Such violations are defined in Chapter 16 “Types of tax offenses and responsibility for their commission” of the Tax Code of the Russian Federation. The main part of them is located in the table below.

| Type of violation | Amount of fine | Grounds (Article Tax Code) |

| Violation by the taxpayer of the established deadline for filing an application for registration with the tax authority | 10,000 rub. | Art. 116 |

| Conducting activities by an organization or individual entrepreneur without registration with the tax authority | 10% of income received as a result of such activities, but not less than 40,000 rubles. | Art. 116 |

| Failure to submit a tax return (calculation of insurance premiums) to the tax authority at the place of registration within the deadline established by the legislation on taxes and fees | 5% of the amount of tax (insurance premiums) not paid within the deadline established by the legislation on taxes and fees, subject to payment (additional payment) on the basis of this declaration (calculation of insurance premiums), for each full or partial month from the day established for its submission, but no more than 30% of the specified amount and no less than 1,000 rubles. | Art. 119 |

| Failure of the managing partner responsible for maintaining tax records to submit a calculation of the financial result of the investment partnership to the tax authority at the place of registration within the period established by the legislation on taxes and fees | 1,000 rub. for each full or partial month from the day established for its submission | Art. 119 |

| Failure to comply with the procedure for submitting a tax return (calculation) in electronic form | 200 rub. | Art. 119.1 |

| Gross violation of the rules for accounting for income and (or) expenses and (or) taxable items | 10,000 rub. (if these acts were committed during one tax period); 30,000 rub. (if these acts were committed during more than one tax period); 20% of the amount of unpaid tax (contribution), but not less than 40,000 rubles. (if these actions resulted in an understatement of the tax base) | Art. 120 |

| Non-payment or incomplete payment of tax amounts (fees, insurance premiums) as a result of understatement of the tax base (base for calculating insurance premiums), other incorrect calculation of taxes (fees, insurance premiums) or other illegal actions (inaction) | 20% of the unpaid amount of tax (fee, contribution); 40% of the unpaid amount of tax (fee, contribution) (if these acts were committed intentionally) | Art. 122 |

| Unlawful failure to withhold and (or) transfer (incomplete withholding and (or) transfer) within the established period of tax amounts subject to withholding and transfer by the tax agent | 20% of the amount subject to withholding and (or) transfer | Art. 123 |

| Failure to comply with the procedure for possession, use and (or) disposal of property that has been seized or in respect of which the tax authority has taken interim measures in the form of a pledge | 30,000 rub. | Art. 125 |

| Failure to submit documents and (or) other information to the tax authorities within the prescribed period | 200 rub. for each document not submitted | Art. 126 |

| Failure to submit information about the taxpayer (payer of insurance premiums) to the tax authority within the prescribed period, refusal of a person to submit documents in his possession with information about the taxpayer (payer of insurance premiums) at the request of the tax authority, or submission of documents with deliberately false information | 10,000 rub. | Art. 126 |

| Submission by a tax agent to the tax authority of documents containing false information | 500 rub. for each submitted document containing false information | Art. 126.1 |

| Failure to appear or evasion of appearance without good reason of a person called as a witness in a tax offense case | 1,000 rub. | Art. 128 |

| Unlawful refusal of a witness to testify, as well as giving knowingly false testimony | 3,000 rub. | Art. 128 |

| Unlawful failure to report (untimely reporting) by a person of information that this person must report to the tax authority, including failure to submit (untimely submission) by a person to the tax authority of explanations in the event of failure to submit an updated tax return within the prescribed period | 5,000 rub.; 20,000 rub. (same acts committed repeatedly within a calendar year) | Art. 129.1 |

It is worth noting that previously, in case of failure to notify the tax office about opening (closing) a bank account within 7 working days, there was a fine of 5,000 rubles. At the moment, this fine has been abolished (Federal Law dated April 2, 2014 No. 52-FZ).

Tax fines are always administrative liability for offenses that are in one way or another related to improperly fulfilled tax payment obligations. At the same time, the subjects of the offense, that is, persons brought to administrative responsibility, can be both citizens and legal entities.

Criminal offenses

You should know that the very concept of “tax fines” has nothing to do with the Criminal Code. Therefore, classifying “fines” as criminal liability is a gross mistake and complete ignorance of the basics of jurisprudence.

A number of articles of the Criminal Code provide for liability for tax crimes, namely Art. 198–199.4 of the Criminal Code of the Russian Federation. The disposition of these articles differentiates the punishment depending on the severity of the crime committed or depending on the personality of the defendant. Among these punishments there are fines, imprisonment, and correctional labor, and regardless of the type of punishment, it will still be a criminal punishment.

Another significant differentiating feature is that the subject of the crime is always only an individual. This means that only a citizen can be held criminally liable, but not, for example, a business entity.

Thus, only specific persons whose guilt in violating tax laws was direct and whose actions fall under the Criminal Code can be brought in as suspects, accused and defendants. In order to be held criminally liable, two conditions must be met:

- the intentional or negligent nature of the defendant's actions;

- infliction of damage to the state on a large or especially large scale by the accused;

- the accused reaches the age of 16 years.

If at least one of these conditions is not present, criminal prosecution is impossible.

Art. requires a separate explanation. 199 of the Criminal Code of the Russian Federation, since, to the untrained eye, it indicates the possibility of bringing an organization to justice. Not really. An official may be held liable: a manager or a chief accountant (or both) guilty of evading tax obligations.

That is, ultimately, an individual will still be brought to criminal responsibility, and it is he who will be subject to criminal punishment, but not an organization or enterprise.

Limitation of actions

This concept means the period within which judicial protection of the rights of the interested party is possible. The limitation period for tax fines is established in Art. 113 and 115 of the Tax Code of the Russian Federation and is called the “limitation period for collection”, since the Federal Tax Service itself can impose mandatory requirements and take some actions to enforce its decisions (applying for funds in a bank or through electronic funds).

The total is equal to three years, as for other requirements. However, there are specifics in its calculation. So, in accordance with Art. 113 of the Tax Code of the Russian Federation, the period is counted from the day the offense was committed or from the day following the tax period in which it was committed.

The second option applies in the case of:

- gross violation of the rules for accounting for taxable items, as well as income and expenses;

- non-payment of the obligatory payment or incomplete payment thereof.

If a person obstructs the inspection, the limitation period is not calculated for this period. This rule applies only to prosecution. That is, within a period of three years from the moment the violation was committed, the citizen and organization can be held accountable. The procedure for actually collecting money is different.

Types of tax obligations

There are a number of tax obligations for both individuals and legal entities.

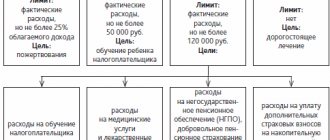

Thus, individuals are required to pay taxes:

- on income (personal income tax) in the amount of 13% on all types of income, including wages, income from rental property, income from winnings, etc.;

- property tax, including real estate tax and transport tax.

Legal entities and individual entrepreneurs bear the following tax obligations, depending on the type and system of taxation:

- VAT;

- for the profit of legal entities (STS, UTII, OSN, PSN). For individual entrepreneurs – personal income tax;

- excise taxes;

- social.

Any deviations from the correct fulfillment of tax obligations are punishable (depending on the amount of damage to the state) either through administrative or criminal liability.

Comments on the article

This article has some features that you need to remember:

- It is imperative to take into account the amount of taxes already paid. If a citizen overpaid last month, the “extra” amount is taken into account in this, even if it was not declared. In other words, only money not received is noted, and not money not noted on paper.

- If a responsible person in a consolidated group of companies does not pay the amount in full due to an error by one of the participants, he is not at fault and is not penalized. Punishment is applied to the direct culprit.

- Articles 122 and 120 cannot be applied simultaneously.

- The penalty is payment of a fine. It is calculated as a percentage of the unpaid portion.

It is worth noting: the debt can also be repaid from amounts that must be returned to the citizen: this can be either tax surplus or illegally collected fines and penalties.

Article 122 of the Tax Code of the Russian Federation with commentaries is responsible for non-payment of taxes to the treasury of the Russian Federation - full or partial. If it is proven that the fault lies with a specific payer, and is not caused by the actions of one of the members of the consolidated group, he will have to pay a fine. The amount will depend on the specific debt and ranges from 20-40%.

Watch the video that explains the consequences of non-payment of taxes in accordance with Article 122 of the Tax Code of the Russian Federation:

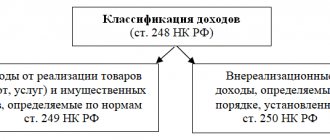

Responsibility under the Tax Code

First of all, it should be understood that the responsibility established in the Tax Code is the same administrative responsibility, although not included in the Administrative Code.

The main types of offenses in the field of tax obligations of the Tax Code of the Russian Federation include:

- “shadow activity” or failure to register with the Federal Tax Service as a tax payer (Article 116 of the Tax Code);

- incorrect calculations of tax obligations (Article 120 of the Tax Code of the Russian Federation);

- evasion of submitting a declaration, explanations and documents to the Federal Tax Service (Articles 119, 123, 122 of the Tax Code of the Russian Federation).

That is, as we see, the Tax Code regulates liability only in terms of organizational issues related to the Federal Tax Service.

Responsibility for violation of the law

The concept of the amount of damage (Article 199 of the Criminal Code of the Russian Federation):

A large amount

is recognized as the amount of taxes and (or) fees amounting to more than 2 million rubles for a period within 3 financial years in a row, provided that the share of unpaid taxes and (or) fees exceeds 10 % of the amounts of taxes and (or) fees payable, or exceeding 6 million rubles.

Extra large size

an amount representing more than 10 million rubles for a period of 3 consecutive financial years is recognized, provided that the share of unpaid taxes and (or) fees exceeds 20% of the amounts of taxes and (or) fees payable, or exceeds 30 million rubles.

A person who has committed a crime under Art. for the first time. 199 of the Criminal Code of the Russian Federation, as well as Article 199.1 of the Criminal Code of the Russian Federation, is exempt from criminal liability if this person or organization, with which this person is charged with evasion of taxes and (or) fees, has fully paid the amount of arrears and the corresponding penalties, as well as the amount of the fine in the amount determined in accordance with the Tax Code of the Russian Federation.

The concept of gross violation of the rules of accounting and tax accounting:

| Gross violation | Content | Base |

| — rules for accounting for income and expenses and objects of taxation |

| Article 120 of the Tax Code of the Russian Federation |

| — rules for maintaining accounting records and presenting financial statements |

| Article 15.11 of the Code of Administrative Offenses |

Explanation to Article 122 of the Tax Code of the Russian Federation

clause 4 Art. 122 Tax Code of the Russian Federation. Non-payment or incomplete payment by a responsible participant of a consolidated group of taxpayers of amounts of corporate income tax for a consolidated group of taxpayers as a result of an understatement of the tax base, other incorrect calculation of corporate income tax for a consolidated group of taxpayers or other unlawful actions (inaction), if they are caused by a message, shall not be recognized as an offense false data (failure to report data) that affected the completeness of tax payment by another participant in the consolidated group of taxpayers held accountable in accordance with Art. 122.1 of the Tax Code of the Russian Federation (see above) (clause 4 introduced by the Federal Law of November 16, 2011 N 321-FZ)

Code of Administrative Offenses

In accordance with the provisions of the Code of Administrative Offenses of the Russian Federation, namely Art. 15.34, 15.9, 15.11, officials of organizations and enterprises are brought to administrative responsibility for offenses related to:

- with untimely registration as a taxpayer;

- with late submission of tax reports;

- with refusal to provide documents to employees of the Federal Tax Service who exercise control over the calculation of tax payments;

- with violations in maintaining accounting records.

Payment order

How to pay a fine to the tax office? Based on Art. 45 of the Tax Code of the Russian Federation, this can be done either by the debtor himself or by his representative. In accordance with the explanations of the Federal Tax Service of the Russian Federation, if payment of a fine to the tax inspectorate is made by a representative, the “TIN” and “KPP” fields of the payment document are filled with values corresponding to the data of the debtor himself. If there is no TIN and when paying for an individual, no values are entered in the “KPP” and “TIN” fields or 0 is indicated.

An individual can transfer the amount through his Personal Account on the official website of the Federal Tax Service or draw up a document there and then contact any commercial bank. The BCC for fines is set specially, not the same as for basic payments. In it, the values from 14 to 17 digits are always set to 3000.

What besides fines?

Persons held accountable for violations in the field of taxation, in addition to an administrative fine or criminal punishment, may also be required to pay penalties accumulated during late payments.

In case of deliberate tax evasion, penalties of up to 40% of the accrued tax may also be applied. It should be taken into account that when calculating penalties and fines, the last 3 years of the taxpayer’s history are taken into account.

As a rule, the penalty is calculated based on the refinancing rate approved by the Central Bank of the Russian Federation.

Article 114 of the Tax Code of the Russian Federation. Tax sanctions (current version)

The commented article regulates a fine as a tax sanction.

The Tax Code of the Russian Federation provides for only one type of sanction for any tax offense - a fine.

If there is at least one mitigating circumstance, the amount of the fine shall be reduced by no less than two times compared to the amount established by the Tax Code of the Russian Federation.

In paragraph 16 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57 “On some issues arising when arbitration courts apply part one of the Tax Code of the Russian Federation” it is noted that paragraph 3 of Article 114 of the Russian Federation establishes only the minimum limit for reducing the tax sanction and the court based on the assessment results relevant circumstances (for example, the nature of the offense committed, the number of mitigating circumstances, the identity of the taxpayer, his financial situation) has the right to reduce the amount of the penalty by more than half.

At the same time, in accordance with Article 71 of the Arbitration Procedure Code of the Russian Federation, the arbitration court evaluates evidence according to its internal conviction, based on a comprehensive, complete, objective and direct examination of the evidence available in the case.

Thus, the current procedural legislation does not contain a prohibition on presenting arguments in court to reduce the amount of a tax sanction due to the presence of mitigating circumstances, when they are taken into account by the tax authority at the stages of pre-trial settlement of a tax dispute, as well as on the inability of the court to take into account these circumstances again and reduce the amount of tax sanctions in case of non-compliance by the tax authority with the principle of proportionality of punishment for the committed offense.

In this regard, the court, when determining the proportionality of the applied tax sanction to the tax offense committed, has the right to take into account any mitigating circumstances, including those previously assessed by the tax authority.

A similar position is enshrined in the letter of the Federal Tax Service of Russia dated August 22, 2014 N SA-4-7/16692.

An increase in the amount of the fine by 100 percent is permissible only in cases where the person held accountable due to an aggravating circumstance committed an offense after being held accountable for a previously committed similar offense.

This conclusion was reached by the Presidium of the Supreme Arbitration Court of the Russian Federation in Resolutions dated December 9, 2008 N 9141/08 and dated April 1, 2008 N 15557/07.

As the Ministry of Finance of Russia explained in letter dated July 24, 2012 N 03-02-08/64, the fine may be increased by 100 percent if a person commits a tax offense within 12 months from the date of entry into force of a court or tax authority decision to prosecute the person to liability for committing a similar tax offence.

As stated in the Resolution of the Federal Antimonopoly Service of the North-Western District dated October 26, 2012 N A05-12621/2011, by virtue of Articles 112, 114 of the Tax Code of the Russian Federation, when determining the amount of penalties, the law enforcement officer takes into account both circumstances aggravating liability and circumstances mitigating liability, since the tax The sanction is a measure of responsibility for committing a tax offense.

It does not follow from the provisions provided for in Chapter 16 of the Tax Code of the Russian Federation that the presence of aggravating circumstances excludes the possibility of using mitigating circumstances.

Therefore, these circumstances must be taken into account when assigning punishment in their entirety.

Comment source:

“ARTICLE-BY-ARTICLE COMMENTARY TO PART ONE OF THE TAX CODE OF THE RUSSIAN FEDERATION” (UPDATE)

Yu.M. Lermontov, 2016

The procedure for bringing to tax liability

The designated mode consists of four stages:

- Identification by officials of regulatory authorities (within their competence, through appropriate audits, obtaining explanations from taxpayers, fiscal agents and payers of fees, insurance premiums, verification of accounting data and reporting, inspection of premises and territories used to generate income, as well as in other forms, provided for by the Tax Code) facts of violation of tax legislation.

- Reviewing the case materials and making a decision. Detection of relevant violations due to inspections (desk or on-site) means that this procedure will be regulated by Art. 101 NK. It is also used when it comes to violations of Art. 120, 122 and 123 NK. Identification of relevant acts by other measures of fiscal control (summoning the taxpayer with a written notice to give explanations for the payment of mandatory payments, inspection, inventory of his property, outside of fiscal audits) indicates the regulation of the procedure in question already under Art. 101.4 NK.

- Appealing decisions of the Federal Tax Service. In this case, you need to use separate provisions of Chapter. , 20 NK, namely Art. 137, partially 138, on the right and regime of appeal - Art. 139 - procedure and deadline for filing a complaint, 139.2 - its form and content, 139.3 - cases of leaving without consideration, 140 - consideration of a complaint.

- Execution of decisions of tax authorities (Article 101.3 of the Tax Code).

Responsibility for non-payment of taxes

There are three types of liability for violation of tax laws that a company or its employee may be subject to: administrative, tax and criminal.

- Administrative liability implies an obligation for the taxpayer to repay the resulting arrears. This type of liability does not provide for any additional sanctions (in the form of punishment in rubles or imprisonment).

- Tax liability involves financial expenses, that is, punishment in the form of a fine in rubles. The inspector has the right to demand that the taxpayer pay off the arrears, charge penalties and fines. The tax authorities will collect these amounts without trial.

- Criminal liability is provided for serious and financially intensive crimes. The culprit is determined by the court, which can place him under arrest and imprison him for a fairly long period, depending on the severity and scale of the crime.

A company, its manager or other official may be simultaneously held liable for several types of liability. For example, an organization may be subject to fines and employees may face criminal charges.

Directors and those who actually run the company are usually punished. Less often, chief accountants and lawyers are subject to criminal prosecution. A lawyer faces punishment if there is indisputable evidence that it was he who developed the tax crime scheme.

About fines from the tax office

Moreover, for taxpayers-organizations, tax authorities can bring to administrative responsibility both the organization itself as a legal entity and its officials - the head of the organization and other responsible employees, i.e. individuals.

Moreover, a fine against an organization does not at all exclude the simultaneous imposition of an administrative penalty on officials of this organization and vice versa.

Badges with a window are plastic and metal. Short deadlines. Low prices. Delivery to your door

Fines from the tax authorities for violations of tax laws

For violations of tax legislation, fines are applied by the tax authority to the taxpayer/tax agent/policyholder, which can be organizations, individual entrepreneurs and individuals not registered as individual entrepreneurs.

But if for violation of tax laws

If an organization is involved, then the fine is imposed on the organization itself, and not on its officials.

- The basis for bringing to responsibility in this case are the following articles of the Tax Code of the Russian Federation, many of us, by the way, are well aware of them:

- Article 119 of the Tax Code of the Russian Federation - failure to submit a tax return (calculation of the financial result of an investment partnership, calculation of insurance premiums);

- Article 119.1 of the Tax Code of the Russian Federation - violation of the established method of submitting a tax return (calculation)

- Article 120 of the Tax Code of the Russian Federation - a gross violation of the rules for accounting for income and expenses and objects of taxation (the basis for calculating insurance premiums);

- Article 122 of the Tax Code of the Russian Federation - non-payment or incomplete payment of tax amounts (fees, insurance contributions);

- Article 123 of the Tax Code of the Russian Federation - failure of a tax agent to fulfill the obligation to withhold and (or) transfer taxes

- Article 126 of the Tax Code of the Russian Federation - failure to provide the tax authority with information necessary for tax control

- Article 126.1 of the Tax Code of the Russian Federation - submission by a tax agent to the tax authority of documents containing false information

- Article 129.1 of the Tax Code of the Russian Federation - unlawful failure to report information to the tax authority

Fines from the tax authorities according to the Code of Administrative Offenses

According to the articles of the Code of Administrative Offenses of the Russian Federation, it is possible to impose penalties simultaneously on both the organization and its officials.

- By the way, the tax service “administers” more than a dozen articles of the Administrative Code, but we will list here the most popular articles that may be relevant to all small and micro businesses:

- Article 13.25 of the Code of Administrative Offenses of the Russian Federation - violation of legal requirements on the storage of documents and information contained in information systems

- Article 14.5 of the Code of Administrative Offenses of the Russian Federation - sale of goods, performance of work or provision of services in the absence of established information or non-use of cash register equipment in cases established by federal laws

- Article 15.11 of the Code of Administrative Offenses of the Russian Federation - gross violation of accounting requirements, including accounting (financial) reporting

- Article 15.23.1 of the Code of Administrative Offenses of the Russian Federation - violation of the requirements of the law on the procedure for preparing and holding general meetings of shareholders, participants in limited (additional) liability companies and owners of investment shares of closed mutual investment funds

- Article 19.5 of the Code of Administrative Offenses of the Russian Federation - failure to comply on time with a legal order (resolution, presentation, decision) of the body (official) exercising state supervision (control), organization authorized in accordance with federal laws to carry out state supervision (official), body (official person) exercising municipal control

The last of the listed articles may generally have a “universal” application to many cases.

The Federal Tax Service of Russia sent a letter dated 09/06/2018 No. ED-18-15/ [email protected] , in which it explains and reminds

the procedure for bringing to justice for violation of tax and administrative legislation, including for what offenses should be punished not only the violating organization itself, but also its officials.

✦ Letter of the Federal Tax Service of Russia dated 09/06/2018 No. ED-18-15/ [email protected]