Planning costs for the restoration of fixed assets

Classification of repair costs

Submitting requests for repairs

Reflection of expenses for repairs, modernization, additional equipment in the accounting of budgetary organizations

Each institution has fixed assets on its balance sheet as part of non-financial assets. During operation, fixed assets wear out and repairs are carried out to maintain them in working condition.

Work on the restoration of fixed assets can be classified according to the nature of the type of work as:

- Maintenance;

- major repairs;

- modernization;

- reconstruction;

- retrofitting

Note!

The reflection of operations in accounting and tax accounting depends on the type of work: costs for current, medium and major repairs of fixed assets are taken into account as part of the current expenses of the institution, and costs for modernization and reconstruction are attributed to the increase in the initial cost of fixed assets.

Depending on whether repairs or modernizations were carried out, income tax is calculated (provided that the work was carried out using funds received from business activities) and the intended use of budget funds, since modernization and repair expenses are reflected according to different KOSGU codes. If a fixed asset was acquired through entrepreneurial activity, the costs of repairing these objects reduce the income tax base as part of other expenses (clause 1 of Article 260 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation)).

The institution has the right to dispose of the net profit received from business activities at its own discretion after paying income tax to the budget. Therefore, you must first pay income tax, and the remaining profit can be used to repair fixed assets.

For your information

During repairs, reconstruction and modernization, work that is similar in nature can be performed; it is not always easy to distribute them by type, and inspection bodies find many mistakes made by accountants when reflecting these operations.

It is necessary to determine the types of work in order to plan the expenditure budget, correctly attribute costs to items (sub-items of KOSGU), and use budgetary and extra-budgetary funds for their intended purpose.

Repair is a set of works to eliminate malfunctions, restore the operability of non-financial assets, maintain technical, economic and operational indicators (useful life, power, quality of use) at the originally intended level, i.e. this is the restoration of the functions of fixed assets for their further use. Repair involves preventive measures, elimination of damage and malfunctions, replacement of worn structures and parts.

Note!

Although during the repair process individual parts of the fixed asset can be replaced with more modern and durable ones, such an event is not associated with a change in the important technical and economic indicators of the fixed asset.

Depending on the volume and nature of the work performed, repairs can be current or major. They differ in complexity, volume, deadline and frequency.

Current repairs are carried out several times a year, major repairs are carried out no more than once a year or less. During routine repairs, individual parts are replaced; during major repairs, the object is dismantled and faulty components are replaced. During routine repairs, minor faults discovered during the daily use of the fixed asset are eliminated, while the object practically does not go out of service. Current repairs are work to systematically and timely protect OS objects from premature wear and tear by carrying out preventive measures.

During a major overhaul , the lost original characteristics are restored, faults are eliminated, replacing worn parts and assemblies.

For your information

There are no differences in the budget classification and the procedure for maintaining budget accounting between current and major repairs, so there is no need to differentiate such expenses.

Modernization is a set of works to improve an object of fixed assets, to increase the technical level and economic characteristics of the object by replacing its structural elements and systems with more advanced ones (for example, installing a larger amount of RAM on a computer).

For your information

Modernization involves replacing components, and the replaced part must be in good working order before replacement. If during the work a faulty unit is replaced, then such work is not a modernization, but a repair.

Reconstruction is a change in the parameters of capital construction projects, their parts (height, number of floors, area, production capacity indicators, volume) and the quality of engineering and technical support.

The concept of reconstruction is applicable only to capital construction projects (buildings, structures). It involves changing the parameters of an object. Reconstruction also includes improving the quality of engineering and technical support.

Retrofitting is the addition of fixed assets with new parts, parts and other mechanisms that were previously absent, which will form a single whole with this equipment, give it new additional functions or change performance indicators. Their separate use will be impossible.

Completion is the construction of new parts to a fixed asset (usually real estate). In this case, new parts must be inseparable from the main asset itself without causing damage.

Repair planning

To determine which category of expenses to include (repair, reconstruction, modernization or additional equipment), first of all you need to find out what type of work needs to be done to restore fixed assets:

- if work is carried out to restore operability, maintain technical characteristics, or external changes that do not affect the change of the fixed asset object to its original functions, then this is a repair;

- if work is carried out to improve the basic characteristics and add new functions of a serviceable object, then this type of work should be classified as reconstruction, modernization or retrofitting.

In this case, you need to determine the purpose of the operation:

– if replacement of units or parts is necessary, this is modernization (reconstruction);

– if units and parts are added to the object - additional equipment (completion).

As a rule, in organizations, by order, those responsible for the operation of property are appointed (for example, the head of the laboratory is responsible for laboratory equipment, a metrologist is responsible for measuring instruments, etc.). Their responsibilities include, among other things, drawing up requests for repairs or modernization for the upcoming financial year.

The organization develops the application form independently.

Applications are approved by the head of the institution.

Based on applications, the economic department plans amounts by type of repair in the estimate of income and expenses. Each planned type of expense must be justified. This will make it possible to draw up a work plan, conclude agreements with suppliers for carrying out repair work, systematize the institution’s activities related to the maintenance and servicing of property, guarantee the continuity of the production process, and ensure the efficiency of the institution’s core activities.

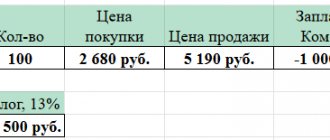

Fragments of applications for the structural unit (laboratory for monitoring physical and chemical factors) are presented in the table.

Fragments of applications for repairs of fixed assets

| Object name | Application number | Cause | Planned events | Planned result |

| Automated workstation (computer included) | 2101542 | The image on the monitor is unclear and cannot be corrected by adjustments. | Diagnostics and repair, if necessary, by means of a third party | Restoring functionality |

| Automated workstation (computer included) | 2101543 | Installing a hard drive into the system unit | System unit repair, hard drive replacement | Restoring the system unit |

| Automated workstation (computer included) | 2101600 | System resources - the amount of RAM - are insufficient to use the Bank-Client program | Upgrading with additional RAM | Possibility to use the Bank-Client program |

| Autoclave AG-1000 horizontal | 2101752 | Automated control system for autoclave | Autoclave modernization | Ability to use sterilization mode, indexing (time, pressure, temperature) |

| Copy machine | 2101644 | The machine hums but does not pick up paper from the tray | Replacing a worn roller with a new one | Restoring functionality |

| Car VAZ-2107 (Lada) | 2101485 | Knocking sound when shifting to subsequent gears | Do-it-yourself repairs | Restoring functionality |

| Laboratory building | 2100378 | The roof is leaking | Partial roof replacement | Restoring performance characteristics |

We conclude contracts for the performance of work on the restoration of fixed assets

When concluding contracts with suppliers and contractors for repair work, it is necessary to determine what type of work to restore fixed assets is provided for in this contract in order to correctly assign costs to KOSGU items.

If actions or events are planned that will increase the cost of fixed assets (reconstruction, modernization, etc.), you should use code 310 KOSGU “Increase in the cost of fixed assets”, but if you are talking about repairing a faulty fixed asset - code 225 KOSGU “Works, property maintenance services."

Within the framework of one contract, various types of work may be provided, therefore, in the “Subject of the contract” section, the costs of the corresponding types of work should be indicated separately. The contractor must prepare various reporting documents for the work performed.

We reflect expenses for current, medium and major repairs in accounting

Expenses for current, medium and major repairs of fixed assets are taken into account as part of the current expenses of the institution under subarticle 225 of KOSGU “Works, services for property maintenance.” Let us note that the costs of purchasing spare parts (construction materials) are reflected not under subarticle 225, but under subarticle 340 of the KOSGU “Increase in the cost of inventories”; the write-off of consumed materials is reflected under subarticle 272 of the KOSGU “Consumption of inventories”.

Note!

This rule does not apply if the cost of the materials used is included in the overall repair estimate and is taken into account by the contractor when drawing up the acceptance certificate for the work performed.

Costs for property repairs are reflected in account 0.109.61.225 “Costs of work, services for maintaining property in the cost of finished products, work, services.”

If the costs of repairs are uneven throughout the year, they must first be reflected in account 0.401.50.000 “Deferred expenses” with subsequent even write-off (clause 302 of the Instructions for the use of the Unified Chart of Accounts for public authorities, local governments, government bodies state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (as amended on August 6, 2015; hereinafter referred to as Instruction No. 157n)).

The spare parts remaining after the repair must be capitalized; this will be reflected in the accounting records by the following entries:

Debit of account 0.105.00.000 “Inventories” (according to the corresponding analytical accounts) Credit of account 0.401.10.180 “Other income”.

Costs that increase the cost of spare parts (such as the cost of delivering them to the institution or bringing them into a condition suitable for use) are first accumulated in account 0.106.00.000 “Investments in non-financial assets” (according to the corresponding analytical accounts).

After the cost of spare parts is finalized, it is written off to account 0.105.00.000 (according to the corresponding analytical accounts).

Situation 1

The institution entered into an agreement to repair a copy machine using funds from business activities. During the repair, the worn paper pickup roller was replaced with a new roller.

The costs of the transaction should be reflected in the following accounting entry:

Debit account 2.109.61.225 Credit account 2.302.25.730.

Replacing a worn roller did not affect the improvement of the technical level and technical characteristics of the copier, so equipment repairs are taken into account as part of the institution’s operating expenses.

From a letter to the editor

Please help me figure it out, this is my first time dealing with the purchase of real estate for an organization, and also with the upcoming renovations.

The situation is this: on September 6, 2015, an organization bought under a purchase and sale agreement two separate buildings (purpose - kindergarten, due to technical condition, not used for their intended purpose - requires major repairs), each with a land plot.

The organization plans to change the use of one of the buildings, reconstruct (add one more floor) into a hotel and sell it. At the moment, the organization is drawing up a reconstruction project and drawing up estimate documentation.

For the second building, the organization plans to change the purpose, reconstruct (build another floor) into a hotel and use it as a hotel complex, i.e. provide rooms for rent. At the moment, the organization is also drawing up a reconstruction project and drawing up cost estimates.

Question 1: Should the first building be subject to property tax, or in this case the building is considered as a commodity and is not subject to property tax? What entries should be used to record the acquisition of the first building and its renovation?

Question 2: Is the second building not subject to property tax in connection with the reconstruction until the date of the occupancy permit issued by the regulatory authorities after the completion of the reconstruction, or is this building subject to property tax from the date of its purchase (September 6, 2015)? What documents, other than the project and estimate for reconstruction, can confirm the process of reconstruction of the building and explain to inspectors why property tax is not charged. What entries should be used to record the acquisition of the second building and its renovation?

Modernization of fixed assets

During operation, fixed assets wear out morally and physically. Modernization is one way to restore them.

If during modernization the initial indicators of the functions of a fixed asset are improved or increased (useful life, power or other technical characteristics), then the costs for them increase the initial cost after completion of all work.

The completion of restoration work is formalized by an act of acceptance and delivery of modernized facilities, which indicates data on changes in the technical characteristics and cost of the fixed asset. Based on the act, costs are written off to increase the value of fixed assets in the debit of account 0.101.00.000 “Fixed assets” (according to the corresponding analytical accounts).

2 ways to modernize fixed assets:

1) economic (with the institution’s own resources);

2) contracting (with the involvement of third-party organizations, entrepreneurs, citizens).

Repair of fixed assets taking into account the provisions of the federal standard

28.03.2018

The activities of any institution are impossible without the use of property. Objects of material assets that meet the criteria established by clause 7 of the FSBU “Fixed Assets” are classified as fixed assets. During operation, objects break down and require repairs. How are repair operations for fixed assets reflected in accounting?

Repair is a set of technological operations and organizational actions to restore the operability, serviceability and service life of an object and (or) its components ( GOST 18322-2016 “Interstate standard. System of technical maintenance and repair of equipment. Terms and definitions”

).

Repair includes operations of localization, diagnostics, troubleshooting and monitoring of operation.

Troubleshooting and restoration of the primary characteristics of the object are carried out:

– by the efforts of the institution’s employees; – through the involvement of a third party organization (individual).

The main questions that arise for an institution when recording operations for the repair of fixed assets are as follows:

– whether the work is a major or current repair; – will the book value of the object change after the work performed; – how to reflect these transactions in the accounting accounts?

We will present the answers to these questions below.

Classification of repair work

The following classification of repair work is used (we will display it in the form of a diagram).

A brief description of repairs (current and capital) in relation to fixed assets is given in Instructions No. 65n

.

From the provisions of this document it follows that repair work (current and major repairs) falls under subarticle 225

“Works, services for property maintenance” KOSGU and include:

– troubleshooting (restoring operability) of individual objects of non-financial assets, as well as objects and systems (security, fire alarms, ventilation systems, etc.) that are part of individual objects of non-financial assets; – maintaining the technical, economic and operational indicators of non-financial asset objects (useful life, capacity, quality of application, quantity and area of objects, throughput, etc.) at the initially envisaged level; – carrying out minor redevelopment of premises; – restoration of museum objects and museum collections included in museum funds; – carrying out work on the restoration of non-financial assets, with the exception of work that is in the nature of reconstruction, modernization, and additional equipment; – restoration of the efficiency of the functioning of facilities and systems, hydrodynamic, hydrochemical cleaning, carried out in addition to technological needs (the list of works performed by the utility service provider, based on the terms of the contract for the supply of utility services), the cost of payment of which is reflected in subsection 223

"Utilities" KOSGU.

The importance of classifying repair work as work of a capital or routine nature is dictated by the peculiarities of reflecting these expenses in accounting accounts. FSBU “Fixed Assets” has identified cases of changes in the value of fixed assets following the results of a major overhaul of an object. Expenses for performing work on current repairs of fixed assets are not taken into account in the cost of such objects.

Including the cost of repair work in the cost of the operating system

After an asset is recognized in accounting as an item of fixed assets, it is accounted for at its book value. The carrying amount is the original cost of the asset, taking into account its changes. From January 1, 2021, government institutions in their work are guided by the provisions of the Federal Budgetary Accounting Standards “Fixed Assets”. As a general rule, expenses for repairs of fixed assets are included in the expenses of the institution. However, the provisions of this standard establish certain cases of changes in the book value of an object during major repairs.

Thus, the FSBU “Fixed Assets” has determined that a change in the book value of an item of fixed assets is possible if it is provided for by this standard and other regulations within the framework of the legislation of the Russian Federation in the case of:

– completions; – retrofitting; – reconstruction (including elements of restoration, technical re-equipment, modernization, partial liquidation (dismantling)); – substitutions

(partial replacement as part of a major overhaul for the purpose of reconstruction, technical re-equipment, modernization) of an object or its component; – revaluation of fixed assets.

Thus, if a major overhaul is carried out for the purpose of modernization, reconstruction, technical re-equipment and during it the object or its component is replaced, these expenses are included in the cost of the fixed asset.

Further, when deciding on the inclusion of repair costs in the cost of a fixed asset, clause 27 of the FSBU “Fixed Assets”

, which establishes that if the procedure for operating a fixed asset item (its components) requires the replacement of its individual components, provided that such components, in accordance with the recognition criteria for a fixed asset item, which are provided for in clause 8 of

the Federal Budgetary Accounting Standards “Fixed Assets”

, are recognized as an asset , the costs of such replacement, including during major repairs, are included in the cost of the fixed asset at the time of their occurrence. At the same time, the cost of the fixed asset item, in respect of which restoration (major repair) work was carried out, is reduced by the cost of the replaced (retired) parts in accordance with the provisions of the FBU “Fixed Assets” on the derecognition (disposal from accounting) of fixed asset items (if subject to documentary confirmation of cost estimates for the disposed object).

The accounting entity enshrines in its accounting policies the application in accounting of the provisions of clause 27 of the Federal Accounting Standards of Ukraine “Fixed Assets”

in relation to groups of fixed assets.

So, to apply clause 27 of the FSBU “Fixed Assets”

and changes in the value of the object as a result of work to carry out its major repairs, the following conditions must be met:

1) the object includes several components, each of which is recognized as an asset (fixed asset) by virtue of clause 8 of the Federal Budgetary Accounting Standards “Fixed Assets”

;

2) the procedure for operating a fixed asset object (its components) requires the replacement of individual such components (components) of the object.

When carrying out work to replace a separate component of an object, the accountant does:

– an operation to dismantle an object, reflecting the disposal of the part being replaced (when the operation is completed, the value of the object decreases); – an operation to include a new part installed during a major overhaul into the cost of an object (when the operation is completed, the value of the object decreases).

If the institution’s balance sheet includes equipment that requires regular inspections for defects, which are a prerequisite for its operation (in accordance with the rules for operating facilities), and also if, during repairs, independent asset objects are created (subject to compliance with the criteria for recognition of fixed assets, provided for in clause 8 of the FSBU “Fixed Assets”

), the costs of creating such assets form the volume of capital investments made with further recognition of these expenses in the cost of the fixed asset item (either with an increase in the cost of the item being accounted for, or with the recognition of independent accounting items) (

clause 28 of the Federal Budgetary Accounting Standards “Fixed Assets”

).

In this case, any amount of costs previously taken into account in the cost of a fixed asset item for the creation of a similar asset during the previous repair is subject to write-off as expenses of the current period (to reduce the financial result) in the amount of the residual value of the replaced asset ( Letter of the Ministry of Finance of the Russian Federation dated December 15, 2017 No. 02- 07-07/84237

).

The case under consideration does not include the costs of current (overhaul) repairs of fixed assets, as a result of which objects recognized as assets are not created. For example, the costs of repairing a premises in the scope of painting, whitewashing, replacing windows, doors, and other similar work are included in the expenses of the current financial year without being included in the increase in the cost of the fixed asset being repaired. The accounting entity enshrines in its accounting policies the application of the provisions of clause 28 of the Federal Accounting Standards “Fixed Assets”

when maintaining records of fixed assets and groups of fixed assets.

Accounting for equipment repair operations

Transactions are reflected in the accounting accounts of a government institution according to the rules provided for by instructions No. 157n

,

162n

.

However, at the time of writing the consultation, the provisions of the above instructions were not brought into compliance with the requirements of the Federal Bureau of Accounting Services. Thus, paragraph 27 of Instruction No. 157n

establishes that a change in the initial (book) value of non-financial asset objects is made in the case of completion, additional equipment, reconstruction, modernization, partial liquidation (disassembly), as well as revaluation of non-financial asset objects. Costs for modernization, additional equipment, reconstruction, including with elements of restoration, technical re-equipment of an object of non-financial assets are included in the increase in the initial (book) value of such an object after the completion of the scope of work provided for in the contract (estimate) and subject to improvement (increase) of the initially adopted standard indicators functioning of a non-financial asset object (useful life, capacity, quality of use, etc.) based on the results of the work performed.

The result of work on the repair of a fixed asset object that does not change its value (including the replacement of elements in a complex fixed asset object (in a complex of structurally articulated items that constitute a single whole)) is subject to reflection in the accounting register - the inventory card of the corresponding fixed asset object by entering records of changes made without being reflected in the accounting accounts.

That is, Instruction No. 157n does not establish cases of changes in the value of fixed assets as a result of work on their major repairs. At the same time, the requirement for the application of the FAS “Fixed Assets” by state (municipal) institutions from January 1, 2021 is established both by the standard itself and by Law No. 402-FZ

.

It follows from the norms of the current regulations that institutions implement the provisions established by the FSB, based on the accounting methodology provided for by instructions No. 157n, 162n and letters of the Ministry of Finance, which explain the features of reflecting certain transactions in the accounting accounts.

The accounting methodology establishes that expenses for repairs of fixed assets that do not change the cost of the repaired objects are reflected in account 0 401 20 225

“Expenses for work, property maintenance services.”

If, as a result of repair work, an institution acquires spare parts, they are taken into account on account 0 105 36 000

“Increase in the value of other inventories - other movable property of the institution”, and then, when they are installed on the object being repaired, are written off as expenses of the institution.

Expenses for major repairs of objects that change their value are formed on account 1,106,31,000

“Increase in investments in fixed assets - other movable property of the institution.”

Next, using examples, we will consider the features of recording operations for the repair of fixed assets in accounting.

Example 1.

The printer included with the computer has broken down. The institution purchased a new spare part for its repair. The printer was repaired by an employee. The cost of the component part is 3,000 rubles.

In the accounting accounts, operations to replace a part of the printer will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| A spare part purchased to replace a damaged one has been accepted for accounting. | 1 105 36 340 | 244 1 302 34 730 | 3 000 |

| The debt to the supplier has been repaid | 244 1 302 34 830 | 244 1 304 05 340 | 3 000 |

| The cost of a spare part installed in the printer has been written off. | 244 1 401 20 272 | 244 1 105 36 440 | 3 000 |

The replacement of a spare part is reflected in the computer inventory card in accordance with clause 27 of Instruction No. 157n

.

Example 2.

Equipment in a government institution has broken down. Equipment repair is carried out by a third-party organization, selected based on the results of competitive methods for determining the contractor in accordance with the norms of Law No. 44-FZ. According to the terms of the concluded contract, the contractor repairs the equipment using its own spare parts. The cost of repair work is 30,000 rubles. Advance amount – 9,000 rubles.

Equipment repair operations will be reflected in the accounting accounts as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| An advance payment has been made for equipment repair services. | 244 1 206 25 560 | 244 1 304 05 225 | 9 000 |

| Costs for the provision of equipment repair services are reflected | 244 1 401 20 225 | 244 1 302 25 730 | 30 000 |

| The previously transferred advance has been credited | 244 1 302 25 830 | 244 1 206 25 660 | 9 000 |

| The final payment under the contract has been made | 244 1 302 25 830 | 244 1 304 05 225 | 21 000 |

Example 3.

On the balance sheet of a government institution, a complex of structurally articulated objects representing a single whole is listed as a single inventory object. The object consists of three elements, each of which has the attribute of an asset in accordance with clause 8 of the FSBU “Fixed Assets”. The institution decided to carry out a major overhaul of one of the elements of this facility, as a result of which the characteristics of the facility will improve. The book value of the inventory item is RUB 210,000. The amount of accrued depreciation is 180,000 rubles. Capital investments in equipment repairs – 60,000 rubles.

When carrying out repair work, the institution determines:

1) the book value of the item to be disposed of (assume it is equal to 40,000 rubles);

2) the amount of depreciation accrued on the disposed element of the fixed asset (for example, in the amount of 38,000 rubles).

In the accounting accounts, operations for major repairs of equipment in accordance with the requirements of the Federal Budgetary Accounting Standards “Fixed Assets” will be shown as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| The operation to dismantle the facility is reflected: | |||

| – in terms of the residual value of the disposed part | 1 401 10 172 | 1 101 1x 410 | 2 000 |

| – in terms of the amount accrued on the disposed part of the depreciation object | 1 104 1x 410 | 1 101 1x 410 | 38 000 |

| The costs of major repairs of equipment are reflected | 1 106 31 310 | 1 302 31 310 | 60 000 |

| The cost of the object was increased by the amount of capital investments made | 1 101 1x 310 | 1 106 31 310 | 60 000 |

For your information:

In

the Letter of the Ministry of Finance of the Russian Federation dated December 29, 2017 No. 02-07-10/88347,

it is explained that the dismantling of fixed assets, as a rule, is due to the adoption by the institution’s commission for the receipt and disposal of assets of a decision on new conditions for the use of fixed assets by the subject of accounting.

As a result, a reclassification of fixed assets occurs, but not the initial recognition of an accounting item. Considering that reclassification does not change the value of fixed assets previously accepted for accounting, both in accounting and for the purposes of assessing and disclosing information in accounting (financial) statements, accounting records are made in the accounting registers on the acceptance for accounting of the resulting dismantling of fixed assets in the debit

of the corresponding analytical accounting accounts

of account 0 101 00 000

“Fixed Assets” and

in the credit of account 0 401 10 172

“Income from operations with assets” with simultaneous reflection in the amount of depreciation accumulated before disassembly on the

credit

of the corresponding analytical accounting accounts

of account 0 104 00 000

“Depreciation” and

debit account 0 401 10 172

“Income from operations with assets”.

Example 4.

The government agency purchased equipment worth 120,000 rubles. After two months of being in operation it broke down. The equipment is under warranty. The supplier contacted the manufacturer and decided to exchange the equipment for a similar one (with similar characteristics, but of a different brand).

The replacement of equipment will be reflected in the accounting accounts as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Investments in the cost of purchased equipment are reflected | 1 106 31 310 | 1 302 31 730 | 120 000 |

| Equipment is accepted for accounting as an object of fixed assets | 1 101 34 310 | 1 106 31 310 | 120 000 |

| Depreciation accrued on equipment | 1 401 20 271 | 1 104 34 410 | 5 000 |

| Equipment returned to the supplier is written off (due to a defect): | |||

| – for the amount of the residual value of the equipment | 1 401 10 172 | 1 101 34 310 | 115 000 |

| – the amount of depreciation accrued on the object | 1 104 34 410 | 4 101 34 310 | 5 000 |

| Equipment accepted for accounting to replace retired equipment | 1 101 34 310 | 1 401 10 172 | 120 000 |

Regarding the last situation, we note that, by virtue of Art. 477 Civil Code of the Russian Federation

, if a warranty period has been established for the product, the buyer has the right to make claims related to defects in the product if defects are discovered during the warranty period.

of the Law of the Russian Federation dated 02/07/1992 No. 2300-1 “On the Protection of Consumer Rights”

states that if a consumer discovers defects in a product and makes a demand for its replacement, the seller (manufacturer, authorized organization or authorized individual entrepreneur, importer) is obliged to replace such product. A product of inadequate quality must be replaced with a new product, that is, a product that has not been used. When replacing a product, the warranty period is calculated anew from the day it is handed over to the consumer.

Since the warranty period for the equipment has not expired, the institution does not bear the costs of its repair (in this case, replacement).

* * *

In conclusion, let us briefly formulate the main conclusions.

1. The importance of classifying work as major or current repairs is dictated by the peculiarities of reflecting these expenses in accounting accounts.

2. FSBU “Fixed Assets” has established cases of changes in the value of a fixed asset based on the results of its overhaul. Expenses for routine repairs of fixed assets are included in the expenses of the institution.

3. Expenses for the repair of fixed assets that do not change the cost of the repaired objects are reflected in account 0 401 20 255

“Expenses for work, property maintenance services.”

If, as a result of repair work, an institution acquires spare parts, they are taken into account on account 0 105 36 000

“Increase in the value of other inventories - other movable property of the institution”, and then, when they are installed, are written off as expenses of the institution.

Expenses for major repairs of fixed assets, changing their value, are formed on account 1,106,31,000

“Increase in investments in fixed assets - other movable property of the institution.”

Silvestrova T., expert of the information and reference system “Ayudar Info”

Send to a friend

Documenting

All business transactions must be confirmed by primary documents (Part 1, Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, clause 7 of the Instructions for the Unified Chart of Accounts No. 157n), therefore an order should be issued signed by the manager institutions on modernization of fixed assets.

The order must indicate the reasons, timing of modernization and those responsible for its implementation.

After the modernization, an act of acceptance and delivery of modernized fixed assets is drawn up (according to form No. OS-3 (0306002)). If the modernization was carried out economically - in one copy, by contract - in two: for yourself and for the contractor.

The act reflects:

- cost of the OS object before modernization;

- amount of costs;

- the cost of the fixed asset after the work has been completed.

Based on the act, accumulated costs are written off on account 0.106.00.00 “Investments in non-financial assets” and entries are made in the inventory card. The executed deed is signed by:

- members of the commission for the receipt and disposal of non-financial assets created in the organization;

- employees responsible for the modernization of fixed assets, or representatives of the contractor;

- employees responsible for the safety of fixed assets after modernization.

The signed act is approved by the head of the institution, after which the act is transferred to the accounting department.

Note!

If the contractor carried out the modernization of a building, structure or premises, these works are classified as construction and installation works, therefore, in addition to the act, an acceptance certificate in form No. KS-2 and a certificate of the cost of work performed and expenses in form No. KS-3 (approved by the Resolution) should be signed Goskomstat of Russia dated November 11, 1999 No. 100).

When concluding an agreement on the restoration of a fixed asset, technical documentation and construction estimates must be drawn up for all work (Article 743 of the Civil Code of the Russian Federation).

GLAVBUKH-INFO

Modernization or reconstruction means work that leads to an improvement (increase) in the initially adopted standard indicators of the functioning of a fixed asset object.Modernization work includes work caused by a change in the technological or service purpose of equipment, a building, structure or other fixed asset, increased loads and/or other new qualities.

As a rule, the modernization of machinery and equipment involves replacing individual parts of machinery and equipment and equipping them with new mechanisms.

Reconstruction includes the reconstruction of existing workshops and facilities for main, auxiliary and service purposes, as a rule, without expanding existing buildings and structures for the main purpose, associated with improving production and increasing its technical and economic level and aimed at increasing production capacity, improving quality and changing the nomenclature products.

Modernization and reconstruction of fixed assets can be carried out by the organization itself and/or by third-party organizations.

When reconstructing individual fixed assets (buildings and structures) carried out as part of capital construction, construction and installation work can be carried out in an economic or contract manner in a manner similar to the construction of new fixed assets.

In accordance with the Methodological Guidelines for Accounting for Fixed Assets, costs for the completion, retrofitting, reconstruction, and modernization of fixed assets must be accounted for in the account for investments in non-current assets.

After completion of the reconstruction or modernization of a fixed asset facility, the costs recorded on the account for investments in non-current assets should increase the initial cost of the facility if, as a result of modernization and reconstruction, the initially accepted standard indicators of the facility’s functioning improve (increase) (useful life, power, quality of application, etc.).

Accounting for costs associated with the modernization and reconstruction of fixed assets, leading to an improvement in the initially adopted standard indicators of the operation of the facility, is carried out in the manner established for accounting for actual costs during the construction or manufacture of fixed assets.

Actual costs for modernization and reconstruction of fixed assets are preliminarily reflected in account 08 “Investments in non-current assets” in correspondence with settlement accounts, accounts for inventory accounting, etc.

An increase in the initial cost of fixed assets as a result of modernization and reconstruction is reflected in the debit of account 01 “Fixed assets” in correspondence with account 08 “Investments in non-current assets”.

When the initial cost of fixed assets increases, monthly depreciation charges taken into account for accounting purposes must also be increased. In this case, depreciation recalculated for such objects should be accrued from the 1st day of the month following the month of acceptance and delivery of reconstructed, modernized fixed assets.

In accordance with PBU 6/01, in cases of improvement (increase) of the initially adopted standard indicators of the functioning of a fixed asset object as a result of reconstruction or modernization, the organization can revise the useful life of this object. Sh&. *

If there is no improvement (increase) in the previously adopted standard indicators of the functioning of fixed assets, then the costs recorded in the account for investments in non-current assets are recorded in the fixed assets account separately (for example, in a separate sub-account 01–3 “Costs for reconstruction and modernization , which do not increase the initial cost of fixed assets").

In this case, a separate inventory card is opened for the fixed asset item for the amount of costs incurred.

Acceptance of completed works on completion, additional equipment, reconstruction, modernization of fixed assets is formalized by a corresponding act.

Acceptance of fixed assets, whose initial value increases as a result of reconstruction, modernization, etc., is carried out on the basis of an act of acceptance and delivery of repaired, reconstructed, modernized fixed assets (form No. OS-3).

Based on this act, corresponding entries are made in the inventory card in which the object was previously recorded.

If it is difficult to reflect all changes in the old inventory card, a new inventory card is opened (preserving the previously assigned number) reflecting the indicators characterizing the reconstructed object.

If an object of fixed assets has several parts that are accounted for as separate inventory items and have different useful lives, the replacement of each such part during restoration is accounted for as a disposal and acquisition of an independent inventory item.

Tax aspects. In tax accounting, as in accounting, the initial cost of fixed assets may change in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of relevant facilities and for other similar reasons.

From January 1, 2006, a new procedure was established for tax accounting of expenses incurred in cases of completion, additional equipment, reconstruction, modernization, and technical re-equipment of fixed assets.

According to Art. 270 of the Tax Code of the Russian Federation, expenses incurred in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment of fixed assets are classified as expenses not taken into account for profit tax purposes

These expenses may increase the initial cost of reconstructed, modernized fixed assets, which must subsequently be repaid by depreciation.

When the initial cost of fixed assets increases, monthly depreciation deductions taken into account for tax accounting purposes must also be increased. In this case, depreciation recalculated for such objects should be accrued from the 1st day of the month following the month of completion of reconstruction or modernization of the fixed asset object.

The organization has the right to increase the useful life of an object of fixed assets after the date of its commissioning if, after reconstruction or modernization of such an object, an increase in its useful life occurs.

In this case, an increase in the useful life of fixed assets can be carried out within the time limits established for the depreciation group in which such fixed assets were previously included.

If as a result of reconstruction or modernization of a fixed asset item there is no increase in its useful life, the organization takes into account the remaining useful life when calculating depreciation.

Example 1. Let’s assume that the organization’s own resources have modernized a fixed asset facility, leading to an increase in the standard performance indicators of the facility.

№

p/p

| Contents of business transactions | Corresponding accounts | ||

| Debit | Credit | ||

| 1 | The cost of purchased materials is reflected according to the supplier’s settlement documents (excluding VAT) | 10-1 | 60 |

| 2 | The amount of VAT presented by the supplier is reflected | 19-1 | 60 |

| 3 | Payment for materials has been made (including VAT) | 60 | 51 |

| 4 | The cost of purchased spare parts is reflected according to the supplier’s settlement documents (excluding VAT) | 10-5 | 60 |

| 5 | The amount of VAT presented by the supplier is reflected | 19-1 | 60 |

| 6 | Payment has been made to the supplier for received spare parts (including VAT) | 60 | 51 |

| 7 | Materials were released for the modernization of the OS facility | 08 | 10-1 |

| 8 | Spare parts were released for the modernization of the OS facility | 08 | 10-5 |

| 9 | Salaries were accrued to employees who performed work to modernize the OS facility | 08 | 70 |

| 10 | Unified social tax was accrued from the amounts of remuneration of workers who performed work to modernize the OS facility | 08 | 69 |

| 11 | The initial cost of an asset has been increased by the amount of actual costs for its modernization | 01 | 08 |

| 12 | VAT amounts paid to suppliers of materials and spare parts are presented for deduction | 68-1 | 19-1 |

Example 2. Let us assume that a fixed asset facility has been modernized, carried out by the organization itself and does not lead to an increase in the standard performance indicators of the facility.

| No. | Contents of business transactions | Corresponding accounts | |

| Debit | Credit | ||

| 1 | Materials were released for the modernization of the OS facility | 08 | 10-1 |

| 2 | Spare parts were released for the modernization of the OS facility | 08 | 10-5 |

| 3 | Salaries were accrued to employees who performed work to modernize the OS facility | 08 | 70 |

| 4 | A single social tax was accrued from the amounts of wages of workers who performed work to modernize the OS facility | 08 | 69 |

| 5 | Reflects the costs of upgrading an OS asset without increasing the initial cost of an OS asset | 01-3 | 08 |

| < Previous | Next > |

We reflect expenses in accounting

Costs for completion, additional equipment, reconstruction and modernization of fixed assets are preliminarily reflected and accumulated in the debit of account 0.106.00.000 “Investments in non-financial assets” (according to the corresponding analytical accounts). This account reflects all costs for this work:

- cost of materials used;

- depreciation of machinery and equipment used to carry out the work;

- wages of those involved in completion, reconstruction or modernization and social contributions from it;

- expenses for paying for third-party services, etc.

After completion of all work and delivery of the completed (retrofitted, reconstructed or modernized) fixed asset, these costs are written off to increase its value in the Debit of account 0.101.00.000 “Fixed assets” (according to the corresponding analytical accounts).

Let's consider the procedure for reflecting in accounting the costs of modernizing a fixed asset.

Situation 2

In August–September 2021, the Federal Budgetary Healthcare Institution “Center for Hygiene and Epidemiology” carried out the modernization of the laboratory equipment “GP Sterilizer” by contract using funds received from business activities.

The cost of the work performed by the contractor is RUB 70,800, including VAT - RUB 10,800.

The acceptance certificate for the completed work was signed in October.

The institution pays income tax quarterly. Accounting and tax accounting data are the same.

The initial cost of the equipment at which it was accepted for accounting is 504,000 rubles. Listed as particularly valuable movable property. When accepted for accounting, the useful life was set at 7 years (84 months). Depreciation is calculated using the straight-line method.

For accounting purposes:

- annual depreciation rate - 14.28572% (1/7 × 100);

- annual depreciation amount - 72,000 rubles. (RUB 504,000 × 14.28572%);

- monthly depreciation amount is 6,000 rubles/month. (RUB 72,000 / 12 months).

Since the modernization lasted less than 12 months, during the period of its implementation the accountant did not stop accruing depreciation on laboratory equipment.

The modernization did not lead to an increase in the useful life of the equipment, therefore, for accounting and tax purposes, the useful life of the modernized equipment was not revised.

During the period of modernization of the equipment of the GP Sterilizer, the following accounting operations should be performed:

in August-September:

Debit account 2.109.61.271 Credit account 2.104.24.410 - 6000 rub. — depreciation was accrued on the equipment being modernized;

in October:

Debit account 2.106.21.310 Credit account 2.302.31.730 - 60,000 rub. (RUB 70,800 -RUB 10,800) - the cost of the contractor’s work to modernize the fixed asset is taken into account;

Debit account 2.210.10.560 Credit account 2.302.31.730 - 10,800 rub. — VAT is taken into account on the cost of the contractor’s work;

Debit account 2.303.04.830 Credit account 2.210.10.660 - 10,800 rub. — VAT is accepted for deduction;

Debit account 2.302.31.830 Credit account 2.201.11.610 - 70,800 rub. — payment has been made for the contractor’s work;

Account credit 18 (KOSGU code 310) - RUB 70,800. — the outflow of funds from the institution’s account is reflected;

Debit account 2.109.61.271 Credit account 2.104.24.410 - 6,000 rub. — depreciation was accrued on the equipment being modernized;

Debit account 2.101.24.310 Credit account 2.106.21.310 - 60,000 rub. — the initial cost of the equipment was increased by the amount of the cost of work on its modernization.

The initial cost of the equipment, taking into account the costs of modernization, will be 564,000 rubles. (RUB 504,000 + RUB 60,000).

For accounting purposes:

- annual depreciation amount - 80,571.46 rubles. (RUB 564,000 × 14.28572%);

- monthly depreciation amount - 6714.29 rubles/month. (RUB 80,571.46 / 12 months).

From October, depreciation charges will be reflected by posting:

Debit account 2.109.61.271 Credit account 2.104.24.410 - 6714.29 rub. — depreciation has been accrued for the equipment being modernized.

The costs of modernization must be reflected in the primary documents for accounting for fixed assets and in the inventory card for accounting for fixed assets.

Question on topic

Repair or modernization?

The organization purchased new monitors to replace old inoperative ones. How to take into account such costs - as modernization or repairs?

Purchased parts of computer equipment (including monitors) cannot be separate objects of fixed assets, since they perform their functions only as part of an associated set. Computers are accounted for as single inventory items (letters of the Ministry of Finance of Russia dated 02.06.2010 No. 03-03-06/2110, 06.11.2009 No. 03-03-06/4/95). This procedure applies to both tax and accounting.

Spare parts necessary for the repair and replacement of worn parts in equipment and machines are classified as inventories, which means that the costs of their acquisition are included in Article 340 of KOSGU “Increase in the cost of inventories.”

It follows from this that the operation of replacing an inoperative monitor should be regarded as a repair of computer equipment, the costs of which do not increase the initial cost. Consequently, the cost of spare parts that are used in the repair process is charged to the institution’s expense accounts 0.106.61.000, or 0.106.71.000, or 0.109.81.000, or 0.109.91.000 under code 272 KOSGU “Consumption of inventories.”

If repair work is carried out by a third-party organization, the costs of paying for its services should also be taken into account on expense accounts under code 225 KOSGU “Works, services for property maintenance”

The same rules apply to other parts of computer equipment: network cards, DVD drive, motherboard, etc.

______________________

The procedure for accounting for operations to replace old, but serviceable parts of a fixed asset with new and more modern ones is not defined by law. As a rule, if such a replacement leads to an increase in the technical characteristics of the object, then the work is considered as an upgrade and the cost of used parts, the costs of their installation are included in the initial cost of the computer (for example, replacing an old monitor with a new one with a larger screen area, increasing RAM or hard memory ).

If, as a result of the work, the technical characteristics of the fixed asset do not improve, the costs of the work are considered as repairs, reflected in the cost accounts of accounting.

Situation 3

FBUZ replaced the old monitor with a new one with a larger screen area and improved technical characteristics. The work was carried out using funds from business activities.

The cost of a new monitor is RUB 31,860. (including VAT 4860 rub.).

Delivery costs by transport company - 1180 rubles. (including VAT 180 rub.).

The initial cost of the old monitor is 10,000 rubles, depreciation is charged 8,000 rubles.

The market price of the old monitor on the date of modernization work is 3,500 rubles.

Let's reflect the costs of modernization:

Debit account 2.106.24.340 Credit account 2.302.34.730 - 27,000 rub. — expenses for the purchase of the monitor and accounts payable to the supplier are reflected;

Debit account 2.210.10.560 Credit account 2.302.34.730 - 4680 rub. — “input” VAT is taken into account on the cost of the new monitor;

Debit account 2.302.34.830 Credit account 2.201.11.610 - 31,860 rub. — payment for the purchased new monitor was made from the institution’s personal account in the treasury;

Debit account 2.106.24.340 Credit account 2.302.22.730 - 1000 rub. — the costs of delivering the monitor and accounts payable to the transport company are reflected;

Debit account 2.210.10.560 Credit account 2.302.22.730 - 180 rub. — “input VAT” on transport services is taken into account;

Debit account 2.302.22.830 Credit account 2.201.11.610 - 1180 rub. — expenses for delivery of the monitor have been paid;

Debit account 2.105.26.340 Credit account 2.106.24.340 - 28,000 rub. (27,000 + 1000) — the initial cost of the monitor is taken into account as part of inventory;

Debit account 2.303.04.830 Credit account 2.210.10.660 - 4860 rub. (4680 + 180) - accepted for deduction of VAT on the cost of the monitor and the cost of transport services;

Debit account 2.104.24.410 Credit account 2.101.24.410 - 8000 rub. — depreciation of the old monitor was written off;

Debit account 2.401.10.172 Credit account 2.101.24.410 - 2000 (10,000 - 8000) rub. — the residual value of the old monitor is written off;

Debit account 2.105.36.340 Credit account 2.401.10.180 - 3500 rub. — the old monitor was capitalized at the market price;

Debit account 2.106.21.310 Credit account 2.105.26.440 - 28,000 rub. — the cost of a new monitor was written off to increase the cost of the computer and increase investments in fixed assets;

Debit account 2.101.24.310 Credit account 2.106.21.310 - 28,000 rub. — the costs of upgrading the computer are included in the initial cost.

Reconstruction of fixed assets: Accounting and taxation

A. Vagapova, JSC “Gorislavtsev and K. Audit”

Often, when purchasing a building, an organization is forced to carry out a whole range of repair and construction work in it in order to bring it to a condition suitable for use. Questions arise whether these works are major repairs or reconstruction and how to take into account the corresponding costs.

The definition of reconstruction is given in the letter of the USSR Ministry of Finance dated May 29, 1984 No. 80 “On the definition of the concepts of new construction, expansion, reconstruction and technical re-equipment of existing enterprises”, as well as in paragraph 8.4 of the Instructions for filling out federal state statistical observation forms for capital construction, approved by Decree of the State Statistics Committee of Russia dated October 3, 1996 No. 123. In accordance with these documents, reconstruction includes the reconstruction of existing workshops and facilities of the main, auxiliary and service purposes, as a rule, without expanding the existing buildings and structures of the main purpose, associated with the improvement of production and increasing its technical and economic level based on the achievements of scientific and technological progress and carried out under a comprehensive project for the reconstruction of the enterprise as a whole in order to increase production capacity, improve quality and change the range of products, mainly without increasing the number of employees while simultaneously improving their working conditions and safety environment.