According to the law, the employer is a tax agent and is obliged to provide the Federal Tax Service with data on calculated, withheld and paid personal income tax (NDFL) for all individuals who were paid monetary, material remuneration or provided another form of financial benefit.

The data must be submitted to the Federal Tax Service in the form “2-NDFL” no later than April 1 or the first working day after the specified date, if this date falls on a day off. The form indicates all income received, tax deductions applied, calculated, withheld and transferred personal income tax for each individual for the reporting tax period. In addition to the specified form, there is a personal form of certificate 2-NDFL, provided by the employer to the employee upon his application for personal purposes, confirming his income and personal income tax.

We will show how personal income tax certificate 2 is generated in 1C 8.3 using the example of “1C: Salary and HR management, edition 3.1” (configuration in edition 3.1.10.110). Filling out 2-NDFL in 1C: Accounting, both 8.3 and 8.2*, is similar to the example under consideration. Below are step-by-step instructions for generating 2-NDFL certificates.

*If you are using the program on the 8.2 platform, it is worth remembering that it does not have all the features of the newest version.

Preparation and testing

To correctly calculate personal income tax, all necessary data on employees must be entered:

- Salary, vacation and sick leave;

- Standard, personal, social, professional deductions;

- All other income and deductions from them.

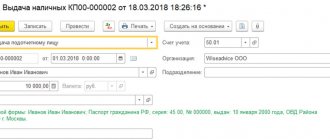

Payroll accruals are entered using the “Payroll accruals” documents in the “Salary - All accruals” section. Sick leave and vacations are also introduced here. The documents automatically generate deductions, personal income tax and insurance premiums.

Fig.1 All charges

Other documents on personal income tax are located in the section “Taxes and contributions/All documents on personal income tax”.

Fig. 2 All documents on personal income tax

Here you can generate 2-NDFL certificates. Let's look at some commonly used types of documents.

Application for deductions for personal income tax - the document indicates standard Deductions for children and personal deductions. For standard deductions, the validity period is indicated: in the header of the document the general details are the month the deductions are valid, and in the table – the month the validity of each deduction ends.

Fig. 3 Application for personal income tax deductions

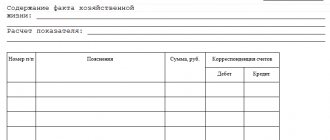

Personal income tax accounting operation - the document takes into account all other income received that is not taken into account in the program, as well as which must be registered manually, accruals, deductions and transfers of personal income tax and some types of deductions. All transactions are recorded on a specific date.

Fig.4 Personal income tax accounting operation

Notification of a non-commercial organization about the right to deductions - the document is used to calculate and accrue property and social deductions. The validity period is specified in the document header.

Fig.5 Notification of the non-commercial organization about the right to deductions

How to create a certificate for employees

Go to the “Taxes and Contributions” menu. (“Salaries and personnel” in 1C: Accounting).

You need to open the list of documents and click “2-NDFL for employees”.

Important! For each individual employee, a certificate is created separately for each year. Click on the “Create” button.

A window will open where you first need to fill out the header. Be sure to indicate the period (the desired year), employee and organization (if you manage several, you will have to select the one you need).

Once you enter these basic data, the rest will come automatically. To update them, click "Fill".

If you are faced with the task of generating a 2-NDFL certificate in the context of OKTMO/KPP codes and tax rates, then be sure to indicate these values in the “Generate” detail.

By clicking on the “question” to the right of the completed field, find out whether income under the selected code is registered for the employee for whom you are preparing the certificate.

If income data is not registered, the program will tell you about it - the corresponding window will not be filled in.

Next, when you have checked all the filled-in data yourself, run the software check and scan the document.

All that remains is to print the certificate for the employee using the required button.

In the header of the finished printed 2-NDFL certificate, you will see a note that this form is not intended for submission to the Federal Tax Service.

Filling out the 2-NDFL certificate for submission to the Federal Tax Service

You can create a certificate in the “Taxes and contributions-2-NDFL for transfer to the Federal Tax Service” section or by selecting the appropriate document in the “Taxes and contributions-All documents for personal income tax” section. In the journal that opens, click the “Create” button to generate a new certificate. First you need to fill out the header of the document:

- Year – the year (reporting period) for which the certificate is provided to the Federal Tax Service;

- OKTMO/KPP – territorial reference of the organization at the place of submission of tax reports. Filled out in the “Main – Organizations” section in the card on the “Registrations with tax authorities” tab;

- In the Federal Tax Service (code)/from the checkpoint - details of the tax office;

- Type of certificate – can take the values “Annual reporting” and “On the impossibility of withholding personal income tax”;

- Buttons “Initial”, “Correcting”, “Cancelling” - indicate the status of the certificate.

Fig.6 Filling out the 2-NDFL certificate for submission to the Federal Tax Service

Filling out the 2-NDFL certificate is done by clicking the “Fill” button. The “Number” button is needed when manually entering employees, which in turn is done with the “Selection” button. Before posting the document, you can check the correctness of the entered data using the “Check” button. In this case, the verification algorithm embedded in the program will be used. The accuracy of the calculations provided and the personal information of the employees included in the card will be checked. Before sending, the certificate must be completed by clicking the “Submit” button. Sending to the Federal Tax Service can be done through a universal data exchange file in xml format using the “Upload” button.

With the 1C-Reporting service connected, you can immediately send the prepared document to the tax office. If this service is not connected, contact us: as part of the business support program with 1C specialists, we will advise you on how to quickly set up and connect this service. If you use this service, go to the menu item “Send-Send to regulatory authorities”. Also in this case, it is possible to check the accuracy of the calculation on-line. In the menu there is the item “Send-Check on the Internet”. If an error occurs, you can see the reason (the line will be red when checking, and the reason will be marked). By double-clicking on any line, you can generate a 2-NDFL reference report in 1C for any employee from the list, but you cannot save and print a certificate obtained in this way.

Free expert consultation

Tatiana Panchenko

Consultant-analyst 1C

Thank you for your request!

A 1C specialist will contact you within 15 minutes.

The procedure for submitting to individuals a certificate of income and personal income tax amounts

Tax agents for personal income tax must issue to individuals, upon their applications, certificates of income received and tax amounts withheld in the form approved by the federal executive body authorized for control and supervision in the field of taxes and fees (clause 3 of Article 230 of the Tax Code of the Russian Federation).

From 01/01/2019, the employer is obliged to issue the employee a certificate of income and tax amounts in a new form in accordance with the order of the Federal Tax Service of Russia dated 10/02/2018 No. ММВ-7-11/ [email protected] Information on income and tax amounts for the tax period 2021 is provided in a new form certificate form.

The Tax Department has approved two new forms of regulated reporting:

- certificate for issuance to an employee “Certificate of income and tax amounts of an individual” (Appendix No. 5 to the Order)

- machine-oriented form - information for the tax inspectorate “Certificate of income and tax amounts of an individual” (Form 2-NDFL) (Appendix No. 1 to the Order).

about the timing of supporting changes in form 2-NDFL in “1C:Enterprise 8” in accordance with the order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected] in “Monitoring Legislative Changes”.

In fact, the indicators in the new certificate remained the same, as in form 2-NDFL, approved. by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/ [email protected] and previously in force. The changes are minor: the employee certificate for the new form now contains no barcode; attribute (possibility of tax withholding); tax authority code; date of issue and number of notices of deductions and notices confirming the right to reduce tax on fixed advance payments.

How to check the correctness of filling out information on form 2-NDFL in 1C 8.2

When filling out the document Certificate 2-NDFL for transmission to the Federal Tax Service, the left window indicates the individuals to whom the income was paid. If you place the mouse cursor on an individual, information about his income or personal data about him will be displayed in the right window:

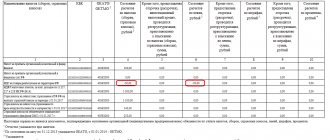

- On the Income, deductions, taxes , information about income, deductions, taxable amount of income, calculated tax, withheld tax, as well as tax transferred for each employee is indicated (Fig. 15). This information is filled in based on data from the personal income tax accumulation registers, which were discussed above.

- On the Taxpayer Personal Data , personal data for an individual is indicated. It is this information that is displayed in the printed form of the Certificate in section No. 2 Data about the individual - recipient of income:

Step 1. Checking the amount of income of an individual, as well as the accrued amount of personal income tax

You can check the amount of salary accrued to an individual and the amount of calculated personal income tax by generating a balance sheet for account 70 “Settlements with personnel for wages” for each individual.

For example, we will check the correctness of filling out personal income tax information according to P.P. Sokolov.

- Amount of income = 120,000 rubles. (from SALT count 70)

- Amount of deduction provided = RUB 8,400. (from the document form Certificate 2-NDFL);

- Taxable base = 120,000 – 8,400 = 111,600 rubles. – coincides with the data in Certificate 2-NDFL;

- Personal income tax calculated = 111,600 * 13% = 14,508 rubles.

This is exactly the amount reflected in the credit of account 68.01 and the same amount is indicated in Certificate 2-NDFL. In our example, the withheld amount coincides with the calculated personal income tax amount when paying income to individuals.

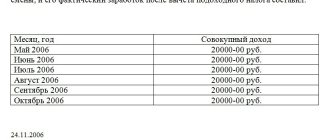

Step 2. Checking the amount of personal income tax transferred to the budget

The amount of personal income tax transferred is indicated for each individual; for this purpose, the total amount of personal income tax paid is distributed monthly. Therefore, it is necessary to check whether the amount of personal income tax transferred for each employee coincides with the total amount of personal income tax transferred for the year. In order to determine the total amount of personal income tax transferred to the budget, you can use the Account Analysis for account 68.01 “Personal Income Tax”:

You can determine the total amount of personal income tax transferred to the budget, reflected in certificates in form 2-NDFL, by adding up the amounts of personal income tax transferred

for each employee, and compare with the data

from the Account Analysis

for account 68.01 “Income Tax for Individuals”.

For example, the amount of personal income tax listed from the Certificate in form 2-NDFL:

- Vorobey A.G. – 11,409 rubles;

- Dyatlov I.V. – 11,483 rubles;

- Rybkina Z.S. – 10,470 rubles;

- Sokolov P.P. – 14,508 rub.

- Total: 47,870 rub.

This amount is filled in according to the register Data transfer of personal income tax to the budget of the Russian Federation. Exactly the same amount is reflected in the transaction record Dt 68.01 Kt 51. Information on the income of individuals is filled out correctly.

Help 2-NDFL in 1C ZUP 3.0: how to generate and print

Step 1 – Preparatory work and data verification

In order for the machine to correctly calculate income tax based on your request, you will need to spend time and ensure that the required information for your subordinates is filled out. Some of the required information includes the following:

- basic salary, sick leave and vacation pay;

- standard tax, personal, social and professional deductions;

- other types of income and deductions from them.

As you know, salary calculation is done by using the payroll command in the salary and personnel section. It is found in all accruals and further in the salary. The developers offer you this command to automatically display the amounts of deductions from income, taxes and contributions to social security and pension.

All other teams for working with taxes are located in salaries and personnel, there follow the personal income tax link and there is functionality for all personal income tax documents. This is where the certificates we are considering and other frequently used operations are generated, and I suggest you familiarize yourself with them in the table.

| No. | Team name | Characteristic |

| 1 | Application for personal income tax deductions | This is where you should include information about child and personal deductions. You enter its validity period in the header of the form with the general details of the month in which the required deduction begins to work. The tabular part requires you to indicate the end of the month when the deduction ends |

| 2 | Tax accounting operation | Here, various other types of income and deductions are taken into account. |

| 3 | Notification of DO about the right to deductions | This form is used when calculating property and social deductions, and the validity period of this type of deduction is entered in the header |

Step 2 – How to fill out a certificate to send to the tax office

The machine provides special functionality to satisfy your request in generating a certificate to respond to the tax service in the salary and personnel section, then go to personal income tax and there you will find the 2-personal income tax field for transfer to the Federal Tax Service. Also here are all the general documents on personal income tax following the path indicated by me, which may be useful to you when working with income tax. The journal has a command for creating a new certificate, and before generating it, you will still have to enter the initial information in the header of the form. So, you will need to fill out:

- the year for which you report to the tax authorities;

- OKTMO/KPP assumes the territorial location of the company to the tax authority where the company is registered. You add this information in the main section in the organizations field and there you find the card in the registration with the tax authorities;

- In the Federal Tax Service (code)/with the checkpoint, it talks about the details of the tax authority;

- The “Original”, “Correcting” and “Cancelling” keys indicate the status of the certificate;

- The type of certificates can be annual reporting or the impossibility of withholding personal income tax.

When you need to create a primary reference, use the initial command. Please indicate the correction number in the certificate. A corrective certificate requires the selection of a corrective one, and in the certificate itself, do not forget to mark the correction number 01-98. When issuing a cancellation certificate, mark the cancellation certificate. In the certificate form, enter the correction number 99.

Keep in mind an important nuance: the type of certificates generated should also be specified and assigned to the machine. So, your annual income statements will have the first sign. In the field about the impossibility of withholding personal income tax, write down those incomes from which tax was not taken. The document table is filled out by you yourself and has a second sign in the form of a certificate.

Submitting 2-NDFL for 2021 from the Salary and Personnel Management configuration, edition 2.5 (2.5.130.2)

I would like to share my experience in preparing for the submission of 2-NDFL for 2018 from 1C from the Salary and Personnel Management configuration, edition 2.5 (2.5.130.2).

To prepare files for reporting, we will need:

- The 1C ZUP 2.5 database itself with the latest update dated March 29, 2018 (release 2.5.130.2)

- Taxpayer Legal Entity 4.60 (the program can be downloaded for free from the official website www.gnivc.ru)

Next I will explain step by step.

Step #1. (picture 1)

We go into 1C with rights to generate reports. Select the “Taxes” tab on the 1C desktop (label 1). Next, go to “Regulated Report” (label 2) and in the “Regulated and Financial Reporting” window that opens, click on creating a new report (label 3)

Step #2. (pictures 2, 3)

In the window that opens, go to the folder “Reporting for individuals” and then from the list select the report “Certificate 2-NDFL for transfer to the Federal Tax Service (from 2015)”

Step #3. (Figure 4, 5)

We will see an unfilled new report on 2-NDFL. What you need to pay attention to is:

- Correctly indicate the tax period - 2021 (label 1)

- Correctly indicate the date of report generation, the “from” field, in the example I indicated 01/21/2019 (label 2)

- Specify the organization for which we are generating the report

After filling out the required fields, click on the “Fill” button (label 3) and select “individuals who received income” from the drop-down list. Once the report is filled with data, I recommend checking the numbers before continuing further.

If everything is filled out correctly and correctly click on the “Write” button (label 4) and then save the report to the local disk by clicking on the “Write file to disk” button (label 5).

After successfully saving the file, proceed to the next step.

Step #4. (Figures 6, 7, Taxpayer Legal Entity.

(Figures 6, 7, Taxpayer Legal Entity.

I will not describe how to install the “Legal Taxpayer” program (this process is described in the instructions for the program, it can be downloaded from the link), but I will go straight to downloading the data.

Let's start, if you have just installed the program “from scratch”, then when you first launch the program, a window will pop up in which you need to select “add a taxpayer from the tax/accounting reporting file (format version 5.xx)”. Click “OK” and select the file that was downloaded from 1C. After successful loading, the program will ask you to additionally fill in the fields OKTMO, OKATO and OGRN, I recommend doing this right away.

Then, in the upper right corner we indicate the period 2021 - this is the period in which we will download the data. We go through the menu items: Documents - Documents on personal income tax - Certificates of income (2-NDFL); in the window intended for generating a report on 2-NDFL.

Then, click on the “Download” button, in the window that opens, indicate the file that was downloaded from 1C and click “Open”. Afterwards, the program will open a window in which it will display the found references, click “Select”, then leave everything unchanged and click “OK”. After successful downloading, the window will close automatically and you will see a report on the downloaded references. You can close the report and a window with downloaded certificates will open.

Step #5. (Figure 9) Unloading from “Taxpayer Legal Entities”

Next, you click “Select all” (label 1), the program will select all the certificates for further processing. Then click “Upload” (label 2), confirm that we want to upload by clicking on the “Yes” button and in the form that opens, enter the name of the signatory, then “OK” and in the last form indicate the registry number, the date the registry was formed, and the path to the folder — where you need to upload the xml file.

If you did everything correctly, a window will be displayed in which the generated file and a list of employees from this file and other information will be displayed. To close the window, click “OK”.

If any of you knows how to work in the “Legal Taxpayer” program, then before uploading the data, you can correct the information and check the uploaded data.

You can upload many times by following step #5.

I hope my article helped you and you will successfully submit and have already submitted your 2-NDFL reporting for 2021 from 1C ZUP 2.5