Current transport declaration form for 2017

For 2021 reporting, transport tax returns must be submitted on new forms. A new declaration form approved by order of the Federal Tax Service of Russia dated December 5, 2021 No. ММВ-7-21/668. Let us explain in the table what has changed in it:

| Declaration indicators | New form | Old form |

| Title page | There is no print field | There is a printable field |

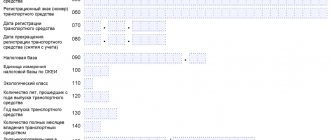

| Section 2 “Calculation of the tax amount for each vehicle” | Added lines: – 070 – vehicle registration date; – 080 – date of termination of registration of the vehicle (deregistration); – 130 – year of manufacture of the vehicle. | In the previous form there were no such lines |

| Lines have appeared for deductions that are used by payers of contributions to the Platon system (owners of vehicles weighing over 12 tons). Line 280 shows the deduction code, and line 290 shows the deduction amount. |

.

The procedure for filling out a tax return for transport tax - regulations

The obligation to submit a declaration under the Tax Code arises only for legal entities if they have taxable objects under Stat. 358. Companies that operate vehicles on a lease basis are not recognized as taxpayers - ownership must be registered in the prescribed manner with government agencies (Article 357 of the Tax Code). If an enterprise does not have any means of transportation during the tax period, it is not required to submit empty “zero” reports.

The deadline for filing the declaration is established in paragraph 3 of the statute. 363.1 of the Code. The single date cannot be changed by regional authorities. Filling out the transport declaration for 2021 and submitting the report to the Federal Tax Service must be carried out no later than 02/01/19; for 2021, you must report by 02/01/18. The form is submitted to the territorial office of the Federal Tax Service at the address of the vehicle location or the place of registration of the legal entity with the status of the largest taxpayer (clause 1, 4 of Statute 363.1). There is no need to submit reports based on the results of the reporting quarters.

Starting from 2021, taxpayers should report on a new form: in this case, it is possible to fill out a transport tax return under Order No. ММВ-7-21/ [email protected] for 2021. Detailed rules for correctly reflecting information are also contained in this regulatory document . In order to draw up a report correctly and not face a refusal to accept documents, it is recommended that you carefully study the procedure for filling out a transport tax return in 2021. Let’s consider the details.

What are the deadlines for submitting the transport declaration for 2021?

Article 363.1 of the Tax Code of the Russian Federation regulates the deadlines for submitting a transport tax return. Organizations submit reports on vehicles once a year. The deadline is February 1 of the following year. If the last day of the deadline falls on a weekend, it is shifted to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). However, since February 1st falls on a Thursday in 2021, the dates will not be postponed. The declaration must be submitted to the Federal Tax Service no later than February 1, 2021.

Please note that the specified deadline for submitting a transport tax return is the same for all companies. There are no special rules or exceptions regarding when a transport tax return is submitted in the Tax Code of the Russian Federation. It is very convenient that the procedure for filling out a tax return for transport tax allows companies to choose how to submit it:

- personally or through a representative;

- by mail with a description of the attachment or by sending an electronic report.

If you choose postal services, the declaration is considered submitted on the day the postal item is sent. And when transmitted via TKS - the date the file was sent.

Submit your transport tax declaration to the same inspectorate where you pay the tax. That is, according to the location of vehicles (clause 1 of article 363, clause 1 of article 363.1 of the Tax Code of the Russian Federation).

Who exactly should report for 2017 in 2021

Legal entities (Article 363.1 of the Tax Code of the Russian Federation) on which vehicles are registered (Article 357 of the Tax Code of the Russian Federation) are required to submit a transport tax return for 2021. And not just any, but those that are recognized as taxable objects: cars, motorcycles, buses, yachts, boats, motor boats, etc. (see Article 358 of the Tax Code of the Russian Federation).

The same article provides a list of items whose registered rights do not oblige you to fill out a transport declaration for 2017, since these are not taxable items. For example, a stolen car or agricultural transport.

Submitting a declaration and paying tax

Payers of transport tax are those organizations in which, in accordance with the legislation of the Russian Federation, transport is registered, recognized as an object of taxation, in accordance with Article 357 of the Tax Code of the Russian Federation.

Transport tax must be calculated for each registered transport in the organization.

The tax base for the tax is the engine power of the vehicle in horsepower. The engine power is indicated in line 10 of the PTS, in accordance with subparagraph 1 of paragraph 1 of Article 359 of the Tax Code of the Russian Federation.

Also, in accordance with paragraph 1 of Article 361 of the Tax Code of the Russian Federation, regional law establishes differentiated rates, which depend on the environmental class and age of the vehicle and tax benefits.

Advance payments and taxes are paid by the organization at the place of registration of vehicles (clause 1 of Article 363 of the Tax Code of the Russian Federation).

Should “physicists” report?

Unlike legal entities, a tax return for transport tax by individuals is not filled out and submitted (Clause 1, Article 362 of the Tax Code of the Russian Federation). Tax authorities themselves will calculate this tax to be paid based on data from the traffic police. Thus, for ordinary citizens, a transport tax declaration for individuals is replaced by a notification from the Federal Tax Service for the payment of transport tax. There is no need to download the transport tax return. By the way, you can check whether the inspectorate calculated the transport tax correctly using a special service on the official website of the Federal Tax Service. Exact link.

As for individual entrepreneurs, they are fully subject to the rules of reporting and payment of transport tax that apply to ordinary individuals. Even if the merchant uses the vehicle to make a profit. Thus, individual entrepreneurs do not submit a transport tax return for 2021, but pay the tax based on a notification from the Federal Tax Service.

Example of filling out a declaration

An example of preparing a transport tax return

Alpha LLC (TIN 5617123456, KPP 561701001) operates in the Orenburg region. The organization has a truck on its balance sheet (identification number – XTH330700M1415144, brand – ZIL-130, registration plate – E 285 MA 56) with an engine power of 155 hp. pp., 2005 release. “Alpha” is the sole owner of the car; the organization has no other vehicles.

The transport tax rate in 2021 is 50 rubles. for 1 l. With. "Alpha" produces agricultural products and from January 1, 2021 has the right to a benefit in the form of a reduction in the tax rate by 50 percent (clause 2 of article 9 of the Orenburg Region Law of November 16, 2002 No. 322/66-III-OZ).

On April 20, 2021, the car was stolen, which was confirmed by a certificate from the Department of Internal Affairs. On August 8, 2021, the vehicle was found and returned to the owner.

The annual amount of transport tax is: 155 l. With. × 50 rub./l. With. = 7750 rub.

Clause 2 of Article 8 of the Orenburg Region Law of November 16, 2002 No. 322/66-III-OZ established tax reporting periods. Therefore, the organization’s accountant calculated advance payments quarterly.

The car was in the possession of the organization:

- in the first quarter – 3 months (January, February, March);

- in the second quarter – 1 month (April);

- in the third quarter – 2 months (August, September);

- in the fourth quarter – 3 months (October–December).

Total for the whole year – 9 months (January–April, August–December).

The advance payment for the reporting period (full quarter), taking into account the benefits, is: 155 l. With. × 50 rub./l. With. × 50% = 3875 rub. × 1/4 = 969 rub.

The vehicle ownership ratio in the first quarter is 1 (Q = 3 months: 3 months). The advance payment for the first quarter is 969 rubles.

The vehicle ownership rate in the second quarter is: 1 month. : 3 months = 0.3333.

The advance payment for the second quarter, taking into account the benefits and the vehicle utilization rate, is equal to: 969 rubles. × 0.3333 = 323 rub.

The vehicle ownership rate in the third quarter is: 2 months. : 3 months = 0.6666.

The advance payment for the third quarter, taking into account the benefits and the vehicle ownership coefficient, is equal to: 969 rubles. × 0.6666 = 646 rub.

The vehicle ownership rate (Q) for the year as a whole is: 9 months. : 12 months = 0.75.

Transport tax, taking into account the coefficient of vehicle ownership for the year, is equal to: 7,750 rubles. × 0.75 = 5813 rub.

The benefit utilization rate (C) for the year is: 9 months. : 12 months = 0.75.

The amount of the tax benefit, taking into account the coefficient Kl, is: (155 hp × (50 rubles/hp – 25 rubles/hp)) × 0.75 = 2906 rubles.

The amount of transport tax taking into account the benefits for the year is equal to: 5813 rubles. – 2906 rub. = 2907 rub.

Taking into account advance payments at the end of the year, the organization charges transport tax payable: 2907 rubles. – (969 rub. + 323 rub. + 646 rub.) = 969 rub.

Based on the available data, Alpha’s accountant compiled a transport tax return for 2021.

Composition of the new transport declaration in 2018

The new transport tax return for 2021 for legal entities consists of a title page and two sections.

As we have already said, in the second section of the declaration for 2021. in which the tax amount for each vehicle is indicated, five lines appeared:

- in lines 070 and 080 you can now indicate when the vehicle was registered (with the State Traffic Inspectorate, Gostekhnadzor, etc.) and when it was deregistered;

- on line 130 – year of manufacture;

- lines 280 and 290 - code and deduction amount are filled in by payers of fees in the Platon system (owners of vehicles weighing over 12 tons).

Data about the car - identification number (VIN), make, registration number, registration date, year of manufacture, take from the title or registration certificate. Indicate the registration termination date (line 080) only for cars that you deregistered in the reporting year.

How to fill out a transport tax return

The composition of the new declaration has not changed. As before, the document includes a title page and two sections. The first is intended to reflect the amounts of TN payable to the regional budget for the period (or to be reduced), including advances already transferred during the year. The second is used to calculate the amount of tax taking into account the tax base, interest rates, benefits and deductions. A separate section is compiled for each object. 2, total number of sheets with section. 2 should be equal to the number of vehicles registered to the company.

The regulatory procedure for filling out a transport tax return consists of uniform requirements for the presentation of the document, as well as entering information into separate pages and sections - title page, sections 1 and 2. The encoding of values is given in separate appendices:

- By delivery period – Appendix 1.

- Types of reorganization/liquidation of a legal entity – Appendix 2.

- Place of filing the tax return declaration with the Federal Tax Service - Appendix 3.

- The method of filing a declaration under TN is Appendix 4.

- Types of vehicles – Appendix 5.

The table with codes is posted below. It is recommended to start filling out a transport tax return by creating a title page. Then, Section 2 is drawn up for each taxable object. At the very end, the data is summarized and the tax payable or reduced for the enterprise as a whole is calculated.

Filling out a new declaration form: examples and samples

Below we provide examples and images of filling out a transport tax return for 2021.

Title page of the declaration

On the title page, indicate basic information about the organization and the declaration.

TIN and checkpoint

Please include these codes at the top of the title. If you are reporting on the location of a separate unit, indicate its checkpoint.

Correction number

Please indicate here:

- if you are submitting a report for the first time – “0–”;

- if you are clarifying something that has already been submitted, the serial number of the report with corrections (“1–”, “2–”, etc.).

Taxable period

Enter code “34” in your transport tax return.

Reporting year

In this case, 2017 is the year for which reporting is submitted.

Next, mark with codes which inspection you are submitting the declaration to:

- In the “Submitted to the tax authority” field, enter the Federal Tax Service code;

- in the line “at the location (registration) (code)” put 260 if you are submitting a declaration at the place of registration of the organization, division, or vehicles. Code 213 means the largest taxpayers, and code 216 their legal successors.

Taxpayer

Here record the full name of the organization in accordance with the constituent documents.

OKVED

In this field, enter the code according to the All-Russian Classifier of Types of Economic Activities (OKVED) OK 029-2014 (NACE revision 2).

Section 1 of the declaration

After completing the title page, skip Section 1 and begin completing Section 2. Based on the information in this section, then complete Section 1.

Let us explain the features of filling out some lines in section 1 of the declaration for 2021.

Line 120

Fill out line 120 only if the tax rate depends on the number of years from the year of manufacture of the car.

Line 140 and 160

In line 140, indicate the number of full months of car ownership during the year, and in line 160 - the coefficient Kv. If you owned the car all year, put 12 in line 140, and 1 in line 160.

Enter the number of months of 2021 during which your organization owns a specific vehicle in line 140. Please note that full months include those in which the vehicle was registered before the 15th day (inclusive) and deregistered after the 15th day. Months in which the vehicle was owned for less than half a month are not taken into account. Divide the number of complete months of vehicle ownership by 12 to obtain the ownership coefficient, which is reported on line 160. This coefficient is rounded to four decimal places.

Line 150

In line 150, put 1/1 if the owner is the only one. Otherwise, it is indicated as a fraction (1/2, 1/3, etc.).

Line 180

Indicate the Kp coefficient (line 180) only for expensive cars.

Lines 190 and 300

In lines 190 and 300, indicate the calculated tax for the year.

Enter the amount of calculated tax on line 190. To do this, calculate it using the formula:

| Page 190 | = | Page 090 | × | Page 170 | × | Page 150 | × | Page 160 | × | Page 180 |

Tax payable on line 300 is calculated using the formula:

| Page 300 | = | Page 190 | – | Page 250 | – | Page 270 | – | Page 290 |

For vehicles that are completely exempt from tax, put a dash in line 300.

Lines 200 – 290

These lines are filled in by “beneficiaries”. Subjects of the Russian Federation have the right to exempt an organization from transport tax or reduce it for some vehicles. In this case, fill out lines 200-270.

When a vehicle falls under the benefit, line 200 indicates the number of full months of use of the benefit in 2017. To calculate the coefficient of use of the Kl benefit (line 210), the data on line 200 is divided by 12 months. The coefficient is rounded to four decimal places. The type of benefit and amount are deciphered in the lines:

- 220-230 – complete tax exemption;

- 240–250 – reduction of the tax amount;

- 260–270 – reduced tax rate.

If vehicle benefits are not established, dashes are placed in lines 220–270.

Section 1 of the declaration

By filling out section 2 for all vehicles, go to section. 1.

If you do not pay advance payments, in lines 021 and 030, indicate the total tax amount for all cars.

If you pay, indicate advance payments in lines 023 - 027, and in line 030 - tax payable at the end of the year.

Next, we will look at filling out the main sections of the declaration using an example.

The car has an engine power of 105 hp. With. was sold and deregistered on December 13, 2017. The car was produced in 2015 and registered on 10/21/2015. In the region there are advance payments, the tax rate is 35 rubles/l. With.

- During the year, the organization owned the car for 11 months from January to November.

- Advance payments for the 1st, 2nd and 3rd quarters – 919 rubles each. (1/4 x 105 hp x 35 RUR/hp).

- The coefficient Kv for calculating tax for the year is 0.9167 (11 months / 12 months).

- The calculated tax amount for 2021 is RUB 3,369. (105 hp x 35 rub/hp x 0.9167).

- The amount of tax payable for the year is 612 rubles. (3,369 rubles – 919 rubles – 919 rubles – 919 rubles).

You can also, which will be handed over no later than February 1, 2018.

Read also

21.12.2018

Lines 170−180 Tax benefits

For some organizations, regional transport tax benefits may be established.

For example, public organizations of disabled people registered in the Moscow region are exempt from paying tax (Part 2 of Article 7 of Law No. 151/2004-OZ of November 24, 2004). You can determine which transport tax benefits an organization is entitled to using the Federal Tax Service Property Taxes: Rates and Benefits service or in the regulations of the constituent entities of the Russian Federation.

If the vehicle is eligible for a benefit, on line 170, indicate the number of full months of use of this benefit in the reporting year.

On line 180, calculate the coefficient of use of the benefit Kl using the formula:

| Page 180 | = | Page 170 | : | 12 months |

Specify the Cl coefficient with an accuracy of ten thousandths according to the rules of mathematics (for example, 0.6667).

An example of rounding the coefficient for using benefits in a transport tax return

The Alpha organization received the right to apply transport tax benefits in early May.

The Alpha accountant calculated the benefit utilization rate: 8 months: 12 months = 0.6666666.

The accountant rounded the result to the fourth decimal place and entered the coefficient 0.6667 in line 180.

Such rules are established by clauses 5.15–5.16 of the Procedure approved by order of the Federal Tax Service of Russia dated February 20, 2012 No. ММВ-7-11/99.

Decipher the type of benefit and amount in the lines:

- 190–200 – complete tax exemption;

- 210–220 – reduction of the tax amount;

- 230–240 – reduced tax rate.

If vehicle benefits are not established, put dashes in lines 190–240.