Reporting depending on the taxation system

Tax returns

In accordance with the chosen taxation system, individual entrepreneurs must submit tax returns to the Federal Tax Service:

| Tax regime | Tax return | Deadline for submitting the declaration |

| Simplified taxation system (STS) | Declaration of the simplified tax system | At the end of the calendar year no later than April 30 of the following year |

| Unified Agricultural Tax (USAT) | Declaration of Unified Agricultural Tax | At the end of the calendar year no later than March 31 of the following year |

| Patent tax system (PTS) | Not served | — |

| General taxation system (GTS) | Declaration 3-NDFL | At the end of the calendar year no later than April 30 of the following year |

| Declaration 4-NDFL | Canceled from 2021! | |

| VAT declaration | At the end of each quarter no later than the 25th day of the first month of the next quarter |

note

that when combining tax regimes, it is necessary

separately

for each taxation system.

Free consultation on individual entrepreneur taxes

Book of accounting of income and expenses (KUDIR)

All individual entrepreneurs using the simplified tax system, OSN, PSN and Unified Agricultural Tax are required to maintain a book of accounting for income received and expenses incurred (KUDIR). Since 2013, the mandatory certification of KUDIR by the Federal Tax Service has been abolished. However, the book must be bound and numbered in any case (the fine for its absence for individual entrepreneurs is 200 rubles).

More details about KUDIR.

Individual entrepreneur reporting according to the taxation system used

Everything is simple here: what basic tax we pay is the declaration we submit. We combine two modes - which means we submit two declarations. Where do we rent? Of course, to the tax office. All information is in the following table:

| Tax regime | Declaration (form) | Due dates |

| General mode (OSNO) | 3-NDFL | Compiled for a year, must be submitted by April 30 of the following year. |

| 4-NDFL | Compiled after receiving the first income, it must be submitted within 5 days after the expiration of a month from the date of receipt of this income (for new individual entrepreneurs) | |

| *VAT declaration | Compiled based on the results of the quarter before the 25th day of the month following this quarter | |

| Simplified mode (STS) | Declaration of the simplified tax system | Compiled for a year, must be submitted by April 30 of the following year. |

| Unified tax on imputed income (UTII) | Declaration of UTII | Compiled for a quarter, must be submitted by the 20th day of the month following that quarter. |

| Patent Regime (PSR) | There is no declaration | Doesn't give up |

| Unified agricultural tax (UST) | Declaration of Unified Agricultural Tax | Compiled for a year, must be submitted by March 31 of the following year. |

| VAT declaration | Compiled based on the results of the quarter before the 25th day of the month following this quarter |

*Well, a small comment: individual entrepreneur in the general mode (OSNO) is a VAT payer, therefore he must report on this tax in addition to personal income tax. From January 1, 2021, entrepreneurs on the Unified Agricultural Tax have also become obligated to pay VAT, so they will also be forced to submit this declaration. The rest of the taxation systems belong to special regimes that exempt from VAT, except for those transactions that are subject to mandatory taxation; accordingly, you only need to submit a declaration according to your regime.

When combining modes, and most often they combine the simplified tax system and UTII, both declarations are submitted. Another option for combining these regimes is with a patent: here there will be only one declaration, since there is simply no declaration under PSN.

We have already written about how to fill out declarations:

- Instructions for filling out a declaration for the simplified tax system - Income;

- Instructions for filling out a declaration for the simplified tax system - Income minus expenses;

- Instructions for filling out a declaration for UTII.

Each tax regime has its own KUDIR form. Let me remind you that KUDIR must be maintained without fail. There is no need to go to the tax office to certify it, this has long been canceled, but you should have it in your possession: printed, numbered and stitched. The form of the book depends on the tax regime:

| Tax regime | Document form |

| General mode (OSNO) | KUDIR for OSNO |

| Simplified mode (STS) | KUDIR for simplified tax system |

| Unified tax on imputed income (UTII) | There is no KUDIR, only physical indicators are recorded (there is no legally established form) |

| Patent Regime (PSR) | Income book for PSN |

| Unified agricultural tax (UST) | KUDIR for Unified Agricultural Tax |

You may need the following items to complete:

- Instructions for filling out KUDIR for the simplified tax system-Income;

- Instructions for filling out KUDIR for the simplified tax system - Income minus expenses;

- Instructions for filling out the KUD for individual entrepreneurs on a patent;

- Instructions for dividing income/expenses between the simplified tax system and imputation (for combining regimes);

- Instructions for reflecting advances in KUDIR for individual entrepreneurs on the simplified tax system.

Reporting for employees

All reporting for employees can be divided into three categories:

- Reporting to the Federal Tax Service (Tax Service).

- Reporting to the Pension Fund (PFR).

- Reporting to the FSS (Social Insurance Fund).

| Where to take it | What to take | When to take it |

| Federal Tax Service | Average number of employees | Canceled from 2021! |

| Certificates 2-NDFL | Based on the results of the calendar year, no later than March 1 of the following year. The deadline has changed! | |

| Calculations 6-NDFL | Based on the results of each quarter, no later than the last day of the 1st month of the next quarter. Annual form - no later than March 1 of the following year. The deadline has changed! | |

| Calculation of insurance premiums | Based on the results of each quarter, no later than the 30th day of the month following the billing (reporting) period. | |

| Pension Fund | Report in the form SZV-STAZH (contains information about the insurance experience of the insured persons) | At the end of the year, no later than March 1 of the year following the reporting year. |

| Report on form SZV-M (contains information that allows you to track working pensioners) | At the end of each month no later than the 15th day of the next month | |

| Report in the SZV-TD form (contains information about the labor activities of employees) | Until the 15th day of the month following the one in which one of the personnel events took place: filing an application to choose the form of maintaining a work record book (LC), hiring a new employee, dismissal, transfer to another permanent job | |

| FSS | Report on Form 4-FSS From January 1, 2021, this calculation includes information only on injuries and occupational diseases | Based on the results of each quarter, no later than the 25th day (for electronic form) and the 20th day (for paper form) of the 1st month of the next quarter |

The procedure for maintaining reports in individual entrepreneurs

When maintaining records, an individual entrepreneur must take into account that he is an individual. The main condition for accounting for the property of an entrepreneur is its isolation, as well as its inseparability from personal obligations. However, such factors cannot be taken into account in the financial statements, and they cannot be indicated in the KuDiR. Therefore, full-fledged accounting of individual entrepreneurs is not possible.

For individual entrepreneurs on a patent, the tax amount is fixed and maintaining any kind of reporting is not required. It can be compiled at the entrepreneur’s own request. But you need to submit reports to the Pension Fund, which is maintained for the purpose of pension savings. Reporting on insurance premiums is carried out by individual entrepreneurs independently.

When drawing up a balance sheet for the year, an individual entrepreneur can be guided by the following rules:

- the balance sheet must reflect the state of the entrepreneur’s finances, as well as assets and liabilities;

- the balance sheet is supposed to be drawn up taking into account the property used in business activities;

- property of an individual entrepreneur that does not relate to economic activity can be taken into account in a separate article;

- if the individual entrepreneur is married without a prenuptial agreement or gets divorced, then the balance sheet should contain half of the property, that is, the part of his wife should be displayed separately, in the form of passive funds or losses.

We should not forget that accounting’s main purpose is to assess the financial condition of an entrepreneur. The property of an individual entrepreneur is his private property, which means that he has the right to take into account everything that he considers necessary to assess profits or losses. At the same time, there are no mandatory requirements for the content of accounting compiled by individual entrepreneurs. So the credibility of such reporting is minimal and cannot be used for tax or audit purposes.

On video: Income and expenses in accounting and tax accounting. Latest changes in legislation

Reporting on cash transactions

Business entities that carry out operations related to the receipt, issuance and storage of cash

(cash transactions) are required to comply with the rules of cash discipline (execution of cash documents, compliance with the cash limit, etc.).

The need to maintain cash discipline does not depend on the chosen taxation system or the presence of a cash register.

However, since June 2014, a simplified procedure for maintaining cash discipline

, which most affected individual entrepreneurs. They are no longer required to maintain a cash register on a par with organizations and draw up cash documents (PKO, RKO, cash book). Entrepreneurs only need to generate documents confirming the payment of wages (payroll and payslips).

Also, according to the simplified procedure, individual entrepreneurs and small enterprises (number of employees no more than 100 people and revenue no more than 800 million rubles per year) are no longer required to set a cash balance limit at the cash register.

Learn more about cash discipline.

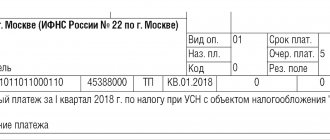

When to pay the simplified tax system

The simplified tax system must be paid every quarter. In 2021 the deadlines are:

- for 2021 - until April 30, 2021,

- for the 1st quarter of 2021 - until April 26,

- for half a year - until July 26,

- 9 months before October 25th.

Pay the simplified tax system to the tax office according to your registration, even if you operate in another region.

Submit reports in three clicks

Elba will help you work without an accountant. She will prepare reports, calculate taxes and will not require any special knowledge from you.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Additional tax reporting

Some individual entrepreneurs carry out activities that require the payment of additional taxes and reporting.

Additional taxes and reporting table

| Surcharge | Reporting type | Deadline |

| Land tax | Land tax declaration | Starting from 2015, there is no need to submit . The Federal Tax Service independently calculates the tax and sends a special notification to the individual entrepreneur |

| Water tax | Water tax declaration | Based on the results of each quarter no later than the 20th day of the 1st month of the next quarter |

| Excise tax | Excise tax declaration | Based on the results of each month, no later than the 25th day of the next month (for straight-run gasoline and denatured alcohol: no later than the 25th day of the third month following the reporting month) |

| Notice of advance payment in 4 copies (including one in electronic form) + copies of payment documents | No later than the 18th of the current month | |

| Mineral extraction tax (MET) | Declaration on mineral extraction tax | At the end of the month no later than the last day of the next month |

| Fees for the use of wildlife objects | Providing information to the Federal Tax Service on received permits for the extraction of wildlife objects | No later than 10 days from the date of receipt of the permit |

| Fees for the use of aquatic biological resources | Providing information to the Federal Tax Service on permits received and collection amounts payable | No later than 10 days from the date of receipt of the permit |

| Providing information to the Federal Tax Service on the number of objects subject to removal from the environment | No later than the 20th day of the month following the last month of the permit validity period | |

| Regular payments for subsoil use | Providing the Federal Tax Service with calculations of regular payments for the use of subsoil | Based on the results of each quarter, no later than the last day of the first month of the next quarter |

For more information about accounting and tax reporting, see the accountant's calendar.

Individual entrepreneur reporting in 2021

Home / Other

The entire complex of reporting documentation that individual entrepreneurs are required to submit to regulatory authorities can be divided into 4 groups:

- Reporting depending on the applied tax regime.

- Reporting for hired personnel (submitted if the individual entrepreneur has employees);

- Reporting on other taxes;

- Statistical reporting (to Rosstat).

Note: in addition to submitting reports, records of income/expenses are kept in KUDiR, as well as records of cash transactions.

If you don’t want to sort through a bunch of reporting and waste time going to the tax office, you can use this online service, which has a free trial period.

Reporting according to the applicable tax regime

Submitted to the Federal Tax Service Inspectorate at the place of residence of the individual entrepreneur (with the exception of the UTII declaration, which is submitted to the Federal Tax Service Inspectorate at the place of business).

| Tax system | Reporting type | Reporting deadlines |

| BASIC | VAT declaration | Based on the results of each quarter until the 25th day of the month (inclusive) following the reporting quarter |

| Form 4-NDFL | Rented after the actual appearance of income from business activities within 5 days after the end of the month in which the income appeared. Note: Based on the declaration, the Federal Tax Service calculates advance payments for personal income tax for the current year. If the individual entrepreneur has been working for more than a year and no significant fluctuations in income are planned for the current year, the form is not submitted (advances are calculated according to the data from Form 3-NDFL for the previous period). If during the current year there is a sharp jump in income (an increase or decrease of more than 50%) - an adjusting declaration is submitted to recalculate tax advances | |

| Form 3-NDFL | At the end of the calendar year until April 30 of the following year | |

| simplified tax system | Declaration of the simplified tax system | At the end of the year until April 30 of the following year |

| UTII | Declaration on UTII | At the end of the quarter no later than the 20th day of the month following the reporting quarter |

| Unified agricultural tax | Declaration on Unified Agricultural Tax | At the end of the year until March 31 of the next year inclusive |

| PSN | Reporting is not submitted | |

| Special regime officers working under agency agreements (commissions, orders) with counterparties on OSNO and receiving/registering tax invoices with VAT for this type of activity | Journal of received/issued invoices | At the end of the quarter no later than the 20th day of the month following the reporting quarter |

When combining tax regimes, reporting should be submitted separately for each applicable taxation system.

Reporting for employees

The reporting submitted by individual entrepreneurs for individuals working under employment agreements or civil partnership agreements does not depend on the tax regime, therefore the list is the same for all entrepreneurs.

| Reporting type | Where is it served? | Submission deadlines |

| Information on the average number of personnel | To the Federal Tax Service at the place of registration | At the end of the calendar year no later than January 20 of the year following the reporting year |

| Unified calculation of insurance premiums (ERSV) | Based on the results of the 1st quarter, half of the year, 9 months and the year. No later than the 30th day of the month following the reporting period (quarter) | |

| Form 6-NDFL | Similar to ERSV, with the exception of the annual report - for the year the form is submitted no later than April 1 of the next year | |

| Help 2-NDFL | At the end of the year no later than April 1 of the year following the reporting year | |

| Form SZV-M | To the Pension Fund branch at the place of registration of the individual entrepreneur as an employer | At the end of each month, before the 15th day of the month following the reporting month |

| Forms: SZV-STAZH, EDV-1 | At the end of the year until March 1 of the year following the reporting year When an individual submits an application for retirement - within 3 days from the moment the person contacts the employer | |

| Calculation 4-FSS | To the FSS branch at the place of registration of the individual entrepreneur as an employer | Based on the results of the 1st quarter, half of the year, 9 months and the year. No later than the 20th day of the month following the reporting period (when the form is submitted on paper), or before the 25th day of the month (inclusive) following the reporting period (when submitted electronically) |

| Application and certificate confirming the main type of activity | Annually before April 15 of the year following the reporting period |

Reporting on other taxes

An individual entrepreneur may conduct activities that are subject to other additional taxes and fees. In such cases, reporting is provided on the following types of other taxes (fees):

| Tax/fee | Reporting type | Submission deadlines |

| Water | Water tax declaration | Based on the results of each quarter no later than the 20th day of the month following the billing quarter |

| Excise | Excise tax declaration | Monthly until the 25th day of the next month (for straight-run gasoline and denatured alcohol: until the 25th day of the third month following the billing month) |

| Notice of advance payment and copies of payment documents | No later than the 18th of the current month | |

| For mining | Declaration on mineral extraction tax | Every month no later than the last day of the next month |

| Regular payments for subsoil use | Calculation of payments for subsoil use | Quarterly no later than the last day of the month following the billing quarter |

| Fee for the use of water resources | Information about issued permits and fees payable | Within 10 days from the date of issue of the permit |

| Information on the number of objects removed from the habitat | No later than the 20th day of the month following the last month of the permit validity period | |

| Fee for the use of wildlife objects | Information on issued permits for the extraction of animals | Within 10 days from the date of issue of the permit |

Reporting to statistical authorities

Entrepreneurs belonging to the small business sector who were included in the Rosstat sample, as well as individual entrepreneurs who own medium or large businesses, are required to submit statistical reports. Statistical authorities send relevant notifications to such individual entrepreneurs. You can check whether a businessman must submit statistical reports independently on the website: statreg.gks.ru

If an individual entrepreneur is required to report to statistical authorities, the following information will be displayed on the website:

- a list of reports to be submitted;

- deadlines for their submission;

- instructions for filling out reporting documentation.

All individual entrepreneurs also submit reports to Rosstat as part of continuous monitoring, which is carried out once every 5 years. The next total audit will take place in 2021; accordingly, all businessmen will have to report to the statistical authorities in 2021.

Read in more detail: All individual entrepreneur reporting

Did you like the article? Share on social media networks:

- Related Posts

- Personal income tax for employees (income tax)

- Taxes and payments for individual entrepreneurs in 2021

- Liquidation of an LLC in 2021: step-by-step instructions

- New form 2-NDFL in 2021

- LLC taxes and payments in 2021

- Insurance premiums for employees in 2021

- Reporting for employees in 2021

- Personal income tax (NDFL)

Discussion: there is 1 comment

- Sergey:

01/10/2019 at 09:06Zero declaration for the simplified tax system for individual entrepreneurs for free or how much does it cost?

Answer