Consequences of low tax burden

According to tax officials, a low tax burden for VAT is a reason to call the taxpayer to a commission.

Identification of such taxpayers is carried out on the basis of VAT returns submitted for a number of tax periods, in which the ratio of the amount of VAT subject to deduction to the amount of calculated tax from the tax base was 89 percent or more (letter of the Federal Tax Service of the Russian Federation dated July 17, 2013 No. AS-4- 2/12722 “On the work of tax authorities’ commissions on the legalization of the tax base”). True, the Ministry of Finance of the Russian Federation recently canceled this clarification from the tax service (letter dated March 21, 2017 No. ED-4-15/5183).

But this does not mean at all that tax authorities will stop comparing the amount of taxpayers’ deductions indicated in their declarations with the acceptable figures for the region. In any case, clause 3 of the Publicly Available Risk Assessment Criteria states that a company has a risk of being included in the on-site inspection plan if the share of VAT deductions is equal to or exceeds 89 percent of the amount of the accrued tax. Please note: a low tax burden in itself is not evidence of non-payment of taxes.

The Federal Tax Service can only assess additional taxes and fine you for non-payment if, based on the results of a tax audit, violations of the Tax Code of the Russian Federation are established (clause 50 of the Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 No. 57).

Safe VAT deduction

It is worth noting that the wording “safe VAT” is not included in the Tax Code of the Russian Federation, and the amount of tax depends on a list of factors: type of activity, markups used, seasonality, etc. The safe share of deductions is usually understood as a threshold, the value of which is not established by law, but exceeding which will attract the attention of the tax service to the company.

There are two values that the Federal Tax Service of Russia is guided by (Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/ [email protected] ):

- The VAT deduction for four quarters should not exceed 89% of the amount of tax accrued for this period.

- The VAT deduction should not exceed the average share of VAT deductions. Data on the “average share” in each region of Russia is determined by calculation from the 1-VAT report, which the Federal Tax Service publishes every quarter on its website.

Important! Compliance with a safe share of VAT deductions in 2021 does not guarantee that the company will not be included in the tax service’s on-site audit plan. A “safe” deduction is an important criterion for tax risks, but not the only one.

Safe share of VAT deductions in the regions of the Russian Federation for the first quarter of 2021

| Region | Share, % | |

| 01 | Adygea republic | 85,8 |

| 02 | Bashkortostan republic | 88,1 |

| 03 | Buryatia Republic | 80,1 |

| 04 | Altai Republic | 92,2 |

| 05 | Dagestan republic | 86,4 |

| 06 | Ingushetia republic | 98,2 |

| 07 | Kabardino-Balkarian Republic | 94,4 |

| 08 | Kalmykia Republic | 74,7 |

| 09 | Karachay-Cherkess Republic | 95,1 |

| 10 | Karelia Republic | 86,1 |

| 11 | Komi Republic | 81,2 |

| 12 | Mari El Republic | 92,4 |

| 13 | Mordovia Republic | 88,5 |

| 14 | Sakha /Yakutia/ republic | 88,1 |

| 15 | North Ossetia-Alania Republic | 86,7 |

| 16 | Tatarstan republic | 88,4 |

| 17 | Tyva Republic | 78,4 |

| 18 | Udmurt republic | 81,0 |

| 19 | Khakassia Republic | 92,8 |

| 20 | Chechen Republic | 102,0 |

| 21 | Chuvash Republic - Chuvashia | 82,2 |

| 22 | Altai region | 89,7 |

| 23 | Krasnodar region | 89,4 |

| 24 | Krasnoyarsk region | 78,4 |

| 25 | Primorsky Krai | 95,9 |

| 26 | Stavropol region | 90,4 |

| 27 | Khabarovsk region | 87,9 |

| 28 | Amur region | 113,4 |

| 29 | Arhangelsk region | 84,9 |

| 30 | Astrakhan region | 55,7 |

| 31 | Belgorod region | 90,7 |

| 32 | Bryansk region | 95,2 |

| 33 | Vladimir region | 83,7 |

| 34 | Volgograd region | 87,3 |

| 35 | Vologda Region | 84,8 |

| 36 | Voronezh region | 92,3 |

| 37 | Ivanovo region | 93,8 |

| 38 | Irkutsk region | 80,4 |

| 39 | Kaliningrad region | 67,7 |

| 40 | Kaluga region | 88,2 |

| 41 | Kamchatka Krai | 90,9 |

| 42 | Kemerovo region | 84,1 |

| 43 | Kirov region | 86,7 |

| 44 | Kostroma region | 85,1 |

| 45 | Kurgan region | 88,8 |

| 46 | Kursk region | 89,1 |

| 47 | Leningrad region | 85,1 |

| 48 | Lipetsk region | 91,4 |

| 49 | Magadan Region | 99,7 |

| 50 | Moscow region | 90,1 |

| 51 | Murmansk region | 79,9 |

| 52 | Nizhny Novgorod Region | 88,0 |

| 53 | Novgorod region | 84,5 |

| 54 | Novosibirsk region | 90,0 |

| 55 | Omsk region | 85,1 |

| 56 | Orenburg region | 74,5 |

| 57 | Oryol Region | 92,3 |

| 58 | Penza region | 89,6 |

| 59 | Perm region | 79,4 |

| 60 | Pskov region | 90,6 |

| 61 | Rostov region | 91,6 |

| 62 | Ryazan Oblast | 86,9 |

| 63 | Samara Region | 86,0 |

| 64 | Saratov region | 85,5 |

| 65 | Sakhalin region | 86,6 |

| 66 | Sverdlovsk region | 87,4 |

| 67 | Smolensk region | 91,6 |

| 68 | Tambov Region | 96,7 |

| 69 | Tver region | 88,7 |

| 70 | Tomsk region | 74,2 |

| 71 | Tula region | 93,3 |

| 72 | Tyumen region | 85,9 |

| 73 | Ulyanovsk region | 90,8 |

| 74 | Chelyabinsk region | 88,6 |

| 75 | Transbaikal region | 91,2 |

| 76 | Yaroslavl region | 85,6 |

| 77 | Moscow city | 89,0 |

| 78 | Saint Petersburg city | 90,4 |

| 79 | Jewish Autonomous Region | 90,6 |

| 83 | Nenets Autonomous Okrug | 125,7 |

| 86 | Khanty-Mansiysk Autonomous Okrug - Yugra Autonomous Okrug | 63,0 |

| 87 | Chukotka Autonomous Okrug | 90,9 |

| 89 | Yamalo-Nenets Autonomous Okrug | 71,0 |

| 91 | Crimea republic | 87,8 |

| 92 | Sevastopol city | 81,4 |

| 99 | Baikonur city | 50,9 |

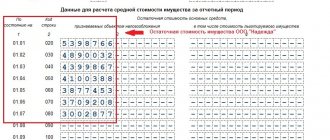

Safe deduction share

The safe share is the difference between the amount of tax payable and the VAT deduction.

The main problem for the taxpayer is that the safe share is not established by law. You can claim for deduction an amount even greater than VAT, but in this case the tax office can:

- send a request for explanations and documents;

- call to the commission;

- include in the on-site inspection plan.

There is no need to be afraid of this. But be prepared to stand up for your rights.

Important! The tax office's attention is not focused only on VAT. Inspectors also look at the tax burden, wage levels, profitability, and so on. It is then compared to industry or regional averages. Any deviation will pique their interest.

High share of tax deductions for VAT. Response to the tax office

After submitting your VAT return, did the tax office receive a request to provide an explanation for the high share of VAT deductions? An example of an explanation is easy to find in open sources, but it is not worth wasting time because explanatory documentation can be provided in any form. It is recommended to indicate that:

- the indicators indicated in the declaration are correct, re-checked and approved in the previous values;

- the organization did not make errors or incompletely reflect information, and clarification is not required;

- The organization has taken measures to increase these indicators in the next reporting period and reduce the share of VAT tax deductions.

It is recommended to decipher and attach to the explanatory note the calculation of the disputed values of the indicators and documentation confirming the information provided in the documentation. To explain why an organization has a high share of VAT tax deductions, an explanation (it is difficult to find a suitable example, because the reasons for each organization are individual) should be provided with the requested documentation attached within five banking days. Without providing written explanations on the issues requested by the inspectors, the entrepreneur is not liable before the law. But a timely response to the tax authorities’ demands on a voluntary basis will save the organization from problems with unreasonable penalties, which inspectors, at their discretion, will impose on the enterprise on controversial issues. Unfortunately, in such situations, controversial issues are resolved not in favor of the organization. Of course, the tax inspectorate evaluates the tax risks of companies based on more than one indicator, so just exceeding the values established on the basis of statistical information will not be the reason for an audit, but it will certainly be the basis for additional demands from inspectors. It is fair to note that, working within the specified indicator, an entrepreneur is not immune from tax audits. So, before submitting the declaration, the leaders of the organization should check such an indicator as the share of tax deductions for VAT, because exceeding the threshold value will provoke a keen interest in the company on the part of the inspection authorities. Although, if the company’s business is legitimate and legal in nature, and the transactions are not related to “fly-by-night companies,” then both the accountant and the director have nothing to fear and have something to provide tax officers with as an objection to the claims. For example, to indicate the objective reasons for the high share of tax deductions for VAT, we will consider a sample explanation.

What's happened?

The share of VAT deduction in the tax return for the third quarter of 2018 is the first thing that Federal Tax Service inspectors will check when receiving a reporting form from an organization. How do they do it? Yes, simply during a desk audit they compare the data on the VAT declared by the taxpayer for deduction with the safe value of the deduction share in the region where he operates. If a taxpayer's claimed deduction exceeds the safe limit, he or she is in trouble. Federal Tax Service inspectors can:

- request clarification;

- invite to a commission;

- schedule an unscheduled inspection.

Although tax returns have already been submitted, we still recommend checking the declared share of VAT deductions using data from the Federal Tax Service of Russia and a special formula. After all, if it turns out to be higher, it is better to prepare for a conversation with employees of the Federal Tax Service of Russia in advance.

In addition, there have been reports that tax authorities are working on creating an information resource with data from taxpayers who have unformed sources in the supply chain for VAT deduction. That is, those who have gaps in VAT. This means that there will be more risks even for conscientious taxpayers.

Calculation of the share of VAT deductions

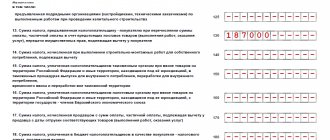

What does this indicator mean and how is it calculated? This is nothing more than a percentage of VAT deductions in the amount of accrued tax. To calculate it, you need only two values, which can be found in section 3 of the VAT return. This is line 190 (VAT deductible) and line 118 (VAT accrued).

The indicator is calculated using the following formula:

VAT deductible / VAT accrued * 100%

In order to see the dynamics of this indicator, it is better to take the relevant data from the last four declarations.

The result of the calculation will be a percentage value corresponding to the share of VAT deductions in the total amount of accrued tax. In other words, this value shows what percentage of the accrued VAT the company claims to deduct. It is this that the tax authorities will compare with the threshold indicator in order to draw a conclusion about the degree of tax risks of the company for VAT. If the proportion of VAT deductions according to the taxpayer’s declaration is greater, then this immediately attracts the attention of tax inspectors.

An example of calculating the safe amount of VAT deduction

Let’s assume that during the reporting period, a taxpayer from Moscow paid VAT in the amount of 100,000 rubles.

It is impossible to say whether this is a lot or a little for this organization. But the picture becomes clearer if we calculate the share of VAT deductions:

According to the company’s declaration, for the specified period the amount of calculated VAT, taking into account the restored amounts, is 1,500,000 rubles (section 3, line 118). The tax deduction for the same period amounted to 1,400,000 rubles (section 3, line 190). Substituting these figures into the above formula 1,400,000/1,500,000, we find that the share of VAT deductions in the amount of accrued tax in the period under review was 93.33%. This is more than the threshold value of 88.52% for Moscow (as of November 1, 2021), which means that the tax authorities have a reason to take the taxpayer into custody.

What should be the amount of VAT in the considered example for Moscow, so as not to attract increased attention from tax authorities?

It can be calculated using the reverse formula: accrued VAT * (100 – safe VAT) / 100 = = 1,500,000 * (100 - 88.52) / 100 = 172,200 rubles.

Based on the criteria used by the Federal Tax Service, the company in our example needs to pay at least 172,200 rubles in VAT in order not to leave the “safe” zone.

How to calculate the share of VAT deductions in 2021

The share of tax deductions for VAT is an indicator of assessing the state of affairs in the organization. Organizations that do not wish to provide information to the inspectorate about the reason for reducing the tax burden risk being included in the list of those who received notification of the appointment of an on-site inspection. If an organization, when compiling information on the tax burden at an enterprise, finds itself at risk according to this criterion, it is recommended to submit an explanation to the tax office about the reasons for the current situation, without waiting for requirements from the inspectorate. Calculation of the share of deductions and comparison with the threshold value approved for 2021 for the region in which the organization operates will help to assess the risks. This indicator represents the percentage of VAT deductions in the amount of accrued VAT. For the calculation, only two values from the declaration are required:

- Line 190 “VAT deductible”;

- Line 110 “VAT accrued”.

We calculate the indicator: VAT deductible / VAT accrued * 100%. An indicator in dynamics is informative, that is, a change in the values of the indicator over two or three reporting periods. Having carried out the necessary calculations, we will find out what percentage of the accrued VAT the organization deducts. This value is compared by tax authorities with a threshold value in order to identify the degree of VAT tax risks in the organization. Organizations with a threshold value higher than that approved in the region in which the organization is registered immediately come under the close attention of inspectors. An example of calculating the share of VAT deductions for an organization (Moscow) According to information from the declaration for the 1st quarter, VAT was charged in the amount of 1,000,000 rubles. The tax deduction for the 1st quarter amounted to 900,000 rubles. The share of VAT deductions = 900,000 / 1,000,000 * 100% = 90% Let us turn to the background information of the internal reporting of the Federal Tax Service of Russia (report on form No. 1-VAT). For the date we are interested in, we establish that the share of tax deductions for VAT in 2021 (Moscow) is 89.9%. In our case, the share of VAT deductions exceeds 89%, explanations for the tax office in this case will be useful, since this is more than the threshold value for Moscow, which means the organization faces a call to the tax office to give explanations. If the share of tax deductions for VAT exceeds 89%, what should I answer to the tax office?