How to calculate dividends

Payments of dividends in a company are initiated by the board of shareholders after the closure of the register. Profit is distributed according to the company's dividend policy.

The amount of payments on preferred shares is determined as a percentage of the par value, or in a fixed form.

Calculation of dividends on ordinary securities:

Distributable earnings / Number of common shares = Dividend amount per share.

To make calculations, you can use an online calculator or find examples of dividend calculations for similar stocks.

As a rule, this information is disclosed in the company's financial statements, so the shareholder does not need to independently calculate this indicator. The amount of dividends per share in the previous reporting year is indicated in the report “Information on accrued income on the issuer's securities,” which is also published in open sources.

Typically, the issuer transfers dividends to preferred shareholders into the account within ten business days. To other shareholders - within twenty-five working days. The maximum period during which dividends are transferred can be approximately a month after the cut-off date.

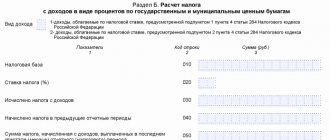

Such payments are subject to personal income tax of 13%. The amount of net dividend income will be the amount minus tax. No benefits - reduced rates or deductions are applied to income tax on dividends. When selling shares and receiving income from exchange rate differences, expenses incurred are taken into account - for the acquisition of securities and their maintenance.

Where do dividends come from, where can you get information?

Dividends are, first of all, an instrument of investment policy. Private companies that are interested in capitalization, attracting investment and creating a profitable business reputation, as a rule, willingly and often pay them to their shareholders.

In Russian companies, dividends are paid from the company's net profit for the reporting period. Less commonly, from the calculated amount of free or net cash flow.

The amount of net profit can be found out from the company’s accounting reports, in particular from Form No. 2 “Profit and Loss Statement”.

After market participants have learned the amount of net profit, it is necessary to find out one more indicator - what part of it the issuing company allocates to paying dividends this year. You can view this information in compiled form here.

To get an idea of how much money the company will allocate, you will need to multiply the amount of net profit by the dividend payout ratio. And to find out the size of the dividend due on one security, the resulting total must be divided by the number of issued shares.

But it should be borne in mind that this is still an approximate and not the only indicator. For example, some joint-stock companies pay dividends that in total exceed the profit received in the reporting year, for example, “Etalon” for 2021 will pay a total of 3.5 billion dividends for the year with a net profit of 0.8 billion rubles. Therefore, calculating net profit to pay dividends does not always help determine the profitability of shares.

You can get accurate information about how dividends are distributed among shareholders and how often they are paid from the company’s dividend policy. Often excerpts from it are contained on official websites.

Payment policies may change, so it is important to keep the information up to date. You should also be prepared for unforeseen circumstances that may affect the amount of dividend income.

You can find out about the most important dates from dividend calendars, for example here.

This is convenient because it contains information on:

- register closing dates,

- profitability of previous periods,

- dividend per share, etc.

Purchase

Shares are traded on stock exchanges. Individuals cannot take part directly in trading on the exchange, and for this they involve brokers - intermediaries between buyers, the exchange and sellers. To purchase securities, the following steps are required:

| Action | Description |

| Choosing a broker | The choice of broker depends on what securities will be purchased. When purchasing shares of Russian companies, you can contact any broker; foreign ones - a broker trading on international exchanges. You need to choose brokers that have a high rating and affordable rates. The average commission for brokerage services is 0.02-0.5% of the transaction size. It is also necessary to take into account the minimum amount of funds with which the broker carries out financial transactions (30 – 100 thousand rubles) |

| Conclusion of an agreement | To sign a brokerage service agreement, you must visit the broker's office. The registration procedure will take about 30 minutes, and a trading account will be opened for the client |

| Purchase | The required amount of funds is transferred to the account, securities are selected, and the purchase is made over the phone or using a special terminal. On stock exchanges, shares are sold in lots. For example, the stake in Sberbank is 10 shares, Surgutneftegaz – 100 shares |

Having become the owner of the stock, all that remains is to wait for the decision on the payment of the next dividends to shareholders. Owners of securities can receive dividend payments by opening an individual investment account, since in this case the owner is exempt from paying income tax.

Types of dividends, on which shares are paid

Dividends are paid on both ordinary and preferred shares. These are types of dividends depending on the type of security.

Preferred shares according to the method of formation are:

- cumulative,

- non-cumulative

Cumulative ones accumulate partially or completely unpaid dividends for previous periods when, for example, the company was going through difficult financial times and suffered losses. In this case, dividends are not paid, they are accumulated and transferred to shareholders in financially favorable periods. They exist to maintain the loyalty of shareholders, so that the securities are not sold, but held, awaiting future dividends.

Cumulative preferred shares are more profitable than all others.

Dividend payments are also distinguished by purpose:

- regular , which are paid on an ongoing basis. Such income is beneficial to the holder, therefore there is the greatest demand for these securities in the market.

- additional , which the company can pay one-time, based on some positive events in its activities - a particularly profitable deal, retained earnings, etc. A company may decide to make a payment to maintain investor interest and enhance the attractiveness of its business reputation. May also be referred to as an extra or special dividend. As a rule, they are larger than regular ones, but are paid out much less frequently and are more difficult to predict.

- liquidation - due when the company is closed due to termination of activities.

According to the frequency of dividend payments, there are:

- once a year

- half year

- quarterly

- monthly

Based on the volume of payments, they are divided into:

- full

- partial (limited)

For example, if dividends are not paid in full, the issuer will pay a penalty to the investor.

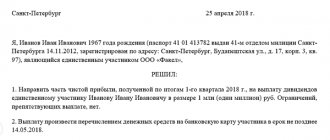

By method of receipt:

- through a broker

- to a bank account

- in cash at the issuer's cash desk

- by postal money order

In order:

- cumulative privileged

- non-cumulative privileged

- preferred with a certain amount of dividend in the charter and with an indefinite amount

- ordinary shares

Payment term

The period for paying dividends depends on the legal form of the organization - LLC or JSC. For joint stock companies, the payment period depends on the status of the shareholders, as well as the moment when these recipients were identified.

| Legal organizational form of organization | Recipient status | Dividend payment period | Base |

| Limited Liability Company | Participant, founder | No later than 60 days from the date on which the relevant decision was made. A shorter period can be established in the company's charter | Clause 3 of Article 28 of the Law of February 8, 1998 No. 14-FZ |

| Joint-Stock Company | Registered in the register of shareholders:

| No more than 10 working days from the moment the recipients are determined. AO recipients can be determined no earlier than 10 and no later than 20 days from the moment the decision on payment is made. A shorter payment period can be established in the company’s charter | Clauses 3, 5 and 6 of Article 42 of the Law of December 26, 1995 No. 208-FZ. |

| Other dividend recipients | No later than 25 working days from the moment the recipients are determined. AO recipients can be determined no earlier than 10 and no later than 20 days from the moment the decision on payment is made. A shorter payment period can be established in the company’s charter |

For which securities is a fixed dividend amount established?

A fixed dividend is established on preferred shares upon issue. It is paid on such securities in the first place and does not depend on the amount of net profit, which may vary in different reporting periods, but is paid from specially created reserve capital or other sources. That is, in this case, the amount of the company’s profit and the amount of dividends are not related.

In the dividend policy of companies, the formulation is often found that the company pays a certain fixed percentage on a preferred share, for example, 10% of its nominal value.

Preferred paper provides more guarantees for receiving dividend income than ordinary paper, since its payment is determined by the company's charter.

Sizing

The size of dividends is established by the policy of the joint-stock company and the availability of income in a specific reporting period. When a company is not making a profit, no dividends will be paid. If the company’s management considers that such a solution is the most effective, profits can be reinvested in the business: equipment is purchased, new offices and branches are opened, etc.

The size of dividends may be more or less than previously paid, regardless of the company's profit.

The dividend policy is determined by the following aspects:

| Aspect | Description |

| Provides stability | In the past financial year there may have been a sharp increase in profit due to a one-time reason, which will not be repeated in subsequent periods. In order not to destabilize the situation on the market and not to deceive the expectations of investors, the size of dividends is not increasing. The opposite situation also happens. |

| Tax policy applies | Sometimes the tax rate on dividends is higher than the company's income tax, which makes payments meaningless |

| Reinvestment of funds is used | Funds are invested in business growth and expansion, maintaining liquidity and financial stability |

| Intent demonstrated | An increase in the amount of dividends attracts investors, increases the market price and liquidity of shares |

Many stocks with high dividend yields are illiquid third-tier securities, and investing in them is very risky.

To determine the amount of payments, most large companies convene a meeting of shareholders. The Board of Directors recommends preliminary values that shareholders cannot exceed. The average return on shares of large and successful companies is 5 - 10% per year.

What formula is used to calculate dividends?

The calculation uses a simple formula, to apply which you need to know the par value of the share and the amount of the dividend.

Most often this value is expressed as a percentage. The amount of dividends on ordinary shares is calculated as the ratio of the nominal value of the securities to its yield.

Dividend yield (DD) is equal to:

DD = YES / TA * 100%, where

YES is the dividend per share, TA is the nominal price of the share.

For example, how to calculate dividends on ordinary shares of Lukoil: the cost of the Central Bank is 1,124 rubles, and the dividend per share for this issuer is 28 rubles, then the dividend yield will be:

28 / 1124 x 100% = 2.49%

Thus, knowing how to calculate the dividend yield of an ordinary share, you can predict your future profit.

Until 2010, the average dividend yield on the Russian market was up to 1-2%, with a stock yield of 8-10%. By 2021, the average yield of Russian securities included in the Top 20 had already reached double-digit numbers and amounted to 12%. Moreover, some of the most profitable industries from this point of view for several years have been hydrocarbon production, telecommunications and the financial sector.

Payment procedure

The period for accrual of dividends to the accounts of shareholders, the form (cash or in kind), as well as the procedure are prescribed in the minutes drawn up at the general meeting of shareholders.

There are differences in the procedure for calculating dividends to holders of ordinary and preferred shares.

Thus, the latter have the right to:

- Extraordinary payment of profits.

- Priority payment of dividends in the event of liquidation of the enterprise.

- Receiving income in the amount established by the charter of the Joint Stock Company and independent of the profitability of the company and restrictions adopted by the decision of the board of directors.

If, after the official decision, the payment of dividends was not made within the prescribed period, investors have the right to file a lawsuit for the forced recovery of profits and the accrual of penalties due to delay.

Basic parameters of ordinary shares

Common stocks have their own special characteristics that every investor needs to know. Trading of ordinary securities is carried out on stock exchanges, as well as on over-the-counter markets.

The following types of share prices are distinguished:

- market - defined as the equilibrium price on the stock exchange, established between supply and demand;

- issue price during initial placement on the market, usually it is higher than the nominal value by the amount of issue proceeds;

- nominal - the share of the authorized capital that falls on one share;

- balance sheet is the result of dividing the company's net assets by the number of securities in circulation.

The purchase price is relevant only in relation to the income or dividends that the buyer will receive on that stock to calculate its dividend yield. All ordinary shares always have the same par value, and the sum of the par values of all ordinary securities is equal to the authorized capital of the company.

Current market rates are available on the official websites of exchanges, brokerage companies and other financial organizations.

Another parameter of stocks is the yield, that is, the ratio of the income received from a security (dividend or interest) to the investment in it, expressed as a percentage.

If the market value is lower than its book price, then the share is considered to be undervalued in the market and its value should be expected to increase in the near or long term. Conversely, if it is overvalued, then most likely it will experience a decrease in the market price.

Another characteristic of a stock is its volatility - that is, the variability of its market price over a certain period of time.

An ordinary share gives the holder the right to vote (according to the principle of one paper - one vote) at a shareholder meeting, but does not guarantee the payment of dividends. Unlike preferred ones, dividend income on them is not guaranteed. It is possible if the company completed the reporting period with profit remaining after payment to the holders of preferred shares.

Also, the reason for non-payment, in addition to loss, may be the presence of court decisions, seizure of the organization’s property and other unfavorable events.

Common shares are considered equity instruments of a lower status relative to other classes of securities, although in Russia the price of common stock on the stock exchange is often higher than preferred stock.

Ordinary shares are perpetual, that is, their buyer after acquisition cannot demand money back. At the same time, the issuer has the right to dispose of the capital received from the sale of securities at its own discretion and not to inform the holders about this.

The purchaser of common stock is issued a certificate of ownership upon purchase. This document contains basic information:

- registration number

- holder details

- name of the issuer's joint stock company

- number of pieces owned

- the name of the organization that is the holder of the register

- par price of paper

A common share is canceled upon the liquidation of the company that issued it. Such liquidation may be voluntary or compulsory.

Sources of dividends

Dividends are paid by the issuing company - the one that issued its own shares and sold them. Payments can come from two types of shares: ordinary and preferred.

Holders of ordinary shares have the right to participate in the general meeting of shareholders and receive dividends in proportion to the invested capital.

In this case, the source of dividends is the organization’s net profit, which remains after taxes and is determined on the basis of annual financial statements. In this case, the meeting of shareholders may decide to leave funds in circulation and not pay dividends for the current period.

Preferred shareholders do not have voting rights, but are entitled to receive dividends in a strictly defined amount, regardless of the profitability of the company. The source of dividends, in this case, will be funds previously formed for this purpose.

Example of profitability calculation

How to calculate dividend yield: the price of one share on the stock market is 150 rubles per share. During the reporting period, this company announced that it would pay 10 rubles per ordinary security. In this case, an example of calculating dividend yield is as follows:

10 / 150 x 100% = 6.67%

The issuer, which acts as a tax agent when paying dividends, by law will withhold 13% personal income tax from each payment. That is, after paying the tax on 10 rubles declared by the company, the investor’s account will actually receive 8.7 rubles. This means that the net dividend yield using the formula will be:

8.7 / 150 x 100% = 5.8%

Choice

Which stocks should you buy to make a profit? Investing in stocks is a very popular way of investing. However, it may be too risky for novice investors. Before purchasing securities, you need to carefully analyze the situation on the stock market, the prospects of a particular company, etc. Securities of government organizations are considered highly liquid and resistant to economic crises. Such investments are profitable in the long term.

It is profitable to invest in steadily growing large organizations, such as:

- Sberbank;

- Lukoil;

- Gazprom;

- Rosneft;

- Rostelecom and others.

Financial experts do not advise investing in foreign stocks due to the unstable political situation. However, some securities of American companies operating in areas such as IT technology, electronics and computer security are very popular.

Will I be notified about the payment?

The register of shareholders to whom dividends are due contains information about the bank details belonging to each of them - money must be transferred to these accounts (clause 8 of article 42 of Federal Law No. 208). This is the company's only obligation to its shareholders. Companies should not send notices about the upcoming payment of dividends and the fact of their accrual to shareholders.

To find out whether there are plans to pay dividends on the shares you hold, you will have to look for information in open sources. As a rule, companies post information about their current dividend policy on their websites. Thus, on the website of PJSC Lukoil you can find information about dividends that were paid in January 2021 based on the register compiled on December 20, 2021. Holders of shares of PJSC Lukoil as of this date receive income in the form of dividends - 192 rubles per share.

Dividend yield

Dividend yield is the ratio of the annual dividend paid by a company to the cost of one share of the same company. This financial indicator allows an investor to evaluate the financial effectiveness of their investments and understand how justified it is to have shares of a certain company in their portfolio.

For example, in 2021, the cost of one share of VTB PJSC was 0.037 rubles. Dividend yield of the stock: 0.00109867761463259 / 0.037 × 100% = 2.969%.

There are companies showing a dividend yield of 7% or more - such indicators are considered good for Russian realities.

It is almost impossible to know in advance what dividend yield the shares of a particular company will show - the founders can pay consistently high dividends for several years in a row, and then decide that it is time to invest in the development of the enterprise and leave investors without bonuses.

Dividends are a fickle and unstable income, so historical returns are not always a comprehensive indicator of a stock's future profitability.

Nevertheless, when conducting a financial analysis of a company’s condition, it is still worth assessing the dividend yield of shares. If a company has found the resources to pay dividends, it means that it has prospects for further development.

Although there is an opposite opinion - some analysts believe that the decision to pay dividends indicates that the company's management does not have a strategy for the further development of the enterprise and simply does not know how to use the profits received.

The dividend yield of shares of any company can be independently calculated using the formula: share yield / share price × 100%. To do this, just go to the website of the company you are interested in and find all the necessary information there. If you don’t want to count on your own, you can use open sets of information on one of the exchanges.