When calculating amounts payable to the budget, you need to know some features:

- If the car was registered before the 15th, it will be taken into account when calculating the amounts. For example, a vehicle was registered with the traffic police on April 13. This means that the full month is taken into account and tax is paid for it. If registration was made after the 15th, the month would not be taken into account.

- When selling equipment and then deregistering it before the 15th, tax for that month is not paid; after the 15th, it is transferred.

Calculation examples

Example 1. The month after registration is not taken into account.

The car was purchased on January 10, 2021. This means that the first month is not used in the calculation. Funds are paid only for February and March according to the deadlines established in the region.

Example 2. The month is taken into account after registration

The equipment was purchased on March 10, 2021, but was registered with the traffic police only on March 17, 2019. The permissible period without registration after purchasing a vehicle is 10 calendar days from the date of execution of the purchase and sale agreement. This time is given to the new owner so that he has time to prepare all the documents. Previously, re-registration was carried out at the time of the transaction together with the previous owner, but several years ago his personal presence at the traffic police became optional, Example 3. The month is not taken into account after deregistration.

The car was registered to the organization on August 17, 2021. This means that the eighth month will not be used in the calculation. The tax is calculated from September. The company sold the vehicle on 02/05/2019, and it was removed from registration control 5 days later. You will not have to pay taxes for February.

Example 4. The month is taken into account after deregistration.

The bus was purchased on 02/07/2018, the tax is transferred to the new owner for this month. Subsequently, he sells the vehicle on March 10, 2019, but it is deregistered only a week later. The tax amount for March 2020 must be included in the return.

An example of calculating an advance payment for a whole year and for part of a year

As mentioned earlier, the amount payable is calculated using the formula NS x NB x ¼. Let's look at detailed examples to calculate everything correctly yourself:

Example 1. Determining the period and amount to be paid when selling a vehicle.

205 hp bus registered on March 16, 2018 in St. Petersburg. On February 10, 2019, the owner of the company decided to sell it. The transaction was completed on April 15, and re-registration with the traffic police was on February 17, 2019.

The tax rate in the Leningrad region in this case is 65 rubles. for each "horse".

The previous owner did not take March 2021 into account when transferring taxes. Money was transferred only for April, then May, June and July, then August, September and October, and subsequently only the balance for the months until February 10 of the following year was transferred.

205 x 65 x ¼ = 3,331.25 – tax for the quarter.

To pay an advance, just take a declaration, calculate the amount to be transferred and indicate the details of the recipient (IFTS): KBK, department code, address, etc. You will also need information about the payer: name of the enterprise, full name. manager, the number of vehicles with a detailed description of the amounts and characteristics of each of them.

Attention! Money is transferred in two ways - online or through a Sberbank branch. In the latter case, when depositing money in a large denomination, you can get change, and when using a bank card, the exact amount due is debited remotely.

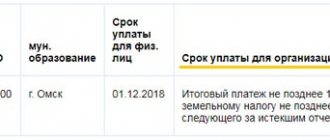

Deadline for payment of advance payment for transport tax

As mentioned earlier, the deadlines for the transfer of state contributions are set by the authorities of the constituent entities individually.

When money is transferred in different regions: Subject

| Peculiarities | |

| Adygea | Until the end of the month following the reporting period |

| Moscow region | |

| Buryatia | |

| Kalmykia | |

| Dagestan | |

| Mordovia | |

| Mari El | |

| Chuvashia | |

| Khakassia | |

| Kamchatka | |

| Stavropol | |

| Primorye | |

| Astrakhan region | |

| Amur region | |

| Vladimir | |

| Bryansk | |

| Vologda | |

| Voronezh | |

| Irkutsk | |

| Bashkortostan | For each quarter no later than the end of the last month |

| Kabardino-Balkaria | Until April 30, July 31, October 31 respectively |

| Komi | 15.05, 15.08, 15.11 – extreme dates for quarters |

| Crimea | Within 30 cal. days after the end of each quarter |

| Udmurtia | Until 10.05, 10.08, 10.11 respectively |

| Arkhangelsk | Until 05.05, 05.08 and 05.11 |

| Volgograd | Within 25 days after the end of the next quarter |

The transfer of advance payments for vehicle taxes is the obligation of all legal entities that own cars, trucks, as well as buses, air and water vehicles. The calculation of amounts is carried out by enterprise accountants independently. Before the deadlines specified in local tax legislation, the money goes to the budget of the Federal Tax Service, and a declaration must also be submitted.

Calculator for calculating transport tax for legal entities

You can calculate transport tax for legal entities in 2021 using an online calculator. It works according to the same calculation formula, but does not yet take into account the Kp coefficient. Therefore, to calculate the final cost of tax on a luxury car, multiply the result of the calculator by the desired factor.

The calculator and rules for its use can be found on this page.

Use the online calculator only to find out the approximate cost of the tax. To calculate the TN for a tax return, perform the calculation using the formula manually.

Who must pay advance payments for transport tax

Transport tax must be paid by those persons (legal entities or individuals) on whom vehicles recognized as subject to taxation by TN are registered (Article 357 of the Tax Code of the Russian Federation). At the same time, the procedure for calculating and paying tax for organizations and citizens is different: organizations calculate the tax independently, and for individuals the tax amount is calculated by the tax authority based on information from the State Traffic Safety Inspectorate (clause 1 of Article 362 of the Tax Code of the Russian Federation).

The obligation to make advance payments for transport tax can be introduced only for organizations (clauses 1, 2 of Article 362 of the Tax Code of the Russian Federation). Citizens pay tax in a lump sum on the basis of the tax notice received (clause 3 of Article 363 of the Tax Code of the Russian Federation).

ATTENTION! Starting with the tax for 2021, legal entities will also receive a tax message with the calculated amount. And they will stop submitting tax return declarations to the Federal Tax Service. However, this does not mean that they will no longer need to calculate tax. This responsibility will remain with organizations in the future. After all, they must know the amount in order to make advance payments throughout the year (if such are established in the region). And the message from the tax office is more of an informational nature, so that the company can compare its accruals with those made according to the tax authorities. And she will receive it after the deadline for paying advances (see, for example, letter of the Ministry of Finance dated June 19, 2019 No. 03-05-05-02/44672).

Read about the basic rules for calculating TN for legal entities in the material.

Deadlines for payment of advance payments for transport tax

TN is a regional tax, therefore some features of its payment are determined by the authorities of the constituent entities of the Russian Federation by the relevant law (Article 356 of the Tax Code of the Russian Federation). In particular, for taxpayers-organizations, the law of the subject establishes the procedure and deadlines for paying tax, including the presence/absence of an obligation and the deadlines (if an obligation is established) for making advance payments for transport tax.

For example, an advance payment system operates in the Moscow region. In accordance with paragraph 1 of Art. 2 of the Law of the Moscow Region dated November 16, 2002 No. 129/2002-OZ, organizations pay advance payments no later than the last day of the month following the expired reporting period.

An essentially similar procedure is provided for in subsection. 1 clause 1 art. 9 of the Law of the Nizhny Novgorod Region No. 71-Z dated November 28, 2002, according to which advance payments for transport tax are made within the following terms:

- for the first quarter - April 30;

- for the second quarter - July 31;

- for the third quarter - October 31.

At the same time, the region may not introduce advance payments for transport tax.

How to calculate an advance payment for transport tax

Advance payments for transport tax are calculated based on the results of the reporting periods. The reporting periods are the I, II and III quarters (clause 2 of Article 360 of the Tax Code of the Russian Federation).

The payment amount is determined as ¼ of the product of the tax base and the tax rate (clause 2.1 of Article 362 of the Tax Code of the Russian Federation). This takes into account the so-called ownership coefficient and the increasing coefficient for expensive cars.

In general, the calculation formula looks like this:

AP = ¼ × NB × NS × Kv × Kp,

where NB is the tax base (for a car this is the engine power in horsepower), NS is the tax rate, Kv is the ownership coefficient, Kp is the increasing coefficient.

The tax rate is also set by the constituent entity of the Russian Federation, and it can not only vary significantly by region, but also change from year to year.

We explained here what the transport tax rate depends on.

The ownership ratio is defined as the ratio of the number of full months during which the vehicle was registered to the taxpayer to the number of calendar months in the tax (reporting) period. The month in which the right to own a vehicle arose before the 15th or was lost after the 15th is considered complete (clause 3 of Article 362 of the Tax Code of the Russian Federation).

The size of the increasing coefficient depends on the average cost and age of the car. Specific values of the coefficient are fixed in clause 2 of Art. 362 Tax Code of the Russian Federation.

From 2021 for cars worth from 3 million to 5 million rubles. no older than 3 years, a single coefficient of 1.1 is applied ( read more in this publication ).

The list of expensive cars must be published annually by the Ministry of Industry and Trade.

The amount of advance payments for transport tax accrued for the tax period 2021 inclusive is reflected in the declaration submitted for the year as an amount that reduces the total amount of tax accrued for the tax period to the amount intended for payment for the last period of the year. At the end of the reporting periods, no reports are submitted.

This material will introduce you to the transport tax return .

Starting from the 2021 tax period, the declaration of transport tax for legal entities has been cancelled.

How is the advance payment calculated correctly?

Let's figure out how to calculate advance payments for transport tax. The AP for transport tax can be calculated and paid only based on the results of the reporting period. In many regions, this period occurs once a year, however, there are cases (as we examined for the Nizhny Novgorod region) when payments must be made quarterly three times a year.

According to Article 362 of the Tax Code, the payment amount should be determined as the base multiplied by the rate and divided by four. This formula takes into account a number of coefficients.

The general formula includes the following indicators:

- tax base (marked as NB);

- rate (NS);

- Possession Rate (PO);

- increase rate (PP).

In the general formula for calculating the advance payment, all indicators are included as follows:

AP=0.25×NB×NS×PO×PP

Based on this formula, it is easy to create an advance payment calculator if the base is known. It should be remembered that local authorities are not only able to change the amount of AP, but also dynamically change it annually. However, AP will always be calculated the same.

The ownership rate (PO) reflects the level of vehicle ownership. In a mathematical sense, this is the ratio of the period during which the vehicle was registered to the length of the tax period.

The increase index (IP) depends on the subtleties associated with the car itself: its year of manufacture, average price. The actual figures are indicated in Article 362 of the Tax Code.

In 2021, a rule was introduced for cars whose price is in the range of 3-5 million rubles. For them, a single indicator of 1.1 was used.

As for issues related to tax returns, the amount of the accident that occurred during the entire reporting period must be indicated in the general annual declaration.

Tax rates and indicators that must be taken into account when calculating the amount of the advance payment are established by local legislative institutions. The development of such completely depends on the rates and indicators prescribed in Article 361 of the Tax Code. When drawing up their own local rates, the authorities must be guided by only one requirement - not to increase them more than ten times.

Are penalties accrued on the advance payment of transport tax in case of non-payment or late payment? Yes, if there is a delay, penalty interest begins to accrue, since the AP is part of the total rate.

If a company or citizen does not have the opportunity to personally pay for the accident, then an authorized person can do this on behalf of the payer.

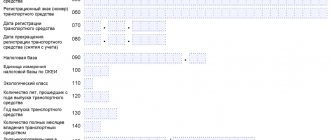

How to calculate an advance payment for transport tax

The calculation of advance payments and transport tax is determined by Art. 362 Tax Code of the Russian Federation. It states that taxpayers-organizations make their own calculations, and individuals pay tax on the basis of a notification from the tax authority.

The tax is calculated for the calendar year for each vehicle separately. The calculation method is the product of the tax rate and the tax base. Advance payment for transport tax is ¼ of the tax amount. It is calculated for 1st, 2nd, 3rd quarters. The tax at the end of the year is paid in the form of the difference between the calculated tax amount and advances paid to the budget.

The tax base is what the tax is collected from. For transport tax, the base is the technical characteristics of vehicles, for example, the power of the car. The entire list of technical characteristics involved in tax calculation is indicated in Art. 359 of the Tax Code of the Russian Federation.

Rates for tax calculation are set by regions. When developing them, the latter should be guided by the rates of the Tax Code named in Art. 361 Tax Code of the Russian Federation. The main requirement is that regional rates should not exceed NK rates by more than 10 times. The appropriate service of the Federal Tax Service allows you to determine the rate correctly.

Example of calculating advance payment for transport tax

The organization has owned a passenger car since 2013. The car is registered in the Moscow region. Tax base – 152 horsepower. Tax rate – 49 rubles per hp.

Tax amount for 2015:

152 hp x 49 rubles = 7448 rubles.

Advance payment amount in 2015:

152 hp x 49 rubles x 1/4 = 1862 rubles.

Based on the results of the calculation, the organization will pay advances of 1,862 rubles each for the 1st, 2nd, 3rd quarters of 2015. The tax amount for the year will be 1862 rubles.

The timing of payment of advances and taxes will depend on the law of the subject of the Russian Federation. For example, in Moscow, organizations are not provided for the payment of advance payments for transport tax (Clause 1, Article 3 of Moscow Law No. 33 of 07/09/2008 “On Transport Tax”), the tax is transferred until February 5 following the year, according to which it is paid. In St. Petersburg, organizations transfer advance payments to the budget until April 30, July 31, October 30 (Clause 2, Article 3 of the Law of St. Petersburg dated November 4, 2002 No. 487-53 “On Transport Tax”), the tax is transferred until February 10 , following the year in which it is paid.

Objects of taxation by transport tax

Legal entities are required to pay transport tax only for those vehicles registered in their ownership that are subject to taxation. A detailed list of vehicles that are and are not subject to taxation is presented in the latest edition of Article 358 of the Tax Code .

Tax Code of the Russian Federation Article 358. Object of taxation

- The objects of taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) and other water and air vehicles (hereinafter in this chapter - vehicles) registered in the prescribed manner in accordance with the legislation of the Russian Federation.

- The following are not subject to taxation:

rowing boats, as well as motor boats with an engine power not exceeding 5 horsepower;

- passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received (purchased) through social welfare authorities in the manner prescribed by law;

- fishing sea and river vessels;

- passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations and individual entrepreneurs whose main activity is passenger and (or) cargo transportation;

- tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance), registered to agricultural producers and used in agricultural work for the production of agricultural products;

- vehicles owned by the right of operational management to federal executive authorities and federal state bodies in which the legislation of the Russian Federation provides for military and (or) equivalent service;

- vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by an authorized body;

- airplanes and helicopters of air ambulance and medical services;

- ships registered in the Russian International Register of Ships;

- offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships.

For transport designated in the Tax Code as not subject to taxation, there is no need to pay transport tax or advance payment.

Calculation of advance payments for transport tax upon the emergence/termination of ownership

If a vehicle is acquired or is removed from ownership in the year for which the tax is calculated, then the coefficient for the number of full months of vehicle ownership is applied.

| Base | date | Accounting for calculations |

| Vehicle registration | inclusive until the 15th of the month | taken into account |

| after the 15th of the month | not taken into account | |

| Deregistration of a vehicle | inclusive until the 15th of the month | not taken into account |

| after the 15th of the month | taken into account |

Example of calculating advance payment for transport tax

The organization is the owner of a truck whose engine power is 204 hp. The place of registration of the vehicle is Rostov region. The tax rate is 35 rubles. The car was sold on October 16, 2015.

Since the car has been sold, the ownership period factor must be used. For 1st, 2nd, 3rd quarters, the tax is calculated in full, that is, the coefficient is not applied. At the end of the year, the coefficient will be 10/12 (October is included in the calculation).

Tax amount for 2015:

204 hp x 35 rubles x 10/12 = 5950 rubles.

Advance payment amount in 2015:

204 hp x 35 rubles x 1/4 = 1785 rubles.

For the 1st, 2nd, 3rd quarters, the organization will pay advances of 1,785 rubles for each quarter. The amount of transport tax will be 595 rubles in addition to the listed advances to the budget.

Special transport

There are special types of transport for which TN and, accordingly, AP are calculated differently.

Such transport includes:

- transport that is considered expensive;

- weighing more than 12 tons.

For expensive cars, when calculating the transport tax, a special increase indicator is used. It depends on the year of manufacture and price. In order to find out which car requires an increased tax, you should familiarize yourself with the list of cars on the website of the Ministry of Industry and Trade.