Help 2-NDFL: what it is and what it looks like

Certificate 2 of personal income tax is a report compiled for each specific employee of the enterprise and containing the following information:

- the amount of taxable income paid to the employee: wages, bonus payments, payment of sick leave, other remuneration;

- the amount of accrued, withheld and transferred to the budget personal income tax;

- tax deductions provided to the employee.

Since 2021, an updated format for submitting a certificate has been introduced, which was approved by order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11 / [email protected] The innovation is that previously a single form 2 personal income tax was used, but now two different forms are used: the first is intended for organizations sending data to the Federal Tax Service (contains two sheets: the main one and the application), the second is issued to the employee upon his request (consists of a one-page form).

Let's give an example: a trade and service company is engaged in refilling cartridges and selling stationery and office products. For 2021, the accountant filled out forms 2 personal income tax certificates for each employee, with a monthly breakdown in the appendix. The completed information for the past year was submitted to the tax office in March 2019. Then, in August, saleswoman Yakimova filed for resignation. During the final payment of her salary, she was provided with personal income tax certificate 2 for the period from January to August 2019.

Note! If an employee requests confirmation of income for several previous years, for example, for 2 years, then certificates are issued in the form that was used during these periods. That is, for 2021 you need to prepare a report using the old form, and for 2021 - using the new form.

The transformations of personal income tax certificate 2, compared to the previous version, are as follows:

| Old form | New form |

| Contains 5 sections. | Consists of 3 sections and an appendix. |

| Document header and section 1. | Replaced by title page. The employer's tax identification number and checkpoint have been added to the header. |

| Section 2 “Data about an individual”. | The data is included in section 1. O. |

| Section 3 “Income taxed at the rate of 13%”. | Paid income and provided deductions, broken down by month, are entered in the application. |

| Section 4 “Standard, social and property tax deductions.” | Replaced by Section 3 of the same title. Descriptions of the type of notification for deductions have been replaced with codes for deductions, and a record has been added confirming the accuracy and completeness of the information specified in the certificate. |

| Section 5 “Total Amounts of Income and Tax.” | Replaced by section 2 with the same name, the indication “based on the results of the tax period” was added. |

Table 1. Differences between the old and new sample of form 2 personal income tax

The new form, intended for sending to the Federal Tax Service, is designed to be machine readable. This will facilitate and speed up the process of checking reports by the tax service.

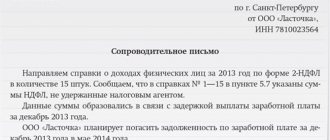

The main sheet of the tax certificate looks like this:

Form 2 personal income tax (1 sheet of form)

An additional sheet is an appendix to the certificate, reflects the employee’s income received for each month and the deductions provided to him, and the corresponding codes are also indicated.

Form 2 Personal income tax (attachment)

The certificate intended for employees looks like this:

Form 2 personal income tax (for employees)

The name has changed in the new format of the certificate for employees. Now the document is called “Certificate of income and tax amounts of an individual.”

This form has not undergone significant changes; details not required by individuals have been excluded from it.

Certificate 2-NDFL for a mortgage or other loan: for what period is it issued?

It all depends on the requirements of the chosen banking institution. As a rule, an employee must work for one employer for at least 3 months. Some banks require you to provide a certificate of income for six months. For a consumer loan, sometimes 2 months are enough.

When applying for any type of loan, it is important to take into account that a certificate of income must be issued for the required period (the month must be closed for salary payments).

That is, if a client applied for a loan at the beginning of September, he should have an income certificate in his hands, in which the last reporting month will be August. The document is valid for 14-30 days from the date of issue.

The certificate must also contain the following information:

- Full name of the employee;

- his position;

- name of the employer and his details;

- income received by the employee, broken down by month;

- signature of the manager and date of preparation of the document.

There is no need to put a stamp on the 2-NDFL if this is not provided for in the statutory documents of the enterprise.

Who needs a 2-NDFL certificate and why, and where it may be required

There are several categories of individuals and legal entities who deal with certificates:

- tax agents;

- individual entrepreneurs (IP);

- working citizens;

- unemployed individuals.

Let's take a closer look at the features of handling Form 2 of personal income tax.

Tax agents

A legal entity or individual entrepreneur acts as a tax agent, which concludes employment contracts with employees, provides the staff with the opportunity to perform their job duties and pays them for their work. At the same time, the tax agent is obliged to withhold personal income tax from the income paid, transfer it to the budget of the Russian Federation, and report this to the tax authorities. Personal income tax certificate 2 serves as such a report.

The process of submitting a certificate to the tax office by a legal entity

Most often, reference data is generated in the accounting program “1C: Salaries and Personnel Management”. Finished documents are uploaded and sent to the tax office in electronic form (for example, using the free software of the Federal Tax Service Inspectorate “Taxpayer of Legal Entities”), or printed and submitted on paper. When submitted in printed form, a special list is attached to the certificates - a register, which indicates information about the employer, the number of certificates submitted, and information about employees. One copy of the register is submitted to the Federal Tax Service along with certificates, the second is returned to the organization.

From January 1, 2021, paper reporting is allowed only to those companies and individual entrepreneurs that pay income to employees of 10 or fewer people. All other enterprises (with more than 10 employees) are required to submit information using electronic document management.

Important addition! The possibility of submitting documents to the Federal Tax Service on electronic media (disks, flash drives, floppy disks) has been cancelled. There are only three reporting options available:

- personally visit the inspection;

- use mail;

- send certificates using the electronic document management system.

Let's continue the example: in March 2021, a trade and service accountant submitted reports for 2021 on Form 2 Personal Income Tax in paper version; this was allowed by the number of employees - 22 people. According to the new rules, since the company has more than 10 employees in 2021, the accountant is required to submit personal income tax certificates for 2021 through electronic communication channels.

Where can I get a 2-NDFL certificate for an informal worker, an unemployed person, or a pensioner?

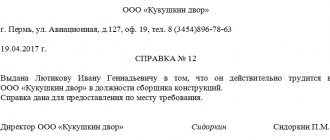

When a person is not officially employed, there is one way out - to make a request to the employer to issue a free-form document (an example is below). A “gray” salary must be confirmed, therefore, the boss and accountant must sign the certificate. However, it is unlikely that management will take such a step, since in this way it puts its company under attack from the tax authorities.

Therefore, some workers in this position are looking for where to obtain a fake document. But falsification is criminally punishable. Moreover, applying for a loan using a fake certificate will end in a fiasco, since the security service carefully checks all information for accuracy. A former employee receiving unemployment benefits has the right to visit the labor exchange and request a certificate of cash payments.

If you quit your job very recently, the employer is required by law to give you 2-NDFL. And it will be relevant for another month. When a person is not registered with the Employment Center and is looking for a new job, you can replace the certificate with copies of the first and last certified pages of the employment record.

Sometimes a person may need a document reflecting family income. Banks offer to show it to them in order to increase the maximum possible loan amount. You will also need it when applying for social assistance, for example, subsidies. Where can I get a 2-NDFL certificate in this case? You should go to the social welfare authorities with an application, a document on family composition, and a certificate of income of parents/children.

Pensioners receiving benefits from a non-state structure order the paper from the regional Pension Fund department. If assistance to elderly people comes from the state, then it is a priori not taxed. But they can ask the Pension Fund for a certificate indicating the amount of the pension.

When submission of a 2NDFL certificate is not necessary

The employer, being a tax agent, may not submit certificates to the Federal Tax Service only if the employee was not paid taxable income during the reporting period.

The employer must understand that if the employee has no income, there is no obligation to submit Form 2-NDFL to him.

There is no need to send information to the tax office in the following situations:

- If employees were paid income that is not subject to taxation by law. These payments are stipulated in Article 217 of the Tax Code of the Russian Federation. These include, for example, benefits for pregnancy and childbirth, alimony payments, and financial assistance in the amount of up to 4,000 rubles.

- When an enterprise cooperates with an individual entrepreneur (pays for his services or buys products from him). In this case, the entrepreneur is obliged to declare his income and pay tax.

- When concluding trade transactions with citizens (including their own employees). For example, the “Your Machine” auto repair shop purchased a Nissan car for 100 thousand rubles from auto mechanic Spitsyn, who works here. The employee himself must report for receiving this income by filling out form 3-NDFL, based on Article 228 of the Tax Code of the Russian Federation. A car service center, when submitting a certificate to the tax office, should not include this amount in the mechanic’s income.

- When presenting gifts to citizens in kind, for example, for advertising purposes. So, at the presentation of a new product, a company gives out small souvenirs to random buyers. In this case, it is impossible to identify the recipients of the income, and it will also not be possible to withhold tax from them.

- If an enterprise sells the principal’s property under a commission agreement. Here, the owner of the property receives income, so the responsibility to report taxes falls on him, and not on the commission agent.

How long is the 2nd personal income tax certificate valid?

The period during which the received document will be valid is not established by law. Therefore, its duration may vary, and is often specified by the organization where the certificate must be submitted.

For example, to obtain a loan, different banks have different requirements for the validity period of the form - from 7 to 30 days. The period for which the salary must be reflected may also vary. In some credit companies it is 1 year, in others – 3 or 6 months.

Example from life:

The Bulanovs decided to spend their vacation in Turkey, so they took out a consumer loan from Sberbank for 300 thousand rubles. The bank specialist warned that we need a certificate of income for 6 months. Its validity period was announced at 1 month. After vacationing in Turkey and paying off the loan, a year later the family decided to buy an apartment and applied to Sberbank for a mortgage. When preparing the package of documents, the Bulanovs took 2 personal income tax certificates from their place of work for the previous six months. But it turned out that this was not enough. To get a mortgage loan, the spouses had to request new forms with 12 months’ salary, and the document expired not in a month, but in 10 days.

When submitting documents to the Federal Tax Service to return the amount of already paid personal income tax, the certificate is valid for 3 years. That is, in 2020, you can return part of the funds spent on the purchase of real estate, treatment or education for the 3 previous years: 2021, 2018 and 2021.

When applying to a visa center, as a rule, the document is required six months in advance; it is valid for 1 month.

When registering with the Employment Center, a certificate from a previous place of work with salary data for the last 3 months will also be valid for 30 days.

To establish guardianship or adoption, the Department of Guardianship and Trusteeship accepts Form 2 of personal income tax, issued no earlier than a month ago. In this case, it is required to reflect income for 12 months.

If the certificate has expired, the employee can ask for another copy from the accounting department at the place of duty.

Recommendations

Before ordering a certificate in form 2-NDFL, it is recommended to check with the authority that requires it about its validity period. This will allow you to prepare all the necessary documents in advance, and order this certificate at the last moment. It is usually produced free of charge within 2-3 business days.

If for some reason an organization differentiates the base for personal income tax and the employee’s total income, you can order a certificate in the form of a bank, which will take into account all of the employee’s income for the reporting period. However, many financial and credit organizations do not accept such a certificate, and those that accept it offer their clients an increased interest rate.

When contacting several banks at once, it is worth ordering several certificates. In this case, it is possible to choose the bank that provides the most favorable lending conditions.

How to make a 2nd personal income tax certificate yourself (instructions)

If you don’t have time to wait for a certificate from your employer, you can get it on the website of the Federal Tax Service. To do this you need to take several steps:

Step 1. Log into the taxpayer’s personal account:

Step 2. Select the “My Taxes” tab:

Step 3. Click on the “Income Information” label:

The screen will display the history of income certificates:

Step 4. Save the document to your computer. There are 2 types of certificates available for download: regular and with an enhanced electronic signature of the tax service, which looks like this:

A document with such a signature has legal force and can be sent by email to the bank, lawyers or other authorities.

Important! 2-NDFL certificates on the Federal Tax Service website show income and payment of taxes for the previous year. And to obtain a loan or other purposes, they usually require information about salaries for the last 3-6 months, so, most likely, you will still have to contact your employer.

Features of issuing personal income tax certificate 2 at the employee’s request

If an individual requests a certificate from an employer, this can be done in the following ways:

- submit an application through the secretary for signature by the manager;

- send the application by mail.

The deadline for providing a certificate in this case is 3 days from the date of submission of the application.

When filing reports from your last place of work through the Federal Tax Service website, the form is completed on the same day. The data is generated based on the information provided for tax purposes by the employer at the end of the reporting period. The finished document is endorsed by the electronic signature of the Federal Tax Service.

If an employee needs a reporting form from an enterprise that has already been liquidated, you can do the following:

- a new employer has the right to request a document through the Pension Fund or the Federal Tax Service;

- An employee can issue a certificate independently through the tax website or by personally contacting the service.

When requesting a certificate through government agencies, you must justify the reason for the need to provide data on the individual’s income:

- calculation of vacation pay;

- accounting for total income;

- provision of standard deductions.

We recommend additional reading: For what period do you need a certificate of income 2 personal income tax for mortgages and loans

The fastest way to generate information is your personal account on the Federal Tax Service website.

Answers to readers' questions

Where can I get a 2nd personal income tax certificate for an individual entrepreneur?

Nowhere. If an individual entrepreneur carries out only entrepreneurial activities, he does not pay personal income tax, so it is not possible to obtain a document. In the case where an individual entrepreneur additionally works for hire, he can request a certificate from the employer regarding this income.

2 personal income tax and 3 personal income tax, what is the difference?

3 Personal income tax is a tax return submitted to the Federal Tax Service for the purpose of reporting personal income tax. It is submitted not by organizations, but by citizens, if they received income other than from their main activity and are required to pay tax on this income. Also, 3 personal income taxes are filled out in order to return part of the personal income tax already paid to the treasury. And form 2 personal income tax serves as the basis for drawing up a declaration 3 personal income tax.

Who signs the 2nd personal income tax certificate and is a stamp needed?

The form is signed by the director and chief accountant of the company. A stamp is placed if this requirement is put forward by the organization to which the certificate is presented. But even without a seal, the document has legal force. In addition, some employers, for example, many individual entrepreneurs, operate without using a seal. That is, if there is a seal, then it is better to put it, but you can present a certificate without a seal - this is not a violation.

What is the tax base in personal income tax certificate 2?

This is the value from which personal income tax is calculated. The tax base is the difference between the total income and all deductions due to the employee. If the amount of deductions is greater than the amount of income, the tax base is 0.

How much does it cost to get a 2nd personal income tax certificate?

On average, such a service costs 2–3 thousand rubles. But the consequences of its purchase can be much more expensive.

How to issue a certificate through State Services?

An account on the State Services website will allow you to log in and go to the Federal Tax Service website, where you can download the document. The procedure for obtaining a certificate is described above.

How to request a 2nd personal income tax certificate at work?

Submit your application to the employer in writing, in free form. It is better to register it, this will oblige the accounting staff to issue you a certificate within 3 days.

Certificate 2 personal income tax and income certificate - are they the same thing?

No. 2 Personal income tax is a form regulated by law, which has a special form. In addition to it, an income certificate developed by the company itself may be issued; it is not strictly regulated. A certificate for calculating sick leave, drawn up in form 182n, is also used. These are all different types of certificates.

I am on maternity leave for up to 1.5 years. Can I get a 2nd personal income tax certificate?

If, while on parental leave, you did not receive taxable income, then a tax certificate will not be submitted for you, since if there is no income, no tax is levied. You can receive a free-form certificate confirming your status and reflecting zero income. If taxable income is paid to you during this period, a standard personal income tax certificate 2 is issued.

How to issue a certificate of average monthly salary

To obtain a certificate of average earnings for 3 or 6 months, sample 2021, the employee must contact the employer with a corresponding application. He can do this both immediately upon dismissal and at any time after. The certificate is issued within 3 days after receiving a written request from the employee (Article 62 of the Labor Code of the Russian Federation).

A certificate of earnings for the last 2 years of work is issued to the employee upon dismissal, even if the employee did not request it. By written agreement with the dismissed employee, the certificate can be sent by mail or provided at another time.

You may also find information related to the dismissal of an employee useful, which can be found in the article “Deduction for unworked vacation days upon dismissal .

Summarize

- Certificate 2 Personal income tax is an official document that is drawn up by the employer - tax agent for each of its employees, subject to the payment of taxable income to him.

- The obligation of companies to submit reports in Form 2 of personal income tax is regulated at the legislative level; for violations of the transmission of information to the Federal Tax Service within the established time frame, fines will follow.

- Since 2021, a new certificate format has been introduced: for the tax service and for issuance to employees.

- Individual entrepreneurs with full-time employees are required to submit reports for them on a general basis. An entrepreneur cannot issue certificates for himself or other individual entrepreneurs.

- Employees of enterprises have the right to receive a certificate form at their place of work for presentation to various authorities: banks, social services, judicial services, and other places of demand.

- The Labor Code establishes a 3-day period for issuing a document, from the moment the employee submits the relevant application.

- In case of refusal or delay in issuing a certificate, a citizen has the right to go to court or to the labor dispute inspectorate.

- It is possible to independently obtain a certificate through the website of the Federal Tax Service or using the State Services portal.

- Falsifying a document may result in penalties and criminal prosecution.

Video for dessert: 9 Unusual Glitches of Nature

Results

- According to the law, a 2-NDFL certificate is issued within a maximum of 3 days (working days).

- The period is counted from the moment the employee submits a written application.

If you find an error, please select a piece of text and press Ctrl+Enter.

I tried very hard when writing this article, please appreciate my efforts, it is very important to me, thank you!

(1 ratings, average: 1.00)

The employer (tax agent) is obliged to issue the employee, upon his written application, a Certificate in form 2-NDFL. And for what period is such a certificate issued (clause 3 of Article 230 of the Tax Code of the Russian Federation)?

As a rule, it is generated for submission to the tax office in its entirety for the past calendar year (this is the tax period for personal income tax (Article 216 of the Tax Code of the Russian Federation)). Also, certificates for the past year are issued to employees.

At the request of the employee, he may be issued 2-NDFL for previous years.

If an employee asks you to issue him a 2-NDFL Certificate for a quarter or several months of the current year, for example, for a mortgage, then give him a 2-NDFL Certificate for this particular period - this is not prohibited by the Tax Code.

That is, in the middle of the year, you can issue an employee a 2-NDFL certificate for the current year, despite the fact that it has not yet ended (for 2-NDFL, the tax period is a calendar year). Just find out from the employee in advance how many months he needs a 2-NDFL certificate.