The significance and role of the BCC in the system of budget regulation

The use of KBK budget classification codes is carried out on the basis of instructions approved by Order of the Ministry of Finance dated 06/08/2018 No. 132n.

The instructions establish the structure, principles of purpose, general requirements for the procedure for the formation and application of the CBC and are mandatory for everyone. The instructions contain a budget classification of income, expenses and sources of financing of various budgets of the Russian Federation, which is used for maintaining budget accounting, generating budget and other reporting and includes the classification:

- budget revenues;

- budget expenditures;

- sources of financing budget deficits.

The codes of operations of the general government sector are enshrined in Order of the Ministry of Finance No. 209n dated November 29, 2017.

Budget revenues are replenished, among other things, by taxes and similar payments. They are quite varied, but each is assigned its own separate budget classification code, with the first three digits of the code indicating the payment administrator. The most common administrator code is 182, code of the Federal Tax Service of the Russian Federation.

In what sources of law are the BCC approved?

The main source of law, the provisions of which are approved (and also changed at different intervals) by the BCC, is the order of the Ministry of Finance of Russia dated 06/06/2019 No. 85n, and from 2021 the order of the Ministry of Finance dated 06/08/2020 No. 98n. This regulatory legal act, in turn, was formed in order to implement the provisions of the Budget Code of the Russian Federation in terms of regulating the classification of income and expenses of the national budget of the state.

However, the BCCs recorded in the order of the Ministry of Finance are in most cases not presented in the form in which they should be indicated in field 104. Moreover, the systematization of the BCCs is in some cases quite difficult to understand. In this regard, information very often requires additional clarification by the departments that administer this or that type of payment to the budget.

Let's study how such problems are solved by the authorities that control the fulfillment of the most common financial obligations to the budget of the Russian Federation, namely the payment of taxes and insurance contributions.

KBK in payment in 2021

What is income for the budget, for taxpayers is payment to the state treasury of taxes and equivalent payments and insurance premiums (except for “injuries”). Therefore, each of them first goes to the accounts of the territorial body of the Federal Treasury and is classified there on the basis of the BCC.

For any taxpayer or tax agent, regardless of its organizational and legal form, it is very important to correctly fill out a payment order, since errors, for example, incorrectly filling out this field in a payment order, can lead to money being credited to the “wrong address.” The Federal Treasury may classify it as “unclarified.” This means that the payer has an unpaid obligation to the state, i.e., outstanding arrears, penalties, fines and other sanctions from the state, in this case to the payment administrator. This can be avoided if you indicate the budget classification code correctly.

Order No. 245n dated November 30, 2018, which amended the current guidelines for the application of the BCC, contains new budget classification codes:

- excise taxes New budget classification codes have been introduced for dark marine fuel, petroleum raw materials for refining, state duties for issuing excise stamps, etc.;

- a new BCC for a single tax for individuals on professional income, a fee introduced for self-employed citizens;

- codes for paying taxes on additional income from the production of hydrocarbons, calculated according to the norms of Art. 333.45 Tax Code of the Russian Federation.

Legal acts according to the KBK for taxes and insurance premiums

The Federal Tax Service of Russia periodically systematizes the norms of Order No. 65n, which approves the BCC, adopting various by-laws and substantively explaining the nuances of using these codes when paying taxes, and from 2021, insurance premiums.

The transfer from 2021 of the main volume of insurance premiums (with the exception of payments for accident insurance, which remained under the jurisdiction of the FSS) under the control of the tax authorities has led to the need not only for the emergence of new BCCs that meet the insurance premiums charged according to the new rules, but also the introduction of transitional BCCs , intended to pay contributions accrued before 2017, and paid already in it.

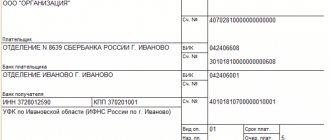

How to correctly indicate BCC in settlement documents

The form of the payment order and the procedure for filling out the transfer of obligatory payments to the budget are approved by the Directive of the Central Bank of the Russian Federation dated 03.03.2003 No. 1256-U, and the rules for filling out are approved by the Ministry of Taxes of the Russian Federation dated 03.03.2003 No. BG-3-10/98. In 2021, the payment order forms established by the Regulation of the Central Bank of the Russian Federation No. 383-P and Order of the Ministry of Finance dated November 12, 2013 No. 107n are used.

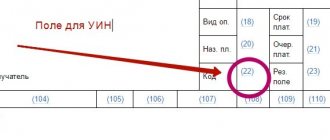

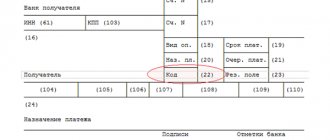

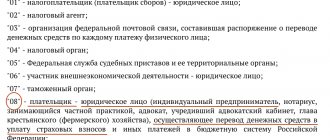

Each field of the order has its own code, with the help of which the Central Bank and the Ministry of Finance establish the rules for filling out the details. For example, field 101 is for payer status.

IMPORTANT!

The KBK field in the payment order is field 104.

Order for payment

The form of this document was developed specifically for making non-cash payments and was put into circulation by the Central Bank of the Russian Federation in 2012 regulation number 383-P.

In addition to the description of the form itself, the regulatory document of the Central Bank of the Russian Federation also specifies other details that must be filled out. These include field 104. In the 2019 payment order, it remained unchanged.

In 2013, the Ministry of Finance of our state issued Order No. 107n, which approved the developed rules for entering information that allows the payment to be identified. According to paragraph 5 of this order, all transactions must be completed indicating the BCC. However, its format must meet a number of requirements.

- KBK consists of 20 characters. Deviation up and down is unacceptable.

- In KBK, all 20 values cannot be zeros.

In addition, each digit of this code must have its own meaning. In the order of the Ministry of Finance of 2013 No. 65n they are described in detail. According to these regulations, the budget classification code must follow this format (see table below).

Also see “Payment order at the request of the Federal Tax Service: details of filling out”.

| Decryption of any KBK | |

| Number order | What does it mean |

| First 3 | Contains information about the payee |

| From 4th to 13th | They talk about the type of income that goes to the budget |

| From 14th to 20th | Subtype of income |

Insurance premiums

From 01/01/2017, all contributions for compulsory insurance of employees, except for contributions for injuries, must be transferred to the Federal Tax Service. For the convenience of payers, the Federal Tax Service website contains information on which BCC to indicate for payments to the budget. To pay insurance premiums for compulsory pension insurance (20%) for June we use 182 1 0210 160.

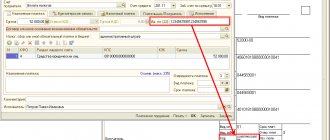

Payment order details for OPS (20%) for June 2021:

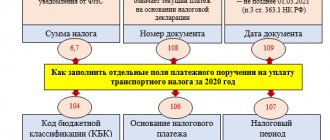

Where:

- field 104 - budget classification code, for example, insurance contribution for compulsory pension insurance;

- field 105 - OKTMO, territory code according to the all-Russian classifier of territories of municipalities at the place of registration of the taxpayer (tax agent);

- field 106 - for current payments, indicate the TP code (current year);

- field 107 - value of the tax period indicator; can take the corresponding value of the period: MC - monthly payments;

- field 108 — document number, in this case it is set to “0”;

- field 109 - date of the document, in this case it is set to “0”;

- field 110 - payment type, not filled in;

- field 24 - purpose, in this case the number of the policyholder in the Pension Fund of the Russian Federation is indicated.

KBK code (decoding)

Filling out cell 104 is a prerequisite for drawing up a payment document. Placing the KBK code according to the norms of Order No. 107n is aimed at identifying the money transfer. The KBK code must meet the established requirements:

- the code contains strictly 20 digits;

- the code cannot consist of zeros;

- Each organization is assigned an individual code value.

KBK consists of the following indicators:

- the first three digits indicate the revenue administrator;

- digits 4 to 13 indicate the code for the type of budget revenue;

- the remaining numbers indicate the revenue subtype code.

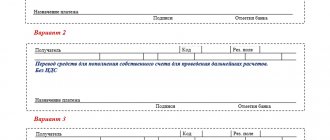

It is worth pointing out that code 104 is written in the payment order only if the recipient of the funds is a budget institution. That is, the field must be filled in in the following payment purposes:

- reimbursement of taxes, state duties, penalties, fines, state duties, arrears;

- reimbursement of mandatory insurance fees;

- payment of customs duties;

- fixed tax and mandatory contributions paid to the accounts of government agencies by individual entrepreneurs;

- other transfers to government organizations.

In cases where the recipient of the payment is an individual or legal entity not related to a government structure, field 104 is not filled in, “0” is entered in the corresponding cell.

What is kbk in a payment card?

Corporate income tax

Sometimes it is necessary to distribute one tax at appropriate rates across different budget levels: federal and regional, for example, on profit.

Let's assume you need to pay tax in the amount of RUB 20,000.00 in 2021. (tax base amounted to RUB 100,000.00).

To do this, you need to generate two payment orders:

- to the federal budget the amount will be 3% - 3000.00 rubles;

- to the budget of a constituent entity of the Russian Federation - 17%, that is, 17,000.00 rubles. in the example.

Each budget level has its own budget classification code:

- to the federal budget - 182 1 0100 110;

- to the budget of a constituent entity of the Russian Federation - 182 1 0100 110.

Field code 104 of the order for the federal budget will contain the corresponding cipher.

For the regional one it will be different.

Current codes for corporate income tax on income received in the form of interest on bonds of Russian companies issued during the period 01.01.2017-31.12.2021.

Purposes of using KBK

In accordance with the norms of current legislation, firms and businessmen must transfer funds to the budget in the form of fees and taxes within the established time frame. This requires filling out payment orders. When paying a tax or contribution to the budget, the value of the BCC in the payment slip is considered quite serious.

So, these codes are used in payment orders for the following purposes:

- Facilitation of the formation of material documentation and analysis of budget indicators;

- Timely and accurate transfer of tax amounts for their intended purpose, broken down into separate accounts;

- Classification of cost and revenue items of the budget, as well as sources of their formation.

In simple words, thanks to KBK you can monitor the history of each payment made, and also check whether it was actually used for its intended purpose.

Payment of tax by an individual

Any citizen (payer) is forced to understand the CBC. This will be required to pay taxes such as land tax and personal property tax.

The basis for payment is a tax notice sent by the tax authority (clause 4 of Article 397 of the Tax Code of the Russian Federation). However, each payer must check whether the details are correct, including the budget classification code.

An example of filling out a payment order for transferring personal income tax from employee salaries to the Federal Tax Service

Let's say the amount was 102,302 rubles.

Let’s look at how to fill out the tax fields of a payment order in 2019 (sample), since this is what most often causes difficulties.

Field 4. Date of payment. The tax must be paid within the established deadlines. For benefits and vacations, create a payment slip no later than the last day of the month for which payments were made. When transferring wages or other income, set a date no later than the day following the day of payment of income to the employee (paragraphs 1 and 2 of paragraph 6 of Article 226 of the Tax Code of the Russian Federation).

We fill out fields 6 and 7 without kopecks, since the tax is calculated and transferred in rubles: 102,302.00 rubles.

In prop 22 put “0”.

Set the payer status (detail 101) to “02”, since the organization acts as a tax agent for employees receiving salaries.

KBK (detail 104) for personal income tax payment will be 182 1 0100 110.

Cell 105. OKTMO for your organization must be clarified with the tax office.

Cell 106 of the form. Reason for payment: TP (current period).

107th field. Tax period: MS.06.2017; If we transfer tax on vacation pay or benefits, you need to indicate the month and year for which the transfer took place. In columns 108 and 109 we put “0”, since there is no data to fill in, the 110th field is empty.

A fully completed personal income tax payment slip will look like this.

The KBK is incorrectly indicated on the payment slip: what to do?

Let us turn to clause 7 of Art. 45 of the Tax Code of the Russian Federation. If an error is discovered in the execution of a document for the transfer of a tax or other obligatory payment to the budget system, but no debt has been incurred for this tax, the taxpayer has the right to submit a free-form statement to the tax authority at the place of his registration that an error has been made. The application must be accompanied by documents confirming payment of the tax (i.e., transfer to the accounts of the Federal Treasury), with a request to clarify the details of the specified payment: its basis, type and affiliation, tax period or payer status. We wrote about this in detail in an article on how to offset or return overpayments on taxes.

Since the KBK belongs to the group of details that allow one to determine the identity of the payment, if an erroneously specified KBK is detected in the order for the transfer of tax, the payer has the right to contact the tax authority with an application to clarify the identity of the payment. This position has been repeatedly expressed by the Ministry of Finance (for example, Letter dated January 19, 2017 No. 03-02-07/1/2145), the Federal Tax Service (for example, Letter dated October 10, 2016 No. SA-4-7 / [email protected] ), as well as the Arbitration by the court in the Resolution of the Administrative Court of the North Caucasus District dated December 4, 2014 No. A53-7943/2013.

Consequences of incorrect indication of BCC by the taxpayer

If a taxpayer records an incorrect BCC in a payment, this may lead to the following legal consequences:

- the amount will be attributed to unidentified receipts (as a rule, in cases where the BCC indicated in the payment order does not correspond to the lists approved by the latest edition of Order No. 65n);

- the amount will be credited to the budget of another level or another department (this is possible if, instead of the required BCC, another is specified - due to an error or ignorance).

Thus, the amount that the taxpayer transfers from his current account, as a rule, still ends up in the budget, even if the BCC is indicated incorrectly. More precisely, it goes to the accounts of the Federal Treasury, from where it is then distributed to the recipients.

However, in a number of cases, it may be necessary to assist the treasury in its redirection to the competent government structure or to the budget of the appropriate level (letter of the Ministry of Finance of Russia dated March 29, 2012 No. 03-02-08/31). This can be done by sending an application to the authority administering the payment (Federal Tax Service or Social Insurance Fund) to clarify the payment details. We will tell you in what order to carry out such requests a little later.

In the meantime, let’s try to answer the question: is it worth fearing the accrual of penalties and fines from the state if the funds contributed to the budget, due to errors in specifying the BCC, end up at the wrong address?

Precedents showing that government agencies willingly fine inattentive taxpayers occur regularly. However, if a company decides to take the government bodies that administer payments and impose sanctions for incorrect BCC to court, it is highly likely to win the case.

Errors when filling out

When filling out the 104th field, you should be extremely careful. If the code was entered incorrectly, the funds will not be credited to the recipient's account. And this will give false information about the unwillingness of a company or individual to comply with obligations to the state budget.

At the same time, it cannot be unequivocally stated that errors when filling out the 104th field lead to negative consequences if the KBK was entered incorrectly or its outdated version was specified.

According to the letter of the Ministry of Finance of 2012 No. 03-02-08/31, an error when specifying the budget classification code does not always mean recognition of an unfulfilled tax obligation of a particular company (IP) if the transfer was made using a different BCC number.

However, the above approach is relevant only for tax payments. For example, if we are talking about paying a state duty, then the organization may be refused to provide it with the relevant government services. The reason may be the incorrect completion of field 104 in the payment order.