Shape and types

Any accounting certificate about debt write-off is a kind of additional explanation in order to make the appropriate entries in accounting and write off “hanging” amounts.

The most important thing is that the mandatory form of this document is not established by law. Therefore, it is advisable to develop your own sample accounting certificate of debt and add it to the accounting policy of the enterprise. It's pretty simple. As a rule, only textual information is included in this certificate, so you should not bother with a complex structure or even a tabular form.

Keep in mind that it should include:

- full information about the debt (contract number, links to the “primary”, etc.);

- calculation of the limitation period.

Also see “Details of accounting documents: basic and mandatory”.

Typically, an accounting certificate of debt is generated based on the results of an inventory. It can either state the existence or absence of a particular debt or contain an instruction to write it off.

The inventory is carried out on the basis of Art. 11 of the Law “On Accounting” No. 402-FZ. And sometimes it is impossible to do without it.

Mandatory cases of inventory are listed in:

- paragraph 27 of the order of the Ministry of Finance dated July 29, 1998 No. 34n;

- paragraph 22 of the order of the Ministry of Finance dated December 28, 2001 No. 119n.

In practice, the following types can be distinguished:

- accounting statement of accounts receivable;

- accounting certificate of accounts payable.

Legal basis

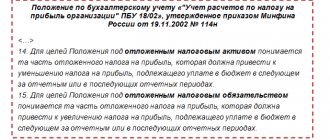

The main task of accounting as part of the inventory of liabilities is to correctly determine the limitation period for a specific debt. Since this directly affects accounting, as well as the final amount of tax payments. Therefore, to avoid mistakes, keep your guide to Chapter 12 of the Civil Code. It covers the main issues of limitation of actions. Let us recall that the total period is 3 years (Article 196 of the Civil Code of the Russian Federation).

The accounting specialist generates an accounting certificate on the write-off of accounts payable on the basis of clause 18 of Art. 250 of the Tax Code of the Russian Federation. That is, based on the results of the inventory, he gives the go-ahead to include it in non-operating income when he sees that the time for a claim on it has passed.

In turn, according to the accounting certificate about the write-off of receivables, it is attributed to non-operating expenses by virtue of Art. 265 and paragraph 2 of Art. 266 Tax Code of the Russian Federation.

Also see “Filling out accounting certificate 0504833”.

Options for writing off accountable funds

Let's consider possible write-off options:

Option 1: The accountant correctly compiled the expense report and submitted all supporting documents. The accountant makes an entry based on the purpose of issuing the advance Dt 26 (44, 10, 41...) Kt 71.

If the accountable person had an overspend, the accountant issues the required amount.

When, after spending, the accountant has unspent money left, he must deposit it in the cash register.

Read more about this in the article “Return by an accountable person of the amount of an unspent advance.”

Option 2: The employee quit. Did not report for accountable funds, did not issue a refund.

The entire amount is recognized as a receivable and, upon expiration of the limitation period, can be written off as a loss to the enterprise. The statute of limitations is 3 years from the date when the accountable should have fulfilled the obligations (Articles 196, 200 of the Civil Code of the Russian Federation; letter of the Ministry of Finance of Russia dated September 15, 2010 No. 03-03-06/1/589; clause 2 of Article 265 of the Tax Code RF). After recognizing the debt as bad, it is necessary to include the amount of the advance in the income of the reporting person and, before March 1 of the year following the end of the year, inform him and the tax office in writing about the impossibility of withholding tax and the amount of the debt (clause 1 of Article 210, clause 5 of Article 226 Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 24, 2009 No. 03-03-06/1/610).

Read all about the procedure for writing off receivables in the article “Procedure for writing off receivables.”

Option 3: The accountant continues to work, but for some reason cannot account for the advance payment.

The organization has the right to withhold the entire amount of the debt from his salary. This can only be done with the written consent of the employee (letter of Rostrud dated 08/09/2007 No. 3044-6-0) and no more than 20% of his salary monthly (Article 138 of the Labor Code of the Russian Federation).

Read more about this in the materials:

- “How to deduct previously reported funds from your salary?”;

- “How to properly write off money from an account without documents?”

Option 4: The accountable person is the director. If he did everything correctly, then the write-off will be the same as always. And if not? We can write off his debt with the dividends due to him.

Read all about writing off a director’s report in the article “Five effective ways to reset the director’s accumulated report.”

Option 5: A tragic situation occurred. The employee died without having time to account for the money received. In the next section, we will consider in more detail what actions an accountant should take in such a situation.

How to write off a “creditor”

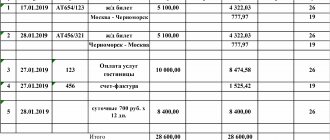

Let’s assume that on March 30, 2021, Guru LLC carried out an inventory of settlements with counterparties, as a result of which an accounts payable to Septima LLC in the amount of 145,000 rubles was identified. The statute of limitations on it expired on March 13, 2017.

Here is a sample accounting statement of accounts receivable for this situation:

| LIMITED LIABILITY COMPANY "Guru" ACCOUNTING REPORT No. 24 DATED 03/30/2017 ON THE WRITTEN OF ACCOUNTS PAYABLE As a result of the inventory of settlements with counterparties on March 30, 2021, accounts payable to the limited liability company "Septima" were identified (TIN 7722123 456, checkpoint 772201001, address: Moscow, Shosseynaya St., 7, building 9), for which the statute of limitations has expired (Act of Inventory of Settlements with Buyers, Suppliers, Other Debtors and Creditors dated March 30, 2021 No. 2-inv). This debt arose under the contract for the supply of goods dated April 25, 2014 No. 63-P. Clause 3.8 of the said agreement establishes the payment deadline - until March 15, 2014 (inclusive). The amount of debt for goods supplied is 145,000 rubles, including VAT - 26,100 rubles. The statute of limitations expires March 13, 2021. Thus, accounts payable in the amount of 145,000 rubles are subject to inclusion in non-operating income for income tax for the first quarter of 2021 on the basis of paragraph 18 of Article 250 of the Tax Code of the Russian Federation and write-off in accounting. Chief Accountant____________Shirokova____________/E.A. Shirokova/ |

How to write off a “receivable”

Let’s assume that on March 30, 2021, Guru LLC carried out an inventory of settlements with contractors, as a result of which the 2013 receivables of Guru LLC were identified due to non-payment of goods supplied to it in the amount of 300,000 rubles

Here is an example of an accounting statement about accounts receivable and their write-off for this situation:

| LIMITED LIABILITY COMPANY "Guru" ACCOUNTING REPORT No. 25 DATED 03/30/2017 ON THE WRITTEN OF ACCOUNTS RECEIVABLE Based on Art. 11 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, clause 27 of the Regulations on Accounting and Reporting in the Russian Federation (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n) and the minutes of the meeting of the inventory commission dated March 30. 2017 No. 17-INV, it was decided to write off the receivables of Sfera LLC in the amount of RUB 300,000. (including VAT – 54,000 rubles). This receivable arose on the basis of the contract for the supply of goods dated December 15, 2013 No. 9-P. It is also confirmed by: • invoices dated December 25, 2013 No. 147 and dated December 26, 2013 No. 149; • invoices dated December 26, 2013 No. 147-SF and dated December 28, 2013 No. 149-SF. According to the terms of the contract for the supply of goods dated December 15, 2013 No. 9-P, the payment period for the supplied goods is 5 (five) working days from the date of presentation of the specified documents. No money was received from Sfera LLC. The statute of limitations for this debt was not interrupted. Based on the inventory report dated March 30, 2017 No. 2-A and the minutes of the meeting of the inventory commission dated March 30, 2017 No. 17-INV, the receivables of Sfera LLC are subject to write-off as non-operating expenses in tax accounting. Reason: Art. 265 Tax Code of the Russian Federation. Chief Accountant____________Shirokova____________/E.A. Shirokova/ |

As you can see, the above example of an accounting certificate on the write-off of receivables is drawn up in more detail. In any case, the structure of both certificates is approximately the same. Also see “Accounting statement: how to draw it up correctly.”

Read also

07.02.2017

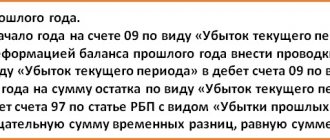

“Penny” balances on the balance sheet. Is it possible to write off before the statute of limitations?

For an accountant, a penny not only protects the ruble, it protects the balance of the balance sheet. There are situations in the economic life of an enterprise in which certain penny balances are formed in the balance sheet on the accounts of settlements with counterparties.

The buyer underpaid, the supplier underdelivered, amounts ranging from a few kopecks to several tens of rubles, no matter how they decorate the balance sheet. The statute of limitations for writing off these amounts will not come soon; the collection process will require financial costs that exceed the debts themselves.

We will tell you in the article what an accountant should do if “penny” accounts receivable and payable appear in the accounting, as well as if discrepancies are identified in the acts of reconciliation of mutual settlements with counterparties.

We get rid of the “penny” receivables and creditors