Financial investments on the balance sheet: definition, list

Contrary to the opinion of some accountants, the following assets cannot be accepted by an organization for accounting as financial investments:

Take our proprietary course on choosing stocks on the stock market → training course

- Own shares of the enterprise that were purchased from shareholders with the purpose of their cancellation or resale;

- material assets purchased for purposes other than normal activities, such as works of art, jewelry, precious metals, etc.;

- bills issued as payment for sold goods, products, works or services issued by the drawer to the seller;

- investments in real estate that have a tangible form and are transferred by the company on a reimbursable basis to other persons for temporary possession (use);

- fixed assets, intangible assets and various types of inventories.

The assets listed below, on the contrary, are full-fledged financial investments, the value of which can be recorded on line 1170 (subject to the requirements from the list following the list):

- municipal and state securities;

- securities of other companies, including debt - bills of exchange, bonds (provided that they indicate the cost and maturity date);

- receivables repurchased in connection with the assignment of claims;

- contributions to the authorized (share) capital of other companies (including subsidiaries and affiliates);

- bank deposits;

- loans issued to other companies;

- other similar investments.

Assets and investments can be accepted for accounting as financial investments only if all the following conditions are met:

- The enterprise must retain documents proving the fact of making a financial investment in the object.

- The investing company must have certain financial risks related to the acquired income-generating assets.

- There must be a probability that financial investments will bring economic benefits in the future in its various forms (in the form of dividends, an increase in the initial cost, etc.).

Common entries for accounting for a company's financial investments

- Implementation of long-term investing in order to attract income in the future

Dt58Kt50 – through cash;Dt58Kt51.52 – via non-cash transfer;

Dt58Kt76 – purchase of securities (shares, bonds) from third-party creditors.

- Providing borrowed funds for the purpose of attracting income in the form of interest (excluding borrowed funds provided to employees)

Dt58Kt50,51,52. - Receiving shares and bonds free of charge

Dt58Kt98.2. - Disposal of investment objects

Dt50,51,52 Kt58 – repayment of receivables for previously provided loans. - Disposal of shares, bonds

Dt90.02 Kt58 – for those companies whose main activity is the sale of securities;Dt91.02 Kt58 – for other companies.

- Cost adjustment

Dt58 Kt91 – additional valuation of assets;Dt91.02 Kt58 – markdown.

List of actual expenses for the acquisition of assets as financial investments

The accounting records of an enterprise must necessarily contain information about the expenses actually incurred by the company in connection with the need to acquire assets in the form of financial investments. Only the following costs may be included in such costs:

- The amount paid to the seller in accordance with the purchase and sale agreement at the time of purchase of an asset that is planned to be accounted for as a financial investment.

- Expenses for the services of intermediaries involved in the transaction of purchase and sale of an asset acquired as a financial investment.

- Costs for paid services of lawyers and experts who are ready to advise the company on financial investments on a paid basis. If, after the organization paid for information (consulting) services, management decided that it was inappropriate to make a financial investment:

- non-profit organizations include such costs in the increase in expenses of the reporting period, during which it was decided not to invest in the purchase of an asset as a financial investment;

- commercial firms include costs for “unused” consultations and information resources as other expenses.

- Other costs that are directly related to the purchase of assets taken into account as financial investments.

Important! At least once a year, an enterprise is required to check its financial investments for impairment (as of December 31 of the reporting period) if signs of impairment are detected. In addition, studies can be scheduled for interim reporting dates. If, based on the results of the audit, a significant decrease in the value of financial investments is established, it is necessary to create an impairment reserve. The amount of the reserve is determined by deducting their estimated value from the initial cost of financial investments.

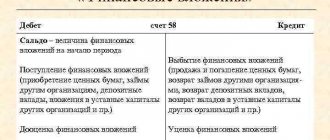

Account 58 “Financial investments”

Order 94n established the following list of subaccounts of account 58:

- 58.1 - shares and shares;

- 58.2 - debt securities;

- 58.3 - loans provided;

- 58.4 - contributions under a simple partnership agreement.

However, the law does not prohibit enterprises from independently establishing a list of subaccounts in accordance with the goals of their accounting policies. At the same time, Order 94n clearly states that the enterprise is obliged to ensure a breakdown of financial investments into long-term and short-term.

Therefore, if the enterprise has financial investments with a period of up to 12 months or more than 12 months, it is necessary to organize their separate accounting, which allows separating the amounts of long-term financial investments from short-term ones.

More information about the procedure for organizing accounting of financial investments can be found in the article “Accounting for financial investments - PBU 19/02”.

Postings for transactions with financial investments in account 58 may look like this:

| Dt | CT | Contents of operation |

| 58.1 | 75.1 | Shares were added to the authorized capital of the enterprise |

| 51 | 58.1 | Received funds for securities (sale of shares) |

| 58.2 | 50 | Purchased bills (debt securities) with cash payment |

| 58.2 | 75.1 | Debt securities are included in the authorized capital of the enterprise |

| 58.1(58.2) | 98.2 | The securities were received by the company free of charge |

Calculation of the indicator on line 1170 “Financial investments”: formula based on the balance sheet

As can be seen from the name of the line of the Balance Sheet, on line 1170 “Financial investments” it is customary to reflect information about the financial investments of the enterprise, the circulation (maturity) period of which is more than 1 year after the reporting date . The indicator value is calculated using the following formula based on the company’s balance sheet data:

The “Explanations” column provides an indication of the disclosure of the indicator. In cases where a company decides to draw up Explanations for Form No. 1 and OFR using the forms from the Examples of Explaining Explanations (Appendix 3 to Order of the Ministry of Finance No. 66n), Tables 3.1 and 3.2 should be indicated in the “Explanations” from line 1150 “Financial investments” .

The cost of long-term financial investments is reflected in the balance sheet as of 2 dates: December 31 of the previous year and the same day of the year preceding the previous one.

An example of determining the cost of financial investments (calculation, postings)

JSC “Your Housing” decides to buy out 1,200 shares of JSC “Stroy Vostok” in January of the current period. Each security cost the joint-stock company 2,300 rubles. In addition, the company had to incur costs for specialist consultation in the amount of 21,000 rubles (including VAT of 4,215.33 rubles). The accountant will record the transactions in the following order:

| Operations | Amount (rubles) | DEBIT | CREDIT |

| Securities accepted for accounting | 2 760 000 | 58.01 | 76 |

| Additional costs involved in the formation of the initial cost of shares are taken into account | 21 000 | 58.01 | 76 |

| The money was transferred to the counterparty, the accounts payable under the transaction were repaid | 2 760 000 | 76 | 51 |

So, since the amounts of additional costs are also taken into account when forming the value on line 1170, the accountant will reflect on the specified line of the balance sheet an indicator equal to 2,760,000 rubles.

Example of filling out line 1170 “Financial investments”

Let's imagine a hypothetical enterprise, Kras Finance LLC. Let's turn to the company's balance sheet - there are no account indicators in the accounting. 55 s/sch. 55.3. Let's consider the available indicators for accounts 58, 59, 73 s/sch. 73.1:

The information will be reflected in the Balance Sheet as follows (fragment of form No. 1):

Let's calculate the cost of the company's long-term financial investments minus the formed reserve:

Now we can imagine how the received information will be reflected in Form No. 1 of the Kras Finance LLC enterprise:

Analysis of long-term financial investments

Before purchasing a financial asset and making an investment, it is necessary to analyze long-term financial investments. This will help evaluate the effectiveness and rationality of the solution used.

The objectives of investment analysis are as follows:

- Analysis of existing options for financial investments, assessment of their strengths and weaknesses, possible acquisition requirements;

- Selection of the most optimal investment portfolio;

- Provide analysis of the effectiveness of a financial asset, that is, calculation of its profitability.

As a rule, multifactor analysis is used to carry out the analysis, which is carried out using special software products. In addition to the fact that the analysis of financial investments is carried out before direct investment, retrospective analysis is also carried out periodically. The company looks at which types of financial assets have increased, which have decreased, etc. This makes it possible to track negative or positive trends in the company. For example, an increase in long-term financial investments indicates that the company has enough free cash, it does not worry about the liquidity of its assets and can easily invest resources in long-term assets that will yield profit only after a year. A decrease in long-term assets may indicate that the company is experiencing difficulties with liquidity and the turnover of assets into funds; it is also not ready to take risks for a long period and therefore resells the assets on its balance sheet or simply stops investing in them.

What information is subject to disclosure in financial statements regarding financial investments?

The accountant of an enterprise making financial investments must disclose in the financial statements at least the information listed below (provided that they are material):

- methods chosen by the organization for assessing financial investments in the event of their disposal (by groups, types) and the expected consequences of changing the methods of such assessment;

- information on issued borrowed funds and available debt securities (namely data on their valuation at discounted value, on the amount of such value, on the selected discounting methods) - such information is subject to disclosure in the notes to the Profit and Loss Statement and the balance sheet;

- the cost of financial investments for which it is realistic to find out the current market value;

- the value of financial investments for which it is impossible to determine the amount of the current market value;

- the difference between the previous assessment of financial investments, which the company relied on to calculate the current market value, and the current market value as of the reporting date;

- information about the reserve formed in case of depreciation of financial investments (here you will need to explain the type of investment, the amount of the formed reserve for the reporting year, the amount of the reserve used during the reporting year, the amount of the reserve included in other income in the reporting year);

- types and value of financial investments, taking into account securities that were transferred to other legal entities (not sold);

- the cost and types of securities and other investments that are encumbered with collateral;

- the difference between the size of the initial cost and the nominal value during the circulation period of the securities (for debt securities for which the current market value could not be determined).

How to reflect financial investments in accounting

Important! Before information about current financial investments is reflected on line 1170 of the Balance Sheet, their value is collected in account 58 “Financial Investments”. At the same time, deposits must be accounted for in subaccount 55.3 “Deposit accounts” of account 55 “Special accounts in banks”. Interest-bearing loans issued to employees of an organization can be reflected in account 73 “Settlements with personnel for other operations” (subaccount 73.1 “Settlements on loans provided”).

If a company has made financial investments in securities, the following information about them must be reflected in analytical accounting:

- full name of the issuer of securities;

- price of securities;

- details, name of the paper;

- the total number of securities purchased;

- storage location for purchased papers;

- the date of purchase of the asset and the day of their disposal.

No matter what accounts information about investments is generated, financial indicators will always be reflected on line 1170 of the balance sheet.

Directions of short-term financial investments

KFV is a method for an organization to protect free funds from inflation or to obtain additional benefits in the future. Since investments of this kind have high liquidity and are part of current assets, they become on the same level as means of payment, and their responsibilities include ensuring the financial obligations of the owner.

KFV share

Most often, short-term investments are made in materials or raw materials. The advantage of this type of investment is that such deposits are least at risk of being lost because the situation in the economy can be predicted for a period of 12 months. The political situation and the exchange rate of the national currency can also be identified as influencing factors.

As for deposits of securities, here the enterprise takes a conscious risk, since in this case it is best to invest in liquid securities, which can be transferred into finance without much difficulty at any time. Only a competent specialist can predict this, perhaps even using some analytical programs. Some enterprises specifically turn to such specialists for advice. This item of short-term financial investment can be classified as liquid only if the securities have a minimal risk of falling in price and can be easily sold.

If we talk about loans, then, as a rule, loans issued for short periods are subject to higher interest rates than long-term ones (LFA). This measure will protect the company from non-refund of funds.

An enterprise has the right to transfer any monetary deposit from long-term to short-term if its purpose or intention to use it further changes. Such a clause must be provided for in the company’s statutory accounting documents.

Short-term financial investments on the balance sheet, example

Example In February 2010, an organization received a loan from another company for a period of 24 months; accordingly, it must repay it in February 2012. In the report for 2010, it will be displayed in the paragraph on DFV.

After two years, it can be transferred to the KFV, since the time remaining for its payment is less than a year. Short-term financial investments are indicated on account 58. This account is intended to bring together information about investments and their movements within the enterprise. Accounts may be opened, for example, 58-1 - “Securities”. Accounting is maintained by groups and types of investments of the organization, regardless of which country the funds or assets are located.

Types of financial investments of the enterprise