Reduced tariff for paying insurance premiums

All information on preferential or reduced rates is in Art. 427 Tax Code of the Russian Federation. It describes in great detail exactly what activities of the payer may give him the right to use the benefit and what other conditions must be met for this.

For clarity, we have collected in one table the types of activities that give the right to benefits and indicate their size.

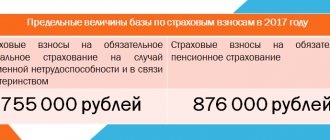

What is included in the base for calculating contributions and after what amount the rate for contributions changes, read the article “Limit amounts for calculating insurance premiums in 2017.”

Use of reduced tariffs

Paragraphs four to thirteen of Article 427 of the Tax Code of the Russian Federation list all the necessary conditions, having fulfilled which, the payer of insurance premiums can count on a benefit, that is, a reduced tariff (20%).

For the most part, beneficiaries include enterprises developing high technologies, operating in special economic zones, collaborating with Skolkovo, etc.

Thus, the main beneficiaries for the payment of insurance premiums are:

- Companies and partnerships operating under the simplified tax system.

- Russian organizations working in the field of high information technologies.

- Shipowner organizations.

- Non-profit and charitable organizations on the simplified tax system.

- Other organizations.

In 2021, there was a reduction in beneficiaries: for example, explanations on the extension of the program for non-profit and charitable organizations and enterprises operating under the simplified tax system were given in Letter of the Ministry of Finance of the Russian Federation No. 03-15-06/54260 dated 08/01/2018. Referring to the minutes of the meeting of the Government Commission, the Ministry of Finance notes that there is no provision for an extension of the grace period for organizations involved in the social sphere.

Since 2021, pharmacy organizations operating on UTII, as well as individual entrepreneurs on the PNS, will also be deprived of benefits (with the exception of leasing property if the individual entrepreneur does not have sales floors or they are less than 50 square meters in area).

Federal Law No. 303 of August 3, 2018, in turn, provides for the extension of the grace period for the payment of insurance premiums until 2024 only for the following categories of social sector payers:

- Non-profit organizations working in the social sphere under the simplified tax system.

- Research organizations.

- Educational establishments.

- Medical organizations.

- Cultural and sports institutions.

- Charitable organizations on the simplified tax system.

Based on this, most organizations using the simplified taxation system are required to apply the standard tariff for insurance premiums from 2021 - 30%.

Calculation of insurance premiums and conditions for applying a reduced tariff

Reduced insurance premium rates can only be applied if certain conditions are met. Their full list is described in subsection. 4-10 p. 1 tbsp. 427 Tax Code of the Russian Federation.

For example, for charitable organizations, a necessary condition for receiving benefits is (subclause 8, clause 1, article 427 of the Tax Code of the Russian Federation):

- application of the simplified tax system;

- charity must correspond to the goals stated in the charter of the enterprise.

Calculation of insurance premiums for 2021 at a reduced rate occurs in the same manner as for standard rates.

The payer must recalculate contributions from the beginning of the year if he has lost the right to use benefits before the end of the year.

The exception is enterprises whose activities are listed in subparagraph. 10–13 p. 1 art. 427 Tax Code of the Russian Federation. They do not require recalculation - they simply do not apply the reduced tariff from the 1st day of the month in which the benefit is lost.

What is written with a pen...

Judicial practice quite often shows us how enormously important the correct wording of the text of the law is. Here is one such situation.

The taxpayer simultaneously applies the simplified tax system and UTII. The main type of its economic activity is named in subparagraph. 5 p. 1 art. 427 Tax Code of the Russian Federation. But this is precisely why UTII is used, not the simplified tax system. Can such a taxpayer take advantage of reduced insurance premium rates?

As mentioned above, in sub. 5 p. 1 art. 427 of the Tax Code of the Russian Federation lists many types of activities. At the same time, reduced insurance premium rates can only be applied by those payers who use the simplified tax system.

This situation is discussed in the letter of the Ministry of Finance of Russia dated June 28, 2017 No. BS-4-11/ [email protected] (brought to the lower inspections of the Federal Tax Service of Russia by letter dated June 28, 2017 No. BS-4-11/ [email protected] ). And recently a new letter from the Federal Tax Service of Russia dated February 22, 2018 No. GD-4-11/ [email protected] , repeating this position.

The officials thought so. By virtue of sub. 5 clause 1 and sub. 3 p. 2 art. 427 of the Tax Code of the Russian Federation for companies and entrepreneurs using the simplified tax system, the main type of economic activity of which, classified on the basis of OKVED, is activity in the production and social spheres, for the period up to 2021 inclusive, a reduced rate of insurance premiums is established in the amount of 20%, provided that the income of such payers for the tax period does not exceed 79,000,000 rubles.

According to paragraph 6 of Art. 427 of the Tax Code of the Russian Federation, the corresponding type of economic activity is recognized as the main type of economic activity, provided that the share of income from the sale of products or services provided for this type of activity is at least 70% of the total income. And the amount of income is determined in accordance with Art. 346.15 Tax Code of the Russian Federation.

On this basis, officials decided that the reduced insurance premium rates established in subparagraph. 3 p. 2 art. 427 of the Tax Code of the Russian Federation, are applied by the mentioned payers of insurance premiums subject to compliance with the specified criteria and the application of the simplified tax system for the main type of economic activity. Conclusion: if the main type of economic activity of the payer of insurance premiums, combining the simplified tax system and UTII, is the activity specified in subparagraph. 5 p. 1 art. 427 of the Tax Code of the Russian Federation, but according to which the payer applies UTII, he does not have the right to apply reduced rates of insurance premiums.

However, there were experts who believed that, albeit purely formally, the officials were wrong. In the subclause in question, only two conditions are literally put forward:

— the subject must apply the simplified tax system;

- the main activity must be mentioned in the list.

It is not said here that the simplified tax system should be applied specifically for the main type of activity, nor is it said that the entity cannot simultaneously apply another taxation system.

There were doubts that the arbitration court would listen to such rather strained arguments, but the Arbitration Court of the Ural District listened (see resolution dated November 15, 2017 No. F09-7163/17)! He clearly indicated that “the payment of UTII by the company for the main type of activity, and not the application of the simplified tax system, cannot be a basis for refusal to apply a reduced tariff, since according to the current legislation, the application of the tariff does not depend on what tax is paid for the main type of activity "

So in the text of the Tax Code of the Russian Federation, every word is important! And with this axiom, we return to the innovation that we talked about at the beginning of the article.

How to apply a reduced tariff when calculating insurance premiums on the simplified tax system?

Enterprises using the simplified tax system have an advantage over others. In this case, it is the simplified tax system that is one of the conditions for using a reduced tariff if the company carries out the activities listed in paragraphs. 1, 5, 7, 8 tbsp. 427 Tax Code of the Russian Federation.

In addition to the Tax Code of the Russian Federation, preferential activities must comply with the assigned OKVED. The directory is approved by the Ministry of Economic Development and is included in the standardization system of the Russian Federation (Rosstandart order “On the adoption and implementation of the All-Russian Classifier of Types of Economic Activities [OKVED2] OK 029-2014 [NACE rev. 2]” dated January 31, 2014 No. 14-st [ed. dated March 20, 2017]).

A complete list of current codes is posted on the website of the Russian Ministry of Economic Development.

How to take advantage of the benefits under the simplified tax system, read the material “Benefits on insurance premiums under the simplified tax system in 2017.”

Reduced insurance premium rates of 15% are valid from April 2021

Publication date: 04/20/2020 03:18

In accordance with Federal Law dated July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in the Russian Federation,” from April 1, 2021, payers of insurance premiums recognized as small and medium-sized businesses have the right to charge insurance premiums at a reduced rate of 15 percent:

- for compulsory pension insurance – 10%;

- for compulsory social insurance in case of temporary disability and in connection with maternity – 0%;

- for compulsory health insurance – 5%.

The new procedure applies to accruals for April 2020 and subsequent months. For March 2021, insurance premiums are calculated according to general rules.

The reduced rate of insurance premiums applies only to accrued payments (remunerations) that exceed the minimum wage (hereinafter referred to as the minimum wage) established by federal law at the beginning of the billing period (year).

As of January 1, 2021, the federal minimum wage is 12,130 rubles.

Thus, if the accrued monthly salary is equal to or less than the minimum wage, insurance premiums are calculated according to the tariffs applied to payers, the amount of which is established by Art. 425 or clause 2 of Art. 427 of the Tax Code of the Russian Federation, amounts of accrued wages exceeding 12,130 rubles are subject to contributions at a rate of 15 percent.

Insurance premiums are calculated for each individual and at the end of each calendar month.

Employers will not be able to take advantage of the reduced rate of insurance premiums for employees who work part-time (part-time (shift) and (or) part-time work week, including with the division of the working day into parts), if the monthly accrual of payments (remunerations) in for such employees is less than the minimum wage (even if the salary is higher than the minimum wage).

When filling out the calculation of insurance premiums for the first half of 2021, small and medium-sized businesses that have exercised the right to apply a reduced tariff at a rate of 15% in relation to payments in favor of individuals for each calendar month exceeding the minimum wage, indicate the insurance premium tariff code “20 "

When filling out subsection 3.2.1 “Information on the amount of payments and other remuneration accrued in favor of an individual” in field “130”, payers indicate the following codes of the insured person:

- for employees in terms of accrued payments (remunerations) up to the federal minimum wage - codes of the insured person in accordance with Appendix No. 7 to the Procedure for filling out the calculation of insurance premiums, approved by Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11 / [email protected] ;

— for employees in terms of excess payments (remunerations) over the minimum wage:

"MS" - Russian citizens;

“VZhMS” - foreign citizens or stateless persons insured in the compulsory pension insurance system, temporarily residing, as well as foreign citizens or stateless persons temporarily staying on the territory of the Russian Federation, who have been granted temporary asylum;

"VPMS" - foreign citizens or stateless persons (with the exception of highly qualified specialists) temporarily staying on the territory of the Russian Federation).

What other changes have been made to Art. 427 of the Tax Code of the Russian Federation?

Federal Law-303 dated 08/03/2018 A number of other changes have been made to Art. 427 of the Tax Code of the Russian Federation, which entered into force on January 1, 2019:

- the rate of insurance contributions for compulsory pension insurance has been established for an indefinite period in the amount of 22% within the limit of the base for calculating contributions for the specified type of compulsory insurance and 10% above the limit,

- the period of application of reduced tariffs in the amount of 20% was extended until 2025 for two categories of payers (which was previously also established until 2021): non-profit organizations carrying out socially important activities in the field of public service, scientific research, healthcare, mass sports, education on the simplified tax system , charitable organizations on the simplified tax system.

Thus, the validity of the reduced tariffs for the following three categories of payers has not been extended:

- enterprises whose main activities correspond to those specified in paragraphs. 5 hours 1 tbsp. 427 NKRF, applying the simplified tax system,

- pharmacy organizations and individual entrepreneurs licensed to carry out pharmaceutical activities, in relation to payments and rewards made to individuals who have the right to engage in pharmaceutical activities, who have chosen the taxation system in the form of paying a single tax on imputed income for certain types of activities,

- Individual entrepreneurs applying the patent taxation system in relation to payments in favor of individuals directly involved in the implementation of activities corresponding to the type of economic activity specified in the patent (with the exception of individual entrepreneurs carrying out the types of activities specified in subparagraphs 19, 45 48 paragraph 2 of Article 346.43 Code).

These payers are from 01/01/2019. The general tariff applies.

Cancellation of reduced tariffs

The Government of the Russian Federation did not make changes to paragraphs. 5 p. 1 art. 427 of the Tax Code of the Russian Federation from 2021, the latest news - the benefits have not been extended, and this is not planned in the future. Initially, the decision to provide the possibility of using reduced tariffs was made only for 2017 and 2021, as stated in paragraphs. 3 hours 2 tbsp. 427 Tax Code of the Russian Federation. Thus, as the Ministry of Finance indicated in Letter No. 03-15-05/75886 dated October 23, 2018, the transition of such contribution payers to the generally established tariff in 2021 is not the abolition of an existing benefit, but the implementation of previously adopted decisions of the legislator.

According to information from the Ministry of Finance of Russia, provided in letter dated August 1, 2021 No. 03-15-06/54260, the Government is not considering the possibility of making a decision in 2021 and 2021 to extend the period of application of reduced tariffs for representatives of medium and small businesses operating in manufacturing and social areas.

Article 427 of the Tax Code of the Russian Federation, subparagraph 5, paragraph 1 in 2021 (as amended on January 1, 2019) does not currently grant them such a right. If previously the total amount of insurance premiums for enterprises that switched to the simplified tax system and having an income of no more than 79 million rubles per year (if the main type of activity according to OKVED corresponds to the list specified in paragraph 5 of paragraph 1 of Article 427 of the Tax Code of the Russian Federation) was 20%, then now it increases to 30%:

- 22% for pension insurance (OPI),

- 2.9% for social insurance (OSS),

- 5.1% for health insurance (CHI).

Thus, the abolition of the benefit from 2021 (the transition to a general tariff, if you follow the vocabulary of law enforcement) significantly increases the financial burden on small and medium-sized businesses.

Reduced insurance premium rates are also not eligible to apply from 01/01/2019. payers specified in paragraphs 5, 6 and 9 of Part 1 of Art. 427 of the Tax Code of the Russian Federation for the same reasons. This group includes organizations in the social sphere and consumer services, representatives of small and medium-sized businesses that have chosen simplified tax regimes.

New form of personal income tax certificate 2 in 2021

Regulatory regulation

A reduction in insurance premium rates for small and medium-sized businesses occurred on April 1, 2020 due to the situation related to the spread of the new coronavirus infection in the country. In an address to the population on March 25, 2020, the President of Russia instructed the Government of the Russian Federation to ensure the introduction of amendments to the legislative acts of the Russian Federation providing for a reduction to 15 percent of the tariffs applied by small and medium-sized businesses in relation to part of the payments and other remuneration in favor of individuals in excess of the minimum wage.

In accordance with this instruction, Article 6 of Federal Law No. 102-FZ dated 04/01/2020 introduced reduced rates of contributions for compulsory health insurance, compulsory medical insurance, compulsory health insurance in case of temporary disability and in connection with maternity for the period from 04/01/2020 to 12/31/2020. And starting from 01/01/2021, the same reduced tariffs will be valid indefinitely on the basis of the new paragraph 2.1 of Article 427 of the Tax Code of the Russian Federation.