Hello, Vasily Zhdanov, in this article we will look at the total financial result of the period. This term, let's call it conditionally in the abbreviation SFR, is net profit (loss) for a specific reporting period, adjusted for the results of the revaluation of both non-current assets and other transactions that are not included in it. This definition can be found in almost all economic analytical sources of information, and therefore is perceived today as generally used.

Important! The SFR of each period is reflected in the financial report. results on page 2500.

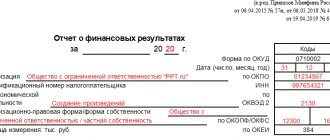

The current form of this report (according to OKUD 0710002) was introduced by Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010 (last amended on April 19, 2019). Economists most often call it Form No. 2. From 2021, an updated report form will be used, which contains the changes introduced by the said Order of 2021. Meanwhile, organizations have the right to make an independent decision about using it before the deadline.

Take our proprietary course on choosing stocks on the stock market → training course

The form is intended for all organizations except credit, insurance and government organizations. Individual entrepreneurs and foreign organizations that operate in the Russian Federation provide this type of reporting upon request. This norm is not their responsibility.

It should also be noted that, starting from 2012 to this day, the profit and loss statement is referred to as a financial statement. results. The basis is information of the Ministry of Finance of the Russian Federation No. PZ-10/2012.

Lines and their names in full-length fin. report No. 2

As you know, there are two forms of this report: full and simplified. The second is intended for those who use simplified methods of accounting. accounting. These include, first of all, representatives of small businesses and non-profit structures. In order to use the simplified form, they should establish the use of the simplified report as the norm in their accounting policies.

Further in the text we will consider the full-format report form, which contains the following lines:

- Page 2110, revenue (profitability from ordinary activities).

- Page 2120, cost of sales (expenses for ordinary activities as part of cost).

- Page 2100, VP (loss).

- Page 2210, commercial expenses (apply equally to the sale of products, services, and works).

- Page 2220, management expenses (related to the management of the organization).

- Page 2200, profit and loss from sales (i.e. directly from activities).

- Page 2310, income from participation in other organizations.

- Page 2320,% receivable (information on interest received).

- Page 2330,% payable (i.e. expenses in the form of interest that must be paid).

- Page 2340, etc. income.

- Page 2350, etc. spending.

- Page 2300, profit and loss before tax.

- Page 2410, current income tax (applied to the calculated amount on the declaration).

- Page 2421, including constant. tax liabilities (assets).

- Page 2460, other.

- Page 2400, emergency, loss.

- Page 2500, SFR.

The listed data is entered as of a specific reporting period. If there is no information on the indicators, dashes are placed on the corresponding lines. Directly on page 2500 the already calculated amount of SFR for the required period is indicated.

The simplified version of the report is a condensed form of the full one. It should be noted that it consists of only seven main lines and does not contain page 2500 (SFR).

Article 2900 “Basic earnings (loss) per share”

This article provides information on basic profit (loss) per share for reference.

, which reflects part of the profit (loss) of the reporting period due to shareholders - owners of ordinary shares. This line is filled in only by joint stock companies.

When forming basic earnings per share indicators in the financial statements, you should be guided by Order of the Ministry of Finance of Russia dated March 21, 2000 N 29n “On approval of Methodological Recommendations for the disclosure of information on profit per share” (see letter of the Ministry of Finance of the Russian Federation dated September 9, 2011 N 07-02-06/171).

To determine basic earnings (loss) per share, you first need to determine:

Basic profit (loss) of the reporting period;

The weighted average number of common shares outstanding during the reporting period.

Then the first indicator is divided by the second (clause 3 of the Methodological Recommendations on earnings per share).

The basic profit (loss) of the reporting period is determined by reducing (increasing) the profit (loss) of the reporting period remaining at the disposal of the organization after taxation and other obligatory payments to the budget and extra-budgetary funds, by the amount of dividends on preferred shares accrued to their owners for the reporting period ( clause 4 of the Methodological Recommendations on Earnings per Share).

The amount of profit (loss) of the reporting period remaining at the disposal of the organization is reflected in line 2400 “Net profit (loss)” of the Profit and Loss Statement.

Weighted average number of ordinary shares

is determined by summing the number of ordinary shares outstanding on the first day of each calendar month of the reporting period and dividing the resulting amount by the number of calendar months in the reporting period. In this case, the data from the register of shareholders of the company on the first day of each month is used (clause 5 of the Methodological Recommendations on earnings per share).

For calculation purposes, the number of common shares outstanding at the beginning of the year must be adjusted to reflect the shares of common stock issued and paid during the period. If shares were repurchased from shareholders, the weighted average number of shares is adjusted for shares repurchased during the period.

The weighted average number of shares is taken into account taking into account the period from circulation during the reporting period. To do this, the number of shares outstanding is multiplied by a time weighted factor. It is a fraction whose numerator is the number of days (months) of shares outstanding, and the denominator is the total number of days (months) in the calculation period.

How to determine the value of the total financial result (CFR)

It should be noted that there are currently no separate detailed explanations for this new indicator. Current regulatory documentation does not explain its economic meaning. Only the procedure for its calculation has been determined, which, in fact, is used everywhere.

As is customary, the value of the SFR is calculated based on the data contained in the financial report. results. To calculate, you need to know three values:

- the amount of emergency, i.e. net profit, loss (registered on page 2400);

- the result obtained from the revaluation of non-current assets (VA), which is not included in the PE for the period under review (registered on line 2510);

- and the result from others. operations that are not considered an emergency (registered on page 2520).

To obtain the amount of SFR, the listed values must be summed. If we translate all this into a mathematical formula for calculation, then the calculation will take the following interpretation:

SFR = Line 2400+ Line 2510+2520

This is the general formula for calculating the SFR according to finance. report. The result of the calculation may be negative, which means a loss. The loss obtained as a result of the calculation should also be displayed on page 2500 as the value of the SFR, but only in parentheses. It should be noted that negative values (i.e. amounts with a minus) are always recorded in the reporting in parentheses, the minus is not placed next to it, because then such an entry will be considered incorrect.

With regard to the SFR indicator, we can conclude that it raises the level of information content of the information displayed in financial data. report No. 2. And this allows you to increase the efficiency of management decisions.

Tip 4: How to calculate financial indicators

Data that characterize various aspects of the enterprise’s activities related to education, as well as the use of all its funds and savings, are financial indicators. At the same time, the main and most frequently used financial indicators can be divided into five groups, reflecting different aspects of the financial condition of the company: liquidity ratios, profitability, business activity, sustainability (capital structure indicators) and investment criteria.

Instruction 1 Liquidity indicators characterize the company's ability to satisfy the claims of consumers of short-term debt obligations. In turn, the absolute liquidity ratio determines what proportion of short-term debt obligations can be covered by cash in the form of deposits and marketable securities. This ratio can be calculated using the ratio of the amount of cash and short-term financial investments to current liabilities. 2 The quick liquidity ratio is calculated as the ratio of the more liquid part of current assets (short-term financial investments, accounts receivable, cash) to short-term liabilities. It is recommended that the value of this indicator be greater than 1. 3 The value of the current liquidity ratio is determined as the quotient of the ratio of current assets to short-term liabilities. It shows whether the company has enough funds that can be used to pay off short-term obligations. 4 Net working capital is expressed in monetary units as the difference between the firm's current assets and its short-term liabilities. This indicator is necessary to support the financial stability of the enterprise, because the excess of working capital over the value of short-term liabilities means that the company will not only be able to pay off all its short-term obligations, but it also has reserves for expanding its activities. 5 Capital structure indicators or financial stability ratios reflect the ratio of equity to debt in the company’s sources of financing. They characterize the degree of financial independence of the company from creditors. In this case, the following values are used to assess the capital structure: - Financial independence coefficient, which characterizes the company’s dependence on external loans. It is calculated as the ratio of equity to total assets. — Interest coverage ratio — characterizes the degree of protection of the creditors themselves from non-payment of interest on the loan provided and shows how many times during the reporting period the company earned funds to pay interest on loans. This indicator can be calculated from the ratio of profit before taxes to interest on the loan. 6 Profitability ratios determine how profitable the enterprise is. The return on sales ratio shows the share of net profit in the volume of all sales of the enterprise. It can be calculated as the ratio of net profit to net sales multiplied by 100%. 7 The return on equity ratio determines the efficiency of using the capital that was invested by the owners of the enterprise. It is calculated using the following formula: net profit must be divided by equity and multiplied by 100%. Video on the topic

How the total financial result is formed: description of lines 2400, 2510, 2520 fin. report No. 2

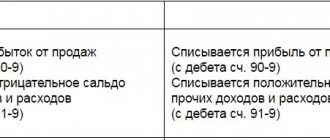

So, a significant share of the total result is net profit (NP). It is subject to adjustment for the results of revaluations, which contain lines 2510 and 2520. Therefore, in addition to the emergency situation, these two indicators should also be taken into account. Let's consider the relationship between these three indicators and some features of their display in reporting.

The first indicator. Profit for the current year is shown by account. 90 (sales) and 91 (other income with expenses). The latter are then written off to the account. 99 (profit, loss), which at the end of the current reporting year is closed on the account. 84 (retained earnings).

The second indicator. As for the revaluation of VA, today it is carried out on the last day of the outgoing reporting year. If by this time there are no amounts of additional capital from a previously carried out revaluation, the markdown is shown in other words. spending. When carrying out an additional assessment as part of a previous revaluation, the amounts of which have already been included in the financial. As a result, this revaluation is shown in other things. income, but page 2510 is then left blank. If amounts of additional capital are involved, they are registered on page 2510 in section. "For reference."

The third indicator. This is another ambiguous indicator that appears in the calculation of the SFR - the result from others. operations (page 2520). What is noteworthy is that, within the framework of the applicable standards, it is not defined exactly what kind of operations we are talking about here. There are no strict regulations on this part. As practice shows, this indicator often includes the difference that arises when recalculating the value of existing assets.

For example, when a Russian organization operates in another country and, when using assets, recalculates their value in foreign currency into denominations. rubles When recalculating, the difference is obtained, which is further displayed using additional capital (in relation to PBU 3/2006, approved by Order of the Ministry of Finance of the Russian Federation No. 154n dated November 27, 2006).

In addition to the above, there is an opinion that the third indicator under consideration also includes the amount of errors for the previous year, which were identified by the time the accounts were formed and approved. reporting. In fact, comparable values of indicators for previous periods are adjusted when compiling accounts. reporting with disclosure of information in the relevant explanations. Errors are corrected in the manner indicated in clause 9, part II of PBU 22/2010 (approved by Order of the Ministry of Finance of the Russian Federation No. 63n dated June 28, 2010).

Taking into account the above, the general formula for calculating the SFR can be presented as follows:

Interpretation of indicators: PE - net profit, Y - loss, RPVA - the result from the revaluation of VA, not included in the PE, RPO - the result from other things. operations not classified as an emergency.

Tip 1: How to calculate financial results

Author KakSimply! The financial result will help you reflect the relationship between income and expenses of your enterprise. This indicator can be positive (profit) if income exceeds expenses, and negative (loss) when expenses exceed income.

Instruction 1 The main indicators of profit in the accounting system of an enterprise are: profit from sales, profit from sales, gross profit, profit before tax and net profit. 2 The profit that an enterprise receives as a result of the sale of its own products is called profit from the sale of goods or services. In this case, the indicator is calculated as the difference between the revenue received and the cost of goods sold. In its full form, the formula can be presented as follows: Prp = C ? Vр - Срп = Vр ? (C - Sep), where Prp is the profit from sales of products, C is the price of a unit of production, Vp is the volume of products sold, Srp is the total cost of products sold, Sep is the total cost of a unit of production. 3 If an enterprise only sells goods or services (without producing them), then in this case they talk about profit from sales, which can be calculated as the difference between gross profit and expenses (administrative + commercial). In its full form, the formula is as follows: Psales = B – Srp – KR – UR, where Psales is profit from sales, B – revenue from sales of products, Srp ? full cost of goods sold, KR - selling expenses, UR - administrative expenses. 4 Gross profit is calculated as the difference between sales revenue and the total cost of products sold.. 5 To obtain the profit before tax (Pdon), you need to add other income to Psales and subtract other expenses. Having calculated Pdon, the organization pays the necessary taxes and receives net profit. The latter is the source of payment of founder's income and the formation of the enterprise's own capital. Video on the topic

Please note: Do not confuse the categories “income” and “profit”. In the first case, we are talking about economic benefits before subtracting costs.

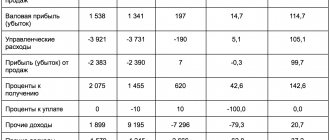

Example 1. Calculation of SFR for filling out line 2500 fin. report of Olmis LLC for the period 2017–2018.

The calculation of the SFR value is based on data from the financial. report No. 2 of Olmis LLC for the period 2017–2018. The general calculation formula is applied. The indicator values used in the proposed example are conditional.

| The name of the indicator and the corresponding financial line. report No. 2 Olmis LLC | Data on it for 2021 from the report of Olmis LLC (thousand Russian rubles) | Data on it for 2021 from the report of Olmis LLC (thousand Russian rubles) |

| State of emergency (loss), page 2400 | 15 000 | 9 980 |

| Result from revaluation of VA, not attributed to emergency (loss), line 2510 | 89 | 130 |

| Result from other operations not classified as an emergency (loss), line 2520 | – | – |

The calculation of the SFR value for Olmis LLC is carried out for each period separately (first for 2021, then for 2021). Since there is no information on line 2520 (there are dashes for it in the financial report), the values that are available are substituted into the general formula for calculation.

SFR calculation for 2021: 15,000 + 89 = 15,089. By analogy, calculation for 2021 is made: 9,980 + 130 = 10,110.

According to the results obtained in Fin. in the report of Olmis LLC on page 2500 for the period 2021, the amount “15,089” should be recorded, and for the period 2021 on the same line - the amount “10,110”.

Rules for drawing up a document

The financial results report has two unified forms:

- regular (includes extended information),

- simplified (the information in it is more compressed).

Regardless of which form the company uses, the report contains the following mandatory data:

- company details,

- date of document preparation,

- profit and loss indicators,

- total values.

You should be very careful when filling out the document, since mistakes, and even more so entering unreliable or deliberately false information into it, are fraught with unpleasant consequences.

If any inaccuracies or corrections were made during the process of filling out the document, it is best to print out a new form and fill it out again.

Example 2. Calculation of the SFR value for line 2500 in fin. report No. 2 of Prom-Style LLC for 2021

Prom-Style LLC carries out several types of activities, including: retail and wholesale trade in manufactured goods, consulting, intermediary activities. Let's assume that according to financial data. report No. 2 of Prom-Style LLC for 2021, the following data was obtained (see table).

| Indicator from fin. report of Prom-Style LLC | Data on it for 2021 (thousand Russian rubles) | SFR calculation for 2021 |

| Emergency (p. 2400) | 500 350 | SFR = PE – RPO |

| RPO (page 2520) | 8 100 | 500 350 – 8 100 = 492 250 |

Explanations for the calculation. According to financial data. According to the report of Prom-Style LLC, no revaluation of VA was carried out in the period under review (2019). Only the result from others is known. operations (8,100 thousand Russian rubles) and the value of the state of emergency (500,350 thousand Russian rubles).

Taking this into account, the SFR should be calculated using formula 2 (see above), substituting the values of only these two indicators. The calculation result is 492,250 thousand rubles. rub. This is the amount that should be indicated on line 2500 for the 2021 financial year. report of Prom-Style LLC.

Line 2100 is

Currently, the only available source of information on the balance sheets of enterprises in Russia is the Federal State Statistics Service. All reporting indicators, including assets and liabilities, information about the head of the company, profit and loss statement, and in general - more than 30 indicators - can be displayed in a report obtained using the Prima-Inform portal.

According to Article 15 402-FZ “On Accounting”, all organizations, with the exception of budgetary and government institutions, must submit annual financial statements in accordance with the constituent documents to the founders, participants of the organization or owners of its property, as well as to the territorial bodies of state statistics at the place of their registration . Therefore, studying such a report will not only make sure that the company with which you are going to cooperate really exists and is conducting business activities, but also understand how stable your potential partner is in a particular area of business.

After paying for the service ( 200 rubles ), you will receive to your e-mail, specified before making the payment, the financial statements of the requested organization for all periods during which this organization reported to the state statistics bodies. Our company does not modify the reporting in any way, providing it to the end user in an “as is” form. Those. Our client sees in his report exactly the same document that employees of government agencies see.

Prima-Inform provides data on all enterprises registered in Russia. So you can at any time get information about any company, wherever you are, the main thing is to be connected to the Internet, and in a few seconds you can get the balance sheet of the enterprise and an extract from the Unified State Register of Legal Entities, registered and conducting business activities, for example, on Far East.

Get a service

Checking the correctness of the balance sheet is based on the following main points:

1) the data of balance sheet items at the beginning of the period must correspond to the data of the balance sheet at the end of the previous period.

If the opening balance at the beginning of the year changes in comparison with the reporting data for the previous year, appropriate explanations must be given;

2) the data of balance sheet items at the end of the reporting period must be justified by the results of the inventory;

3) the amounts of balance sheet items for settlements with financial, tax authorities, and banking institutions must be reconciled with them and be identical;

4) the final balance data must correspond to turnover and account balances. The general ledger or other similar accounting register at the end of the reporting year;

5) balance sheet data at the beginning and end of the year must be compared. Any discrepancies in the methodology for the formation of the same item in the opening and closing balance sheets must be explained

Checking the correctness of reflection of non-current assets in the balance sheet

Checking the correct reflection of intangible assets and fixed assets in the balance sheet includes two main points:

1) it is necessary to make sure that the corresponding assets of the enterprise included in the composition of intangible assets and fixed assets are actually available;

2) it is necessary to make sure that it is appropriate to choose a methodology for displaying business transactions and assessing the client’s property:

a) division of fixed assets and intangible assets into groups for which accounting is kept;

b) choosing a depreciation method for fixed assets and intangible assets;

3) it is necessary to check whether there were any changes in the methodology for accounting for fixed assets and intangible assets during the audited period;

4) it is necessary to check the correctness of accounting for the acquisition, depreciation and disposal of intangible assets and fixed assets

The availability of fixed assets is checked on the basis of inventory cards, inventory lists and actual availability

The correctness of depreciation calculation is checked selectively by drawing up calculations for 1-2 quarters

Checking the correctness of financial investments reflected in the balance sheet

Financial investments include investments by an enterprise in government securities (bonds and other debt obligations), securities and authorized capital of other enterprises, as well as the provision of positions to other businesses.

They are reflected in the balance sheet respectively under the headings “Long-term financial investments” and “Current financial investments”

When checking the correctness of the reflection of financial investments in the balance sheet, the availability of securities, their value, owner and compliance of all details are checked. When reviewing balance sheet data, the auditor may decide to conduct a more in-depth review of certain issues.

Checking the correctness of reflection in the inventory balance

When checking the compliance of the actual availability of production inventories, as well as stocks of low-value and wearable items and finished products with accounting data, it is necessary to: refer to the data of the summer other inventory; select groups of stocks for which a complete check of individual stocks (for example, the most valuable or scarce) in storage areas should be carried out, and define groups for selective checking of the LCD.

It is important to pay attention to compliance with the procedure for storing material assets in warehouses, compliance of storage locations with the conditions for storing certain types of reserves, and the existence of contracts with financially responsible persons. After this, you should check the valuation and movement of the stock.

How to submit an income statement

Today, a document can be submitted to the tax service in three main ways.

- First : by going to the tax office in person. In this case, the report can be given either directly by the head of the company or by a proxy acting on his behalf (but then you must have a power of attorney certified by a notary).

- The second option: send the financial results report via electronic means of communication: however, here you need to keep in mind that the company must have a registered electronic signature.

- The third way to submit a report: sending it via Russian Post by registered mail with acknowledgment of delivery.