Financial investments in the balance sheet structure

In the structure of the balance sheet, financial investments are assets recorded in lines 1170 and 1240. Line 1170 is located in the first section of the balance sheet “Non-current assets”, and line 1240 is in the second section (“Current assets”).

In line 1170 the amounts of long-term financial investments are recorded (for a period of more than a year), and in line 1240 - short-term (for a period not exceeding a year). In accounting, a breakdown of financial investments by the period for which they are formed must be carried out, as this is provided for by the instructions for using the chart of accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n, hereinafter referred to as Order 94n) and PBU 19/02.

The main part of the financial investments reflected in lines 1170 and 1240 of the balance sheet is recorded in accounting in the form of a debit balance of the account. 58, on which financial investments are recorded. To it is added the debit balance of financial investments in accounts 55 and 73 (in terms of deposits and loans to employees of the enterprise, respectively). In addition, the amount of debit balances of accounts 58, 55, 73 should be reduced by the credit balance of account 59 (formation of reserves for financial investments).

IMPORTANT! It is advisable to account for assets reflected in accounts 55 and 73, classified as financial investments, in separate sub-accounts depending on the investment period. Then, when creating a balance, there will be no problems filling out lines 1170 and 1240.

Read about the basic principles of drawing up a balance sheet for an enterprise in the material “Balance Sheet (Assets and Liabilities, Sections, Types).”

An example of filling out line 1170 “Financial investments” from ConsultantPlus Indicators for accounts 58, 59 and 73, subaccount 73-1, in accounting (indicators for account 55, subaccount 55-3, are missing) ... See in K+ a fragment of the balance sheet on line 1170 , as well as other reporting indicators. Trial access is available for free.

Let's take a closer look at what assets are reflected in account 58.

Long-term financial investments: for what period are they issued, to which account do they belong, what line is in the balance sheet?

Long-term financial investments on the balance sheet are financial investments with a period exceeding 12 months. Their analytical accounting is also kept on the account. 58. The amount of long-term financial investments in the balance sheet is line 1170. As in the case of short-term financial investments, the amount reflected in the balance sheet includes not only the debit balance of the account. 58. Here you also need to add the debit balances on your account. 55 and 73 in terms of assets classified as long-term financial investments. In these accounts, such assets include:

- deposits with a maturity of 12 months (Dt account 55.3);

- loans provided to employees of an organization with a repayment period of more than 12 months (Dt account 73.1).

The amount of account debit balances. 58 (subaccount “Long-term financial investments”), 55.3, 73.1 before it is reflected on line 1170 of the balance sheet, it must be reduced by the balance of the loan account. 59 (reserves for long-term investments).

More information about the accounting of this type of assets can be found in the material “Accounting for financial investments - PBU 19/02”.

Thus, the main difference in the characteristics of long-term and short-term investments is their duration. There are no other differences between short-term and long-term financial investments. Securities purchased by an enterprise can be a long-term source of investment, or they can be used for speculative purposes and purchased for a short-term period. Deposits can also be placed for different periods; the situation is similar with issued loans.

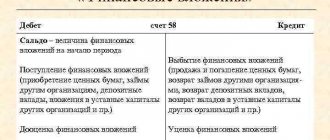

Account 58 “Financial investments”

Order 94n established the following list of subaccounts of account 58:

- 58.1 - shares and shares;

- 58.2 - debt securities;

- 58.3 - loans provided;

- 58.4 - contributions under a simple partnership agreement.

However, the law does not prohibit enterprises from independently establishing a list of subaccounts in accordance with the goals of their accounting policies. At the same time, Order 94n clearly states that the enterprise is obliged to ensure a breakdown of financial investments into long-term and short-term.

Therefore, if the enterprise has financial investments with a period of up to 12 months or more than 12 months, it is necessary to organize their separate accounting, which allows separating the amounts of long-term financial investments from short-term ones.

More information about the procedure for organizing accounting of financial investments can be found in the article “Accounting for financial investments - PBU 19/02”.

Postings for transactions with financial investments in account 58 may look like this:

| Dt | CT | Contents of operation |

| 58.1 | 75.1 | Shares were added to the authorized capital of the enterprise |

| 51 | 58.1 | Received funds for securities (sale of shares) |

| 58.2 | 50 | Purchased bills (debt securities) with cash payment |

| 58.2 | 75.1 | Debt securities are included in the authorized capital of the enterprise |

| 58.1(58.2) | 98.2 | The securities were received by the company free of charge |

Short-term financial investments: definition and line in the balance sheet

Investments in financial assets with a maturity of less than 12 months (acquired rights to receivables, short-term interest-bearing loans, deposits, securities, other financial investments) are short-term financial investments.

They are reflected on line 1240 of the enterprise’s balance sheet. Let us recall that 1240 is one of the asset lines of the balance sheet, characterizing the current assets of the enterprise. IMPORTANT! Clause 20 PBU 4/99 “Accounting statements of an organization” indicates that the company’s own repurchased shares must also be included among short-term financial investments. However, this directly contradicts paragraph. 4 clause 3 PBU 19/02 “Accounting for financial investments”. What should I do? There is a general legal principle according to which a contradiction between normative acts of the same level (PBU 4/99 and PBU 19/02 are normative documents of the same level) is resolved in favor of the one that has a later date of adoption. In our case, it is the norms of PBU 19/02 that must be followed, since it came into force in 2003, and PBU 4/99 - in 2000. Therefore, you should not classify your own repurchased shares as financial assets.

Line 1240 reflects the sum of the balance on Dt 58 (in terms of short-term financial investments), the balance on Dt 73 (in terms of short-term loans to personnel) and the balance on Dt 55 (in terms of short-term deposits). This amount should be reduced by the balance under Kt 59 in terms of the formation of reserves for short-term financial investments.

The difficulty is presented by the fact that for the count. 58 of the modern chart of accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, hereinafter referred to as order No. 94n) there is no division into long-term and short-term financial investments. In this case, the enterprise independently has the right to open first and second order subaccounts in accordance with the goals of its accounting policy.

In addition, in the instructions for using the chart of accounts (order No. 94n) regarding the account. 58 explicitly states that an enterprise is obliged to “ensure the possibility of obtaining data on short-term and long-term assets.” Such a detailed division will also significantly simplify the process of drawing up a balance sheet for an enterprise.

More information about how to work with the chart of accounts can be found in the article “Chart of accounts for accounting.”

Accounting for financial investments in accounts 55.3 and 73.1, standard transactions

Account 55.3 reflects the enterprise's deposits - funds provided to financial institutions for the purpose of receiving interest income. They can also be short term or long term. Account 73.1 reflects loans provided by the enterprise to its employees.

Here are some typical entries when accounting for financial investments in accounts 55.3 and 73.1.

| Dt | CT | Operation description |

| Account 55.3 “Deposit accounts” | ||

| 55.3 | 51 | Funds were transferred to the deposit account |

| 76 | 91 | Interest accrual on deposit |

| 55.3 | 76 | Interest is transferred to a deposit account (if the company does not withdraw it) |

| 51 | 76 | Interest transferred to the company's current account |

| 51 | 55.3 | Closing the deposit |

| Account 73.1 “Settlements with personnel for loans provided” | ||

| 73.1 | 50 | A loan was issued from the company's cash desk to an employee |

| 73.1 | 51 | The loan is transferred to the employee’s card |

| 73.1 | 91.1 | The company has accrued interest on the loan issued to the employee (if the loan agreement provides for this) |

| 70 | 73.1 | Withholding interest or loan amount from the employee's salary |

| 50 | 73.1 | Repayment of a loan by an employee to the company's cash desk |

| 91.2 | 73.1 | The company has written off the employee’s loan debt (if such a decision has been made) |

What is included in current assets

To understand what is included in current assets, let's look at the balance sheet. So, current assets include:

- stocks;

- VAT on purchased assets;

- accounts receivable;

- financial investments (except for cash equivalents);

- cash and cash equivalents;

- other assets that meet the criteria of current assets.

Based on the composition of current assets, we can conclude that these are the most liquid assets of the organization, i.e. those that can be quickly sold and receive cash.

Now let’s figure out which accounts need to be taken from in order to fill in information about current assets in each line of the balance sheet.

Gross, net and own current assets

Current assets, depending on the source of financing, are divided into:

Own current assets are part of the assets that are formed from the organization’s own capital.

Net - the amount of working capital that was formed at the expense of own funds and long-term loans with a term of attraction of more than 12 months.

Gross - total volume (equity and borrowed capital).

Accounting for interest on financial investments

Operations for the provision of loans are reflected using subaccount 58.3 “Loans provided”. Such financial investments must be formalized by loan agreements. Essential information in the agreement is the amount and term of the loan, as well as the amount of interest accrued on such obligations.

Typical wiring may look like this:

| Dt | CT | Operation description |

| 58.3 | 51 | The amount provided to the borrower is reflected |

| 76 | 91 | Interest accrued on the loan provided |

| 51 | 76 | The borrower paid interest on the loan |

| 51 | 58.3 | Loan repayment |

Value of financial assets

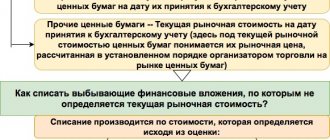

Russian organizations accept financial investments for accounting at their original cost.

The costs take into account:

- amounts paid under contracts;

- the cost of various services associated with the corresponding investments;

- remuneration for intermediaries;

- other costs of financial investments.

To correctly establish the value of financial investments for accounting purposes, all available sources are used.

One type of asset is traded on the market. Such investments are subject to accounting and reporting at the end of the relevant year at the current market value. It is determined by adjusting the value determined at the previous reporting date. This adjustment is made at the organization's discretion:

- or once a month;

- or once a quarter.

Other assets are not traded on the securities market. They are accounted for at the reporting date according to historical cost. They provide for the need:

- control depreciation;

- introduce a provision for impairment.

When financial investments are impaired, an analysis of the reasons that served as the basis for the corresponding result should be carried out. For this purpose, control is needed over all financial investments for which the current market value is not taken into account if there are signs of impairment.

Analytical accounting is created for account 59. The cost of investments in respect of which such a reserve has been created corresponds to the balance sheet minus the corresponding reserves.

According to section IV PBU 19/02 accounting for the disposal of financial investments is carried out when:

- repayment;

- sale;

- gratuitous transfer, etc.

The disposal of the corresponding asset for which the current market value is not determined is accounted for:

- or at original cost;

- or at the average initial cost;

- or using the FIFO method.

When disposing of financial investments, the following entries are made in accounting: Dt 76 - Kt 91 (income from sales is taken into account), Dt 91 - Kt 58 (the original cost is written off), Dt 51 - Kt 76 (receipt of cash).

- Purpose of the article: display of long-term financial investment funds (purchased securities, investments in the authorized capital of third-party companies, etc.) for a period of more than 12 months.

- Line number in the balance sheet: 1170.

- Account number according to the chart of accounts: Debit balance account 58 + debit balance account 55 – credit balance account 59 + debit balance account 76 (for long-term interest-bearing loans to employees).

The company's financial investments mean investment, i.e. an asset of an enterprise that does not own a tangible form, but is capable of generating income:

- securities: state, municipal, third-party companies and institutions;

Note! This type of asset also includes debt securities with a predetermined price and maturity date, such as bills of exchange. - investing company funds in the authorized capital of third-party companies (including subsidiaries);

- loans provided by the company to third-party contractors and employees (with income in the form of interest);

- receivables formed upon assignment of the right of claim, etc.

Note from the author! When filling out financial statements, it is necessary to take into account that line 1170 includes exclusively long-term financial investments, i.e. investing for periods of more than a year. Other financial investments are registered as part of current assets.

According to accounting rules, in order to recognize invested finances as assets of an organization, the following conditions must be met:

- documentary confirmation of the company’s rights to a financial investment and to receive assets from the use of this right - a purchase and sale agreement, a personal account statement, etc.;

- the organization's acceptance of possible risks from financial investments (insolvency, price fluctuations, illiquidity of assets, etc.);

- the opportunity for the company to benefit from investments made in the future (for example, the difference between the sales price and the purchase price for transactions with securities, dividends from participation in the activities of another company, etc.).

Line 1170 – balance sheet asset: long-term financial assets for a period of more than a year are displayed here, the purpose of which is to generate additional income for the company.