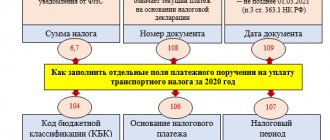

The presence of the KBK in the payment document is a condition necessary for the correct and timely crediting of taxes, insurance premiums and other payments received from organizations and entrepreneurs to the budget. Budget classification codes are reflected in field 104 of the payment order for the payment of taxes and fees. The BCCs applied in 2021 are contained in the latest edition of Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n (as amended on November 2, 2017).

Please note that in this article we provide information about the main BCCs for next year, known today, but until the end of 2017 it is impossible to say with complete certainty whether the BCCs will change again in 2018, so entrepreneurs and organizations should continue to monitor all changes legislation.

KBK NDFL

There were no changes to the BCC for personal income tax payment next year. When transferring income tax, it is necessary to take into account the status of the payer, as well as for whom the tax is paid. Thus, the BCC for 2018 will be different for tax agents who paid any income to individuals and transfer personal income tax for them, and for individual entrepreneurs paying tax for themselves.

KBK Personal Income Tax 2021 for individuals when transferring tax by organizations or individual entrepreneurs - tax agents:

| Code | Decoding |

| 182 1 0100 110 | Personal income tax on income paid by the tax agent, including KBK dividends in 2021, personal income tax on which is transferred by the tax agent |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on income received by individual entrepreneurs, private notaries, and other private practitioners (Article 227 of the Tax Code of the Russian Federation) |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on income received by citizens not from tax agents, as well as from the sale of property, winnings, etc. (Article 228 of the Tax Code of the Russian Federation) |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | fixed advance payments from the income of non-residents working for citizens on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation) |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on the profits of a controlled foreign company received by controlling persons |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

KBK 2021: budget classification codes for 2021 for payment of insurance premiums

Since 2021, insurance premiums are controlled by different bodies: the Pension Fund, the Federal Tax Service and the Social Insurance Fund. Accordingly, changes have occurred in the BCC for making payments.

KBK 2021 for payment of insurance payments to the Federal Tax Service

| Payment name | BCC of the main payment | KBK fine | KBK penalties |

| Funded pension | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Insurance pension for periods from 01/01/2017 (payment is made in 2021 for 2017-2018) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Additional payment to pensions for employees of coal industry organizations | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Supplement to pension for flight crew members of civil aviation aircraft | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Payment in a fixed amount for an insurance pension (from incomes within and above 300,000 rubles) for periods from 01/01/2017 (we pay in 2018 for 2017-2018) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Contributions in case of temporary disability due to maternity for periods from 01/01/2017 (we pay in 2021 for 2017-2018) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| In FFOMS for periods from 01/01/2017 (we pay in 2021 for 2017-2018) | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| In the Federal Compulsory Medical Insurance Fund in a fixed amount for the period from 01/01/2017 (we pay in 2021 for 2017-2018) | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| For the insurance part of the labor pension at an additional rate for employees on list 1 (the rate does not depend on the special assessment) (in 2018 we pay for 2017-2018) | 182 1 0210 160 | 182 1 0200 160 | 182 1 0200 160 |

| For the insurance part of the labor pension at an additional rate for employees on list 1 (the rate depends on the special assessment) (in 2021 we pay for 2017-2018) | 182 1 0220 160 | 182 1 0200 160 | 182 1 0200 160 |

| For the insurance part of the labor pension at an additional rate for employees on list 2 (the rate does not depend on the special assessment) (in 2018 we pay for 2017-2018) | 182 1 0210 160 | 182 1 0200 160 | 182 1 0200 160 |

| For the insurance part of the labor pension at an additional rate for employees on list 2 (the rate depends on the special assessment) (in 2021 we pay for 2017-2018) | 182 1 0220 160 | 182 1 0200 160 | 182 1 0200 160 |

Payment of insurance premiums to the Social Insurance Fund is carried out according to the following KBK:

- Insurance against industrial accidents and occupational diseases – 393 1 0200 160

- Fine for late or incomplete fulfillment of obligations – 393 1 0200 160

- Penalty – 393 1 0200 160

Payment of contributions to the Pension Fund is carried out according to the following KBK:

- Additional contributions to the funded pension (at the request of an employee who participates in the state co-financing program) – 392 1 0200 160

- Employer contributions in favor of insured persons for funded pension (from employer funds) – 392 1 02 02041 06 1200 160

Any insurance premiums must be paid within the time limits established by law.

KBK 2021 – insurance premiums

Contributions to “pension”, medical and social insurance from January 1, 2021 are transferred to the Federal Tax Service, and not to the Pension Fund and Social Insurance Fund, as was previously the case. At the same time, the KBK for insurance premiums was updated, with the exception of the code for insurance premiums for “injuries,” which is still transferred to the Social Insurance Fund.

For KBK for 2021, changes in terms of insurance premiums paid to the Federal Tax Service and the Social Insurance Fund were not accepted.

The BCC for transferring insurance premiums for employees is the same for both organizations and individual entrepreneurs. But when paying fixed “pension” and medical contributions “for oneself”, an individual entrepreneur must use separate codes.

Here are the KBK 2021 codes with explanation:

| Code | Decoding |

BCC for Pension Fund contributions | |

| 182 1 0200 160 | Insurance contributions to the Pension Fund for the payment of insurance pensions for periods expired before January 1, 2021 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance contributions to the Pension Fund for the payment of insurance pensions, for periods starting from January 1, 2021 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 182 1 0200 160 | Insurance contributions to the Pension Fund for the payment of funded pensions |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Contributions paid by coal industry organizations to the Pension Fund for the payment of pension supplements |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance premiums at an additional rate for persons employed in the work specified in clause 1, part 1, art. 30 of Law No. 400-FZ of December 28, 2013, for the payment of an insurance pension (regardless of the results of a special assessment of working conditions (list 1) |

| 182 1 0220 160 | Insurance premiums at an additional rate for persons employed in the work specified in clause 1, part 1, art. 30 of Law No. 400-FZ of December 28, 2013, for the payment of an insurance pension (depending on the results of a special assessment of working conditions (list 1) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance premiums at an additional rate for persons employed in the work specified in paragraphs. 2-18 hours 1 tbsp. 30 of Law No. 400-FZ of December 28, 2013, for the payment of an insurance pension (regardless of the results of a special assessment of working conditions (list 2) |

| 182 1 0220 160 | Insurance premiums at an additional rate for persons employed in the work specified in paragraphs. 2-18 hours 1 tbsp. 30 of Law No. 400-FZ of December 28, 2013, for the payment of an insurance pension (depending on the results of a special assessment of working conditions (list 2) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

BCC for compulsory medical insurance contributions | |

| 182 1 0211 160 | Insurance premiums for compulsory medical insurance, credited to the FFOMS budget for periods expired before January 1, 2021 |

| 182 1 0211 160 | penalties |

| 182 1 0211 160 | fines |

| 182 1 0213 160 | Insurance premiums for compulsory medical insurance, credited to the FFOMS budget for periods starting from January 1, 2021 |

| 182 1 0213 160 | penalties |

| 182 1 0213 160 | interest |

| 182 1 0213 160 | fines |

KBK for social insurance contributions | |

| 182 1 0200 160 | Insurance contributions in case of temporary disability and in connection with maternity for periods expired before January 1, 2017 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance premiums in case of temporary disability and in connection with maternity for periods starting from January 1, 2017 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 393 1 0200 160 | Insurance contributions for compulsory social insurance against accidents at work and occupational diseases (for “injuries”) |

| 393 1 0200 160 | penalties |

| 393 1 0200 160 | fines |

KBK IP fixed payment in 2021 | |

| 182 1 0200 160 | Fixed contributions of individual entrepreneurs for the payment of an insurance pension (from income not exceeding 300 thousand rubles) for periods expired before January 1, 2021 |

| 182 1 0200 160 | Fixed contributions of individual entrepreneurs for the payment of an insurance pension (1% of income received in excess of 300 thousand rubles) for periods expired before January 1, 2021 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Fixed contributions of individual entrepreneurs for the payment of an insurance pension, for periods starting from January 1, 2021 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 182 1 0200 160 | Fixed contributions of individual entrepreneurs for the payment of funded pensions |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0211 160 | Fixed contributions to compulsory medical insurance for periods expiring before January 1, 2021 |

| 182 1 0211 160 | penalties |

| 182 1 0211 160 | fines |

| 182 1 0213 160 | Fixed contributions to compulsory medical insurance for periods starting from January 1, 2021 |

| 182 1 0213 160 | penalties |

| 182 1 0213 160 | fines |

Contributions paid to the Pension Fund - KBK in 2021

I Insurance contributions for compulsory pension insurance

For billing periods starting from January 1, 2021

182 1 0210 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0210 160 Payment penalties

182 1 0210 160 Interest on payment

182 1 0210 160 Amounts of monetary penalties (fines) for payment

Contributions for billing periods expired before January 1, 2021

182 1 0200 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0200 160 Payment penalties

182 1 0200 160 Interest on payment

182 1 0200 160 Amounts of monetary penalties (fines) for payment

Insurance premiums at an additional rate for insured persons employed in the types of work specified in clause 1, part 1, art. 30 of the Federal Law of December 28, 2013 No. 400-FZ

1) At a tariff that does not depend on the results of a special assessment of working conditions (class of working conditions)

182 1 0210 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0210 160 Payment penalties

182 1 0210 160 Interest on payment

182 1 0210 160 Amounts of monetary penalties (fines) for payment

2) At a tariff depending on the results of a special assessment of working conditions (class of working conditions)

182 1 0220 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0200 160 Payment penalties

182 1 0200 160 Interest on payment

182 1 0200 160 Amounts of monetary penalties (fines) for payment

Insurance premiums at an additional rate for insured persons engaged in the types of work specified in clause 2 - 18, part 1, art. 30 of the Federal Law of December 28, 2013 No. 400-FZ

1) At a tariff that does not depend on the results of a special assessment of working conditions (class of working conditions)

182 1 0210 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0210 160 Penalty for the corresponding payment

182 1 0210 160 Interest on the corresponding payment

182 1 0210 160 Amounts of monetary penalties (fines) for payment

2) At a tariff depending on the results of a special assessment of working conditions (class of working conditions)

182 1 0220 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0200 160 Penalty for the corresponding payment

182 1 0200 160 Interest on the corresponding payment

182 1 0200 160 Amounts of monetary penalties (fines) for payment

Insurance contributions for compulsory pension insurance in a fixed amount (for individual entrepreneurs)

1) Contributions for billing periods starting from January 1, 2021

182 1 0210 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0210 160 Payment penalties

182 1 0210 160 Interest on payment

182 1 0210 160 Amounts of monetary penalties (fines) for payment

Additional social security contributions for flight crew members and coal industry workers

1) Contributions from organizations using the labor of flight crew members of civil aviation aircraft to pay supplements to pensions

182 1 0200 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0200 160 Payment penalties

182 1 0200 160 Interest on payment

182 1 0200 160 Amounts of monetary penalties (fines) for payment

2) Contributions paid by organizations of the coal industry for the payment of additional payments to pensions

182 1 0200 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0200 160 Payment penalties

182 1 0200 160 Interest on payment

182 1 0200 160 Amounts of monetary penalties (fines) for payment

II Contributions to the federal compulsory health insurance fund

Insurance premiums for compulsory health insurance for the working population

1) Contributions for billing periods starting from January 1, 2021

182 1 0213 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0213 160 Penalties on contributions

182 1 0213 160 Interest on insurance premiums

182 1 0213 160 Amounts of monetary penalties (fines)

2) Contributions for billing periods expired before January 1, 2017

182 1 0211 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0211 160 Penalties on insurance premiums

182 1 0211 160 Amounts of monetary penalties (fines)

Insurance premiums for compulsory health insurance in a fixed amount (for individual entrepreneurs)

1) Contributions for billing periods starting from January 1, 2021

182 1 0213 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0213 160 Penalties on insurance premiums

182 1 0213 160 Amounts of monetary penalties (fines)

2) Contributions for billing periods expired before January 1, 2017

182 1 0211 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0211 160 Penalties on insurance premiums

182 1 0211 160 Amounts of monetary penalties (fines)

Income tax - KBK 2021

The KBK list for 2021 has been replenished with codes for income tax payers who receive income in the form of interest on ruble bonds of Russian organizations (Order of the Ministry of Finance of the Russian Federation dated 06/09/2017 No. 87n).

Here are the main BCCs for income tax:

| Code | Decoding |

| 182 1 0100 110 | Income tax (except for consolidated groups of taxpayers), credited to the federal budget |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Income tax (except for consolidated groups of taxpayers), credited to the budgets of constituent entities of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Profit tax of organizations of consolidated groups of taxpayers, credited to the federal budget |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Profit tax of organizations of consolidated groups of taxpayers, credited to the budgets of constituent entities of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Tax on the income of foreign organizations not related to activities in the Russian Federation through a permanent representative office |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Tax on dividends from Russian organizations received by Russian organizations |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Tax on dividends from Russian organizations received by foreign organizations |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Tax on dividends from foreign organizations received by Russian organizations |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Tax on income received in the form of interest on state and municipal securities |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Tax on income from profits of controlled foreign companies |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | Fines |

| 182 1 0100 110 | Income tax on interest received on bonds of Russian organizations |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

KBK 2021: codes for paying “Income Tax”

Income tax is a direct tax. It is levied on the profits of enterprises and organizations, individual entrepreneurs and other persons engaged in commercial activities. When transferring this tax, certain budget classification codes are used. If you specify an incorrect BCC, the contribution will be credited to the wrong account. As a result, the taxpayer will be issued a fine and a penalty will be charged for each day of late payment.

The following persons are not payers of this tax:

- entrepreneurs on UTII;

- entrepreneurs on the simplified tax system;

- entrepreneurs on the Unified Agricultural Tax;

- persons involved in the gambling business;

- foreign organizations that operate through permanent representative offices in the Russian Federation and also receive income from sources in the Russian Federation.

The tax rate for income tax is 20%. Of this, 18% goes to local budgets, and 2% to the Federal budget. In some cases, this tax rate can be reduced to 13.5%.

| Income tax | BCC of the main payment | KBK fine | KBK penalties |

| Tax to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax to the Federal Budget (for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on income of foreign organizations not related to activities in Russia through a permanent establishment | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax upon implementation of production sharing agreements that were concluded before October 21, 2011. | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on income of Russian organizations in the form of dividends from Russian enterprises | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on income of foreign enterprises in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Taxes on dividends from foreign enterprises | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on interest on bonds of Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on profits of controlled foreign companies | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

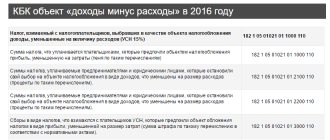

KBK for simplified tax system in 2021

For “simplified” people, BCCs differ depending on the applied object of taxation: “income” or “income minus expenses.” Since 2017, the minimum “simplified” tax is transferred to the same KBK as the single tax under the “income-expenditure” simplified tax system. This procedure will continue to apply in 2021.

| Code | Decoding |

KBK simplified tax system "income" 2018 | |

| 182 1 0500 110 | Single tax under the simplified tax system “income” (6%) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK simplified tax system “income minus expenses” 2018 | |

| 182 1 0500 110 | Single tax under the simplified tax system “income minus expenses” (15%) ( including transferring the minimum tax to this KBK simplified tax system in 2018 ) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Minimum tax under the simplified tax system (only for tax periods expired before January 1, 2021 ) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

Why do we need KBK in 2021?

The budget classification code (BCC) is a common combination of numbers known to accountants, as well as employees of banking and budgetary institutions. It characterizes a specific monetary transaction and is a convenient way to group expenses/income sent by organizations and individual entrepreneurs to the budget. Thanks to the KBK, departments can correctly interpret information about the payment being made (purpose, addressee, etc.). A correctly written KBK allows you to:

- make payment transactions accurately (for example, for taxes, insurance premiums, penalties, fines and excise taxes).

- track the history of movement of funds;

- make the work of public service employees easier;

- record arrears of payment.

The budget classification code is a guarantee that in 2021 the money will go to the right account, and the company or individual entrepreneur will not be penalized.

If you have any questions about the use of KBK in 2021, please contact the forum:

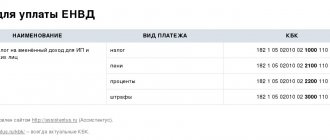

KBK UTII 2021

The values of the BCC UTII-2018 for individual entrepreneurs and organizations are the same. No changes are expected next year.

| Code | Decoding |

| 182 1 0500 110 | Single tax on imputed income for certain types of activities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK compulsory medical insurance in 2021 for legal entities

Mandatory health insurance contributions must be paid every month from employees' salaries. The terms of transfer are specified in the Tax Code of the Russian Federation in Art. 431 clause 3.

The main payment is transferred to the following KBK:

182 1 0213 160

The main administrator of funds is the Federal Tax Service. Its code is "182". These are the first three characters in the budget classification code.

KBK penalties for compulsory medical insurance 2021 for legal entities:

182 1 0213 160

KBC fine for compulsory health insurance in 2021 for legal entities. persons:

182 1 0213 160

Payment of the main payment is made no later than the 15th day of the month following the reporting month. Individual entrepreneurs use other budget classification codes when transferring.

KBK: patent tax system 2021

To pay the “patent” tax, the entrepreneur must apply the BCC corresponding to the type of budget: city districts, municipal districts, or federal cities.

| Code | Decoding |

| 182 1 0500 110 | “Patent” tax credited to the budgets of urban districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | “Patent” tax credited to the budgets of municipal districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | “Patent” tax credited to the budgets of federal cities of Moscow and St. Petersburg |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

What is the KBK directory and why is it needed?

The KBK Directory is a list of budget classification codes that are current for 2017-2018 for inclusion in documents when paying tax and insurance contributions, penalties, fines, excise taxes, state duties and other payments.

KBK is a special 20-digit code that allows you to organize revenues into the state budget. It consists of 20 digits, which indicate:

- 1-3 – revenue administrator;

- 4-13 – code of type of income;

- 14-17 – program, i.e. basis for payment: taxes, penalties, etc.

- 18-20 – economic classification.

Using the directory, accountants of organizations and individual entrepreneurs will correctly fill out payment orders and send the payment to the correct destination. Thus, they will be able to avoid fines, penalties, suspension of activities and other sanctions for failure to make or late payment of mandatory payments to the state financial system.

How to use the budget classification code directory?

- decide what type of payment you will be looking for;

- select the name of the payment (fine, penalty, contribution) in the corresponding cell of the directory table;

- copy the KBK specified for this type of payment;

- enter the copied budget classification code in the payment order field numbered 104.

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using the CUBE right now 14 days FREE ACCESS

KBK for VAT 2021

The values of the KBK VAT-2018 for legal entities and individual entrepreneurs are the same, but depend on the type of taxable transactions - import of goods from abroad, or sales in Russia.

The tax agent applies the VAT listed by KBK in 2021 on an equal basis with VAT payers.

| Code | Decoding |

| 182 1 0300 110 | VAT on goods (work, services) sold on the territory of the Russian Federation |

| 182 1 0300 110 | VAT penalties |

| 182 1 0300 110 | KBK - VAT fines 2018 for legal entities and individual entrepreneurs |

| 182 1 0400 110 | VAT on goods imported into Russia (from the republics of Belarus and Kazakhstan) |

| 182 1 0400 110 | KBK penalties for VAT 2018 |

| 182 1 0400 110 | fines |

BCC for 2021: fee for the use of water resources, wildlife, mineral extraction tax

Certain taxes are imposed for the use of any natural resources. They are paid according to separate budget classification codes.

Fee for the use of inland water bodies – 182 1 0700 110

Penalty for late payment of fees (inland water bodies) – 182 1 0700 110

Penya (inland water bodies) – 182 1 0700 110

Fee for the use of water bodies (except internal) – 182 1 0700 110

Penalty for late payment of the fee (except for internal facilities) – 182 1 0700 110

Penalty (except for internal facilities) – 182 1 0700 110

A fee for the use of wildlife objects has also been introduced. It must be transferred according to the following BCC - 182 1 0700 110. The fine is sent to the following budget classification code - 182 1 07 04010 01 3000 110, and the penalty - 182 1 0700 110.

Water tax:

- Basic payment – 182 1 0700 110

- Fine – 182 1 0700 110

- Penalty – 182 1 0700 110

MET – mineral extraction tax. Separate KBK are provided for its payment. It all depends on the type of mineral.

| MET | BCC of the main payment | KBK fine | KBK penalties |

| Combustible natural gas from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Oil | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Gas condensate from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Minerals mined on the continental plume or in the exclusive economic zone of the Russian Federation or from subsoil outside the territory of the Russian Federation | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Common minerals | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Coal | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Natural diamonds | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Other minerals (except natural diamonds) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

KBK property-2018 for legal entities

The BCC for corporate property tax remains unchanged in 2021.

| Code | Decoding |

| 182 1 0600 110 | Tax on property not included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Tax on property included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

KBK table for 2021: property taxes for legal entities and individuals

Property taxes are paid by all businesses and individuals. It represents a contribution to the local budget for the use of movable or immovable property.

Important! The tax is paid regardless of the taxation system.

When transferring, separate BCCs are used for legal entities and individuals.

| Property tax of organizations (enterprises) | BCC of the main payment | KBK fine | KBK penalties |

| For property included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For property that is not included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

For property that belongs to individuals, you must pay according to other budget classification codes.

| Property tax for individuals | BCC of the main payment | KBK fine | KBK penalties |

| Within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of districts with intracity division | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of intracity districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of rural settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of intersettlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of urban settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| In the cities of Moscow, St. Petersburg and Sevastopol | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

KBK land tax 2018 for legal entities

Codes for land tax of legal entities, as before, depend on the location of their land plot. Codes of fines and KBK penalties for land tax are distributed in the same way.

| Code | Decoding |

| 182 1 0600 110 | Land tax for organizations whose land is located within the boundaries of intra-city municipalities of federal cities |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land is located within the boundaries of urban districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations that own land within the boundaries of urban districts with intra-city division |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations with land within the boundaries of intracity districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax from organizations owning a plot located within the boundaries of inter-settlement territories |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning land located within the boundaries of rural settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning land located within the boundaries of urban settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

KBK taxes in 2021: Unified Agricultural Tax, simplified tax system, UTII, patent

Unified agricultural tax - unified agricultural tax. This taxation system is designed specifically for agricultural producers. Taxpayers are legal entities and entrepreneurs who produce agricultural products. products and also provide services in the field of livestock and crop production.

KBK for payment of unified agricultural tax – 182 1 0500 110

KBC to pay the fine – 182 1 0500 110

KBK for payment of penalties – 182 1 0500 110

The single tax under the simplified taxation system (simplified taxation system) is a tax paid by entrepreneurs, which includes several mandatory payments. Taxpayers using the simplified taxation system are exempt from paying personal income tax on employees.

KBK single income tax (6%) – 182 1 0500 110

KBC fine for non-payment of single tax (6%) – 182 1 05 01011 01 3000 110

KBK penalty for non-payment of single tax (6%) – 182 1 05 01011 01 2100 110

According to the “income minus expenses” system, separate codes are provided:

- KBK from income minus expenses (15%), incl. minimum tax – 182 1 0500 110

- KBC fine for non-payment of tax – 182 1 0500 110

- KBK penalty – 182 1 0500 110

UTII is a single tax on imputed income. It is applied in conjunction with the general taxation system. They are replaced by paying several taxes and fees.

Objects of taxation under the UTII system:

- repair, maintenance, vehicle storage, washing services;

- retail;

- household and veterinary services;

- motor transport services;

- placement of outdoor advertising and advertising on vehicles;

- catering services;

- leasing of retail spaces and land plots for trade;

- temporary accommodation and accommodation services.

When paying tax, use the following KBK - 182 1 0500 110. If the payment is not made on time, the company faces a fine. It must be paid according to the following BCC - 182 1 0500 110. A penalty is charged for each day of delay. It is paid according to the following BCC - 182 1 0500 110.

A patent is a special taxation system that allows residents and non-residents to work on the territory of the Russian Federation.

| Patent | BCC of the main payment | KBK fine | KBK penalties |

| Tax to the budgets of municipal districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax to the budgets of city districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax to the budgets of urban districts with intracity division | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| To the budgets of intracity districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Transport tax – KBK 2021 for organizations

Unlike individuals, organizations calculate and pay transport tax on their own, so it is important to indicate the correct BCC in the payment order. There is only one code for this tax, and separate BCCs are intended for payment of penalties and fines.

| Code | Decoding |

| 182 1 0600 110 | Transport tax for organizations |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

KBK for water tax in the payment order

Every year, the Ministry of Finance updates the codes that classify the type of payment. You can track updates through the reference information of Order of the Ministry of Finance No. 65n or on the official website of the tax authorities.

Budget classification codes for water use and resource extraction in the payment order indicate the type of payment for the collection. Enterprises may be charged fines, penalties or interest for late payment of the state duty itself. Therefore, the organization must indicate each type of funds paid in the payment order. The latter is filled out online on the tax authorities’ website or manually.

When filling out the KBK water tax payment in 2021, the system will automatically indicate the required code. But when filling out the form manually, you need to know the code that is indicated in field 104.

The Ministry of Finance sets ciphers without specifying the administrator, that is, without the first three digits. Instead, “000” is written. For example, 000 1 0700 110. It is prohibited to indicate such a BCC on a payment order. The first three-digit number must be replaced with the administrator code. For water extraction collection, this number is “182”. You can determine the administrator code in Appendix No. 7 of Order of the Ministry of Finance No. 65n dated July 1, 2013 (as amended on November 26, 2018).

Administrator code search algorithm:

- Follow the link and open the list.

- Select the service to which the payment is sent. In the case of the fee in question - to the Federal Tax Service.

- Find the name of the administrator - Federal Tax Service.

- Find water tax.

The register of chief administrators indicates all services to whose budget payments are sent to the Russian Federation.

KBK trade fee 2021

The trade tax is currently only valid in one region - in Moscow (Moscow Law No. 62 dated December 17, 2014), and is paid by all payers using a single BCC.

| Code | Decoding |

| 182 1 0500 110 | Trade tax paid in the territories of federal cities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Trade tax paid in the territories of federal cities (other revenues) |

| 182 1 0500 110 | Interest accrued on amounts of overcharged (paid) payments, as well as in case of violation of the deadlines for their return |

Budget classification codes: KBK codes for 2018 for payment of state duties

State duty is a fee charged by authorized official bodies for performing certain functions. Such bodies include: courts, registry offices and other government agencies.

| Government duty | KBK |

| On proceedings in the Constitutional Court of the Russian Federation | 182 1 0800 110 |

| On proceedings in arbitration courts | 182 1 0800 110 |

| On proceedings in constitutional (statutory) courts of constituent entities of the Russian Federation | 182 1 0800 110 |

| On proceedings in the Supreme Court of the Russian Federation | 182 1 0800 110 |

| For proceedings in courts of general jurisdiction, magistrates (except for the Supreme Court of the Russian Federation) | 182 1 0800 110 |

| For registration, liquidation of legal entities and entrepreneurs, as well as amendments to documents and other legal actions | 182 1 0800 110 |

| For state registration of rights, restrictions on rights to real estate and transactions with it | 321 1 0800 110 |

| For accreditation of branches and representative offices of foreign organizations, commissioned on the territory of the Russian Federation | 182 1 0840 110 |

| For the right to use the names “Russia”, “Russian Federation” and words or phrases formed on their basis in the names of enterprises | 182 1 0800 110 |

| For vehicle registration and other legal actions related to changes and issuance of vehicle documents, registration plates and driver's licenses | 188 1 0800 110 |

| For consideration of applications for concluding or amending a pricing agreement | 182 1 0800 110 |

| For obtaining information from the Unified State Register of Legal Entities and Unified State Register of Individual Entrepreneurs (including for urgent receipt) | 182 1 1300 130 |

| For performing actions related to obtaining Russian citizenship | 188 1 0803 110 |

| For the state registration of media and making changes to the registration record | 096 1 0800 110 |

| For state registration of media or making changes to the registration record, the products of which are intended in the territory of the constituent entities of the Russian Federation or municipal formation (other receipts) | 096 1 0800 110 |

| For state registration of media or making changes to the registration record, the products of which are intended in the territory of the constituent entities of the Russian Federation or municipal formation (payment of interest on the amounts of overcharged payments) | 096 1 0800 110 |

New KBK for 2021

Resort fee

In 2021, tourists in the resort areas of Crimea, Altai, Krasnodar and Stavropol territories will be levied a resort tax (Law No. 214-FZ dated July 29, 2017). The collection of the fee will begin on 05/01/2018, the new BCC for its transfer has already been approved by the Ministry of Finance of the Russian Federation (letter of the Ministry of Finance dated 09/06/2017 No. 02-05-11/57536).

| Code | Decoding |

| 182 1 1500 140 | Fee for the use of resort infrastructure |

KBK excise taxes 2018

Excise tax codes have been supplemented with three new types: for Russian electronic cigarettes, nicotine-containing liquids and tobacco heated during use (Order of the Ministry of Finance of the Russian Federation dated 06.06.2017 No. 84n):

| Code | Decoding |

| 182 1 0300 110 | Excise taxes on electronic cigarettes produced in the Russian Federation |

| 182 1 0300 110 | Excise taxes on nicotine-containing liquids produced in the Russian Federation |

| 182 1 0300 110 | Excise taxes on tobacco and tobacco products heated during consumption, produced in the Russian Federation |

New KBK: Recycling fee

The BCC of the recycling fee itself remains the same, but new codes for penalties for late payment have been added:

| Code | Decoding |

| 153 1 1200 120 | Recycling collection |

| 153 1 1210 120 | Penalties for late payment for wheeled vehicles and trailers imported into the Russian Federation (except for those imported from the Republic of Belarus) |

| 153 1 1210 120 | Penalties for late payment for wheeled vehicles and trailers imported into the Russian Federation from the Republic of Belarus |

Changes and new BCCs in 2018

Since 2021, there have been further changes in the budget classification codes that must be taken into account when filling out payment orders, that is, when filling out field 104.

Change No. 1: BCC for income tax

New codes have been introduced for income tax on income received in the form of interest on bonds of Russian organizations in rubles issued during the period from January 1, 2021 to December 31, 2021 (Order of the Ministry of Finance dated 06/09/2017 No. 87n). Here are the new codes:

| Payment | New KBK |

| Tax | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fines | 182 1 0100 110 |

Change No. 2: BCC on excise taxes

The Ministry of Finance has supplemented the list of budget classification codes for excise taxes. New codes have been introduced for electronic cigarettes, nicotine-containing liquids, and heating tobacco (Order of the Ministry of Finance dated June 6, 2017 No. 84n).

| Type of excise tax | KBK | ||

| Excise tax | Penalty | Fines | |

| For electronic nicotine delivery systems manufactured in the Russian Federation | 182 1 0300 110 | 1 0300 110 | 1 0300 110 |

| For nicotine-containing liquids produced in the Russian Federation | 182 1 0300 110 | 1 0300 110 | 1 0300 110 |

| For tobacco (tobacco products) intended for consumption by heating, produced in the Russian Federation | 182 1 0300 110 | 1 0300 110 | 1 0300 110 |

Change 3: Resort Fee

Starting from 2021, a new BCC will be introduced for paying the resort fee - 000 1 1500 140 (“Payment for the use of resort infrastructure (resort fee)”. Instead of three zeros, you will need to indicate the income administrator code. Let us remind you that the resort fee can be introduced from May 1, 2021 in certain territories in Crimea, Krasnodar, Stavropol and Altai territories by the laws of the constituent entities of the Russian Federation.

In 2021, the fee will not exceed 50 rubles per tourist per day of stay. In subsequent years it can be increased to 100 rubles. The fee rate may vary depending on the season and length of stay of the tourist. Also see “Resort Tax: How It Will Be Collected.”

KBK for individuals

Property tax is assessed to individuals by tax authorities based on Rosreestr data in accordance with Chapter. 32 NK. For individuals, there are more code options, so choosing the correct KBK for property tax 2018 is more difficult, but if payment is made on a receipt received from the Federal Tax Service, the required code is already indicated in it.

First, it is determined in which territory the taxable property is registered (city, village, etc., it must be taken into account that this division is administrative), then the BCC is determined:

- 182106 01010031000110 - cities of federal significance (Moscow, St. Petersburg, Sevastopol);

- 18210601020041000110 – urban districts (without intra-city division);

- 18210601030051000110 – inter-settlement territories;

- 18210601030101000110 - rural settlements;

- 18210601020111000110 - within the boundaries of cities with intra-city division;

- 18210601020121000110 - within the boundaries of intracity districts;

- 18210601030131000110 - urban settlements.

KBK changes in 2021

From January 1, 2021, according to Art. 374 ch. 30 Federal Law No. 117 dated 05.08.2000 (as amended on 25.12.2018), the duty from organizations is charged only for real estate and leased, entrusted or joint real estate.

According to paragraph 4 of Art. 374 Federal Law No. 117, enterprises do not pay property duty for:

- land, natural resources, since they have separate fees;

- for plots and real estate intended for military operations and owned by the state;

- cultural heritage sites;

- nuclear installations, etc.

For ownership, temporary or permanent, separate fees are paid, regulated by the tax legislation of the Russian Federation.

Order of the Ministry of Finance of the Russian Federation No. 65n dated July 1, 2013 (as amended on December 20, 2018) prescribes the BCC for property in 2021 for legal entities. And according to clause 2 of Order of the Ministry of Finance of Russia No. 277n dated December 20, 2018, the established codes are valid from 2021 to 2021 inclusive.

BCC for property fees, which are not included in the Unified Gas Supply System Coding of the type of payment for organizations that pay property fees without being in the Unified Gas Supply System.

| Tax name | Payment | KBK |

| Tax on property of organizations on property not included in the Unified State Social System | Tax | 182 1 0600 110 |

| Penalty | 182 1 0600 110 | |

| Interest | 182 1 0600 110 | |

| Fines | 182 1 0600 110 |