Accounting statements in 2021 are generated from the same basic reporting forms as for previous financial years. The information presented in it covers all operations carried out by the company for 2021, including those indicated in interim (usually quarterly) reports, if their presentation is regulated by law or carried out in order to ensure internal control of the company's activities. This publication will discuss which reporting packages are mandatory for enterprises of different organizational and legal forms.

Composition of the annual financial statements for 2021

The main reports are:

- balance sheet of the enterprise (form No. 1), which gives a general idea of the balances of property, capital and liabilities at the end of the reporting year in comparison with the balances at the beginning. The document is generated in a table, the left side of which contains information about existing assets, and the right side – about their sources. A prerequisite for the formation of a balance sheet is the equality of the parts of the table.

For example, the property in total terms on the balance sheet asset amounted to 12,000 thousand rubles, which means that the balance sheet liability should be the same amount, ensuring that the cost of the property is covered by capital (own and borrowed) and debt to creditors;

- financial results statement (FPR) – form No. 2, which explains to the user what financial flows the company has from different types of activities, and also reflects the total result of the company’s work for the year as a whole. The amounts of profit/loss in the financial financial statements must be correlated with the balance sheet data. For example, the amount of retained earnings in the balance sheet should be equal to the amount of net profit in the general financial market if profits were not distributed in the year.

The annual reporting package is supplemented by annexes to the main forms:

- Form No. 3 – “Report on Changes in Capital” (OIC), detailing the dynamics of changes in all types of capital in the company in the reporting and preceding years. The information in the OIC also corresponds to the balance sheet data on the availability of equity capital, formed in the 3rd section. Thus, lines 3300, 3200, 3100 of the OIC for the corresponding periods and types of capital should be equal to balance sheet lines 1310, 1320, 1350, 1370, 1300;

- Form No. 4 “Cash Flow Statement” (CFDS), reflecting the amount of reserves of cash and cash equivalents quickly converted into money in the company at the beginning and end of the reporting year;

- For non-profit enterprises, a report on targeted financing (form No. 6) is mandatory.

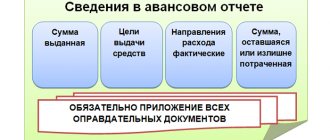

A separate document to the reporting package includes appendices (form No. 5) that decipher the balance sheet and financial information data. Although this document is not officially included in the financial statements, it is often necessary to convey to the regulatory authorities the main details of the company's activities. The reporting and explanations to it are supplemented, which provide an objective assessment of the financial and property status of the company, general information and analysis of the most important indicators.

All reporting forms are approved by Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010 (as amended on March 6, 2018). It also defines the recommendations and procedure for filling out financial statements, and also presents simplified versions of the balance sheet and financial statements, filled in with grouped values without item-by-item differentiation of data, as should be done when generating familiar reporting documents.

OKVED codes in the financial statements for 2021 are reflected in accordance with the OK 029-2014 classifier (Rosstandart order No. 14-st dated January 31, 2014).

What does the accounting set include?

A set of financial statements for 2021 must be submitted to the tax inspectorate and statistical authorities no later than April 1, 2021* (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation, article 18 of the Federal Law).

*Note.

03/31/2019 falls on a day off, and therefore companies must submit financial statements for 2021 to the Federal Tax Service and statistical authorities no later than 04/01/2019.

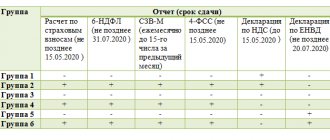

The composition of the presented financial statements for 2021 is systematized in the table:

| Who represents | What forms | Reasons |

| Organizations not related to small businesses | Balance sheet | Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n, Letter of the Federal Tax Service of the Russian Federation dated July 16, 2018 No. PA-4-6/ [email protected] |

| Income statement | ||

| Statement of changes in equity | ||

| Cash flow statement | ||

| Report on the intended use of funds received | ||

| Small businesses | Balance sheet | Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n (Appendix No. 5), Letter of the Federal Tax Service of the Russian Federation dated July 16, 2018 No. PA-4-6/ [email protected] |

| Income statement | ||

| Non-profit organizations | Balance sheet | Order of the Ministry of Finance of the Russian Federation of July 2, 2010 No. 66n, Information of the Ministry of Finance of the Russian Federation “On the peculiarities of the formation of financial statements of non-profit organizations” (PZ-1/20015), Letter of the Ministry of Finance of the Russian Federation dated July 4, 2018 No. 07-01-10/46137. |

| Income statement | ||

| Report on the intended use of funds |

Accounting statements can be provided both on paper and in electronic form. At the same time, the signature of the chief accountant on the paper form is not required (Order of the Ministry of Finance of the Russian Federation dated April 6, 2015 No. 57n). To date, the obligation to submit financial statements in electronic form has not been established (letter of the Federal Tax Service of the Russian Federation dated December 7, 2015 No. SD-4-3/21316, letter of the Ministry of Finance of the Russian Federation dated June 11, 2015 No. 03-02-08/34055).

Important!

Starting with reporting for 2021, tax authorities will accept financial statements only in electronic form through a specialized operator for electronic reporting (Federal Law of November 28, 2018 No. 444-FZ). Relief has been made for small businesses. “Kids” will be required to submit financial statements through a special operator for 2021.

Accounting statements for 2021: who submits them

All legal entities maintain accounting and submit annual reports based on it. This requirement does not apply to individual entrepreneurs - they are completely exempted by the legislator from these responsibilities (subject to keeping records of income and expenses - Article 6 of Law No. 402-FZ of December 6, 2011). We also note that credit institutions and public sector enterprises report using other reporting forms.

At the end of the year, most companies present a full package of these reporting documents. Moreover, if the financial statements of an LLC are presented with this list, then joint-stock companies must attach to the set of reports an auditor’s report confirming the reliability of the given indicators.

Representatives of small businesses - companies with up to 100 employees and a revenue turnover of up to 800 million rubles. per year, has the right to keep simplified records, i.e. submit only simplified balance sheets and financial statements. Small companies may not prepare other forms of reporting. If the activities of such a company are based on the use of targeted budget revenues, then a report on targeted financing is added to the main package of annual reporting. Read more about accounting for small businesses here.

Preparation of annual reports

Currently, the composition of the annual reporting that organizations must submit includes:

- Balance sheet (BB);

- Financial results report (FRS);

- Applications to BB and OFR.

The main reporting forms are BB and OFR; the composition of the annexes to them is determined individually for each organization.

The source for filling in the balance sheet indicators is accounting data at the beginning and end of the reporting period. The balance sheet has: an Asset, which reflects information about the organization’s property, and a Liability, which includes various sources of its funds.

The financial results statement, the main indicators of which are revenue, cost, commercial and administrative expenses, characterizes the financial results of the organization’s activities at the end of the reporting period.

Financial results are the main criterion for evaluating activities for the vast majority of companies. The reporting period in this case is considered to be the calendar year from January 1 to December 31 inclusive.

For all reporting indicators, except for the report compiled by newly created organizations, data must be provided for at least two years - the reporting year and the previous one. Accounting statements must be prepared in Russian in the currency of the Russian Federation.

Deadlines for submitting accounting reports for 2021

The legislator has allowed 3 months after the end of the financial year to prepare accounting reports in both full and simplified form, approve them and submit them to regulatory authorities. Those. All reporting forms for 2021 must be submitted no later than March 31, 2021. But given that this day falls on a Sunday, the last day for submitting financial statements for 2018 will be April 1.

Both in the Federal Tax Service and in the Rosstat department, accounting reports 2018 can be submitted both in paper and electronic format, the number of company personnel does not play a role in this case.

If you don't report for 2021

If you do not submit financial statements to the Federal Tax Service for 2018 on time, the inspectorate may fine the organization under Article 126 of the Tax Code. The fine in 2021 is 200 rubles. for each document included in the reporting that tax inspectors received late.

When determining the fine, the entire list of documents that a specific organization must submit is taken into account (letters of the Federal Tax Service dated November 16, 2012 No. AS-4-2/19309, Ministry of Finance dated May 23, 2013 No. 03-02-07/2/18285). For example, as part of the financial statements for 2018, an organization must submit the following forms:

- Balance sheet;

- Income statement;

- Statement of changes in equity;

- Cash flow statement;

- explanations in tabular and text forms.

If an organization fails to submit its financial statements on time, the fine will be 1,000 rubles. (200 rub. × 5).

In addition, for late submission of financial statements at the request of the tax inspectorate, the court may impose a fine of 300 to 500 rubles from the responsible employee. (Part 1 of Article 23.1, Part 1 of Article 15.6 of the Administrative Code).

If you fail to submit financial statements to Rosstat on time or submit them incompletely, an administrative fine will be charged. An official of an organization faces a fine of 300 to 500 rubles. (to the manager). The organization itself can be fined from 3,000 to 5,000 rubles. Such sanctions are provided for in Article 19.7 of the Code of Administrative Offenses (letter of Rosstat dated February 16, 2016 No. 13-13-2/28-SMI).

Read also

20.10.2018

Approval of accounting records

The prepared financial statements are signed by the head of the company. Let us remember that it becomes legally significant and actually drawn up only after approval by the top management, for example, by a meeting of shareholders.

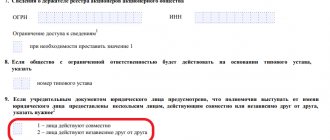

The date of approval of the financial statements is indicated in the title of the balance sheet. The legislator has established the deadlines possible for holding a meeting of shareholders - a JSC has the right to hold it no earlier than 2 months after the end of the financial year - from March 1 to June 30 (Article of the Law on JSC dated December 26, 1995 No. 208-FZ). For LLCs, the period for holding a general meeting of participants is set from March 1 to April 30 after the reporting year (Article of the Law on LLCs dated 02/08/1998 No. 14-FZ). The exact deadlines are established by the charters of the companies.

Publicity of financial statements

Since the company’s reporting must be open to all users (participants, creditors, partners, credit institutions, current and potential investors), the legislator in PBU 4/99 (clause 47) established the obligation to publish it.

Organizations whose publication of information about their activities is mandatory include joint-stock companies, credit institutions, insurance companies, LLCs that issue bonds and other securities. The deadline for publication of accounting (financial) statements for 2021 is no later than June 1, 2021.

Due dates

Particular attention should be paid to reporting to tax authorities and statistics authorities on time in order to protect yourself from penalties provided for by the Code of Administrative Offenses of the Russian Federation. Reports for the past year should be submitted at the location of the organization no later than March 31 of the year following the reporting year. The deadline for submitting financial statements for 2021 is April 1, 2021, because... March 31, 2019 coincides with a public holiday.

Preparation of annual reports is a very responsible process that must be carried out in compliance with all rules and requirements established by law. Requirements are constantly changing, so it is extremely important to carefully monitor all innovations to avoid errors and violations. Remember that even if you did not conduct any activity, you are not exempt from filing zero reports.

To avoid mistakes and fines, as well as save a decent amount on a full-time accountant, we suggest turning to a team of qualified specialists for the preparation and submission of annual reports!

Select the required service and fill out the feedback form or call the number listed on the website - company employees will conduct an initial consultation and tell you about the further procedure.