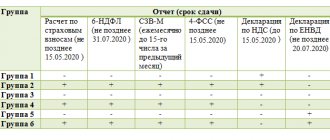

Annual reporting, mandatory for LLCs and individual entrepreneurs working under the simplified tax system

The set of mandatory annual reports for persons using the simplified procedure depends on whether it is an organization or an individual entrepreneur. Moreover, the differences in these sets are quite significant. They are determined by the following factors:

- An individual entrepreneur, unlike a legal entity, has no obligation to keep accounting (subclause 1, clause 2, article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ) and, accordingly, submit accounting reports based on accounting data (clause 1 of Art. 13 of Law No. 402-FZ);

- An individual entrepreneur who does not have employees does not submit those reports that are mandatory for persons making payments to individuals;

- An individual entrepreneur, even if he has objects subject to taxation, does not independently calculate property taxes (on property that is not excluded from taxation when applying the simplified tax system, transport, land).

At the same time, there is reporting that must be submitted by all simplifiers without exception. This is a simplified tax system declaration, generated annually at the end of the year and reflecting the accrual of the main tax for this special regime, replacing (clauses 2, 3 of Article 346.11 of the Tax Code of the Russian Federation):

- income tax for legal entities and personal income tax for individual entrepreneurs;

- property tax (except for that calculated from the cadastral value);

- VAT (except for mandatory payment in certain situations).

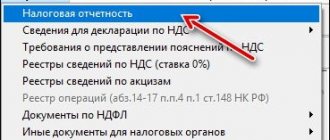

Find the declaration form under the simplified tax system for 2020-2021 here.

However, for this mandatory reporting there is a difference, depending on whether the taxpayer belongs to legal entities or individual entrepreneurs. It consists in the deadline for submitting the declaration, the deadline of which, established for the year following the reporting year, will be (clause 1 of Article 346.23 of the Tax Code of the Russian Federation):

- for a legal entity - March 31 (subitem 1);

- for individual entrepreneurs - April 30 (subsection 2).

Find out what annual reports and within what time frame taxpayers submit under the simplified tax system in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The simplified tax system declaration limits the list of reports required for individual entrepreneurs to report to the simplified tax system for the year if the entrepreneur does not have employees. If there are such employees, then he will have to submit the entire set of reports related to their presence.

Do you have any questions when calculating simplified tax or filling out a declaration? On our forum you can get an answer to any of them. For example, in this thread you can find out the main differences between the simplified tax system “income” and “income minus expenses”.

USN: tax accounting and reporting 2021

The annual financial statements 2021 according to the simplified tax system “closes” the reporting periods and is a kind of “summing up” of the company’s economic activities over the past year. The simplified taxation regime allows legal entities to use special reporting forms that list only the basic performance indicators of the company. Enterprises submit two forms of financial statements to the simplified tax system:

- balance (simplified);

- income and expense report (simplified).

The basis for calculating basic indicators is the book of income and expenses, in which, starting from 2021, a separate column will include “trading fees” and a register of primary documentation. But any enterprise has the right to use a “large” balance sheet if, for some reason, it is more convenient for the accountant to submit it. In 2018, submitting reports according to the simplified tax system to the tax office when closing a period without a balance sheet is impossible.

Please note: a simplified balance sheet cannot be used by enterprises whose activities are subject to mandatory audit. These exceptions are spelled out in more detail in clause 5 of Art. 6 of Law No. 402-FZ.

The balance sheet contains fewer lines and is faster to fill out. But this does not mean that any indicators should be overlooked. You should also not fill out all the lines of the balance sheet: if, for example, the organization does not have fixed assets and uses leased property, a dash should be entered in the corresponding line of the balance sheet. If any indicators require explanation, an accompanying note with explanations is attached to the established forms.

Reporting on payment of income to individuals

The lists of reports and the dates of their submission for mandatory reporting submitted in connection with the payment of income to employees are the same, regardless of who they are generated by (legal entity or individual entrepreneur). This is the reporting:

- personal income tax;

- insurance premiums;

- length of service

IMPORTANT! The report on the average headcount until 2021 was submitted in the form given in the appendix to the order of the Federal Tax Service of the Russian Federation dated March 29, 2007 No. MM-3-25 / [email protected] no later than January 20 of the year following the reporting year (clause 3 of article 80 Tax Code of the Russian Federation). From the reporting campaign for 2021, information is submitted as part of the ERSV. See here for details.

There will be two annual reports for personal income tax. They must be submitted at the same time (no later than April 1 of the year following the reporting year - clause 2 of Article 2340 of the Tax Code of the Russian Federation):

- on the total amounts of tax withheld when paying income - in form 6-NDFL (contained in the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] );

- about income paid to each individual and the tax withheld from them - in form 2-NDFL (given in the order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11 / [email protected] ).

IMPORTANT! If it is not possible to withhold tax on an individual’s income, the Federal Tax Service must be notified about this no later than March 1 of the year following the year of payment of such income (clause 5 of Article 226 of the Tax Code of the Russian Federation), reflecting the relevant information in the certificate of Form 2-NDFL.

When reporting for the 1st quarter, information from certificate 2-NDFL must be submitted as part of 6-NDFL.

For what the new form will look like, see the Review from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

For insurance premiums, you will also need to submit 2 reports:

- in the Federal Tax Service - consolidated, concerning contributions to the Social Insurance Fund (for insurance in connection with maternity and temporary disability), the Pension Fund and the Compulsory Medical Insurance Fund - in the form given in the order of the Federal Tax Service of Russia dated September 18, 2019 N ММВ-7-11 / [email protected] , not later than January 30 of the year that began at the end of the reporting year (clause 7 of Article 431 of the Tax Code of the Russian Federation);

- in the FSS - dedicated to contributions for accident insurance in form 4-FSS, approved by order of the FSS of the Russian Federation dated September 26, 2016 No. 381, no later than 20 (for those submitting a report on paper) or 25 (for those submitting it electronically) January of the year following for reporting (Clause 1, Article 23 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ).

Another report - on the length of service of employees - must be sent to the Pension Fund no later than March 1 of the year following the completed reporting period (Clause 2, Article 11 of the Law “On Individual (Personalized) Accounting..." dated 04/01/1996 No. 27-FZ) , according to the form SZV-STAZH.

What else do LLCs submit to the simplified tax system per year?

In addition to the simplified tax declaration and reports related to the payment of income to employees, mandatory reporting for the year for an LLC using the simplified tax system will include:

- accounting;

- declarations for such taxes as property tax, calculated from the cadastral value, land, transport - if there is an object of taxation (transport and land tax declarations are submitted for the last time at the end of 2020).

NOTE! Here we are not talking about taxes that have a quarter as a tax period (i.e., VAT and water tax), reporting for which at the end of the year coinciding with the end of the next quarter, if there are grounds for this, will also have to be submitted.

LLCs operating on a simplified basis, in terms of indicators characterizing the scale of their activities, usually meet the criteria of a small enterprise. And this compliance gives them the opportunity to choose between the usual (full) and simplified forms of accounting and preparation of accounting reports (subclause 1, clause 4, article 6 of Law No. 402-FZ).

A simplified form of reports implies the presence of a smaller number of lines in them and the inclusion in these lines of indicators combined according to certain principles, which are shown separately in full reporting. The procedure for drawing up simplified reporting does not provide for the preparation of explanations for it. With regard to the preparation of explanations for full reporting, small enterprises have the right to choose: explanations can be given if they are essential for the correct interpretation of the reporting data.

Both versions of reporting forms with a description of the filling rules are given in the appendices to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. Taking into account the fact that LLCs may not prepare explanations for any of these options on the simplified tax system, the following reports are mandatory for submission:

- balance sheet;

- financial results report.

Both of these forms must be submitted to the Federal Tax Service within the period coinciding with the deadline for legal entities to send the simplified taxation system declaration to the tax authority (no later than March 31 of the year following the reporting year - subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). Starting from 2021, there is no need to submit reports to Rosstat.

You need to report for 2021 on updated forms. Machine-readable forms can be downloaded here. If the company belongs to the SMP, then it is possible to submit reports for 2021 for the last time on paper. From now on, the balance will be accepted only electronically via TKS.

Tax returns (if there are grounds for filing them) will need to be sent to the INFS no later than the deadlines occurring in the year following the reporting year. March 30 (clause 3 of Article 386 of the Tax Code of the Russian Federation) - for property tax, compiled in the form contained in the order of the Federal Tax Service of Russia dated August 14, 2019 No. SA-7-21 / [email protected]

You no longer need to report land and transport taxes. Tax officials will independently calculate the amount of tax and send a notification.

Get free demo access to the ConsultantPlus reference and legal system and go to the Ready Solution to find out all the details of the innovations.

To learn about which objects simplifiers will have to pay property tax, read the material “For which real estate objects is the tax base calculated based on the cadastral value?”

Simplified financial statements in 2021: what is included, due dates

Accounting statements in 2021, when simplified, involve submitting two reports on time. This is a simpler reporting option than the basic tax system. That is why many enterprises choose the simplified tax system, unless their activities meet the established criteria. Let's look at what reports need to be prepared and where to submit them.

What is simplification?

What is simplified reporting 2021? Simplified taxation or simplified taxation system is a simplified taxation system. This is one of five taxation systems that operate on the territory of the Russian Federation for business entities (individuals and legal entities).

Typically, beginning businessmen, as well as those who do not go beyond a moderate amount of income, use this particular system because of its simplicity and convenience. In addition to these advantages, simplified reporting in 2021 implies a reduced tax rate, which cannot but attract.

It turns out that this is reflected both in the amount of reporting in 2018 with simplification (accounting and other types) for control authorities, and in the payment of tax fees (their amount is smaller). But to apply the simplification, you need to meet a number of conditions:

- no more than one hundred employees;

- profit for the year is no more than 120 million rubles (this condition was changed in 2021, before that the limit was 60 million, multiplied by the deflation coefficient);

- the residual value of assets should not exceed 100 million rubles.

Additionally, another criterion is used for LLCs: if there is a share of other legal entities in the authorized capital of the organization, then it should not exceed 25%. The company itself, which claims to use simplified reports in 2021, should not have branches or divisions.

Simplified tax reporting

If you compare the simplified reporting calendar for 2021 and the simplified tax system, the difference will be noticeable to the naked eye: many fees that you don’t have to pay on the simplified tax system allow some companies to do without an accountant.

The main feature of the simplified filing of tax reports in 2018 is that a single simplified tax replaces several fees paid by those who work under the OSN:

- income tax (it is replaced by the simplified annual report 2021);

- property tax;

- VAT;

- for individual entrepreneurs this is also personal income tax for themselves.

But there are conditions under which some types of simplified tax reports in 2021 need to be submitted and tax paid on them. Thus, income tax will have to be calculated if the subject of taxation using the simplified tax system has income from dividends or some other income.

Simplified accounting

In 2021, simplified financial statements, according to the law, must be provided by all organizations. In the past, simplified LLCs were in some cases exempted from this honorable privilege, but now this obligation lies with every legal entity.

There is no need to submit a simplified accounting report 2021 for individual entrepreneurs. Accounting statements are submitted to the tax service.

To work according to the simplified reporting calendar 2021, the organization must start by developing an accounting policy. The sequence of actions here is as follows:

- It is necessary to indicate that the company will submit simplified reporting in 2021.

- Determine how to make a simplified report for 2021, develop a methodology for combining accounts (submit a shortened working chart of accounts to the control body).

- Determine which sample accounting forms to use to apply simplification.

- Familiarize yourself with the legally acceptable accounting rules and choose the ones that suit you.

- Establish a procedure for document flow and processing of accounting documents.

There is methodological information on what simplified reports 2021 LLC and other forms are submitted. It is set out in PZ-3 dated November 1, 2012 from the Ministry of Finance.

Accounting reporting for simplification in 2021:

- balance sheet, otherwise form No. 1;

- profit and loss statement (data on financial results), otherwise form No. 2.

You can use both full and simplified forms to simplify LLC reporting for the 2021 tax year, but simplified ones are usually used. This is possible if the company's accountant has developed an accounting policy based on the above recommendations.

The deadline for submitting simplified reporting for 2021 is March 31 of the following reporting year.

Simplified balance sheet

The balance sheet is the main document of the simplified accounting reports of LLC 2021. It represents generalized data about the assets of commercial activities, as well as the sources of their occurrence, and liabilities. Data are valued in monetary terms. Using the balance sheet, you can track what is happening to the company and assess the state it is in.

In simplified form, what kind of reporting is reflected in the balance sheet in 2021:

- material assets of the organization;

- stock size;

- status of settlements;

- investment indicators.

The indicators that are present in the balance sheet can be used for analysis, so usually investors, partners, suppliers and creditors are also interested in simplified financial tax reporting in 2021. Everyone wants to understand who they are dealing with. An experienced accountant will quickly determine from the balance sheet whether it is worth contacting a particular company.

Form 1 has two parts:

- assets;

- liabilities.

Assets characterize all the resources that a company owns. Liabilities represent the sources of formation of these resources. The main property that a correctly compiled balance sheet should have is the equivalence of assets and liabilities. Totals for liabilities and assets should be equal. LLC reports, when simplified in 2021, form the so-called double entry principle, on the basis of which a balance sheet is formed.

The principle of double entry in accounting. accounting

The principle of double entry in simplified 2018 reporting for LLCs is based on the idea that every business transaction has two aspects: an increase in one thing and a decrease in something else. Something appears somewhere, but at the same time something disappears somewhere else. One cannot exist without the other. This principle was formulated by the Italian mathematician Luca Pacioli back in the 15th century.

In simpler terms, this principle for generating simplified tax reports for 2021 means the following: there are two areas of accounting, credit and debit. They are interconnected, so any transaction affects both of these accounts. Consequently, any operation is dual in nature. So, if you purchase products for 10 thousand rubles, this means that there will be 10 thousand rubles on the debit account (these are material assets), but on the credit account there will also be 10 thousand (debt to the supplier).

Before simplifying the 2021 annual reports, it is very important to understand this principle.

Contents of the balance sheet

The simplified reporting submission for 2018, which is included in the accountant’s calendar, contains two reports as part of Form 1 of the balance sheet: an asset and a liability. The assets section is divided into two parts:

- fixed assets;

- current assets.

The liabilities section in the 2021 simplified report for 2021 is divided into 3 parts:

- capital and reserves;

- long term duties;

- Short-term liabilities.

According to the simplified tax reporting article for 2021, it should become clear where this asset/liability came from, what size it is, and what it is intended (or possible) to be used for.

Rules to follow when preparing a balance sheet

There are some rules that must be followed. They do not depend on the year the report was submitted; these are general recommendations for financial statements:

- incoming information in the balance sheet must be current at the end of the previous reporting year;

- Offsetting between items can be done only if this is permitted by the Accounting Regulations;

- the simplified deadlines for submitting tax reports for 2018 should be observed;

- articles need to be confirmed by data on inventory, obligations or settlements.

Gains and losses report

The annual profit and loss report shows what results the company has achieved in the course of its activities. It reflects income and expenses, which can be used to determine how much one item prevails over the other. This is also an extremely important document for understanding the company’s economic performance. The data in it is provided as a cumulative total: starting from the beginning of the year and until the reporting date of the deadline for submitting simplified LLC reports for 2018.

There are several items that should be covered in this report:

- the amount of revenue from the sale of goods or services;

- interest income;

- income from holding shares in other companies;

- other income;

- non-operating income;

- extraordinary income.

The way in which the Form 2 income statement is prepared varies significantly depending on how the entity recognizes its income due to:

- the nature of the activity;

- type of profit;

- the amount of profit;

- conditions for receiving income;

- type of income (regular or all other).

Some data for this type of reporting must be taken from documents submitted for the previous 2021 simplified reporting period.

Advantages and disadvantages of simplification

The advantages of simplifying the submission of financial statements for 2018 are obvious:

- taxes need to be paid significantly less in total;

- reporting is simpler;

- the tax rate is reduced compared to the OSN.

But the system and the 2021 accounting reporting deadlines for simplification also have disadvantages:

- income restrictions. If the company achieves a higher income than the simplified tax system allows, it will have to submit all reports according to the OSN. The results are summarized for the first three quarters of the year;

- difficulties in completing transactions without VAT;

- If the opportunity to simplify the reporting in 2021 disappears, the number of forms will increase sharply, and the company may not be ready for this.

Types of simplification and object of taxation

What simplified reports need to be submitted in 2021 and what are its types? There are two types, respectively, two objects of taxation on this system:

- income (the default tax rate is 6%, but this may change for some regions);

- income minus expenses (in this case the rate will be 15%, but it can also be reduced).

The deadlines for simplified reports for 2021 on different forms remain the same. The tax rate reduction can be quite significant. Thus, in some regions the tax amount reaches 1% on income and up to 5% on income minus expenses.

If you are just deciding to switch to the simplified tax system, then when choosing an object of taxation, you should think about whether the company or individual entrepreneur has a lot of expenses that can be documented (cash receipts, documents, etc.), when you will have to submit simplified 2018 reports Now.

By applying the second simplified reporting scheme in 2021, you can reduce the tax by half if you deduct insurance premiums for employees as expenses. For individual entrepreneurs, the tax can be reduced to zero. It is important that before submitting a declaration that reflects the reduction in tax on expenses for social insurance contributions, payments for them must already have been made. Only in this case can they become a basis for reducing the tax base.

Typically, a business that specializes in services chooses a simplified scheme for submitting reports starting in 2021 with an income of 6%, since in this case there are not so many expenses. The main expense here is time or effort, but it will not affect the amount of tax. It is better to pay tax only on revenue.

But for those whose business is trade, the difference in simplified LLC reporting in 2018 can be simply enormous. So, in retail trade, a normal profit is considered to be 10-15%, and the costs are very significant. Most of the funds are spent on purchasing goods. Here it is more profitable to use income minus expenses.

Results

Mandatory annual reporting for any simplified tax system is the simplified taxation system (STS) declaration. LLCs always, and individual entrepreneurs if they have hired employees, must submit reports related to the presence of such employees and the payment of income to them. The LLC, in addition, has the obligation to submit accounting reports and (if there are grounds for assessment) - declarations for property tax, calculated from the cadastral value, land and transport taxes.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.