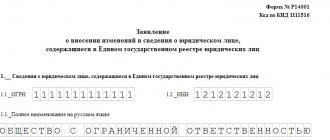

Form P15016: appointment

Order of the Federal Tax Service of Russia dated August 31, 2020 No. ED-7-14/ [email protected] approved the forms and Requirements for filling out documents sent to tax authorities during the state registration of business entities. These forms have different purposes. If a legal entity is registered, then form P11001 is sent to the Federal Tax Service, and if liquidation is carried out, form P15016 is sent. This form has been used since Order No. ED-7-14/ [email protected] into force - November 25, 2020.

The considered form of application R15016 for the liquidation of a legal entity essentially combines the structure of two previously used forms of notification and application for liquidation - R15001 and R16001 (approved by order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6 / [email protected] ) .

Let's get acquainted with the features of the new form P15016; we will also provide a sample of filling out the document in this article.

How are the new forms approved?

Order of the Federal Tax Service No. ED-7-14/ dated August 31, 2020, registered with the Ministry of Justice of Russia on September 15, 2020, approved the forms of documents provided upon registration of legal entities and individual entrepreneurs, and the requirements for their execution. The P15001 form to be filled out during the liquidation of an organization in 2021 is called “Application (notification) about the liquidation of a legal entity” and now has the number P15016. The order also updated other forms:

- application for state registration of a legal entity upon its creation;

- application for state registration of an individual as an individual entrepreneur;

- application for amendments to information about an individual entrepreneur or legal entity and others.

How to fill out the application form P15016

The application can be filled out manually or on a computer. All text values are written in capital letters. Completed pages are numbered consecutively. Detailed general rules for filling out an application are given in paragraph 4-24 of the Requirements for filling out.

Form P15016 includes:

- Title page.

Here you must indicate the OGRN and TIN of the legal entity, as well as the reason code for which notification P15016 is generated. Based on this code, it is determined whether sheet A should be included in the document.

- Leaf A.

It is mandatory to fill out sheet A in application P15016:

- if the Title Page in clause 2 contains code 2 (formation of a liquidation commission, appointment of a liquidator) or 3 (making a decision on liquidation);

- in the event that code 6 is entered, except for an LLC operating on the basis of a standard charter, which provides that each participant in the LLC is its sole executive body (director) and independently acts on its behalf (or that each participant, together with the other participants of the company, exercises the powers of such body (director)).

Let us note that one of the innovations provided for by the form is the possibility of its use at all stages of liquidation. For example, to reflect the extension of the liquidation period of an LLC (indicating code 5 on the Title Page).

If the code is 1, 3 or 5, then the next field indicates the period of liquidation of the company.

Sheet A consists of two pages. The sheet records information about persons who have the right to act on behalf of the company without a power of attorney. Since on one copy of Sheet A it is possible to indicate data for only one individual or legal entity, if it is required to indicate data for several individuals (legal entities), several Sheets A are included in Form P15016.

The sheet (on one or more of its copies) may be marked with a note restricting access to information about a particular specified individual or legal entity.

- Sheet B is filled out if a mark(s) are placed on sheet A regarding access restrictions in relation to an individual or legal entity.

Clause 16 of the Requirements provides a regulatory framework that defines the grounds for appropriate restrictions on access to information about legal entities or citizens specified in clauses 1, 2, 3 of sheet A: Law of 03.08.2018 No. 290-FZ and Decree of the Government of Russia dated 06.06.2019 No. 729. For example, the reason for restricting access to information about a legal entity in the Unified State Register of Legal Entities may be the introduction of international sanctions against it.

- Sheet B reflects information about the individual applicant.

Here they indicate information about an individual representing an organization without a power of attorney (for example, about a director), or on the basis of the authority provided for by federal law or an act of a state or municipal body. Information on Sheets A and B about the same individual who submits and fills out P15016 may thus be duplicated (in this case, it would be a good idea to make sure that they are the same in different sheets so that there are no errors). It is possible to include several sheets B in the application, because There may be several corresponding authorized persons.

On the first page the passport details of the applicant are indicated (clause 2), and on the second page of sheet B in clause 3, they confirm the accuracy of the information specified in the application, the fact that settlements with creditors have been completed, and also certify that settlements with employees in connection with the liquidation of the company have been carried out. This is also one of the innovations in filling out “liquidation” documentation for the Federal Tax Service.

The telephone number and e-mail of the applicant are also indicated here, to which the documentation from the Federal Tax Service is sent electronically. If you enter code 1 in the “issue on paper” field, the Federal Tax Service, having processed the application under consideration, will issue response documentation to the applicant on paper.

Next, the applicant personally enters his last name, first name and patronymic, and puts a personal signature. If the application is sent to the Federal Tax Service electronically, these lines are not filled in, but the applicant will need an enhanced qualified electronic signature.

Clause 4 of sheet B is filled out by a notary or other authorized person who has witnessed the personal signature of the applicant, and his TIN is indicated (subclause 4 of clause 106 of the Requirements approved by the order).

Below is the completed form P15016, a sample document is also available at the link below.

Download application P15001 (form and sample)

3411 downloads

Form p15001 (interim liquidation balance sheet)10215 downloads

After settlements with creditors are completed, a final liquidation balance sheet is drawn up. After its approval, you need to pay the state duty and send an application to the tax authority in form P16001 to register the termination of the company’s activities, after which the liquidation process is completed.

New application form for liquidation of a legal entity

Previously, when liquidating an organization, it was necessary to fill out two forms - No. P15001 “Notification of liquidation of a legal entity” and No. P16001 “Application for state registration of a legal entity in connection with its liquidation.” Now the application and notification are combined into one new form - No. P15016 “Application (notification) about the liquidation of a legal entity.” In it, the applicant must, in particular, confirm that all payments have been made to employees dismissed due to liquidation. Let us recall that such an obligation is provided for by the new wording of subparagraph “a” of paragraph 1 of Article 21 of Federal Law No. 129-FZ dated 08.08.01 (see “How to pay “compensation” under the new rules when reducing staff or liquidating a company”).

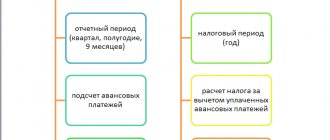

How to fill out an application when changing the charter

Filling out form P13014 when making changes to the charter, if this does not affect the information in the Unified State Register of Legal Entities, is the simplest case. You only need to fill out the first page and sheet H for the applicant.

On the first page, fill in the following items:

- OGRN and TIN codes of the organization that reports changes to the charter;

- reason for providing information - in this case the number “1” is entered.

Below in paragraph 2 you must indicate in what form changes to the charter are submitted:

- “1” if this is a new edition of the entire constituent document;

- “2” if this is an appendix to the charter.

Now you need to fill out Sheet H for the applicant. When making changes to the charter, this is the director of the LLC (the number “1” is entered in paragraph 1).

On the first page of sheet N of form 13014, indicate:

- full name of the manager and his tax identification number (if assigned);

- Date and place of birth;

- details of the identity document: document code (for a Russian passport - “21”), series and number, date and issuing authority.

On the second page, the applicant confirms the accuracy of the information and indicates his contacts: telephone number and email address, to which the Unified State Register of Legal Entities (USRLE) entry sheet will be sent, confirming the amendments to the charter. Below you can enter the value “1”, then the record sheet will be sent not only electronically, but also in paper form.

Please note: you can only sign the application in the presence of a notary. But if the director has an electronic signature, then notarization of form P13014 is not required.

Sample of filling out form 13014 when changing the charter

General procedure for filling out applications

Not only the forms of documents have changed, but also the requirements for their execution. So, according to the new rules, applications can be filled out:

- “by hand” - in printed capital letters in black, purple or blue ink (previously it was only possible to write in black ink);

- on a computer - in Courier New font, 16-18 points high, in black.

As before, corrections and additions (additions) are not allowed. But now double-sided printing is allowed. That is, statements can be printed on both sides.

The new forms must be used from November 25th. From the same date, the order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] , which approved the current application forms, will no longer be in force.

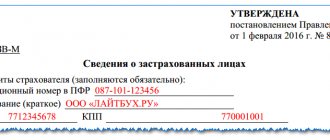

Notification form

The notification submitted to the Federal Tax Service department about the start of the liquidation procedure has the standard form p15001, established by Federal Tax Service Order No. ММВ-7-6 / [email protected] dated January 25, 2012. The document consists of the main part and 2 sheets - A and B.

The notification form contains the following information:

- information about the organization to be closed;

- date and personal data of the liquidator;

- information about the applicant who applied to the Federal Tax Service;

- signature of the person authorized to submit the notification.

You can download the new form p15001 for free here in two formats - PDF and Excel - or on the official website of the tax authority. The article presents the current document form.

Features of the P13014 form

Until November 25, 2021, two different forms were used:

- P13001 - only for reporting facts that make changes to the charter;

- P14001 – to report other changes about the LLC.

[email protected] of August 31, 2020 came into force, all changes to the charter and registration information are reported using a single form P13014.

New form P13014 (form to fill out)

There are a total of 59 pages in this application, but only those that are relevant to the specific situation are filled out.

As for the general requirements for filling out Form 13014, they are the same as for other registration forms:

- capital block letters are used;

- when filling out on a computer, only Courier New font 18 points high in black is allowed;

- When filling in manually, black, blue, and purple ink are allowed;

- the address is indicated in accordance with FIAS;

- blank sheets and pages are not included;

- Continuous page numbering is indicated;

- The finished application is not stapled, but you can staple it together.

Changes to the Unified State Register of Legal Entities in Moscow on a turnkey basis

Form P15001: notice of liquidation

At the first stage, according to established practice, a notification is submitted to the registration authority about the decision made by the participants to liquidate the organization with simultaneous indication of information about the appointment of a liquidator or RLC (when creating a liquidation commission). To do this, you need to mark two points in the form (see sample filling).

Important: follow the official recommendations for filling out P15001 (approved by the Order of the Federal Tax Service of Russia).

To prepare documents, it is recommended to use a special program, which is available on the tax website - here.

Required data

This form is filled out if you have standard data, as with all types of registration:

| Company data | Source |

| Brand name | Extract from the Unified State Register of Legal Entities |

| OGRN | –//– |

| TIN | –//– |

| Date of decision on liquidation | Relevant decision/protocol |

| Date of the decision to appoint a liquidator or liquidation commission | –//– |

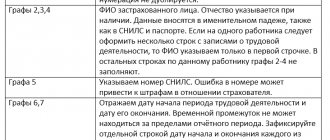

And for the applicant, who is the liquidator or the chairman of the liquidation commission (PLC):

| Applicant information | Source |

| Full name | Passport |

| Passport details | –//– |

| Place of residence/stay | –//– |

| TIN | Tax website |

As you can see, the documents are standard.