How to fill out standard tax deductions for children in 3-NDFL in the “Declaration” program

What does “Status changed” mean?

Deduction code 104 and 105

Where to enter deduction codes 126, 127, 128 in 3-NDFL

Tax deduction codes 114, 115, 118

Sample and example of filling

3-NDFL for a disabled child

How to fill out standard deductions in 3-NDFL in your personal account

Results

As a general rule, the standard deduction is provided by the employer. This is what is written in paragraph 3 of Article 218 of the Tax Code. However, if for some reason this does not happen, the taxpayer has the right to independently apply to the Federal Tax Service within 3 years. We will tell you in detail how to apply for 3-NDFL for a tax deduction for children in 2021 in the article.

If you have questions or need help, please call Free Federal Legal Advice.

- The call throughout Russia is free 8 800 350-94-43

How to fill out standard tax deductions for children in 3-NDFL in the “Declaration” program

The easiest way for those who prefer to personally take documents to the Federal Tax Service is to use the “Declaration”. It is posted on the department’s website in the “Software” section.

Advantages of the method:

Important! Each year has its own version of the product. That is, if you plan to report for 3 years at once, you need to download and install 3 programs, for each year separately. In this article we look at the process of working with the report for 2017. Previous versions are generally similar.

You should work in stages, moving vertically along the tabs from top to bottom.

Let's briefly look at the main steps:

- Step 1. Set the conditions.

All parameters here are already set by default. Difficulty can only arise with the inspection number and OKTMO. Electronic services on the department’s website come to the rescue.

You will need the “Address and payment details of your inspection” service. We enter the registration address in the window and get the required numbers.

In total, we get the completed first tab.

- Step 2. Fill in your passport information. There shouldn't be any difficulties at this stage.

Advice!

Be sure to write a contact phone number so that the inspection inspector can promptly ask questions and clarify some information.

- Step 3. Register income.

At this stage, we carefully transfer all the values from the 2-NDFL certificate for the reporting year into the form. Before entering the numbers, in the top panel “Sources of Payments”, use the “+” sign to add the employer who issued the certificate.

Important!

For the system to take into account income received from this employer when recalculating personal income tax, check the appropriate box.

The final appearance of the completed page:

- Step 4. Fill in the basic information.

- In the 3-NDFL preparation program, you need to check the “Provide standard deductions” box. Otherwise, the tab remains inactive and standard deductions for children when filling out 3-NDFL are not generated.

- The next line gives you 4 options to choose from:

- Code 104,500 per month;

- Code 105 3000 per month;

- There is no 104 or 105 deduction;

- The code has changed.

The default is the third option. If you additionally plan to return the tax “to yourself,” choose the appropriate option.

- Choose your status (single parent or not). The default option is the standard option when more than one parent is contacting.

- If the number of children in a year has not changed, put a tick in the appropriate lines and indicate the number: the first line is for the first two children, the second is for the third and subsequent ones.

Example 1

The Afanasyevs have three sons: younger minors and one full-time student. Parents check 2 boxes:

- If a child was born or adopted during the year, this change is adjusted manually by month.

Example 2

The Petrovs gave birth to their second daughter in June 2021. The eldest goes to kindergarten. In the “Declaration”, the father manually enters the actual quantity in each month, from January to May - 1, from June - 2:

- Step 5. Check.

Before printing, click the “Check” button. If everything is in order, the finished report can be printed.

Possible difficulties:

- The program incorrectly calculates the deduction for children in 3-NDFL.

Check whether you have correctly reflected the number of children (including disabled people) and your status. Remember that with income over 350,000 rubles. Personal income tax is no longer recalculated.

- 3-NDFL does not include a deduction for children.

Check if you have activated the tab. If the field contains a note that the number of children has not changed, manual adjustment of this indicator is no longer possible.

What does “Status changed” mean in 3-NDFL when deducting for children

This option should be selected for those whose parental status changed during the reporting year. As it is written in paragraph 12, paragraph 4, paragraph 1 of Article 218 of the Tax Code, a parent ceases to be considered the only one from the next month after marriage.

Example 3

Elena is a single mother. She is raising 10-year-old Andrei alone. In August 2021, Elena got married. The woman should indicate the change starting September 2021:

Thus, Elena has the right to count on a reduction in the personal income tax base by 28,000 rubles. per year: 2,800 rubles. per month until August and 1,400 rubles. - From september. She will return 3,640 rubles from the budget. (13%).

If you have questions or need help, please call Free Federal Legal Advice.

Example of form 3-NDFL

A service such as reducing the tax base in connection with raising children is regulated by Article 218, located in the Tax Code of the Russian Federation. Individuals whose responsibilities include providing for children (this can be not only parents, but also guardians or adoptive parents) have the right to pay tax on a slightly smaller amount than they earn.

First page

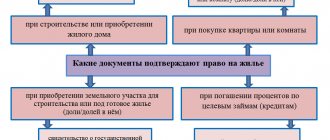

In order to receive standard tax compensation, you must enter data on the first sheet of the 3-NDFL form, the so-called title page. Since all individuals have encountered most of the data required in this sheet at least once in their lives, we suggest focusing on the less understandable parameters:

- Correction number. For this value there are three cells in which you need to enter a specific code. If the 3-NDFL form for the current tax period is issued for the first time, then in the first cell you need to put a zero, and in the rest there are dashes; if again, then a unit, and in the rest also dashes.

- Tax period code. It is not enough to indicate in the declaration the year for which the individual wishes to receive compensation. Additionally, you need to enter the tax period code. As a rule, this is a two-digit numerical combination that carries information about the duration of a given period. If it is necessary to note that this period is 365 days, then code 34 is written, if nine months - 33.

- Category code. In order to indicate the category to which the taxpayer who claimed the standard deduction belongs, codes consisting of three digits were invented. If an individual is not engaged in private activities, pays personal income tax from sources of profit and sends a declaration form for verification to obtain a tax discount, then he must enter code 760.

- Pagination. On the title page, the taxpayer will need to indicate at the top that this is the first page of form 3-NDFL, and at the bottom, additionally note how many sheets are included in the tax return form. These numbers must be entered with two zeros. That is, if this is the first sheet, then write - 001, if the second - 002, and then according to the same principle.

Sections

After the title page in 3-NDFL, sections number one and number two follow. In the first of them, the applicant for a standard tax discount in line with code 010 must note that the document is being submitted for the purpose of reimbursement of material resources from the state treasury. After this, you need to enter two codes - budget classification and OKTMO (a combination of numbers established by the all-Russian classifier for the purpose of faster identification of the territory belonging to a municipal entity), and then indicate the amount of compensation in rubles.

Attention! The OKTMO code can consist of either eight numbers or eleven. In situations where the first option occurs, dashes must be added to the last empty cells.

In the second section, it should be noted how much percent of the applicant’s profit for deduction goes to tax fees, the type of income, as well as its amount. In addition, you will need to indicate the amount of the standard deduction, as well as the tax base from which income tax will be withdrawn in the future.

It is also necessary to calculate the amount to be reimbursed from the state budget. To do this, you need to subtract from the personal income tax amount already withheld the amount of tax that would have been removed from the profit if the deduction had been issued.

Income sheet

Sheet A is included in the 3-NDFL declaration, in which the applicant for the deduction is required to enter all sources of his income. The parameters of each source are indicated in a separate part of the page. An applicant for standard compensation will need to write the following information on sheet A:

- TIN and tax rate. This part of the tax return contains the identification number of the source of profit, not the taxpayer himself. You will also need to indicate the tax rate. Often this value is 13%.

- Codes. First of all, the income type code is entered. The most commonly used code is 06, which means that we are talking about the profit of an individual excluding personal income tax, which he received as a result of working under an employment agreement. You will also need to enter the registration reason code and OKTMO.

- Source of payment. In a separate field, which, unlike others, is not divided into cells, you should enter the name of the source that provides profit to the applicant for deduction. This name is indicated in block letters of the Russian alphabet and placed in quotation marks.

- Several amounts. An individual will need to write the amount of his profit and next to the amount from which taxes are deducted by law. Even if it is the same value, it still needs to be entered twice. Just below is written the amount of tax that was assessed by the tax inspector, and a little to the right is the amount of personal income tax paid by the taxpayer.

Standard deduction worksheet

The tax return contains a sheet such as E1. It is intended both for processing standard compensation and for receiving social deductions. In this case, you will only need to work with the first paragraph of page E1, in which you only need to fill in a couple of lines:

- 030 – in this field you must indicate how many months passed before the amount of profit of the applicant for tax base reduction exceeded the mark of 350,000 rubles (the report must be produced starting in January). If an individual received less than this amount during the year, then the number 12 is entered.

- 040 – Here is written the amount that a parent is entitled to as compensation for raising one child. The value written in the line with code 040 must necessarily coincide with the amount entered in the field marked 040 in the second section of the declaration.

- 080 – This line contains the total amount declared for the provision of tax compensation in sheet E1 of form 3-NDFL. Often this is the same parameter that is displayed in field 040. However, if an individual is entitled to several types of standard compensation, then this fact must be taken into account.

If the applicant for the deduction provides for the child independently (mother or single father), then he has the right to compensation in an increased amount and must indicate its amount in line 050, if he is a guardian of a disabled person - in line 060, if the applicant for a double deduction due to refusal from the tax credit of the second parent - in line 070.

All other fields of sheet E1, in which the applicant for a standard deduction did not enter information, must be filled in, and zeros must be entered in them. The first zero is placed in the very last cell of the field, located before the point, and then two more zeros are written in the remaining cells on the right side. The page must be signed by the taxpayer.

Deduction code 104 and 105, what is it

The employer marks each type of income and deduction with a special code and puts it in the 2-NDFL certificate. Their classification and meanings are given in the Order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11/ [email protected] Thus, the deduction code for a single mother for her first child is 134, and the standard deduction code for 1 child is 126. Thus, the tax sees what payments have been made to the taxpayer and what personal income tax recalculations he has already received.

According to this order, codes 104 and 105 refer to the so-called “self-deductions” provided for in paragraphs 1 and 2 of paragraph 1 of Article 218 of the Tax Code. They are provided for 500 or 3000 rubles. for each month to certain categories of citizens (veterans, Chernobyl survivors, etc.).

Important!

It is allowed to return tax “for yourself” and for children at the same time.

Calculate standard deductions using this source, what is it

Example: A citizen purchased a car in 2021 for 500,000 rubles, sold it in 2021 for 230,000 rubles. There are documents confirming the purchase and the sale amount. The car was sold cheaper, but since there are no documents confirming payment upon purchase, tax will have to be paid, it will be 32,500 rubles. If there are no documents confirming payment upon purchase, then the tax amount upon sale of the car will be (400,000 - 250,000) * 13% = 19,500 rubles. (both have been owned for less than 3 years), there are no documents for purchase. Example 2: A citizen sold a car for 350 thousand in 2021. The car was sold cheaper than the purchase price - there is no income, there is no tax base. Example 1: A citizen sold 2 cars in 2021, one for 120 thousand rubles, there are no documents confirming the purchase amount, he took advantage of a tax deduction of 250 thousand.

We recommend reading: Collection of loan debts by bailiffs in Gor Teikov

Example: A citizen purchased a car in 2021 for 450,000 rubles, sold it in 2021 for 420,000 rubles. There is no tax base (sale price is lower than purchase price). rubles in 2021, paying (350 -250)*13%= 13,000 rubles. The declaration is submitted one for the entire volume of sales in the tax year, and not for each vehicle separately. And in 2021, a car that has been owned for less than 3 years is also sold. But income and deductions/expenses are accounted for on a separate line for each transport separately.

Where to enter deduction codes 126, 127, 128 in 3-NDFL

These codes relate to parents (adoptive parents) and differ according to the child’s serial number:

As we have already described above, in the program, data on the number of children is entered either by checking marks or manually, and the amount of tax refund is calculated automatically. On a paper form, the total amount of such deductions is indicated in one figure in line 030 on sheet E1. In this case, you need to calculate it yourself.

Example 4

Marina has 2 young children. With a salary of 20,000 rubles. she is entitled to standard deductions for personal income tax for the first and second child under codes 126 and 127. A total of 2,800 rubles. per month.

Sample of a completed tab in the program:

Sample sheet of paper form:

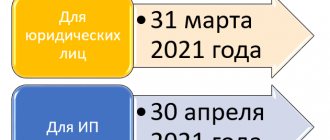

Tax deduction codes 114, 115, 118 where to write in 3-NDFL

As of 2021, codes 114 through 125 have been eliminated. The changes were introduced by Order of the Federal Tax Service dated November 22, 2016 No. ММВ-7-11/ [email protected] Instead, in the 2-NDFL certificates for 2021 and 2021. new ones are added, from 126 to 149. This innovation is due to the fact that in Article 218 of the Tax Code the amounts for disabled children have changed depending on the category of the applicant (parent or guardian).

Important!

In 2-NDFL certificates for 2015, codes are indicated as before.

However, these code numbers are not important for filing a declaration. On the form (sheet E1), deductions are divided into 4 lines without indicating the code:

- general for children (line 030);

- single parent (040);

- for a disabled child (050);

- for a disabled child to a single parent (060).

3-NDFL for a disabled child

Completing a declaration for a disabled child has its own characteristics:

- If the number of such children supported by the applicant has not changed during the year, a tick is placed in the appropriate box.

- If it has changed, the quantity is entered manually by month.

- The applicant's category is indicated in a special window that appears. The guardian, trustee or adoptive parent checks the box, the natural parent and adoptive parent leaves the box empty.

Important!

The deduction for a disabled child is summed up with the usual one, depending on the number of children. In order for the program to correctly calculate the amount, you must declare both.

Example 6

Veronica has 2 minor sons, one of whom is disabled. When completing the declaration, Veronica will separately indicate the total number of children and the number of children with disabilities:

The deduction amount per month will be 1,400 rubles. for one son and 13,400 rubles. on the second. Total 177,600 rub. in a year. The refund is 13% (23,088 rubles).

On the form on sheet E1, the deduction for the number of children is entered in line 030 as a total figure, for disability - in 050. Lines 070 and 190 are intended for the total amount.

Simple taxes

Next, fill out the deduction for the child. If you have the right to a single deduction, select the “deduction for a child (children)” item; if you have the right to a double deduction, as a single parent, select the “deduction for a child to a single parent” item. If the number of children has not changed during the year, check this box and write the number of children. The program will automatically enter the same number for all months. If the number of children has changed during the year, fill in the boxes manually. There are three boxes opposite each month. In the first box we put the number of children 1 or 2. In the second box we put the number of children, starting from the third, that is, there are only three children, we put 1. If there are only 5 children, we put 3. In the third box we write the number of disabled children. Here's what happened in our example:

After we have filled out the personal data in the first part of the instructions, namely full name, passport details, address, phone number, we will continue filling out for the standard tax deduction. Let’s take this example: suppose that you have 1 child and you have the right to a standard deduction “for yourself” in the amount of 3,000 rubles. Read here what the standard deduction for yourself and the standard deduction for a child are.

How to fill out standard deductions in 3-NDFL in your personal account

Working in your personal account (PA) simplifies and speeds up the entire procedure as much as possible. When filling out 3-NDFL online, standard tax deductions are calculated automatically, and almost all information is already contained in the system (including information about income received).

Procedure:

- We go to the desired section “Life Situations”.

- Choose the delivery method.

- We go through the proposed stages sequentially. Most of the data is already displayed in the system.

- In Step 3, check the box next to the corresponding line.

- At Step 5, select “for children”, indicate income (manually or from a certificate available in the system), add information about all children (including adults). If necessary, we make a note about the child’s disability and our status (guardian, single parent).

- Click on the “Calculate” button. The system itself determines the amount based on the information provided. Here we attach supporting documents (birth certificates, adoption documents, disability certificates, etc.)

- The document is completed and ready to send. To do this, you need to sign it with an electronic signature.

Standard tax deductions

The law states that if a taxpayer is entitled to several standard tax deductions at the same time, he is granted one maximum of these deductions. In this case, for example, the deduction for children is preserved regardless of the provision of other standard tax deductions.

3. If you are the only parent (sole adoptive parent), you will also need to prepare an additional copy of one of the following documents certifying that you are the only parent:

We recommend reading: Pension Fund did not approve a loan for maternity capital in a consumer society

Results

- The easiest way is to apply for 3-NDFL to return the deduction for a child through your Personal Account . This method requires a minimum of calculations and registration. The only difficulty is not to forget to indicate all children, including those who are no longer subject to deductions due to age.

- The Declaration program automatically calculates the amount of deduction based on the information entered . All data, including income, must be entered manually. If an error is made during filling, the program will indicate it during verification.

- The most time-consuming method is the traditional form . In this case, you need to calculate the amount of tax to be refunded yourself, and also correctly indicate all the required codes, focusing on the sample or instructions from the Federal Tax Service.

Filling out 3-NDFL on the Federal Tax Service website when applying for a deduction for a child

Filling out the 3-NDFL declaration in the taxpayer’s Personal Account is currently the fastest and easiest way to generate these reports. Let us consider in detail how to fill out 3 personal income taxes on the website of the Federal Tax Service (FTS) online.

Note: if the declaration was filled out in a program installed on a computer or on a form downloaded from the Internet, it can be downloaded and sent as a generated file. To do this, you must select “Send the generated declaration”

.