Who calculates UTII

According to ch. 26.3 of the Tax Code of the Russian Federation, payers of UTII may recognize persons providing services listed in clause 2 of Art. 346.26 Tax Code of the Russian Federation. However, this same norm provides for requirements that must be met in order to be able to apply the special regime in question. If the taxpayer satisfies all the conditions for being on UTII, taking into account clause 1 of Art. 346.32 of the Tax Code of the Russian Federation, he needs to calculate the tax and pay it to the budget.

Read more about the features of existing special regimes in the article “Special tax regimes in 2021 (types and nuances)”.

Is UTII for individual entrepreneurs suitable for all entrepreneurs?

The term “ single tax on imputed income for certain types of activities ” indicates specifics: businessmen with specific types of activities can only work on UTII.

A complete list of types of entrepreneurship is given in clause 2 of Article 346.26 of the Tax Code of the Russian Federation and covers:

- Retail trade.

- Household and veterinary services.

- Parking services.

- Vehicle washing, repair and maintenance services.

- Passenger transportation services.

- Services for the transportation of goods by road.

- Catering.

- Services for distribution and placement of advertising.

- Temporary accommodation and accommodation services.

- Services for the transfer of retail spaces and land plots for temporary use.

This list from the federal law is regulated by local legislation, so we advise you to be guided by the regional law on the introduction of imputed income in your territory.

Restrictions have been introduced on some activities. For example, the area of a retail and catering hall is within 150 square meters. m., number of vehicles for cargo transportation up to 20 cars, hotel area up to 500 sq.m. Read our article What types of activities does the imputed tax for individual entrepreneurs approve for application in 2021? So, UTII in 2021 will be acceptable for individual entrepreneurs if:

- The regime is valid within the municipality.

- Local law specifies the type of business.

- The average number of employees of an entrepreneur is less than 100 people.

- The activity does not concern participation in a property trust agreement or partnership.

- The service does not involve the rental of auto and gas filling stations.

- The individual entrepreneur did not acquire a patent or use the unified agricultural tax regime.

If a condition from the list on the imputation is violated, the entrepreneur loses the right to it and is considered transferred to the general taxation system from the beginning of the quarter in which the violation was committed. You will have to calculate and pay taxes according to the general system.

The imputation replaces 3 payments:

- Personal income tax from doing business.

- Property tax on an individual when using personal property in business.

- VAT.

What is the tax base for UTII in 2021 per month

The algorithm for forming the UTII tax base is contained in Chapter. 26.3 of the Tax Code of the Russian Federation, as well as the “Procedure for filling out the UTII declaration”:

Tax base UTII = Basic profitability × Physical indicator × K1 × K2,

Where:

- basic profitability (hereinafter referred to as BD) - an individual value characteristic of each type of activity, which is established by the state;

- physical indicator (hereinafter referred to as FP) - a value that is determined independently by each payer according to the list of clause 3 of Art. 346.29 of the Tax Code of the Russian Federation: employees, retail space, square meter, etc.;

- K1 is a coefficient set annually by the Ministry of Economic Development (K1 for 2021 is left at the same value as in 2015 and 2021 - 1.798);

- K2 is a coefficient that adjusts the tax base depending on the conditions of business, established in municipalities, which determines its significant differentiation not only between regions, but also within them.

Let's give an example

LLC on UTII in 2021 is engaged in the provision of motor transport services for the transportation of passengers in the city of Khimki. Transportation is carried out by a minibus designed for 12 passengers.

Let's determine the indicators that will be required to calculate the tax base:

basic profitability – 1,500;

physical indicator – 12;

K1 – 1.798;

K2 – 1 (decision of the Council of Deputies of the Khimki Urban District of the Moscow Region “On the taxation system in the form of a single tax on imputed income for certain types of activities in the Khimki Urban District” dated October 3, 2007 No. 13/3).

The tax base for 1 month is calculated in the following way:

Tax base UTII = 1,500 × 12 × 1,798 × 1 = 32,364 rubles.

Tax amount calculation

The established tax rate is applied to the tax base, which is the monthly basic yield multiplied by the number of physical indicators and adjusted by two coefficients - K1 and K2.

Basic profitability is established for a given line of activity. Specific figures are stated in paragraph 3 of Article 346.29 of the Tax Code. It also talks about what should be considered a physical indicator for each type of business. Thus, when providing household services, the basic profitability is 7,500 rubles for each physical indicator - one employee, which, by virtue of the application of Chapter 26.3 of the Code, includes an individual entrepreneur. The provision of motor transport services for the transportation of goods is calculated based on a base income of 6,000 rubles for one vehicle used for the transportation of goods. Similar indicators in connection with the physical indicator and profitability are established for each area of entrepreneurship that can be registered as imputed.

The K1 coefficient is set every year at the federal level. In 2021, its value is 1.798, according to By the way, this coefficient has not increased since 2015.

The value of the K2 coefficient is set by local authorities at the regional level.

Example of UTII calculation

IP Samoilov A.S. engages in retail trade through a stationary retail chain without a sales area. Trade is carried out at two sales points located in the territory where UTII has been introduced. Let us assume that the K2 coefficient in this area is 0.5. The UTII rate in 2021 is 15%. Thus, the quarterly tax base in 2021 will be:

9000 x 2 x 3 x 1.798 x 0.5 = 48,546.00 rubles

The amount of tax payable will be:

48,546.00 x 15% = 7,281.90 rubles

How to calculate the tax base for UTII for less than a month

If any of the months the taxpayer was in the regime discussed in the article was incomplete, the calculation should be made using the following formula:

Tax base of UTII = DB × FP × K1 × K2 × Days of incomplete month spent on UTII / Number of days of the month.

Example

IP Ivanov is engaged in retail trade of food products (except alcohol) in the city of Zheleznodorozhny, Moscow region. For this type of activity, the taxpayer applied UTII. Hall area – 10 sq. m. However, as of May 15, 2017, the individual entrepreneur ceased to carry out activities on UTII.

For the calculation we use the following data:

basic profitability – 1,800 rubles;

K1 – 1.798;

K2 – 0.9 (decision of the Council of Deputies of the Zheleznodorozhny urban district dated October 19, 2011 No. 04/19).

When calculating the tax for the month, the taxpayer should use the coefficient 15/31, where 15 is the number of days in May during which the individual entrepreneur applied UTII, and 31 is the number of days in May.

Thus, the calculation of the tax base for May in this case is as follows:

Tax base UTII = 1800 × 10 × 1.798 × 0.9 × 15/31 = 14,094 rubles.

Subtleties of calculation and features of working on UTII

Payment of the single tax on imputed income is simple and does not depend on the profit received. But it is important to take into account some subtleties and pitfalls.

The Tax Code and laws of the Russian Federation allow companies that provide household servants to switch to UTII. But keep in mind that clients in this case must be individuals.

Be careful when calculating UTII when providing transport services or organizing parking. For parking, the entire area of the subject is taken into account, and for transportation services, only actually used vehicles need to be taken for calculation.

Delivery of products is subject to UTII if it is a separate service. If in your business you use free delivery, the costs of which are already included in the price of the product, then you do not need to pay imputed tax for it.

Many controversial issues regarding the application and calculation of UTII arise around the sphere of retail trade and marketing. Before starting work in these industries, study the laws, norms of the Tax Code, documents of the Ministry of Finance to build an effective and profitable company.

back to menu ↑

A single tax on imputed income

Is it possible to reduce the UTII tax base?

Taking into account paragraph 2 of Art. 346.32 of the Tax Code of the Russian Federation, individual entrepreneurs making fixed payments for insurance premiums have the right to completely reduce the accrued amount of the single tax by the amount of these payments transferred for the quarter in which UTII is calculated, but this right can only be exercised if the individual entrepreneur does not have hired employees.

On reducing the tax base by the amount of a fixed payment, see the material “One-time payment of a fixed payment may be unprofitable for UTII .

Individual entrepreneurs and companies with hired employees also reduce the accrued tax (albeit by no more than half) by the amount of insurance premiums paid.

On the procedure for calculating the tax base for UTII for individual entrepreneurs, see the material “UTII in 2016–2017 for individual entrepreneurs: features of imputation” .

What is UTII

The single tax on imputed income is the main tax paid by individual entrepreneurs and other small businesses. This tax replaced a whole series of other taxes and fees that existed previously, and thanks to UTII, reporting was significantly simplified; in addition, representatives of small businesses were spared from unnecessary attention from the fiscal authorities. UTII is assigned by regional and municipal authorities; it is not one of the federal taxes, but UTII is regulated by the federal Ministry of Finance.

The business that pays UTII is specified in the relevant laws, and its payers are such organizations, for example, as a car wash and car service, a sales tent and a small cafe, a hairdresser and a veterinary clinic.

The general meaning of the tax is that a certain amount of the level of his income is calculated and assigned (imputed) for an entrepreneur, which he must achieve based on the results of his work, and a tax is levied on the income calculated in this way. Thanks to this, the tax inspectorate does not need to strictly monitor countless sales tents or car washes, and businessmen are not forced to hide their income.

At the beginning of 2021, UTII was paid by more than two million small businesses - 1,800 thousand individual entrepreneurs and about 300 thousand LLCs. Based on the results of the first three quarters of 2021, revenue from UTII in favor of local budgets amounted to approximately 55 billion rubles.

What is the UTII rate in 2021?

To calculate the amount of single tax Art. 346.31 of the Tax Code of the Russian Federation provides for a rate of 15% (clause 1 of Article 346.31 of the Tax Code of the Russian Federation). From the 4th quarter of 2015 (Article 4 of the Law of the Russian Federation “On Amendments...” dated July 13, 2015 No. 232-FZ), regions received the right to introduce a rate ranging from 7.5 to 15%, depending on the types of taxpayers and types of activities they carry out (clause 2 of article 346.31 of the Tax Code of the Russian Federation).

For more information about the UTII tax rate, see the material “Tax rate for UTII in 2015–2016” .

UTII rate

The UTII rate under Russian legislation has not changed in 2021, it is 15%. However, according to Federal Law No. 232-FZ dated July 13, 2015, regional authorities received more powers in determining it; they can reduce it to 7.5%. This was done to provide benefits to certain types of small businesses that are important for a specific region of Russia.

According to experts, it is impossible to talk about reducing the UTII rate thanks to this Federal Law. Local authorities are not obliged, but only have the right to reduce the tax burden for entrepreneurs. At the same time, the entire “imputation” feeds the revenue side of the budget of the municipality or city. So regional authorities are not very interested in reducing the UTII rate.

Organizations engaged in certain types of activities are allowed UTII. Its main advantage is that UTII replaces a number of taxes and allows for simplified accounting; it is calculated regardless of income and is beneficial to companies whose income is above average. UTII is calculated as the product of imputed income and the tax rate. All indicators are determined by Article 346.29 of the Tax Code of the Russian Federation.

How the UTII value is calculated is shown in the diagram, where:

- Basic profitability (its value depends on the type of activity) is multiplied by the sum of physical indicators for three months (usually the area of the premises or the number of employees).

- In this case, the basic profitability decreases or increases using coefficients K1 and K2. The inflation coefficient (K1) is set every year, and K2 is an indicator by type of activity, regulated by local laws.

- Then the resulting imputed income is multiplied by the UTII rate:

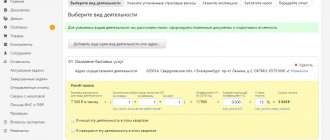

How to fill out a UTII declaration

From the 1st quarter of 2015, the declaration form stipulated by the order of the Federal Tax Service dated July 4, 2014 No. ММВ-7-3/ [email protected] . In 2017, it is used as amended by the order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3 / [email protected]

Section 2 of the declaration is completed as follows:

line “040” reflects the basic profitability;

“050” – current value of K1;

“060” – current value of K2;

“070”–“090” is a physical indicator, with:

in column “2” – the physical indicator itself;

in column “3” - the number of days of the month of conducting activities on UTII;

in column “4” – tax base.

Section 3 is filled out like this:

in line “005” – indicate the taxpayer code: “1” (for individual entrepreneurs with employees, and (for individual entrepreneurs without employees);

“010” – the amount of tax accrued for the period;

“020” – the amount of accrued and paid contributions to the funds by taxpayers who have employees;

“030” – the amount of contributions to funds paid by individual entrepreneurs without employees;

“040” – the total amount of tax to be paid.

Corrective coefficient of basic profitability K2 - what is it?

The adjustment coefficient of basic profitability K2 is one of the coefficients that is used to adjust the monthly value of basic profitability when calculating the taxable base of UTII.

For this adjustment, 2 coefficients are applied:

- K1 is a deflator coefficient, established annually at the federal level and mandatory for use;

- K2 is a coefficient depending on the conditions of the activity, which can be set at the regional level.

The value of the coefficient K2 can range from 0.005 to 1 inclusive (clause 7 of article 346.29 of the Tax Code of the Russian Federation). Accordingly, it is downward. If the coefficient is not set, then it is assumed to be 1, and no downward adjustment of the base occurs.

The monthly base from which the tax paid under UTII is calculated is obtained by multiplying the established clause 3 of Art. 346.29 of the Tax Code of the Russian Federation the value of the monthly basic profitability by type of business activity by the adjustment coefficients K1 and K2 and by the actual value of the physical indicator used for this type of business activity.

Deadlines for paying UTII in 2021

Payment of UTII is carried out in accordance with paragraph 1 of Art. 346.32 of the Tax Code of the Russian Federation (25th day of the month following the reporting quarter), taking into account the possibility of their transfer if they coincide with public days off. In 2017, there are no such coincidences, and the payment deadlines will be as follows:

until January 25, 2017 – for the 4th quarter of 2021;

until 04/25/2017 – for the 1st quarter of 2021;

until July 25, 2017 – for the 2nd quarter of 2021;

until October 25, 2017 – for the 3rd quarter of 2021;

until January 25, 2018 – for the 4th quarter of 2021.

For more information on the rules for paying UTII, see the material “Procedure and deadlines for paying UTII in 2017” .

Cash registers in UTII

What is the situation with the online cash register for UTII in 2021:

- Retail trade for individual entrepreneurs and LLCs, which previously used sales receipts and PKOs for primary documents, can continue to do so until July 2018 (No. 290-FZ);

- Individual entrepreneurs and LLCs using strict reporting forms also work until July 2021;

- Individual entrepreneurs and LLCs that used cash register receipts should replace this method with online cash registers. These actions must already be done from February 2021 - otherwise it will not be possible to register.

In July 2021, for the first time, all entrepreneurs and organizations using UTII taxation must switch to online cash registers.

The right to reduce UTII

- The single tax for individual entrepreneurs “for themselves” who have hired employees cannot be reduced . The norm is valid only for the amount of payments in favor of employees performing work in the area that, as stated in the legislative framework, is subject to UTII.

- For an individual entrepreneur operating without outside help, the single tax rate on imputed income relative to the amount of insurance premiums paid “for oneself” can be significantly reduced.

Attention! The reduction in the UTII rate, provided that external employees are involved, cannot exceed 50% of the accrued tax. Therefore, assuming the amount of deductions, if an individual. The indicator (FP) is the number of workers; it is necessary to consider whether all of them are really needed in a given area of employment. If an individual entrepreneur pays taxes only “for himself,” then the 50% limit does not apply to him.

In conclusion, we would like to note that the single tax for individual entrepreneurs has no restrictions regarding the amount of income received. Therefore, as soon as your business goes uphill, you don’t need to worry about the legality of the chosen system of paying taxes to the state - UTII.

https://youtu.be/4v0H-kGnN_8