Transport costs in the estimate documentation

Transportation costs are the costs associated with delivering construction materials and equipment and other resources to the place where they are used.

Transport costs are taken into account in the price of construction resources as additional costs and have a clearly regulated amount in percentage terms. Transportation costs in the estimate are, in fact, an addition to the net selling price of materials and equipment from the manufacturer or supplier, without, of course, taking into account other expenses (such as the profit of the sales organization).

The percentage of transportation costs for materials in the estimate, or rather its value, is a very important issue that is often missed when calculating the total cost of construction and installation work, which leads to errors in estimate calculations.

Transportation costs in estimating are often combined with other costs closely related to the delivery of materials. Such a combined group of expenses is usually called procurement, storage and transportation costs in estimates (or in other words, procurement, storage and transportation). This includes the following costs:

- — cost of containers, packaging and props;

- — cost of loading and unloading operations;

- — the cost of transporting goods.

When using materials, products, structures and equipment in estimates based on collections of estimated prices for construction resources, transportation costs are already taken into account in their cost. They are determined on the basis of average statistical data. In turn, when using at actual cost (according to price lists, supplier prices, invoices, invoices), transportation costs must be taken into account additionally, since often these costs are not included in the cost of materials, but are accepted separately at actual costs.

As mentioned above, there are average statistical data on the cost of transport costs in relation to the cost of building materials, equipment, etc. Therefore, when drawing up estimate documentation, it is customary to use fixed price premiums established by standards to resources accepted at actual cost (price lists, invoices - invoices, etc.). Thus, this makes it possible to simplify the calculation of the transport component and strictly regulate the upper thresholds of such surcharges. Let's look at these fixed limits and how they are determined for transportation cost elements.

Transport costs - what are they?

Transportation costs are the most important cost item in the accounting of any organization, so they require correct documentary support. But given that such expenses accumulate all the organization’s costs directly related to organizing the delivery of goods from the seller to the buyer, the documents confirming them can be very diverse - both in form and in the features of preparation and calculations.

Thus, transport costs can consist directly only of the delivery service. It also happens that this type of expense consists of many components related to the payment of wages to the driver, the calculation of insurance premiums, depreciation of the car, and the purchase of fuel. This situation is possible, for example, if the buyer’s employee transports the purchased goods on his own in a personal car.

Find out how to take into account transport costs in the tax accounting of the supplier and the buyer in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

The cost of containers, packaging, props in the estimate.

Containers, packaging and props are one of the most important components, and they are necessary to protect material assets from damage during transportation and movement, and naturally they are included in the cost of estimates.

So, according to clause 4.57 of MDS 81-35.2004, if materials, equipment, products, structures are used according to collections of estimated prices (FSSC, construction price), the cost of containers and packaging, props is already taken into account in the cost. But if the actual cost and the cost of the goods do not take into account the costs of containers and packaging, then they must be taken into account additionally in the estimate calculations. Usually, in addition to the cost of the goods, the supplier writes down the cost of packaging and containers on a separate line in the invoice or commercial proposal, but more often this is forgotten and the estimator has to separately calculate these prices. Clause 4.58 helps him with this. all the same document MDS 81-35.2004. Where it is said that in the absence of detailed information about the characteristics of containers and packaging, the cost can be calculated as a percentage of the cost of materials and equipment, namely:

- — large technological equipment – from 0.1% to 0.5%;

- — machine equipment – up to 1%;

- - electrical equipment, instrumentation and automation, tools - up to 1.5%.

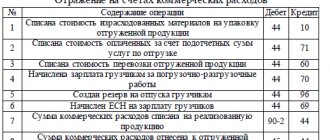

Transport costs by materials: accounting

Source: Glavbukh magazine

In accounting, transportation and procurement expenses (TZR) include costs associated with the procurement and delivery of materials to the organization (clause 70 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

TZR, in particular, include:

— costs associated with loading and unloading operations;

— transportation costs;

— travel expenses associated with the procurement and delivery of materials;

- fees for storage of materials at places of purchase, at railway stations, ports, marinas;

— warehouse expenses (if warehouses are used both for the procurement of materials and for storing goods (finished products), such expenses can be attributed to current costs);

— expenses for the maintenance of procurement points, warehouses organized in places where materials are procured;

— fees for loans and borrowings raised for the purchase of materials (accrued before the materials were accepted for accounting);

— shortages and spoilage within the limits of natural loss;

— markups, allowances, commissions for intermediaries

Such a list is given in paragraph 70 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

An approximate nomenclature of TZR is given in Appendix 2 to the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

In accounting, take into account transportation and procurement costs in one of the following ways:

- directly in the actual cost of each unit of materials;

— separately on account 15 “Procurement and acquisition of materials” (with subsequent attribution to account 16 “Deviation in the cost of material assets”);

- separately on a separate sub-account opened to account 10 “Materials”, for example on the sub-account “Transportation and procurement costs”.

Fix the chosen method of accounting for goods and materials in the accounting policy. This procedure is established by paragraph 83 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

If an organization includes material and equipment in the actual cost of materials, then do not keep separate records of these expenses. When materials arrive, make the following entries:

Debit 10 Credit 60 (20, 21, 75...) – the receipt of materials is reflected;

Debit 10 Credit 60 (76, 23, 26...) - attributed to the TZR to the cost of materials.

If the organization accounts for material and materials separately on account 10, then upon receipt of materials, make the following entries:

Debit 10 Credit 60 (20, 21, 75...) – reflects the receipt of materials at book value;

Debit 10 subaccount “Transportation and procurement expenses” Credit 60 (76, 23, 26...) – TZR taken into account.

If an organization accounts for inventory items separately on account 15, then upon receipt of materials, the following entries need to be made:

Debit 15 Credit 60 (76) – the receipt of materials is reflected in the assessment provided for in the contract (other documents);

Debit 15 Credit 60 (76) – taken into account in the actual cost of TZR materials;

Debit 10 Credit 15 – materials were capitalized at the accounting price.

Write off deviations of the actual cost from the book price at the time of posting the materials using the following entries:

Debit 16 Credit 15 – reflects the deviation of the actual cost of received materials from their book price;

Debit 15 Credit 16 – reflects the excess of the book price over the actual cost of purchased materials.

If TZR is reflected separately, then their analytical accounting should be carried out in the context of individual types and groups of materials. This means that the total amount of TRP associated with the procurement and delivery of heterogeneous materials must be distributed between them.

There is an exception to this rule. If the ratio of TRP and the cost of procured (delivered) materials is insignificant, then they can not be distributed and taken into account in the total amount:

- or on account 10 subaccount “Transportation and procurement costs”;

- or on account 15 “Procurement and acquisition of materials” (with subsequent attribution to account 16 “Deviation in the cost of material assets”).

This procedure is provided for in paragraph 84 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

If an organization maintains separate records of goods and materials, materials are reflected in accounting at accounting prices. An organization can use the following as accounting prices:

— planned price approved by the organization;

— negotiated price;

— actual cost of materials for the last reporting period (month, quarter, year);

— average price of the group (if the planned price is set not for a specific item number, but for their group).

If the accounting price deviates from the actual cost by more than 10 percent, it must be revised. Such rules are established by paragraph 80 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

If inventory items are accounted for separately, then they must be written off to the same accounts to which materials are written off. Document this at the end of the month with the following posting:

Debit 20 (23, 25, 26...) Credit 16 (10 sub-account “Transportation and procurement expenses”) - written off TZR for materials consumed.

This is stated in paragraph 86 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

KBK for VAT >>> KBK for the simplified tax system >>> KBK for the Pension Fund of the Russian Federation >>> KBK for personal income tax >>> KBK for contributions >>> KBK for land tax >>> KBK for income tax >>> KBK for property tax > >> KBK for transport tax >>>

The cost of loading and unloading operations in the estimate documentation

Loading and unloading work is work associated with loading into transport and unloading from transport materials, products, structures, which are carried out during the delivery of these resources to a construction site.

Loading and unloading operations can be carried out using different methods:

- 1) Manually;

- 2) Using available means - winches, rigging devices, jacks, hoists;

- 3) Using large equipment - cranes, loaders, excavators, conveyors, etc.

The cost of these works, if it is not included in the price of the goods, can be applied according to collections of estimated prices for loading and unloading operations (FSTSpg), taking into account the categories of materials, products, structures, equipment and depending on the method of loading and unloading. The cost of work on these collections is calculated in tons. These collections contain a very large list of such works.

In the absence of any work in these collections, and also by agreement with the construction customer, the actual cost of mechanisms and machinery can be applied, taking into account the time spent on work. The actual cost is determined based on the preparation of a separate calculation for these works according to the current price tags of organizations and price lists. Unlike the size of transportation costs for materials in the estimate, loading and unloading operations do not have a fixed percentage in relation to the cost of building materials and equipment.

Accounting and tax accounting

Accounting for goods and materials is characterized by the ability to implement accounting operations using two methods:

- Including costs directly in the cost of materials.

- Separate display of the valuation of material assets and the size of the inventory.

In the first case, accounting entries D10 - K60 are relevant. This method is suitable for transactions for the supply of similar products, provided that price fluctuations are absent or insignificant. For example, one delivery batch contained homogeneous assets, the cost of transportation services was fully allocated to the price of materials.

When separately accounting for the cost of transported material assets and the costs of their transportation and procurement, the following options are possible:

- the use of a combination of 15 and 16 accounts, the last of which is intended to record cost deviations;

- by introducing into the working chart of accounts an additional subaccount to 10 or 41 accounts to designate TZR;

- by attributing the amount of costs to the cost of goods, which is accumulated in account 44 (this rule is relevant for trading organizations and can only be applied to goods).

Write-off is carried out in proportion to the cost of materials transferred to production departments. For example, TZR are accumulated on account 15 over the course of a month; at the end of each monthly interval, expenses are distributed for materials used for production purposes (or according to values sold).

IMPORTANT! An enterprise can use only one of these methods; the selected option must be specified in the accounting policy.

In the reporting documentation, the amount of transportation and procurement expenses is reflected in the balance sheet. In this document, costs are included in inventories and reflected in the amount on line 1210. In relation to the financial performance statement, transportation and procurement costs can be indicated in several ways:

- when fully attributed directly to the cost of materials, expenses are shown in column 2120;

- when maintaining separate accounting with subsequent distribution - in the cell under code 2120 or 2210.

Business entities that are authorized to keep records in a simplified form are given the right to include the entire volume of TRP directly in the costs of ordinary types of activities performed. They can immediately attribute to expenses not only the amount of technical equipment, but also the cost of the materials themselves. The rule also applies to assets intended to be used for administrative purposes.

Tax accounting, like accounting, provides two options:

- direct crediting of the amount of TZR to the cost of transported material assets;

- separate reflection of delivery operations.

In the latter case, the amount of transportation and procurement costs accumulates during the month, and at the end of the month it is distributed between goods released to production workshops, products sold and units remaining in warehouses. For each nomenclature name of materials, the calculation of TZR is carried out using the formula:

Inventory for goods released from the warehouse = Valuation of valuables issued for the period under review * (Inventory that were recorded in relation to the balance of materials at the beginning of the period + Total value of material assets for the reporting period) / (Valuation of tangible assets issued during the reporting period + Valuation expression of balances of assets calculated at the end of the period).

For the purposes of tax accounting for goods, the method of one-time attribution of goods and materials to other expenses is used (an exception is made only for transport costs incurred in connection with delivery to the warehouse). Insurance costs are taken into account by the date of transfer of the insurance premium, the date of actual payment includes customs duties, and reimbursements to intermediaries are recognized by the date of signing the report or act of services rendered.

The cost of freight transportation in the estimate

When drawing up estimates for construction and installation work financed from the federal or municipal budget, collections of estimated prices for the transportation of goods by road are required. These collections were developed in databases based on the price level for 2001 (FER, TER, etc.) and are translated into the current level through indexation.

However, in the calculations between the Customer and the Contractor, the actual costs of transporting goods at current market prices in a particular region can be used, but this is only possible if there is no competitive type of transportation in the price collections or this type of work is financed from a non-state budget. In these cases, a calculation is also drawn up justifying the actual transportation costs.

The procedure for calculating estimated prices for the transportation of goods by road in 2021 is determined by Order of the Ministry of Construction of Russia No. 517/pr dated September 4, 2019 “On approval of Methodological Recommendations for determining estimated prices for materials, products, structures, equipment and prices of services for the transportation of goods for construction » section 3.

This order explains in detail how to correctly and accurately calculate the cost of transporting goods by road, depending on the class of cargo, types of vehicles, transportation distance and types of roads along which transportation is carried out.

Procurement, storage and transportation costs in estimates

Most often, when calculating estimate documentation, we use the term transportation and procurement costs (TPP) - this concept, in addition to the above costs, can be divided into smaller, but important costs associated with the procurement and delivery of material assets (goods, raw materials, materials, tools). However, this term is more applicable to accounting than to budgeting, but it is often considered in this form.

Transportation and procurement costs include:

- - costs of loading, transportation and unloading, provided that they are not included in the price of the goods;

- — expenses for procurement, storage of materials, maintenance of warehouses, wages of workers associated with procurement, storage, shipment;

- — costs of paying for the services of intermediary organizations;

- — costs of payment for storage of materials at suppliers’ warehouses, railway stations, ports, marinas;

- — expenses for paying interest on loans associated with the purchase of goods;

- - and other expenses.

The amounts of transportation costs for materials and equipment in the estimate, procurement and warehouse, as well as packaging, containers and props can be summarized as a single reference in the following table:

Table No. 1. Amounts of procurement, storage and transportation costs in the estimate documentation

| № | Cost item | Method for determining estimated prices and the amount of transportation costs. |

| 1 | Fare | 1. Collections of estimated prices (FSTSpg, construction price). 2. Calculation of the cost of transportation costs based on actual expenses. 3. Calculation according to Order of the Ministry of Construction of Russia No. 517/pr dated 09/04/2019. 4. In the absence of standards, transport costs can be accepted in the amount of 3 - 6% of the selling price. |

| 2 | Procurement and storage costs | 1. For budget construction - 1.2% of the cost of materials and equipment. |

| 3 | Expenses for packaging, containers, props | 1. If the cost is not included in the price and in the absence of detailed information about the characteristics of the container and packaging, the cost can be calculated as a percentage of the cost of materials and equipment: - large technological equipment - from 0.1% to 0.5%; — machine equipment – up to 1%; - electrical equipment, instrumentation and automation, tools - up to 1.5%. |

What documents are needed to justify transportation costs?

Depending on the delivery method, the documentary justification also changes.

In accordance with clause 6 of the Decree of the Government of the Russian Federation “On approval of the Rules for the transportation of goods by road” dated April 15, 2011 No. 272 (hereinafter referred to as Resolution No. 272), which regulates the delivery process by car, the main document is the waybill (hereinafter referred to as TN). TN is an integral part of any contract for the carriage of goods; it is drawn up in three identical copies - for each participant in the legal relationship: the carrier, the seller and the buyer. It contains information:

- about the parties to the transaction;

- product;

- accompanying documents (a list of them is provided);

- car;

- place and date of loading/unloading of goods;

- delivery times;

- other information specified in Appendix 4 to Resolution No. 272.

Decree of the Government of the Russian Federation “On approval of the Rules for the transportation of goods by road” dated April 15, 2011 No. 272, Appendix 4 - waybill.

Let us note that earlier than the TN, the consignment note form 1-T (hereinafter referred to as the TTN) was introduced, approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78, which can still be used at the present time.

Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78, form 1-T.

When transporting by rail, such a document is the railway consignment note (Article 2 of the Law “Charter of Railway Transport of the Russian Federation” dated January 10, 2003 No. 18-FZ).

For air and river transportation, your own waybills will also apply: air cargo or river.

Transportation of certain types of materials often requires drawing up an estimate, which shows how these costs are formed. In particular, the use of estimates is carried out by construction contracting organizations to correctly calculate the cost of delivery, taking into account both the characteristics of the supplied material and the method of its organization.

In clause 4.59 of the resolution of the Gosstroy of Russia “On approval and implementation of the Methodology for determining the cost of construction products” (with the appendix MDS 81-35.2004) dated 03/05/2004 No. 15/1 (hereinafter referred to as MDS 81-35.2004) the features of calculating transport costs of construction materials.

Thus, the estimate calculates transportation costs based on:

- type of vehicle;

- shipping tariff;

- points of departure and arrival;

- the distance traveled by the transport for delivery;

- other conditions affecting delivery.

Example

LLC "Put" carries out transportation of construction materials by road. Cargo class - 1, cargo weight - 3 tons, carrier tariff for 1 ton of cargo - 10,000 rubles. for every 50 km. In accordance with the estimate, the carrier delivered construction materials from Balashikha to Vladimir, while the length of its route was 150 km. In addition, the estimate included the cost of loading and unloading construction materials, which amounted to 60,000 rubles. for 1 ton.

Based on the specified data, the cost of transportation of 1 ton = 10,000 × 150 / 50 + 60,000 = 90,000 rubles.

At the same time, clause 4.60 of MDS 81-35.2004 stipulates that if it is not possible to make a calculation, then the delivery calculation can be made using the standards established for each specific case, and in case of their absence - in the amount of 3-6% of the selling price .