Net profit indicator: who, where and why calculates it

Net profit and commercial activity are inextricably linked concepts.

For the sake of profit, new production facilities are created, material and labor resources are intensively used, and effective ways are sought to increase the profitability of commercial activities. Net profit is one of the important final performance indicators of any company. Not only the management and owners of companies are interested in obtaining net profit. Good net profit indicators attract new investors, contribute to making positive decisions on issuing loans to the company, as well as strengthening the company’s authority in market conditions.

It is net profit that allows firms to develop their material base, invest in expanding production, improving technology and mastering advanced techniques and methods of work. All this leads to the company entering new markets, expanding sales volumes and, as a result, an increase in net profit.

Find out how to analyze net profit from the article “Procedure for analyzing net profit of an enterprise.”

Many financial indicators take part in calculating net profit, and the formula for calculating it is not as simple as it seems at first glance. In the accounting records of any company, net profit is reflected in line 2400 of the financial results statement (OFR), and all indicators in column 2 of this report are involved in determining net profit .

Learn about the structure and purpose of the ODF from this publication.

A detailed algorithm for calculating net profit is given in the next section.

Methods for analyzing the net profit of an enterprise

Let's consider various methods of analyzing the net profit of an enterprise. The purpose of this analysis is to determine factors, cause-and-effect relationships between indicators that affect the formation of net profit as the final indicator of the enterprise’s performance.

The following analysis methods can be distinguished, which are most often used in practice:

- Factor analysis;

- Statistical analysis.

These types of analysis are opposite in nature. Thus, factor analysis focuses on identifying significant factors that influence the formation of the enterprise’s net profit. Statistical analysis emphasizes the use of time series forecasting methods and is based on an analysis of the pattern of changes in net income over the years (or other reporting periods).

Take our proprietary course on choosing stocks on the stock market → training course

Factor analysis of an enterprise's net profit

The main factors in the formation of net profit are presented in the formula described earlier. To assess the influence of factors, it is necessary to evaluate their relative and absolute changes for 2013-2014. This will allow us to draw the following conclusions:

- How did the factors change during the year?;

- Which factor had the greatest change in net income?

In financial analysis, these approaches are called “Horizontal” and “Vertical analysis”, respectively. Below are shown the factors that form the amount of net profit and their relative and absolute changes during the year. The analysis was made for the enterprise OJSC “Surgutneftekhim”.

As we see, during 2013-2014, other expenses and other income changed as much as possible. The figure below shows the change in the factors that form the net profit for 2013-2014 for Surgutneftekhim OJSC.

Let's consider the second method of assessing and analyzing the net profit of an enterprise.

Statistical method for analyzing the net profit of an enterprise

To estimate the future amount of net profit, various forecasting methods can be used: linear, exponential, logarithmic regression, neural networks, etc. The figure below shows a forecast of net profit based on an analysis of changes in the indicator over 10 years. Forecasting was carried out using linear regression, which showed a downward trend in 2011. The accuracy of forecasting economic processes using linear models has an extremely low degree of reliability, so the use of linear regression can serve more as a guide to the direction of changes in profit.

Comparison of net profit with other indicators of enterprise performance

In addition to assessing and calculating the net profit of an enterprise, it is useful to conduct a comparative analysis with other integral indicators that characterize the efficiency and effectiveness of the enterprise. These indicators include: sales revenue (minus VAT) and net assets. Net assets show the financial stability of the enterprise and its solvency, revenue reflects its production and sales performance. The figure below shows a graph of a large Russian enterprise, OJSC ALROSA, and the relationship between its three most important indicators. As you can see, there is a close relationship between them, and it can also be noted that there is a positive growth trend in the enterprise’s net assets, this indicates that funds are being directed to expand production capacity, which in the future should increase the amount of net profit received.

Take our proprietary course on choosing stocks on the stock market → training course

The impact of the company's main performance indicators on net profit

Net profit is a multi-component indicator - this can be seen from the composition of its calculation formula. Moreover, each parameter involved in the calculation is also complex. For example, a company's revenue may be divided into different lines of business or geographic segments, but its entire volume must be reflected in the formula for calculating net profit.

For information on how revenue and gross income of a company are related, see the article “How to correctly calculate gross income?” .

An indicator such as cost may have a different structure in certain companies and have a different impact on net profit. Thus, you should not expect a large net profit if amounts equal to or exceeding the amount of revenue received are spent on the products manufactured by the company (this is possible in case of material-intensive or labor-intensive production or the use of outdated technologies).

The impact on net profit of selling and administrative expenses is obvious: they reduce it. The magnitude of such a reduction directly depends on the ability of the company’s management to rationally approach the structure and volume of this type of costs.

However, even with zero or negative sales profit, which is influenced by the indicators listed above, it is possible to obtain a net profit . This is due to the fact that, in addition to profits from its core activities, the company can earn additional income. This will be discussed in the next section.

Net profit: definition

Profit is an economic category that expresses the final result of the economic activity of an individual company or industry as a whole. Net profit is the difference between revenue and total expenses of an enterprise (indicators for a certain period are used). When determining it, all the company’s expenses for the reporting period are taken into account. In other words, what is net profit is an indicator by which you can see how much money a business brings in.

The amount of net profit can be used to judge the commercial success of a business. It can be presented both in monetary terms and as a percentage of other values, for example, the amount of investments, gross income, etc. An entrepreneur must consider the profit of an enterprise if he wants to know whether his project is worth the effort. The percentage ratio of profit to capitalization is of more interest to investors.

Net revenue is also considered when there is a need to determine the profitability of microeconomic processes, production costs and other indicators. For any business, it is very important to determine the amount of profit, since it serves as a guideline when drawing up interim plans for the development of production, sales, supply, warehousing, transportation, etc.

Income depends on factors such as:

- net revenue, that is, the amount of profit received from direct sales;

- cost of goods sold is the total cost of producing a product or service. (costs of raw materials, payment for energy resources, wages of production personnel, social contributions, etc.);

- commercial costs - costs for storing and selling finished products, their packaging, advertising, transportation;

- management costs - for the maintenance of non-production premises, office equipment for marketing and financial departments, salaries of administrative staff, etc.

To a lesser extent, the financial result of any business depends on:

- operating expenses or income, consisting of payments or receipts that are made by the company in the course of its activities, but are not directly related to production (dividends, rent payments, etc.);

- non-operating expenses or income that are not related to sales, but are not taken into account as part of other transactions (interest on loans, penalties, fines, penalties, losses or profits of previous years, etc.)

An entrepreneur can influence the first group of factors and, if necessary, change them. It will not be able to influence external factors that depend on the state of the market.

The role of other income and expenses in the formation of net profit

Often, the company's core activities do not bring it the desired net profit. This happens especially often at the initial stage of a company’s formation. In this case, the additional income received by the company can be of great help.

For example, you can make a profit from participating in other companies or successfully invest free funds in securities. The income received will help increase net profit. Even a regular agreement with a bank on using the balance of money in the company’s current accounts for a certain percentage will allow the company to receive additional income, which will certainly affect its net profit.

But if a company uses borrowed funds in its work, the interest accrued for using the loan can significantly reduce the net profit - one should not forget about the impact of the fact of borrowing on net profit. The amount of interest on borrowed obligations (even calculated at the market rate) can seriously reduce net income, and in certain cases lead to losses and bankruptcy.

Whether the company's debts can be collected from the chief accountant in the event of bankruptcy, find out by following the link.

A variety of income and expenses not related to the company's core activities have a significant impact on net profit. For example, renting out unused space or equipment can bring good additional income and have a positive impact on your net profit. Net profit will increase if the company's assets that are not used in its activities are sold.

At the same time, we should not forget about the need for constant monitoring of the composition and amount of other expenses - as they increase, net profit decreases. For example, net income may decrease as a result of excessive spending on charity and other similar situations.

We will tell you in this material how to reflect charity expenses in accounting.

Formula for calculating net profit

In practice, calculating the actual profit of large companies can be quite difficult. An accountant must be able to properly identify and classify revenue and all costs. But the calculation and subsequent analysis of profit makes it possible to develop measures to increase it, find ways to reduce production costs, and expand the sales market.

The net profit indicator is determined for the following reasons:

- The profit of any business is distributed among all its participants, but in order to divide it, you must first make calculations. Without this indicator, dividend distribution cannot be carried out.

- Determining the company's net profit is required to calculate the amount of taxes that will need to be paid for the reporting period.

- If a business suffers losses, then it is important to know the amount to compensate them.

- Calculating profits makes it possible to evaluate the results of business activities with a view to further rationalizing them, that is, reducing production costs.

- The calculated profit serves as an indicator of profitability of sales, which also has the definition of an indicator of the enterprise's pricing policy, since it shows the efficiency of its work.

To analyze small businesses, they mainly use marginal profit, and for large enterprises, operating profit.

The procedure for calculating net profit is as follows:

- Based on the financial statements, it is necessary to calculate the profit from sales (revenue) of a business entity for the past period.

- Variable expenses are subtracted from the resulting amount, and a result is obtained that reflects the marginal profit.

- Then the amount of fixed expenses is subtracted and operating profit is determined.

- Other expenses are deducted. As a result, profit before taxes is determined.

- Mandatory tax payments are subtracted, and only then the net profit is obtained.

Net income is an indicator of profitability, and in relation to revenue, the indicator characterizes the profitability of the enterprise, to determine which a formula is used to calculate profit as a percentage. Using simple mathematical operations, you can calculate the share of net income in the company's revenue.

The formula by which net profit is calculated:

PE = OP – OR

Where:

- PE – net profit;

- OP – total profit;

- OR – total expenses.

We can say that net profit is equal to the difference between income and expenses from any business activity.

The general formula for calculating net profit includes the following:

PE = B – Seb. + PrD - PrR - NN

Where:

- PE – net profit;

- B – revenue;

- Seb. – cost of products sold;

- PrD – the amount of other income;

- PrP – expenses for the billing period;

- TN – the amount of tax charges.

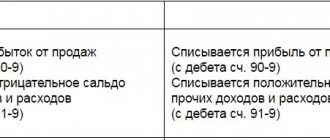

All items of income and expenses used in the formula are also included in the financial report of the enterprise (form No. 2). It can be considered as a clear example of calculating net income. The formula for calculating it using form lines looks like this:

- Page 2400 = page 2110 – page 2120 – page 2210 + page 2340 – page 2350 – page 2410.

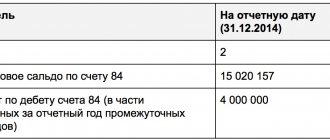

Net profit is also present in the balance sheet, but here it is not as clearly expressed as in form No. 2. In this document, net profit is defined as the difference in the values of retained earnings (line 1370) for adjacent reporting dates. But it should be noted that this method is not always used, but only when throughout the entire billing period there was no distribution of profits between business owners or any other use of them. Modern technologies allow you to calculate your net profit online.

The net profit of an enterprise is an indicator calculated in different ways

Net profit, the calculation formula for which was described in the previous sections, can be determined in another way. For example:

Page 2400 = page 2300 – page 2410

Net profit, the calculation formula for which is given above , is equal to profit before tax minus income tax.

This algorithm for calculating net profit is simplified and can be used, for example, by small enterprises that have the right not to apply PBU 18/02 “Accounting for income tax calculations.”

IMPORTANT! The criteria for small enterprises are given in Federal Law No. 209-FZ dated July 24, 2007 “On the development of small and medium-sized enterprises in the Russian Federation.”

For more information on the criteria for small businesses, see this article.

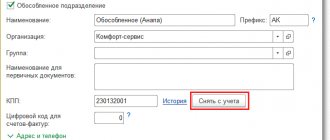

Information about deferred tax assets and liabilities is generated in accounting and is required to reflect differences arising between tax and accounting accounting.

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Positive factor

If the indicator decreases

Negative factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- Profit (loss) from sales 2200 Definition Profit (loss) from sales 2200 is the gross profit (loss) of the enterprise minus selling expenses and general business expenses. This indicator reflects the effect obtained...

- Profit (loss) before tax 2300 Definition Profit (loss) before tax 2300 is the difference between all the organization’s income (from core activities and from other activities) and all its expenses, but...

- Gross profit (loss) 2100 Definition Gross profit (loss) 2100 is the difference between revenue (line 2110) and cost of sales (line 2120). This indicator reflects the effect obtained from the sale of goods...

- Retained earnings (uncovered loss) 1370 Definition Retained earnings (uncovered loss) 1370 is the amount of retained earnings or uncovered loss of an organization. It is equal to the amount of net profit (net loss) of the reporting period, i.e....

- Current income tax 2410 Definition Current income tax 2410 is the amount of income tax generated according to tax accounting data for the reporting (tax) period Calculation formula (according to reporting) Line...

- TOTAL for section III 1300 Definition of TOTAL for section III 1300 is the sum of indicators for lines with codes 1310 - 1370 and reflects the total amount of the organization’s own capital: 1310 “Authorized capital ...

- Deferred tax assets 1180 Definition Deferred tax assets 1180 are an asset that will reduce income taxes in future periods, thereby increasing after-tax profits. The presence of such an asset...

- Structure of financial results The report consists of a set of indicators that together give the final financial result - net profit or loss. The main performance indicators of the organization come at the very beginning...

- Deferred tax liability 1420 Definition Deferred tax liability 1420 is a liability in the form of a portion of deferred income taxes that will result in an increase in income taxes in one or...

- Other 2460 Definition Other 2460 are other indicators that influence the amount of the organization’s net profit: taxes paid when applying special tax regimes, penalties and fines, surcharges for...

Results

Net profit is a complex indicator that includes all types of income received by the company, taking into account expenses incurred. If the company's costs exceed the total of sales revenue and additional other income, then we can talk about the absence of net profit and the company's activities are unprofitable.

Net profit allows merchants to expand their business, master new technologies and markets, which, in turn, has a positive effect on the increase in net profit.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Why is it necessary to calculate profit from sales?

The concept of net profit is directly related to the income of a commercial organization, so initially you need to calculate the profit from the sale of products. This parameter allows you to assess the level of profitability of the company, the quality and rationality of the advertising budget and other waste. If revenue in the current period of time is higher than in the previous period, the profitability of the company has increased. The same applies to expenses for advertising, rent, personnel, etc. If an investment does not provide additional income, it may be worth abandoning it.

The main goal of every businessman is to increase income. Most often this is achieved by increasing the sales market and reducing costs. In order to correctly assess opportunities, a comprehensive analysis of the company's performance is carried out and a growth and expansion policy is developed, which is based on current revenue from product sales.

To calculate revenue from turnover and promote its growth, you need to understand the structure of the indicator and know what parameters affect it.

The following factors influence the size of sales:

- sales of goods of own production and products of other manufacturers;

- width and depth of assortment;

- margin;

- expenses from commercial activities;

- depreciation expenses;

- economic situation in the niche occupied;

- tax policy;

- force majeure and other emergency situations.

When drawing up a business plan for an enterprise, special attention should be paid to the first four factors, since their optimization can significantly affect the growth of sales revenue. Often in the reporting documentation, the owner of the company and its shareholders calculate the percentage of profit, which reflects how much the profitability of the company has increased or decreased.