Other non-current assets on the balance sheet are

Line 1190

reflects information about other assets whose circulation period exceeds 12 months and which are not reflected in other lines of Section I of the balance sheet.

For example: [Debit balance on account 01 “Fixed assets”] (sub-account “Young plantings”)

[Debit balance on account 07 “Equipment for installation”] [Debit balance on account 08 “Investments in non-current assets”] [Debit balance on account 15 “Procurement and acquisition of material assets”]

(in the part related to equipment for the installation)

[Account balance 16 “Deviation in the cost of material assets”]

(in the part related to equipment for the installation)

[Debit balance in account 60 “Calculations with suppliers and contractors"]

(in terms of advances and prepayments for work, services related to the construction of fixed assets)

[Debit balance of account 97 “Deferred expenses"]

(in terms of expenses with a write-off period of more than 12 months)

Other non-current An organization's assets may include:

- equipment requiring installation, which is understood as equipment put into operation only after assembling its parts and attaching them to the foundation or supports, to the floor, interfloor ceilings and other load-bearing structures of buildings and structures, as well as sets of spare parts for such equipment;

- investments in non-current assets of the organization, accounted for in the corresponding subaccounts of account 08 “Investments in non-current assets”, in particular the organization’s costs in objects that will subsequently be taken into account as objects of intangible assets or fixed assets, as well as costs associated with the implementation of incomplete R&D;

- expenses related to future reporting periods and accounted for in account 97 “Future expenses” (for example, expenses for the development of natural resources, a one-time (lump-sum) payment for the right to use the results of intellectual activity and means of individualization);

- the cost of perennial plantings that have not reached operational age;

- the amount of transferred advances and advance payment for work and services related to the construction of fixed assets.

How to organize equipment accounting for installation

When new mechanisms arrive at production facilities, they are assembled, installed on special platforms, and in some cases they may need to be connected to utility networks. After these activities, the equipment is put into operation.

Installation can be carried out on your own or with the involvement of specialists from other organizations. Installation activities include:

- installation actions;

- assembly;

- connecting measuring instruments;

- connection of control elements;

- checking the functionality and serviceability of equipment;

- wire insulation.

Equipment for installation is accepted for accounting at a cost consisting of:

- purchase prices,

- costs incurred in connection with its delivery, loading and unloading, storage, etc.

At the next stages, during the installation of equipment, the amount of expenses for its installation, adjustment, and bringing it to working condition is added to this amount. If several pieces of equipment are being prepared for operation at once, then the accumulated total costs of their assembly and installation should be distributed among them.

Equipment to be installed – asset or liability? This type of fixed assets is accounted for on the active synthetic account 07 of the same name. Analytical accounting is carried out by type of equipment requiring installation and its storage location.

Equipment for installation is reflected in the organization's balance sheet on line 1190 in the group of other types of non-current assets. These cannot include vehicles, mechanisms for agricultural and construction purposes, integral machine structures and tools with production equipment and devices, without which the operation of specific equipment is possible.

Composition and structure of non-current assets

The composition of the non-current assets of the enterprise is detailed in different ways by different documents of the Ministry of Finance of the Russian Federation:

- by order No. 43n dated 07/06/1999, which approved PBU 4/99, dedicated to the methodology for compiling accounting reports, non-current assets included intangible assets, fixed assets (with the inclusion of non-refundable assets), profitable investments in materiel and financial investments;

- by order No. 94n dated October 31, 2000, which approved the chart of accounts, non-current assets are divided into fixed assets (with the allocation of income-generating investments), intangible assets, depreciation of fixed assets and intangible assets, capital investments in them (with the allocation of equipment requiring installation) and ONA;

- By order No. 66n dated 07/02/2010, containing the latest form of balance sheet recommended for use, these assets are divided into 9 articles: intangible assets, R&D, intangible and tangible exploration assets, fixed assets, profitable investments in materiel, financial investments, non-current assets and other non-current assets .

There are no contradictions between them, but the concept of non-current assets for the purposes of its reflection in the balance sheet still needs to be clarified. Non-current assets on the balance sheet are the company’s own property, which for a long time (more than a year) is used in its main activities in order to generate income. The components of non-current assets are:

- NMA;

- OS;

- unfinished investments in their creation;

- financial investments;

- SHE.

ONA (account 09), which are temporary differences in income tax that arise due to a discrepancy between accounting and tax data, is a rather random phenomenon for non-current assets . They do not correspond to the meaning of a non-current asset either in essence (this is not property, but a certain estimated amount of tax), or in terms of duration of existence (they may not be long-term). Not all organizations use them, and they, as a rule, do not play a significant role in non-current assets , so we will not dwell on them.

Features of equipment accounting for installation

Fixed assets subject to pre-operational assembly, configuration and installation are accounted for by the enterprise in a synthetic account separate from other non-current assets. For these objects, separate accounting is carried out on a special account until the equipment acquires the properties of a working asset. After the entire complex of installation and commissioning work, the main asset is launched. At this moment, documentation for commissioning of the installed equipment is drawn up, and an entry for the transfer of the asset to the operating system is recorded in accounting.

Equipment is reflected in accounting data based on the total amount of costs incurred for its purchase and pre-operational preparation:

- cost of equipment paid to the supplier;

- costs incurred at the stage of delivery of the asset and its shipment to the buyer’s site;

- costs associated with commissioning and installation activities;

- the amount of resources spent by the new owner of the equipment to ensure the necessary storage conditions for the equipment before its launch;

- construction of supports for equipment, platforms, foundations.

When several units of assets requiring assembly and subsequent installation are simultaneously purchased, the total costs accumulated for their preparation are subject to distribution among the facilities involved. Installation can be done on your own or with the involvement of specialists from third-party organizations. The installation process involves carrying out such work as:

- installation on a site designated for the operation of this type of equipment;

- assembly of components;

- connection of measuring and control instruments, utility networks;

- checking the correct setup;

- assessment of the performance of the asset, the serviceability of all its parts;

- wiring insulation.

REMEMBER! Equipment requiring installation, which was not put into operation at the reporting date, must be reflected in the financial statements.

In the Balance Sheet form, line 1190 is provided for it, in which the value of such assets is summed up with the monetary valuation of other non-current assets.

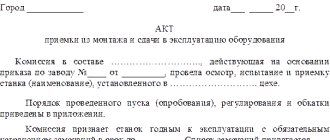

Registration of equipment to be assembled and installed by an enterprise is carried out on the basis of documentation confirming the fact of acceptance and transfer of the asset (for example, a signed OS-14 act). The direction of equipment for installation is reflected in the OS-15 act. This event is accompanied by a transfer of the value of the installed fixed asset to the account for investments in non-current assets.

The amount of expenses incurred in connection with installation activities is credited to the value of the asset based on one of two documents:

- certificate of work performed by the contractor;

- accounting information.

The last form is used in cases where pre-operation work was carried out by employees of the equipment owner, and third parties were not involved in installation. After the preparatory stage is completed, the functionality of the equipment, the correctness of its connection, and the safety of the new workplace for personnel are checked. The next step is commissioning. From this moment on, the equipment is classified as fixed assets.

What do intangible assets of organizations consist of?

Intangible assets, according to PBU 14/2007, approved by Order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n, include documented rights to unique intangible objects, for example, rights to works, designs, technologies, brands (marks), reputation.

In the balance sheet they are divided:

- on NMA;

- R&D;

- intangible exploration assets that arise only in organizations engaged in the development of natural resources and can be depreciated during the process of their creation.

The cost of operated intangible assets in accordance with clause 35 of PBU 4/99 in the balance sheet is shown minus depreciation on them. Those. data on intangible assets in non-current assets consists of balances on accounts 04 and 08 (for intangible exploration assets) reduced by depreciation amounts (account 05). If the data on intangible assets listed on account 08 does not correspond to the analytics highlighted in the balance sheet, then they may be:

- added to the balances of used intangible assets when their amount is insignificant (up to 5%) compared to the residual value of intangible assets;

- allocated to an additionally entered separate line in non-current assets ;

- shown in the line “Other non-current assets ”.

In simplified reporting (Appendix 5 to Order No. 66n), it is allowed to reflect on 1 line both the residual value of operated intangible assets and existing unfinished investments in them.

What applies to the enterprise OS

In accordance with PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, fixed assets represent a set of own property involved in the operation of the enterprise - from land and buildings to inventory. This also includes objects leased with the condition of being included on the balance sheet of the lessee.

In the balance sheet they are divided:

- on material exploration assets that arise only from organizations engaged in the development of natural resources and can be depreciated during the process of their creation;

- OS;

- profitable investments in materiel, which are fixed assets owned by the enterprise, but not exploited by it in its own production, but transferred for this purpose to the outside.

According to clause 35 of PBU 4/99, the cost of operating fixed assets is shown in the balance sheet minus depreciation on them. Those. fixed assets in consists of balances on accounts 01, 03 and 08 (for tangible exploration assets) reduced by depreciation amounts (account 02). If the fixed assets data listed on account 08 does not correspond to the analytics highlighted in the balance sheet, then they may be:

- attached to the balances of the fixed assets used when their amount is insignificant (up to 5%) compared to the residual value of the fixed assets;

- allocated to an additionally entered separate line in non-current assets ;

- shown in the line “Other non-current assets ”.

Together with the balances on account 08 for investments in fixed assets, the balances on account 07 are taken into account.

In simplified reporting (Appendix 5 to Order No. 66n), it is allowed to reflect on 1 line both the residual value of operating fixed assets and existing unfinished investments in them.

The concept of equipment for installation in accounting

In accounting, the term “equipment for installation” combines a complex of depreciable tangible assets that must undergo a number of preparatory activities before the date of commissioning. These objects are characterized by the following properties:

- long-term use of the equipment is expected;

- high acquisition cost;

- after the start of operation, the asset is able to influence the amount of material benefit received by the enterprise;

- cannot be launched without initial installation on a special platform or work site; some types of equipment require the supply of communications, the creation of supports or preparation of the foundation;

- assembly of the main elements is required;

- Equipment may require setup and programming.

The group of fixed assets to be installed includes production, technological assets, energy and laboratory equipment.

IMPORTANT! Vehicles, agricultural and construction machines, tools used by production workers, household equipment and free-standing machines cannot be included in the equipment for installation.

What is included in financial investments

The composition of financial investments is determined in PBU 19/02, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n. These are securities, deposits in the management company, loans issued, deposits and receivables acquired under an assignment agreement.

Among financial investments, only those with a maturity period exceeding 1 year are classified as non-current assets Taking into account this requirement, balances on accounts 55, 58 and 73 are selected non-current assets.

Account and typical transactions

The designation of an asset as belonging to fixed assets that cannot be put into operation immediately after acquisition and require additional installation and configuration work is carried out by assigning their cost to account 07. This account is active, its purpose is a separate accounting of technical equipment that, at the date of acquisition, is not ready for commissioning.

Receipt of equipment is recorded by debit turnover on account 07, transfer for assembly, installation or configuration - by credit account.

NOTE! The debit balance of account 07 should be reflected in the Balance Sheet.

Using a synthetic 07 account, the efficiency of monitoring the safety of installed equipment increases. The company entrusted with the assembly of technical equipment receives its components in an off-balance sheet account 005 by debit turnover. When the equipment is transferred back to the customer of the work, the cost of the fixed asset ready for operation is debited from the 005 account as a credit entry.

The customer of the pre-operational work package uses the following standard correspondence in his accounting:

- Debiting account 07 with simultaneous credit transactions on account 20 or 23 - the entry indicates the economic production of technical equipment for completing production lines.

- D07 - K75 - confirmation of the fact that the founder has made a non-monetary contribution to the capital of the company in the form of equipment requiring assembly.

- D07 - K79 - the equipment was delivered from a branch or separate division of the enterprise.

- D07 – K86 – the purchase of equipment is part of the targeted financing program;

- D07 - K60 or 76 - the main equipment to be installed was purchased from the supplier.

Other non-current assets - what are they?

The line “Other non-current assets ” is intended to reflect data in one of 2 cases:

- For some reason, they cannot be included in any of the lines highlighted in non-current assets in the recommended form of the balance sheet.

- They are essential to be combined with one of the highlighted lines in the balance sheet. Most often it shows non-current assets formed by large balances in account 08 (for example, work in progress).

To learn how the section dedicated to non-current assets in the balance sheet will look like, read the article “Balance Sheet (Assets and Liabilities, Sections, Types)”

Other non-current assets (examples)

Other non-current assets in the balance sheet are property, information about which is not included in other lines of section 1 of the balance sheet. The cost of other non-current assets is reflected on line 1190 of the balance sheet.

Other non-current assets include:

- perennial plantings that have not yet reached the age of exploitation;

- equipment that requires installation;

- expenses of the organization in objects that will subsequently be accepted for accounting as fixed assets and intangible assets, as well as expenses associated with the implementation of unfinished R&D;

- advances and prepayments for work and services related to the construction of fixed assets;

- deferred expenses with a write-off period of more than 12 months.

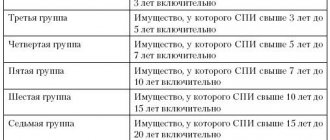

Let us show in the table based on the data of which accounting accounts line 1190 of the balance sheet is formed (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n):

Accounting for equipment requiring installation

Related publications

Technical inventory and part of the main production equipment can be put into operation only after mandatory installation work and configuration. Such properties can be possessed by both individual technical complexes and additional elements that are intended to be built into equipment. Separate accounting must be maintained for this category of fixed assets subject to pre-assembly.