Gifts to employees are part of the corporate culture and an element of employee motivation. New Year's holidays, February 23, March 8, weddings, birth of a child, retirement - the most common reasons for which employers give gifts. Gifts can include, for example, sweets, flowers, souvenirs, and also amounts of money. 1C experts consider the issues of legal regulation and personal income tax taxation of gifts to employees and the procedure for reflecting them in “1C: Salaries and Personnel Management 8” edition 3.

Legal regulation and taxation of gifts to employees

The legislation of the Russian Federation allows the presentation of gifts to employees both within the framework of labor and civil relations. Article 22 of the Labor Code of the Russian Federation gives the employer the right to reward employees for conscientious, effective work.

The method of incentives is not specified in the legislation. You can reward an employee and provide an incentive for conscientious performance of duties with either a bonus or a valuable gift.

Article 129 of the Labor Code of the Russian Federation defines wages. Employee remuneration is remuneration for work, other compensation payments and incentive payments. If a payment or some kind of income in kind is included in the wage system (i.e., listed in local regulations, is of a regular periodic nature, is related to the quality of work, output, depends on position or length of service), then the word “gift” is used in the everyday sense . Formally, this gift is part of the remuneration system and, in essence, is a bonus.

From the point of view of civil relations, donation is regulated by Chapter 32 of the Civil Code of the Russian Federation. A legal entity has the right to transfer (donate) material assets to an individual (including an employee) free of charge. The gift can be dedicated to the New Year, Defender of the Fatherland Day, International Women's Day, Airborne Forces Day, employee's birthday, etc. The form of the gift agreement is not regulated by law.

The employer's intentions to give gifts to his employees should not be secured in collective and employment agreements, regulations on wages and bonuses, since such gifts are not related to the performance of job duties.

The legislation establishes the rules for giving and accepting gifts. When presenting a gift to an employee, the accountant should:

1. Determine whether the gift is related to the employee’s work achievements:

- if, for example, a gift is associated with long-term and fruitful work of an employee, then it is more correct to immediately register it as a bonus, issued in cash or in kind, and issue a corresponding order on the bonus. When giving an employee a valuable gift as remuneration for work, personal income tax must be calculated on its full value (clause 6, clause 1, article 208, article 209, clauses 1, 3, 4, article 210 of the Tax Code of the Russian Federation);

- if gifts are given, for example, on the occasion of the Spring and Labor Day (May 1), then a gift agreement should be drawn up. According to paragraph 2 of Article 574 of the Civil Code of the Russian Federation, it is mandatory to conclude a gift agreement when the donor is a legal entity and the value of the gift exceeds 3,000 rubles. It can be recommended to make it a rule when making a gift, depending on the reason and regardless of the amount, to issue either an order for a bonus or to draw up a gift agreement. The Russian Ministry of Finance, in letter No. 03-04-06/40051 dated August 12, 2014, explains that income will be considered a gift only if the gift is documented. The deed of gift serves as such a document.

2. Calculate the tax base for personal income tax and withhold tax from the employee’s income:

- According to paragraph 28 of Article 217 of the Tax Code of the Russian Federation, income exempt from taxation includes the cost of gifts received by taxpayers from organizations or individual entrepreneurs, which does not exceed 4,000 rubles. for the tax period. Thus, the employer must take into account all gifts given to the employee. When the total value of gifts for the year exceeds 4,000 rubles, the employer will have the obligation of a tax agent for personal income tax;

- in accordance with the current codes of types of income for reflection in personal income tax reporting (approved by order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11 / [email protected] ), the income code in the form of a gift “2720” provides for a deduction with code “501” in in the amount of 4,000 rubles. For some categories of citizens - veterans and disabled people of the Great Patriotic War, etc. - an increased deduction of 10,000 rubles is provided. (Clause 33 of Article 217 of the Tax Code of the Russian Federation) with code “507”;

- income exceeding the preferential amount of 4,000 rubles is subject to personal income tax. The tax rate depends on the employee's tax status. For a tax resident, the personal income tax rate is 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation), for a non-resident - 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation). Please note that preferential categories of non-residents - refugees, citizens of countries party to the EAEU Treaty, highly qualified foreign specialists, etc. - remain primarily non-residents. When receiving a gift, they pay personal income tax at a rate of 30%. If the tax status of the personal income tax changes, it is necessary to recalculate, including that calculated when giving a gift.

3. Find out whether the value of the gift is subject to insurance premiums and, if necessary, calculate them. A gift agreement is a civil law agreement that provides for the transfer of property to an employee (Clause 1, Article 572 of the Civil Code of the Russian Federation). At the same time, the organization does not have an object of taxation for insurance premiums (clause 4 of Article 420 of the Tax Code of the Russian Federation). When giving an employee a valuable gift as remuneration for work, the cost of the gift is included in the calculation base for insurance premiums in accordance with the Tax Code of the Russian Federation.

Please note that when receiving a gift, an employee should clarify that the employer, the tax agent, had the opportunity to withhold personal income tax. Information about withheld tax is contained in certificate 2-NDFL. Otherwise, the employee needs to report his income in the form of a gift received by submitting a tax return 3-NDFL to the Federal Tax Service.

Note

For information on how to determine the tax status of an individual, register him in “1C: Salaries and Personnel Management 8” (rev. 3), reflect the change in tax status in the program and calculate personal income tax, see the article “Personal income tax for non-residents: accounting in 1C :ZUP 8".

| 1C:ITS For more information on how to reward an employee with a gift, see the “HR Directory” in the “Personnel and Remuneration” section. |

Gifts for employees in 1C:ZUP 8 (rev. 3)

The 1C: Salaries and Personnel Management 8 program, edition 3, has all the necessary mechanisms for registering gifts to employees, but requires their connection and configuration.

Let's look at setting up and using the program's functionality for registering gifts using examples.

Example 1

| Employee V.S. Borovskikh, who is a tax resident of the Russian Federation, received a gift for his 50th anniversary - a bronze sculpture of a horse worth 2,000 rubles. Neither the collective agreement nor the bonus regulations for the organization Statistical Institution LLC provide for mandatory gifts to employees in honor of the fiftieth anniversary. The employer decided to give a gift, and for V.S. Borovskikh is income with code “2720”. The cost of the sculpture is less than 3,000 rubles, but upon receiving a gift from V.S. Borovskikh signed his consent to receive the gift in the gift agreement - the statement of gift delivery. Earlier during the year, the employee had already received gifts for the holidays in the amount of 2,500 rubles. |

The organization Statistical Institution LLC practices giving gifts, therefore, when setting up the 1C: Salary and Personnel Management 8 version 3 program, the corresponding option is activated by the flag Gifts and prizes are given to employees of the enterprise (menu Settings - Payroll calculation).

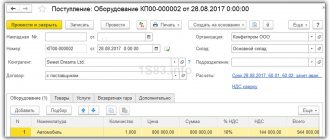

To register a gift on the Salary tab, create a new document Prize, gift and set the Gift flag (Fig. 1).

Rice. 1. Document “Prize, gift”

In the document Gift Issue Date 10/12/2018, the date of actual receipt of income is recorded. From the point of view of personal income tax, this is income with code “2720”. This income corresponds to a deduction with code “501” in the amount of 4,000 rubles. in year. In Example 1, employee received gifts in the amount of 4,500 rubles during the year. Deduction 2,500 rubles. has already been applied when delivering previous gifts. When registering the next gift, the remaining part of the deduction of 1,500 rubles is applied. Personal income tax is calculated from 500 rubles. at a rate of 13% (since V.S. Borovskikh is a tax resident of the Russian Federation) and amounts to 65 rubles. The calculated personal income tax in the document Prize, gift should be withheld at the next payment of money and transferred no later than the next day, i.e. the day following the day of payment of income.

When paying wages for September on October 15, 2018, personal income tax in the amount of 65 rubles. withheld along with the September salary tax (Fig. 2).

Rice. 2. Withholding personal income tax on income in kind when paying out funds

The gift was transferred to the employee under a gift agreement, so it did not become subject to insurance premiums.

Example 2

| Unlike Example 1, a gift agreement was not concluded upon delivery of V.S. Borovsky bronze sculpture of a horse for the anniversary. |

The cost of the gift is less than 3,000 rubles, so there was no need to conclude a gift agreement. It turns out that the gift was given within the framework of labor, and not civil relations, and is subject to insurance premiums, since it is not listed among the non-taxable payments enshrined in Article 422 of the Tax Code of the Russian Federation.

In the 1C: Salary and Personnel Management 8 program, edition 3, to register the need to withhold insurance contributions, you should set the Gift (prize) provided by the collective agreement flag in the Prize, gift document (Payroll menu - Prizes, gifts). Insurance premiums from the cost of gifts will be calculated at the next salary calculation in the document Calculation of salaries and contributions, even if this employee does not have any accruals.

Example 3

| V.S. Borovskikh received a gift envelope containing 2,000 rubles for his anniversary. |

In accordance with paragraph 1 of Article 572 of the Civil Code of the Russian Federation, an employer can give an item to an employee, and Article 128 of the Civil Code of the Russian Federation indicates that the item can also be cash.

A monetary gift from an employer not related to work activity (for a holiday, anniversary, etc.) is the employee’s income (Clause 1 of Article 210 of the Tax Code of the Russian Federation) with the code “2720”.

The cost of cash gifts, as well as gifts in kind, is subject to personal income tax in an amount exceeding 4,000 rubles. for the tax period, at a rate of 13 or 30% depending on the tax status of the employee.

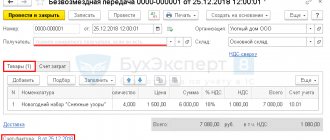

If the organization practices donating funds, then in the program “1C: Salaries and Personnel Management 8” edition 3, preliminary settings should be performed (Fig. 3).

Rice. 3. Setting up the type of payment for registering a cash gift

In the Settings menu - Accruals - Create button, you should create a new Accrual.

On the Main

follows:

- in the Name field, enter the name of the accrual, for example, “Money Gift”;

- in the Purpose of accrual field, indicate Other accruals and payments;

- in the Accrual field select

Based on a separate document; - document type set One-time accrual

.

On the Taxes, fees, accounting

in the personal income tax field, the switch must be set to the taxable field and indicate the income code - 2720.

The amount exempt from taxation (no more than 4,000 rubles per tax period) is reflected as a deduction with code “501” and in the program is applied to income with code “2720” by default. In the Income Category field, you must select Other Income.

The organization practices the execution of gift agreements for gifts of any amount, and not just for those whose value exceeds 3,000 rubles. For insurance premiums, in the Type of income field, you must select Income that is not subject to insurance premiums. Setting up Accruals is done once. To reflect a monetary gift in the program, you should create a One-time accruals document in the Salary menu. The configured accrual type “Money Gift” is selected as an Accrual in the document. For the selected employee, the amount of the monetary gift is indicated in the Result field. Personal income tax is calculated taking into account the deduction of 4,000 rubles. and all gifts (income with code “2720”) in kind and in cash registered for the employee in the current tax period (in the current year).

The date of actual receipt of income in the form of a cash gift is the day of its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). The tax withheld from such a gift must be transferred to the budget no later than the day following the day it was paid to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Normative base

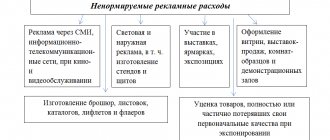

If we are talking with you about documentary confirmation of the purchase of material gifts, as well as the issuance of funds, then it would not be out of place to talk about the regulatory framework in which this regulation is precisely prescribed. In particular, paragraph 1 of Article 572 of the Civil Code of the Russian Federation determines who, from the point of view of legislation, is the donor and the recipient. The same article also states that documentary evidence of the act of transferring material assets from one person to another will be a gift agreement concluded between the parties. It’s hard to imagine that girls and women would sign contracts for bouquets of flowers... That’s how it should be, in theory.

However, paragraph 2 of Article 574 of the Civil Code of the Russian Federation informs that a gift agreement may not be concluded, but only if the nominal value of the gift does not exceed an amount equal to 3,000 rubles. Otherwise, it will no longer be possible to do without paper.

And yet, if bouquets of flowers or some other gifts for a group of employees cost more than 3,000 rubles, it is possible to reduce bureaucratic procedures to a minimum by concluding a so-called “collective agreement” with employees (Article 154 of the Civil Code of the Russian Federation). In this case, there will be no need to draw up a separate document for each employee, but it will be enough for everyone to sign on one paper.

At the same time, the process of giving gifts, the basis for which is the labor exploits of a team or one individual employee, is no longer regulated by the Civil Code, but by the Labor Code. In our article on employee bonuses, we talked about how, why and why management rewards outstanding specialists. Within the framework of the current article, a material or monetary gift for production success can be considered a bonus (Article 191 of the Labor Code of the Russian Federation).