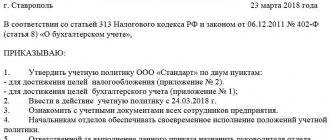

Accounting policy of an enterprise: general requirements for registration

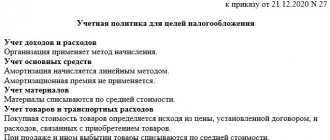

The accounting policy is drawn up in accordance with the rules established by the accounting law No. 402-FZ of December 6, 2011, as well as PBU 1/2008. In addition, each industry may have its own regulations that affect its content.

The accounting policy consists of two parts: accounting and tax. They can be drawn up as a single document consisting of two sections, or two separate provisions can be made.

The organization's accounting policies are applied continuously from year to year, and reasonable changes to it can only be made from the beginning of the reporting year. The order on the accounting policy is approved by the manager no later than 90 days after registration of the company. For example, the accounting policy for 2021 had to be adopted before December 31, 2019, and the document approved in 2021 will come into force only from January 1, 2021.

An organization's accounting policies should reflect accounting methods only for actual assets, transactions, and liabilities. It is advisable to fix in the text of the document those accounting aspects for which there is a choice from several options, or the law does not contain an unambiguous interpretation on them. For example: what methods of depreciation are used, how reserves are created, etc. It makes no sense to rewrite unambiguous provisions of the PBU, or the Tax Code, that do not offer a choice.

Accounting policies for accounting tasks

The accounting policy for solving accounting problems is formed on the basis of the Law “On Accounting”, which was published in 2011, and is supported by a number of equally important Regulations, a Chart of Accounts and Instructions for its correct use.

According to the stated legislative acts, the accounting policy includes the following principles and components:

1. Bukh. accounting is organized by a special department, a division that exists at every enterprise. This important structure is headed by the chief accountant.

2. In the bay. Double entry accounting is used. What does it mean? Any change in the expenditure part is reflected on 2 lines at once, which allows you to achieve a holistic balance of components.

3. Accounting is always subject to and corresponds to the Chart of Accounts, which are indicated in Appendix 1.

4. If changes in accounting policies are coming, they should be shown point by point and sequentially.

5. Separate employees or divisions are not needed to maintain a separate balance sheet.

6. Primary reporting forms are always constant and developed in a single format.

7. People holding certain positions can claim the right to sign documents if their superiors are absent. Their list is included in Appendix 2.

8. Accounting register. accounting is the Household Accounting Book. activities identified in the Appendix, which also describes the current principles of accounting policy in the organization.

9. It is customary to take 1 calendar month as the reporting period.

10. How significant the level is is indicated in the amount of 5% of the total size of the object for which accounting is kept, or the corresponding accounting item. accounting.

11. If there is a need to get rid of an error made in the last reporting period, identified by the accountant independently, it is necessary to make an appropriate entry in the current statements, where the necessary entries and accounts are indicated.

12. As for the inventory, which affects the property and liabilities of the organization, it is initiated at least once a year and is a preparatory stage for drawing up a balance sheet for the year.

13. There is no need to revaluate fixed assets.

14. An object accepted by an accountant on the balance sheet is always considered a fixed asset, but only if it is used in the statutory work of the enterprise or for the needs of management and control. In this case, pay attention to the conditions:

- the object must be suitable for use over a long period of time, for a period of 1 year or more;

- the company is not considering selling the property in the future;

- the price of the object in the form in which it arrived at the organization is more than 40,000 rubles.

15. How long fixed assets can be used is indicated in the 2002 Classification of Fixed Assets.

16. Depreciation calculations are carried out without taking into account reduction factors.

17. Depreciation is calculated using the straight-line method.

18. If the property has been registered with the enterprise for more than 1 year, and its original price was 40,000 rubles, write-off occurs gradually.

19. Costs related to property repairs are included in the organization's costs, but they never include costs for regular, planned repairs required by technological requirements.

20. Inventory in the warehouse is distributed to account 10.

21. Finished products should be charged to account 41.

22. The number of each individual material stock is taken as the unit of inventory calculation.

23. Purchased inventories are carried taking into account the actual cost, account 16 does not apply.

24. If inventories go out of accounting, they should be reflected in the accounting book. accounting based on average cost.

25. The cost price for inventories is the price at which the property was purchased from the supplier; it is advisable to confirm the cost with a document.

26. The cost also includes transportation and procurement costs.

27. There is no need to reflect the revaluation of intangible assets.

28. If an intangible asset has depreciated, there is no need to show this on the accounts or balance sheet.

29. Depreciation in the context of intangible assets is shown in the same way as depreciation of tangible assets.

30. Expenses related to the production and sale of goods and services are allocated to account 20.

31. Accounts receivable and payable should be included in account 76.

32. Debt obligations are a type of other costs.

33. The volume of money supply located in bank accounts is assessed in account 51.

34. Capital accounting is possible using account 80.

35. Revenue is determined in accordance with the procedure for receiving money from customers or clients, if the basic conditions described in categories a, b, c and d of paragraph 12 of PBU 9/99 are met.

36. Accounting for the results of a company’s economic activities includes reflection on account 99.

37. If there is a formalized and signed agreement regarding a construction contract, the profit and cost part are provided without the use of PBU 2/2008.

38. Investments assume the unit of accounting policy is a series.

39. Expenses received as a result of the acquisition of financial investments, in value less than the level of materiality fixed in paragraph 10 of the current accounting policy at the enterprise, are classified as other expenses.

40. The current market price of financial investments, on the basis of which the market valuation is determined, is subject to adjustments and changes every 3 months.

41. If it is impossible to understand the market price from financial investments, then the investments must be displayed in accounting, focusing on the reporting number for the primary cost.

42. The cost of financial investments takes into account each unit separately.

43. The extent to which financial investments have lost weight must be monitored annually; this is done with the aim of timely formation of a reserve.

44. Contributions to the reserve for doubtful debts are made every quarter.

45. There is no need to create a reserve for future vacation pay for employees.

46. PBU 18/02 is not valid.

47. PBU 11/2008 is not used.

48. PBU 16/02 does not apply.

49. Those persons who have the right, on the instructions of their superiors, to receive accountable money are included in Appendix 3. Advance accounts are generated and then shown no later than 30 calendar days. When the employee returns home, within 3 days he is obliged to submit a report on expenses to his superiors.

50. The schedule for the movement and display of documents is determined by the order of the head of the organization. The chief accountant is responsible for maintaining the schedule.

51. The preparation of interim reporting and documentation for the year involves the use of balance sheet report forms according to Form 2.

52. Mandatory documentation, at the request of the owner, can be supplemented with additional papers, for example, a report on changes in capital and on the movement of money supply. Such documents help to create a more complete picture of the organization’s current financial position.

“Accounting policies of the organization” PBU 1/2008: changes

From 08/06/2017, amendments to PBU 1/2008 “Accounting Policy of the Organization” came into force (Order of the Ministry of Finance of the Russian Federation dated 04/28/2017 No. 69n). Its provisions include, in particular, the following innovations:

- PBU “Accounting Policies” now applies to all legal entities, except credit and government organizations,

- a rule has been introduced on independent choice of the accounting method, regardless of the choice of other organizations, and subsidiaries choose from the standards approved by the main company (clause 5.1),

- the concept of rational accounting has been clarified - accounting information must be useful enough to justify the costs of its formation (clause 6),

- in cases where there is no specific method of accounting in federal standards, the organization develops it itself, based on paragraphs. 5 and 6 PBU 1/2008 and accounting recommendations, consistently referring to IFRS standards, federal (PBU) and industry accounting standards (clause 7.1), and to companies conducting simplified accounting (small enterprises, non-profit organizations, Skolkovo participants) , when forming an accounting policy, it is enough to be guided by the requirements of rationality (clause 7.2),

Yulia Busygina,

Head of Accounting Education at SKB Kontur School

In order for financial statements to be reliable, a number of basic activities must be completed:

- Check the availability of primary accounting documents on the basis of which accounting entries were compiled during the year.

- Make sure that all facts of the organization’s economic life are reflected in the accounting records.

- Check your accounting for errors. It is easier to correct them this year than to correct them next year.

- Review and revise accounting policies for accounting purposes.

- Conduct an inventory of assets and liabilities. In accordance with clause 27 of the Accounting Regulations (approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n), an inventory of assets can be carried out in the period from October 1 to December 31 of the reporting year. And the inventory of obligations is as of December 31 inclusive, since the reporting period in this case is a calendar year (see paragraph 1 of Article 15 of Law No. 402-FZ and the recommendations of the Ministry of Finance of Russia in letter dated 01/09/2013 No. 07-02-18 /01).

- Reform the balance sheet as of December 31 of the reporting year.

Vacation schedule and reserves

Also, no later than two weeks before the start of the new calendar year, you need to draw up a vacation schedule for 2021. The corresponding order must be dated no later than December 17, 2015 (Part 1 of Article 123 of the Labor Code of the Russian Federation).

As of December 31, it is necessary to take an inventory of the reserve: compare the actual amounts of expenses incurred in the current year for vacation pay and contributions to the reserve. The rules for creating a reserve for vacation pay in accounting are not regulated. Therefore, it is important that the accounting policy establishes the procedure for creating the reserve. Also, by the end of the year, an estimate of contributions to the reserve for vacation pay in 2021 should be drawn up.

Intensive workshop “Vacation 2015” with a 10% discount

To learn more

Contents of the accounting policy of the organization (LLC)

Accounting policies should reflect:

- list of regulations on the basis of which the company keeps records: Law on Accounting No. 402-FZ, PBU, Tax Code of the Russian Federation, etc.,

- working chart of accounts, prepared as an annex to the accounting policy,

- positions responsible for organizing and maintaining records in the company,

- forms of the “primary” used, accounting and tax registers - unified forms, or independently developed,

- depreciation issues – calculation methods, frequency (monthly, once a year, etc.),

- limits on the value of fixed assets, the procedure for their revaluation,

- accounting of materials, finished products, goods,

- accounting of income and expenses,

- the procedure for correcting significant errors and the criteria for classifying them,

- other provisions that the organization deems necessary to reflect.

If the “accounting” part of the organization’s accounting policy is quite universal for everyone, then the tax part will be different for each taxation regime, but in any case should contain:

- information about the applicable tax system, and if there is a combination of tax regimes - the procedure for maintaining separate accounting,

- how taxes are paid in separate divisions, if any,

- whether the company has tax benefits, and under what conditions they apply.

Accounting policy for 2021

For any company, accounting policy is the main document regulating the life of the organization. Accounting policies establish operating rules both for the current year and for a longer period of time. Therefore, it is necessary to draw up an accounting policy thoughtfully, and not simply by downloading a standard document from the Internet. In addition, it is important to pay special attention to the mandatory elements of accounting policies and changes in legislation.

Traditionally, accounting policies are divided into two parts:

- accounting policies for accounting purposes;

- accounting policy for tax accounting purposes.

The company develops the structure and elements of its accounting policies independently. The elements can be divided into the following main groups: main; special; additional elements.

The main elements of accounting policies are those elements that are established by law. For accounting purposes, the main elements are established by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n “On approval of accounting provisions”; for tax accounting purposes, the main document is the Tax Code.

For accounting purposes the following are approved:

- a working chart of accounts containing synthetic and analytical accounts necessary for maintaining accounting records in accordance with the requirements of timeliness and completeness of accounting and reporting;

- forms of primary accounting documents, accounting registers, as well as documents for internal accounting reporting;

- the procedure for conducting an inventory of the organization’s assets and liabilities;

- methods for assessing assets and liabilities;

- document flow rules and accounting information processing technology;

- procedure for control of business transactions;

- other solutions necessary for organizing accounting.

For tax accounting purposes, the accounting policy reflects the procedure for calculating and paying taxes, and we are talking, first of all, about the recognition of income and expenses for tax accounting purposes.

Special elements are those elements that are characteristic of a specific industry (for example, construction, beauty industry) or for a specific company, taking into account a long production cycle.

Additional elements of accounting policies are those elements that the company wants to additionally reflect independently.

It should be noted that no fundamental changes in the field of accounting are expected in 2021; new federal standards have not been adopted.

GOOD TO KNOW

An individual entrepreneur does not have the obligation to draw up accounting policies for accounting purposes. However, individual entrepreneurs are required to develop accounting policies for tax accounting purposes, and this obligation does not depend on the tax regime applied by the entrepreneur.

Accounting policies for accounting purposes

For accounting purposes, it is advisable to reflect the following provisions in the accounting policy:

1. It is necessary to determine what kind of financial statements the “simplified” person will submit.

In the accounting policy, fix the choice of the option of accounting reporting forms, because by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n, small businesses have the right to choose between:

- common reporting forms;

- simplified general forms;

- forms intended only for small businesses.

2. You need to decide on the chart of accounts maintained by the company.

To maintain accounting records, a small business entity can reduce the number of synthetic accounts in the working chart of accounts it accepts in comparison with the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

A small business entity can open for generalization of information:

a) on production inventories - account 10 “Materials” (instead of accounts 07 “Equipment for installation”, 10 “Materials”, 11 “Animals for growing and fattening”);

b) about the costs associated with the production and sale of products (works) (instead of accounts 20 “Main production”, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General expenses”, 28 “Defects in production”, 29 “ Service industries and farms"), 44 "Sale expenses";

c) about finished products and goods - account 41 “Goods” (instead of accounts 41 “Goods” and 43 “Finished products”);

d) on accounts receivable and payable – account 76 “Settlements with various debtors and creditors” (instead of accounts 62 “Settlements with buyers and customers”, 71 “Settlements with accountable persons”, 73 “Settlements with personnel for other transactions”, 75 “ Settlements with founders", 76 "Settlements with various debtors and creditors", 79 "Intra-business settlements").

A small business entity, based on the clarifications of the Ministry of Finance of the Russian Federation No. PZ-3/2012 “On a simplified accounting system and financial reporting for small businesses,” may provide in the working chart of accounts:

a) for accounting for funds in banks - account 51 “Settlement accounts” (instead of accounts 51 “Settlement accounts”, 52 “Currency accounts”, 55 “Special accounts in banks”, 57 “Transfers in transit”);

b) for capital accounting – account 80 “Authorized capital” (instead of accounts 80 “Authorized capital”, 82 “Reserve capital”, 83 “Additional capital”);

c) for accounting of financial results - account 99 “Profits and losses” (instead of accounts 90 “Sales”, 91 “Other income and expenses”, 99 “Profits and losses”).

GOOD TO KNOW

You can change the accounting methods in the accounting policy to more profitable ones only at the end of the year by issuing an order from the manager, for example, on December 31. The changes will take effect from the new year.

3. For accounting purposes, it is important to establish accounting ledgers.

Simply put, accounting ledgers are documents maintained by an organization. According to the law, the forms of accounting registers are approved by the head of an economic entity on the recommendation of the official responsible for maintaining accounting records (clause 5 of Article 10 of Law No. 402-FZ).

But it’s better not to “reinvent the wheel” and use unified forms. To do this, you can use the forms that are approved in the appendix to the order of the Ministry of Finance of the Russian Federation dated December 21, 1998 No. 64n “On Standard Recommendations for the Organization of Accounting for Small Businesses.” The recommendations approved by this order should be applied taking into account changes that have occurred in the legal regulation of accounting. Please pay attention to the status of regulations referred to in this document.

4. Methods for assessing assets and liabilities.

Thus, in this section you can reflect the order of grouping assets and liabilities.

In addition, it is important to determine how income and expenses will be recognized. Most organizations take into account income and expenses on an accrual basis in their accounting (Section IV PBU 9/99 and PBU 10/99, respectively).

Another important issue is the issue of accounting for low-value assets and depreciation. Most companies account for assets in accounting in the same way as in tax accounting. It is important to note that there have been changes in asset accounting for depreciation purposes starting in 2021. Thus, depreciation must be calculated in tax accounting if the object is used to generate income, the useful life is more than 12 months, and the cost is more than 100,000 rubles. Let us recall that in 2015, the value of property for which depreciation is not charged, for accounting and tax purposes, was only 40,000 rubles. Now in tax accounting it has changed, but in accounting it remains the same.

If the company has intangible assets, for example a trademark, then the accounting policy must reflect the procedure for accounting for intangible assets, including depreciation.

To calculate depreciation of intangible assets, you must choose one of the methods established in clause 28 of PBU 14/2007. The following methods are provided: the linear method, the reducing balance method, the method of writing off the cost in proportion to the volume of production (work).

In addition, accounting may revalue fixed assets and intangible assets. But since it is not carried out in tax accounting, most companies do not use the revaluation mechanism.

GOOD TO KNOW

Accounting policies can be changed due to changes in legislation at any time during the year. Amendments will take effect in the order specified in the document that makes them.

5. Document management.

Along with other decisions necessary for organizing accounting, document flow rules and technology for processing accounting information are approved (letter of the Ministry of Finance of the Russian Federation dated May 28, 2007 No. 07-05-06/134).

According to Art. 7 of Law No. 402-FZ, accounting and storage of accounting documents are organized by the head of the economic entity. Thus, the general director can take responsibility for and organize document flow in microenterprises. In addition, the manager can delegate document management and signing of reports to the chief accountant.

Based on Art. 29 of Law No. 402-FZ, primary accounting documents, accounting registers, accounting (financial) statements, audit reports thereon are subject to storage by an economic entity for periods established in accordance with the rules for organizing state archival affairs, but not less than 5 years after the reporting year . But in tax accounting, this period is limited to only 4 years, so many companies set an increased period, the same as in accounting and for tax accounting purposes.

This section also needs to reflect whether accounting is carried out automatically or manually; it is also important to establish to what extent the company uses electronic document management.

6. Organization of control of business operations.

It is also important to establish the procedure for maintaining internal control. Article 29 of the Law “On Accounting” establishes the obligation of an economic entity to organize and carry out internal control of the facts of economic life. Accordingly, even if a company is not obliged to conduct a statutory audit, its responsibilities include organizing internal control. The features of internal control need to be fixed in the accounting policies.

In this section, it is important to assign control over the conduct of business transactions, as well as the procedure for checking the maintenance of accounting records.

The main elements of internal control of an economic entity are:

a) control environment;

b) risk assessment;

c) internal control procedures;

d) information and communication;

e) assessment of internal control.

The control environment is a set of principles and standards for the activities of an economic entity that determine the general understanding of internal control and the requirements for internal control at the level of the economic entity as a whole. The control environment reflects the management culture of an economic entity and creates the appropriate attitude of personnel towards the organization and implementation of internal control.

Risk assessment is the process of identifying and analyzing risks.

During such an assessment, an economic entity considers the likelihood of distortion of accounting and reporting data based on the following assumptions:

a) occurrence and existence: facts of economic life reflected in accounting took place in the reporting period and relate to the activities of the economic entity;

b) completeness: the facts of economic life that took place in the reporting period and are to be attributed to this period are actually reflected in the accounting records;

c) rights and obligations: property, property rights and obligations of an economic entity reflected in accounting actually exist;

d) valuation and distribution: assets, liabilities, income and expenses are reflected in the correct monetary measurement in the appropriate accounting accounts and in the appropriate accounting registers;

e) presentation and disclosure: accounting data is correctly presented and disclosed in the accounting (financial) statements.

An economic entity may apply the following internal control procedures:

a) documentation (for example, making entries in accounting registers on the basis of primary accounting documents, including accounting certificates; inclusion in the accounting (financial) statements of significant estimated values solely on the basis of calculations);

b) confirmation of correspondence between objects (documents) or their compliance with established requirements (for example, checking the execution of primary accounting documents for compliance with established requirements when accepting them for accounting);

c) sanctioning (authorization) of transactions and operations, providing confirmation of the competence to carry them out; typically performed by personnel at a higher level than the person carrying out the transaction or transaction (for example, approval of an employee's expense report by his supervisor);

d) data reconciliation (for example, reconciliation of settlements of an economic entity with suppliers and customers to confirm the amounts of receivables and payables; reconciliation of cash accounting account balances with cash balances according to cash book data);

e) delimitation of powers and rotation of responsibilities (for example, assigning powers to draw up primary accounting documents, sanction (authorize) transactions and operations and reflect their results in accounting to different persons for a limited period in order to reduce the risks of errors and abuses);

f) procedures for monitoring the actual presence and condition of objects, including physical security, access restrictions, inventory (information of the Ministry of Finance of Russia No. PZ-11/2013).

7. Other events.

GOOD TO KNOW

In tax and accounting, it is convenient to choose the same method of writing off inventory items in order to avoid unnecessary discrepancies.

Accounting policy for tax accounting purposes

For tax accounting purposes, the Tax Code does not establish mandatory elements of maintaining tax accounting in a company.

At the same time, it is advisable to consolidate the following provisions in the accounting policy:

1. It is necessary to indicate what taxes the company pays and what tax reporting it submits.

In 2015, in particular, a trade tax appeared in a number of regions, and trading companies are forced to pay it, therefore the procedure for calculating and paying the trade tax should be reflected in the accounting policy for 2021.

In addition, in 2021, the procedure for filing personal income tax reports will change: so, from next year, instead of once, you will have to submit reports quarterly. At the same time, “simplified” will be responsible for the accuracy of the data submitted to the tax authority.

2. The object of taxation and the procedure for accounting for income and expenses.

Another mandatory element of accounting policy is the fixation of the selected object of taxation - “income” or “income reduced by the amount of expenses”.

The procedure for accounting for income and expenses and their types specific to a particular company also require reflection in the accounting policy.

Particular attention should be paid to the procedure for reflecting expenses (clause 3 of Article 346.16 of the Tax Code of the Russian Federation). Since 2015, the LIFO method has been excluded from the code. This means that a company can, for tax accounting purposes, use one of the following valuation methods when writing off raw materials and materials used in the production (manufacturing) of goods (performing work, providing services):

- by cost per unit of inventory;

- at average cost;

- at the cost of the first acquisitions (FIFO).

Interest expenses in relation to loans and credits are taken into account in 2015 in any amount, except for loans and credits to related parties, in which case Art. 269 of the Tax Code of the Russian Federation. Therefore, from the tax policy of the simplified tax system in 2021, it is necessary to exclude the rule on the procedure for their regulation.

For tax purposes, property worth more than 100,000 rubles will be considered depreciable in tax accounting, just as in accounting.

3. Tax accounting registers.

Article 346.24 of the Tax Code of the Russian Federation provides for only one version of the tax accounting register - this is the Book of Income and Expenses of organizations and individual entrepreneurs using a simplified taxation system (approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n). At the same time, clause 1.4 of the Procedure for filling out the Income Accounting Book provides for the possibility of maintaining it both on paper and in electronic form.

Thus, the accounting policy must be developed taking into account the mandatory provisions of the accounting policy and changes in legislation.

But the most common question is: why does the “simplified” one need an accounting policy for tax and accounting purposes?

GOOD TO KNOW

You can supplement your accounting policy at any time. This may be required, for example, if you have new operations or activities and you need to regulate the procedure for accounting for them.

Why does a simplifier need an accounting policy for tax and accounting purposes?

Accounting policies are needed for various purposes.

Firstly, the accounting policy allows you to level out tax risks in the event of controversial issues with the inspection authorities.

Secondly, accounting policies provide important information for founders, directors, and investors about the organization of tax and accounting.

Thirdly, accounting policies are established by law.

According to Art. 8 of Law No. 402-FZ, accounting policy is a set of methods for maintaining accounting records by an economic entity. Accounting policies must be applied consistently from year to year.

The accounting methods chosen by the organization when forming its accounting policies are applied from January 1 of the year following the year of approval of the relevant organizational and administrative document.

A change in an organization's accounting policy can be made in the following cases:

- changes in the legislation of the Russian Federation and (or) regulatory legal acts on accounting;

- the organization's development of new accounting methods. The use of a new method of accounting implies a more reliable representation of the facts of economic activity in the accounting and reporting of the organization or less labor intensity of the accounting process without reducing the degree of reliability of the information;

- significant changes in business conditions. A significant change in the business conditions of an organization may be associated with reorganization, changes in types of activities, etc. (Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n “On approval of accounting regulations”).

Fourthly, the company can regulate the accounting features that are specific to a particular company.

The organization must determine the procedure for accounting for individual income and expenses independently and consolidate its decision in its accounting policies. For example, organizations that have chosen income reduced by the amount of expenses as an object of taxation independently choose a method for assessing purchased goods (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation). Thus, accounting policies help resolve many issues.

GOOD TO KNOW

It is not necessary to change your tax accounting policy every year. Approve it for any period as you wish. You need to correct the document only if you yourself decide to change your accounting methods or tax legislation has changed.

Accounting policy of the simplified tax system

The nuances of tax accounting policy with “simplified” depend on the selected object: “income” (6%), or “income minus expenses” (15%).

When applying the simplified tax system “income”, tax policy should reflect:

- income accounting procedure,

- indicate how the paid insurance premiums reduce the tax base,

- in what order and at what rate are taxes and advance payments calculated,

- tax register - KUDIR.

With the object “income minus expenses”, special attention should be paid not only to income, but also to expenses, indicating:

- the procedure for accounting for fixed assets, the method of calculating depreciation,

- composition of material costs,

- procedure for accounting for sales costs (if any),

- recognition of past losses in the current period,

- procedure for calculating and paying the minimum tax,

Otherwise, the tax policy points will be similar to those indicated for the simplified tax system for “income”.

OSNO accounting policies

One of the main points of tax policy under OSNO is accounting for income tax. The document should reflect:

- procedure for recognizing direct and indirect expenses of an enterprise (cash or accrual method),

- the procedure for accounting for fixed assets, whether increasing coefficients are used for depreciation, depreciation bonus, for which objects,

- methods for assessing materials, raw materials and goods,

- Are reserves formed to evenly distribute expenses throughout the year (vacations, bad debts, OS repairs, etc.),

- accounting for transactions with securities,

- in what order is income tax and advance payments on it calculated and paid,

- applicable tax registers, etc.

The specifics of VAT accounting when developing accounting policies should be pointed out to those who are exempt from tax or who carry out transactions taxed at a rate of 0% - this concerns the order of distribution of “input” VAT.

Main innovations

The following changes to the Tax Code will need to be taken into account in 2016:

- The initial cost of depreciable property increased to 100 thousand rubles. (previously 40 thousand rubles).

- The limit for quarterly income tax (advance) has been increased. Now the average quarterly income for the four previous quarters for this form should not exceed 15 million rubles. (previously 10 million rubles).

In addition, with the help of changes in accounting policies, it is possible to smooth out fluctuations in the organization’s income and expenses, which will avoid questions from regulatory authorities. In this case, entrepreneurs will be able to protect themselves in advance from unscheduled inspections, which reduces the burden on the business. For this purpose you can use:

- The cost of inventories can be written off either one-time or gradually. Previously, companies could only use instant write-offs, which led to significant fluctuations.

- Redistribution between direct and indirect costs. Using this tool, companies can increase or decrease expenses in a specific period.

- Reserves formed in accordance with doubtful accounts receivable. If the delay exceeds 45 days, then up to 50% of the debt may fall into the reserve. If this indicator exceeds 90 days, then the amount of the reserve may correspond to the full amount of the doubtful debt. This mechanism allows organizations to manage the amount of reserves, which in turn is reflected in the accounting of expenses.

- uniform accounting of vacations.