Every citizen of the Russian Federation is a taxpayer. The state replenishes the budget by deducting interest from wages. Regardless of the field of activity, citizens make mandatory payments. The amount of funds that goes to the state treasury is provided for by the current legislation of the Russian Federation.

The key place in the field of taxation is occupied by the personal income tax. In our publication today, we propose to find out what this tax is, what tax rates exist for personal income tax, what is subject to taxation and what is not, we will figure out how to calculate personal income tax in 2021, we will give examples of calculation.

Personal income tax: main features

Personal income tax is a tax on the income of individuals, through which the state treasury is filled. This tax is levied on the profitable part of the tax subject, which are individuals, namely:

- tax residents of the Russian Federation (persons staying in Russia for at least 183 days a year);

- tax non-residents of the Russian Federation (persons receiving profit in Russia).

Currently, there is talk behind the scenes in governments about equalizing personal income tax rates for residents and non-residents. Where this alignment will lead and when it will be done remains unknown. In any case, the Russian Federation budget for 2021 has already been approved, so if such an event occurs, it will not be earlier than 2021. Therefore, let’s consider the current personal income tax situation for 2021.

Personal income tax or personal income tax is calculated based on interest rates. It should be noted that the calculation of interest on wages is carried out only after taking into account tax deductions provided by the state. Personal income tax is calculated from the amount remaining after deduction. Tax deductions for children for non-residents are not provided for by the legislation of the Russian Federation.

Personal income tax rates in 2021

Personal income tax rates exist at 9%, 13%, 15%, 30% and 35%.

Tax rate 9%:

- receiving dividends (until 2015);

- receiving interest on mortgage-backed bonds (before January 1, 2007);

- receipt of income by the founders of the trust management of mortgage coverage (before January 1, 2007, based on the acquisition of mortgage participation certificates that were issued to managers of mortgage coverage).

Tax rate 13%:

for tax residents:

- wage;

- remuneration under civil contracts;

- income from the sale of property;

- other income.

Since 2015, dividends are taxed at a rate of 13%, rather than 9%.

for tax non-residents:

- from carrying out labor activities;

- from carrying out labor activities as a highly qualified specialist (based on the law “On the legal status of foreign citizens in the Russian Federation”);

- from the implementation of labor activities of the State program to assist the voluntary resettlement to the Russian Federation of compatriots living abroad, as well as members of their families who jointly moved to permanent residence in the Russian Federation;

- from the performance of labor duties by crew members of ships that sail under the state flag of the Russian Federation.

Tax rate 15%:

- dividends received from Russian organizations by non-resident individuals of the Russian Federation.

Tax rate 30%:

- all other income of non-resident individuals of the Russian Federation.

Tax rate 35%:

- income from winnings (prizes) in excess of the established amounts;

- interest income on deposits in banks in terms of excess of the established amounts;

- income from savings on interest when taxpayers receive borrowed (credit) funds in excess of the established amounts;

- income in the form of fees for the use of funds of members of a credit consumer cooperative (shareholders), as well as interest for the use of funds by an agricultural credit consumer cooperative (which were raised in the form of loans from members of an agricultural credit consumer cooperative or associated members of an agricultural credit consumer cooperative) in part of the excess established sizes.

Personal income tax on deposits

Income tax on interest on deposits is withheld only if:

- The interest rate on foreign currency deposits is more than 9%.

- The interest on deposits in rubles exceeds the official rate of the Central Bank of Russia by 10 points. Let's say the Central Bank rate is 8%. If the interest on the deposit exceeds 18% (8% + 10 points), personal income tax will have to be paid. If the deposit reward is less than the established norm (in our example, 18%), tax is not withheld.

On a note! For persons who are in the country for less than 183 days a year, i.e. are non-residents, income tax is 30%. For other groups of the population - 35%.

Personal income tax rates on deposits

The tax is calculated based on the profit received by the investor. The size of the effective rate does not matter, even if it is higher than the norm established by the state. Only the nominal rate specified in the contract is taken into account.

Tax is not withheld from the entire amount of profit received from the deposit, but only from the difference between the established norm and the deposit rate.

Example. The rate on ruble deposits is 20%, and the Central Bank rate is 8%. This means that tax will only need to be paid on 2%, since 18% (8%+10 points) is not subject to personal income tax. If the deposit amount is 50,000 rubles, the total amount of income will be calculated as follows: 100,000*20%=20,000 rubles. Tax must be paid not on all 20,000, but only on 2,000 rubles (100,000*2%). Since the owner of the deposit is a resident of the Russian Federation, the tax rate will be 35%. And the tax amount is 2,000*35%=700 rubles. Thus, the bank client will receive a profit of 20,000-700 = 19,300 rubles.

On a note! The obligation to pay tax rests not with the depositor, but with the bank. Employees of the financial institution themselves will calculate and withhold the required amount. Therefore, the individual does not need to take any action.

Income tax is withheld during the payment of income on the deposit.

General rules for calculating personal income tax

The general rules for calculating personal income tax are established by the provisions of Art. 225 Tax Code of the Russian Federation:

1. To calculate personal income tax for the tax period, all income subject to income tax is determined (clause 3 of Article 225 of the Tax Code of the Russian Federation).

2. For each type of income, the tax rate should be clarified in accordance with Art. 224 Tax Code of the Russian Federation.

3. The tax base for personal income tax for the tax period is calculated. It must be remembered that in order to calculate personal income tax when applying several tax rates, the tax base is calculated separately for each type of income.

Personal income tax and Moscow renovation of housing stock

Those whose housing was subject to demolition and renovation in Moscow should be aware of what changes in income tax await them in 2021 and in the future.

According to Law No. 352-FZ of November 27, 2021, there will be no tax on income in the form (new clause 41.1 of Article 217 of the Tax Code of the Russian Federation):

- equivalent monetary compensation for old housing;

- housing (share in housing), which was provided instead of the one that was subject to renovation.

Also, the Tax Code of the Russian Federation stipulates a mechanism for providing a property deduction in the event of the sale of housing provided for renovation (new subparagraph 2, paragraph 2, Article 220 of the Tax Code of the Russian Federation). Income can be reduced by expenses associated with the purchase:

- vacated housing;

- and/or living space provided in connection with renovation.

And the period of ownership of the new apartment is combined with the period of ownership of the previous housing (new paragraph of paragraph 2 of Article 217.1 of the Tax Code of the Russian Federation).

How to calculate personal income tax on wages in 2021

In order to calculate personal income tax on wages, you need to use a special formula, which looks like this:

N = PS x OS, where:

N - personal income tax, PS - interest rate, OS - taxable amount.

Please note that in order to determine the fixed assets, it may be necessary to make additional calculations due to the fact that tax deductions may be used on the income side.

OS = DC - V, where:

DC - income part of the person, B - deductions.

No personal income tax with targeted social assistance

Law of October 30, 2021 No. 304-FZ clarified the wording of paragraph five of paragraph 8 of Article 217 of the Tax Code of the Russian Federation from 01/01/2018. According to it, amounts of targeted assistance to citizens who are legally entitled to receive social support are not subject to income tax.

The source of these payments may be:

- federal treasury;

- regional budget;

- municipal budget;

- off-budget fund.

The appearance of this amendment is due to the fact that the current legislation does not disclose who “socially vulnerable categories of citizens” are.

An example of calculating personal income tax from salary without deduction:

Citizen Ivanov A.S. receives a salary of 35,000 rubles. It is necessary to find out how much his monthly personal income tax will be.

In this case, the calculation of personal income tax in 2021 is made from wages, which means at a rate of 13%. Thus:

35,000×13% = 4,550 rubles.

In this amount from citizen Ivanov A.S. Personal income tax will be withheld every month. His net income will be:

35,000 - 4,550 = 30,450 rubles.

As you can see, calculating the personal income tax amount is quite simple.

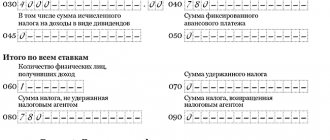

Certificate and calculation of 2-NDFL

Certificate 2-NDFL is a document in which a person reflects his income, wages and the amount of taxes paid.

The 2-NDFL certificate must contain the following information:

- employer information;

- employee information;

- income taxed at a rate of 13%;

- tax deductions;

- calculations of taxes, income and deductions.

An example of data entered into the 2-NDFL certificate:

Citizen Petrov S.N. has a monthly income of 55,000 rubles. Child deductions (5 years old) are applied to his salary. Let's consider what calculations in this case need to be made to fill out the 2-NDFL certificate.

Calculation of annual income

55,000×12 (months) = 660,000 rubles (per year).

Tax deduction calculation

The deduction per child is 1,400 rubles. In 2021, you can use the benefit with an income not exceeding 350,000 rubles (for 2021, they plan to raise the maximum income bar by 50,000 rubles to 400,000 rubles), which means you need to calculate how many months Petrov can use the child deduction:

350,000 / 55,000 = 6 months.

Calculation of the amount of deduction for the year

6 months x 1,400 rubles = 8,400 rubles.

Let us subtract the amount of deduction from the total annual income:

660,000 rubles - 8,400 = 651,600 rubles.

Calculation of tax paid

653,000 rubles x 13% = 84,704 rubles.

Thus, S.N. Petrov, having calculated the personal income tax, must enter the following information into the 2-personal income tax certificate:

- tax amount - 84,704 rubles;

- income - 660,000 rubles;

- the amount of deductions is 8,400 rubles.

Deflator coefficient for foreigners with a patent

Order of the Ministry of Economic Development of Russia dated October 30, 2021 No. 579 for the 201st year established a deflator coefficient of 1.686. Let us remember that in 2021 it was 1.623.

In 2021, the fixed advance payment of 1,200 rubles for obtaining or renewing a work patent for a foreigner will be increased by this figure (clause 3 of Article 227.1 of the Tax Code of the Russian Federation). You should also not forget about the coefficient that is set in your region.

Taking into account the new deflator coefficient, the fixed advance in 2018 will be 2032.2 rubles (1200 rubles × 1.686). But the final amount for a patent depends on the coefficient in a particular region of Russia.

Let us remind you that in 2021, an employer can reduce the tax on a foreigner’s income by fixed payments if such an employee submits an application and the Federal Tax Service issues a special notice to the company (clause 6 of Article 227.1 of the Tax Code of the Russian Federation).

Also see “2-NDFL for a foreign worker”.

Read also

01.02.2018

Calculation of 3-NDFL

Certificate 3-NDFL is a special document intended to be filled out by certain categories of persons (for carrying out activities that are related to a certain type of income). Such persons include:

- persons who independently calculate taxation (lawyers, individual entrepreneurs);

- residents of the Russian Federation (whose income was received outside of Russia);

- persons with additional income (profit).

The above categories of citizens are required to annually provide the tax service with information about the income received and the taxes that were paid on it.

It should be noted that this document makes it possible to apply for the use of a deduction. To receive it, you need to make the necessary calculations and indicate the amount to be returned.

An example of calculating personal income tax in 2021

Citizen Sidorov bought an apartment worth 1,700,000 rubles. This purchase was subject to tax. At the end of the year, Sidorov plans to submit an application for deduction. Let's calculate what the amount of the deduction will be. The operation was taxed at a rate of 13%.

1,700,000×13% = 221,000 rubles.

Thus, Sidorov will indicate in the 3-NDFL certificate the deduction amount of 221,000 rubles. In addition, to receive a deduction, you must have all supporting documents (purchase agreement, receipts, etc.).

Calculation of penalties for personal income tax

For late payment of personal income tax, fines are provided in the form of a penalty, which is calculated according to the formula:

Penalty = Arrears X Refinancing rate (key rate) valid during the period of delay X 1/300 X Number of days of delay

The penalty is calculated for each subsequent day after the deadline for paying taxes.

Example

Citizen Elkin was 8 days late in paying taxes. The amount of mandatory payment was 2,800 rubles. Let's calculate how much penalty will need to be paid along with the main tax.

1. Calculation of the amount of fines for one day:

2,800 rubles X 7.75% X 1 / 300 X 1 = 0.72 rubles.

2. Now let’s calculate the total fine for all days:

0.72 rubles X 8 days = 5.79 rubles.

If the delay in payment of personal income tax was more than 30 days, say 36 days, then the calculation of the penalty will be as follows:

(2800 rub. x 7.75% x 1/300 x 30 days) + (2800 rub. x 7.75% x 1/150 x 16 days) = 44.85 rubles.