Tax period codes for VAT

According to the Order of the Federal Tax Service dated October 29, 2014 N ММВ-7-3 / [email protected] (as amended on December 28, 2018).

| Code | Name of period |

| 01 | January |

| 02 | February |

| 03 | March |

| 04 | April |

| 05 | May |

| 06 | June |

| 07 | July |

| 08 | August |

| 09 | September |

| 10 | October |

| 11 | November |

| 12 | December |

| 21 | I quarter |

| 22 | II quarter |

| 23 | III quarter |

| 24 | IV quarter |

| 51 | I quarter during reorganization (liquidation) of the organization |

| 54 | II quarter during reorganization (liquidation) of the organization |

| 55 | III quarter during reorganization (liquidation) of the organization |

| 56 | IV quarter during reorganization (liquidation) of the organization |

| 71 | January, during the reorganization (liquidation) of the organization |

| 72 | February, during the reorganization (liquidation) of the organization |

| 73 | March, during the reorganization (liquidation) of the organization |

| 74 | April, during the reorganization (liquidation) of the organization |

| 75 | May, during the reorganization (liquidation) of the organization |

| 76 | June, during the reorganization (liquidation) of the organization |

| 77 | July, during the reorganization (liquidation) of the organization |

| 78 | August, during the reorganization (liquidation) of the organization |

| 79 | September, during the reorganization (liquidation) of the organization |

| 80 | October, during the reorganization (liquidation) of the organization |

| 81 | November, during the reorganization (liquidation) of the organization |

| 82 | December, during the reorganization (liquidation) of the organization |

Income tax and its reporting periods

As mentioned above, at the end of each reporting period it is necessary to make advance payments for this tax, which also involves filing tax returns.

The reporting periods for income tax can be a calendar quarter or a month. The period for submitting reports depends on the method of calculating advance payments - quarterly or monthly upon receipt of profit.

The reporting periods for making quarterly advance payments will be:

- 1 quarter;

- half year;

- 9 months;

- year.

Important! Quarterly advance payments must be paid no later than the deadline by which the “profitable” declaration for the corresponding period is submitted.

When making advance payments, they are based on the amount of profit actually received, that is, payment occurs monthly:

- Month;

- 2 months;

- 3 months and so on according to the funded system until the end of the year.

Important! Monthly advance payments are due by the 28th day of the month following the previous one.

That is, both types of income tax returns are prepared according to the cumulative system.

Codes of tax periods according to the simplified tax system

According to the Order of the Federal Tax Service of Russia dated February 26, 2021 N ММВ-7-3/ [email protected]

| Code | Name of period |

| 34 | Calendar year |

| 50 | The last tax period upon reorganization (liquidation) of the organization, as well as upon termination of activities as an individual entrepreneur |

| 95 | Last tax period when switching to a different taxation regime |

| 96 | Last tax period upon termination of business activity (including in respect of which the taxpayer applied a simplified taxation system) |

What period is the reporting period according to the simplified tax system?

In accordance with Art.

346.19 of the Tax Code of the Russian Federation, reporting periods according to the simplified tax system are quarter, six months and 9 months. The tax period is a calendar year. Law No. 325-FZ dated September 29, 2019 amended paragraph 4 of Art. 55 Tax Code of the Russian Federation. According to the amendments made from 01.01.2018, the fact of registration or liquidation of an organization and individual entrepreneur in the reporting year on the simplified tax system does not matter; the tax period in any case is recognized as a calendar year (clause 13 of article 1, clause 10 of article 3 of the law dated 09.29.2019 No. 325-FZ).

Previously, the tax period was determined according to the following rules:

| Event | Taxable period |

| Registration of a legal entity or individual entrepreneur in the period from January 1 to November 30 | From the date of registration to December 31 of the reporting year |

| Registration of a legal entity or individual entrepreneur in the period from December 1 to December 31 | From the date of registration to December 31 of the following year |

| Liquidation of a legal entity or individual entrepreneur in the reporting year | From January 1 to the date of exclusion from the Unified State Register of Legal Entities (USRIP) |

| Registration and liquidation of a legal entity or individual entrepreneur in the reporting year | From the date of registration to the date of exclusion from the Unified State Register of Legal Entities (USRIP) |

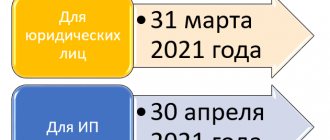

At the end of the reporting period, there is no need to submit a declaration under the simplified tax system. In general, it is submitted by a simplified form at the end of the calendar year no later than March 31 (legal entity) or April 30 (individual entrepreneur).

The title page of the declaration contains the field “Tax period code”. The tax period codes are taken from the order of the Federal Tax Service “On approval of the tax return form under the simplified tax system” dated 02.26.2016 No. ММВ-7-3 / [email protected] If the business continues to exist, the taxation system does not change, code 34 is indicated on the title page of the declaration. This code denotes the calendar year period. In the next field “Reporting year” the year for which the report is submitted is recorded (for example, in the reporting campaign for 2021, “2019” is entered in this column).

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

However, the “Tax period code” field may contain other codes. Let's look at which ones exactly.

Tax period codes for UTII

According to the Order of the Federal Tax Service of Russia dated June 26, 2018 N ММВ-7-3/ [email protected]

| Code | Name of period |

| 21 | I quarter |

| 22 | II quarter |

| 23 | III quarter |

| 24 | IV quarter |

| 51 | I quarter during reorganization (liquidation) of the organization |

| 54 | II quarter during reorganization (liquidation) of the organization |

| 55 | III quarter during reorganization (liquidation) of the organization |

| 56 | IV quarter during reorganization (liquidation) of the organization |

Filling out and submitting the declaration

In accordance with Art. 346.30 of the Tax Code of the Russian Federation, the tax period (TP) for UTII is a quarter, and in accordance with Art. 55 of the Tax Code of the Russian Federation, three months in advance it is necessary to determine the basis for the calculation and calculation of the amount of tax payable to the budget. Let's consider the system of basic obligations that are associated with this concept.

To understand how the tax period for UTII is established, let’s look at clause 3 of Art. 346.32 Tax Code of the Russian Federation. It follows from it that the declaration must be submitted no later than the 20th day of the first month of the next NP. For example, the tax period of the 3rd quarter of 2021 includes July, August and September 2021 and ends on 09/30/2020. Consequently, the declaration for the 3rd quarter. 2021 must be submitted no later than 10/20/2020.

Detailed guidance from ConsultantPlus experts will help you fill out all sections of the declaration correctly.

There is a rule that provides for the postponement of deadlines, in particular, if the last day for filing a declaration falls on a non-working day, it must be submitted on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). But 10.20.2020 is Tuesday, a working day, there are no postponements, reports must be submitted no later than the specified date.

When creating a declaration (the form was approved by order of the Federal Tax Service dated June 26, 2018 No. ММВ-7-3/ [email protected] ), you should carefully fill out the “Tax period (code)” field.

To answer the question of which tax period code to indicate in UTII for the 3rd quarter of 2021, you need to look at Appendix No. 1 to the procedure for filling out the declaration. Here we will see that:

- 21 is the code for 1 square;

- 22 - code 2 sq.;

- 23 - 3 sq.;

- 24 is the 4th quarter code.

Codes are also provided for organizations (not for individual entrepreneurs!) formed through reorganization (51 - 1st, 54 - 2nd, 55 - 3rd and 56 - 4th quarters).

In 2021, not a single code has changed, they all correspond to the above indicators.

Codes of tax periods for income tax

According to Order of the Federal Tax Service of Russia dated October 19, 2021 N ММВ-7-3/ [email protected]

| Code | Name of period |

| 13 | First quarter for the consolidated group of taxpayers |

| 14 | Half-year for the consolidated group of taxpayers |

| 15 | Nine months for a consolidated group of taxpayers |

| 16 | Year by consolidated group of taxpayers |

| 21 | First quarter |

| 31 | Half year |

| 33 | Nine month |

| 34 | Year |

| 35 | One month |

| 36 | Two month |

| 37 | Three months |

| 38 | Four months |

| 39 | Five months |

| 40 | Six months |

| 41 | Seven months |

| 42 | Eight months |

| 43 | Nine month |

| 44 | Ten months |

| 45 | Eleven months |

| 46 | Year |

| 50 | Last tax period for reorganization (liquidation) of an organization |

| 57 | One month for a consolidated group of taxpayers |

| 58 | Two months for a consolidated group of taxpayers |

| 59 | Three months for a consolidated group of taxpayers |

| 60 | Four months for a consolidated group of taxpayers |

| 61 | Five months for a consolidated group of taxpayers |

| 62 | Six months for a consolidated group of taxpayers |

| 63 | Seven months for a consolidated group of taxpayers |

| 64 | Eight months for a consolidated group of taxpayers |

| 65 | Nine months for a consolidated group of taxpayers |

| 66 | Ten months for a consolidated group of taxpayers |

| 67 | Eleven months for a consolidated group of taxpayers |

| 68 | Year by consolidated group of taxpayers |

Please note: codes 35-46 and 57-68 are indicated by taxpayers paying monthly advance payments based on the actual profit received.

“Profitable” report with codes 21, 31, 33, 34

Reflecting the tax reporting period, code 21 in the income tax return is similar to the quarterly tax coding discussed in the previous section and means the report for the 1st quarter. The number 31 is entered in the semi-annual declaration. Code 33 denoting the tax period in the income tax return indicates that the information reflected in this document relates to the reporting period from January 1 to September 30 (for 9 months), and tax period 34 is entered in the annual “profitable” declaration.

The specified codes are not used by all taxpayers filing a “profitable” declaration. Firms that pay monthly advance payments on actually received profits use a different coding: 35, 36, 37, etc.

Such encryption of the tax period of the “profitable” declaration is provided for in Appendix 1 to the procedure for filling out the declaration, approved by Order of the Federal Tax Service dated September 23, 2019 No. ММВ-7-3/ [email protected] , applied from reporting for 2021. A similar encoding existed before.

You can see and download a practical example and a sample of filling out an income tax return in ConsultantPlus, having received free trial access to the system.

To learn about the deadlines for submitting a profit tax return, read the article “What are the deadlines for submitting an income tax return?” .

Codes of tax periods for corporate property tax

According to the Order of the Federal Tax Service of Russia dated March 31, 2017 N ММВ-7-21/ [email protected]

| Code | Name of period |

| 21 | I quarter |

| 17 | Half year (2nd quarter) |

| 18 | 9 months (3rd quarter) |

| 51 | I quarter during the reorganization of the organization |

| 47 | Half-year (2nd quarter) during the reorganization of the organization |

| 48 | 9 months (3rd quarter) upon reorganization of the organization |

| 34 | Calendar year |

| 50 | Last tax period for reorganization (liquidation) of an organization |

Tax period code in the payment slip: field 107

The tax period code is indicated not only in declarations, but also in payment orders for transferring tax payments to the budget. Field 107 is intended for this.

Find out how to fill out field 107 correctly in the material “Indicating the tax period in the payment order.”

Unlike the 2-digit codes indicating the tax period in declarations, the “payment” code for the tax period consists of 10 characters. Its composition:

- the first 2 characters indicate the frequency of tax payment in accordance with tax legislation (MS - month, CV - quarter, etc.);

- the next 2 characters are the number of the month (for monthly payments from 01 to 12), quarter (for quarterly payments from 01 to 04), half-year (for semi-annual payments 01 or 02);

- in 7–10 digits - indication of the year for which the tax is paid.

For example, in field 107, the tax period may look like this: “Qtr.03.2020” - this means payment of tax for the 3rd quarter of 2020.

In addition to the tax period code, payment orders for the payment of taxes also use other codes, for example the budget classification code KBK. To find out in which field of the payment order you need to indicate it, where to get information about the correct BCC and what the consequences of indicating it incorrectly, read the materials:

- “Deciphering the KBK in 2021 - 2021 - 18210102010011000110, etc.”;

- “Fill in field 104 in the payment order (nuances).”

Tax return submission method codes

| Code | Method name |

| 01 | On paper (by mail) |

| 02 | On paper (in person) |

| 03 | On paper with duplication on removable media (personal) |

| 04 | Via telecommunication channels with an electronic signature |

| 05 | Other |

| 08 | On paper with duplication on removable media (by mail) |

| 09 | On paper using a barcode (in person) |

| 10 | On paper using a barcode (by mail) |

Tax return submission place codes

| Code | Name of place |

| 120 | At the place of residence of the individual entrepreneur |

| 210 | At the location of the Russian organization |

| 215 | At the location of the legal successor who is not the largest taxpayer |

So, as you noticed, tax period codes are unique for each type of tax returns, including income taxes, corporate property taxes, the simplified tax system and UTII. Therefore, you should be careful when choosing them.

Transaction codes in the VAT return

In some sections of the VAT return there are columns called “Operation code”. These are sections such as:

- section 2 – to be filled out by tax agents;

- sections 4-6 - filled out by organizations and individual entrepreneurs who had export operations;

- section 7 - filled out by organizations and individual entrepreneurs for transactions that are not subject to taxation (exempt from taxation), transactions that are not recognized as an object of taxation, transactions for the sale of goods (work, services), the place of sale of which is not recognized as the territory of the Russian Federation, as well as for payment amounts, partial payment on account of upcoming deliveries of goods (performance of work, provision of services), the duration of the production cycle of which is more than 6 months.

As you can see, with certain codes, the declaration reflects not ordinary transactions for the sale of goods on the territory of the Russian Federation, but “special” VAT transactions.

All VAT transaction codes are given in Appendix No. 1 to the Procedure for filling out the declaration (approved by Order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/558).

View codes for VAT returns with explanations

If you do not fill in the necessary codes in the declaration, the declaration will not pass format-logical control and will not be accepted by the tax authority.

Read also

05.10.2016