Issuance of reports from the cash register

The first possible way to issue money to a business traveler is to issue cash from the cash register.

Money is issued by drawing up an expenditure cash order based on an application from an employee approved by the manager, or an order from the director of the enterprise. How to properly process the issuance of money from the cash register, what requirements must be met, read the article “How to fill out a cash expense order (RKO)?”

The cash order will reflect the correspondence of the accounting accounts:

Dt 71 “Settlements with accountable persons” (71-1, 71-2) Kt 50 “Cash” (50-1).

The use of subaccounts depends on the adopted working chart of accounts (clause 4 of PBU 1/2008).

To ensure consistency between the work of the accountant and the computer accounting programs used, it is advisable to approve the subaccounts recommended by the developers. For example, it is advisable to count. 71 use subaccounts:

- 71-1 - for payments in rubles;

- 71-2 - in currencies.

You can open sub-accounts for account 50:

- 50-1 “Organization cash desk”;

- 50-2 “Operating cash desk”;

- 50-3 “Money documents”.

When issuing money from the cash register, the posting will look like this: Dt 71-1 Kt 50-1.

When traveling abroad, it is allowed to issue money in foreign currencies. Reflect the receipt of money to the cash desk from a foreign currency account by posting Dt 50 Kt 52.

In this case, it is advisable to create a separate sub-account for account 50 for each type of currency. Reflect the issue from the cash desk in foreign currency for a foreign business trip by posting Dt 71-2 Kt 50 (sub-account corresponding to the currency).

If funds for a business trip are issued in foreign currency, then exchange rate differences appear. Exchange rate differences will arise if the date of receipt of currency at the cash desk and the date of its issue do not coincide. It is necessary to determine the difference between the amounts recalculated at the official rate for each date - the date of receipt of money in the cash register and the date of its issue.

Reflect the positive exchange rate difference in accounting by assigning it to other income of the organization: Dt 50 (corresponding subaccount) Kt 91-1.

The negative difference goes to the organization's expenses: Dt 91-2 Kt 50 (corresponding subaccount).

ConsultantPlus experts explained in detail how to take into account the costs of renting an apartment for employees on a business trip. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Reflection of travel expenses in accounting

An approved advance report - in Form AO-1 or an independently developed form - with documents attached to it confirming expenses incurred in the interests of the company will serve as the basis for reflecting these expenses in accounting.

The accountant, when checking the advance report, makes an adjustment calculation of daily allowance (if the business trip was shorter or longer than planned) on the basis of travel tickets, from which he takes the departure date and return date. The departure day is considered to be the current day if the departure time on the tickets is before 24:00 inclusive, and the next day is from 00:00.

REMINDER! If the trip was made by personal transport, then the daily allowance is calculated according to the waybill and accommodation invoices, according to which the accountant can track the date of arrival and departure to calculate the day on a business trip.

If there are no travel documents, as well as papers confirming the fact of residence at the place of business trip, the employee provides an official note about the actual length of stay on the business trip, confirmed by the record of the receiving party. The responsible person of the organization to which the employee was sent must put a mark on the date of arrival and departure (clause 7 of the Regulations on business trips dated October 13, 2008 No. 749).

If an employee has used official or personal transport and needs compensation for its use and gasoline, then he must submit a memo, a waybill that calculates the mileage traveled, and attach invoices and receipts for the purchase of fuel. The possibility of reimbursement of such expenses should be provided for in the accounting policy.

Housing rental documents confirming payment must also be checked: checks, receipts, rental agreement, receipt from the owner of the house or apartment. During the verification, the amount actually paid and confirmed is taken into account and approved.

Travel allowances are transferred to a personal card

Currently, non-cash payments using bank cards are becoming widespread. Issuing travel allowances is no exception. It is also possible to transfer accountable amounts to an employee’s salary card (letter of the Ministry of Finance of the Russian Federation, Treasury of the Russian Federation dated September 10, 2013 No. 02-03-10/37209, No. 42-7.4-05/5.2-554).

In accounting, the transfer of travel allowances should be reflected by posting Dt 71-1 Kt 51 - transfer of money for reporting.

You can learn about the important nuances of such an operation from the article “Transferring a sub-report to an employee’s card from a current account.”

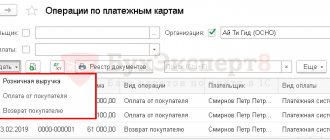

Using a special card account

A posted employee can be issued a corporate bank card opened in his name - debit or credit.

Dt 55 “Special bank account” Kt 51 - transfer of funds from the current account to a special account.

If the card account is opened in foreign currency, then the transfer occurs from the foreign currency account: Dt 55 Kt 52.

How to reflect in the organization's accounting travel expenses associated with sending an employee on a business trip abroad if he independently purchased foreign currency to pay for travel expenses (hotel payment)? Read the answer to this question in ConsultantPlus by receiving trial demo access to the legal reference system. It's free.

It is recommended to open sub-accounts for account 55 to account for settlements in rubles and for accounting in foreign currency.

As funds are spent on the debit card, the movement of money should be reflected by posting Dt 71 Kt 55 - money was used (withdrawn) for travel expenses.

If you use a credit card opened on the basis of a bank loan agreement, then the crediting of money according to the credit line to the card account is reflected as follows: Dt 55 Kt 66 (67)

Also, as funds from the credit card are spent, we make an accounting entry Dt 71 Kt 55.

The interest accrued by the bank for the use of loan funds is reflected in the entry Dt 91-2 Kt 66 (67).

Procedure for reimbursement of travel expenses

The rules for sending employees on business trips both on the territory of the Russian Federation and on the territory of foreign states are determined by the Regulations on the specifics of sending employees on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

The procedure and amount of reimbursement to employees for expenses related to business trips are determined by a collective agreement or a local regulatory act of the organization (clause 11 of the Regulations on Business Travel, Article 168 of the Labor Code of the Russian Federation).

According to Article 168 of the Labor Code of the Russian Federation, if an employee is sent on a business trip, the employer is obliged to compensate him for:

- travel expenses;

- expenses for renting residential premises;

- additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission or knowledge of the employer. For example, telephone costs, entertainment expenses, transportation costs, etc.;

And when sent on a business trip to the territory of a foreign state, the employee is additionally reimbursed (clause 23 of the Regulations on Business Travel):

- expenses for obtaining a passport, visa and other documents;

- mandatory consular and airport fees;

- fees for the right of entry or transit of motor vehicles;

- expenses for obtaining compulsory health insurance;

- other mandatory payments and fees.

The daily allowance amount is established by a collective agreement or a local regulatory document of the organization (LND). You can set separate daily allowance rates for each country or group of countries. The maximum amounts that are not subject to personal income tax and insurance contributions for compulsory pension, medical and social insurance in case of temporary disability and in connection with maternity are 700 rubles. for each day of being on a business trip in the Russian Federation and 2,500 rubles. — outside the territory of the Russian Federation. There is no standard established for income tax and contributions for injuries (clause 1 of Article 217, clause 12 of clause 1 of Article 264, clause 2 of Article 422 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated November 17, 2011 No. 14-03- 11/08-13985).

Payment of daily allowances for business trips outside the territory of the Russian Federation is regulated by paragraphs 18-20 of the Regulations on Business Travel:

- for a one-day business trip, daily allowance is paid in the amount of 50% of the norm for business trips abroad;

- the dates of crossing the state border of the Russian Federation when traveling from the territory of the Russian Federation and to the territory of the Russian Federation are determined by the marks of the border authorities in the passport;

- when an employee is sent on a business trip to the territory of countries with which intergovernmental agreements have been concluded, on the basis of which marks are not made when crossing the border, the date of crossing the state border of the Russian Federation is determined by travel documents (tickets);

- when an employee is traveling from the territory of the Russian Federation, the date of crossing the state border is included in the days for which daily allowances are paid according to the norm for business trips abroad. When an employee travels to the territory of the Russian Federation - on days for which daily allowances are paid according to the norms for Russia. If an employee is sent on a business trip to the territory of two or more foreign states, daily allowances for the day of crossing the border between states are paid in foreign currency according to the standards established for the state to which the employee is sent.

Upon returning from a business trip, the employee, within three working days, is obliged to provide the employer with an advance report on the amounts spent in connection with the business trip and make a final payment for the advance payment issued to him for travel expenses, attaching documents confirming the expenses (clause 26 of the Business Travel Regulations).

The supporting documents on expenses associated with the business trip attached to the advance report must be translated into Russian (clause 9 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n). The translation can be done either by a professional translator or by a full-time employee of the organization (letter of the Ministry of Finance of Russia dated April 20, 2012 No. 03-03-06/1/202).

1C:ITS

For more information on the procedure for reimbursing employees for travel expenses, including the calculation of daily allowances, see the “HR Handbook” in the “Legal Consultations” section.

Travel allowances issued in cash documents

Traveler's checks may be issued to posted employees. A traveler's check is an obligation of the issuer to pay the amount of the check to its owner. Accounting for traveler's checks is kept in account 50-3 “Cash documents”. The following entries must be made in accounting:

- Dt 50-3 Kt 60 (76) - purchase of traveler's checks;

- Dt 71 Kt 50-3 - traveler's checks issued.

Unfortunately, the use of traveler's checks is not common in the Russian Federation. They can only be exchanged for money, but even then not in all financial institutions. Therefore, this type of financial document is most convenient to use when traveling on business trips abroad. The use of traveler's checks as a means of payment has its advantages - both in the simplicity and safety of their use.

The organization can purchase and issue travel documents to the posted employee. The accounting of travel documents is carried out similarly to the accounting of cash checks in account 50-3.

How the writing off of travel expenses from accountable persons is taken into account in the accounts

After the end of the business trip, the employee reports for the accountable amounts received. To do this, he draws up an advance report or another document, independently finalized and approved in the accounting policy.

From November 30, 2020, the organization can independently set the deadline for the accountable person to submit the advance report. The previous requirement that the JSC must be submitted no later than 3 working days after the expiration date for which the reports were issued, or from the date of return to work, has been cancelled.

Read everything about advance reports in the article “Features of advance reports in accounting.”

If there is an unused balance of travel allowances, the balance should be returned to the cash desk and reflected in the entry Dt 50 Kt 71.

The unspent balance can be transferred from the employee’s card to the organization’s current account: Dt 51 Kt 71.

The return of the balance to a special card account is reflected by posting Dt 55 Kt 71.

Travel expenses can be written off as follows:

- Dt 08 (10, 41...) Kt 71 - non-current assets, inventory and materials were purchased;

- Dt 19 Kt 71 - the amount of input VAT is reflected;

- Dt 20 (23, 26...) Kt 71 - expenses are charged to the cost of products (services, works);

- Dt 44 Kt 71 - expenses are recognized as commercial expenses or expenses for the main activities of a trading organization;

- Dt 91 Kt 71 - non-production expenses were approved and written off.

You can study this topic in more detail in the article “Accounting for settlements with accountable persons.”

Find out how to take into account travel expenses under the simplified tax system in the Ready-made solution from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Travel expenses under the simplified tax system “income minus expenses”

When sending an employee on a business trip, the organization uses the simplified tax system to calculate travel expenses in the same way as under the OSNO. Having reimbursed the employee for all travel expenses stipulated by law, the enterprise has the right to reduce its income by them for tax purposes, subject to documentary confirmation and economic justification of the expenses incurred (subclause 13, clause 1, article 346.16 of the Tax Code of the Russian Federation).

A distinctive feature is the date on which travel expenses are included in expenses. Since accounting for expenses on the simplified tax system is carried out on a cash basis, the date of recognition of expenses is considered to be the date of approval of the advance report. However, if the employee has spent his own funds and the company reimburses him for them, the reimbursed payments should be included in the book of income and expenses at the time of issuing money from the cash register (Clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

One more nuance. According to the Ministry of Finance, an individual entrepreneur without employees on a simplified basis cannot take into account the costs of his own trips. The department justifies this position as follows: a business trip is a trip by an employee at the direction of the employer. But an individual entrepreneur does not have an employer, just as he cannot be his own employee (letters from the Ministry of Finance dated 02/26/2018 No. 03-11-11/11722, dated 07/05/2013 No. 03-11-11/166). The courts, as a rule, do not agree with such conclusions (Resolution of the Federal Antimonopoly Service of the Far East of Russia dated August 22, 2011 No. F03-3248/2011).

For more information about the recognition of expenses under the simplified tax system, read the material

“Accepted expenses under the simplified tax system in 2021 - 2019” .

Results

The posting when issuing money to the travel expenses account will depend on the source of the issue - be it cash, non-cash money, cards or monetary documents.

Examples of transactions for settlements with accountable persons are given in the article “Procedure for settlements with accountable persons - transactions”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.