How are rights and responsibilities distributed when issuing a bank guarantee?

A bank guarantee (or bank guarantee) is a credit institution’s obligation to pay a third party’s agreement if it does not fulfill its terms.

Widely used in government procurement, in this way suppliers guarantee the execution of contracts or participation in tenders. Warranty obligations are documented. They represent one of the risk insurance tools. There are three parties involved in registration:

- principal;

- beneficiary;

- guarantee.

Trilateral cooperation is mutually beneficial. Each side has certain bonuses. Of course, drawing up guarantee obligations is not always convenient and beneficial for the main debtor - the principal. But in some cases, obtaining a bank guarantee is the only way to conclude a contract. For example, it is necessary to carry out procurement activities within the framework of 44-FZ. It will not be possible to receive a profitable state or municipal contract without registration.

Parties of the bank guarantee:

| Transaction side | Definition | The terms of participation |

| Principal | This is the main debtor who must fulfill the obligations determined by the agreement, loan, contract. At the initiative of the principal, a guarantee is issued. | For the debtor, receiving a bank guarantee is an admission to concluding an agreement or receiving a loan. In the absence of warranty obligations, the principal will not be allowed to bid or purchase. Upon receiving admission, the company enters into a contract or receives the required asset. |

| Beneficiary | Debtor's creditor. This is the company or person to whom the guarantee will be paid if the principal defaults. | Fully insured against financial risks. The terms of the contract are either fulfilled in full, or the beneficiary receives compensation in the form of a guarantee. It is paid even in case of partial non-fulfillment of the contract. |

| Guarantee | Credit and financial organization. For example, a bank, insurance company, financial institution. An entity that undertakes to pay the principal's warranty obligations. | Receives a commission. For example, as a percentage of the guarantee amount or in a fixed amount. The fee for providing guarantee obligations is an additional source of income for the credit institution. |

Documents and grounds for accounting for guarantees

All transactions and operations of the company must be reflected appropriately in accounting. Issuing a bank guarantee is no exception. But regardless of which accounting accounts the transactions will be reflected in, supporting documents are required.

According to Ch. 23 of the Civil Code of the Russian Federation, an agreement between the principal and the guarantor is not a mandatory condition for cooperation. For example, the procedure for providing a bank guarantee is specified in the main contract. But banks require you to sign a separate agreement to provide a guarantee. It is this document that will be the basis for reflecting the bank guarantee in accounting.

The BG is issued in the form of a paper document or an electronic certificate is issued. Both documents have the same legal force. But the electronic one must be certified by enhanced qualified signatures of the parties. Both electronic and paper versions must disclose the key terms of provision. This is the guarantee amount, validity period, terms of provision and commission amount.

Reflection of a bank guarantee in budget accounting

But before reflecting the BG in the accounting records of a budgetary institution, you need to make sure that the guarantee is registered in the register of bank guarantees of the Unified Information System for the procurement of goods, works and services. The said register must contain information such as the details of the guarantor bank, the validity period of the BG, as well as the amount that the guarantor will pay to the beneficiary if the principal fails to fulfill the terms of the contract.

According to special Instruction No. 157N, in a budgetary institution, bank guarantees are accounted for in off-balance sheet account number 10, which is intended to ensure the fulfillment of obligations. It is important to remember that the amount of the bank guarantee must necessarily be equal to the amount of the obligations that it secures. And if a bank guarantee has arrived, the entries in budget accounting look like this.

When crediting occurs, the BG is reflected in the off-balance sheet account “ten” as an increase in the amount of the liability with a “plus” sign. When the obligation expires, it looks like a decrease in this off-balance sheet account by the amount of the obligation with a minus sign. In this case, movement, both in debit and credit, is not expected.

Obtaining guarantees: registration with the beneficiary

To reflect the received bank guarantee in the beneficiary's accounting, a separate off-balance sheet account 008 is provided. The cost of the guarantee cannot be accepted into balance sheet accounts.

Upon receipt, reflect the amount on account 008 “Securities for obligations and payments received” by debit operation. It is necessary to provide analytical accounting for each collateral received. The write-off of the bank guarantee upon full fulfillment of obligations should be reflected in the credit turnover on account 008.

Accounting for a bank guarantee received:

About some features of bank guarantees

Bank guarantee is widely used for:

- Ensuring obligations during participation in competitive and tender procedures. Such a guarantee gives the customer confidence that the counterparty who won the contract will fulfill its obligations according to the established deadlines.

- Guarantees of fulfillment of obligations. This type of bank guarantee document acts as collateral and, when requirements are not met, assures the beneficiary that compensation will be received.

- In order to act as a guarantee for the return of the advance payment. This is due to the fact that one of the requirements of executing firms in most cases is the need to provide an advance. This leads to certain risks for the beneficiary. Therefore, this guarantee document makes it possible, under certain circumstances, to return the advance payment.

Before reflecting a bank guarantee in the accounting records of a budgetary institution, you need to check its mandatory registration in the state register. To do this, you need to go to a special website that contains information about:

- Where is the banking organization located and what is its name, indicating its TIN.

- What amount of money must be paid by the institution that acts as a guarantor in the event of failure to comply with the terms of the contract or contractual agreement by the executor.

- What is the validity term of a bank guarantee? This is one of the most important points.

In order to record a bank guarantee in a state institution and in a budget institution, you can find information about the principal’s data in the register (his actual address, full name, identification number). There you can also see a copy of the contract for the execution of which a guarantee document is provided. The entire list of documentation must be endorsed with a special electronic signature.

Obtaining guarantees: accounting with the principal

Officials' opinions on whether the principal's bank guarantee is registered vary. Some experts believe that debtors should not reflect warranty obligations in their accounting. This is explained by the fact that the principal does not receive the money in fact. The guarantee is issued for the beneficiary. And it is issued by the credit institution, and not by the principal himself. Consequently, there is no reason to make entries for a bank guarantee in accounting.

The second opinion obliges the principal to record the bank guarantee in off-balance sheet accounts. Which account the company will use should be determined in its accounting policy. For example, account 008 or 009 “Securities for obligations and payments issued.”

The need to reflect the principal in the accounting is due to the fact that this allows you to show information:

- about a change of creditor;

- on the imposition of additional sanctions for non-fulfillment of the contract;

- on changing the conditions for providing a bank guarantee.

IMPORTANT!

If the receipt of a bank guarantee is classified as a major transaction, disclosure of information about it is mandatory in the financial statements. It is necessary to organize reliable accounting of guarantee obligations on off-balance sheet accounts.

How to keep accounting records for the principal

It is believed that BG should be accounted for in off-balance sheet accounts 008 and 009, but this is not entirely true, because the security was received for the creditor and was not issued by him personally, but by the guarantor. As a result, you don’t need to keep records yourself.

Do I need to pay VAT? When issued by a bank or credit institution, no (according to 395-1-FZ). This rule does not apply to those issued by an insurance company.

Although the guarantee itself is not subject to income tax, it is issued for transactions that are subject to it. Moreover, if the final operation is carried out without VAT, then it is impossible to apply input VAT to the deduction.

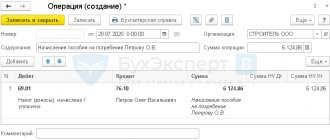

If there is a need to provide a bank guarantee for payment obligations for products, the following entries are generated:

- Transfer the reward to the guarantor: Dt 76, Kt 51.

- Include in other expenses: Dt 91, Kt 76.

- Take into account the amount of remuneration to the guarantor in the total cost of the goods: Dt 41, Kt 76. Accept the goods for accounting: Dt 41, Kt 60.

- If the debt to the lending institution is repaid, but arose to the guarantor: Dt 60, Kt 76.

If the obligation to repay borrowed funds is secured by a bank guarantee, the entries should be as follows:

- Get a loan: Dt 51, Kt 66.

- Interest under the loan agreement is included in expenses: Dt 91, Kt 66.

- Debt to the guarantor in terms of reimbursement of the amount paid by him to the creditor: Dt 66, Kt 76.

Failure to fulfill obligations: accounting features

If the obligations of the main debtor are not fulfilled on time or not in full, then a warranty case occurs. That is, the beneficiary makes claims against the guarantor.

Requirements are documented. The creditor must send a written request to the guarantor. Documents confirming the occurrence of a warranty claim should be attached to the letter. That is, papers confirming the fact of non-fulfillment of obligations. These can be acts, conclusions of commissions, photographs, etc.

The guarantor reviews the beneficiary's claims and makes a decision. If the claim is accepted, the beneficiary’s accounting records the following transactions:

An example of reflection in the accounting of a beneficiary

Buyer LLC and Supplier JSC entered into an agreement for the supply of goods with deferred payment. JSC Supplier requested a guarantee for the full amount of delivery of goods - 800,000 rubles.

The beneficiary (JSC Supplier) will account for the bank guarantee in the accounting department as follows:

| Operation | Debit | Credit | Amount, rub. |

| A bank guarantee was received from the bank under an agreement with LLC “Buyer” | 008 | — | 800 000 |

| The goods were shipped according to the contract | 62 | 90 | 800 000 |

The principal (Buyer LLC) did not fulfill the obligation to pay for the delivery. For failure to fulfill obligations, the beneficiary filed a claim with the bank. The banking organization accepted the claim from Supplier JSC. The bank guarantee was transferred in full to the benefit of the beneficiary.

The beneficiary reflected the transactions in accounting:

| Operations | Debit | Credit | Sum |

| A bank guarantee has been received in the current account | 51 | 76 | 800 000 |

| The offset of the received guarantees from the bank in favor of the debt under the agreement is reflected | 76 | 62 | 800 000 |

| Payment security under the contract has been written off | — | 008 | 800 000 |

IMPORTANT!

When fulfilling the principal's obligations, only transactions on off-balance sheet accounts are reflected in accounting.

Specifics of bank guarantee documents

In order to record bank guarantees in a budgetary institution, it is necessary, first of all, to understand the mechanism for issuing it and the specific features of the document.

Three parties take part in the preparation of this type of guarantee, which are called:

- The beneficiary is the name given to the person who lends to the principal.

- Principal - is the debtor according to the application or contractual agreement, the execution function of which lies with the bank guarantee.

- Guarantor - acts as a person who is responsible for issuing the guarantee security and is obliged to pay the creditor funds if he provides an official notification of the need to pay them according to the conditions specified in the bank guarantee document.

When accounting for a bank guarantee in a government institution , you should know that it cannot be revoked at the request of the guarantor who issued it. Also, the beneficiary cannot transfer to a third party who is not a party to this unilateral transaction the right to demand that the obligations under the guarantee be fulfilled. And it is recognized as independent of the application or contract for which it exists.

In addition, the price of such a security document is quite reasonable and affordable when compared with other similar financial instruments.

Having chosen a type of security such as a bank guarantee, accounting in the accounting department of a budgetary institution does not depend on its varieties, the most common of which are:

- Guarantee documents that secure a specific contract or agreement (for foreign economic purposes, for lending or borrowing)

- To ensure tender relations for public procurement.

- To make a customs payment.

- Guarantees that are designed to ensure the return of the advance payment.

A mandatory requirement for bank guarantees is their inclusion in a special state register of such documents. Without it, it is considered ineffective and incompetent.

Accounting for unfulfilled obligations of the principal

After payment of the bank guarantee, the credit institution submits claims to the principal. A claim is sent to the debtor demanding compensation for the cost of the guarantee obligations transferred to the creditor.

The recourse banking claim is reflected in the principal’s accounting records with the following entries:

| Operation | Debit | Credit |

| The guarantor's claims are recognized in accounting | 60 | 76 |

| Obligations to the bank have been repaid | 76 | 51 |

Example of accounting for the principal

A supply agreement for the amount of 3,000,000 rubles was concluded between LLC More and LLC Solntse. Under the terms of the agreement, More LLC issued a bank guarantee from a credit institution in the amount of 3 million rubles for 1 calendar month.

More LLC did not fulfill the terms of the agreement, and the bank paid 3 million in favor of Solntse LLC. The credit institution filed a recourse claim. The following entries were made in the principal's accounting:

| Operation | Debit | Credit | Sum |

| The guarantor's claims are recognized in accounting | 60 | 76 | 3 000 000 |

| Obligations to the bank have been repaid | 76 | 51 | 3 000 000 |

Accounting in the budgetary sector

Explanations on how to keep records of bank guarantees in a budgetary institution were given by officials in the official letter of the Ministry of Finance dated July 27, 2014 No. 02-07-07/31342.

The transaction is reflected on the balance sheet:

Grounds for write-off: the contractor fulfilled the terms of the contract or violated them, or the contract was terminated in the prescribed manner.

IMPORTANT!

In the case of a collateral form of security carried out on the basis of Art. 96 of Law No. 44-FZ, recording cash receipts on off-balance sheet account 10 is unacceptable!

The contractor violated the terms of the contract, the bank transferred the money to a budgetary (autonomous) organization, accounting of the bank guarantee received in this case:

- Dt 2.201.11.510 Kt 2.205.41.660 - reflects the receipt of funds from the bank under an official guarantee to the current account. Simultaneous increase in off-balance sheet 17 KOSGU 140;

- Dt 2.205.41.560 Kt 2.401.10.140 - income is accrued on funds received under a bank guarantee.

Procedure for accounting for bank guarantees

Current legislative norms put forward several principles for accounting for bank guarantees in the reporting of budgetary organizations:

- The transaction is recorded strictly on the day the guarantee document is received;

- The amount specified in the document must fully comply with the obligations of the public procurement contract;

- On the day the financial obligations expire, the guarantee amount is written off from the off-balance sheet account 10

In order to reflect the funds received under the guarantee in accounting, the following posting system is used:

1) Dt 2.201.11.510 Kt 2.205.41.660 - funds received to the personal account of the BU (payment to the beneficiary of the amount for which the GB was issued);

2) Dt 2.205.41.560 Kt 2.401.10.140 - accrual of income in the amount of security for the budgetary fund if it comes into the possession of a budgetary institution.

Accounting in government institutions

A bank guarantee and accounting in the accounting departments of government institutions are carried out differently. When funds are received into a current account, they are accounted for according to KFO 3, since they are received at temporary disposal and are required to be transferred to budget revenues. Accounting entries for transactions depend on the powers delegated to a particular government institution to administer budget funds.

Postings for accounting in a government institution are reflected in the table:

| Operation | Debit | Credit | Notes |

| Funds under the bank guarantee were received in accordance with the established procedure | KIF 3,201 11,510 | GKBK 3 304 01 730 | For PBS, RBS, GRBS and budget revenue administrators |

| Guarantee funds transferred to the budget | GKBK 3 304 01 830 | KIF 3,201 11,610 | |

| Accrued profit from receipt of funds to the budget | KDB 1 209 40 560 | KDB 1 401 10 140 | For budget administrators |

| Calculations by the administrator of budget revenues are reflected | KDB 1 304 04 140 | KDB 1 209 40 660 | For limited administrators only |

| The guarantee amount is credited to the budget | KDB 1 210 02 140 | KDB 1 209 40 660 | Only for administrators with full privileges |

Bank guarantee: tax accounting

Let's determine how to keep tax records of a bank guarantee in 2020:

- Income tax. Bank guarantees are not taken into account in the base for calculating income tax until it is received in cash and income is accrued. Such instructions are contained in subparagraph 2 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

- VAT. The amount of the bank guarantee is not taken into account when calculating the base for value added tax. Why? Funds received under a bank guarantee are not income from the sale of goods or provision of services, and therefore should not be taken into account in VAT calculations.

- USN. Guarantee funds accounted for in off-balance sheet account 10 should not be included in the calculation of the tax base (Article 251, 346.15 of the Tax Code of the Russian Federation), since this is a liability, not income. When crediting money to a current account under a bank guarantee, the amount should be reflected when calculating income under the simplified tax system. Receipts are included in non-operating income when calculating the single tax.

We reflect the bank guarantee in tax accounting

When accounting for bank guarantees for taxes, we comply with the norms of the Tax Code of the Russian Federation. Registration of receipts is recorded as other costs of production and sales of products. A number of tax reports have a section that reflects the accounting of the bank guarantee in tax accounting - the costs of the security must be demonstrated to the Federal Tax Service in the reporting period when it was actually provided. We reflect on the fact of provision, and not on the timing of payments. The day of receipt of guarantee obligations is the date of signing the agreement with the guarantor bank.

When accounting for taxes on collateral, do not forget about the following rules:

- The purchase of goods, works and services under a government contract is subject to VAT. The exception is tax-exempt products.

- The use of warranty options is not subject to VAT (clause 3, clause 3, article 159 of the Tax Code of the Russian Federation).

- The guarantee payment transferred by the guarantor for the dishonest actions of the principal is included by the beneficiary in income in the same way as non-guarantee proceeds would be taken into account.

- Expenses for a bank guarantee - commission to the bank - are taken into account for tax accounting purposes as other or non-operating expenses.

- Security costs are recognized in equal parts for the entire duration of the agreement with the guarantor (letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/4 dated January 11, 2011).

Accounting for commission on bank guarantee

Issuing a bank guarantee is a paid service. The commission set by the bank is one of the sources of income for the financial institution. The fee for providing warranty obligations is determined as follows:

Moreover, the bank has the right to establish a special procedure for repaying the commission fee. For example, the principal will pay the commission in one amount. Or the bank guarantee fee is charged monthly, similar to loan payments. All these conditions must be enshrined in the agreement on the provision of a bank guarantee.

The commission can be taken into account in two ways:

- Include a bank guarantee in the price of the property. This procedure is allowed only if the guarantee is issued before the property asset is accepted onto the balance sheet. After an asset has been accepted for accounting, it is not allowed to include a guarantee in the initial cost of the property.

Typical wiring:

| Operation | Debit | Credit |

| The commission is transferred in favor of the guarantor bank | 76 | 51 |

| Commission fees are included in investments in non-current assets | 08 | 76 |

| Other investments in non-current assets are reflected | 08 | 60 |

| The asset is accepted for accounting (property is reflected in fixed assets) | 01 | 08 |

- Attribute the costs of paying the commission to other company expenses. This method is used if a bank guarantee commission is presented for property that has already been accepted onto the balance sheet.

Typical wiring:

| Operation | Debit | Credit |

| The commission fee is reflected as part of the company’s other expenses | 91-2 | 76 |

Two types of entries to reflect the commission on a bank guarantee when purchasing property

The supplier of expensive equipment or the seller of the building may make it a mandatory condition when concluding an agreement with the buyer that there is a bank guarantee. In the buyer's accounting, the guarantor's remuneration will be recognized as an expense. However, the accounting for this expense will be different depending on the moment at which it was made: before the purchased property is registered or after it. In each case, a different set of accounting entries is applied to reflect the commission for issuing a bank guarantee.

- The guarantor's remuneration was paid before the acquired property was reflected in the accounting accounts.

What entries are used to record a bank guarantee from the principal in such a situation? The amount of remuneration to the guarantor is included in the cost of the acquired asset, since this expense is directly related to its acquisition (clause 6 of PBU 5/01 “Accounting for inventories”, clause 8 of PBU 6/01 “Accounting for fixed assets”).

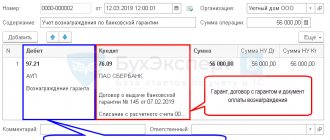

For such a case, the following set of transactions is used:

The specified accounting scheme reflects the transactions for payment of the bank guarantee and for its reflection in accounts payable until the transfer of money by the principal.

PJSC "Modern Technologies" plans to purchase an office building worth RUB 150,364,199. from Real Estate+ LLC. As security for obligations, the buyer provided the seller with a bank guarantee.

Warranty conditions:

- remuneration to the bank (4% of the transaction amount) - 6,014,568 rubles. (RUB 150,364,199 × 4%);

- Warranty period - 1 month;

- The procedure for paying the commission is the entire amount at a time.

PJSC Modern Technologies paid the commission and purchased the property from the seller. The following entries were made in accounting:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 76 | 51 | 6 014 568 | Commission transferred to the guarantor bank |

| 08 | 76 | 6 014 568 | The amount of remuneration to the guarantor is included in the cost of the building |

| 08 | 60 | 150 364 199 | The cost of the building is reflected in non-current assets |

| 01 | 08 | 156 378 767 (150 364 199 + 6 014 568) | The building is included in the principal's fixed assets |

We talk about the nuances of tax accounting for a bank guarantee in this article.

- The guarantee is issued after the value of the asset has been generated.

Here, accounting standards do not allow the amount of the guarantor's remuneration to be taken into account in the initial cost of the asset. Once the accounting value of the property has been formed, it is not allowed to change it.

In such a situation, other expenses are recognized and postings are made:

The situation is dangerous if the remuneration to the guarantor, paid before the initial cost of the asset is formed, is taken into account as part of other expenses. This will cause a distortion in the amount of property tax, which is calculated according to accounting data. Considering that from 2021 the value of movable property is excluded from the tax base, the unlawful write-off of remuneration to the guarantor as part of other expenses will distort the property tax base if the buyer purchased real estate.