Basic Concepts

Any organization goes through different stages during its existence. It is rare that any of them manage to exist without debt. As a rule, either she or someone owes her money. These processes are called “accounts payable” and “accounts receivable”.

Accounts receivable is the total amount that must be returned by the organization's partners. There are a number of reasons why it forms:

- The company provided a service or supplied goods, but did not receive payment for them under the contract.

- The organization provided a loan, but the funds were never returned.

- The structure transferred the advance payment towards the shipment of goods in the future or to obtain services, but they were never carried out.

That is, this is a type of debt when the debtor (debtor) is an individual or legal entity that has not fulfilled its obligations to a specific organization.

Accounts payable, accordingly, are debt obligations of the company to other persons. Based on the reason for the appearance of debt, the following types can be distinguished:

- A company's debts for goods supplied or services provided.

- Advance payments on the organization's accounts for which it has not yet managed to make payments.

- Unpaid contributions to extra-budgetary funds and tax deductions.

- Wages to employees during the period when they have already been accrued but not yet paid.

- Monetary overspending of accountable persons.

- Debts to other creditors in the form of a penalty.

During liquidation, the debt can be written off

. Thus, accounts payable are not necessarily loan debts, but simply a natural part of the normal functioning of the organization.

These types of debts within the article are of interest in connection with the process of liquidation of the enterprise. Therefore, it is worth dwelling on this concept. It is discussed in detail by the Civil Code of the Russian Federation (Article 61). Liquidation of a legal entity is considered to be a procedure in which the final closure of the organization occurs. At the same time, neither her rights nor her obligations are transferred to third parties. At the final stage of liquidation, it is excluded from the lists of the Unified State Register of Legal Entities, and all unpaid debts (both creditors and receivables) are automatically cancelled.

What are accounts receivable?

Accounts receivable is the amount of debts owed to an organization from its partners, legal entities or individuals. This debt can appear in various situations, for example:

- Your company (seller) delivered a product or provided a service, but the buyer did not pay for it.

- Your organization (lender or creditor) transferred funds to the company (debtor) under a loan agreement (interest-bearing or interest-free). But the debtor did not return it.

- Your company (buyer) has made an advance payment towards future deliveries or work performed. But the seller did not make the shipment or did not provide the services promised under the contract.

In simple terms, accounts receivable arise when your organization has fulfilled its obligations, but counterparties have not.

Reasons why write-offs occur

Russian legislation identifies several reasons why the resulting debt should be written off:

- The statute of limitations has expired for a lawsuit aimed at returning either money or goods.

- Mutual obligations are terminated due to the impossibility of their fulfillment.

- The decision to terminate obligations was made by government bodies having the appropriate powers.

- Obligations terminate due to the death of the person responsible for the debt.

- Write-off of receivables and payables is carried out upon liquidation of the enterprise.

Write-off of receivables of a liquidated enterprise

The receivables of a liquidated enterprise are written off on the basis of an extract from the Unified State Register of Legal Entities (letter of the Ministry of Finance of Russia dated March 25, 2016 No. 3-03-06/1/16721). This register must contain a record of the liquidation of the debtor.

For safe write-off, we recommend collecting the following package of documents:

- Copies of the primary documents on the basis of which the receivables being written off arose.

- An extract from the Unified State Register of Legal Entities for a company that was liquidated and whose debt we want to write off.

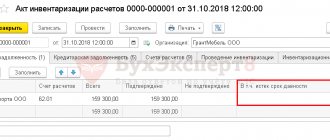

- Accounts receivable inventory report. This document will indicate the amount of the debt, its duration, as well as the impossibility of collecting it due to the liquidation of the debtor. The document that served as the basis for the write-off must be attached to the act: the decision of the inventory commission on the write-off (if such a decision is not in the act).

- Order from the head of the organization on write-off. This is due to the fact that decisions regarding the company’s activities are made exclusively by the manager.

The date of write-off will be the date of making an entry in the Unified State Register of Legal Entities on the termination of the activities of the debtor company (clause 1 of Article 272 of the Tax Code of the Russian Federation) or the date of the inventory of receivables (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 15, 2010 No. 1574/10 in case No. A56-4354/ 2009).

It often happens that an organization learns about the liquidation of its debtor in a different period when such liquidation occurred. In this case, the organization has two options:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- submit an updated income tax return - after all, these expenses relate to the previous period, and the company has already reported for it (paragraph 1, clause 1, article 54 of the Tax Code of the Russian Federation);

- write off in the current period, because errors and distortions in calculating the tax base, which led to an increase in tax payable, can be corrected in the current period (paragraph 3, paragraph 1, article 54 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated December 7, 2012 No. 03- 03-06/2/127).

But companies using the simplified system will not be able to include debt in expenses, since the list of companies’ expenses on the simplified tax system is closed and this type of expense is not included (clause 1 of Article 346.16 of the Tax Code of the Russian Federation). The same applies to Unified Agricultural Tax and UTII.

It is up to you to decide who will collect the documents. Perhaps this will be a legal department or a lawyer, or maybe a manager who led the company being liquidated, or maybe a specialist from the financial department or accounting department.

The main thing is that all of the above documents are transferred to the accounting department.

In accounting, the write-off of accounts receivable during the liquidation of an enterprise is included in other expenses (clause 12 of PBU 10/99 “Expenses of the organization”), and in tax accounting it is included in non-operating expenses (subclause 2 of clause 2 of Article 265 of the Tax Code of the Russian Federation).

Short circuit write-off process

There are several reasons that can be regarded as grounds for writing off accounts payable. They are defined in the Civil Code of the Russian Federation and the Tax Code of the Russian Federation. Such reasons include the expiration of the statute of limitations (it is 3 years), as well as the liquidation of the enterprise. The process itself looks like this:

- Carrying out an inventory of the company's payments, which should show the true amount of debt.

- Drawing up an accounting statement that provides an explanation of the reasons for the debt.

- Drawing up an order signed by the head of the company to carry out a write-off.

Creditor - failure to fulfill debt obligations to a person who has provided services to the company

When maintaining accounting records and submitting reports to the tax authorities, you should remember that documents confirming the fact of liquidation should be attached to the documents on writing off accounts payable. The whole point of the write-off manipulation is that the organization's debt should be included in the income item. This is what writing off accounts payable looks like when closing a creditor.

If the counterparty has been liquidated, tax law requires that the debt be taken into account as taxable income. Disputes can only arise over the issue of time frame. The Code does not provide a clear answer to when to register a write-off.

The regulatory authorities provide clarification on this issue, requiring that the write-off take place immediately after the company is excluded from the Unified State Register of Legal Entities. However, if we turn to judicial practice, we see that a number of court decisions allow write-off only after the statute of limitations has expired. To write off short-term payments, three types of entries are used: Debit (60, 62, 76) Credit 91 – 1.

Accountants have a lot of questions when calculating VAT on write-offs. The algorithm of actions in this case will depend on how the payment for the delivered (or not performed) services or goods took place. Moreover, the actions of the recipients of services and the persons who were supposed to provide them are somewhat different.

For example, if the buyer did not deduct VAT, then when the debt is written off, the tax is not restored. Provided that it was deducted, it must be included along with the debt in non-operating expenses.

When writing off, suppliers should not deduct VAT from the advance received. If tax is included in non-operating income, it should not be excluded from the amount of overdue debt.

How to write off accounts receivable if the organization is liquidated

The Ministry of Finance issued clarifications on this topic. In the department’s letter No. 03-03-06/1/48327 dated 07/01/19, officials explained in detail how to determine the moment for writing off receivables for a liquidated organization in tax accounting.

The Ministry of Finance notes that if there are several grounds for classifying a receivable as uncollectible, then for tax purposes it should be recognized strictly in the tax (reporting) period in which the first ground appeared. For example, if at first the debt was recognized as bad due to its maturity, and then the debtor was excluded from the Unified State Register of Legal Entities (the corresponding entry was made), the debtor should be recognized as subject to write-off on the date it was recognized as bad.

Find out about the nuances of writing off bad receivables in tax accounting in ConsultantPlus:

If you don't have access to the system, get a free trial online.

The process of writing off accounts receivable

When a debtor is liquidated, the write-off date should indicate the date when the organization was excluded from the Unified State Register of Legal Entities or the date when an inventory of the existing debt was carried out.

Receivables - debts of individuals to the company

Provided that the liquidation became known somewhat later than the event itself, the law establishes two ways of further action:

- Provide the tax service with an updated return for the past period, if the filer has already reported for it.

- Write off the debt in the current period.

When maintaining accounting records during liquidation, accounts receivable must be included in “other expenses”, and when preparing tax reports - in non-operating expenses.

Writing off a debtor's receivables during liquidation has its own peculiarities of drawing up accounting entries. They depend on the fact of the creation or absence of a reserve for the presented debt. Provided that it has been laid, the wiring will look like this:

- Debit 91 Credit 63 – reserve has been pledged.

- Debit 63 Credit 62 (60, 76) – writing off bad debts.

In the absence of a reserve, the postings are drawn up in the following form:

Debit 91 Credit 62 (60, 76) – writing off bad debts to the category of other expenses.

Provided that the reserve existed, but its size was insufficient, part of the debt should be written off at its expense, and the rest as other expenses.

Despite the write-off, the debt is reflected in the balance sheet account for the next 5 years. All documents must be retained for the same period. On the basis of which the write-off was made.

When maintaining tax reporting, the same algorithm of actions is maintained as when preparing accounting records. That is, if there is a reserve, the write-off is carried out at its expense, and if there is no reserve, it is recorded as non-operating expenses.

It is necessary to write off debts in accordance with the law

The counterparty is excluded from the Unified State Register of Legal Entities: is it possible to write off receivables?

Good afternoon, For the write-off of receivables, the norms of the Civil Code of the Russian Federation provide for the following grounds: - the obligation is terminated by the impossibility of fulfillment if it is caused by a circumstance for which neither party is responsible (Article 416 of the Civil Code of the Russian Federation) - if, as a result of the issuance of an act of a state body, execution the obligation becomes impossible in whole or in part, the obligation is terminated in full or in the relevant part (Article 417 of the Civil Code of the Russian Federation) - the obligation is terminated by the liquidation of a legal entity (debtor or creditor) (Article 419 of the Civil Code of the Russian Federation) - expiration of the limitation period (Article 195 of the Civil Code of the Russian Federation , Article 196 of the Civil Code of the Russian Federation) In tax accounting, according to paragraph 2 of Art. 266 of the Tax Code of the Russian Federation, bad debts (debts that are unrealistic for collection) are those debts for which the established limitation period has expired, as well as those debts for which, in accordance with civil law, the obligation has been terminated due to the impossibility of its fulfillment, on the basis of an act of a state body or liquidation organizations.

If the debtor organization is excluded from the Unified State Register of Legal Entities as an inactive legal entity, then the debt is considered hopeless (uncollectible).

In Letters of the Ministry of Finance of the Russian Federation dated July 24, 2015 N 03-01-10/42792, dated January 23, 2015 N 03-01-10/1982, dated December 8, 2016 N 03-03-06/1/73076, it is said: Thus, the debts of a legal entity that has actually ceased its activities to the taxpayer may be recognized as uncollectible in the manner prescribed by Article 266 of the Code from the date of exclusion of such a legal entity from the Unified State Register of Legal Entities.

In this regard, your organization has the right to write off as expenses the receivables of the debtor organization excluded from the Unified State Register of Legal Entities as of the date of such exclusion.

To recognize a debt as bad (uncollectible) in tax accounting, the creditor organization must have an extract from the Unified State Legal Entity on the liquidation of the legal entity (debtor).

Bad receivables are included directly in non-operating expenses in the following cases (clause 2, clause 2, article 265 of the Tax Code of the Russian Federation, clause 5, article 266 of the Tax Code of the Russian Federation): - if the organization does not create a reserve for doubtful debts - if the organization creates a reserve for doubtful debts debts, but the amount of the created reserve is not enough to write off the entire amount of bad debt. The balances of uncollectible accounts receivable not covered by the reserve are also included in non-operating expenses.

Letter of the Ministry of Finance of the Russian Federation dated January 16, 2018 N 03-03-06/2/1551

Sincerely, A. Greshkina

What documents need to be completed?

To write off in accordance with the letter of the law, you should refer to the Accounting Regulations. Based on clause 77, it is necessary to prepare the following documents:

- An order from a manager to carry out a write-off.

- Inventory report.

- Written justification for the need to write off the debt.

In addition, in order not to raise questions from regulatory authorities, it is necessary to submit documents that can explain the economic feasibility of the procedure. These include:

- A claim against the debtor, if one has been filed.

- A court decision on the impossibility of satisfying the claims.

- Resolution of the FSSP on the return of the writ of execution due to a reasoned refusal to execute it.

It would be useful to bring up a number of other documents that can provide justification for the write-off (as a rule, this is primary documentation that proves that the statute of limitations has already expired):

- Invoices for delivered goods, certificates of work performed, etc.

- Certificate from the Unified State Register of Legal Entities on the exclusion of the debtor from the list of legal entities.

- A court decision declaring a debtor bankrupt.

- A court decision that the concluded transaction is declared invalid, and the profit received must be collected into the budget.

The write-off is accompanied by filling out the necessary documents

Thus, before making a write-off, an accountant must necessarily prepare the following groups of documents:

- Confirming that attempts were made to repay the debt.

- Evidence that the debtor is insolvent.

- Proving that there are direct grounds for starting write-off.

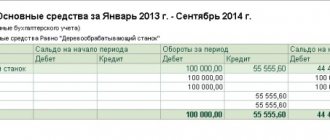

Accounting entries in connection with the write-off of accounts receivable, tax accounting

The procedure for writing off debt depends on whether a reserve was created for such debt or not.

If a reserve for bad debts was created, the entries would be as follows:

Dt 91 Kt 63 - a reserve for doubtful debts has been created or additionally accrued.

Dt 63 Kt 62 (60, 76) - bad receivables are written off against the reserve.

If a reserve for bad debts was not created, then the following entries will be made in accounting:

Dt 91 K 62 (60, 76) - bad receivables not covered by the reserve are written off as other expenses.

It happens that the created reserve is not enough to write off the entire debt. In this case, part of the debt will be written off against the reserve, and the remainder will be charged to expenses.

The written-off debt must be accounted for in off-balance sheet account 007 for five years (clause 77 of Accounting Regulations No. 34n). The documents that served as the basis for such write-off are stored for the same number of years (Article 29 of the Law “On Accounting” dated December 6, 2011 3 402-FZ).

In tax accounting, a similar procedure will be used: writing off debt in connection with the liquidation of the debtor is done at the expense of the reserve, and if there is none, then the receivable is charged to non-operating expenses.

IMPORTANT! Some unscrupulous organizations specifically resort to liquidation procedures in order not to pay their debts. The managers of such enterprises will be subject to criminal prosecution (Article 196 of the Criminal Code of the Russian Federation - deliberate bankruptcy, Article 197 of the Criminal Code of the Russian Federation - fictitious bankruptcy).