Selecting a period for calculating the average salary

The Labor Code of the Russian Federation establishes a period of 12 months for determining average earnings. This is the most objective calculation method, taking into account the fact that unworked time, for example, business trips, is subtracted from the period. For some workers, wages fluctuate greatly throughout the year. This is especially true for the piecework form of payment and additional bonus payments to the salary.

In cases where an employee receives wages every month in equal parts, to simplify the calculation, the company has the right to establish a shorter billing period: 3, 6 months, or any other. The main condition is the absence of a negative impact of changes on employees.

Duration

Typically, the answer to the question: “What is a billing period?” sounds simple. Most often this is one calendar month. However, it is important and necessary to understand that this is not always the case. For example, in pension legislation such a period is considered to be one year. In some cases, the billing period may be shorter (six months, quarter) and significantly shorter (days or even several hours). The last case is relevant when it comes to the stock exchange. Brokers do have a limited number of hours to complete securities transactions.

So, you must understand that when answering the question: “What is a “billing period”?”, it is impossible to name a specific period of time. In each case, this depends on the scope of application, and sometimes is decided individually.

Rules for determining the billing period for calculating the average salary

According to labor legislation, the recommended and maximum pay period is a year (for the purpose of determining the average salary). But this does not mean that all 365–366 days will be included in the calculation. During calculations, only days actually worked are taken into account. It is recommended to exclude from the calculation:

- The periods during which the employee received average wages. Hence, breaks to feed the baby should be excluded.

- Time of incapacity for work on sick leave.

- Maternity leave.

- Duration of unpaid leave.

- Paid days off provided additionally to care for disabled children.

- Periods of downtime due to the fault of the employer.

- The time of a strike in which the employee did not take part, but could not work because of it.

- Other periods provided for by the legislation of the Russian Federation.

Having excluded such periods from the total duration of the period of time under consideration, the accountant can begin to calculate the average salary.

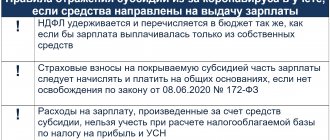

Payment of contributions in the billing period

Payment of insurance premiums from payments to individuals assumes that during the billing period (year) you calculate and pay contributions in the form of monthly mandatory payments (clause 3 of Article 431 of the Tax Code of the Russian Federation). For example, insurance premiums for March 2021 must be paid no later than April 15, 2021. And this must be done throughout the entire billing period – 2021.

According to Art. 10 of Law No. 212-FZ, the calculation period for insurance premiums is the calendar year. This means that insurance premiums are calculated on an accrual basis from the beginning of the year.

Reporting periods for insurance premiums—Q1, half-year, 9 months of the calendar year, calendar year. This means that insurance premiums are calculated on a quarterly basis on an accrual basis.

At the end of the reporting period, two calculations must be submitted:

1) to the Pension Fund of the Russian Federation for insurance contributions to the PRF, FFOMS

and

TFOMS.

It must be submitted by the 15th

the second calendar month following the reporting period, i.e. until May 15, August 15, November 15, February 15;

2) to the Federal Social Insurance Fund of the Russian Federation for social insurance contributions in case of temporary disability and in connection with maternity. The deadline for its submission is until the 15th day of the calendar month following the reporting period (until April 15, July 15, October 15, January 15).

If the reporting date falls on a weekend or holiday, it is moved to the first working day.

Organizations and entrepreneurs whose average number of employees exceeds 50 people are required to provide payments in electronic form.

5.3.2. PROCEDURE FOR CALCULATION AND DATES FOR PAYMENT OF INSURANCE PREMIUMS

The amount of insurance premiums is calculated separately

to every state extra-budgetary fund.

The amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, subject to payment to the Federal Social Insurance Fund of the Russian Federation, is reduced by the amount of expenses incurred by the employer for these payments.

The employer is obliged to keep records of the amounts of accrued payments and other remuneration, the amounts of insurance premiums related to them, in relation to each individual in whose favor the payments were made.

Each calendar month, the employer must calculate all contributory payments made to each individual individual on an accrual basis and multiply the amounts of these payments by the corresponding insurance premium rates. The result is a value calculated on an accrual basis from the beginning of the year. The employer must pay the difference between this amount and the amount previously accrued from the beginning of the billing period for the previous calendar month, including insurance premiums, by the 15th

dates of the next month.

Insurance premiums are paid in four

separate payment orders to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal and territorial funds of compulsory medical insurance.

Transfers should be made no later than the 15th day

of the month following the worked month. If the payment order allows

If there is an error - the account number of the Federal Treasury or KBK is incorrect, the name of the recipient bank is incorrect - and this led to the incorrect crediting of money, then the obligation to pay contributions is not considered fulfilled. Penalties will be charged for late payment of contributions.

Overpayment of insurance premiums can be offset or refunded. In this case, the overpayment can only be offset against future payments or arrears under the same fund.

For example, it will not be possible to offset overpaid contributions to the PRF against arrears on payments to the Social Insurance Fund of the Russian Federation.

Law No. 212-FZ

does not provide for the obligation to pay advance payments.

Example

5.5.

Payment of insurance premiums The amount of insurance premiums accrued and paid by the organization for January was (conditionally):

in the PRF - 2000 rubles, in the Federal Social Insurance Fund of the Russian Federation - 300 rubles, in the FFOMS - 600 rubles,

For January-February, insurance premiums were accrued: to the PRF - 5,000 rubles, to the Federal Social Insurance Fund of the Russian Federation - 700 rubles, to the Federal Compulsory Medical Insurance Fund - 800 rubles. At the same time, 150 rubles were issued for sick leave in February.

No later than March 15, the organization must transfer in four separate payment orders:

14. in the PRF the amount of 3000 rubles. (5000 rub. - 2000 rub.);

15. to the Federal Social Insurance Fund of the Russian Federation in the amount of 250 rubles. (700 rub. - 300 rub. - 150 rub.);

16. to the FFOMS in the amount of 200 rubles. (800 rubles - 600 rubles).;

5.3.3. CALCULATION AND PAYMENT OF INSURANCE PREMIUMS BY BRANCHES OF LEGAL ENTITIES

Branches and structural divisions of legal entities, called separate divisions in the Tax Code of the Russian Federation, may have a separate balance sheet and current account. In this case, they pay insurance premiums accrued for payments to their employees, and also submit calculations for insurance contributions to extra-budgetary funds directly at their location.

If the branch does not have a separate balance sheet and current account, then payment of insurance premiums and reporting is carried out

(compiled) centrally at the location of the parent organization.

A similar rule applies to separate divisions located outside the territory of the Russian Federation, regardless of the presence or absence of a separate balance sheet and current account.

A settlement period is a certain period of time during which all settlement transactions for a particular economic transaction are carried out. In various industrial areas, the billing period can be interpreted differently, but the essence remains the same: within a limited time frame, it is necessary to pay off all passive debts in order to start work “from scratch” after the billing period.

An example of determining the period for calculating the average salary

Consider a situation in which it is necessary to calculate the average salary for the past 12-month period:

The employee went on a business trip on February 14, 2021. For this period, the company paid him an average salary. To calculate the value, it is necessary to consider the period from 1.01. until 31.12. last year, 2015. The employee was not at the workplace all the time:

- from April 12 to April 23, 2015 – on a business trip;

- from July 5 to July 25, 2015 – was on unpaid leave;

- from November 20 to November 28, 2015 – was incapacitated for work on sick leave.

Based on these data, the accountant determined the billing period:

- from January 1 to April 11;

- from April 24 to July 4;

- from July 26 to November 19;

- from November 29 to December 31.

According to the working time schedule, weekends will be excluded from the total number of days.

Codes of calculation periods for insurance premiums

The code for the billing period for calculating insurance premiums is indicated on the title page and in section 3. The third section is responsible for personalized information, information about it is below.

Code of the billing (reporting) period on the title page

On the title you need to fill out all the fields except the section “To be filled out by a tax authority employee.” Also on this sheet there are fields “Calculation (reporting) period” and “Calendar year”.

In the line “Calculation (reporting) period” you need to write the code of the billing period for calculating insurance premiums for which the data is provided. All codes for the new form are presented in Appendix No. 3 to the Procedure for filling out a single calculation for insurance premiums. We have listed them in the table below.

Example

The accountant submits calculations of contributions for the six months. This billing period corresponds to period 31.

In a quarter, the accountant will report for 9 months - select code 33.

Table. Period codes with decoding

Important:

On the title page there is no longer any need to indicate the average and payroll number of the organization, as was the case in RSV-1. There is also no space for printing; the report can be certified simply by a signature.

For clarity, below is an example of filling out a report and using the billing period code in calculating insurance premiums for 9 months.

Calculation period for vacation: rules for determining

The length of the period for which the number of days of paid leave is calculated depends on the duration of the employee’s work at the enterprise. But in general, it cannot last more than 12 months. Regardless of which half of the year the employee goes on vacation, the period will consist of one year. In this case, it begins from the first day of the calendar month of the start of the holiday until the last date of the 12th month. For example, an employee was on legal vacation from 12/28/15 to 01/15/16. The billing period for vacation will be determined in the interval from 12/1/14 to 30/11. 15.

In cases where the employee actually worked less than a year, the calculated period is considered to be from the first working day until the last day of the month preceding the vacation. For example, an employee was hired on August 1, 2015, and his vacation falls on December 27–14.01. In this case, the billing period is the time from 1.08. until November 30, 2015.

The Labor Code of the Russian Federation provides the opportunity to set the terms on the basis of which vacation payments are calculated independently. A prerequisite is to indicate the period in the personal or collective employment contract.

Reporting period in 2021

The reporting periods for insurance premiums are the first quarter, six months, 9 months of the calendar year and the calendar year (clause 2 of Article 423 of the Tax Code of the Russian Federation). For those policyholders who do not pay benefits to individuals and transfer insurance premiums only “for themselves,” there are no reporting periods. We are talking about individual entrepreneurs, lawyers, notaries and other persons engaged in private practice (subclause 2 1. 1 of article 419 of the Tax Code of the Russian Federation).

They can pay insurance premiums either monthly or in a lump sum for the year. Moreover, the deadlines for the monthly payment of contributions have not been established, however, in general, the entire payment must be transferred no later than December 31 of the current year (clause 2 of Article 432 of the Tax Code of the Russian Federation).

However, if individual entrepreneurs attract employees, then they additionally calculate and pay insurance premiums from employee benefits. For such contributions, the billing period will consist of reporting periods. Based on their results, it is necessary to submit a calculation of insurance premiums, which was approved by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551 (clause 7 of Article 431 of the Tax Code of the Russian Federation).

Accrual of vacation payments in days

After determining total earnings, to calculate vacation pay, you should calculate the average daily wage. If the employee has worked in full for the last 12 months, without deductions for the days of the pay period, then the calculation is made using the formula: SD.z. = Salary : 12 : 29.3.

Where:

- Salary – the total amount of earnings for the entire period;

- 29.3 – average number of days in one month;

- 12 – value of the billing period in months (in this case the year is set).

Let's consider an example of calculating average daily earnings for calculating vacation payments: from March 14 to April 27, 2021, accountant X will be granted annual paid leave. For the calculation, the period from 03/01/15 to 02/29/16 is used, which is fully worked out, without deductions. X receives a monthly fixed salary of 18 thousand rubles. Calculate average daily earnings.

Let's do the calculations:

- The total salary for the year will be: 18,000 × 12 = 216,000 rubles.

- The average daily wage will be determined at: 216,000: 12: 29.3 = 614.33 rubles.

- In total, for 14 days of vacation, the company must pay the amount: 614.33 × 14 = 8600.62 rubles.

Settlement and reporting period for calculation of insurance premiums in 2017

What is the settlement and reporting period for insurance premiums is enshrined in Art. 423 Tax Code of the Russian Federation:

These are the time periods for which the company must submit a report. As for the reporting deadlines, payers need to submit a calculation of insurance premiums no later than the 30th day of the month following the billing (reporting) period. There are no separate deadlines for submitting calculations on paper or electronically.

In the calculation of insurance premiums in 2021, both periods are reflected in one line, only with different codes.

For each billing period, the accountant enters his own code in the reporting. We described further how to designate the billing period when calculating insurance premiums in 2021, and what code to use.

Important:

The following sections of the report must be submitted: title, section 1 with its subsections, appendix 2 relating to section 1 and section 3. The remaining sections are provided for employers who made payments and disbursements at tariffs different from the standard.

Accrual of vacation pay for periods not fully worked

When determining the period of work for which an employee is granted paid rest, the following time is not taken into account:

- receiving average earnings;

- illness, maternity leave;

- unpaid leave;

- additional days off to care for a disabled child;

- downtime due to the fault of the enterprise;

- other cases provided for by law.

When subtracting the listed periods, it turns out that the employee did not work the entire period calculated for vacation, but only part of it. This results in an incomplete rest time that needs to be determined.

To find how many calendar days of the pay period the employee is due for vacation, you need to perform several mathematical operations:

1. Calculate the number of days worked in a part-time working month: Td. = 29.3 : Td.m. × Tot.d., where:

- Td.m. – number of calendar days of the month;

- That.d. – number of days actually worked.

2. Determine the amount of average daily earnings using the formula: SD. = Z: (29.3 × Tm. + Td.), where:

- Z – total amount of earnings accrued for the period;

- Tm. – number of fully worked months;

- etc. – the number of days worked in a part-time working month (see clause 1).

If there are several incomplete months in one period, the calculation should be made separately for each of them, and then the results should be summed up.

Interpretations of the concept of “billing period”, its main economic functions

Before considering the meaning of the billing period in economics, we will give an example of its definitions in various spheres of economic life. For example, in the gas industry, the billing period denotes the period for which it is necessary to determine the gas consumption made by an individual consumer, issue him an invoice and wait for payment to be made.

That is, in the situation considered, the billing period is regular time periods. In the case of lending, the situation will be slightly different: the billing period is the time from the first loan payment to the last, that is, until the amount is paid in full. It can be noted that even if the type of product for which the calculation is made changes, we are still dealing with full repayment of the debt.

The first and most important function of the billing period is to determine the time frame for carrying out financial transactions. After all, if the billing period did not exist, then financial transactions could be carried out without time restrictions: pay for utilities (for example) not monthly, but after countless years, without fear of turning off water/light/gas and so on. The absence of a specific settlement period would turn all entrepreneurs on Earth into global creditors, and the entire ordinary population into global debtors.

The second function: the billing period makes possible the existence of such a thing as financial statements, because the balance sheet is a list of all income and expenses of the enterprise for a specified time, that is, for billing periods. Financial reporting allows you to analyze the reliability and profitability of enterprises and assess risks.

The third feature, billing periods, allows people to track changes in their budget, their expenses, and their income. In many families today, all receipts are reviewed monthly or weekly, and all purchases made in stores are analyzed. Then the expenses received are compared with income, and a conclusion is made about the correct or incorrect spending of money. Thus, we can conclude that the absence of the term “accounting period” in the economic system would make any.

Stay up to date with all the important events of United Traders - subscribe to our

When we actively use a bank card, a lot of various operations (transactions) go through its account - these are payments in stores, online payments, automatic debits, through an external transfer or terminal. Moreover, during all these calculations we can spend both our own money and the bank’s money, or even all together in different proportions. In order not to get confused in all these cash flows, one day it was decided to sum up the official summary of all relationships between the bank and the credit card holder once a month.

A billing period is a period of time between two calendar dates during which all credit card transactions are recorded: expenses and top-ups. It is used for calculating and paying interest, as well as determining. Typically this period is one month or 30 days.

Correct use of the billing period is the key to successful management of your finances, the key to financial well-being and bank trust. Conversely, neglect of these cherished dates is the most common cause of delays and damaged credit histories.

Let's see why. First, the billing period is used to determine how long the credit card's grace period is valid. If we want it to last as long as possible, then we should make the main expenses on the card as close to the beginning of the period as possible. For example, if the start date of the billing period is the 1st day of each month, then the 55-day period (the exact duration depends on the card and bank) will be calculated from the same date. If we buy something on credit at the beginning of the month, we will get 55 days to pay our debt without interest; if we buy something at the end of the month, we will get only 20 days.

Secondly, the end date of the billing period is the deadline for paying interest, the minimum payment or full repayment of the loan. Please note that by this time the money should already be in the card account; on the last day it is actually debited. If you wait until the last minute, send money to the card (by transfer, through a terminal, or something else) only on this day, then there is a high chance that it will not have time to reach the bank, and you will end up with an overdue debt with all the ensuing consequences.

Thirdly, the exact start dates and duration of the settlement period are not constant and the same for all banks. Some adhere to the beginning and end of the calendar month, others use the date of issue of a specific card. If you hope that all banks use the same dates, it is easy to miscalculate and make a purchase at the most inopportune moment or be late with the next installment to repay the loan. And if you have several cards, and each credit card has its own billing period, you can again confuse it due to your own carelessness.

To get rid of all these problems and learn how to use the billing period correctly, you need to follow a few simple rules:

- Always carefully study the terms of the loan agreement, and, if something is unclear, check all the necessary dates with a bank employee.

- Try to issue all cards at approximately the same time, preferably at the beginning of the month, in order to maximally equalize the start and end times of the billing period.

- Strive to pay off your loan with plenty of time to avoid situations with same-day payments.

- If you have a large purchase coming up with a card, it is better to make it at the beginning of the period, so that as much time as possible passes before the first payment or full repayment of the loan, and you have time to earn or collect the required amount.

From 2021, new billing period codes have been installed in the calculation of insurance premiums. Below we have provided new codes in the form of a convenient table and their decoding for 2021.

An example of calculating average daily earnings for an incomplete period

Consider the situation: an employee will be granted paid leave from June 15, 2021. The monthly billing period for payments is from 06/1/15 to 05/31/16, this time was not fully worked: from February 18 to 25, the employee was sick. In addition to sick leave payments, the employee is due a salary totaling 240 thousand rubles.

Let's make the calculation:

- Number of days for fully worked months: 11 × 29.3 = 322, for February: 29.3: 29 × 21 = 21.

- In total, the following will be used to calculate vacation pay: 322 + 21 = 343 days.

- Average daily earnings will be: 240,000: 343 = 699.7 rubles.

What to exclude from the billing period

The following days should be excluded from the calculation period when:

- The employee was paid the average salary. By such days I mean periods of paid vacation, business trips (with the exception of the period of feeding a child);

- The employee was on sick leave or maternity leave;

- The employee took leave at his own expense (without pay);

- The employee took additional paid time off to care for people with disabilities;

- The employee, for reasons beyond the control of the employer or the employee himself, did not work. For example, days of power outages;

- The employee was released from work.

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

Calculation period of sick leave benefits

An officially employed employee has the right to receive financial compensation for a period of illness if the fact is confirmed by a doctor and sick leave is provided. The period for calculating the amount of payment is considered to be 2 years. The amount is calculated based on total earnings for the period by multiplying it by the compensation coefficient and the number of days of disability. The resulting number is divided into 730–732 days.

When making payments to employees, it is extremely important to correctly determine the period for which payments are due to an individual. The established time limits directly affect the average salary and many other social benefits and compensations.

Responsibility for violations in reporting

If, when checking the report, the inspector finds an error, the company will be notified of its elimination in electronic or paper form. At the same time, the period established for eliminating the error is 5 working days when sending an electronic notification and 10 when sending by mail. If the company, for any reason, ignores the inspector’s requirement, the calculation receives the status of unrepresented. For this, the company will be fined in the amount of 5% of the calculated insurance premiums for each month of delay.

The amount of the fine cannot exceed 30% of contributions, but it cannot be less than 1000 rubles.

The legislative framework.

in the individual conditions of working with the bank, the billing period was defined as a “calendar month,” so when I made the calculation, I finished it on the last day of the current month, although it started not on the 1st, but on the 5th, but the bank I counted from 5th to 4th, so we got different numbers that influenced the percentages that appeared on their part addressed to me.

Is there any prospect of challenging the illegality of these charges or is it logical that the calendar month should have at least 28 days and then the truth is on their side?

Hello, if your agreement with the bank specifies the billing period as a “calendar month”, then in accordance with clause 3 of Art. 192 of the Civil Code of the Russian Federation, the billing period in your case will expire on the corresponding date of the last month of the established period. Those. for January 2021 - this is the period from January 1 to 31, for February 2021 - this is the period from February 1 to 29, for March 2016 - this is the period from March 1 to 31 inclusive. But it’s not clear why your billing period starts on the 5th, if the billing period is a calendar month, i.e. from the 1st day of the month until the last day inclusive, therefore, they cannot judge the legality of the bank’s demands without seeing the contract and working conditions.

How to calculate vacation days

The labor legislation of the Russian Federation determines the minimum duration of labor leave at 28 calendar days. In addition to the minimum labor leave, legislation may grant an employee the right to additional leaves, due to which the total duration of labor leave is increased. Calculation of the number of vacation days in this case will include additional days of vacation for work in harmful (dangerous) working conditions, in conditions of irregular working hours, etc. Certain categories of workers also have the right to extended vacation: military personnel, medical workers, miners, etc.

Calculation of an employee's vacation days when granting the next vacation is carried out based on the number of unused days of labor leave in the previous and current working year.

Calculation of vacation pay: for what period to make

Calculation of the vacation period (or payroll period) is necessary for the correct calculation of average daily earnings, on the basis of which vacation pay and compensation for unused vacation are paid (payment of compensation can be made both upon dismissal and when replacing part of the vacation with monetary compensation to a working employee).

According to the general rule of Article 139 of the Labor Code of the Russian Federation, the billing period is defined as 12 calendar months before the month the employee is granted leave. It begins on the first day of the first month and ends on the last day of the last month of the billing period.

To determine the average daily earnings, the salary accrued to the employee for this period is divided by 12 and by 29.3 - the legally established average number of calendar days in a month. This formula is used to calculate vacation pay in calendar days.

The billing period includes only the time during which the employee actually performed work functions. Periods excluded from the calculation of vacation pay:

- periods of temporary disability, including maternity leave for employees;

- leaves without pay, absenteeism;

- periods for which the employee was paid the average salary or part of it (vacation under a collective agreement, downtime) and others.

The calculation of vacation pay for past periods is carried out in a manner similar to the calculation of vacation for the current working year. If an employee has unused vacation for previous years, a calculation period of 12 calendar months preceding the month of his going on vacation will be taken to calculate vacation pay.

To calculate vacation pay, it is necessary to determine the period for which the employee’s average daily earnings will be calculated. This period is called the settlement period. The total amount of vacation pay is determined from the average daily earnings and the duration of the vacation.

For what period are vacation pay accrued? The determining factor for this is the length of time an employee has worked for a given employer before going on leave. The calculation period for calculating vacation pay directly depends on whether the employee has worked for the employer for a full year or not. If you have worked with the employer for more than a year before going on vacation, the period for calculating vacation pay includes 12 calendar months before the month the employee goes on vacation. The period for calculating vacation pay is calculated according to the actual length of the month - from the 1st to the last day of the month inclusive (for example - in August to the 31st, in February to the 28th or 29th, etc.)

What period should I take to calculate vacation pay when providing vacation to an employee who has not worked a full year for a given employer? In this situation, all the time worked by him with the employer before going on vacation must be included in the billing period. All days of work must be included in the calculation - from the first day of hiring to the last day of the month before the month of going on vacation. For example, an employee was hired on January 10, 2015, and was granted leave from September 14, 2015. The calculation period will include days from January 10 to August 31, 2015. The same procedure will apply when part of the billing period falls on the current calendar year, and part on the previous one (for example, from November 1, 2014 to July 15, 2015).

The Labor Code (namely, Article 139 of the Labor Code) allows for an alternative option for determining the pay period. For example, in a collective agreement (agreement), regulations on wages or a local act, an employer may establish that the calculation period for vacation pay in an organization is 6 months. The only condition for introducing an alternative pay period is that the situation of workers does not worsen. In the event that the procedure established by the employer for calculating the working period turns out to be less beneficial for employees, the calculation of vacation pay must be carried out according to the rules established by labor legislation.

When calculating vacation pay, certain periods established by law are excluded from the billing period. Among them are periods paid according to average earnings, time spent on unpaid leave, and others.

Calculation of average wages. Other periods...

Is it possible to provide other periods for calculating average wages? Yes, it is possible, if it does not worsen the situation of workers and is enshrined in a collective agreement or a local regulatory act (Article 139 of the Labor Code of the Russian Federation). But, having chosen a different period, the accountant, when calculating average earnings, needs to make the calculation twice:

- Based on 12 months;

- Based on another period established in the organization.

The resulting amounts will need to be compared. And if in the second case the average earnings turn out to be lower than the average earnings calculated for 12 months, then another period cannot be applied.

Further, when calculating average earnings, it is necessary to exclude from the calculation period the time that is named in paragraph 5 of Resolution No. 922. For example, the time when the employee maintained average earnings, when the employee was sick, and other times is excluded from the calculation period.

In general, at first glance, there should be no difficulties in the calculation. But non-standard situations may arise, for example, if the employee did not work during the billing period or the entire time of the billing period should be excluded. What to do in such cases?

Examples of calculating average earnings. Determining the days of the billing period

Situation 1. Calculating average earnings for a business trip

The employee went on a business trip on April 15, 2021. The billing period will be from April 1, 2021 to March 31, 2021. But at this time the employee was on maternity leave. And we know that this time should be excluded from the calculation. What to do in this case?

Solution

: let us turn to paragraph 6 of Resolution No. 922, which states: “... in the event that the employee did not have actually accrued wages or actually worked days for the billing period or for a period exceeding the billing period, or this period consisted of time excluded from the billing period period in accordance with paragraph 5 of Regulation No. 922, average earnings are determined based on the amount of wages actually accrued for the previous period, equal to the calculated one.”

From this norm we conclude: to calculate average earnings, the previous period equal to the billing period should be used. In this situation, from April 1, 2015 to March 31, 2021.

But a situation may arise when the employee did not work both during the billing period and before the start of the billing period. What to do in this case? Consider the following situation.

Situation 2. If the employee did not work during the billing period

The employee was hired on April 1, 2021, and on April 15, the employer sent her on a business trip. Paragraph 7 of Resolution No. 922 states: “... if the employee did not have actually accrued wages or actually worked days for the billing period and before the start of the billing period, the average earnings are determined based on the amount of wages actually accrued for the days actually worked by the employee in the month of occurrence of an event that is associated with the preservation of average earnings.” Accordingly, the calculation period will be from April 1, 2017 to April 14, 2021 inclusive.

Calculation period for accruing the cash back bonus.

Cash back is credited on each last day of the spending period. At the same time, its size cannot exceed 3,000 rubles. (everything higher is burned). If the client has several cards and the total cash back exceeds this threshold, then it will be credited in proportion to the money spent.

Cash back is calculated based on:

- 1% for all payment transactions during the settlement period (max. RUB 3,000)

- 5% for increased bonus categories (they change at the discretion of TKS, for example, in October, November and December 2014 - gasoline, automobile services, pharmacy chains, transport) (max. RUB 3,000)

- Up to 30% on special offers from bank partners (you can activate them in your online account or in the application for your mobile device). If a refund was made under a special offer, and the client has already received a reward, the bank will write off the accrued bonuses from the account. The maximum bonus amount can be 6,000 rubles. If a client has several TKS cards, and the total amount of bonuses for them exceeds this threshold, then bonuses will be awarded in proportion to 6,000 rubles. on all cards.

For example, if you spend about 10,000 rubles per month on a card. and have a balance of 30,000 rubles, then in a year you can return about 4,700 rubles.

Calculation period in the 4-FSS report

Some lines and columns of the 4-FSS statement are filled in with an accrual total. That is, from the beginning of the year (from the date of registration) to the end of the reporting period (deregistration with the Federal Tax Service).

Example

The accountant of Lik LLC submits the 4-FSS calculation for the 3rd quarter of 2016. The company was founded in March 2014 and is still operating today. The accounting records include the following data:

| Data | Period | |||

| 01.01.2016-30.09.2016 | July | August | September | |

| Amount of accrued wages | 1 134 874,33 | 97 345,76 | 99 544,33 | 101 230,40 |

| Contributions accrued 2.9% | 32 911,36 | 2 823,03 | 2 886,78 | 2 935,68 |

| Contributions paid 2.9% | 32 108,24 | 2 987,83 | 2 823,03 | 2 886,78 |

| Contributions for injuries accrued 0.2% | 2 269,75 | |||

| Contributions paid for injuries 0.2% | 2 214,46 | |||

When filling out the title page in the “Reporting period” field, the accountant entered code 09, that is, the calculation is submitted for 9 months with a breakdown of information for the last 3 months: July, August, September.

An example of filling out the form can be seen here: