Until 2013, entrepreneurs were automatically UTII payers for the relevant types of activities. Currently, the transition to UTII is voluntary, and if an individual entrepreneur or LLC does not fall under restrictions regarding its application, then they have the right to use it at their own discretion.

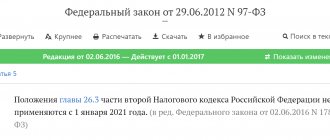

Despite the fact that working on UTII will be prohibited by the Tax Code of the Russian Federation from 2021, there is still one year left to take advantage of this optimal taxation system for small businesses.

In our material today we will find out how to register as a UTII payer in 2021.

Procedure and rules for registering UTII

Individual entrepreneurs and LLCs can register as a UTII payer only at the place of activity within the UTII framework.

If an individual entrepreneur or LLC has several stores located in different cities or districts of the city, then it is necessary to register UTII with the regional Federal Tax Service at the location of each store.

If the type of activity within the framework of UTII is not tied to a specific territory, for example, advertising on vehicles or delivery and peddling street trading, then an application for UTII registration is submitted to the Federal Tax Service at the place of registration of the individual entrepreneur or LLC.

When registering, in the case of carrying out activities in two or more territories, the application is submitted to the tax authority to which the place of business activity, indicated first in the application, belongs.

Transition period

The regulatory deadlines for the transition to UTII are established by Article 346.28 of the Tax Code of the Russian Federation. The Code regulates a five-day period during which an entrepreneur is required to submit an application to the tax authority.

The inspectorate should be notified within the established time frame only if the activity being carried out corresponds to the criteria established in the list of the first subsection of our article, and also if the entrepreneur has already actually begun to apply UTII.

In other cases, the tax authority will refuse to accept the application and register as a UTII taxpayer. The period is calculated from the date that the entrepreneur himself indicated in the application.

Ways to switch to UTII

The transition can be made voluntarily only from the beginning of the calendar year.

If an individual entrepreneur or LLC has not switched from the simplified tax system or OSNO to UTII before January 15, 2020, then it will no longer be possible to do this during 2021. Exceptions will be made for newly registered individual entrepreneurs and LLCs, for which the choice of taxation system is possible within 30 days from the date of registration.

The transition from the simplified tax system or OSNO to UTII means that you can only use UTII, and, therefore, if you previously used the simplified tax system, you must submit a notice of refusal to work on this system before January 15, 2021.

You can download the notice of refusal to work on the simplified tax system using the link located at the end of the article.

In order to start working on UTII in 2021, you must submit an application before January 5, 2021:

- for individual entrepreneurs in the form of UTII-2;

- for a legal entity in the form of UTII-1.

When adding a new type of activity for which it is possible to use UTII, you can combine UTII and the simplified tax system.

In this case, an application must be submitted no later than 5 days from the start of application of UTII:

- for individual entrepreneurs in the form of UTII-2;

- for a legal entity in the form of UTII-1.

If the place of activity on UTII differs from the place of registration of an individual entrepreneur or LLC, it is necessary to submit the following documents before submitting an application for the use of UTII or at the same time:

- TIN certificate (certified copy);

- OGRN certificate (certified copy);

- identification document of the person submitting the documents;

- power of attorney to submit documents if the documents are submitted by a representative of an individual entrepreneur or LLC.

Within five days from the date of receipt of the application for registration of an LLC or individual entrepreneur as a single tax payer, the tax authority is obliged to issue a notice of registration of UTII. The date of registration as a single tax payer is the date specified in the application submitted by an individual entrepreneur or LLC for registration as a single tax payer.

Let us explain some situations that taxpayers may encounter when abandoning the simplified tax system in favor of UTII:

Example 1

The individual entrepreneur applied the simplified tax system and sold products. Payment for the products was received already during the period when the individual entrepreneur was on UTII. What needs to be paid: tax according to UTII or according to the simplified tax system?

There is no need to pay a simplified tax; you only need to pay UTII for the period of sale.

Example 2

The individual entrepreneur received an advance payment during the period of being on the simplified tax system, and carried out the sale during the period of application of UTII. What to pay: imputed or simplified tax? You must pay tax according to the simplified tax system for the period in which the funds were received.

It is necessary to report and pay UTII at the place of filing the application as a UTII payer.

It is worth noting that simultaneously with submitting an application for registration of an individual entrepreneur, you cannot submit an application for the use of UTII. The Federal Tax Service has the right to refuse to accept these two applications simultaneously. The fact is that in order to start using UTII, it is necessary to create a basis for carrying out business activities on UTII. Such a basis, for example, could be a lease agreement for a retail space or an employment contract concluded with an employee. Such actions will confirm the fact of the start of business activity.

Deadlines for transition to payment of imputed tax

The possibility of switching to paying UTII depends on what tax regime the transferred activity was conducted in before and whether it was conducted previously at all.

The deadlines for registration of UTII for those switching to a special regime with OSNO are not specified by law. These taxpayers can start working on imputation at any time convenient for them. They don’t have to wait until the end of the year or the beginning of next month.

A type of activity that was previously carried out on the simplified tax system can be registered under UTII only from the new calendar year.

But you can conduct newly started activities on UTII from the first day of work.

As a rule, taxpayers are registered with UTII at the place of business activity, but those who plan to engage in:

- placement of advertising on transport;

- delivery and distribution retail trade or public catering through a non-stationary retail network, including without stationary halls;

- providing transportation services for passengers and cargo.

Taxpayers who register for several types of activities fill out section 2 of the UTII declaration for each type of activity transferred to UTII.

When carrying out several types of work on the territory of one urban entity, the future taxpayer needs to register UTII for each type of activity

If work is carried out within the boundaries of one city, but in territories that are under the control of various tax inspectorates, the application can only be submitted to one of them. In this case, the new imputed person will be registered with the tax office that is indicated first.

To register, entrepreneurs submit an application to the tax office in the form of UTII-2, and legal entities - UTII-1.

This might also be useful:

- Coefficients K1 and K2 UTII for 2021

- Changes in UTII for individual entrepreneurs in 2021

- UTII for individual entrepreneurs in 2021

- Reducing UTII by the amount of insurance premiums in 2021

- Increase in UTII from 2021

- Calculation of UTII for less than a month in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

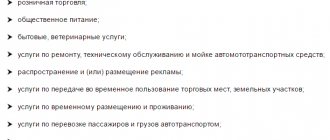

When you can’t use UTII

At no time and under any conditions is it possible to move to “imputation” if the organization or individual entrepreneur violates the following conditions:

- the number of hired personnel exceeds 100 people;

- other legal entities and organizations have a share in the authorized capital of more than 25%;

- the enterprise is a simple partnership;

- the transition of individual entrepreneurs to the simplified tax system took place on the basis of a patent;

- the taxpayer applies a single agricultural tax.

In addition, there are a large number of restrictions on the use of UTII for businessmen directly within the field of activity. Here are some examples:

- those motor transport enterprises in which the number of transport units is above 20 are not entitled to apply UTII;

- for retail sales, the sales floor area should not exceed 150 sq.m.;

- in the advertising business, only those companies that are involved in the placement or distribution of advertising can work with imputation. The production of advertising structures, leasing of advertising space or development of services are no longer suitable for UTII;

- the use of UTII is impossible if an enterprise or individual entrepreneur works not only with individuals, but also with legal entities in the types of activities falling under the “imputation”.

This is not the entire list of such restrictions. A more detailed list can be found in the Tax Code of the Russian Federation. So, before switching to “imputation”, you must make sure that both the type of activity and its conditions do not contradict the rules for applying UTII in a particular region.

Thus, the transition to imputation in the middle of the year is possible only if the organization or individual entrepreneur applies the general tax regime. It is impossible to switch from the simplified tax system to “imputation” within a year, therefore, no matter how much you would like it, you will have to wait for the new calendar year.

Comments

Maria 01/15/2017 at 18:02 # Reply

You can switch to UTII throughout the year, not only from January 1

Natalia 01/16/2017 at 12:09 # Reply

Maria, good afternoon. You have confused the concepts of “switching to UTII” and starting to “apply UTII”. You can start using UTII not only from January 1, but you can switch from another taxation system to UTII only from the beginning of the calendar year. For example, you cannot switch from the simplified tax system to any taxation system within a year. I quote from the Tax Code of the Russian Federation, Article 346.13, paragraph 3. “Taxpayers using the simplified taxation system do not have the right to switch to a different taxation regime before the end of the tax period, unless otherwise provided by this article.” If you have lost the right to use the simplified tax system, then you can only switch to OSNO within a year. It’s the same with other tax regimes - they can only be changed from the beginning of the calendar year. If you added another type of activity during the year for which you did not apply, for example, the simplified tax system, then you have the right for this type of activity to apply for the use of UTII within a year (within 5 days after the start of the activity on UTII). Thus, switching to UTII and starting to apply UTII are different concepts.

Inna 05/25/2017 at 12:56 # Reply

Strange article and strange answer, Natalia. “If you added another type of activity during the year for which you did not apply, for example, the simplified tax system, then you have the right for this type of activity to apply for the use of UTII within a year (within 5 days after the start of the activity on UTII). » — What if I didn’t add any new types of activities, but simply decided to provide services not to organizations, but to the population, which naturally fall under household services. I can use the simplified tax system for settlements with organizations, and UTII for settlements with the population. And don’t wait for your January 1st next year! Your article is not correct, it gives incorrect information.

Natalia 05/25/2017 at 01:28 pm # Reply

Inna, good afternoon. Read the letter of the Ministry of Finance of the Russian Federation No. 03-11-11/29241 dated July 24, 2013, which states that UTII and the simplified tax system cannot be applied simultaneously for the same type of activity. So you will have a violation if you provide the same services to organizations using the simplified tax system and to the population using UTII. In this case, even January 1 will not help. The letter provides an example with retail trade, but if this seems strange to you, send a letter to the Federal Tax Service for a more accurate answer. Once again I will repeat the quote from the Tax Code of the Russian Federation (Article 346.13. Procedure and conditions for the beginning and termination of the application of the simplified taxation system): 3. Taxpayers using the simplified taxation system do not have the right to switch to a different taxation regime before the end of the tax period, unless otherwise provided by this article . 6. A taxpayer applying a simplified taxation system has the right to switch to a different taxation regime from the beginning of the calendar year, notifying the tax authority no later than January 15 of the year in which he intends to switch to a different taxation regime. Quote (Article 346.19. Tax period. Reporting period): 1. The tax period is a calendar year.

07/04/2017 at 01:57 pm # Reply

You can refuse the simplified tax system until January 15. But why refuse if you can, within 5 days from the start of your activity, register for secondary registration as a UTII payer at any time of the year, maintain 2 systems in parallel, and at the beginning of the year abandon the simplified tax system?

ostapx1 07/04/2017 at 16:29 # Reply

“Should we abandon the simplified tax system at the beginning of the year?” The article says “you can refuse the simplified tax system until January 15.”

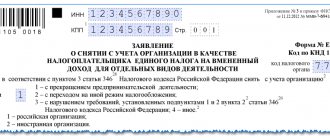

The procedure for filling out the UTII-1 form

The application form for registration as a UTII payer (UTII form-1) and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941.

At the top of the application, indicate the tax identification number and checkpoint; you can view them in the registration notice.

In the “tax authority code” field, enter the code of the tax office at the place of registration. Take it from the notice of registration of a Russian organization (clause 6 of Appendix No. 9 to the order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941).

Also, the code of the Federal Tax Service of Russia can be determined by the registration address using the Internet service on the official website of the Federal Tax Service of Russia.

In the “organization name” field, indicate the full name that corresponds to the constituent documents (for example, charter, constituent agreement).

Indicate the OGRN number in accordance with the state registration certificate. You can also view this number in the notification of registration with Rosstat.

Enter the date from which the taxation system in the form of a single tax on imputed income will be applied for certain types of activities.

Indicate the number of pages on which the annex to the application is compiled. For example, if the application contains a two-page attachment, indicate “2—”. If you attach copies of documents to the application, indicate the number of sheets that confirm the authority of the representative of the organization.

Provide information about who is submitting the application on the title page in the field “Power of attorney and completeness of the information specified in this document, I confirm.” If this is the head of the organization, then indicate “3”, and if a representative – “4”. Below, write your last name, first name, and patronymic in full - as in your passport. Next, you need to indicate his TIN and telephone number where you can contact the person who confirms the information.

On page 2 of the UTII-1 form, in the “Code of type of entrepreneurial activity” field, indicate the code in accordance with Appendix No. 5 to the Procedure approved by Order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/353. For example, if the type of activity of the organization is the provision of repair, maintenance and washing services for vehicles, then enter the code “03”. This field must be filled in (clause 20 of Appendix No. 9 to the order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941).

Enter the address at which the organization or entrepreneur will conduct the imputed activity. Namely, postal code, region code, district, city, town, street, house number, building, apartment (office). Take the digital region code from the directory in Appendix No. 2 to the Procedure, approved by Order of the Federal Tax Service of Russia dated December 11, 2012 No. MMV-7-6/941.