We are opening a separate division: how and where to submit 6-NDFL

The company's obligation to register and submit 6-NDFL for separate divisions (OP) arises if income is paid:

- employees performing labor duties at stationary workplaces geographically remote from the head office (created for a period of more than 1 month);

- to individuals under civil contracts concluded by authorized persons on behalf of the OP.

If income is paid to at least 1 such individual, the accounting service may have a question: how to fill out and submit 6-NDFL for a separate division?

Each OP is required to submit 6-NDFL at the place of its tax registration, regardless of:

- on the number of OPs registered by the company;

- the number of individuals receiving income from the OP;

- other conditions of the OP’s activities.

See also: “The Federal Tax Service has explained how to submit 6-NDFL for employees in another city.”

Tax agents - the largest taxpayers (CT) have the right to choose the address for filing 6-NDFL at the place of registration:

- companies as CN;

- or their OPs.

From 01/01/2020, it is possible to switch to centralized submission of 6-NDFL for OPs that are located in the same municipality. 6-NDFL on them can be submitted to the tax office at the location of one of these divisions, or to the Federal Tax Service of the parent organization, if the head office is located in the same municipality as the OP (even if the OP is the only one (see letter from the Federal Tax Service dated November 15, 2019 No. BS-4-11/23247).

To select the responsible department, you need to submit the following notification to the Federal Tax Service. The deadline is defined as the first working day of the corresponding year, but notifications for 2021 were accepted until 01/31/2020 inclusive.

The notification only needs to be submitted to one inspection - the one that takes into account the responsible OP, the rest of the Federal Tax Service will be notified automatically.

How to open an OP and organize accounting in it - see this article .

The algorithm for filling out sections 1 and the 6-NDFL report for separate divisions is no different from a similar report for the parent company.

NOTE! The requirements for filling out 6-NDFL are contained in the order of the Federal Tax Service of Russia dated October 14, 2015 No. MMB-7-11/ [email protected] (as amended on January 17, 2018).

Close attention will require filling out the title page of the 6-NDFL report, or rather the cells intended for the codes of the tax authority to which it is submitted, as well as the checkpoint and OKTMO department.

On the title page of 6-NDFL, it is necessary to reflect the checkpoint and OKTMO of the OP that paid income to individuals, and with centralized reporting from 2021 - the checkpoint of the responsible OP.

How to fill out 2-NDFL and 6-NDFL for a closed division

The Federal Tax Service cited the specifics of filling out 2-NDFL certificates and calculating 6-NDFL in the event of closing a separate division of an organization.

In a letter dated 02/03/2020 No. BS-4-11 / [email protected] , the department reminds that Russian organizations with separate divisions submit 2-NDFL certificates and 6-NDFL calculations in relation to employees of these divisions to the tax authority at the place of registration of such divisions.

If before the closure of a separate division, 2-NDFL certificates and 6-NDFL calculations for this division were not submitted at the place of registration, then the parent organization submits these reports for the closed separate division to the tax authority at the place of its registration.

In this case, in the 2-NDFL certificates and 6-NDFL calculations, the TIN and KPP fields of the organization are indicated, and the OKTMO code of the closed, separate division is indicated in the OKTMO Code field.

In this case, in the field “Form of reorganization (liquidation) (code)” the code “9” “closing a separate division” is indicated, and in the line “TIN/KPP of the reorganized organization” the TIN and KPP of the closed separate division of the organization are indicated.

Previously, the Federal Tax Service provided similar explanations in letters dated December 12, 2019 No. BS-4-11/ [email protected] and dated December 23, 2019 No. BS-4-11/ [email protected]

Now the Federal Tax Service clarifies that when submitting a calculation in form 6-NDFL for the year for a closed separate division in the field “Submission period (code)”, the organization has the right to indicate code “90” (the year during the reorganization (liquidation) of the organization).

BUKHPROSVET

Tax agents are required to submit calculations in form 6-NDFL for the first quarter, half a year, 9 months, and also for the year. For the year, the calculation is provided no later than March 1 of the year following the expired tax period. Quarterly calculations are submitted to the Federal Tax Service no later than the last day of the month following the corresponding period. There is no need to submit a zero calculation of 6-NDFL (letter of the Federal Tax Service dated March 23, 2016 No. BS-4-11/4958).

If the number of individuals who received income in the tax period is up to 10 people, tax agents can submit the 6-NDFL calculation for 2021 on paper. Other tax agents report electronically. The same applies to certificates in form 2-NDFL. Failure to comply with the electronic form will result in a fine of 200 rubles for each payment/certificate.

2-NDFL certificates for 2021, taking into account the postponement of the reporting deadline, will need to be submitted no later than March 2, 2020. If an employee requests a certificate, the employer is obliged to issue it within 3 working days from the date of receipt of the employee’s written application. For 2021 and subsequent tax periods, information on the income of individuals and the amounts of tax withheld and transferred to the budget will be presented as part of the calculation in Form 6-NDFL.

A separate division is closing: where to submit 6-NDFL upon closure

If a division closes, how to submit 6-NDFL? A similar question may arise at any time after a decision is made to liquidate one or more OP of the company.

In this case, employees of this OP may be:

- Transferred to another OP or head office.

Important to consider! Recommendation from “ConsultantPlus”: In the transition month, if an organization transfers employees of a closed division to work in another division that pays wages, such income and the tax on them must be included in 6-NDFL, submitted at the place of registration... (for more details, see K +).

For information on how to fill out a report when an employee moves between departments, read the material “How to fill out 6-NDFL if the employee “roams” between departments (examples).”

- Fired. If the company as a whole is liquidated along with all OPs, the final 6-NDFL report drawn up under this OP will be the last report that will reflect the amounts of income and personal income tax, as well as the corresponding dates (receipt of income, withholding of tax and its transfer) for dismissed employees .

For information on the procedure for dismissing employees during a company reorganization, see the article . ”

When registering 6-NDFL for OPs that are planned to be liquidated, you must adhere to the following rules:

- reporting period for 6-NDFL - from the beginning of the year (or from the moment of registration of the enterprise, if it is created and liquidated during the calendar year) until the date of deregistration (completion of the liquidation process);

- The latest 6-NDFL report must be submitted at the location of the OP being closed.

About the features of reflecting payments upon dismissal in 6-NDFL, read the material “How to correctly reflect payments upon dismissal in 6-NDFL?”

Tax agents - CNs - are again given the opportunity to choose: submit the latest 6-NDFL report for the liquidated OP to the inspectorate with which the company is registered as a CN, or at the place of registration of the liquidated OP.

What to do if it was not possible to report to the place of registration of the OP before its closure, see here .

Filling out 6-NDFL for separate divisions

On the question of how to submit 6-NDFL (as a primary report or as an updated form), we inform you as follows.

According to clause 2.2 of the Procedure, on the line “Adjustment number”, when a tax agent submits the initial Calculation to the tax authority, “000” is entered; when submitting an updated Calculation, the correction number (“001”, “002”, and so on) is indicated.

In the case under consideration, an organization with separate divisions submitted the 6-NDFL calculation at the location of only the parent organization.

In our opinion, when submitting the 6-NDFL calculation at the place of registration of separate divisions, in the line “Adjustment number” the correction number of the primary calculation “000” is indicated, since the calculation was not submitted.

We believe that in the situation under consideration, at the place of registration of the parent organization, it is also necessary to submit a 6-NDFL calculation with updated indicators of income and withheld amounts of personal income tax in relation to employees of the head office. Since in this case, the calculation will be submitted again at the place of registration of the parent organization (minus information about the amounts of personal income tax calculated and withheld from the income of employees of a separate division), then in the line “Adjustment number” you should enter “001”.

Results

6-NDFL for separate divisions is submitted to the tax office at the place of their registration. The same rule applies when submitting the last 6-NDFL report in case of closure of a unit.

The largest taxpayers have a choice: to report for the division in Form 6-NDFL to the inspectorate for the largest taxpayers or at the place of registration of the division.

From 01/01/2020, in some cases, it is possible to submit a single 6-NDFL in several separate sections.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 14, 2015 No. MMB-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

6-NDFL when opening remote branches

Due to the fact that the remote structures of the enterprise are not independent in their powers, the main burden of submitting reports to the regulatory authorities lies with the head legal entity. face. At the same time, some reports are submitted with the participation of remote branches of the company, and Form 6-NDFL also applies to such reporting documentation.

Read about the differences between branches and representative offices here.

The company has an obligation to report if income is received (Part 4, Clause 2, Article 230 of the Tax Code of the Russian Federation):

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

- at least one full-time employee of a geographically remote structure;

- counterparties-citizens in civil transactions concluded on behalf of legal entities. persons by branch.

The sequence of filling out the reporting documentation 6-NDFL is determined by the order of the Federal Tax Service of Russia “On approval of the form...” dated October 14, 2015 No. ММВ-7-11 / [email protected] When generating reports for a branch, special attention should be paid to filling out the title page of the form, regardless of whether who submits the calculation (clauses 1.10, 2.2 of the Procedure for filling out the 6-NDFL calculation):

- the line “KPP” always indicates the KPP that is assigned to the organization at the place of registration of its separate division;

- on the line “Submitted to the tax authority (code)” - the four-digit code of the tax authority with which the unit is registered;

- on the line “At location (accounting) (code)” - code 220;

- on the line “(tax agent)” - name of the organization;

- on the line “Code according to OKTMO” - OKTMO code of the municipality in which the separate subdivision is located. You can find out the details using the Federal Tax Service “Find out OKTMO” service.

The remaining sections of the report are formed according to the same rules as for the main legal entity.

A sample of filling out the title page of form 6-NDFL for a separate division is presented below.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Two separate divisions were closed. How to fill out 6-NDFL, title page?

Question:

Two separate divisions were closed. How to fill out 6-NDFL, title page?

Answer:

If the 6-NDFL for a closed (liquidated) separate division was not submitted before the closure of the OP to the Federal Tax Service Inspectorate where it was registered, the calculation must be submitted to the Federal Tax Service Inspectorate at the place of registration of the organization’s head division. In this case, there are features of filling out the title page 6-NDFL . What they are, the 1st class adviser to the state civil service of the Russian Federation, specialist of the Federal Tax Service of Russia Dmitry Aleksandrovich Morozov explained to us: “ When submitting to the Federal Tax Service at the place of registration of the parent organization for the calculation of 6-NDFL for a closed OP, the title page should indicate:

- TIN and KPP - of the parent organization, and OKTMO code - of the closed OP ( item 1 of the Collection );

- in the line “Submission period (code)” - code from Appendix No. 1 to the Procedure for filling out the calculation of 6-NDFL <approved. By order of the Federal Tax Service dated 10/14/2015 N ММВ-7-11/ [email protected] >, corresponding to the period for which the 6-NDFL calculation is submitted for the liquidated OP (21 - for the first quarter, 31 - for half a year, 33 - for 9 months and 34 - per year).

Codes 51, 52, 53 and 90 are entered only upon liquidation/reorganization of the organization itself;

- in the line “At the location (accounting) (code)” - 214. After all, the 6-NDFL calculation is submitted to the tax authority with which the head office of the organization is registered;

- in the line “(tax agent)” - the name of the organization itself providing the information, and not its liquidated separate division <p. 2.2 The procedure for filling out the calculation according to form 6-NDFL, approved. By order of the Federal Tax Service of October 14, 2015 N ММВ-7-11/ [email protected] >.

I also note that when submitting a 6-NDFL calculation by the parent organization for a liquidated enterprise, there is no need to fill out the lines “Form of reorganization (liquidation) (code)” and . ” These lines are filled in in the event of reorganization (liquidation) of the organization.”

(Source - {Article: Filling out the title page of 6-NDFL by the parent organization after closing the OP (“General Ledger”, 2021, N 6) {ConsultantPlus}})

Extract from {<Letter> Federal Tax Service of Russia dated May 22, 2019 N BS-4-11/ [email protected] “On consideration of the appeal” {ConsultantPlus}}:

After completion of the liquidation (closing) of a separate division and failure to submit certificates in form 2-NDFL and (or) payment in form 6-NDFL for such a separate division, the organization submits certificates in form 2-NDFL and calculation in form 6-NDFL in relation to employees of this separate division divisions to the tax authority at the place of registration of the organization. In this case, the organization in certificates in form 2-NDFL and in calculations in form 6-NDFL indicates the TIN and KPP of the organization, and OKTMO of a closed separate division.

Extract from the Ready Solution: How to pay personal income tax and submit reports for a separate division (ConsultantPlus, 2019) {ConsultantPlus}:

The procedure for submitting the 6-NDFL calculation when closing a separate division differs from that for an existing division.

If you did not have time to submit the calculation before the division was closed, the parent organization should report to the tax authority at the place of its registration within such a period (clause 2 of Article 230 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated May 22, 2019 N BS-4-11 / [email protected] ):

- the division is closed in the I, II, III quarter - no later than the last day of the month following the quarter in which the separate division was closed;

- the division was closed in the fourth quarter - no later than April 1 of the following year.

The Tax Code of the Russian Federation and the Procedure for filling out the 6-NDFL calculation do not provide for the specifics of filling out and submitting calculations for a separate division after its closure.

When filling out the calculation, you should indicate on the title page (clauses 1.10, 2.2 of the Procedure for filling out the 6-NDFL calculation, Letter of the Federal Tax Service of Russia dated May 22, 2019 N BS-4-11/ [email protected] ):

- on the line “Checkpoint” - checkpoint of the organization;

- on the line “Submitted to the tax authority (code)” - the four-digit code of the tax authority with which the organization itself is registered;

- on the line “At location (accounting) (code)” - code 213 (for organizations that are the largest taxpayers) or 214 (for other organizations);

- on the line “(tax agent)” - name of the organization;

- on the line “Code for OKZemlya-SERVICE”

Actions when closing a separate division

6 Personal income tax when closing a separate division is also submitted to the inspectorate. At the same time, it is important what happened to the personnel of the liquidated OP:

- they were transferred to another office - then a new division will report for them;

- they were fired - it is required to submit the final payment according to OKTMO of the closed OP.

The OP where to submit 6 personal income taxes has been closed

After making a decision on liquidation and starting the procedure, prepare all required reports for submission to the Federal Tax Service, incl. 6 personal income tax.

Submission deadline for closing a separate division:

- if closed in the first quarter - until April 30;

- in the second quarter – until July 31:

- in the third quarter – until October 31;

- in the fourth quarter – until March 1.

Note! In this case, the submitted report will be final; the period in such a form is the period from the beginning of the year until the day of liquidation.

Payment for liquidated enterprises

If you did not have time to submit reports before the liquidation of the OP, then send 6 personal income taxes for a closed, separate division to the inspectorate, which takes into account the parent company with the following features:

- in the form, write down the checkpoint and TIN of the main office, and OKTMO - the closed OP;

- reorganization code – 9 (means liquidation);

- TIN and KPP of the reorganized organization are the details of the liquidated unit.

The form must be submitted no later than the deadline established for submitting the calculation.

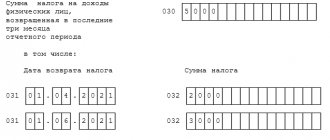

Example of filling out 6 personal income tax for OP at closing

This is what a completed form looks like from the checkpoint of a liquidated separate unit:

When and where to submit the 6-NDFL report in 2021

In 2021, organizations and individual entrepreneurs submit a 6-NDFL report in the prescribed form, the form of which can be downloaded here ⇒ 6-NDFL. As in previous years, the report is compiled quarterly on an accrual basis - for the 1st quarter, half-year, 9 months and calendar year.

The place of submission of the 6-NDFL report is the territorial body of the Federal Tax Service at the place of registration of the organization (for legal entities) or the place of residence of the individual entrepreneur (for entrepreneurs).

The deadline for submitting the 6-NDFL report in 2021 has not changed - until the last day of the month following the reporting period (end of the quarter, half-year, 9 months). The 6-NDFL annual report for 2021 is submitted no later than 03/31/2021.

If the last day for submitting the report falls on a weekend or holiday, the tax agent can submit the document on the next day (the nearest business day after the weekend or holiday).

A table with deadlines for filing the 6-NDFL report in 2021 is presented below:

| No. | Reporting period 6-NDFL | Deadline for filing 6-NDFL | |

| 1 | 1st quarter 2021 | 01.01.2021 – 31.03.2021 | Until 30.04.2021 inclusive |

| 2 | 1st half of 2021 | 01.01.2021 – 30.06.2021 | Until 31.07.2021 inclusive |

| 3 | 9 months of 2021 | 01.01.2021 – 30.09.2021 | Until 31.07.2021 inclusive |

| 4 | 2021 (12 months) | 01.01.2021 – 31.12.2021 | Until 31.03.2021 inclusive |

If the deadline for submitting a report is violated, the taxpayer is subject to a fine of 1,000 rubles. This amount is collected if the business entity is late with the report for up to a month. If the period of delay is more than 1 month, then a fine of 1,000 rubles is collected. for each full and partial month of delay.