and expenses of an organization arise. These include the rules for recognizing and determining the amount of income and expenses.

Revenue recognition refers to the determination by an organization of the right to receive revenue (income), its amount, confidence in the increase in economic benefits, the transfer of ownership to the buyer, and also that the expenses related to this revenue can be determined. If it is impossible to determine at least one of the conditions in accounting, accounts payable are recognized.

Recognition of expenses means determining the amount of the expense, confidence in the reduction of economic benefits, and also that the expense is carried out in accordance with legal requirements. If at least one of the conditions is not met, accounts receivable are recognized in accounting.

The most important point in organizing the accounting of financial results is the rule for determining the amount of income and expenses, i.e. their assessment. At the same time, the determination of the amount of revenue is understood as a measurement of the value that the organization received in exchange for the products and goods it supplied and has many meanings. In this case, we mean the price of exchange of products, goods and services determined by the relevant agreement.

The amount of expenses is recognized in accounting in their actual amounts. The theoretical justification for this rule is the approach according to which the organization carries out all major expenses with the aim of generating income. Therefore, according to the principle of completeness, one of the most important principles for the formation of reliable information, all expenses are recognized in accounting, regardless of the intention of their implementation.

Income and expenses recognized in appropriate amounts, depending on the nature, as well as the conditions for their receipt and areas of activity, are divided into:

· income (revenue) and expenses from ordinary activities;

· income and expenses from other income.

The correlation of income and expenses within these groups gives rise to profits and losses both in ordinary activities and in other income.

In turn, income and expenses from other income are divided into operating, non-operating and extraordinary income and expenses. Accordingly, the accounting will highlight operating, non-operating and extraordinary profits and losses.

In this regard, the most important point in organizing the accounting of financial results is the circumstance that will make it possible to determine which groups of transactions belong to ordinary activities and which to other activities.

For accounting purposes, an organization independently recognizes its activities as ordinary or other, depending on its nature, types of income and expenses, as well as the conditions for their receipt and occurrence. Thus, there is a need to define the types of activities that will be defined as normal by the organization.

Regulatory regulation of accounting identifies 4 subjects of activity that can be recognized by an organization as ordinary.

These activities include:

·production and sale of products and goods;

· provision for a fee for temporary use (temporary possession and use) of its assets under a lease agreement;

· provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

·participation in the authorized capital of other organizations.

Consequently, depending on the subject of the organization’s activity, the composition of expenses and income within the above groups may differ fundamentally. It is necessary to take into account that currently most organizations are multidisciplinary, whose activities are related not only to the production of products (works, services), but also to trade, financial investments and other types of activities. Therefore, in accounting practice, situations are possible when a number of activities are immediately defined by the organization as ordinary.

The criterion for such a determination in accounting is the application of the principle of materiality of information. In accordance with it, for commercial organizations the subject of activity can be considered work, services, production of products, etc., constituting in value terms 5% or more of the sales volume of this organization. For non-profit organizations and unitary enterprises, the subject of their activities is determined in the constituent documents.

Thus, the correlation of expenses and income based on the principles and rules discussed above allows us to identify the financial result of the reporting period. Consequently, the fundamental principle of accounting, the principle of temporal certainty of the facts of economic activity, makes it possible to correctly determine the financial result of the reporting period, and the rule for recognizing and determining income and expenses contributes to the most accurate calculation of the required value.

⇐ Previous3Next ⇒

Results

Assets transferred for operation are written off as expenses at the time of their transfer and are no longer taken into account in the balance sheet asset.

Accounting for valuables written off the balance sheet, but used in the organization’s business activities until they are worn out, liquidated or sold, can occur on an off-balance sheet account. The regulations for its use must be approved by the accounting policy. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Off-balance sheet account MC 04 - what is it and how to use it?

> > > February 01, 2021 MTs 04 off-balance sheet account - what is it? Let's look at what the MTs.04 off-balance sheet account is, provided for by the chart of accounts of the 1C: Accounting program, and in what cases it is used.

In the chart of accounts of the 1C: Accounting program there is a number of additional off-balance sheet accounts in addition to the 11 generally accepted ones. This is done for more thorough and convenient accounting.

Account MC.04 is a subaccount of the MC account “Material assets in operation” along with three more subaccounts:

- MC.01 “Fixed assets in operation”,

- MC.02 “Workwear in operation”,

- MTs.03 “Special equipment in operation.”

МЦ.02—an off-balance sheet account used to account for special clothing issued to an employee to perform his official duties. Account MTs.03 accumulates information on special tools and equipment transferred into operation.

Account MTs.01 is often used if the fixed asset is reflected differently in tax and accounting.

The introduction of these accounts into accounting is due to the need to control property written off from the organization’s balance sheet, included in costs, but used in the organization’s economic activities.

Their debit reflects the values to be accounted for, broken down by item items, financially responsible persons and storage locations.

The loan reflects the write-off of assets.

In this case, transactions are recorded only in debit or only in credit of such accounts - correspondence is not typical for off-balance sheet accounts.

You can familiarize yourself with the features of using off-balance sheet accounts in accounting in the article.

According to the Chart of Accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), the balance sheet account 10.09 is used to capitalize inventory and household supplies. To reflect this business operation in the 1C: Accounting program, the document “Receipt of goods and services” is provided. When instruments and other inventory are accepted for accounting, a new document is created with the transaction type “Purchase, commission”.

The document is filled out indicating:

- from whom,

- what has to happen

- at what price.

- in what quantity,

Account 10.09 “Inventory and household supplies” is selected as a debit accounting account. An entry in the credit of account 10.09 occurs when inventory and other household property are transferred into operation. For this purpose, a document “Transfer of materials into operation” is created and carried out.

When transferring inventory, fill out the “Inventory and Household Supplies” tab:

- the employee accepting them for use,

- the nomenclature of transferred values is selected by position,

- the accounting account 10.09 and the method of reflecting costs are indicated.

When posting a document, values are written off from accounting account 10.09 to the cost account.

At the same time, these values are debited to account MTs.04 in the context of nomenclature, quantity and financially responsible persons. In this way, proper control over the safety of the organization’s property can be organized.

What are off-balance sheet accounts?

Off-balance sheet accounts (AB) are intended to store information about the objects used by the company. Their key feature is that the company does not have ownership rights to these objects. They are temporarily part of the company. Provided on the basis of various agreements. These objects may include:

- rented premises, warehouses;

- valuables transferred for safekeeping;

- raw materials accepted for processing;

- equipment adopted for the purpose of installation work.

The principle of property separation and off-balance sheet accounts

The organization of off-balance sheet accounts is based on the principle of property separation. It states that the accounting of an organization's assets should not coincide with the accounting of the assets of its owners, as well as the assets of other organizations under the care of this organization. The same principle applies not only to assets, but also to liabilities.

Objects temporarily included in the assets, provided under certain agreements, do not belong to the enterprise. However, during a certain period of time, it is the enterprise that is responsible for them, which means it must take them into account in a certain way. But such values cannot be mixed together with those owned by right of ownership within the same accounting accounts.

Off-balance sheet accounts are auxiliary accounts within the framework of accounting. They become relevant if you need to obtain information not contained in balance sheet accounts. This feature explains their name. Balances from off-balance sheet accounts will not be included in the balance sheet. They are displayed behind the total of this indicator. That is, they are recorded on the balance sheet.

IMPORTANT! Information from the accounts in question does not affect financial performance. For this reason, they will not appear in the company's financial statements.

What are off-balance sheet accounts for?

Off-balance sheet accounts perform the following functions:

- Accounting for the availability of property and tracking transactions with it. Accounting may also concern objects that belong to the enterprise, but their value is written off as expenses.

- Collection of data necessary for the formation of explanations for the main balance sheet and financial statements.

- Control over the operation of property to which the enterprise does not have ownership rights.

- Control over the safety of the objects in question.

- Supporting role to monitor the execution of property papers without delays. In particular, documents are drawn up on the receipt of objects and their disposal.

- Full organization of accounting in this area.

Properly executed off-balance sheet accounts allow you to obtain all the data on objects that are located on the territory of the enterprise, but do not belong to it. Information is necessary to analyze the company's creditworthiness and determine its financial stability.

Off-balance sheet accounts in budgetary organizations

If the organization is classified as a budget organization, off-balance sheet values are recorded in it according to a simplified scheme - there is no need to keep corresponding records. When property is capitalized, the necessary entry is made in the debit of a certain off-balance sheet account. At the time of write-off, this entry is made against the loan. It is allowed to introduce additional off-balance sheet accounts for greater reliability of management accounting, naturally, indicating them when developing accounting policies.

So. Off-balance sheet accounts allow you to display information about property that is located on the territory of the enterprise, but does not belong to its property. Other data is also stored on the AP. Having off-balance sheet accounts during tax audits will allow you to avoid making unnecessary tax deductions. It is also a source of important information about the company's activities. The information allows you to track operations carried out by the enterprise.